Counterpoint Research Weekly Newsletter

Intel maintained #1 place in Q2 2023 amid memory market slow down, which dragged down major memory players performance such as Samsung, SK Hynix and Micron. In addition, Nvidia took over the second place from Samsung due to the revenue booming on its data center business supported by strong AI server demand. Nvidia expects to see another wave of revenue growth in the upcoming quarter which could make its revenue expand again. Qualcomm’s revenue was capped by looming handset revenue and thus ranked #4 in the quarter. Broadcom and AMD’s revenues were relative resilient amid demand uncertainty.![]()

Use the button below to download the high resolution PDF of the infographic:

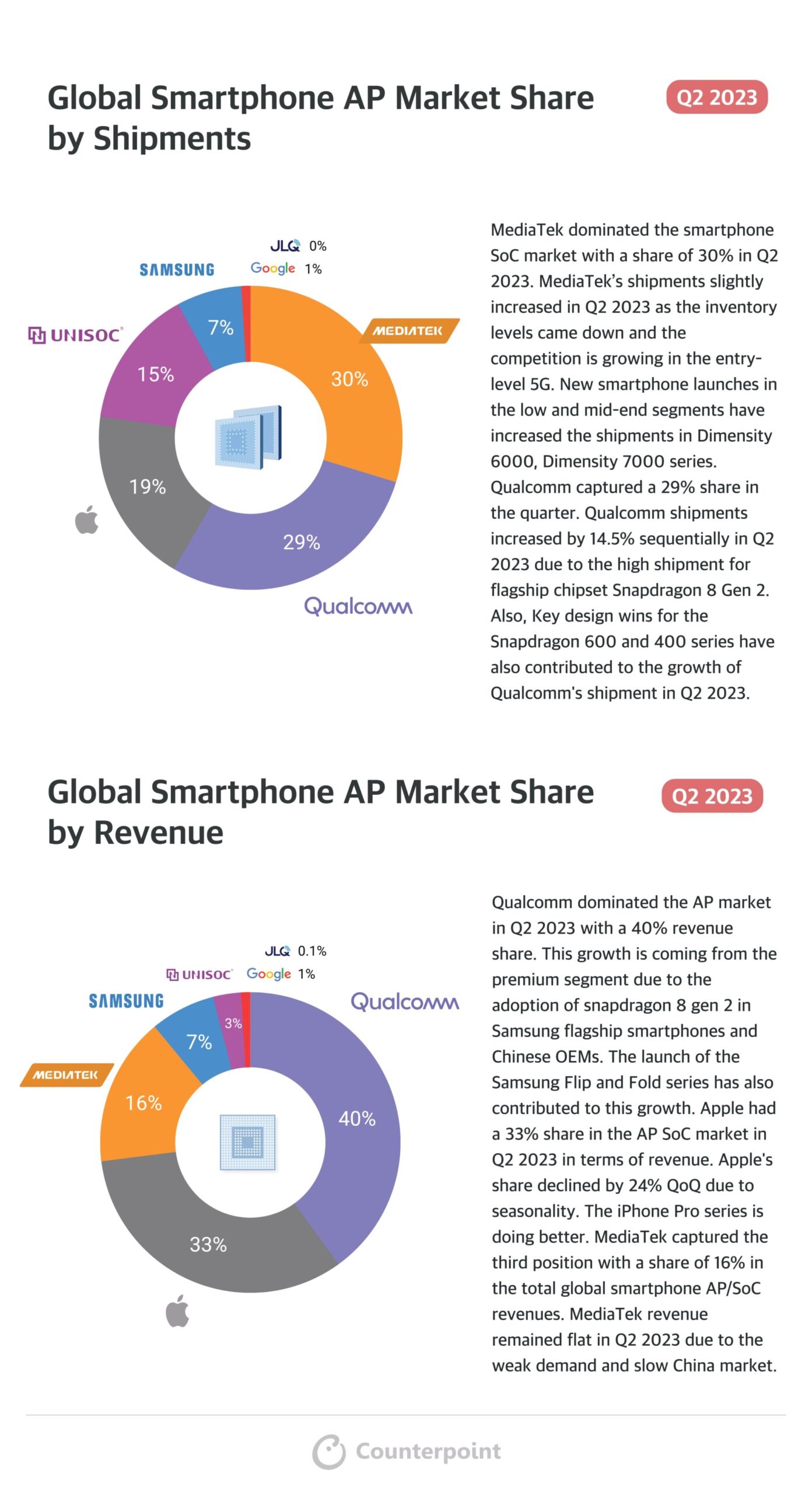

MediaTek dominated the smartphone SoC market with a share of 30% in Q2 2023. MediaTek’s shipments slightly increased in Q2 2023 as the inventory levels came down and the competition is growing in the entry level 5G. New smartphone launches in the low and mid-end segments have increased the shipments in Dimensity 6000, Dimensity 7000 series. Qualcomm captured a 29% share in the quarter. Qualcomm shipments increased by 14.5% sequentially in Q2 2023 due to the high shipment for flagship chipset Snapdragon 8 Gen 2. Also, Key design wins for the Snapdragon 600 and 400 series have also contributed to the growth of Qualcomm’s shipment in Q2 2023.

