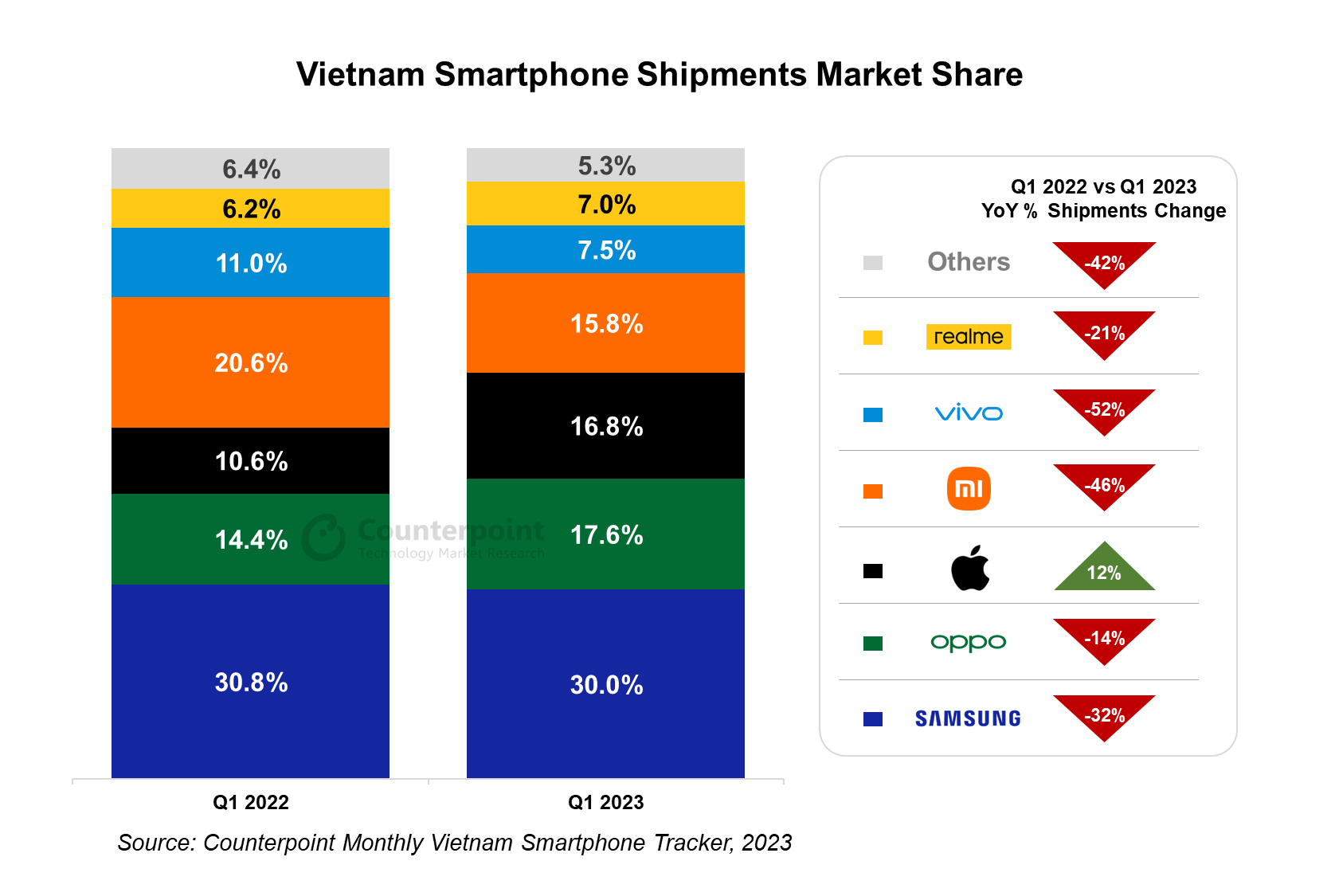

- Samsung led the market in Q1 2023 with 30% share, Apple was the only brand to grow YoY

