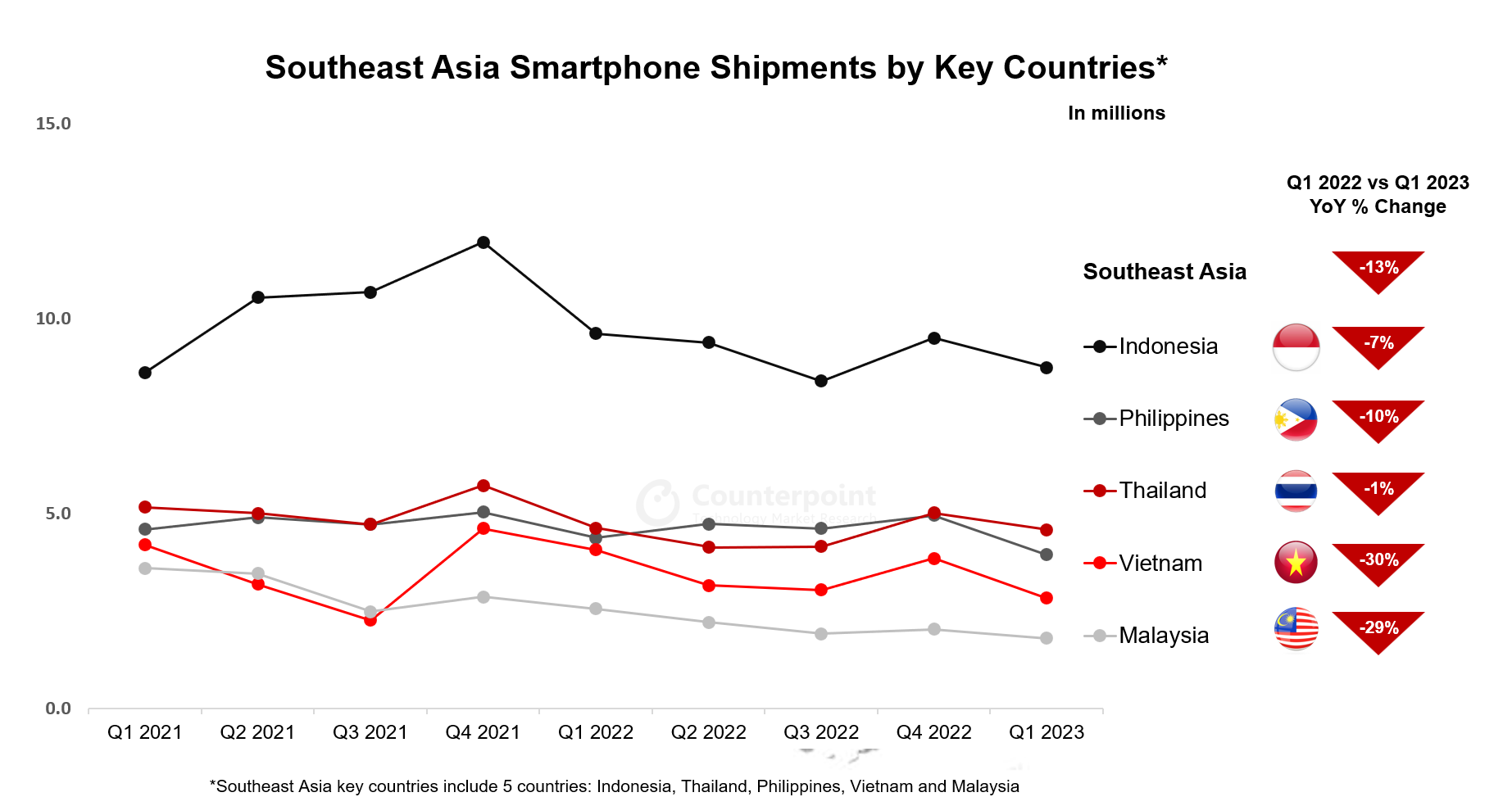

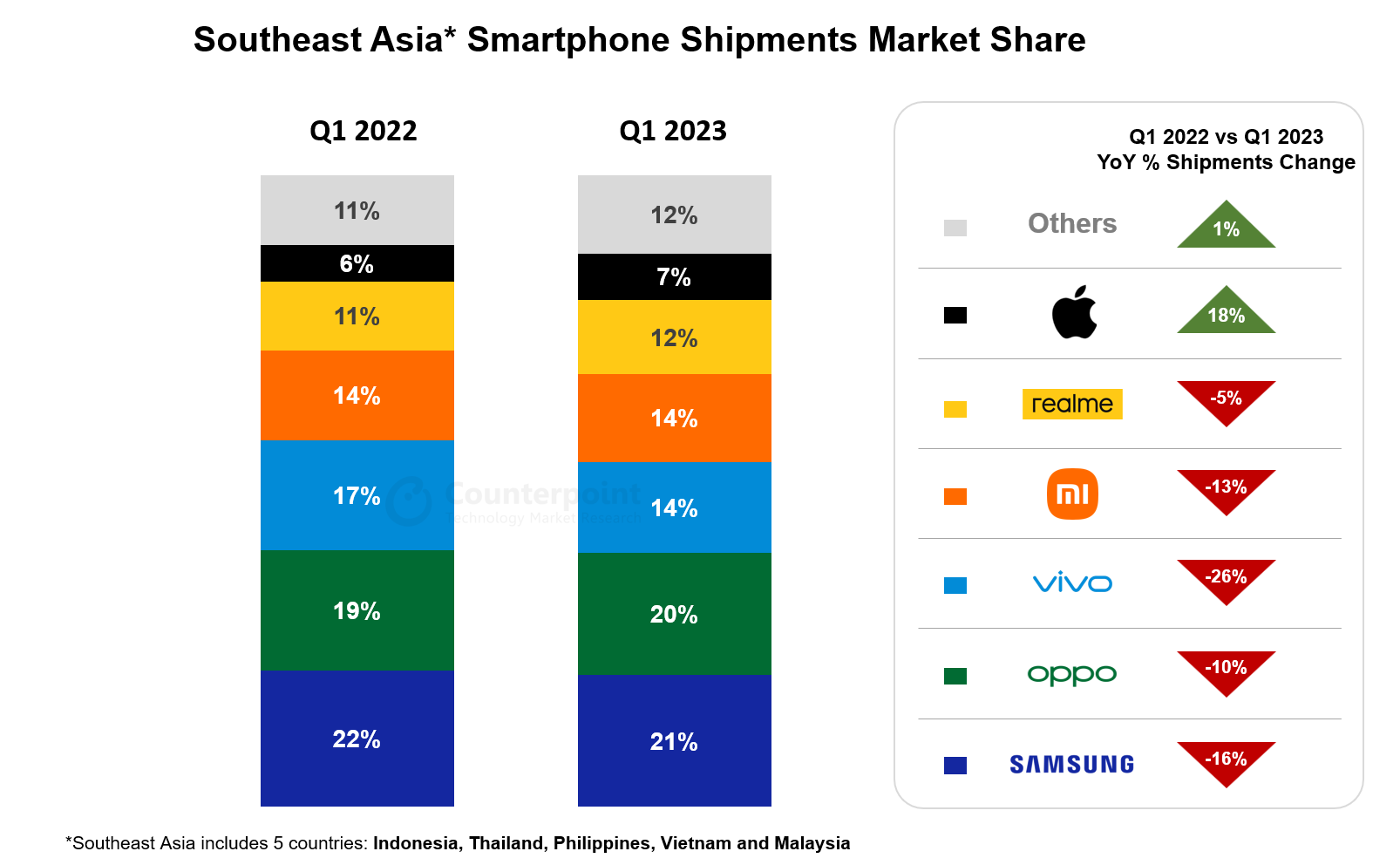

- Smartphone shipments in Southeast Asia’s five key markets* declined 13% YoY in Q1 2023.

- Apple’sshipments increased by 18% YoY during the same period.

- Infinixwitnessed a 41% increase as the brand grew across SEA markets.

- While mid-to-high-end ($201-$600) ranges suffered the most, the>$600 rangeshipments increased by 4%.

