Thailand Smartphone Shipments: Rocky 2020 Ends Flat But on a Bright Note

波士顿、多伦多、伦敦、新德里、北京g, Taipei, Seoul – March 23, 2021

Thailand’s smartphonemarketnormalized in the fourth quarter of 2020 to help bring a challenging and erratic year to a close just slightly off 2019 in terms of unit shipments. An unexpectedly strong Q3 which saw 27% YoY shipment growth driven by pent-up demand and online buying helped to offset a first half plagued by lockdowns and negative consumer sentiment.

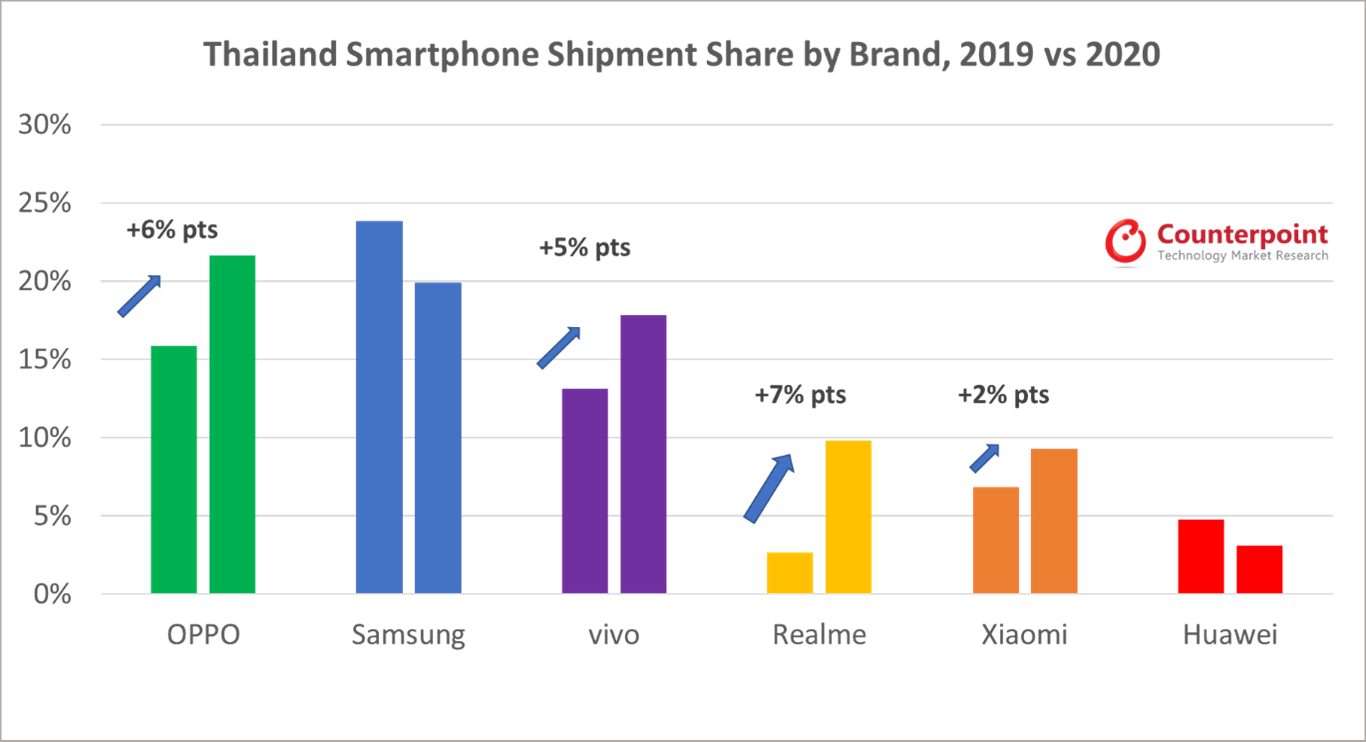

According to Counterpoint Research’s Q4 2020 Channel Share Tracker, Thailand’s 2020 smartphone shipments declined only 2% annually to come in at just over 20m shipments. Especially strong performance from Realme,OPPO, vivo and Xiaomi during the second half helped carry the overall market, allowing it to stay almost flat for the year despite pandemic challenges.

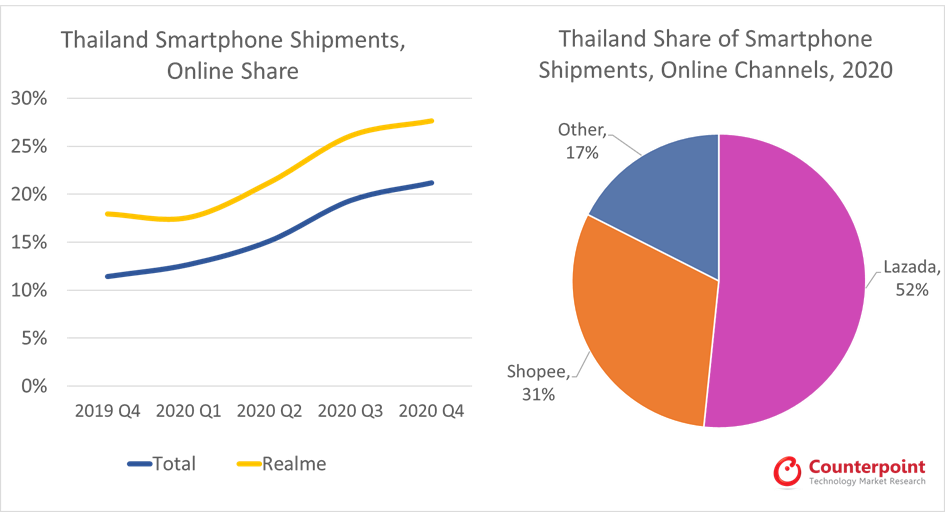

Along with the recovery we also saw distribution and product mix continue to shift. Online channels saw significant growth during the second half as consumers increasingly went online to buy their devices.

Glen Cardoza, Senior Analyst at Counterpoint Research, stated, “The jump to online is a trend we’re seeing across the region and something accelerated by the pandemic. Lazada continues to dominate in Thailand, but we’re seeing Shopee and smaller players gather strength, squeezing Lazada out of its majority to end the year at a combined 51% share of the Q4 online market.”

Cardoza also noted, “Realme今年是一个杰出的人,结束与高吗est online share of shipments and largest overall market share gains. Efforts in developing strong relationships with its online partners coupled with a feature-rich budget portfolio helped the two-year old vendor come out on top.”

Across the broader market, feature sets continue to improve and underscore the significance of imaging. Consulting Director Charles Moon observed, “When we compared 2020’s 10 best-selling devices to the previous year’s, we saw big spec improvements coming from cameras, display sizes and memory capacity. Quad cams in 2020 accounted for well over a quarter of the top 10 shipments compared to only 10% in 2019.”

Improvements are coming as a package deal, according to Moon. “Along with the camera upgrades, there’s accompanying storage increases and bigger screens. Over one third of top-10 device shipments had 128GB storage capacity and screen sizes of 6.5” or above. We expect this trend to continue, driven by intense competition in the mid-end, and the introduction of ‘mid-budget’ 5G smartphones.”

Background:

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

DISCLAIMER:

Counterpoint Technology Market Research All Rights Reserved. Reproduction of this publication in any form without prior written permission is forbidden. The information contained herein has been obtained from sources believed to be reliable. However, we disclaim all warranties as to the accuracy, completeness of this report. Counterpoint shall have no liability for errors, omissions or inadequacies in the information contained and any direct/indirect damages. All opinions and estimates herein are subject to change without notice.