- Philippines smartphone shipments fell 20% YoY due to sustained low demand driven by a combination of factors like high taxes and inflation.

- Xiaomi rose to the third position on the Note 12 series’ success and 19% YoY shipment growth.

- Back-to-back launches propelled TECNO’s YoY growth to 73%.

- Premium buyers shrugged off higher costs to drive the segment’s 26% YoY growth.

- 5G smartphones under $200 witnessed 25% YoY growth.

Jakarta, Hong Kong, London, Boston, Toronto, New Delhi, Beijing, Taipei, Seoul – August 10, 2023

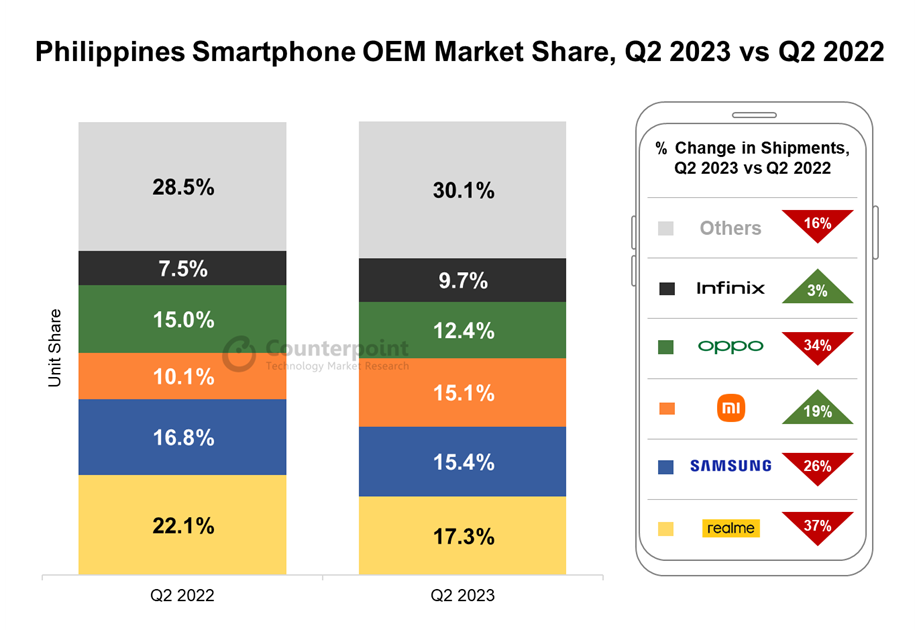

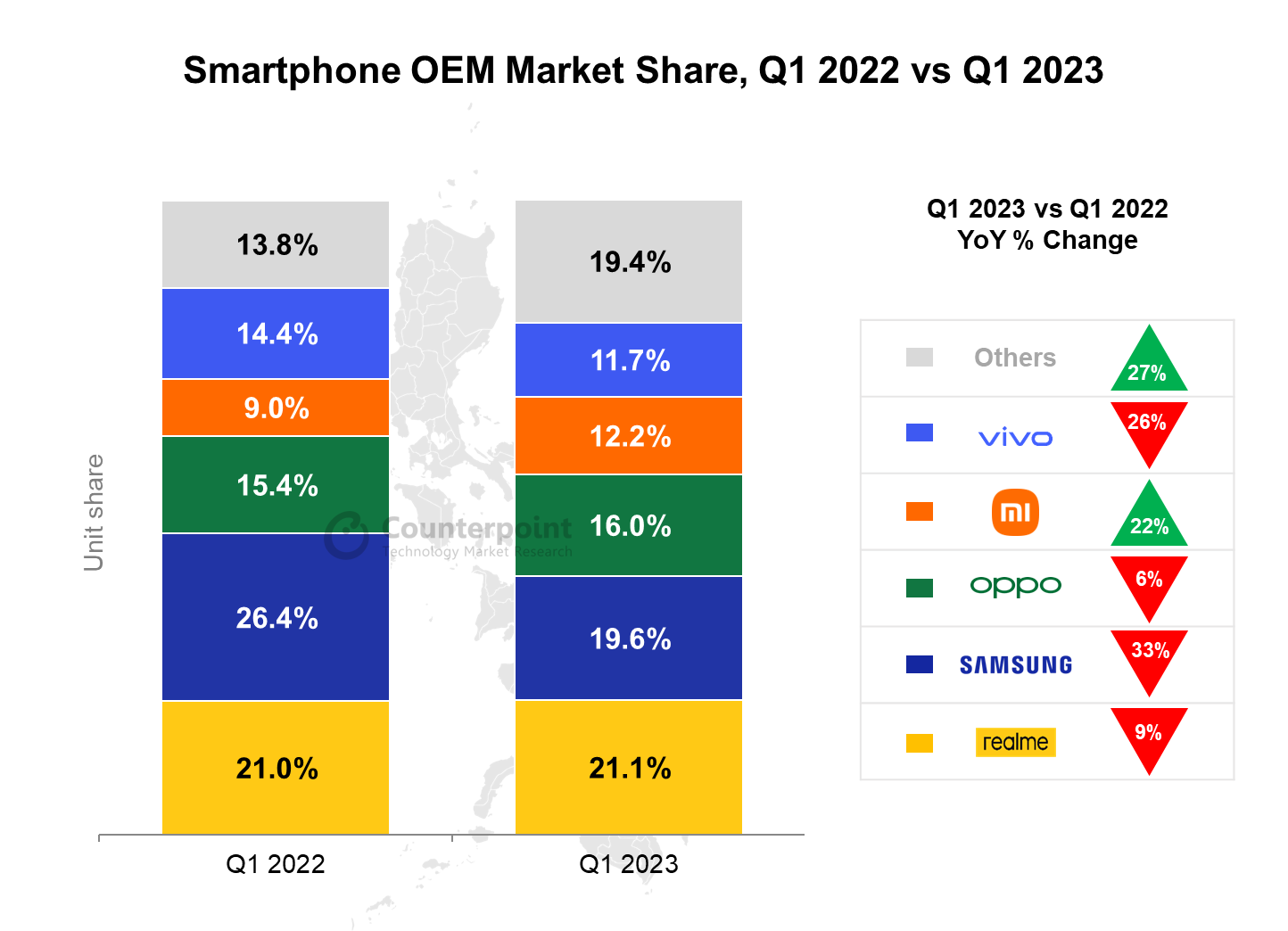

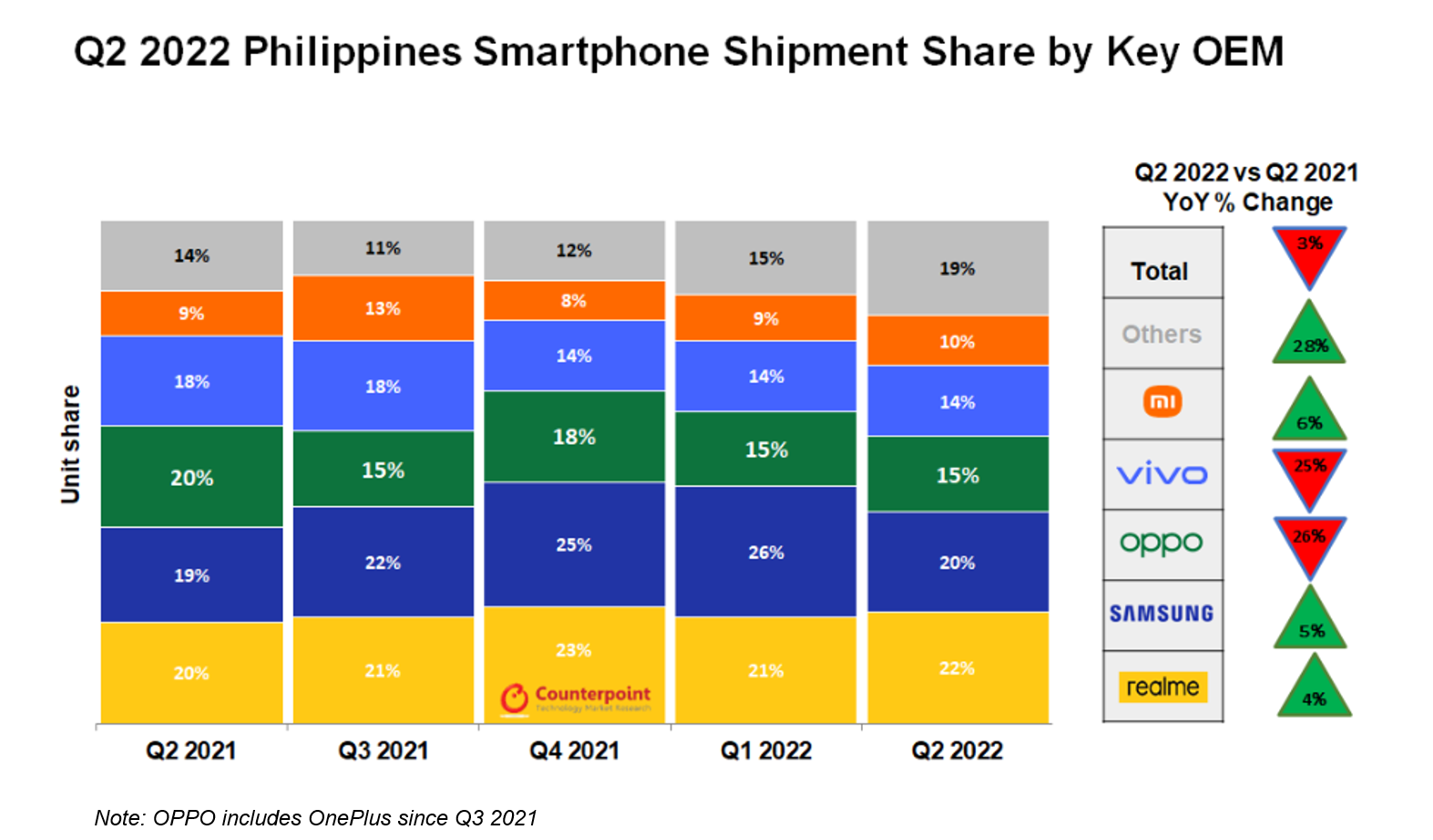

Smartphone shipments in the Philippines recorded a 20% YoY decline in Q2 2023 due to sustained low demand driven by a combination of factors such as high consumption taxes, elevated production and distribution costs following public utilities’ privatization, and a weak Peso, according toCounterpoint Research’s Philippines Monthly Smartphone Channel Share Tracker.

