- China’s EV market growth continued to slow, with Q2 2023 EV unit sales seeing a rise of only 37% YoY – lower than the global average

- Strong results from four of China’s big 5 EV makers were offset by a mix of tepid and disappointing results across a range of key manufacturers

- Chinese OEMs look prepped to expand globally, with share of global (ex-China) auto sales set to pass a significant 10% milestone in Q3 2023

- SAIC Group and BYD Auto account for the bulk of exports, with the latter well positioned for long-term growth as it enters Europe in earnest later this year

Beijing, Hong Kong, London, New Delhi, Boston, Seoul – September 8, 2023

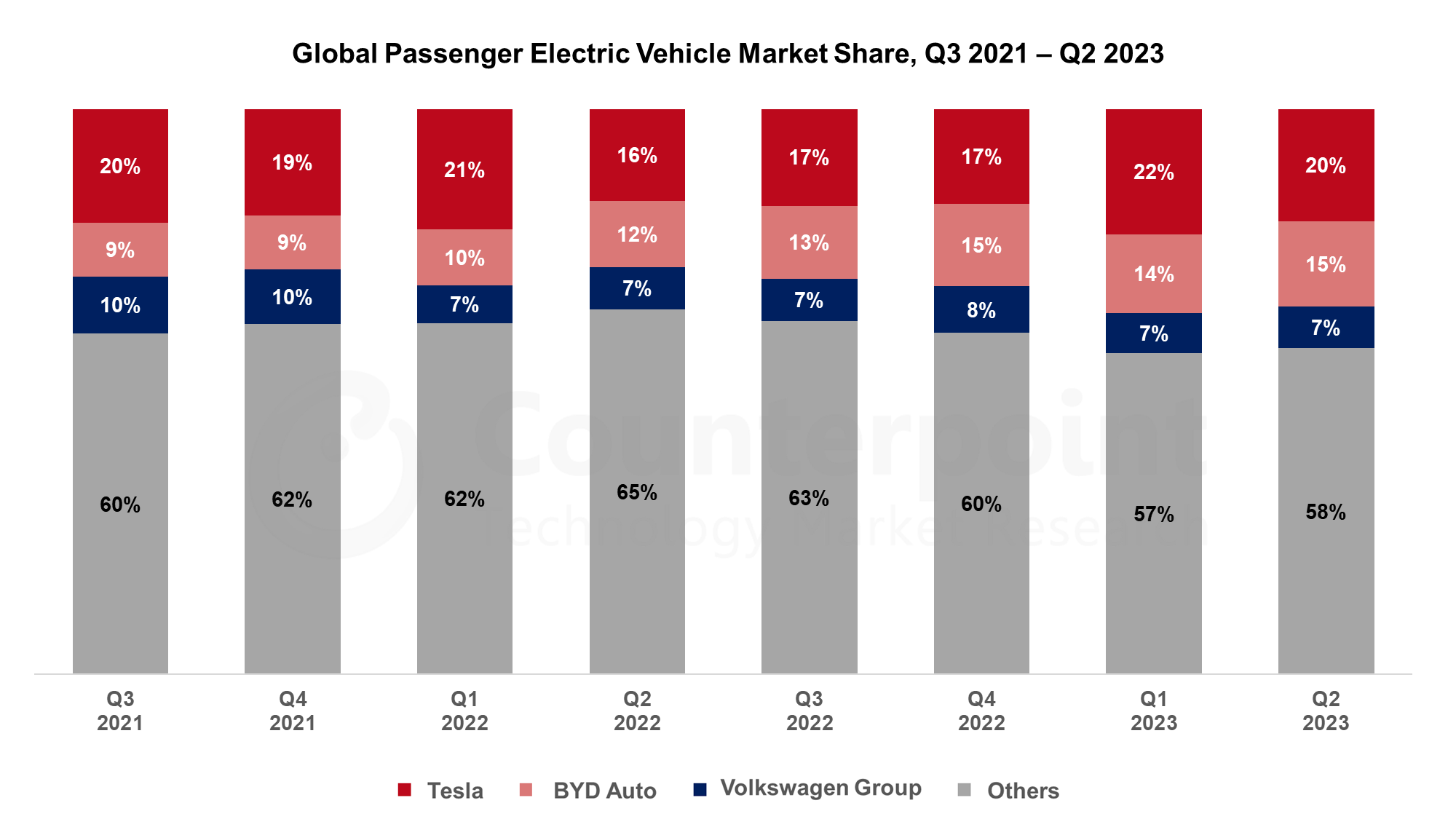

According to Counterpoint Research’s latest2023年第二季度,中国客运电动汽车跟踪器battery electric vehicle (BEV) unit sales in the country grew only 37% YoY, lower than theglobal average of 50%, highlighting a slowdown in domestic growth as the frail Chinese economy impacted demand in the world’s biggest EV market.

