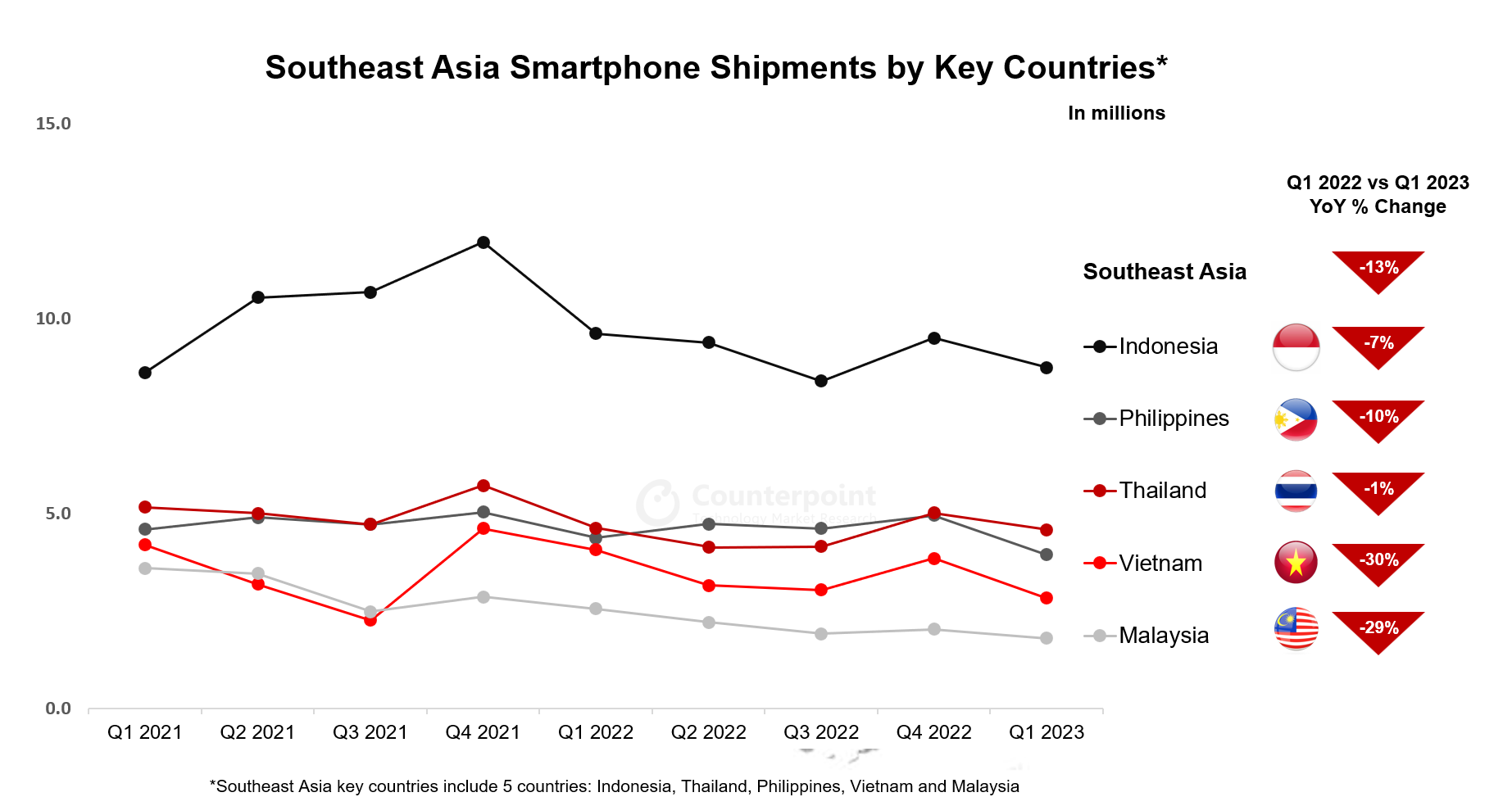

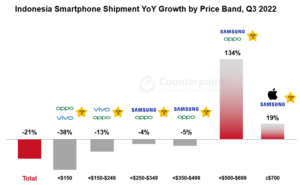

- Indonesia’s smartphone shipments declined in Q2 2023 due to macroeconomic headwinds.

