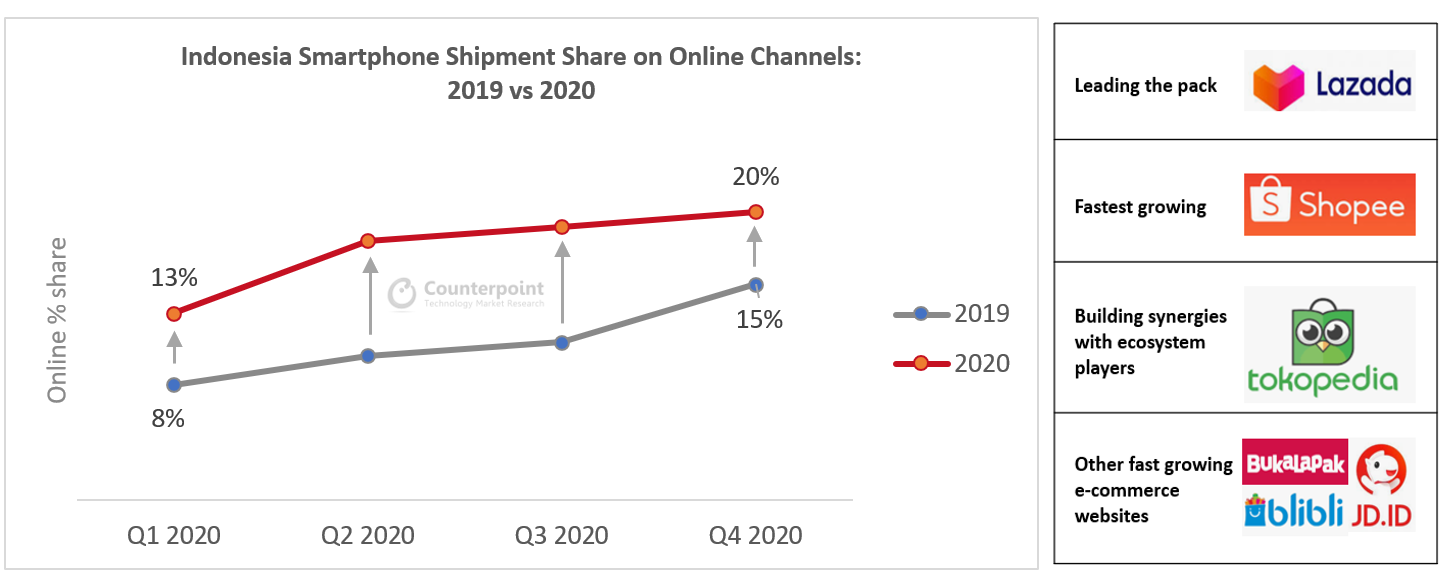

Online Channels Grab Record 20% of Indonesia Smartphone Sales in Q4 2020

- Xiaomi and realme led in Indonesia’s online channel sales in Q4 2020.

- Online sales increased YoY across all four quarters in 2020.