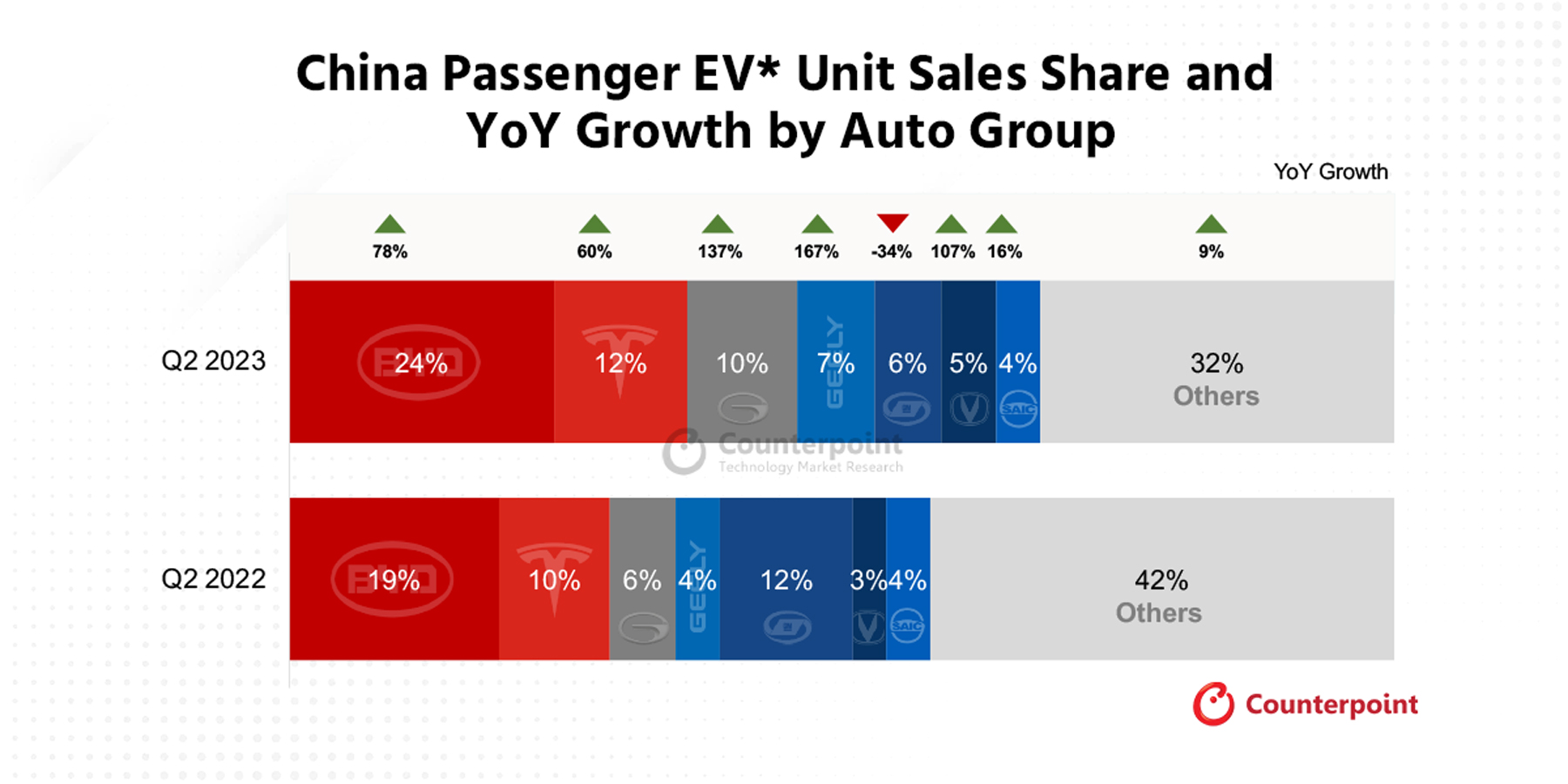

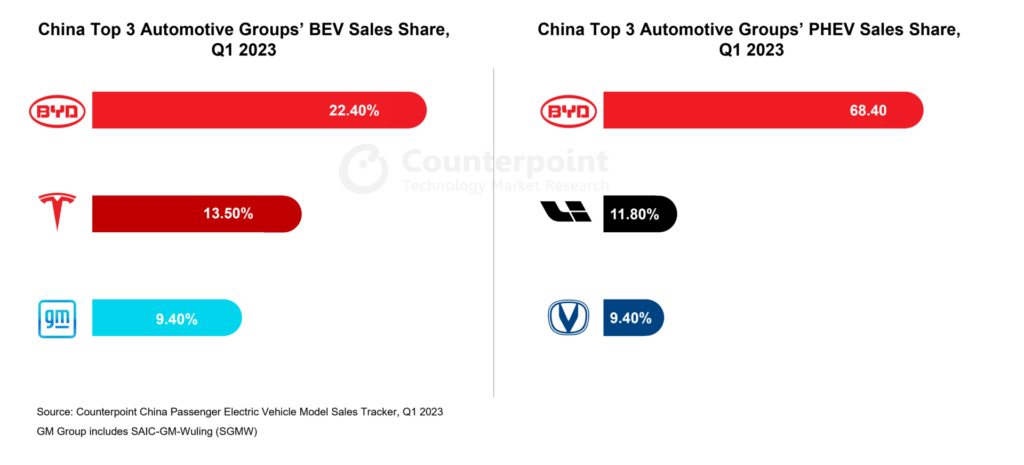

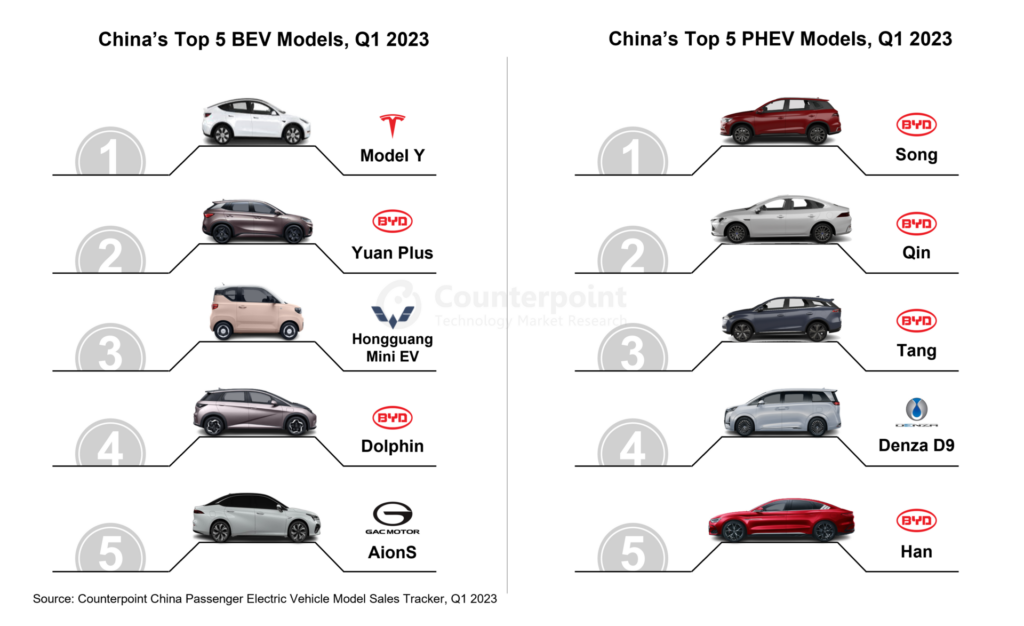