高通主导美联社市场在2023年第二季度40% revenue share. This growth is coming from the premium segment due to the adoption of snapdragon 8 gen 2 in Samsung flagship smartphones and Chinese OEMs. The launch of the Samsung Flip and Fold series has also contributed to this growth. Apple had a 33% share in the AP SoC market in Q2 2023 in terms of revenue. Apple’s share declined by 24% QoQ due to seasonality. The iPhone Pro series is doing better. MediaTek captured the third position with a share of 16% in the total global smartphone AP/SoC revenues. MediaTek revenue remained flat in Q2 2023 due to the weak demand and slow China market.

Use the button below to download the high resolution PDF of the infographic:

TSMC maintained its leadership in the foundry market with a stable 59% market share in Q2 2023. In contrast, Samsung Foundry’s market share dipped by nearly 1% to 11%, primarily due to ongoing smartphone inventory adjustments and the loss of smartphone AP SoC orders from a US client. On the other hand, UMC saw an increase in market share, driven by the continued strength of DDICs and automotive applications in Q2 2023.

In Q2 2023, the 5/4nm segment continued to dominate the market, holding a significant 21% market share. This strength was driven by robust demand, particularly in the field of AI, with key customers like Nvidia and Broadcom fueling this momentum. In contrast, the 7/6nm segment experienced weakness due to a slower-than-expected recovery in the smartphone market. On the other hand, the 28/22nm segment remained robust, as demand for primary applications, including DDIC and automotive-related applications, remained strong throughout Q2 2023.

Use the button below to download the high resolution PDF of the infographic:

Published Date: 16th August 2023

Overview:This insightful report covers key trends in Smart Home Security Cameras, Cellular IoT Connections, AI-driven transformations, revenue dynamics, and emerging technologies. It offers concise, valuable insights for informed decision-making across diverse industries.

[one_half padding=”0 20px 0 0″]

[/one_half]

[one_half_last padding=”0 0 0 30 px”]

[/one_half_last]

Table of contents:

[one_half]

[/one_half]

[one_half_last]

[/one_half_last]

Published Date: 8th August 2023

Overview:This comprehensive analysis covers global EV trends, connected car sales, regional market dynamics, key players, emerging technologies, pricing strategies, and market growth. It also provides concise, insightful automotive trends for informed decision-making.

[one_half padding=”0 20px 0 0″]

[/one_half]

[one_half_last padding=”0 0 0 30 px”]

[/one_half_last]

Table of contents:

[one_half]

[/one_half]

[one_half_last]

[/one_half_last]

Published Date: 24th July 2023

Overview:This is a comprehensive analysis of the latest developments in the wearables industry covering product reviews, market trends, and regional insights. It also includes the Sony WH-CH720N headphones, Apple’s Vision Pro, Meta’s Quest 3, smartwatch markets in China and India, MediaTek’s expansion, AR/VR value chain in China, Apple’s device ecosystem, and wearable innovations at MWC Barcelona 2023.

[one_half padding=”0 20px 0 0″]

[/one_half]

[one_half_last padding=”0 0 0 30 px”]

[/one_half_last]

Table of contents:

[one_half]

[/one_half]

[one_half_last]

[/one_half_last]

Published Date: 24th July 2023

Overview:这是一个行业的综合分析,encompassing topics like international policies affecting self-reliance plans, regulatory acts in the US, earnings of major players, semiconductor manufacturing in India, emerging technologies in the market, and key events shaping the industry’s future. It provides valuable insights for stakeholders seeking a concise overview of the semiconductor landscape.

[one_half padding=”0 20px 0 0″]

![]()

[/one_half]

[one_half_last padding=”0 0 0 30 px”]

[/one_half_last]

Exhaustive table of contents below:

[one_half]

[/one_half]

[one_half_last]

[/one_half_last]

Note: The report comprises of carefully selected aggregated insights published by our analysts during Q2 2023. The data presented herein corresponds to the Q1 2023.

Published Date: 12th July 2023

Overview:This report provides a comprehensive analysis of the global smartphone market, covering various topics and regions gathered throughout Q2. It includes insights into consumer preferences, market trends, and key players. The report offers a broad perspective on the industry, exploring topics such as foldable smartphones, market strategies, display technologies, reviews of smartphone models and much more. This report serves as a valuable resource for industry stakeholders seeking a concise overview of the global smartphone market.

[one_half padding=”0 20px 0 0″]

[/one_half]

[one_half_last padding=”0 0 0 30 px”]

[/one_half_last]

Exhaustive table of contents below:

[one_half]

[/one_half]

[one_half_last]

[/one_half_last]

Note: The report comprises of carefully selected aggregated insights published by our analysts during Q2 2023. The data presented herein corresponds to the Q1 2023.

