- The US remains the top market for Tesla followed by China and Europe.

- Aiming to develop an in-house AI ecosystem, Tesla has started building its own Dojo training supercomputer.

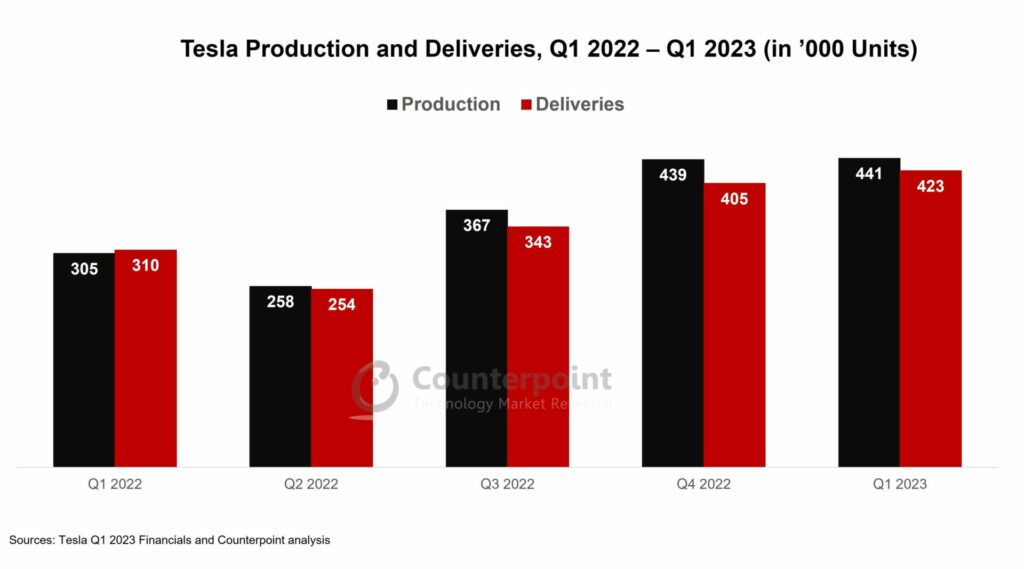

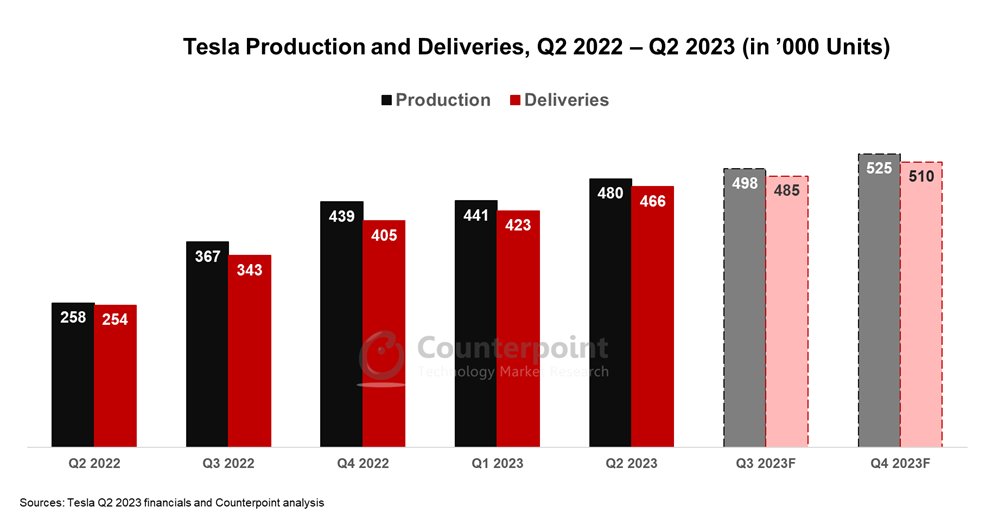

- With this growth trajectory, Tesla is expected to achieve sales of around 1.9 million units by the end of 2023.