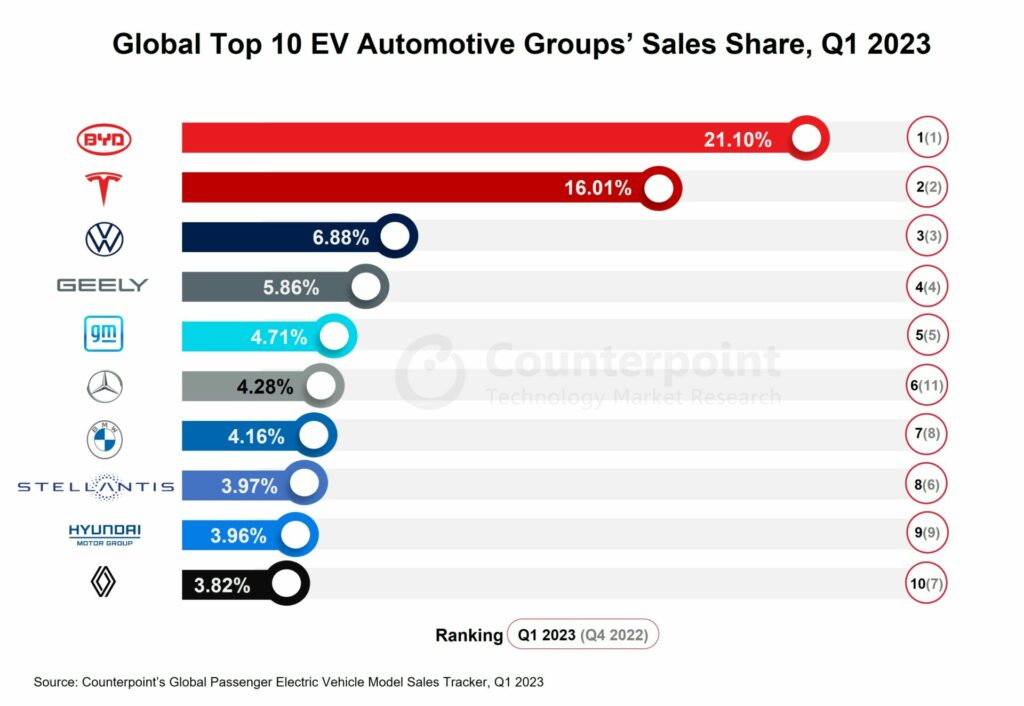

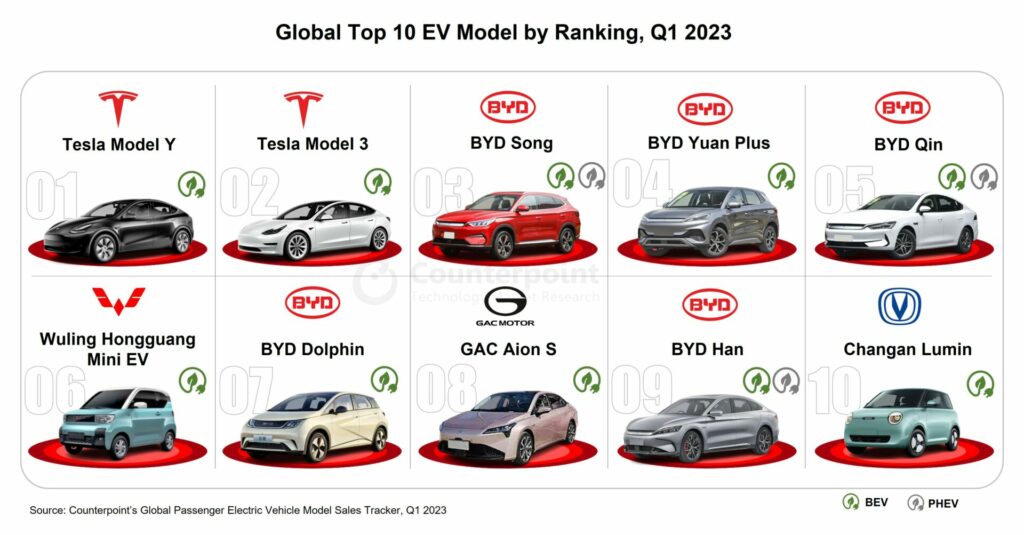

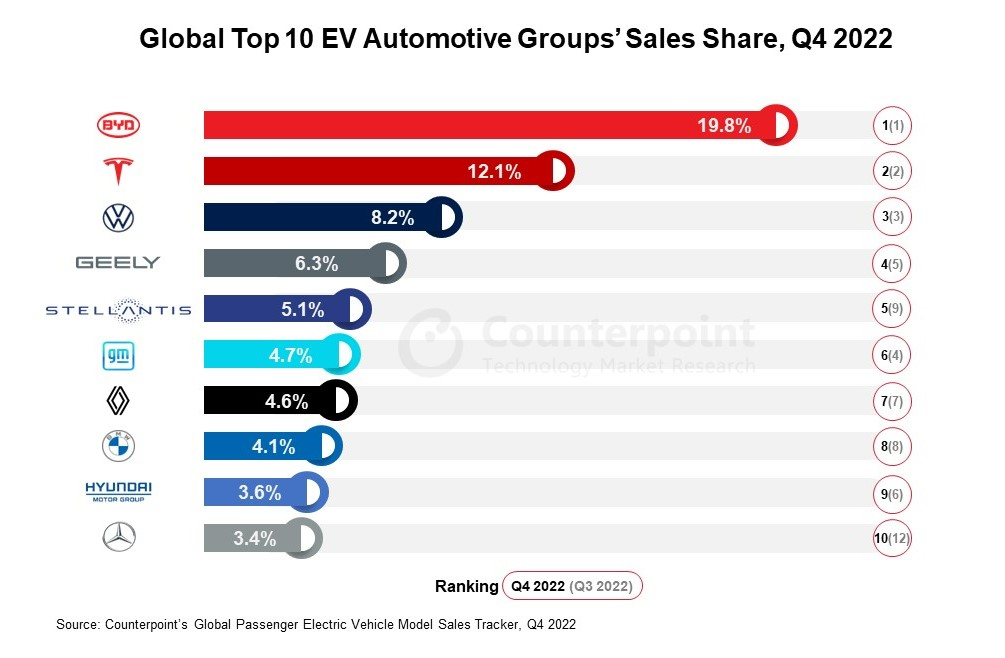