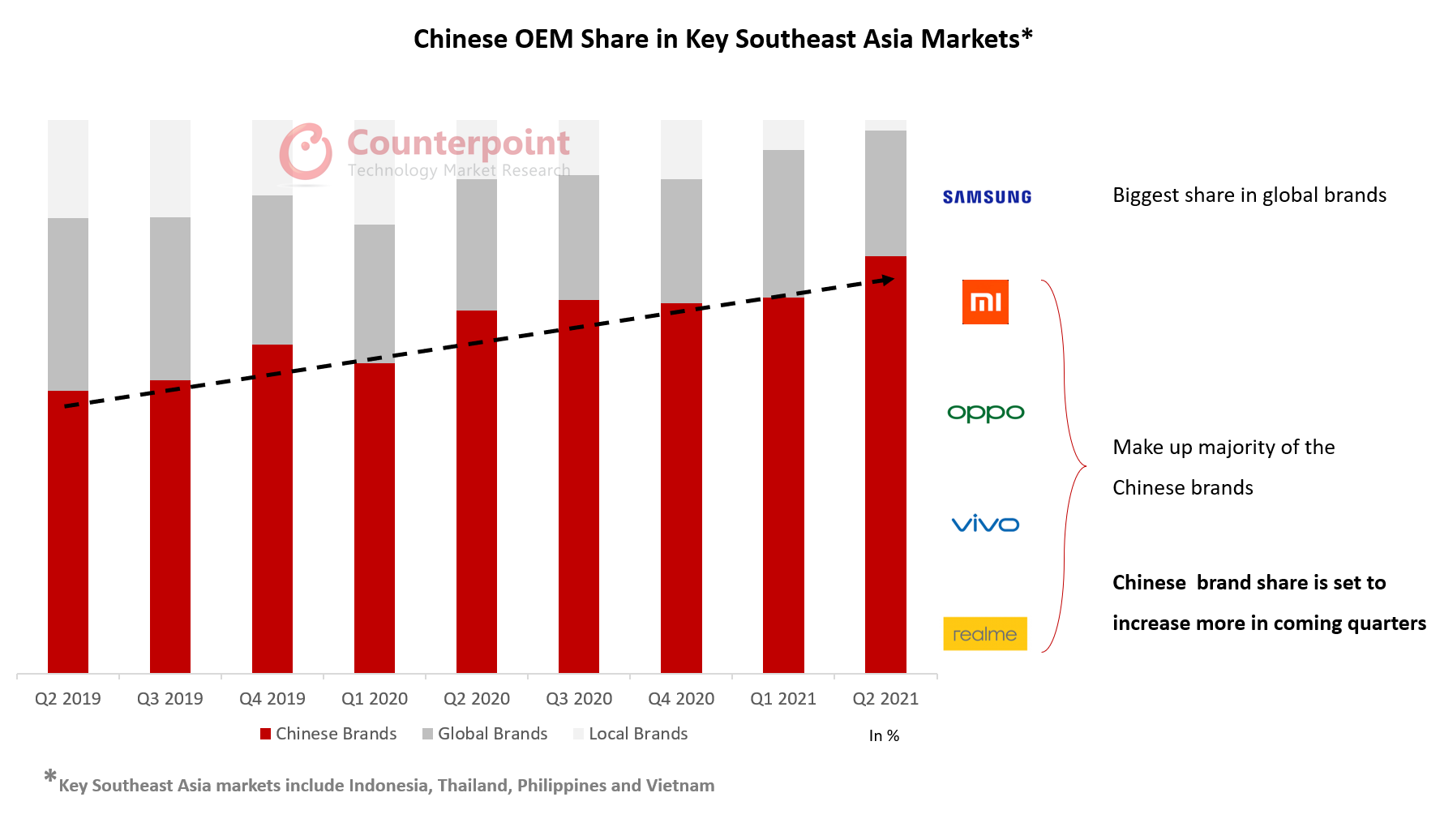

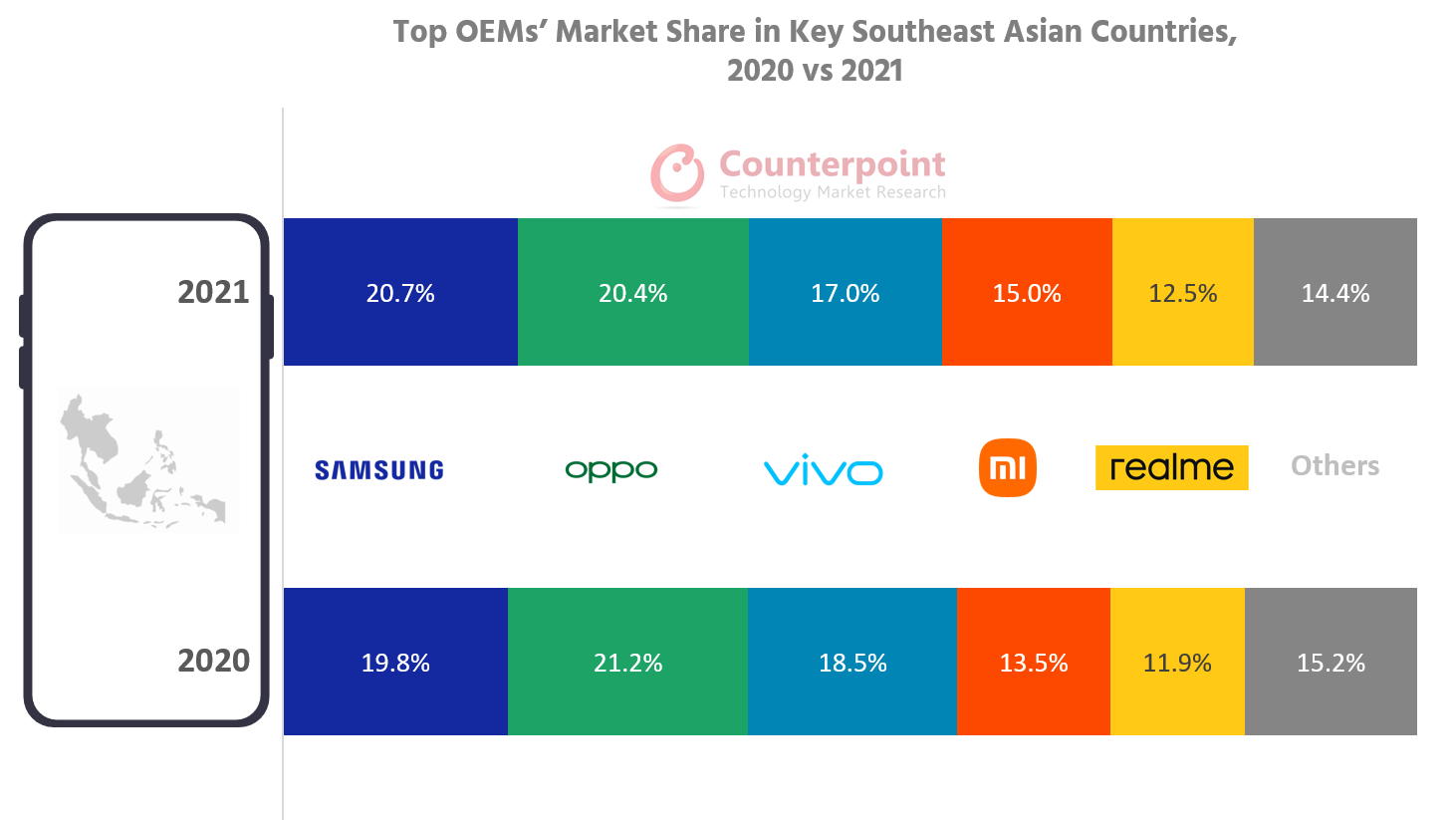

Many of the major brands saw significant downswings this quarter. Thoughrealmecontinued to be the number one brand, its market share reduced to 17.3% after a 37% YoY decline in shipments due to limited product launches and weakened smartphone demand. The brand could keep its number one spot due to the popularity of its C55 model, which was also the market’s top-selling model in Q2 2023, and the C53 model, which was sold out on Lazada overnight.地空导弹ungexperienced a YoY shipment decline of 26% in Q2 2023, owing again to fewer model launches and limited promotions in the budget segment.

Xiaomiovertook OPPO to take the third position in the Philippines in Q2 2023. The brand recorded 19% YoY growth boosted by a good reception of its Note 12 series. Xiaomi also held its annual fan festival in April, where it offered promotions, especially on the newly launched Note 12 series and popular 12C model, further fuelling its growth.

OPPOandvivowitnessed shipment declines of 34% and 43%, respectively. Both brands were part of the payday promotions in June, but the offers were restricted more toward the older models to clear inventory.Infinixrecorded marginal growth of around 3% but increased its market share to 9.7% to enter the top five brands for the quarter. Its budget Hot 30 series performed well, while the Note 30 series got a good reception as a decent gaming phone.

TECNOperformed well in this quarter, recording 73% YoY shipment growth driven by its quick, successive model launches. The newly launched Spark Go and Spark 10 series are doing particularly well due to their competitive prices.

Shipments of smartphones priced less than $200 and in the $200-$399 segment decreased by 22% and 16% YoY, respectively, due to constrained consumer spending. The $400-$599 segment recorded a bigger decline of 54% as it saw fewer launches by major brands such as Samsung and realme.