[rev_slider alias=”mediatek-earnings”][/rev_slider]

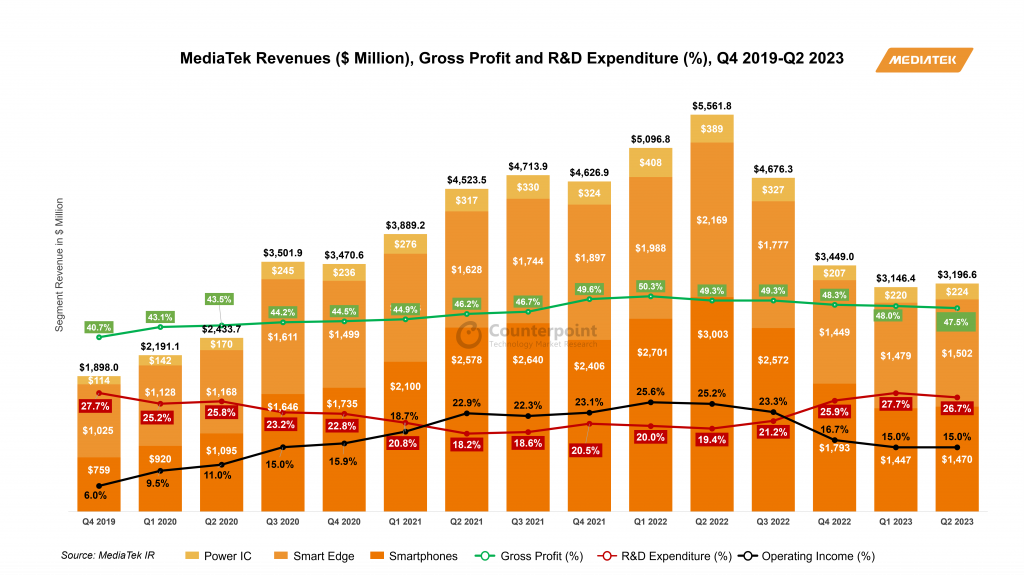

MediaTek’srevenues were slightly up sequentially but down 43% annually in Q2 2023. Inventory has gradually come down to a relatively normal level, but the demand forsmartphoneswill remain slow due to the global macroeconomic situation and therefurbishedsmartphonemarket. Against this backdrop, MediaTek is diversifying its portfolio by focusing on theauto, smart edge and customASIC segments. The company is estimated to take over two years to get material revenues from these segments.

AI and ASIC Opportunity

CEO:“As for ASIC, we recently see growing enterprise ASIC business opportunities in AI and datacenter markets. With our strong IP and SoC integration capabilities, we aim to continue to grow this business in the future.”

Parv Sharma’s analyst take: “With the growth in generative AI, the demand for edge AI processing has accelerated. Being one of the top players in edge devices, MediaTek is well-positioned to benefit from this shift. The company will focus on winning enterprise ASIC projects but catching up with major players like Broadcom and Marvell will take time, as customers typically work with existing suppliers for repeat projects.”

Growing focus on auto and partnership with NVIDIA

CEO:“We’re very excited about the recently announced partnership between MediaTek and NVIDIA to develop a full-scale product roadmap for the automotive industry. We believe our industry-leading low-power processors and 5G, WiFi connectivity solutions, combined with NVIDIA’s strong capability in software and AI cloud, will help us become highly competitive in the future connected software-defined vehicles market and shorten our time to market to accelerate our growth.”

Shivani Parashar’s analyst take: “MediaTek launched Dimensity Auto to focus on cockpit and connectivity solutions. With its partnership with NVIDIA, the company aims to develop a full-scale product roadmap for the automotive industry. Auto design cycles are long so it will take some time (2026-2027) for the company to increase revenues from this segment. Overall, we can say the auto segment will become a long-term revenue growth driver for MediaTek.”

Customer and channel inventories come down

CEO:“We observed that customer and channel inventories across major applications have gradually reduced to a relatively normal level. Recent demand from our customers has shown certain level of stabilization. However, our customers are still managing their inventory cautiously as global consumer electronics end market demand remains soft. For the near-term, we expect our business to gradually improve in the second half of the year”

Shivani Parashar’s analyst take: “According to our supply chain checks, inventory levels are coming down and will get back to normal in the second half of 2023. OEMs will start restocking but will be cautious due to weak consumer demand and global macroeconomic conditions.” Result summary

Result summary

Related posts

Weaker-than-expected macroeconomicsituationcontinuedto weigh on TSMC’sQ2 2023 business performance.Muted smartphone and PC/NB demand negatively impactedtheoverall utilization rateduring the quarter.Though largely expected by the market, the company further cut its full–year revenue guidance ontheweaker end demandexpected forH2 2023.However,TSMCprojects astrong AI demand inQ32023and,going forward,sees itself asthe key enablerfor AI GPUsandASICs that requirealarge diesize.We give ourtakeson the key points discussed during theearnings call:

Is AI semiconductor demand real?

Can AI semiconductor demand offset short-term macro weakness?

Is TSMC CoWoScapacity enough to fulfill current AI demand?

