Global Passenger Electric Vehicle Market Share, Q3 2021 – Q2 2023

Global Passenger Electric Vehicle Market Share, Q3 2021 – Q2 2023

Published date: August 31, 2023

This page depicts our quarterly data forglobal electric vehicle salesmarket share from Q3 2021 to Q2 2023.

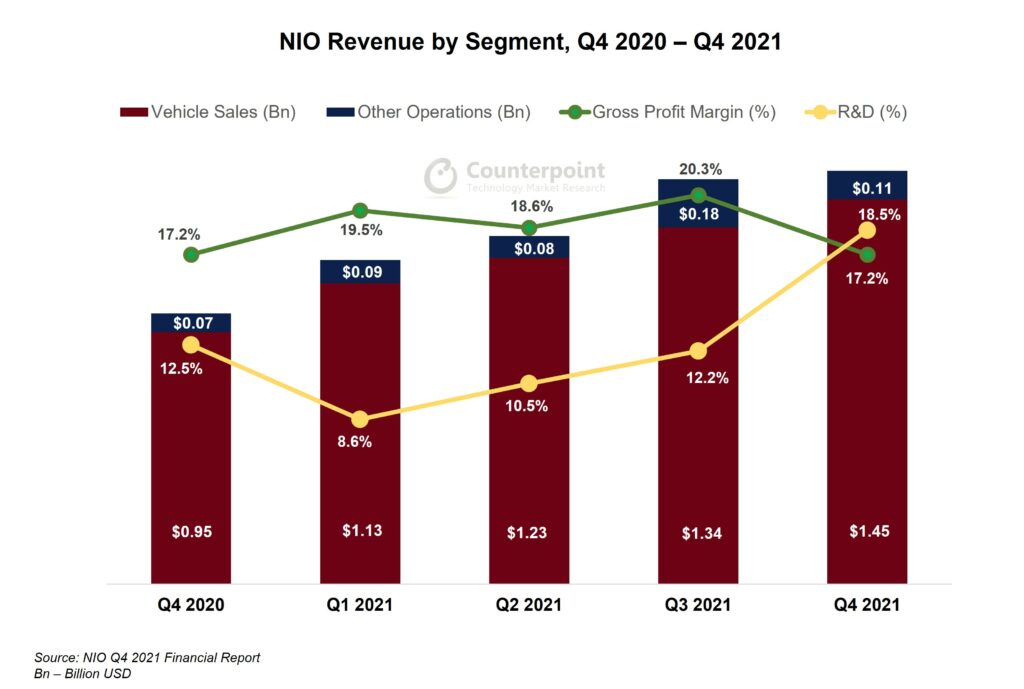

| Global Passenger Electric Vehicle* Market Share, Q3 2021 – Q2 2023 | ||||||||

| Auto Group | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 |

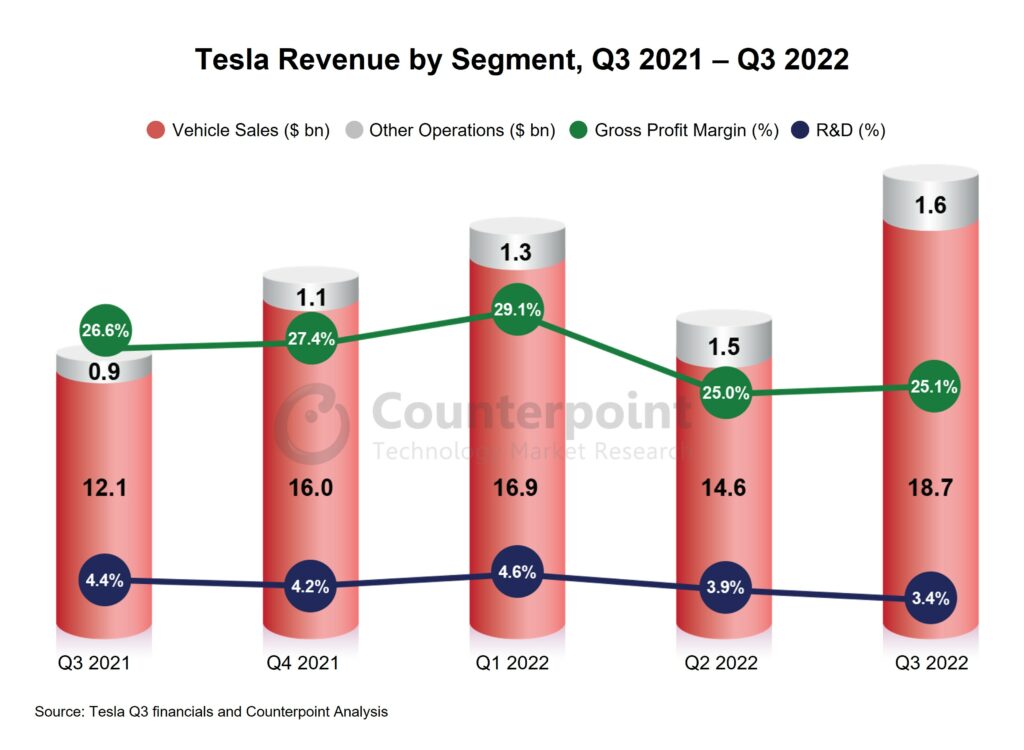

| Tesla | 20% | 19% | 21% | 16% | 17% | 17% | 22% | 20% |

| BYD Auto | 9% | 9% | 10% | 12% | 13% | 15% | 14% | 15% |

| Volkswagen Group | 10% | 10% | 7% | 7% | 7% | 8% | 7% | 7% |

| Others | 60% | 62% | 62% | 65% | 63% | 60% | 57% | 58% |