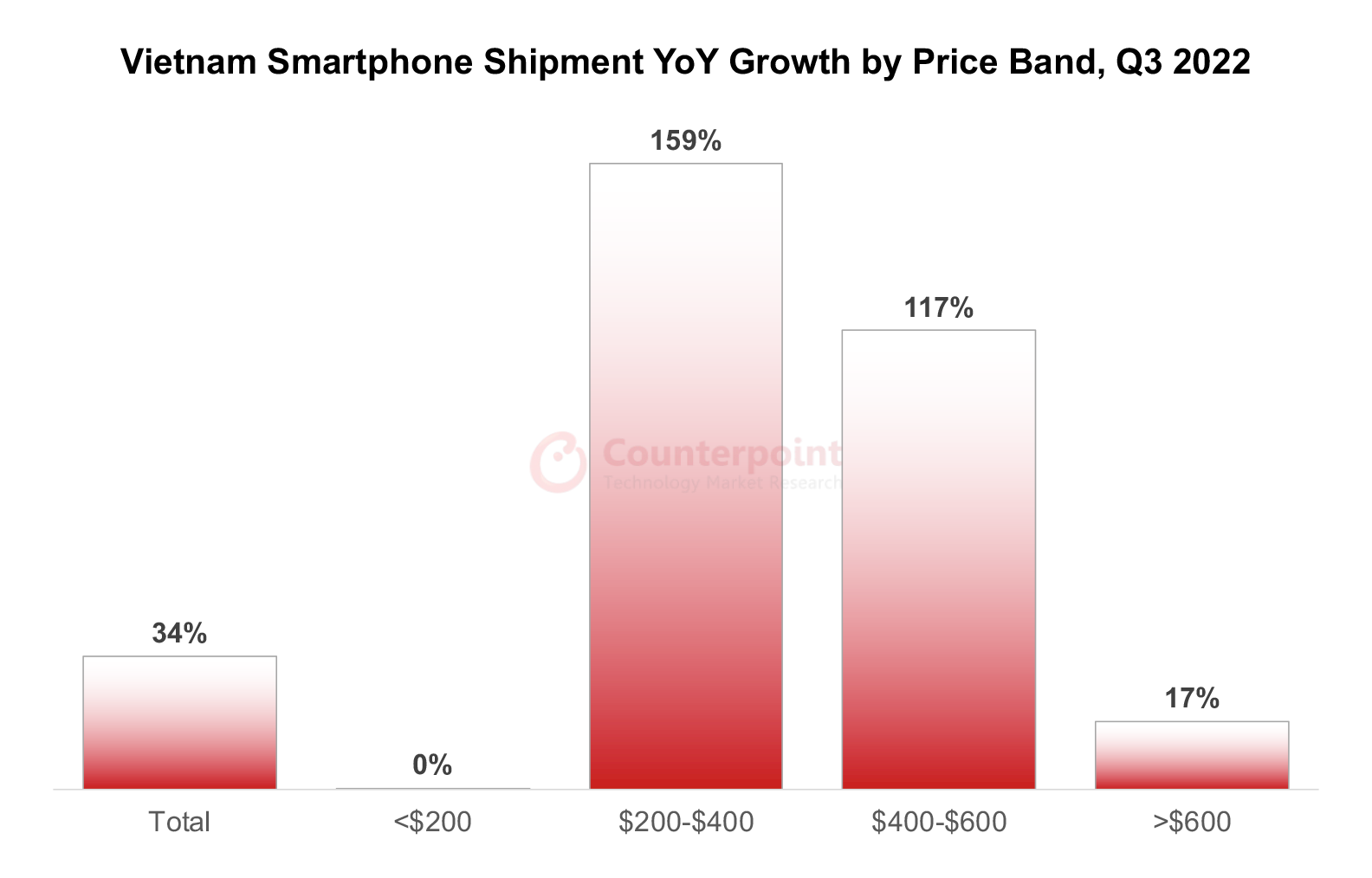

- >$600 price band captured record high 24% shipment share in Q1 2023

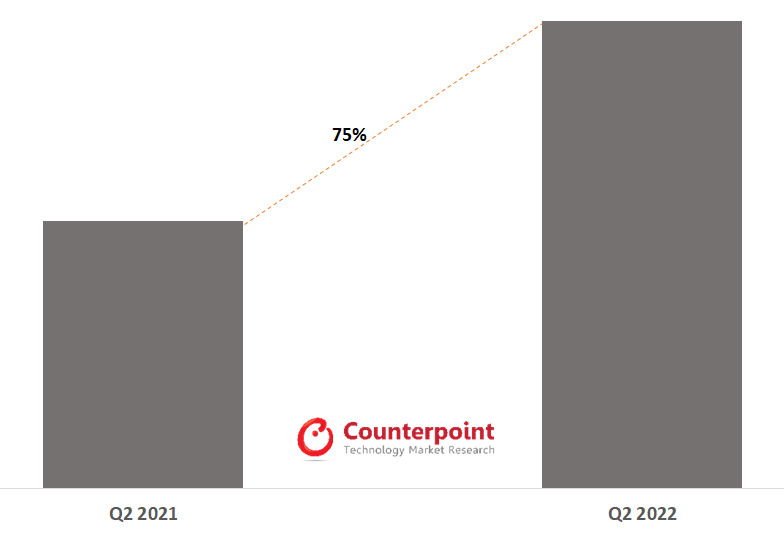

- 5G smartphone shipments increased 18% YoY in Q1 2023, despite overall fall in shipments

- 在200至400美元价格区间,5 g出货than doubled YoY

Jakarta, Hong Kong, London, Boston, Toronto, New Delhi, Beijing, Taipei, Seoul – May25, 2023