N3E/N3/N2 status

Results summary

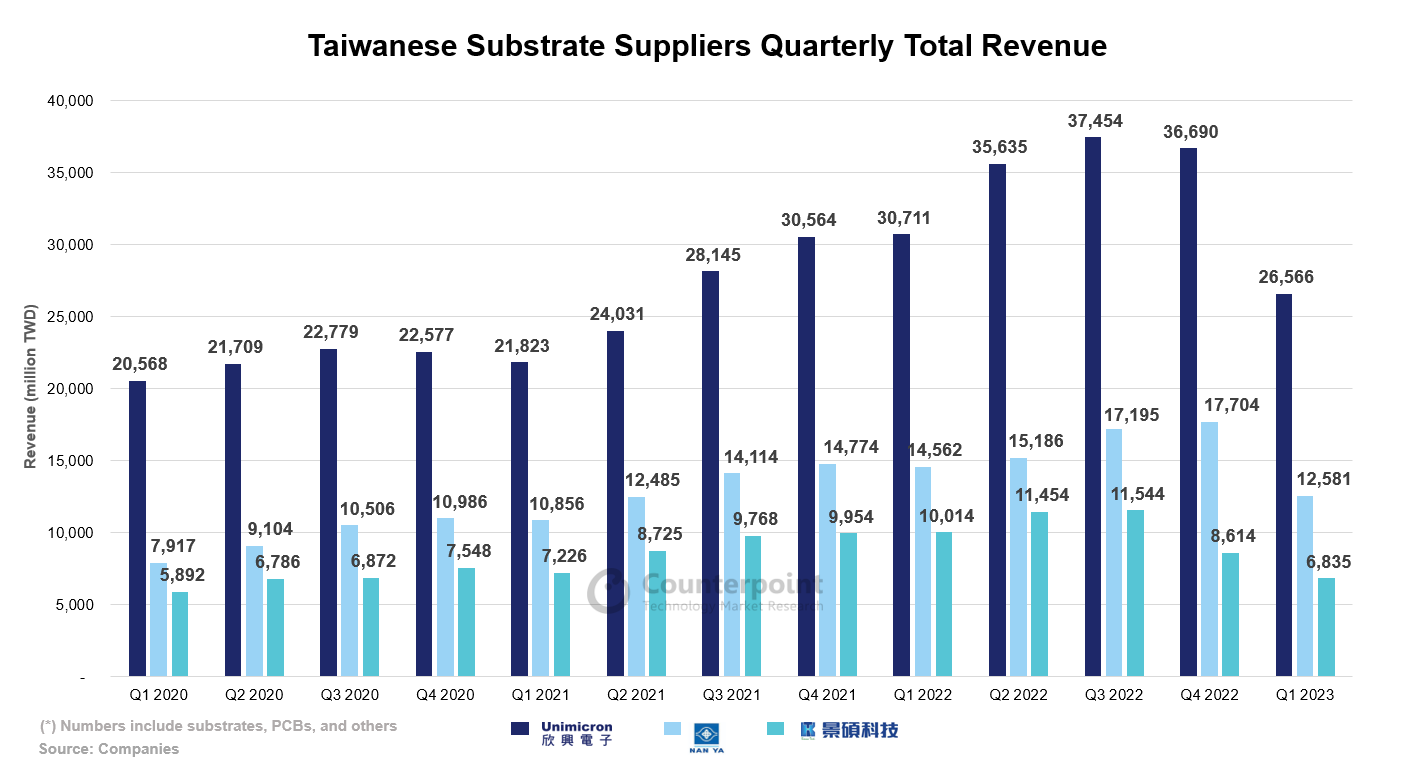

The disappointing Q1 2023 results of Taiwan’s IC substrate makers including Unimicron, Kinsus and Nanya PCB indicate that the cyclical downturn is worse than expected and is likely to continue to weigh on IC substrate makers’ Q2 2023 performance. However, Q2 2023 or Q3 2023 may mark a trough for the IC substrate sector.

After severe inventory corrections across several end applications such as PC/NB and server segments since H2 2022, the improvement in PC/NB and server inventory will help boost ABF substrate demand, narrowing the demand-supply gap of ABF substrates in H2 2023. Three Taiwanesesubstratevendors have guided that the overall ABF substrate utilization rate will continue to trend down in Q2 2023. However, Unimicron expects to see an improvement in utilization rate towards the end of Q2 2023, which we believe will be mainly driven by the high-end substrate products used for Intel’s Sapphire Rapids and AMD’s Epyc Genoa.

NVIDIA’s A100 and H100 both utilize TSMC’s CoWoS advanced packaging technology. The ABF substrate size for data center GPUs is larger with higher layer counts, driving long-term demand growth for high-end ABF substrates. However, the demand for ABF substrates from data center GPUs accounts for only a low-single-digit percentage of the total ABF substrate demand. Therefore, the contribution from AI/HPC applications will not be significant in the short term. On the other hand, global leading ABF substrate suppliers such as Ibiden and Unimicron are continuously expanding their ABF substrate capacity, raising concerns about long-term oversupply in the low-to-mid-end ABF substrate market.

Most of the BT substrate demand comes from smartphone and memory applications. However, the demand has been weak after the smartphone and memory market entered an inventory correction phase in 2022. Starting in Q4 2022, there have been signs of improving demand from certain end applications like TV SoCs, driven by rush orders. On the smartphone side, demand remains weak due to a slower-than-expected recovery inChina’s smartphonemarket, particularly for Android smartphones. This is evident from the increased inventory days of companies likeMediaTekandQualcommin Q1 2023. The ongoing smartphone inventory correction is expected to continue for some more time. We will have to wait until at least late Q4 2023 for a recovery in smartphone demand to positively impact BT substrate demand.