Source:Global Passenger Electric Vehicle Model Sales Tracker: Q1 2018 – Q2 2023

DOWNLOAD:

(Use the buttons below to download the complete chart)![]()

![]()

Global electric vehicle market highlights:

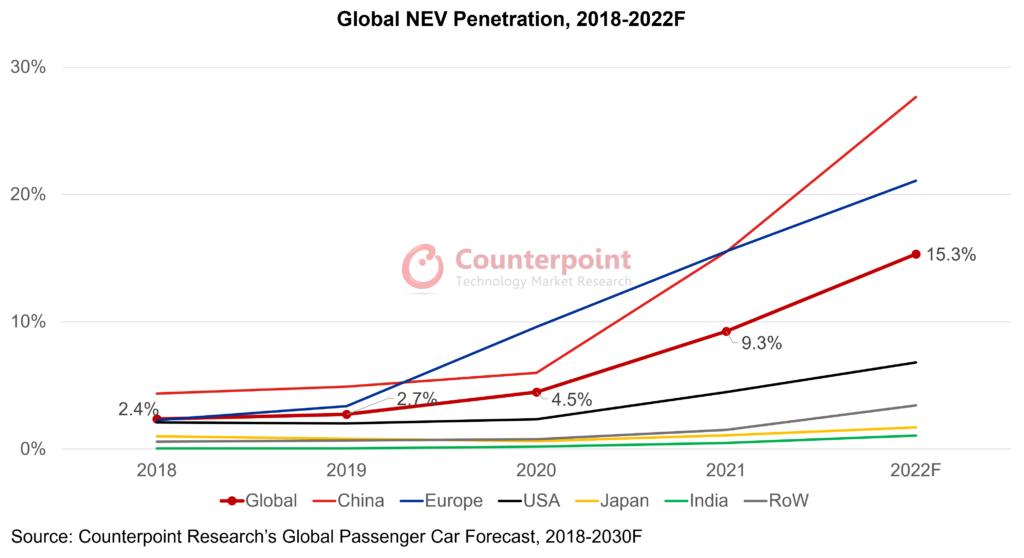

- BEV sales during Q2 2023 grew over 50% YoY.

- One in every 10 cars sold during Q2 2023 was a pure battery electric vehicle (BEV).

- China remained the leader in global BEV sales followed by USA and Germany.

- BEV sales in the USA grew by almost 57% YoY, the highest among the top 3 EV markets.

- Tesla Model Y retained its title as the ‘best-selling’ passenger car globally.

- With the present growth trajectory, total BEV sales are expected to reach over 10 million units by the end of 2023.

