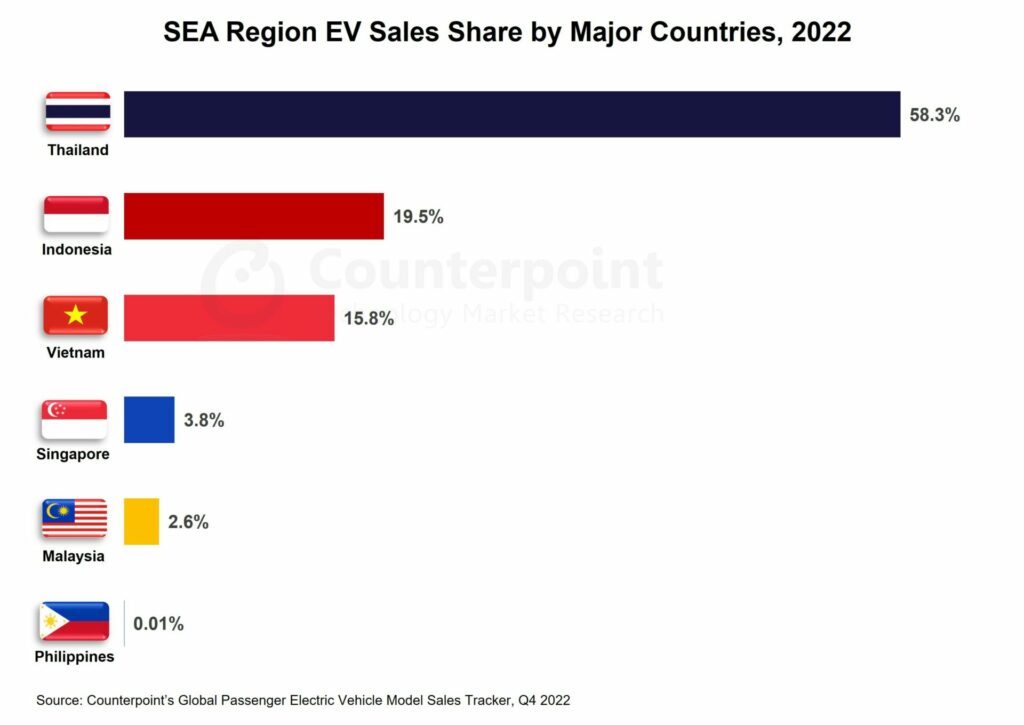

- Thailand led the region’s passenger EV sales in 2022 with a 58% share.

- Nearly two in three EVs sold in 2022 were BEVs.

- Wuling’s newest model Air EV was the region’s bestseller.