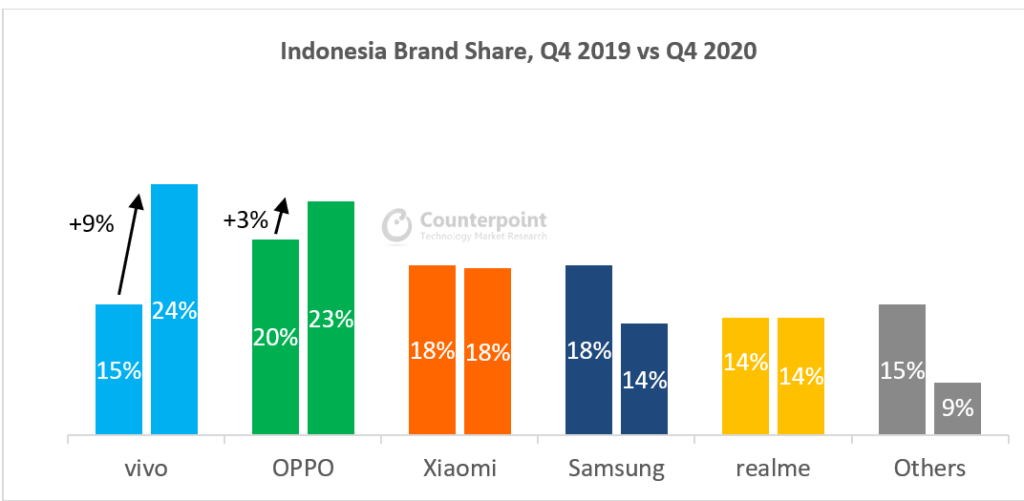

- Indonesia’s smartphone market grew 23% YoY in Q4 2020.

- With increasing investments, the Indonesian ecosystem is gearing up for higher smartphone demand and supply.

London, San Diego, New Delhi, Beijing, Buenos Aires, Seoul, Hong Kong – March 22, 2021

Overall smartphone online sales inIndonesiareached their highest point in Q4 2020, according to the latestCounterpoint Channel Share Tracker. Brands in Indonesia started focusing their energies on online channel sales quite early in 2020.

Senior Analyst Glen Cardozasaid,“将尽可能多的股票quarters and benefit from the pent-up demand in Q3 and Q4, most brands already had their online partners working towards an aggressive array of online campaigns. All this took the online proportion of smartphone sales much higher than expected, with a record 20% of the Q4 2020 sales coming from the online mode.Xiaomiandrealmeled the online sales as a proportion to their total sales in 2020. Having said that, all brands have different strategies of using offline and online channels to their benefit. The online push, however, is here to stay.”

Source: Counterpoint Channel Tracker Q4 2020

Thee-commercesector in Indonesia has strengthened since 2019. Big brands like Lazada still rule. Shopee saw the highest growth in 2020, but there are others who are eyeing a bigger slice of the online pie as well.Cardozasaid, “There is an increased presence of smaller e-commerce platforms like Bukalapak, Blibli, Akulaku, andJD.ID. There have also been initiatives to form synergies across allied sectors. Online marketplaces are looking to build competencies by partnering with other ecosystem players. This will lead to an enhanced and more matured ecosystem that will support higher distribution and sales, even in geographically challenging locations. ActiveChinese探讨了tment in the region’s5Ginitiatives and e-commerce sector will bring about a much-needed capital boost for this economy.”

With a population of more than 270 million, Indonesia leads theSEAregion as its biggest economy. The country has a strong and fast-growing智能手机-savvy consumer base. Despite still dealing withCOVID-19and related issues, Indonesia saw its smartphone sales going up 23% YoY in Q4 2020. vivo led the brand share focusing on the IDR 1.5 million to 3 million range.

Source: Counterpoint Channel Tracker Q4 2020

Research Analyst Tanvi Sharma said,“Brands likeOPPOandvivohave continued their efforts to strengthen offline networks across the country. On the other hand, brands like Xiaomi and realme are actively focusing on both offline and online channel networks. Chinese brands in Indonesia consistently gave Samsung a tough competition in 2020.”

Sharmaadded, “Indonesia being a price-sensitive market, brands have shown a consistent focus on launching economically priced models. They have, however, also increased their offerings in the mid-range brackets. Specific price ranges made up the bulk of smartphone volumes sold. Models like the OPPO A15 and A11K, and the vivo Y12i and Y20 sold most.”

OEMs are looking at a partially untapped market in Indonesia which is on its way to growing further. Besides, there is still a big portion of the handset-using population that relies on feature phones. This is another opportunity for the country’s smartphone players.

Background:

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Glen Cardoza

Tanvi Sharma

Follow Counterpoint Research

press(at)www.arena-ruc.com