Top Electric Vehicle Brands highlights:

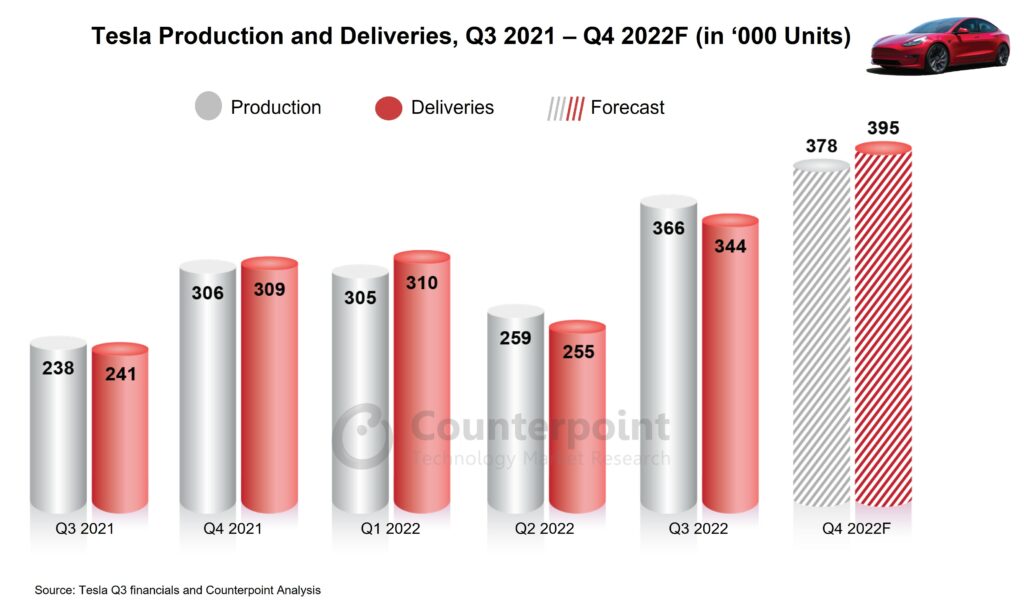

Tesla: Tesla sales soared by 83% YoY during Q2 2023. Tesla Model Y accounted for 64% of Tesla’s global sales. Model Y retained its title as the ‘best-selling’ passenger car model globally.

BYD Auto: During Q2 2023, BYD Auto’s BEV sales grew by 96% YoY, faster than Tesla. BYD Yuan Plus (or Atto 3) was the best-selling BYD model followed by BYD Dolphin and BYD Seagull. BYD Seagull was introduced in April 2023 during the Shanghai auto expo. BYD Seagull also ranked #9 among the top 10 best-selling BEV models globally. BYD exported over 35,000 EVs during Q2 2023. Almost two-thirds of its exported BEVs were sold in Thailand, Israel and Australia.

Volkswagen Group: BEV sales of VW group grew by 48% YoY during Q2 2023. VW ID.4, Audi Q4-etron and VW ID.3 are the top 3 best-selling models of the group, accounting for nearly 50% of the group’s total BEV sales.

* Our present analysis takes Pure Battery EVs (BEVs) into account. We have removed Plug-in Hybrid EVs (PHEVs) from our analysis to avoid confusion.

For our detailed research on the global EV sales market in Q2 2023, clickhere.

For a more detailed electric vehicle model sales tracker, click below:

Global Passenger Electric Vehicle Model Sales Tracker: Q1 2018 – Q2 2023

This report tracks the global passenger vehicle sales* by brand and by model across 23 regions (China, USA, Germany, UK, France, Spain, Japan, India, Italy, South Korea, Thailand, Indonesia, Vietnam, Brazil, Argentina, Russia, Malaysia, Philippines, Singapore, ROE, LATAM, MEA and Oceania) quarterly. The report will help to understand regional trends, brand dynamics and type of EV penetration. The period covered in this report is from Q1 2018 to Q2 2023.

*Sales here refers to wholesale figures, i.e., deliveries out of factories by respective brands/companies.

*Under electric vehicles, the report only considers battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). Hybrid electric vehicles and fuel cell vehicles (FCVs) are not included.

[one_fourth padding=”0 15px 0 0″]

[/one_fourth]

[three_fourth_last padding=”0 0 0 0″]

Table of Contents:

• Definition

• Pivot Table

• Flatfile

[/three_fourth_last]

Note: Numbers based on passenger vehicles only. For EVs, we consider only BEVs and PHEVs. Hybrid EVs and fuel cell vehicles (FCVs) are not included in this study.