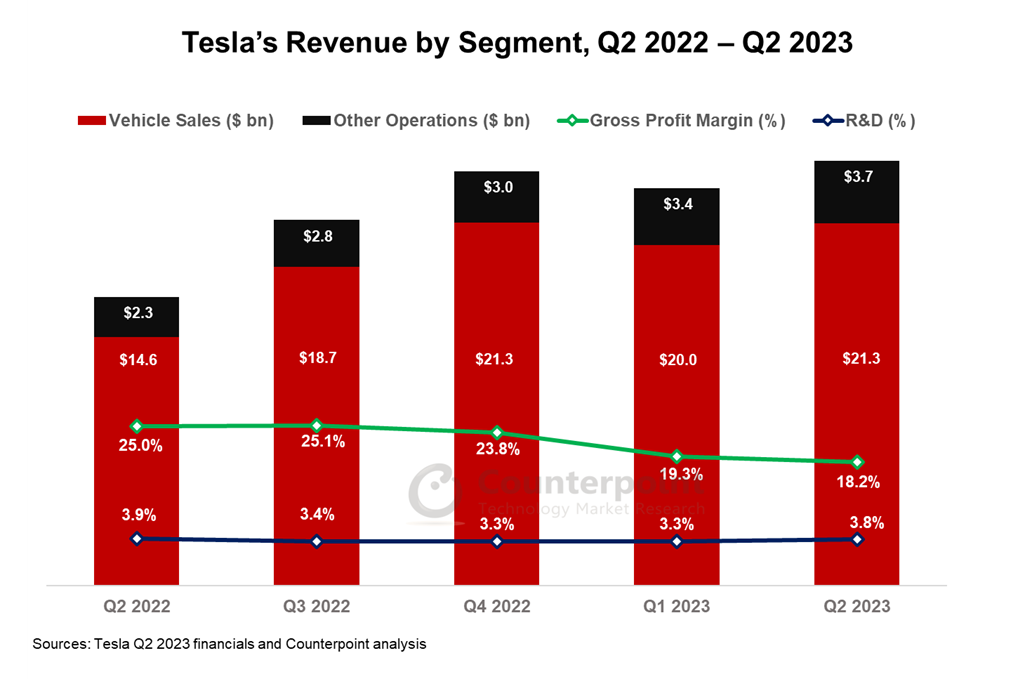

Teslaachieved remarkable results in Q2 2023, with its revenue growing 47% YoY to reach the record-breaking figure of nearly $25 billion. The company’s vehicle deliveries too hit a record at 466,915, growing 83% YoY. The US retained its position asTesla’s largest market, contributing to 37.6% of the total sales, whileChinaandEuropefollowed closely behind.Global price cutsfor the Model Y and Model 3, along with tax subsidies in the US and China, were two of the biggest drivers for Tesla’s Q2 sales.

Tesla CEO Elon Musk, during the earnings call, discussed a few key things like the long-awaited Cybertruck deliveries, Tesla’s advantage in competitive pricing of vehicles and the possibilities of attaining complete FSD:

Cybertruck delivery outlook

CEO:“Demand is so – so far, off the hook, you can’t even see the hook. So, that’s really not an issue. I do want to emphasize that the Cybertruck has a lot of new technology in it. Like a lot… So, always very difficult to predict the – the ramp initially, but I think we’ll be making them in high volume next year, and we will be delivering the car this year.”

Soumen Mandal’s analyst take:“麝香当然是夸大网络truck, not that it needs to anymore, but there is also significant expectation setting with discussions on internal production and supply chain hurdles. Is this another Model Y? That’s a tough act to follow, but the Cybertruck does bring a slew of unique parts and processes. So, longer term, we expect to see another products flywheel off from it.”

Tesla’s price cuts for its vehicles

CEO:“And we, you know — we just — we just course according to what the mood of the of the public is, you know. Buying a new car is a — it’s a big decision for vast majority of people. So, you know, anytime there’s economic uncertainty, people generally pause on new car buying, at least to see to see what happens.

And, you know — and then, obviously, another challenge is the — the interest rate environment. As interest rates rise, the affordability of anything bought with that decreases, so effectively increasing the price of the car. So, when interest rates rise dramatically, we actually have to reduce the price of the car because the — the interest payments increase the price of the car. So — and this is at least — at least up until recently was to believe the sharpest interest rate rise in history. So, we had to do something about that. And if someone’s got a crystal ball for the global economy, I really appreciate it. If I could borrow that crystal ball.”