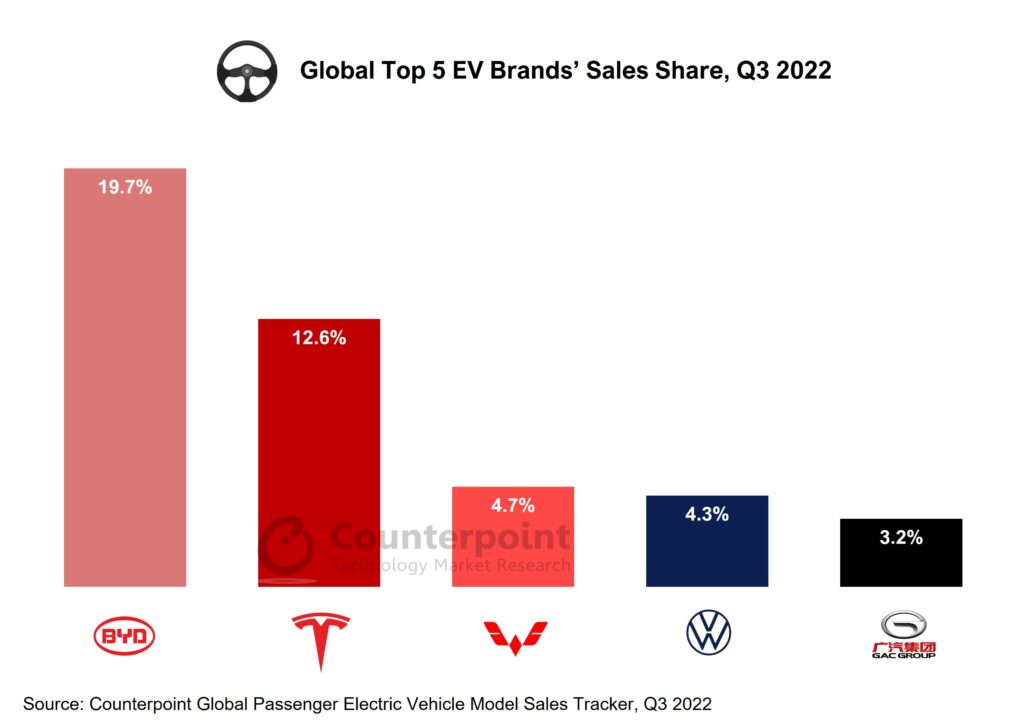

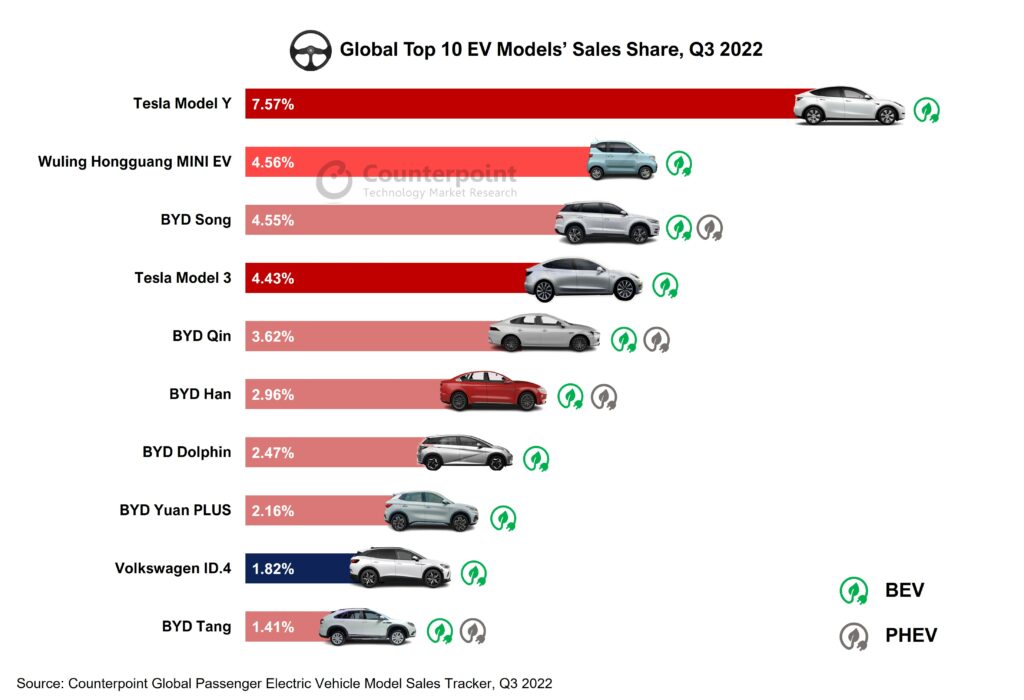

BYD Auto and Tesla continued to dominate unfazed, accounting for more than one-third of domestic unit sales. But the market also saw GAC Group establish itself as a solid number three on the back of strong demand for its line of compact Aion sedan and hatchbacks as it aggressively reduced prices in the midst of a price war.