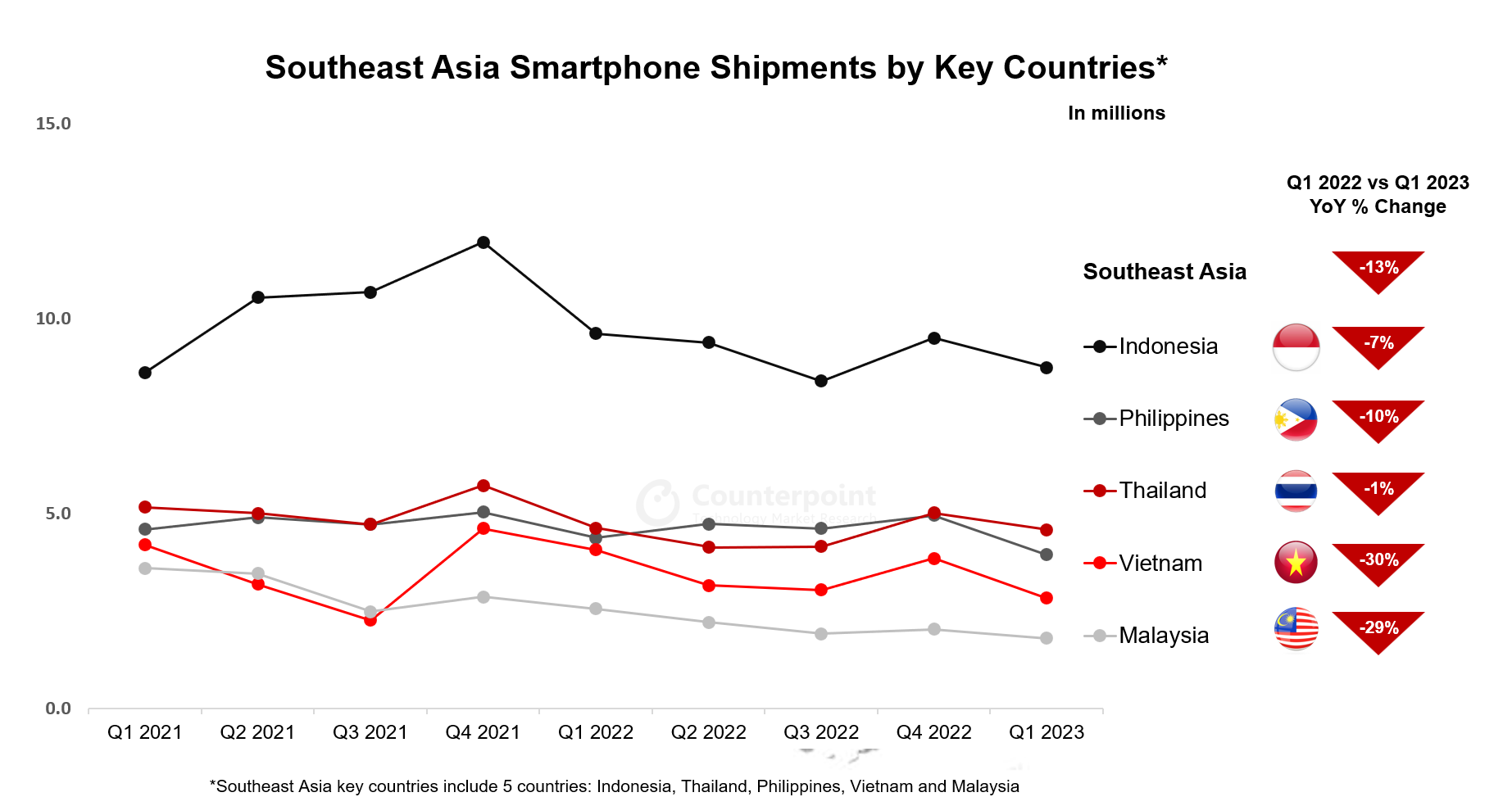

Vietnam’s smartphone market declined 30% YoY in Q1 2023, according toCounterpoint Research’s Vietnam Smartphone Channel Share Tracker, marking the industry’s worst Q1 decline ever. Poor macroeconomic conditions and weak consumer demand constrained the country’s smartphone market as people delayed their smartphone purchases during the period.

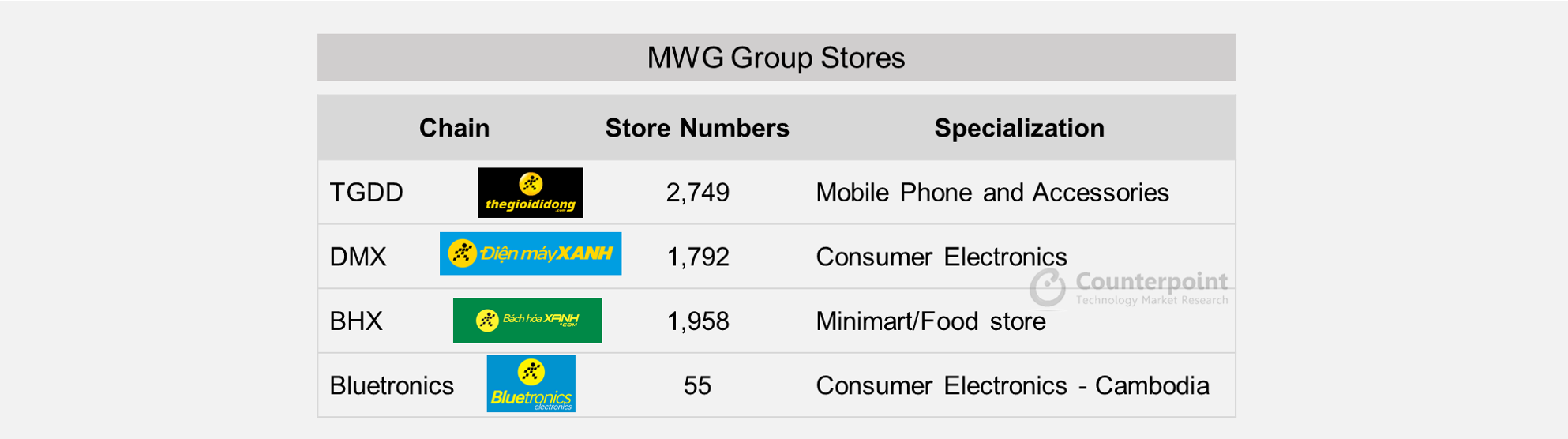

Vietnam’s GDP grew 3.3% in Q1 2023, one of its lowest numbers in recent years. Investment into the country declined as FDI volumes were reduced. Citing poor business conditions, retailers had to scale back their expansion plans and re-evaluate their business strategies. Retail stores operated for fewer hours, which reduced the employees’ working hours and their incomes as well. Footfall in the retail stores was also quite low after Vietnam’s Tết festival in January.

