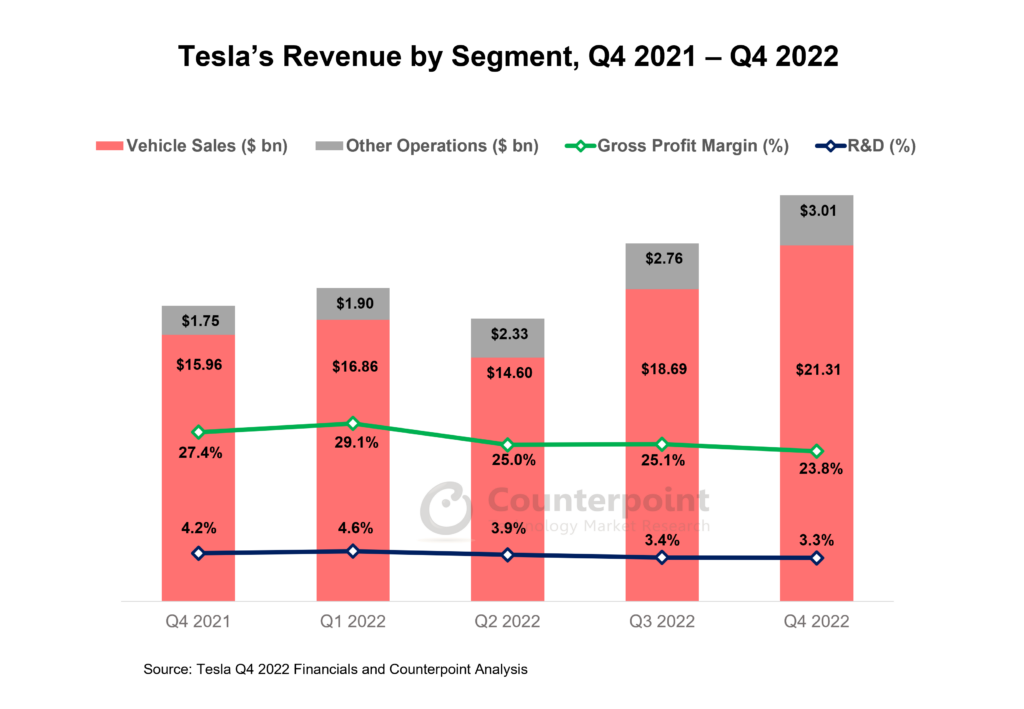

- Tesla’s total revenue stood at $24.3 billion in Q4 2022 with 37% YoY growth.

- Tesla deployed 2.46 GWh of energy storage during Q4, a growth of almost 152% YoY.

- Tesla’s vehicle deliveries are expected to exceed 1.7 million units globally in 2023.