New Delhi,London,San Diego, Buenos Aires, Hong Kong, Beijing, Seoul –3月31日, 2023

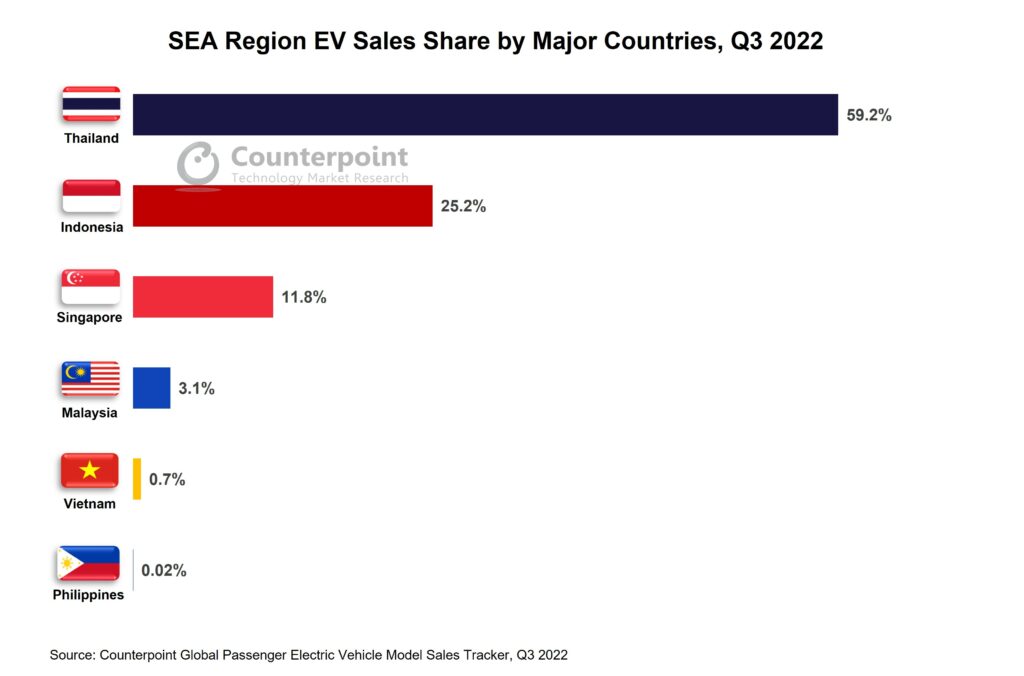

Passenger electric vehicle (EV*) sales** in Southeast Asia (SEA#) accounted for just under 2% of the region’s total passenger vehicle sales in 2022, according to the latest research from Counterpoint’sGlobal Passenger Electric Vehicle Model Sales Tracker.Thailandwas the most advanced, accounting for 58% of the region’s EV sales, followed byIndonesiaandVietnam.Thailand’s government has been pushing EV sales through demand-side incentives and corporate income tax incentives for EV manufacturers.

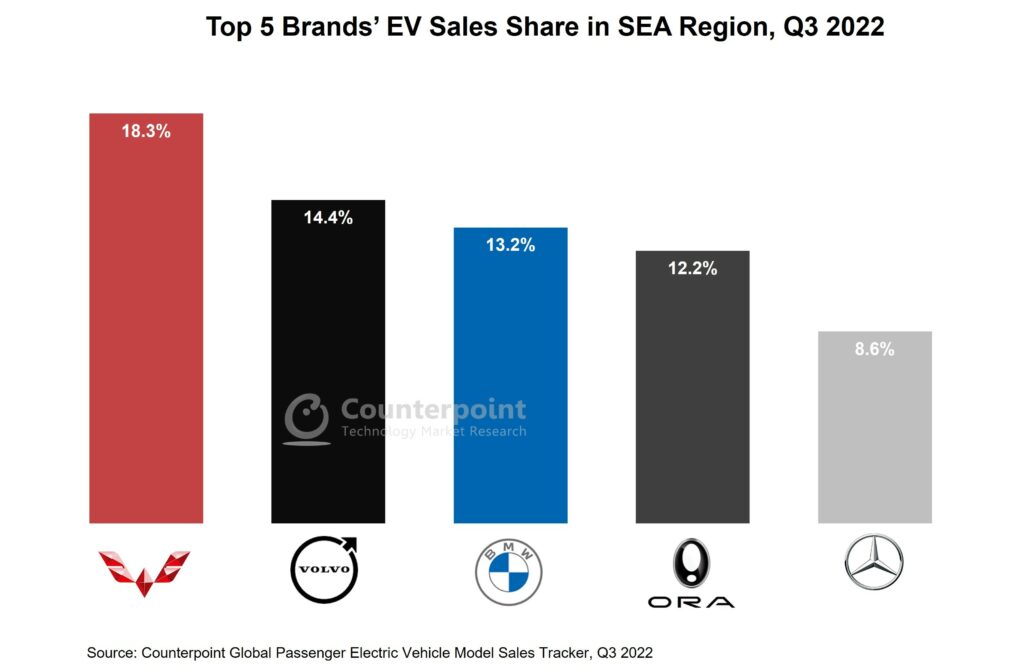

Wuling’s Air EVwas the best-selling model across the region in 2022, being one of the most affordable EV options. In terms of automotive groups,Vingroupled the SEA EV sales, closely followed byWuling(part of SAIC-GM-Wuling group) andVolvo(Geely Holdings subsidiary). Battery EVs (BEVs) represented 64.6% of the total EV sales while plug-in hybrid EVs (PHEVs) constituted the rest.