Soumen Mandal’s analyst take:“Tesla’s strong supply chain and reduced cost of production due to low raw material cost, especially for lithium, has encouraged the company to reduce prices of its vehicles. Alongside what Musk described as ‘interest rate rises’, Tesla’s price reduction has made all variants of the Model 3 and Model Y eligible for IRA tax credit in the US, where it will benefit in the long term. So, macroeconomic policies and geopolitical relations play a crucial role in deciding such price reductions, incentives or discounts.”

Autonomy (FSD): Timing

CEO:“…the reason I’ve been optimistic [on achieving full self-driving] is what it tends to look like is the — we’ll make rapid progress with the new version of — of FSD. But — but then, it will curve over logarithmically. So — so, at first, like, a logarithmic curve looks like, you know, just sort of fairly straight upward line, diagonally up. And so, if you extrapolate that, then you — you have a great thing. But then because it’s actually logarithmic, it curves over. And then, there have been a series of logarithmic curves. Now, I know I’m the boy who cried FSD, but man, I think — I think we’ll be better than human by the end of this year.”

Abhik Mukherjee’sanalyst take:“Almost every auto OEMs are spending on autonomy. Tesla is also walking in the same direction and is building an in-house AI service that includes in-house real-time data sets, neural Net training, vehicle hardware and software. Tesla is expecting to reach perfect FSD soon and for this, it is also building a Dojo supercomputer. Early development of FSD will give Tesla amassivefirst-mover advantage over its competitors. We assume Tesla FSD might also get adopted by other automakers, like Tesla NACS is being adopted.”

Autonomy (FSD): Disruption

CEO:“这不是关于获得更多份额。只是you can think of every car that we — that we sell or produce that — that — that has a full Autonomy capability as actually something that, in the future, may be worth as much as five times what it is today…If you’ve got an autonomous — if that vehicle is able to operate autonomously and — and use — be used in either dedicated or autonomous or partially autonomous like — like, Airbnb, like maybe sometimes you allow your car to be used by others, sometimes you want to use it exclusively, just like, you know, Airbnb, you know, doing Airbnb with a room in your house… So, I think it’s sort of it would be — I think it — it does make sense to sacrifice margins in favor of making more vehicles because we think, in the not-too-distant future, they will have a dramatic valuation increase. I think the Tesla fleet value increase to the point at which we can upload full self — you know, full self-driving and it’s approved by regulators, will be the single biggest step change in asset value maybe in history.”

Abhik Mukherjee’sanalyst take:“Although we are excited about autonomous vehicles, Tesla currently is a bit far from achieving perfect FSD. Incidents involving Tesla vehicles are frequently reported. Currently, Tesla FSD is only available in the US and it will need a lot of approvals from regulators to ensure 100% safety before it can be rolled out to other regions, especially in Europe where regulations are much stricter. Though achieving complete FSD could disrupt the market in future, currently Tesla must work to make its FSD software incident-free.”