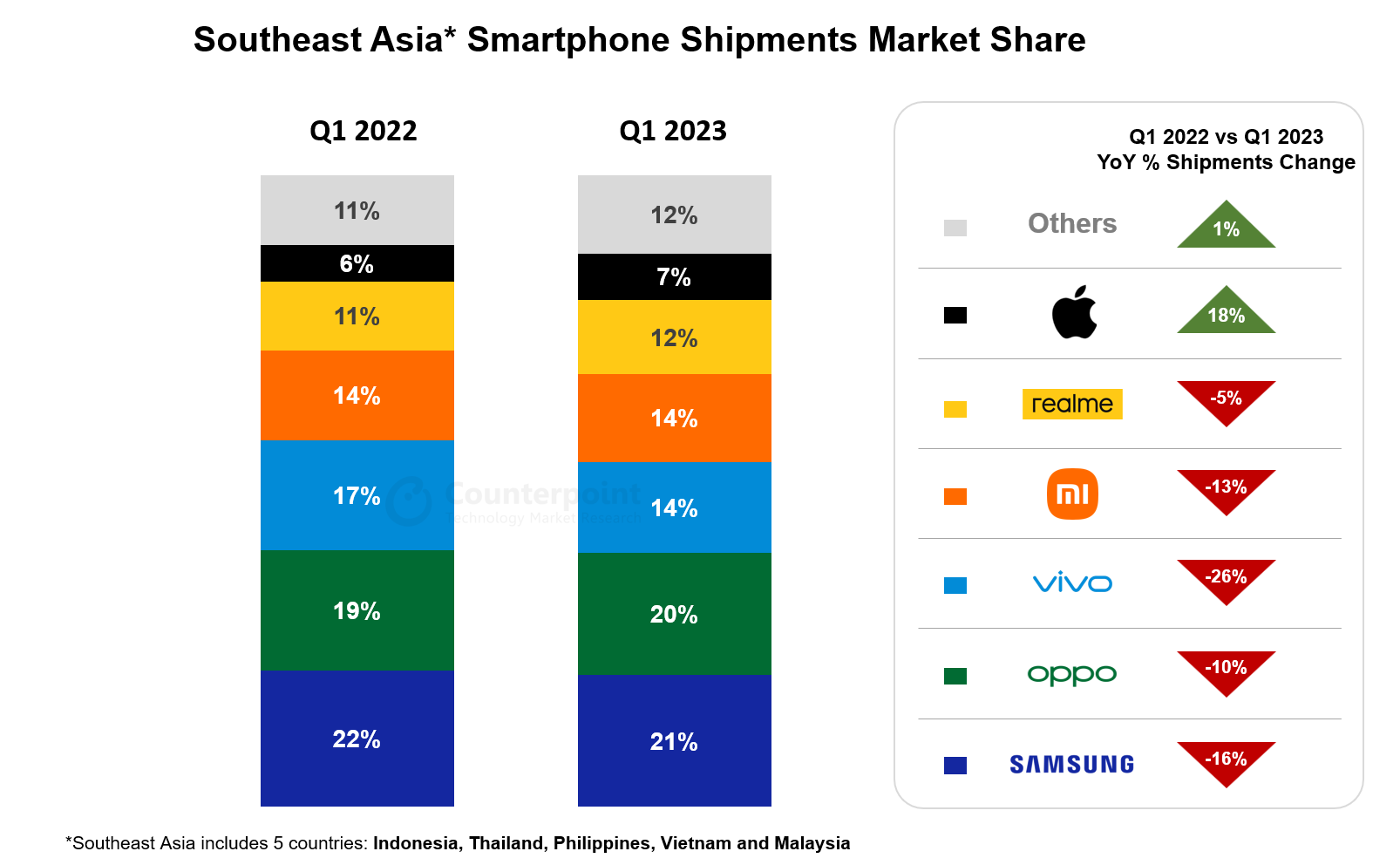

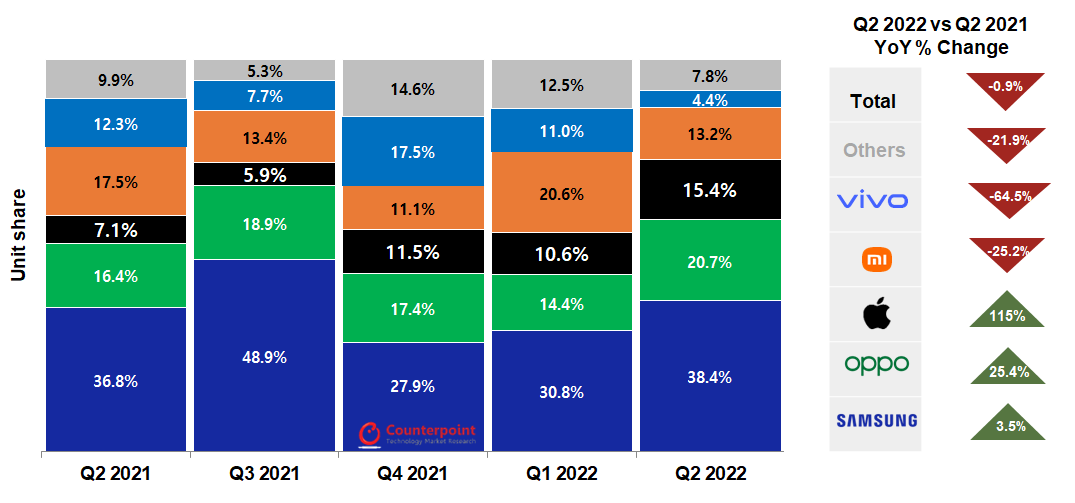

OEMs initially misread the demand, leading to inventory buildup in the channels, after which retailers tried to push thesmartphonesat discounted prices to clear the inventory. All the top OEMs except Apple witnessed a YoY decline in shipments in Q1 2023.

Senior Analyst Glen Cardozasaid, “The demanding situation in the Vietnam smartphone market is unlikely to be resolved in Q2 2023. It will take some time for the smartphone market to recover in light of the difficulties that the economy has suffered. Vietnam, being one of the top global exporters of smartphones, will also look for the global economy to stabilize. When the situation starts to improve by the end of 2023, the market may benefit from the pent-up demand, especially in the lower-price segments.”