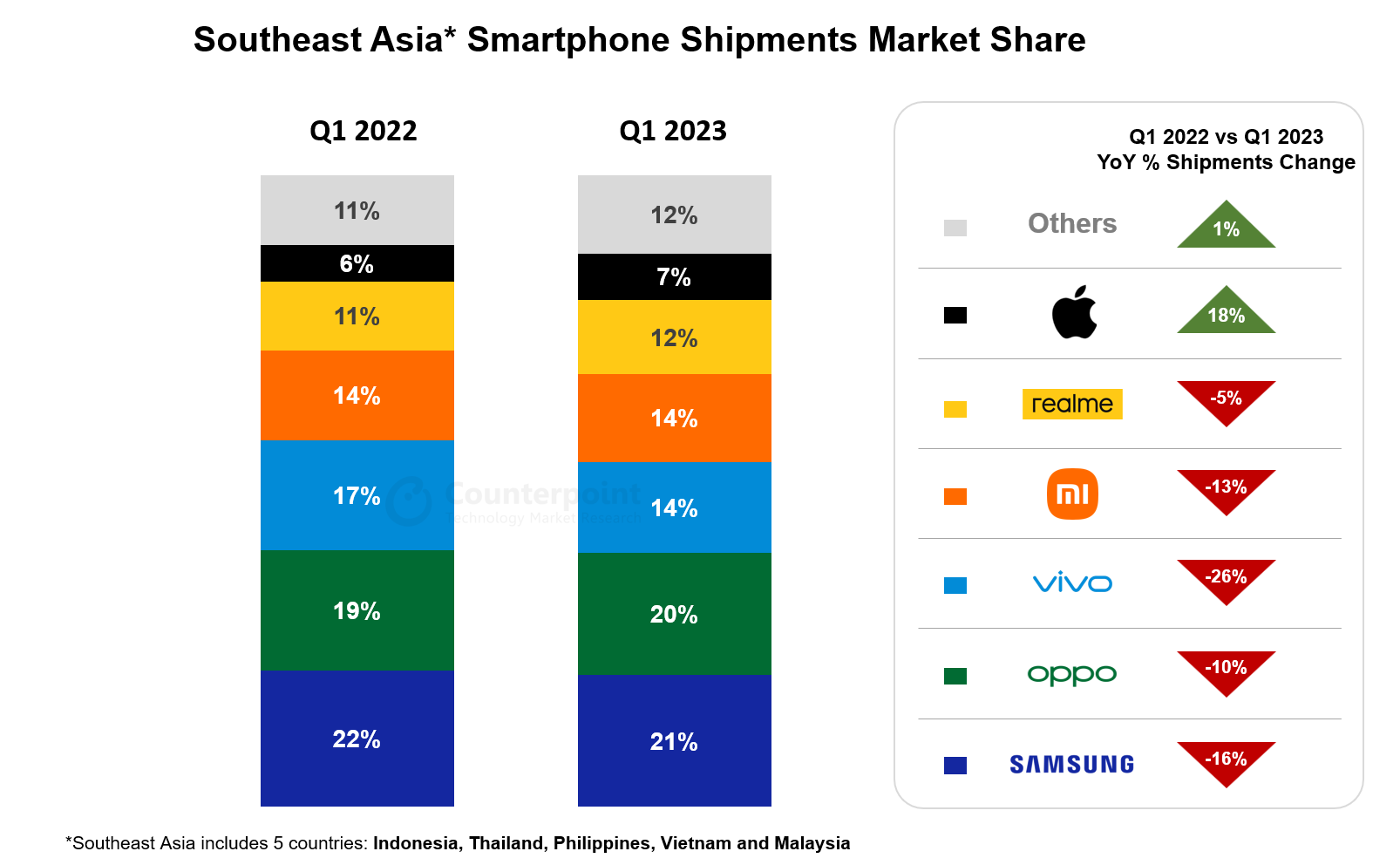

- OPPO overtook Samsung to recapture the top spot with a 21% share.

- Top OEMs except Infinix recorded declines. Infinix’s shipments grew 17% YoY.