Jakarta, Hong Kong, London, Boston, Toronto, New Delhi, Beijing, Taipei, Seoul – May 15, 2023

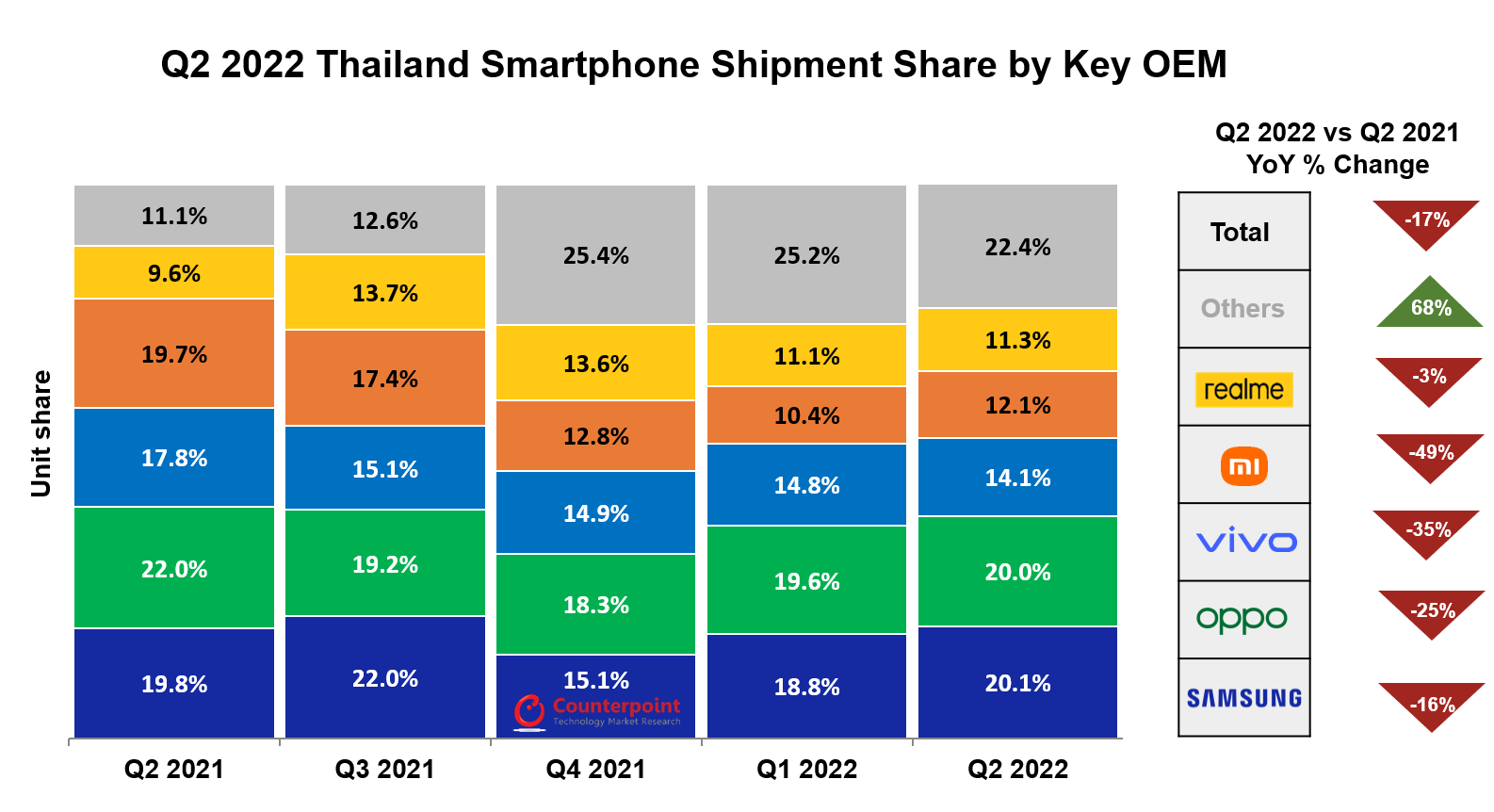

Smartphone shipments inSoutheast Asia’sfive key countries (Indonesia, Thailand, Philippines, Vietnam and Malaysia) fell 13% YoY due to low demand and a seasonal drop, according to Counterpoint Research’sSoutheast Asia Monthly Smartphone Channel Share Tracker.

