Philippines Online Channels Blossom in 2020 as Smartphone Shipments Shrink

Boston, Toronto, London, New Delhi, Beijing, Taipei, Seoul – April 8, 2021

The Philippine’s smartphone market struggled last year according toCounterpoint Research’s Q4 2020 Channel Share Tracker, with overall shipments falling 8% on an annual basis. Although the third quarter saw a strong YoY increase, it was not enough to bring a pandemic impacted 2020 even with the previous year, resulting in total shipments falling to 18.4mn units.

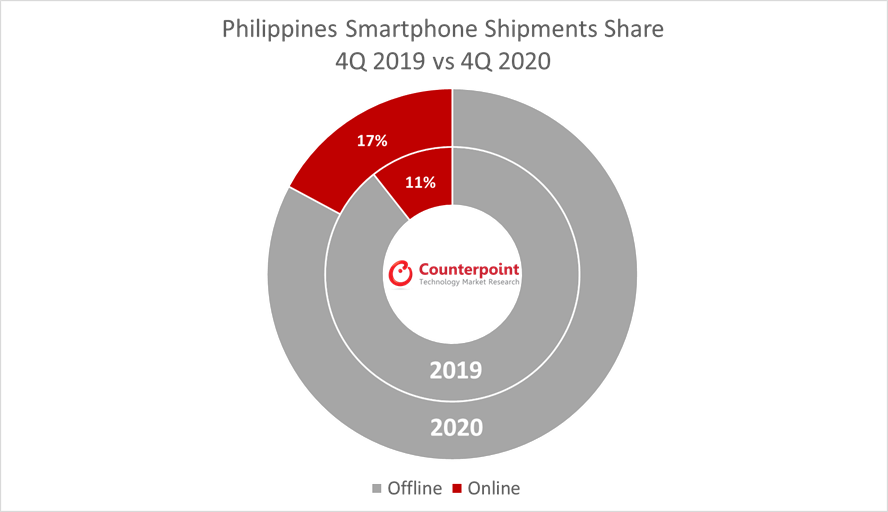

However, similar toregional peers in SE Asia, the Philippines enjoyed strong growth in online channels, which handled over 50% more units in 2020 than the previous year. By 4Q 2020, 17% of total shipments went to online.

Counterpoint Research Senior Analyst Glen Cardoza notes, “The Philippines reflects what we’re seeing in other markets across the region – consumers are going online by necessity. What will be interesting to see is if they stay for the convenience. At least for the short term, we expect online channel share to continue rising, especially through 1H with this second wave of infections bringing more lockdowns.”

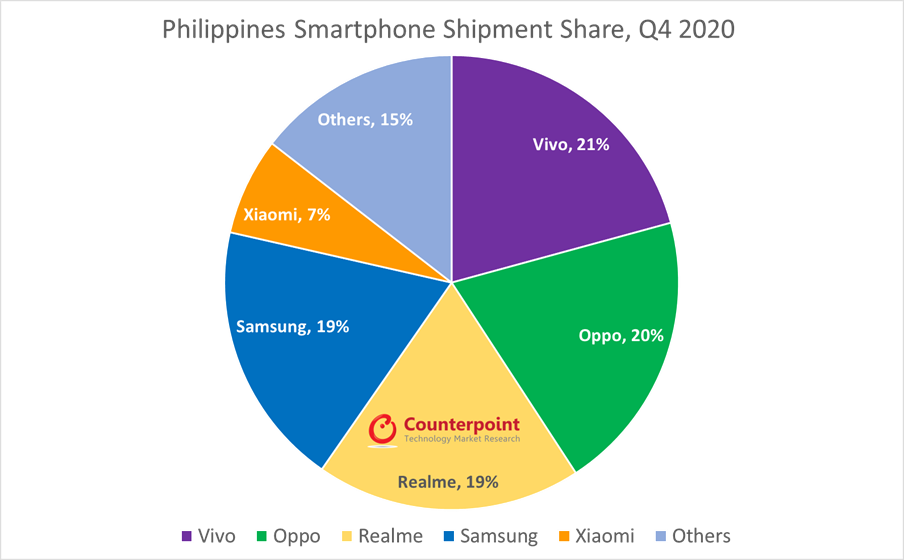

Two-year old Realme was a bright spot, growing annual shipment share from single digits in 2019 to 18% last year. Mr. Cardoza highlights, “Realme has had a whirlwind two years since its launch, and momentum is gaining for the upstart. It had 68% YoY shipment growth in Q4 2020 to secure the number three spot for the year. Moving into 2021 it is in a great position, especially considering its strength in online.”

On consumer purchasing trends, Mr. Cardoza says, “Price has always been important in the Philippines and last year was no exception, with average retail prices of top-10 device shipments in the $120-$150 range. In terms of specs, we’re starting to get a better picture of the balance between what consumers are willing to pay and the must-have features they want.”

Counterpoint’s Channel Share Tracker provides visibility across a broad range of smartphone specs including price, camera setup, storage capacity, battery size, screen size and other key metrics. Mr. Cardoza adds, “It has been interesting to see what Filipino consumers are prioritizing beyond just price. Comparing 2019 and 2020, we’re seeing big movements in display size, storage, camera setups and most of all, battery capacity – the jump to 5000mAh-plus has been quick, driven in large part by requirements from bigger and better screens and more sophisticated camera setups. It also highlights the continuing role smartphones play in keeping Filipinos connected, especially during times of social distancing.”

Background:

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Contacts:

Charles Moon