Wuling’s Air EVwas the best-selling model across the region in 2022, being one of the most affordable EV options. In terms of automotive groups,Vingroupled the SEA EV sales, closely followed byWuling(part of SAIC-GM-Wuling group) andVolvo(Geely Holdings subsidiary). Battery EVs (BEVs) represented 64.6% of the total EV sales while plug-in hybrid EVs (PHEVs) constituted the rest.

Commenting on the market dynamics,Research AnalystAbhilash Guptasaid, “Passenger EV demand is increasing gradually across the SEA region but sales are tiny compared toglobal EV sales, constituting just 0.5% of the global total for 2022. However, as geopolitical tensions are rising between China and the West, SEA is becoming an attractive option for Chinese auto manufacturers looking to expand abroad. Therefore, we can expect to see more production plants in SEA in the longer term, which will help boost EV sales.Thailandhas the largest auto manufacturing sector in SEA. It is aiming to leverage its manufacturing expertise to attract automakers to produce and sell EVs there.IndonesiaandVietnamhave the advantage of mineral resources, which gives them an edge over others in the region. The SEA countries have set lofty EV targets and have introduced many incentives to promote EV adoption among consumers and to attract EV manufacturers to set up bases.”

Commenting on the market outlook,高级分析师Soumen Mandalsaid, “Although EVs are currently a niche market in SEA, we do expect their sales to double in 2023. However, it will be difficult for the SEA countries to achieve theirEV targetsand increase the share of renewables in the electricity grid at the same time.

SEA countries have the opportunity to display their manufacturing capabilities and grow, given the interest of many international auto manufacturers to invest in the region. Those that enter the market early will have an edge, allowing them to secure a substantial share of the market. The SEA region could adopt the approaches taken byChinaandEurope, which provide incentives based on CO2emission levels. Doing so would encourage both consumers and manufacturers to shift towards more environment-friendly vehicles.”

*For EVs, we consider only BEVs and PHEVs. This study does not include hybrid EVs and fuel cell vehicles (FCVs).

**Sales refer to wholesale figures, i.e., deliveries from factories by the respective brands/companies.

#SEA includes Indonesia, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam.

The comprehensive and in-depth ‘Global Passenger Electric Vehicle Sales Tracker, Q1 2018-Q4 2022’ is now available for purchase atreport.www.arena-ruc.com.

Feel free to reach us at press@www.arena-ruc.com for questions regarding our latest research and insights.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Soumen Mandal

Brady Wang

Peter Richardson

Counterpoint Research

Related Posts

- One in Four Cars Sold in China in 2022 Was an EV With BYD Powering Country’s Outperformance

- Berlin Factory Takes Tesla to Top Spot in Europe EV Sales as Chinese Brands Gain Ground

- Global Electric Vehicle Sales Crossed 10 Million in 2022; Q4 Sales up 53% YoY

- AI Voice Assistants to Push Success of Autonomous Driving, Software-defined Vehicle

- Tesla Reports Record Revenue, Deliveries in Q4 2022

- Thailand Leads Southeast Asia EV Market With 60% Share

- Mercedes Fends off VW in Europe EV Market

- BYD Widens Gap with Tesla in Q3 2022, Leads Global EV Market

- China Q2 EV Sales Almost Doubled YoY, Despite a Weak Quarter

- Tesla’s stellar Q3 performance

- China EV Charging Points Soar 56% YoY in 2021; 42% CAGR Seen for 2022-2026

- One in Two Cars Sold Will Have Electric Powertrain by 2030

- ADAS Penetration Crosses 70% in US in H1 2022, Level 2 Share at 46.5%

- LiDAR Now High on Automotive Industry Radar