- Xiaomi’s shipment decline softened to 12% YoY in Q2 2023.

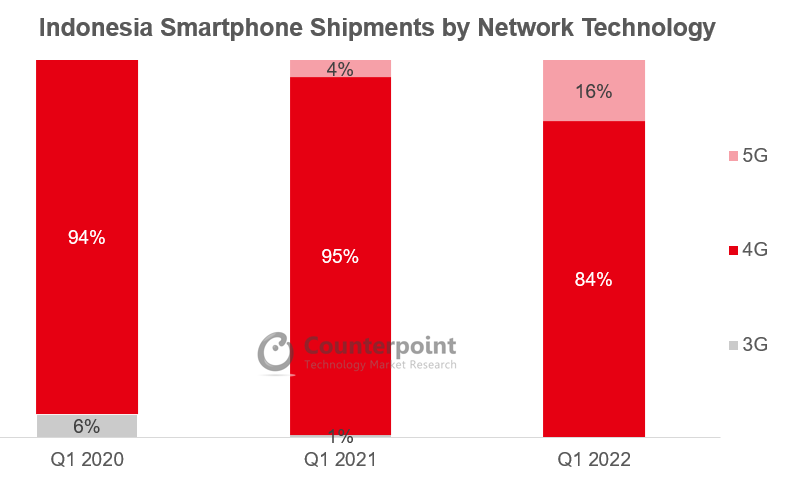

- 5G smartphone shipments in the <$400 price band increased 11% YoY.

Jakarta, London, Boston, Toronto, New Delhi, Beijing, Taipei, Seoul – August 14, 2023

Withmacroeconomicheadwinds continuing to impact demand, Indonesia’s智能手机shipments declined 10% YoY in Q2 2023, according to Counterpoint’sMonthly Indonesia Smartphone Tracker. The increase in shopping activity during the Eid al-Fitr festivities in April was also lower than last year. Promotions such as price discounts, bundled offers and installment and trade-in schemes failed to have the desired impact on sales. Consumers’ buying interest shifted to accommodating the increased price of commodities like fuel, and household and personal products, along with services availed during the festival season, such as travel.

Indonesia Smartphone Shipments Market Share by OEM, Q2 2022 vs Q2 2023

OPPOrecaptured the top spot inthe marketin Q2 2023 with a 21% share,largely supportedby its low-endmodels intheA17 series.The brandcontinued its aggressive marketing campaign and the models released in the previous quarter, such as the Reno8 T series and Find N2 Flip, had a spillover effect on its visibility in the market. The Galaxy A04 series made a significant contribution toSamsung’s volumes, restricting the brand’s shipment share decline to just 1% point.

Among topOEMs, onlyInfinixsaw an increase in its shipments, at 17% YoY. The brand focused on the <$200 price band, offering better specifications in its models. Besides, Infinix was aggressive with its marketing activities to increase awareness and visibility for the brand. Its newly launched products, such as the Note 30 series, Hot 30 series and the Smart 7 series, contributed significant volumes to the brand’s overall shipments.

Xiaomi’s shipment decline significantly softened to 12% YoY in Q2 2023 from 47% YoY in Q2 2022. Recent initiatives indicated thatXiaomihad worked on strengthening its supply and distribution. The OEM made strong marketing moves during the quarter, such as new product launches and rejigging of discount schemes. Xiaomi sub-brand Redmi’s performance was driven by its newly launched models, especially the Redmi A2 series and Redmi Note 12 series.

5G智能手机shipments in the <$400 price band increased 11% YoY in Q2. Key OEMs in this segment included Samsung with its Galaxy A14 5G, A23 5G and A34 5G series and Xiaomi with its Redmi Note 12 series. Newcomer iQOO Z7 5G series also joined this segment.

Outlook

Looking ahead, we expect a continued macroeconomic recovery in H2 2023 to lift the smartphone market.Senior Analyst Febriman Abdillahsaid, “Price becomes more crucial considering the current macroeconomic climate, which has increased commodity prices. Giving incentives to consumers, like discounts, bundled offers, bonuses and trade-in schemes, can be one option to keep the market attractive. The incentives may even be relevant for the mid-range and premium segments.”