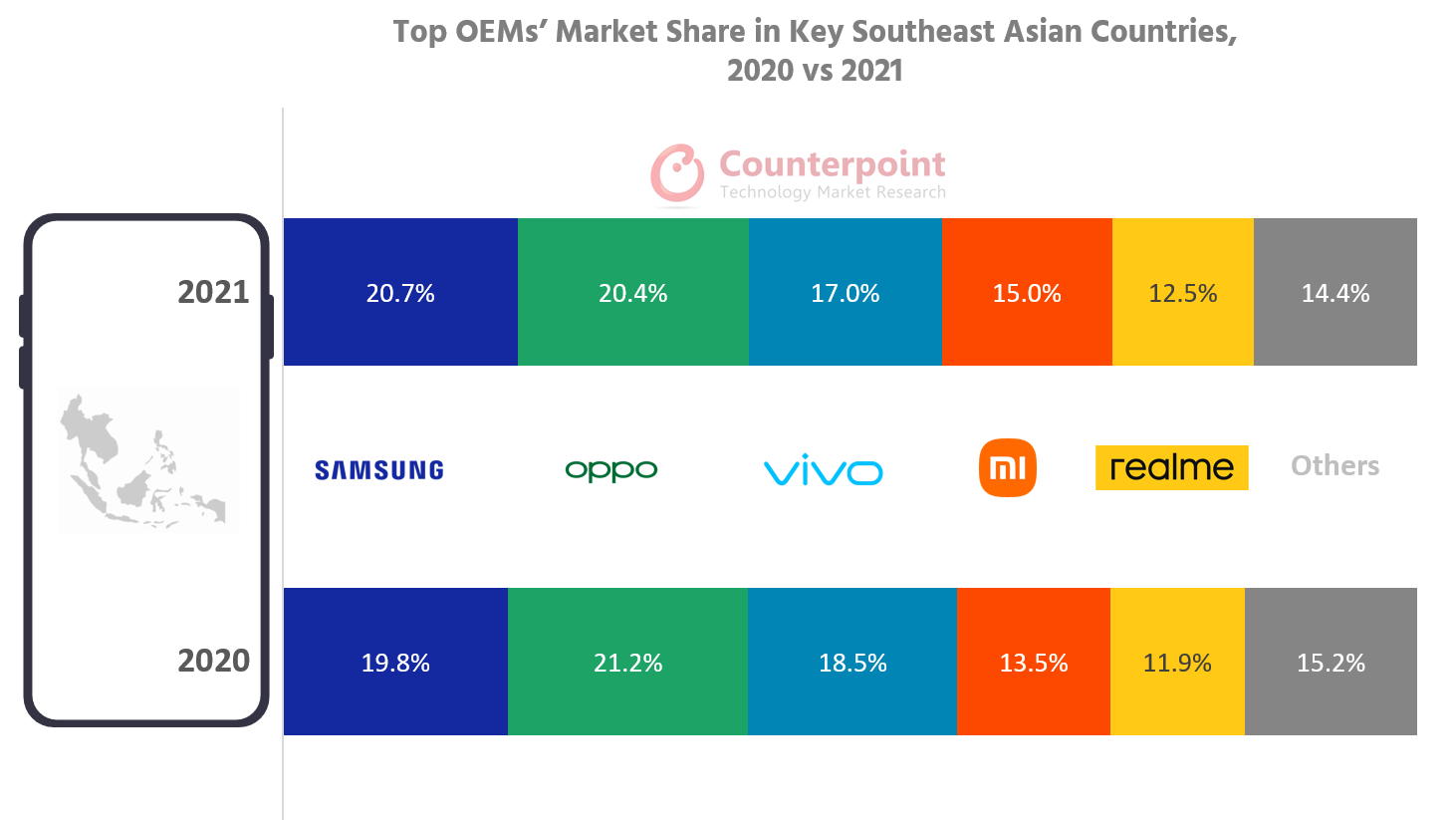

三星是顶级品牌2023年一季度30%的market share, despite a 32% YoY fall in in shipments during the quarter. Samsung ranked foremost because if its better portfolio and competitive models. The Galaxy A04 was the top model in the <$200 price segment and was very popular among consumers. In the $200-$400 price segment as well, Samsung captured seven of the top 10 spots in Q1 2023, led by the Galaxy A14 5G. These two were the top price bands in Vietnam during the period with a combined shipment share of 71%. This dominance of lower price bands and customers’ preference towards global brands rather than Chinese brands helped Samsung maintain its leadership position in the market.