San Jose, Buenos Aires, London, New Delhi, Hong Kong, Beijing, Seoul – June 12, 2023

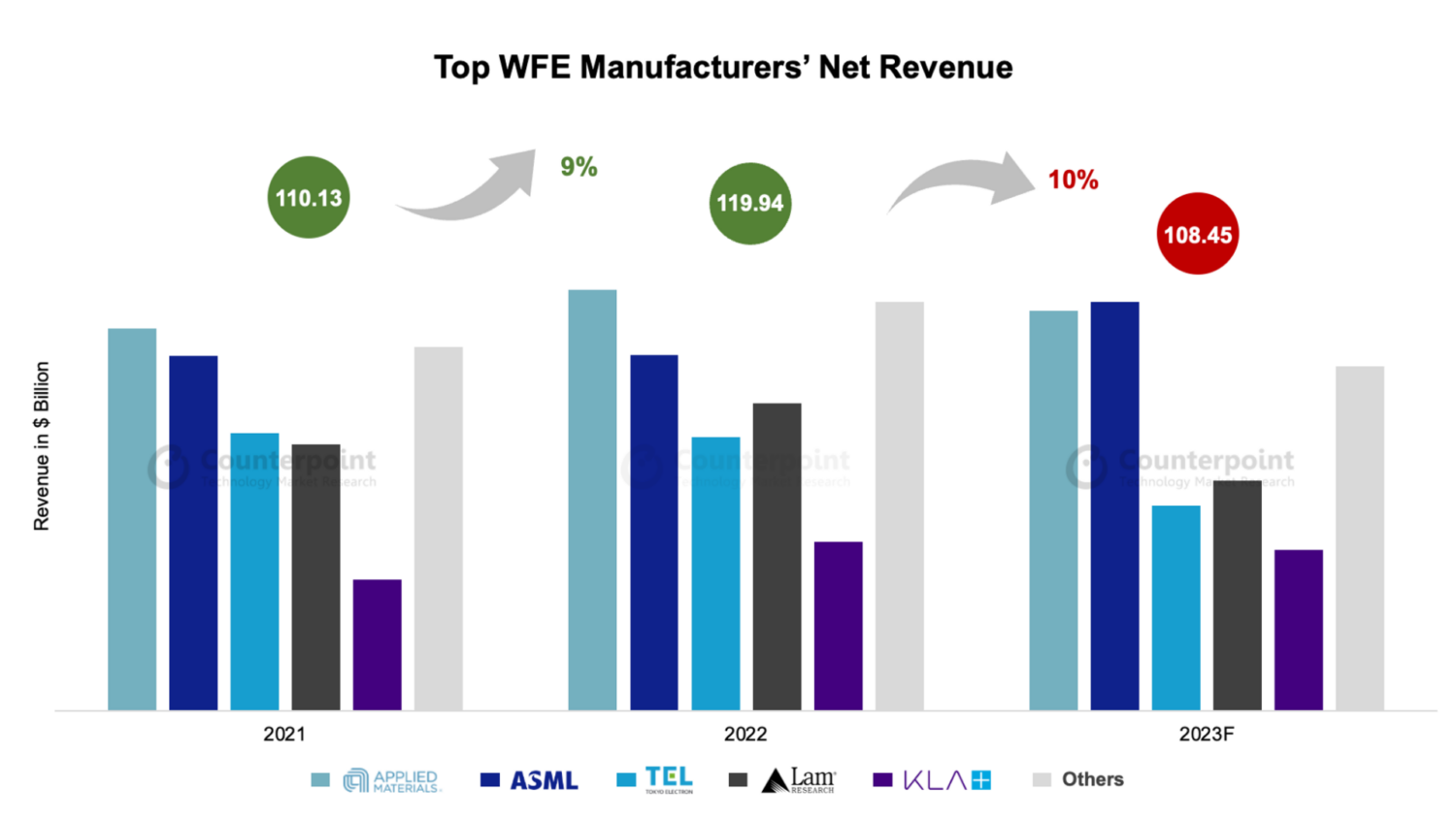

Wafer fab equipment (WFE) manufacturers’ revenue increased 9% YoY to a record $120 billion in 2022 despite themacroeconomicslowdown, currency fluctuations, component shortages and logistics disruptions. The increase was due to continued strength in investments by customers for both leading and mature node devices across segments, includingIoT,AI, HPC,automotiveand5G. The top five suppliers’ systems and service revenue increased to a record $95 billion.

TheWFE市场的再保险venue is expected to decline 10% YoY in 2023 to $108.45 billion after three consecutive years of growth. Despite a weakerWFEbackdrop for 2023, theEUVlithography outlook remains strong due to the continued penetration of EUV into memory and logic, and foundries ramping up production of 3nm process nodes by applying Gate-All-Around transistor and FinFET architectures with increased EUV technology adoption.

Associate Director Dale Gaisaid, “During the past six months,TSMChas pushed out new capacities in 7/6nm and 5/4nm in the light of weaker market demand, while the capital spending on 3nm remains nearly the same as it planned at the beginning of 2023.”