At the brand level, Xiaomi’s new initiatives to bring prices down may attract consumers and help the brand grow this year. Infinix may grow further as it becomes more popular in the market.

Feel free to contact us atpress@www.arena-ruc.comfor questions regarding our latest research and insights.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Febriman Abdillah

Follow Counterpoint Research

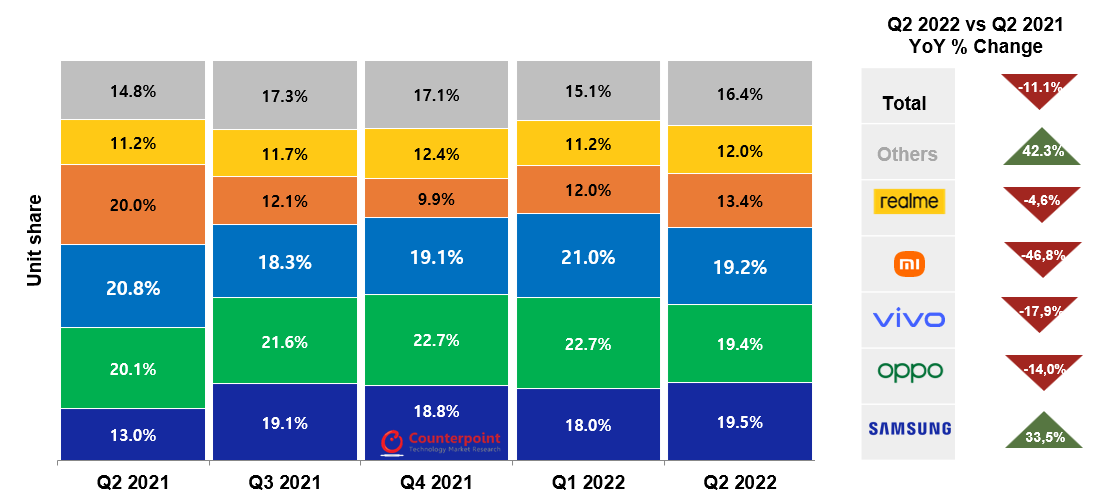

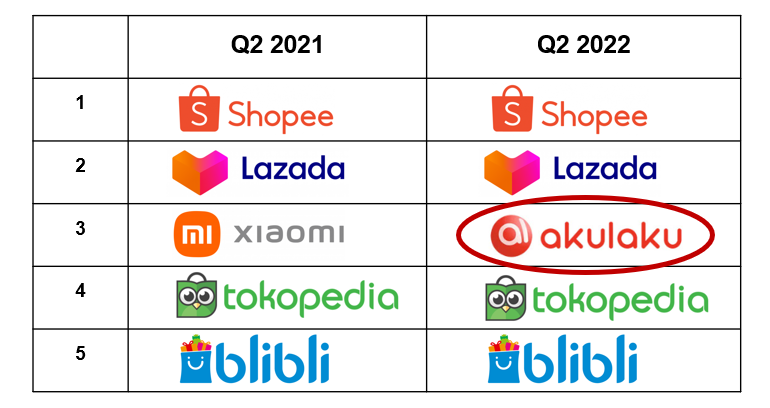

Source: Counterpoint Monthly Indonesia Channel Share Tracker, Q2 2022.

Source: Counterpoint Monthly Indonesia Channel Share Tracker, Q2 2022.