Financial highlights

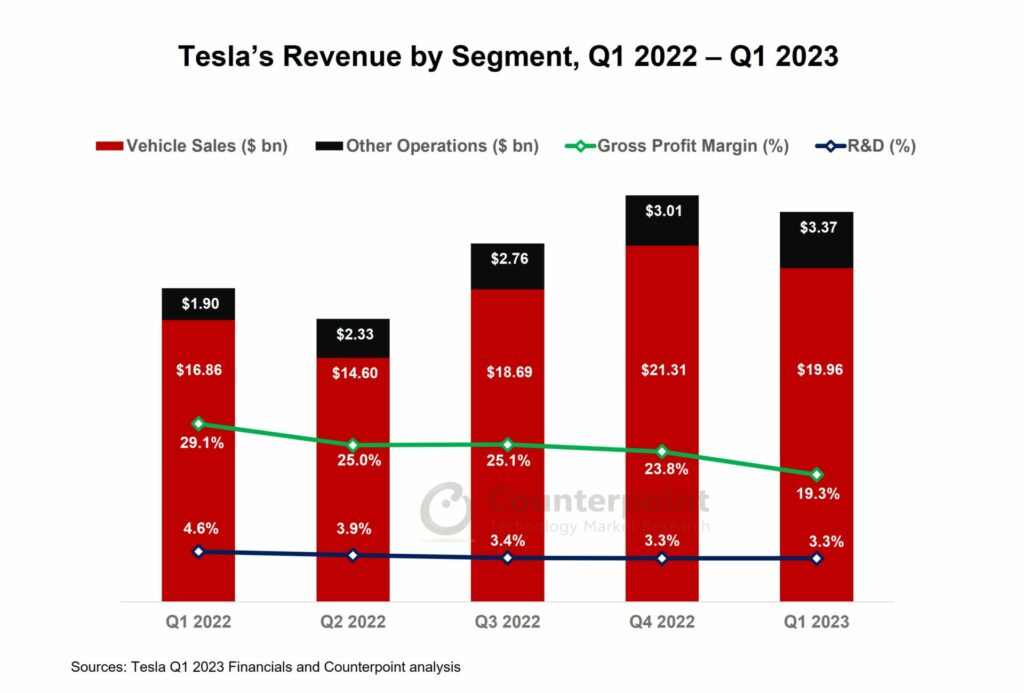

- In the automotive segment, Tesla achieved revenue of$21.26 billion, an annual growth of7%.Around 4% of this revenue was derived from sales of regulatory credits and automotive leasing.

- In addition to theautomotivesegment, Tesla experienced significant growth in its other businesses, such as energy generation and services, with revenues surging by57%YoY to reach$3.65 billionin Q2 2023. Tesla deployed7 GWhof energy storage and66 MWhof solar panels during the quarter.

- Tesla achieved a gross profit of$4.53 billion, a 7.1% YoY increase. High vehicle deliveries, low cost of production due to lower raw material costs and IRA tax credits for EVs in the US contributed to this result. But the low ASP of vehicles due to the voluntary global price cuts also hurt Q2 profitability.

- Tesla’s Q2 operating profit was62%, a decline of 1.8 percentage points sequentially. The reduction can be attributed primarily to the significant expenses incurred in ramping up the production for Cybertruck, Tesla’s in-house 4680 cells and thedevelopment of AIthrough its Dojo training computer. Other additional costs were associated with a new ‘Get to Know Your Tesla’ UI and facelifts for the Model 3 and Model Y.

Outlook

With the current growth trajectory, we expect Tesla deliveries will reach around1.9 million到2023年底。其强大的供应链和vertically integrated production have given Tesla a competitive advantage.

Other growth opportunities are arising from the adoption ofTesla’s NACS charging standardby several OEMs including Ford, GM, Rivian, Volvo, Polestar and Nissan for the North American market. This allows these auto companies to leverage Tesla’s extensive network of charging stations across North America, enhancing the convenience and accessibility of electric vehicle charging for their customers. But it also gives Tesla the option to increase its revenue by charging licensing fees from OEMs adopting its proprietary NACS ports.

Related posts

- Southeast Asia BEV Sales Grow 10x YoY in Q1 2023, Thailand Leads

- European EV Sales Increased Over 13% YoY in Q1 2023 with Tesla Model Y as Bestseller

- US EV Sales Up 79% YoY in Q1 2023 Helped by Tax Credit Subsidy

- China EV Sales Defy Subsidy Cuts, Maintain Strong Growth in Q1 2023

- Global EV Sales Up 32% YoY in Q1 2023 Driven by Price War

- Global Passenger Electric Vehicle Market Share, Q2 2021-Q1 2023

- Google Puts Auto Expansion in Top Gear

- Connected Car Sales Grew 12% YoY in 2022 With Volkswagen Group in Lead

- AI Voice Assistants to Push Success of Autonomous Driving, Software-defined Vehicle

- Thailand Leads Southeast Asia EV Market With 60% Share

- Price Cuts Boost Tesla Revenue in Q1, Profit Slumps Compared to 2022

- Tesla Reports Record Revenue, Deliveries in Q4 2022

- Tesla’s stellar Q3 performance

- China Cloud on Tesla’s Q2 2022 Numbers; Fundamentals Remain Strong