For OPPO, the A17 series has been popular since its launch in Q4 2022. The OPPO A17 and A17k together accounted for 24% of all OPPO shipments in Q1 2023. With an increasing share in the >$600 price band, OPPO launched theFind N2 Flipin Vietnam as well. The model was available at a discount of up to $200 on pre-booking to combat the ever-increasing pricing competition in the higher-price segment.

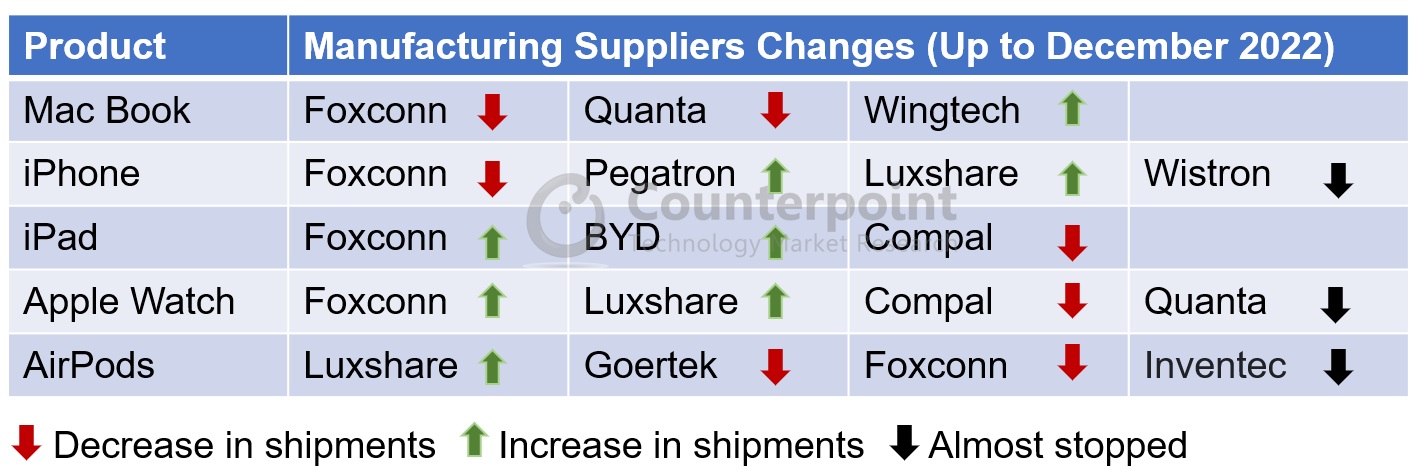

Appleclimbed to third place in Q1 2023. There was high demand for the iPhone 14 Pro series early in the quarter, which eventually fizzled out. Apple unexpectedly cut iPhone prices during the quarter to boost demand and clear the high inventory in channels. The price of the iPhone 14 Pro Max was lowered by an average of 12% in Q1 2023 compared with its launch price. Due to the reducediPhoneprices, Apple shipments increased 12% YoY in Q1 2023. This helped the >$600 price band capture a 24% share of the market in Q1 2023, compared to just 17% in Q1 2022.

Meanwhile, Xiaomi and vivo faced a difficult Q1 2023, declining 46% YoY and 52% YoY, respectively. Demand in the <$200 price band declined in Q1 2023 with shipments falling 38% YoY. The two brands each lost market share during the quarter as both have high exposure to this price band.