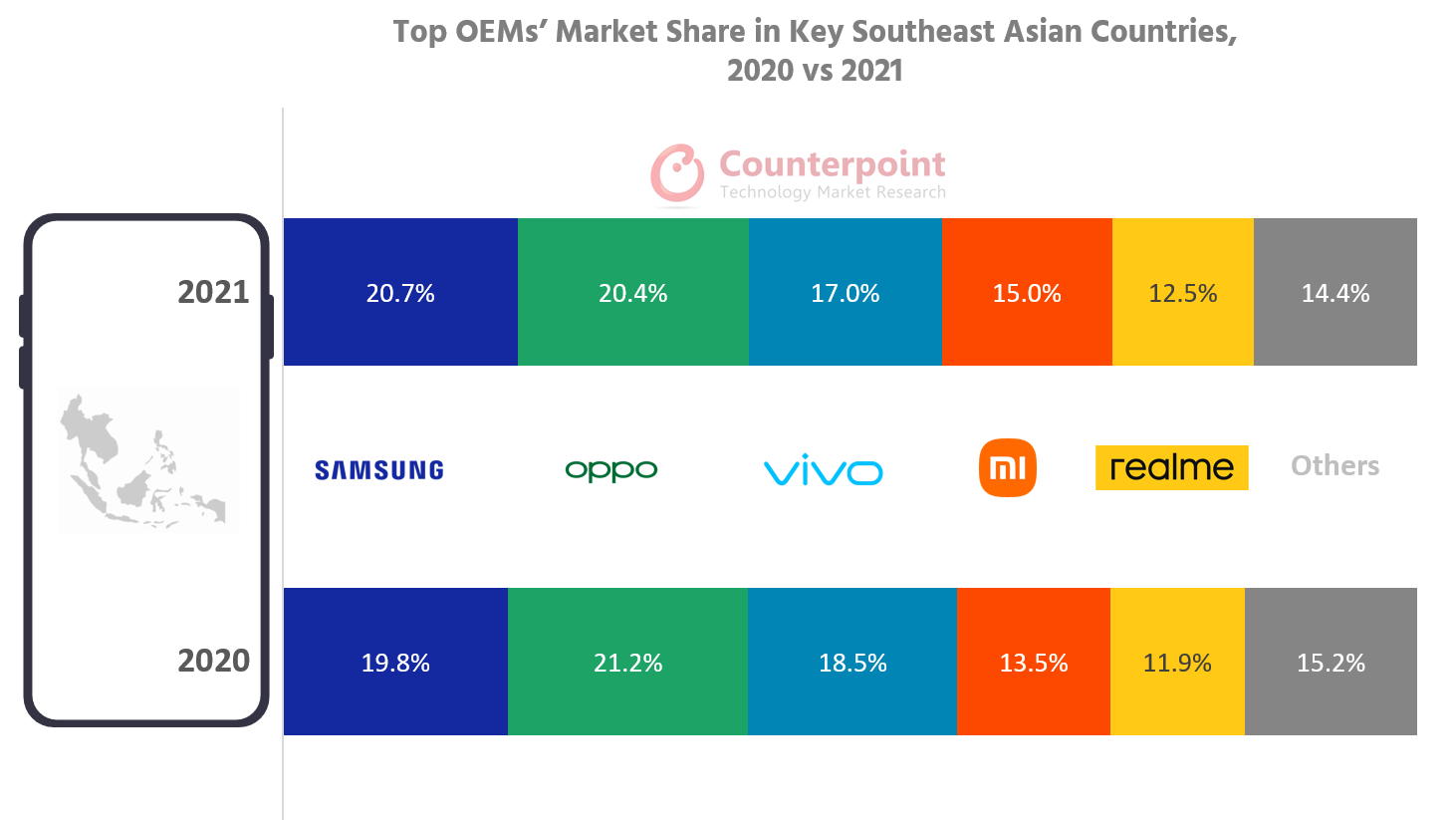

All key SEA countries saw a decline in Q1 2023 but some more than others. Countries like Vietnam received relatively more shipments in Q4 2022 and so OEMs felt the need to reduce volumes in Q1 2023. Consumer sentiment has not completely revived in Vietnam. Factors like a 10% fall inSamsung’sproduction, seasonally low smartphone demand after Q4 2022, and reduced revenues for OEMs and operators were also among the driving factors.Indonesiaand Thailand did comparatively well than the other countries as demand started improving in March 2023.

Source: Counterpoint Research Southeast Asia Monthly Smartphone Tracker

All key SEA countries are coming out of the geopolitical effects from last year while still reeling under some inflation effects. For instance, thePhilippinessuffered high inflation at the start of this year. However, operators continue to remain aggressive on 5G development and partnerships with tech companies. The industry has resumed its earlier levels of advancement as foreign investments are again entering big economies likeIndonesia和马来西亚。有合作发生on the financial services front as well. For example, OPPO inIndonesiais partnering with banks to provide banking services while AIS, the leading operator inThailand, has partnered with Bangkok Bank to provide financial services on digital platforms. Consumers are not exactly feeling the improvements on the ground though. Most smartphone purchases are being delayed.

Source: Counterpoint Research Southeast Asia Monthly Smartphone Tracker

Vietnam is a growingAppleiPhone market. The demand for theiPhone 13 and 14series was good in Q1 2023. Indonesia has seen growth iniPhoneshipments as well. Overall, iPhone shipments grew 18% YoY in Q1 2023.

Infinixis the official smartphone partner for Mobile Legends professional league in the Philippines. Infinix has improved on promoting itself as agaming brandin the region. Overall, though Infinix’s volumes are not on a par with the top brands, it continues to grow in the region. The brand grew 41% in Q1 2023.