Source:Wafer Fab Equipment Revenue Tracker, Counterpoint Research

Commenting on the WFE market,Senior Analyst Ashwath Raosaid, “The size of the WFE market in US dollar terms contracted by more than 8% in 2022 due to the impact of currency fluctuations, especially depreciation in the yen and euro-denominated sales since the beginning of 2022. Increased R&D spending in 2022 ahead of the inflection positions the WFE market to outperform the semiconductor market in the long term as these new technologies transition to volume manufacturing.”

Commenting on the market dynamics playing out in 2023, Rao said, “Manufacturers are more skewed towards foundry-logic segments today unlike in 2019, and with overall backlog strength, increased visibility in terms of long-term agreements and subscription model will help limit the downside. The weakness in wafer fab equipment spending in 2023 will drive lead time and inventory normalization. The slowdown in memory-oriented investments will begin to recover gradually starting in the second half of 2023, and 2024 will be a big year for the equipment industry. Manufacturers are well positioned to take advantage of the opportunity.”

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the technology, media and telecom (TMT) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Ashwath Rao

Dale Gai

Neil Shah

Follow Counterpoint Research

press@www.arena-ruc.com

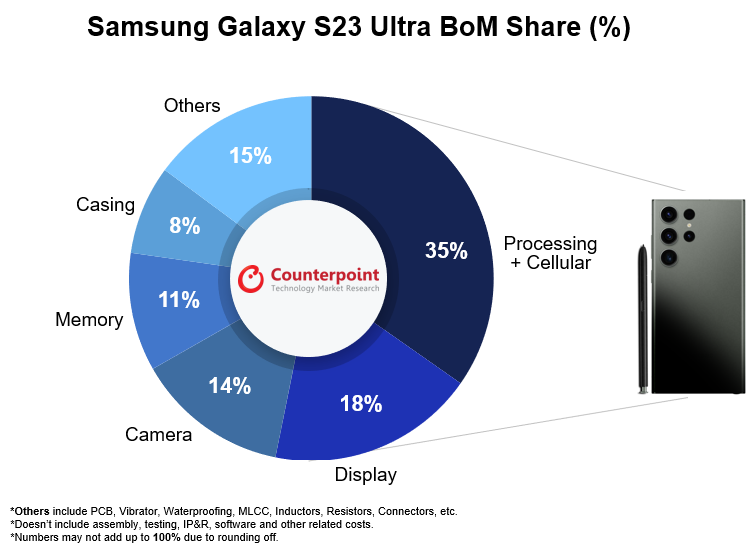

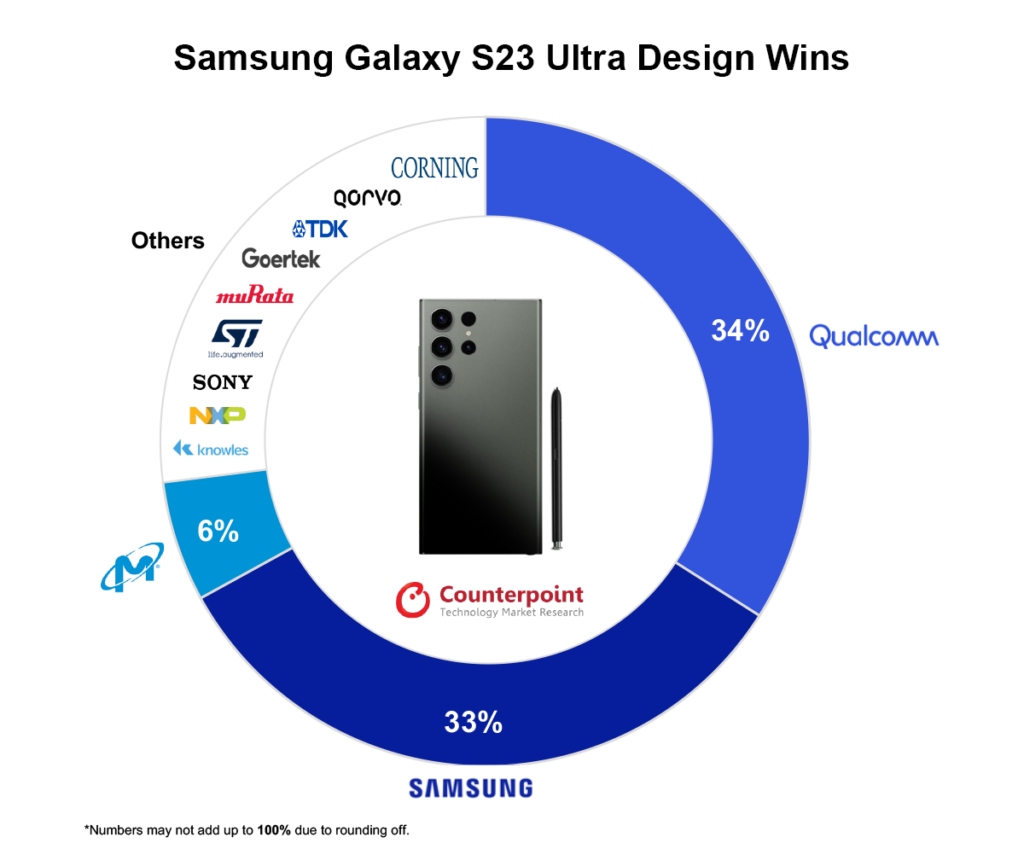

Producing an 8GB+256GB Galaxy S23 Ultra (Sub-6GHz) variant costs Samsung around $469, according to the latest bill of materials (BoM) analysis by Counterpoint’s component research service. The major components driving cost in thesmartphoneare the SoC, display and camera subsystem. Due to excess inventory and supply, components related to theRF sub-systemand memory were subjected to a cost decrease.