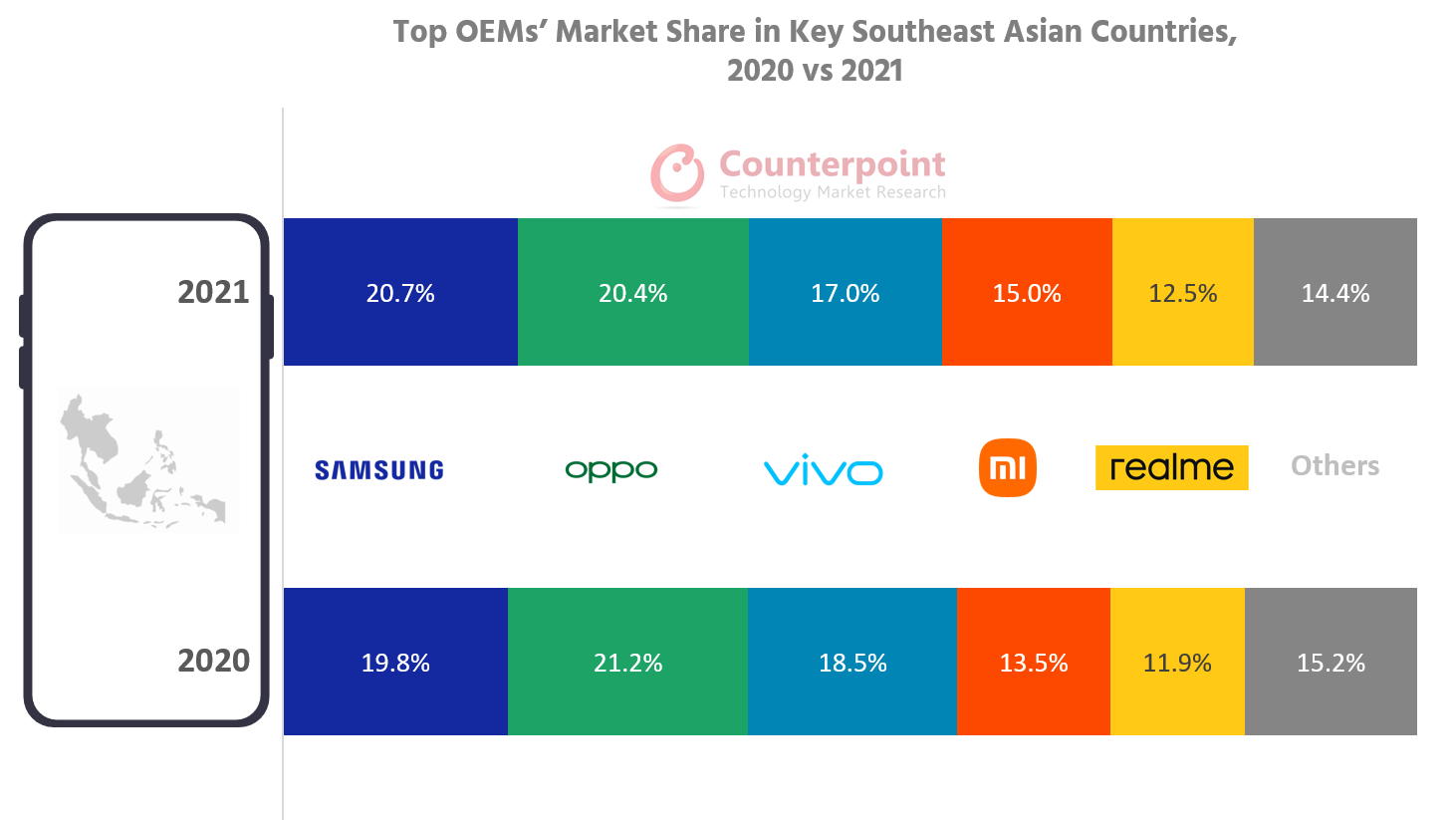

Commenting on the Indonesian smartphone market,Research Analyst Tanvi Sharma说:“等品牌相对应的人带来捆绑campaigns like Joy-Full, which provided benefits and after-sales promos. There were also strategic partnerships between major OEMs and e-commerce players, like between vivo and JD.com. Had it not been for the component shortages during the second half, the growth would have been even higher. To meet the challenge, brands focused on their mid-tier portfolios and increased the selling price in some cases to pass on the increased cost to the end consumer.”

Commenting on the Indonesian smartphone market,Research Analyst Tanvi Sharma说:“等品牌相对应的人带来捆绑campaigns like Joy-Full, which provided benefits and after-sales promos. There were also strategic partnerships between major OEMs and e-commerce players, like between vivo and JD.com. Had it not been for the component shortages during the second half, the growth would have been even higher. To meet the challenge, brands focused on their mid-tier portfolios and increased the selling price in some cases to pass on the increased cost to the end consumer.”