However, the premium segment (>$600) witnessed a 26% YoY increase, the only segment to show YoY growth. Apple still led this segment with a 43% share. The brand’s official reseller, Powermac, has expanded its Apple Premium Partnership store presence to give Apple customers an enhanced experience along with deals and promotions. Other offers by retailers centered around 0% installments and iPhone bundled offers.

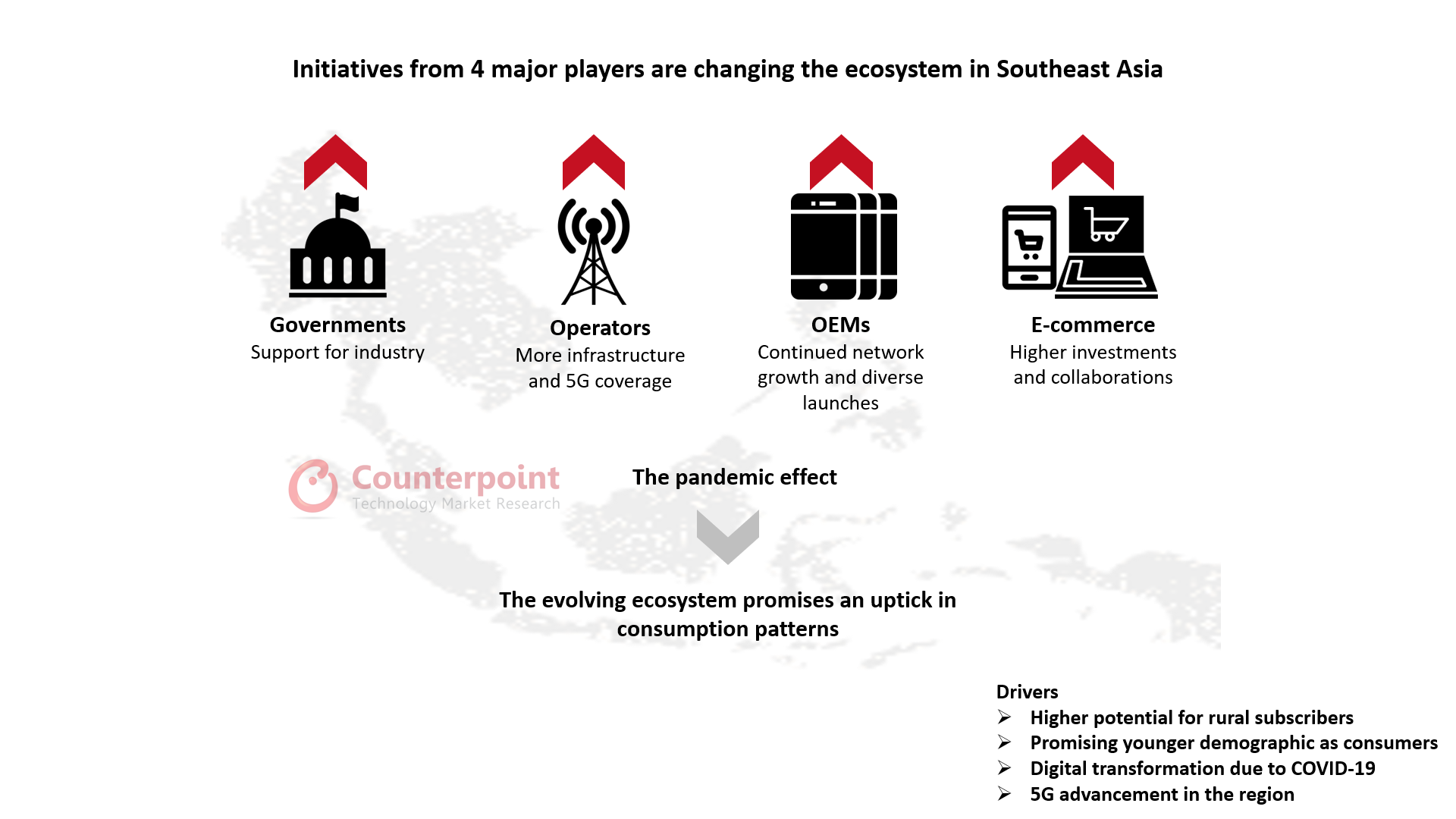

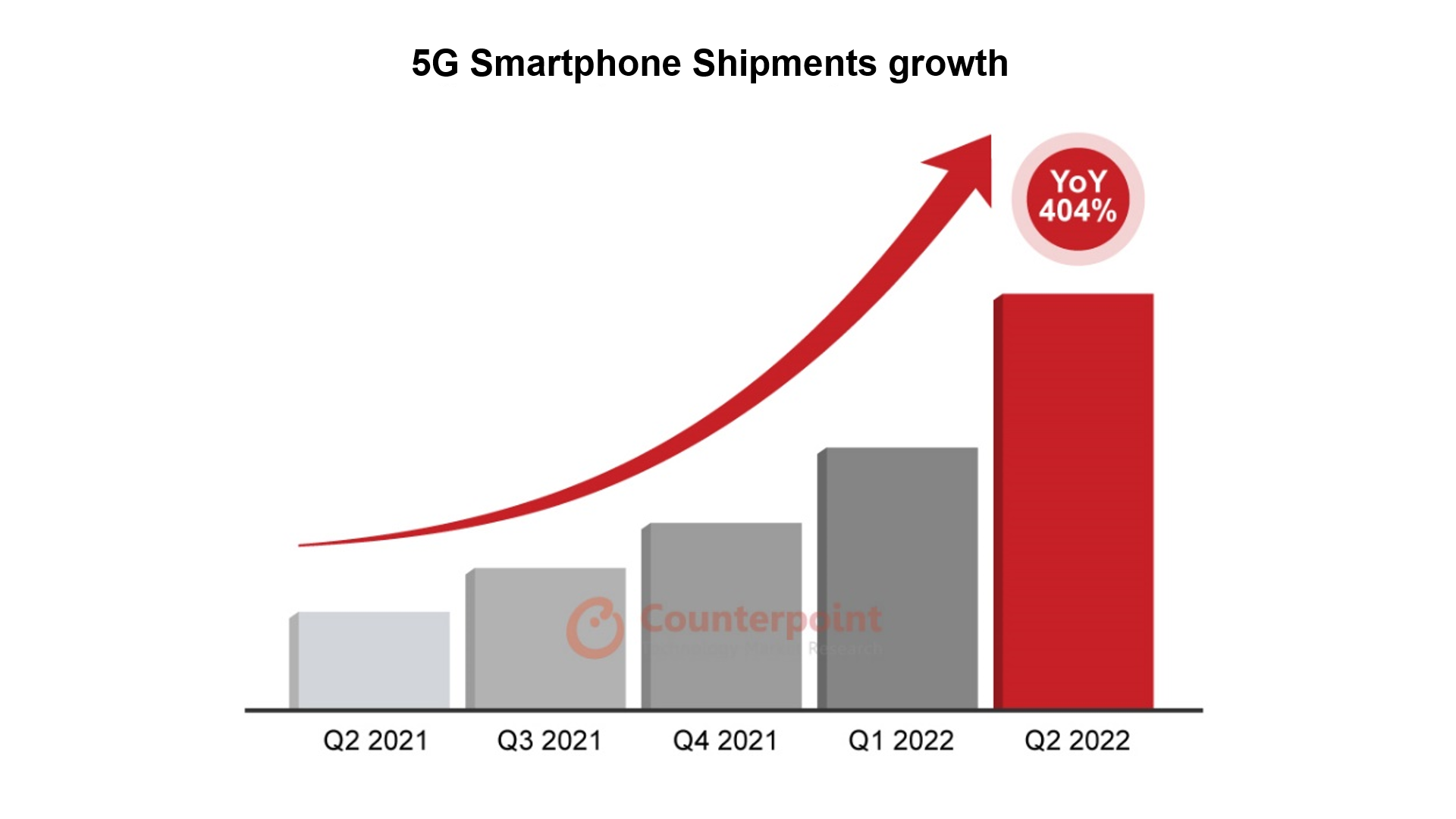

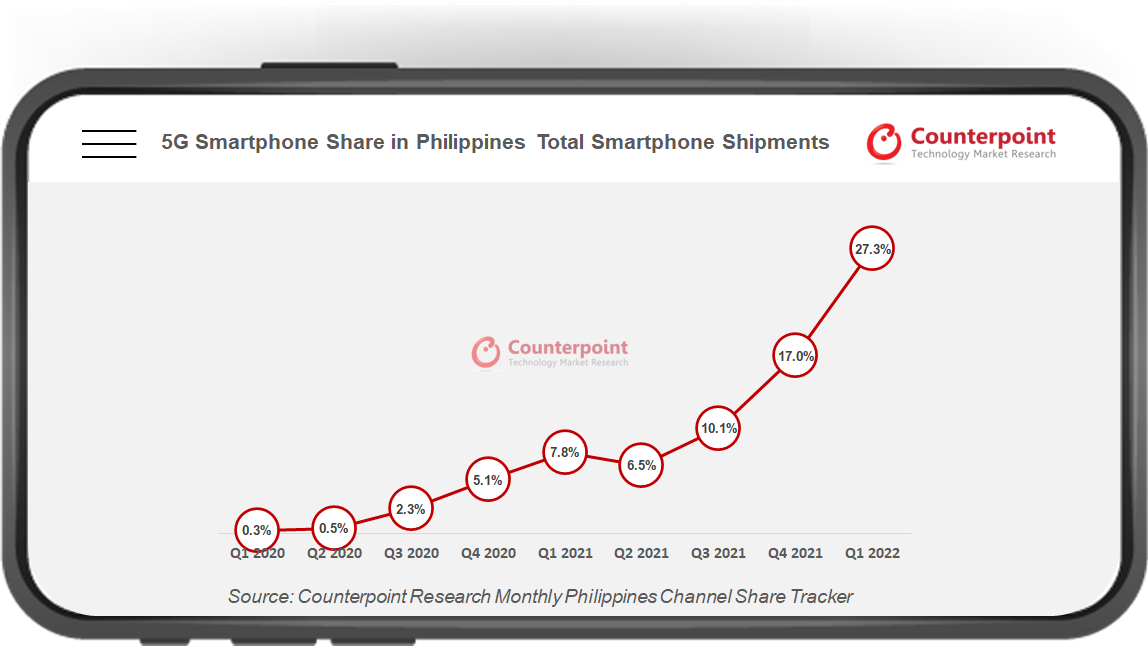

For this quarter, 5G smartphones saw a decline in all price segments except the below $200 segment, which witnessed a 25% YoY growth driven by the introduction of Infinix Zero 5G and Note 30, along with