TheS23 Ultrafurther builds upon Qualcomm’s design, showcasing a customized version of the Snapdragon 8 Gen 2 chipset, manufactured onTSMC’s 4nm process node. Samsung has chosenQualcomm chipsetsdue to enhanced cellular support, increased performance gain from both the CPU and GPU, and better battery life. The GPU also has support for raytracing and has gained a slight uplift of 39MHz clock speed.

Qualcomm’s share in the S23 Ultra has increased to an all-time high after attaining design wins for the fingerprint sensor IC, key power management ICs, audio codec,RFpower amplifiers, Wi-Fi + Bluetooth, GPS and Sub-6GHz transceiver.

Samsung is the second largest beneficiary. It is an exclusive supplier of the 256GBNAND flashand the 6.8-inch AMOLED display for the S23 Ultra. Thedisplaycan sustain 1750 nits of peak brightness and has a resolution of 1440 x 3088 pixels that allows the users to view pictures and videos in sharp detail. The 120Hz LTPO panel also supports adaptive refresh rate.

In thecamera sub-system, the design wins are shared between Samsung (SEMCO) and Sony. Samsung provides the 200MP wide-angle camera (S5KHP2) and the 12MP selfie camera (S5K3LU), while Sony offers the 12MP Ultrawide (IMX564), 10MP Telephoto and Periscope Telephoto (IMX754) sensors.

Other component suppliers

Silicon Mitus and Maxim are the providers of power management ICs that support the regulation of power for display and other key components.

For sensing components,STMhas registered design wins related to the laser autofocus module, accelerometer, gyroscope, barometer, and touch panel controller. The battery is packaged by Samsung and the cell is provided by ATL. The quick charging IC, which charges up to 45W, is sourced fromNXPwhile the 15W wireless charging IC is from Convenient Power.

Samsung’ssourcing strategyand choice of components are enabling the brand to have a competitive edge in terms of cost efficiency.

For detailed component and pricing analyses, queries, or for acquiring this research, contactinfo@www.arena-ruc.com

