- One in every seven cars sold during Q1 2023 was an EV.

- Tesla Model Y becomes the best-selling passenger car model globally for the first time ever.

- EV sales are expected to reach over 14.5 million units by the end of 2023.

New Delhi,London,San Diego, Buenos Aires, Hong Kong, Beijing, Seoul – June 7, 2023

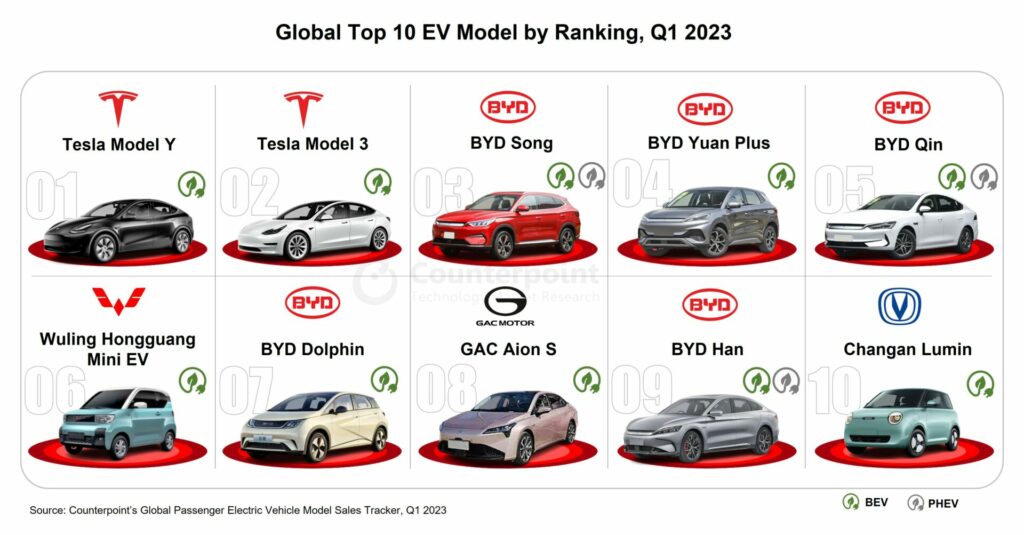

Global passenger electric vehicle* (EV) sales in Q1 2023 rose 32% YoY, according to the latest research from Counterpoint’sGlobal Passenger Electric Vehicle Model Sales Tracker.One in every seven cars sold during Q1 2023 was an EV. Battery EVs (BEVs) accounted for 73% of all EV sales during the quarter, while plug-in hybrid EVs (PHEVs) made up the rest.