TECNO’s 5G version of the Spark 10 series. Telecom operators are making efforts to keep up with operators like Globe Telecom, which recently rolled out its 5G services at 66 more sites. However, 5G infrastructure development is still slow in the Philippines and is mainly centered around urban areas like Greater Manila, Cebu and Davao.

Outlook

Inflationary pressures have been decreasing in the Philippines, thus giving some relief to consumers. While we may see another quarter of YoY decline, demand is likely to increase, especially with online and offline channel promotions. The premium segment is also expected to do well as Apple and Samsung launch premium models in the coming quarter.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Glen Cardoza

Follow Counterpoint Research

Research Analyst Tanvi Sharmasaid, “Businesses tried to increase the pace of their digital efforts to keep up with the continued expansion of cashless payments and e-commerce. Smartphone brands offered heavy discounts and exclusive schemes in the 9.9 Super Brand Day Sale. Besides, consumers were seen rapidly moving towards 5G-enabled smartphones.”

Research Analyst Tanvi Sharmasaid, “Businesses tried to increase the pace of their digital efforts to keep up with the continued expansion of cashless payments and e-commerce. Smartphone brands offered heavy discounts and exclusive schemes in the 9.9 Super Brand Day Sale. Besides, consumers were seen rapidly moving towards 5G-enabled smartphones.”