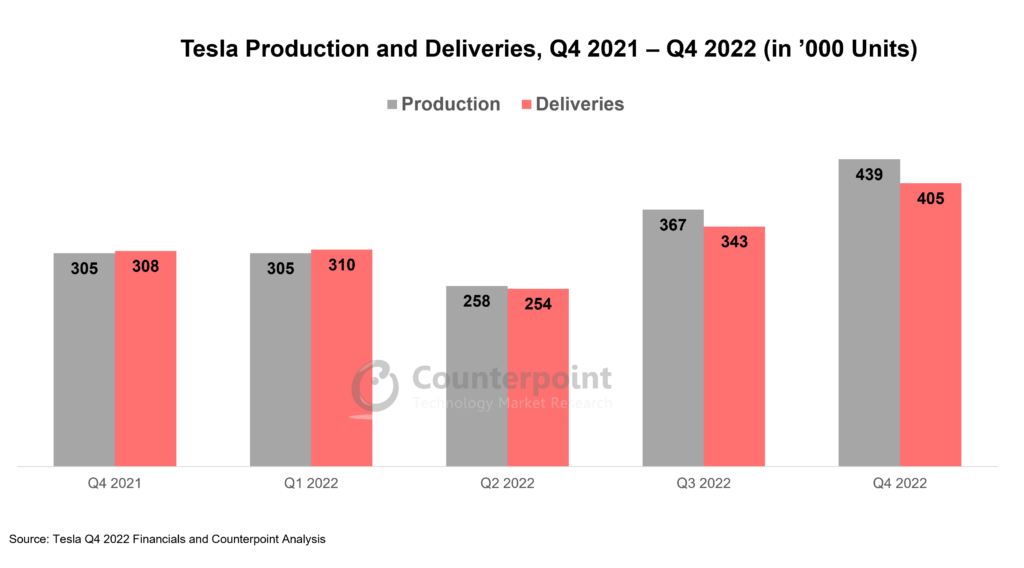

骑在405278年第四季度车辆交付记录2022, Tesla registered a record total revenue of $24.3 billion during the quarter, an increase of 37% YoY. Deliveries rose 31.3% YoY in Q4, bringing the 2022 annual total to1.3 million units. TheUS was the leading marketin Q4, followed by China and Europe. The annual deliveries of Tesla’s premium Model X and Model S grew 167% YoY to reach 66,000 units.

Tesla’s sales inChinafell short of expectations again due to the COVID-19 outbreak. Production at the Shanghai factory, which exported more than 106,000 units in Q4, was halted during the last week of December. Although no specific reason was stated officially, rising COVID-19 cases among workers were a likely cause for the unexpected production halt. On the other hand, the weekly Model Y production in the Berlin factory touched 3,000 units. The rising production in Germany has helped Tesla gain a strong grip on欧洲电动汽车的马rket. The Model Y remained Europe’s top-selling car model during November and December. Tesla’s in-house 4680 cell production rate also reached 1,000 cars per week.

Financial summary

- Tesla’stotal revenueduring Q4 2022 stood at $24.3 billion, an increase of 37% YoY. The company generated more than $20 billion from automotive sales. During Q4, the widespread release ofTesla’s full self-driving(FSD) feature generated $0.32 billion in revenue, indicating that the company is striving to increase the proportion of software revenue in its overall product mix.

- Revenue from Tesla’sother businesseslike energy storage, solar panel deployment, charging and vehicle servicing grew by almost 72% YoY to exceed $3 billion. Other businesses contributed 12% of Tesla’s Q4 revenue.

- Tesla deployed 2.46 GWh ofenergy storageduring Q4. At 151.7%, it saw the highest YoY growth till now.

- Tesla’s total revenue for 2022 exceeded $81.4 billion, a 51% YoY growth.

- During Q4,gross profitalso increased by 19% YoY and stood at $5.7 billion. In October, Tesla reducedvehicle prices in Chinaafter increasing them a couple of times during H1 2022. Initially, it was thought the increase in demand would make up for the price cut but the negative foreign exchange impact restricted further gross profit growth.

- Tesla’sinventoryin Q4 stood at 34,423 units, bringing the annual total to 55,760 units. The COVID-19 outbreak in China and the increased production in the Berlin factory are probable causes of the higher inventory. In addition, Tesla is facing stiff competition as legacy automakers and new players are offering more affordable EVs. In January 2023, Tesla lowered prices globally, which may help in clearing out inventories and achieving economies of scale.

Outlook

Tesla’s strong fundamentals are expected to keep the company ahead of most other electric vehicle brands globally. Tesla announced price cuts in January 2023, which has resulted in the demand ballooning to twice the production. Besides, pilot production of the Tesla Semi began in 2022 and the vehicle is expected to hit the road soon. The company also plans to start production of theCybertruckin mid-2023. Furthermore, Tesla recently announced an investment of $3.6 billion to set up a 100GW capacity cell factory and a high-volume semi factory. Tesla’s 2023 vehicle deliveries are projected to exceed 1.7 million units, with a 31% YoY growth. This seems attainable if the company’s recent price cuts remain in effect for most of the year.

相关的帖子:

- Top 10 CES 2023 Automotive Announcements

- Tesla Leads US EV Market, Eclipsing Next 15 Brands Combined

- 这里保持位置平台领导;TomTom Surpasses Google to Take Second Position; Mapbox Moves to Fourth

- Mercedes Fends off VW in Europe EV Market

- BYD Widens Gap with Tesla in Q3 2022, Leads Global EV Market

- Tesla’s stellar Q3 performance

- China Q2 EV Sales Almost Doubled YoY, Despite a Weak Quarter

- China EV Charging Points Soar 56% YoY in 2021; 42% CAGR Seen for 2022-2026

- One in Two Cars Sold Will Have Electric Powertrain by 2030

- ADAS Penetration Crosses 70% in US in H1 2022, Level 2 Share at 45%

- LiDAR Now High on Automotive Industry Radar

- Connected Car Sales Overtake Non-connected Cars in Q2 2022