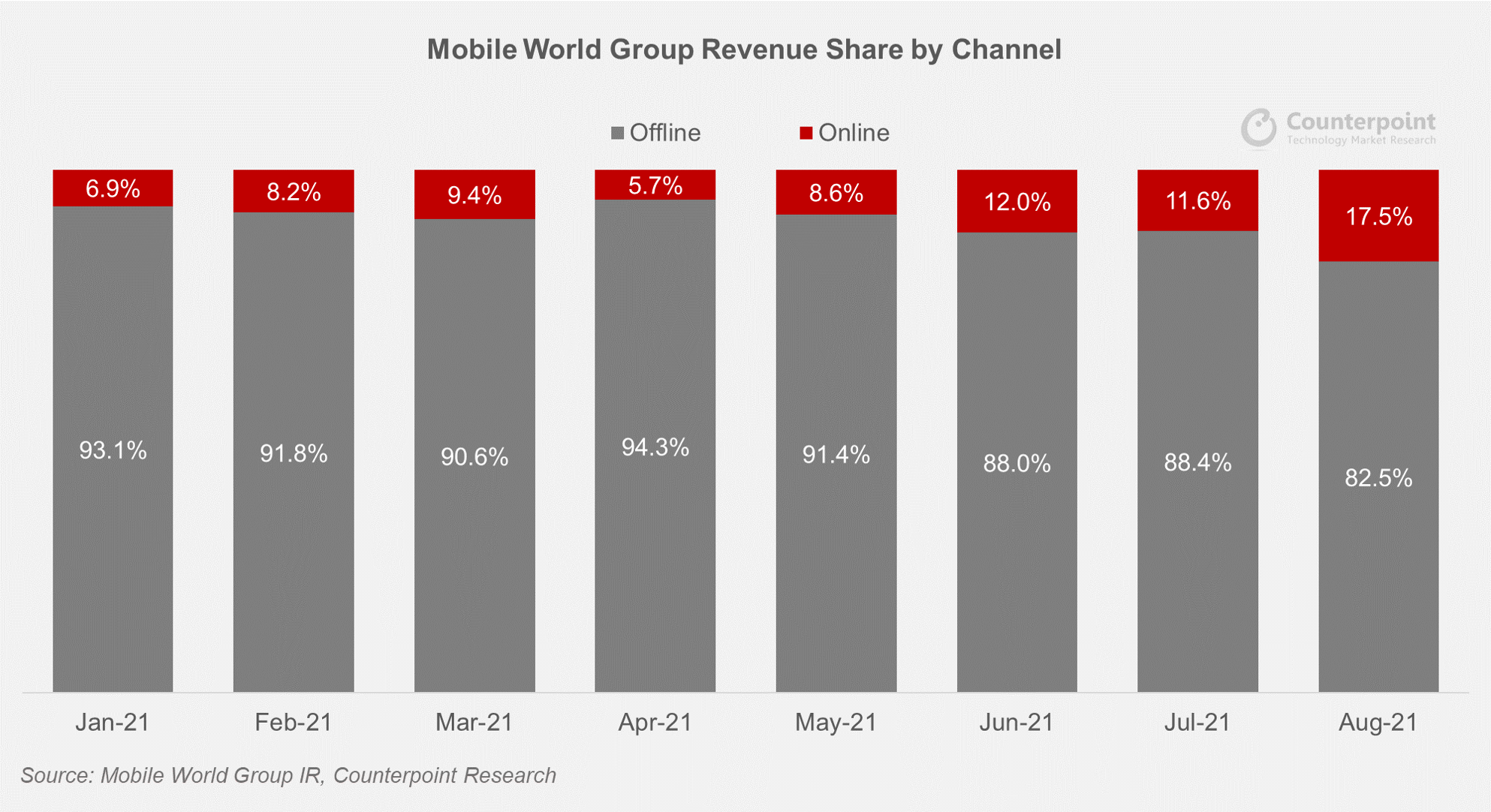

Online shipments’ share fell to 15% in Q1 2023 from 17% in Q4 2022, as promotional activities on online channels were reduced after the festive period. With offline retail chains offering discounts and price cuts on premium devices as well, e-commerce platforms struggled to attract customers.

The Vietnamese government considers5G connectivityas a crucial factor in the pursuit of digital transformation. It aims to have 100% of the population’s devices connected to a 5G network by 2030. 5G smartphone shipments are on the rise, climbing 18% YoY in Q1 2023. Although shipments of 5G smartphones in the below $200 retail price segment are yet to pick up the pace, 5G smartphone shipments in the $200-$400 price band doubled in Q1 2023 from that in the year-ago quarter.

Outlook:

