Apple announced the newiPhone 14series on September 9, five days before last year’s iPhone 13 announcement. Apple andcarrierstores across the country opened their doors at 8 am on September 16 for the official launch of the iPhone 14 and iPhone 14 Pro and Pro Max. Here are the seven key takeaways from the launch:

- Inventory is much improved overlast year’s launch which was affected by component shortages

- At opening, manyApplestores still had plenty ofinventoryfor those looking to purchase iPhones as walk-ins, although the supply is waning now and some Pro Max models are on back order at carriers. This was very different compared to last year where customers often had to have devices shipped to them during the launch period due to shortages.

Sources: Apple.com, carrier websites

- iPhone 14 Pro Max and iPhone 14 Pro lead early sales

- 早期采用者和升级继续选择the Pro models instead of the base iPhone 14. This is typical for the early months of a new iPhone launch. Many are upgrading from older devices such as the iPhone X series. Fewer are upgrading from the iPhone 13 Pro series. The new deep purple color is a forerunner for color choice.

- iPhone 14 – early upgraders are hesitant

- Apple store and carrier reps will have a hard time convincing iPhone owners to purchase an iPhone 14 as it is almost identical to the $100 cheaper iPhone 13. Some of the improvements are an additional core on the A15 bionic chip, a 1.6% bigger battery, a slightly wider F1.5 aperture 12MP rear camera, along with crash detection and Emergency SOS via satellite (which hasn’t rolled out yet).

- Savvy customers will know these differences and either hold off or go for the iPhone 13 instead. Reps may also advise iPhone 13 users not to upgrade, especially in cases where devices still need to be paid off or no tangible benefit can be found for an upgrade.

- Carrier pre-order deals are similar to last year, but Verizon not the forerunner anymore

- Verizon,AT&Tand T-Mobile have similar pre-order deals compared to last year, offering up to $800 off for the base model and up to $1,000 off for the Pro series devices with trade-ins and unlimited plans.Verizon’s iPhone 14 Pro promotion offers another $200 via e-gift card for switchers. This is worse compared to last year when it offered an extra $500 via Prepaid Mastercard.

- Apple store trade-in values are less competitive than last year

- The highest trade-in values for Apple phones this year are $720 for aniPhone 13 Pro Maxand $600 for an iPhone 13 Pro. Last year’s offers were better at $790 for an iPhone 12 Pro Max and $640 for an iPhone 12 Pro. Lower trade-in values make Apple’s own promotions weaker year over year.

Source: Apple.com

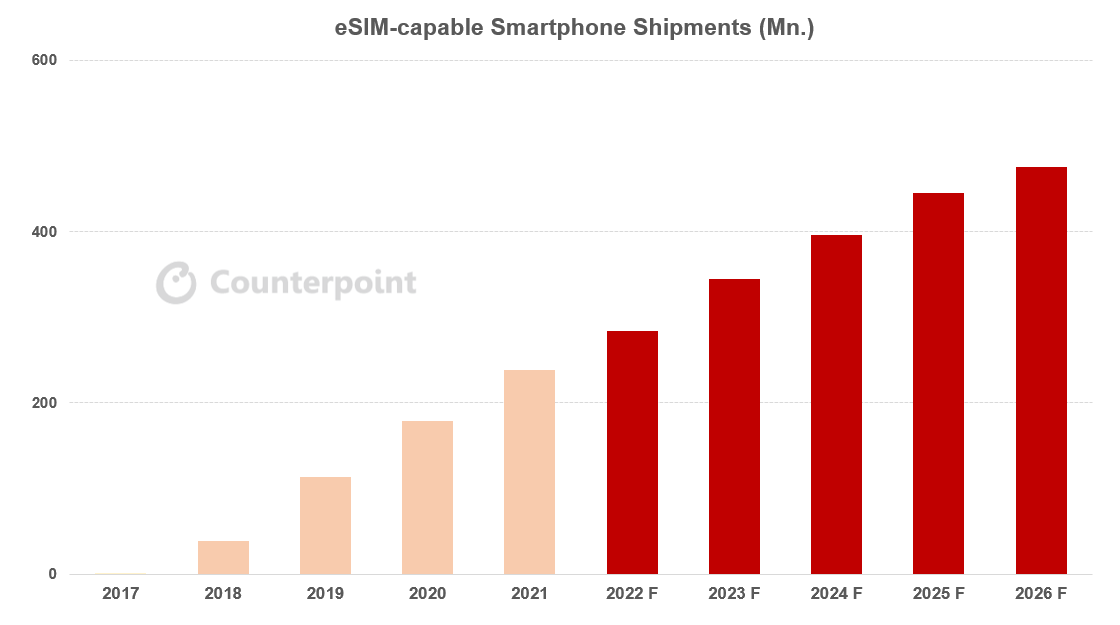

- eSIMwoes a mixed bag

- Having eSIM-only iPhones was a big point of concern for reviewers and media as it makes switching from multiple SIM cards more difficult, especially when travelling in other countries where eSIM isn’t as widespread.

- 人希望美国iPhone和购买send it to someone abroad are also more hesitant to do so with the iPhone 14.

- eSIM activations have been going smoothly at carrier store locations, according to reps. However, there are complaints coming from people trying to transfer their eSIMs over themselves, as this is a new and unfamiliar process for many. In addition, iOS 16 introduced a bug that impacted new device activations, which required a firmware update to iOS 16.0.1 to fix the issue.

- Store traffic is managed by Apple’s appointment system

- Apple has followed a system for several years now where people need to book an appointment to purchase a device. The long lines we see now are for those looking to grab an appointment spot to purchase a device. The hype of previous iPhone launches is more subdued in today’s environment.

Conclusion

The iPhone 14 series is off to a strong start, especially for the iPhone 14 Pro and Pro Max. It remains to be seen how the iPhone 14 stacks up compared to the similarly spec’d and more affordable iPhone 13. However, thesuccessof the iPhone will likely continue despite the current state of the economy as Apple products are more shielded from inflationary pressures and consumers continue to see strong promotions to help sell devices.