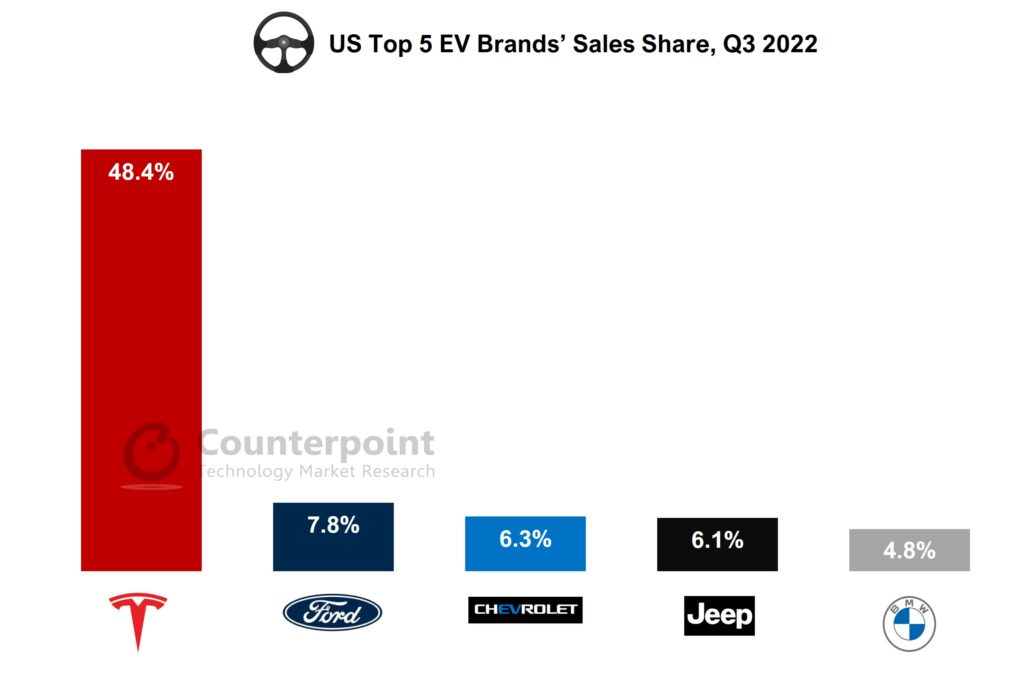

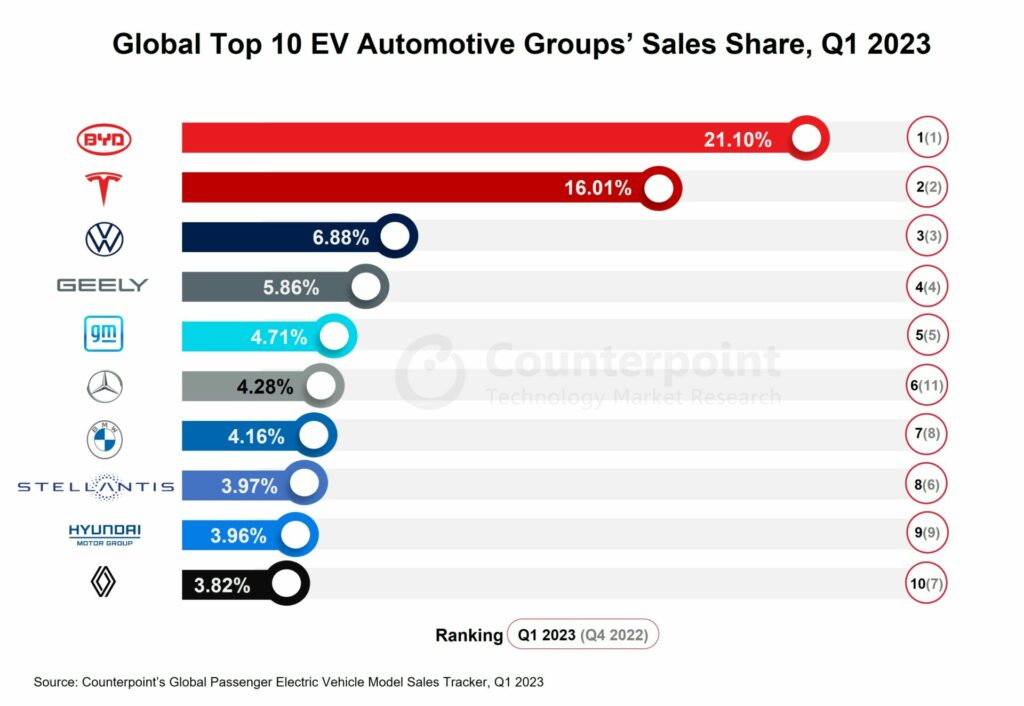

TheUSsurpassedGermanyto become the world’s second-largest EV market in Q1 2023 whileChinaremained theleader.在中国,电动汽车销售经历了惊人的29%YoY growth, despite a 12% decline in overall sales of passenger vehicles in the country. In the US, EV sales soared over 79% YoY during the quarter. The top 10 automotive groups, encompassing 48 automotive brands, dominated the global EV market in Q1 2023, capturing three-fourths of the total global EV sales.

Commenting on the market dynamics,Research Analyst Abhik Mukherjeesaid, “Global EV sales were largely driven by China with 56% of total EV sales in Q1 2023 coming from this market. The elimination of the NEV purchase subsidy in China resulted in lower-than-expected EV sales in January 2023.Tesla slashed pricesfor its models globally in January, following which other automotive brands announced similar cuts for their car models starting in February, which led to an improvement in EV sales. During February and March, almost 40 automakers, includingBYD,NIO,Xpeng,Volkswagen,BMW,梅塞德斯–Benz,Nissan,HondaandToyota, reduced their vehicle prices by a couple of hundred dollars to tens of thousands of dollars, which eventually stoked a competitiveprice warin China. Initially, it was thought that the price war would end soon and that auto OEMs would benefit from increased sales. However, as the price war continues to stretch, several automakers in China have reported reduced earnings and even losses.”