While certain brands have been in focus at the start of this year, the price range share favored two consumer groups in Q1 2023. <$200 smartphones witnessed a 4% YoY growth despite an overall decline in volumes. Since entry-level phone shipments had been consistently low, pent-up demand motivated higher shipments in Q1 2023. However, not all countries saw a spike in low-end smartphone demand. OEMs in Vietnam were still looking to push these volumes. ThePhilippines’ low-income families are reeling under high tax and inflationary issues, restricting low-end smartphone purchases. Premium-end (>$600) smartphone shipments continued to rise and saw 4% YoY growth. Mid-to-high-end ($201-$600) smartphone shipments suffered the most across the region.

Commenting on the SEA economies in 2023,Senior Analyst Glen Cardozasaid, “Southeast Asia is at a stage where different consumer types are behaving in a different manner. Low-end smartphone buyers are recovering but they are not just there yet. Mid-to-high-end smartphone buyers are holding on to their wallets and extending the ownership of their phones, whilehigh-to-premium smartphonebuyers are unaffected by the economics of the situation. These consumers are going out and choosing to buy the S series, foldables andiPhones. While5Gis becoming a norm, operators are coming out with creative packages and providing options for all types of smartphones. The coming months are likely to see a bit more improvement in consumer sentiment while governments make sure that their countries remain largely unaffected by global macro issues.”

The Vietnamese government is looking to commercialize 5G in the country this year. This will facilitate a new level of manufacturing and consumer usage if done earlier than later. While theMalaysiangovernment and industry work on 5G commercialization and the terms for it, consumers are already equipped with5G smartphones.

With an increase in tourism in SEA countries earlier in the year, there is a chance that tourism business and revenue will increase this year. Countries likeThailandare also concentrating on eco-tourism initiatives that focus on sustainability, all through smartphones. All these developments are likely to spell normalcy for the public, leading to a likely improvement in consumer sentiment in the coming quarters.

*Key Southeast Asia countries/marketsinclude Indonesia, Thailand, Philippines, Vietnam and Malaysia.

Feel free to contact us atpress@www.arena-ruc.comfor questions regarding our latest research and insights.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Glen Cardoza

Follow Counterpoint Research