“We’re also seeing strong numbers from several mid-sized domestic players that are having success across a broad range of vehicles – from sub-compact city cars through to long-range luxury cruisers. But many automakers are struggling as the market eases,” notes Ethan Qi, Associate Director. “China’s a big market but there’s also a lot of small carmakers, so any kind of slowdown and you’re probably going to see some consolidation as weaker companies inevitably exit.”

China Passenger EV* Unit Sales Share and YoY Growth by Auto Group

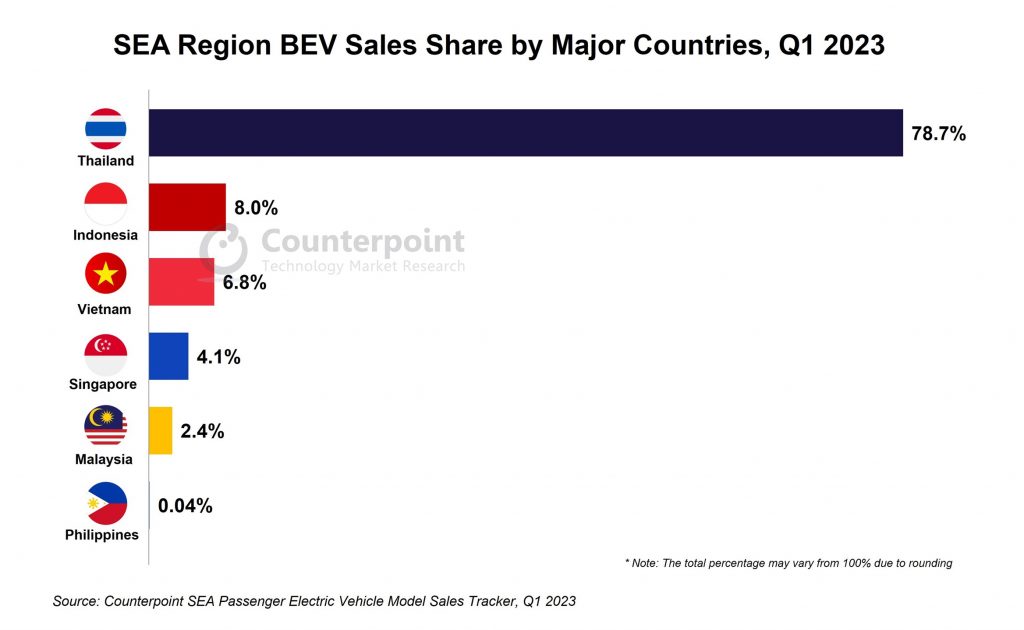

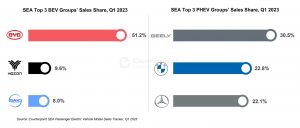

Many Chinese OEMs are looking externally for growth and are gaining a foothold in markets like Europe and Asia. “If you exclude China, by far the biggest market for EVs globally is Western Europe. It’s not China, but growth has started to accelerate this quarter,” says Qi. “Right now it’s all about MG, the SAIC-owned British badge that’s spearheading Chinese growth in the region with its compact cars and SUVs. It’s filling a vacuum in the affordable segment, where traditional names are struggling to supply consumers with EVs in that $20,000 – $40,000 sweet spot. This is where Chinese brands have a lot of depth.”

Chinese OEM Overseas EV Sales and Market Share

BYD Auto is enjoying success across a diverse group of markets mainly in Asia, but it is gearing up for Europe growth with new models to be shipped into the region later this year.

伊凡Lam高级分析师、制造业、指出,“BYD has all the classic advantages of a Chinese tech company including scale and proximity to the supply chain. What makes them stand out even more is their vertical integration right through to the battery. This helps them dominate at home. And as they expand production outside China, it will also make them a serious threat to global competitors.”

“I wouldn’t be surprised if they’re able to grab a lot of share quickly because of the latent demand for affordable EVs in Europe. And a planned 2025 factory will only bolster their advantage over the long term,” muses Lam. “The maxim ‘If you can make it in China, you can make it anywhere’ really does apply here.”

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Follow Counterpoint Research