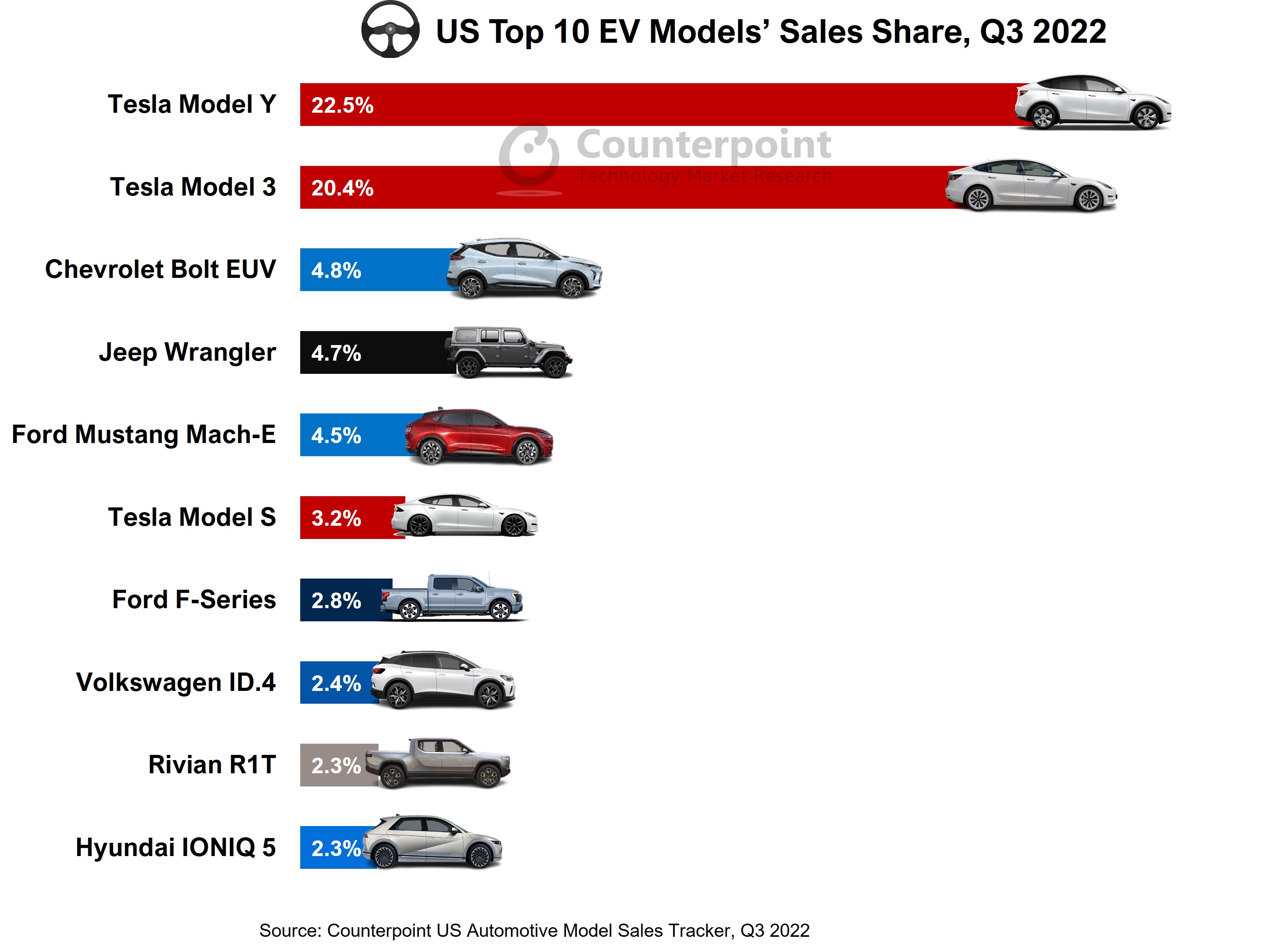

Thetop 10 EVmodels accounted for37%of the total passenger EV sales in Q1 2023. Tesla’s Model Y remained the best-selling model globally followed by Tesla’s Model 3 and BYD’s Song. In Q1 2023, Tesla’s Model Y achieved the notable distinction of becoming thebest-sellingpassenger car modelworldwide, surpassing even conventional fuel vehicles.

Commenting on the market outlook,Senior Analyst Soumen Mandalsaid, “Although sales of the traditional internal combustion engine (ICE) vehicles remained stable in Q1 2023 compared with that in the year-ago period, the significant growth in EV sales indicates arapid transitionfrom traditional vehicles to EVs.”

“By the end of 2023, global EV sales are expected to surpass14.5 million units, according to our forecast. With the implementation of the EV tax credit subsidy in the US, EV sales in the country are projected to significantly increase this year. To meet the eligibility criteria for the tax credit, automotive OEMs are moving to partner with battery suppliers and establish battery manufacturing plants across North America. Consequently, the US is poised tosurpassthe EU in the race tobuild EV batteries.”

*Sales refer to wholesale figures, i.e. deliveries from factories by the respective brand/company.

*For EVs, we consider only BEVs and PHEVs. Hybrid EVs and fuel cell vehicles (FCVs) are not included in this study.

The comprehensive and in-depth ‘Global Passenger Electric Vehicle Sales Tracker, Q1 2018-Q1 2023’ is now available for purchase atreport.www.arena-ruc.com.

Feel free to reach us at press@www.arena-ruc.com for questions regarding our latest research and insights.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Abhik Mukherjee

Soumen Mandal

![]()

Neil Shah

Peter Richardson

对比研究

相关的帖子

- 谷歌将汽车的前女友pansion in Top Gear

- Connected Car Sales Grew 12% YoY in 2022 With Volkswagen Group in Lead

- Price Cuts Boost Tesla Revenue in Q1, Profit Slumps Compared to 2022

- Global Electric Vehicle Sales Crossed 10 Million in 2022; Q4 Sales up 53% YoY

- Berlin Factory Takes Tesla to Top Spot in Europe EV Sales as Chinese Brands Gain Ground

- EV Sales in US up 54.5% YoY in 2022; Tesla Market Share at 50.5%

- AI Voice Assistants to Push Success of Autonomous Driving, Software-defined Vehicle

- Tesla Leads US EV Market, Eclipsing Next 15 Brands Combined

- Thailand Leads Southeast Asia EV Market With 60% Share

- 梅塞德斯Fends off VW in Europe EV Market

- BYD Widens Gap with Tesla in Q3 2022, Leads Global EV Market

- A Promising Yet Challenging Market for Self-driving SoCs

- China EV Charging Points Soar 56% YoY in 2021; 42% CAGR Seen for 2022-2026