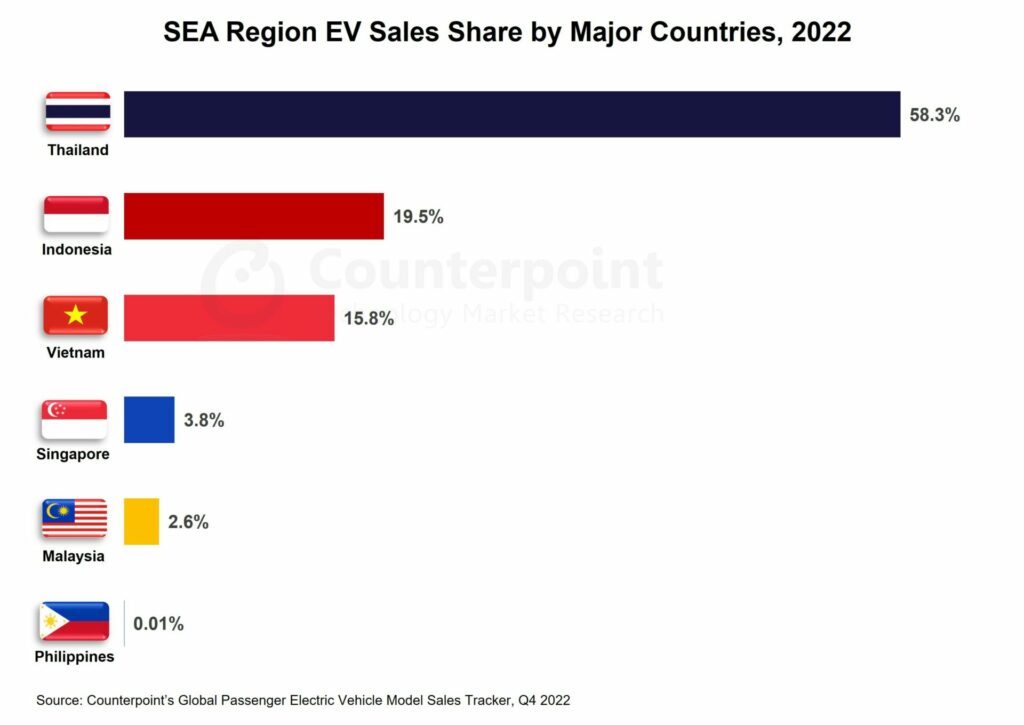

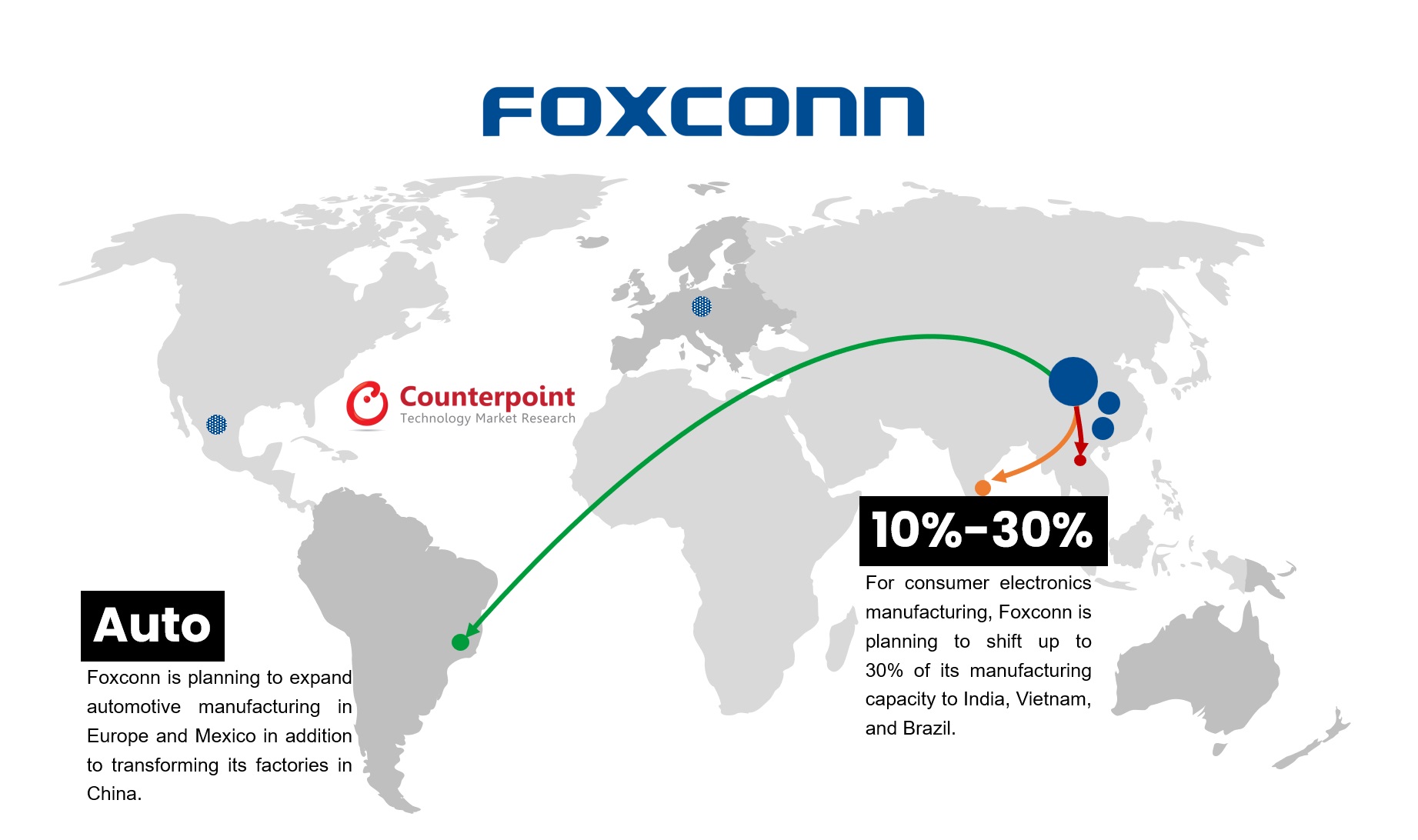

Vietnam has been one of the worst affected countries by the low consumer demand and inventory pileup inSoutheast Asia. Consequently, the recovery time for the country’s smartphone market is also likely to be longer. Vietnam’s smartphone market is expected to remain flat in 2023 compared with the year-ago period. Once the Vietnamese government commercializes 5G, new opportunities will arise in Vietnam from a manufacturing and investment perspective and will be one of the main drivers of the country’s economic revival.

Analyst Contacts

Glen Cardoza

Shubham Nimkar

Follow Counterpoint Research

Related Posts

Global Smartphone Market Declines 14% YoY in Q1 2023; Apple Records Highest-Ever Q1 Share

- Apple Shines in a Declining Southeast Asia Smartphone Market

Festive Season Restricts Decline in Indonesia Smartphone Shipments to 8.1% YoY in Q1 2023

Survey: 72% of Smartphone Users in India Experience Low-battery Anxiety

In July this year,

In July this year,