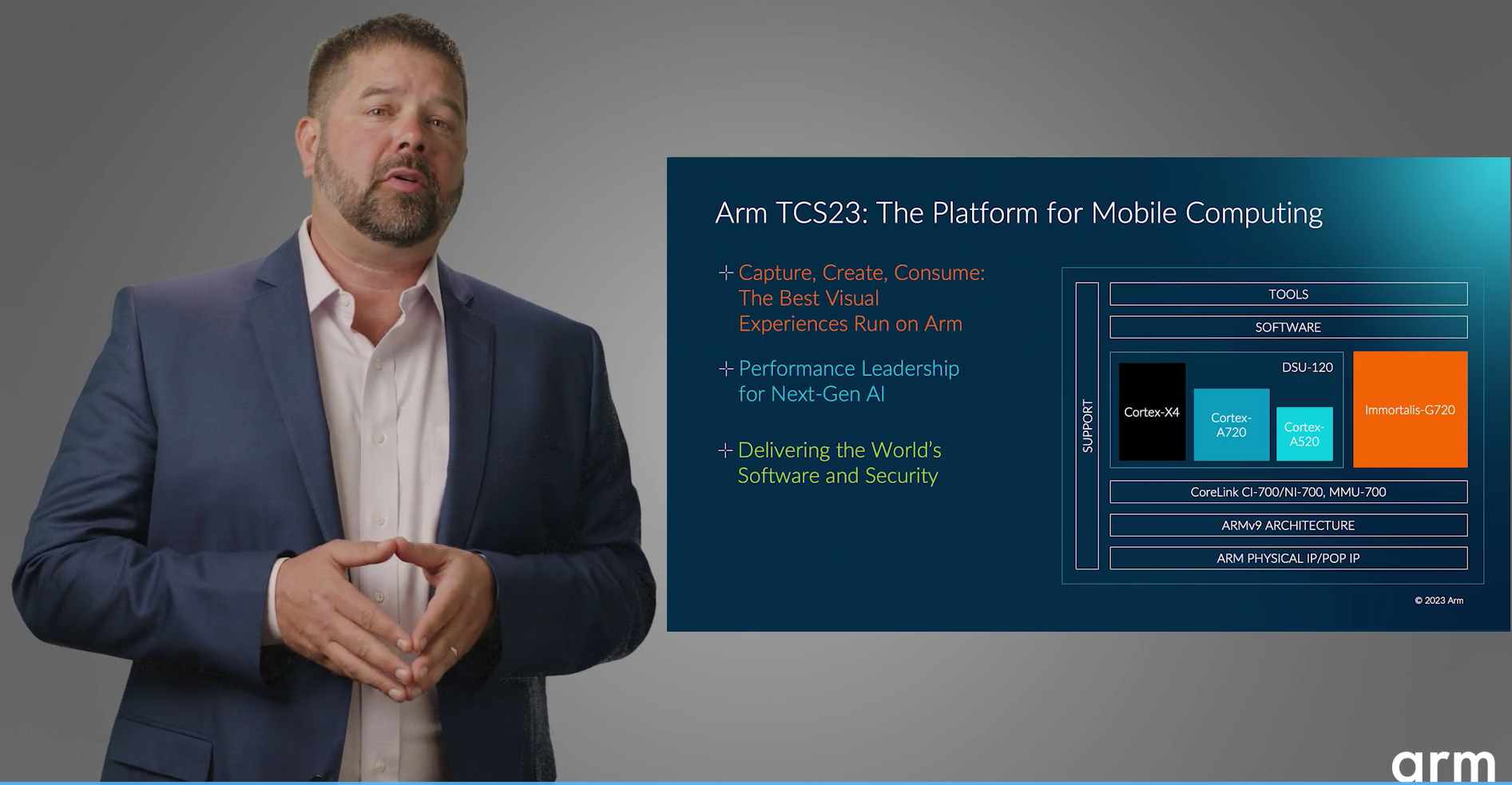

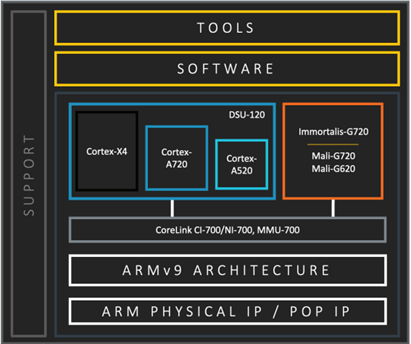

Leading mobile computing SoC architecture companyArmglobally unveiled its Total Compute Solutions 2023 (TCS23) platform at the Computex 2023 expo, being held in Taipei from May 30 to June 2. The latest generation of TCS will power the next-generation secure, intelligent (AI) and immersive (3D visual) experiences.

Arm commenced the TCS journey in 2021 with a focus on three key aspects of SoC design –ComputePerformance,SecurityandSoftware(DeveloperAccess). This complete package helps an SoC designer to integrate Arm IP offerings across CPU, GPU and System IP (Interconnect, SLCs, MMUs) to reduce complexity, costs and time to market.

TCS23 brings optimized physical IP, new GPU and advanced software tools

Arm continues to innovate across the stack, from its Physical/Pop IP, CoreLink System IP, ARMv9 architecture CPU cluster (Cortex-X4, -A720 and -A520) to new architecture-driven 5thGen GPU (Immortalis-G720), to power visual computing applications designed for 3nm nodes and supported by advanced software and toolsets.

Source: Arm

Source: Arm

CPU advancements

See here:

Arm also announced thetapingout of the upcomingCortex-X4on theTSMCN3Eprocess, an industry first.

Arm also announced thetapingout of the upcomingCortex-X4on theTSMCN3Eprocess, an industry first.

System IP and GPU advancements

Security and software advancements

Roadmap, ecosystem traction and outlook

Source: Arm

Source: Arm, Counterpoint Analysis

See here:

[one_half padding=”0 10px 0 0″]

[/one_half]

[one_half_last padding=”0 0 0 10 px”]

[/one_half_last]

See here:

[one_half padding=”0 10px 0 0″]

[/one_half]

[one_half_last padding=”0 0 0 10 px”]

[/one_half_last]

Overall, theend-to-end system optimization provided by TCS23with enhancements across hardware and software unlocks performance and efficiencies to power future mobile computing experiences.Armremains alinchpinandTCS a foundational platformfor the industry to build onlow-power but high-performance computing experiences.

Published Date: May 11, 2023

This page shows thequarterly revenue sharefor the top players in the global semiconductor foundry market from Q3 2021 to Q1 2023.

![]()

| Global Semiconductor Foundry Revenue Share (%) |

Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 |

| TSMC | 55% | 53% | 54% | 56% | 59% | 59% | 59% |

| Samsung Foundry* | 15% | 16% | 15% | 13% | 12% | 13% | 13% |

| GlobalFoundries | 6% | 6% | 6% | 6% | 6% | 6% | 7% |

| UMC | 7% | 7% | 7% | 8% | 7% | 7% | 6% |

| SMIC | 5% | 5% | 6% | 6% | 6% | 5% | 5% |

| Others | 12% | 12% | 12% | 11% | 10% | 10% | 10% |

(*)Samsung includes foundry service for its internal logic IC business

This page provides a view on the global foundries revenue share from 2021 till 2023. Here are some highlights from Q1 2023:

DOWNLOAD:

(Use the buttons below to download the complete chart)![]()

![]()

Read our foundry quarterly report for Q1 2023here.

For detailed insights on the data, please reach out to us atsales(at)www.arena-ruc.com. If you are a member of the press, please contact us atpress(at)www.arena-ruc.comfor any media enquiries.

Related Posts: