- EV sales penetration dropped to 18.4% in Q1 2023 from 27.6% in Q4 2022

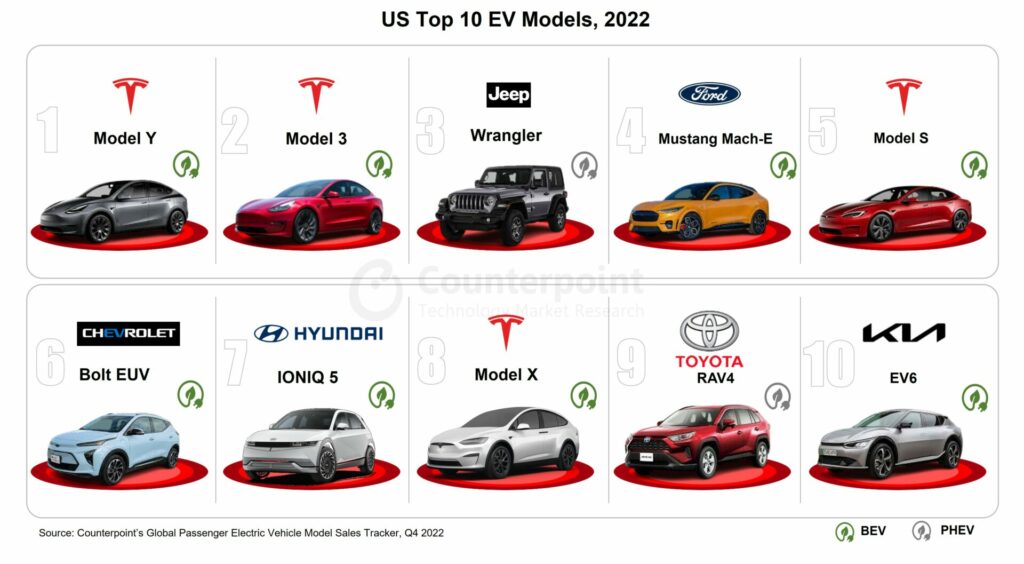

- 特斯拉模型Y是最畅销的EV模型all major countries except Spain.

- EV sales penetration is expected to exceed 25% again by the end of the year.

London, New Delhi,San Diego, Buenos Aires, Hong Kong, Beijing, Seoul – July 5, 2023

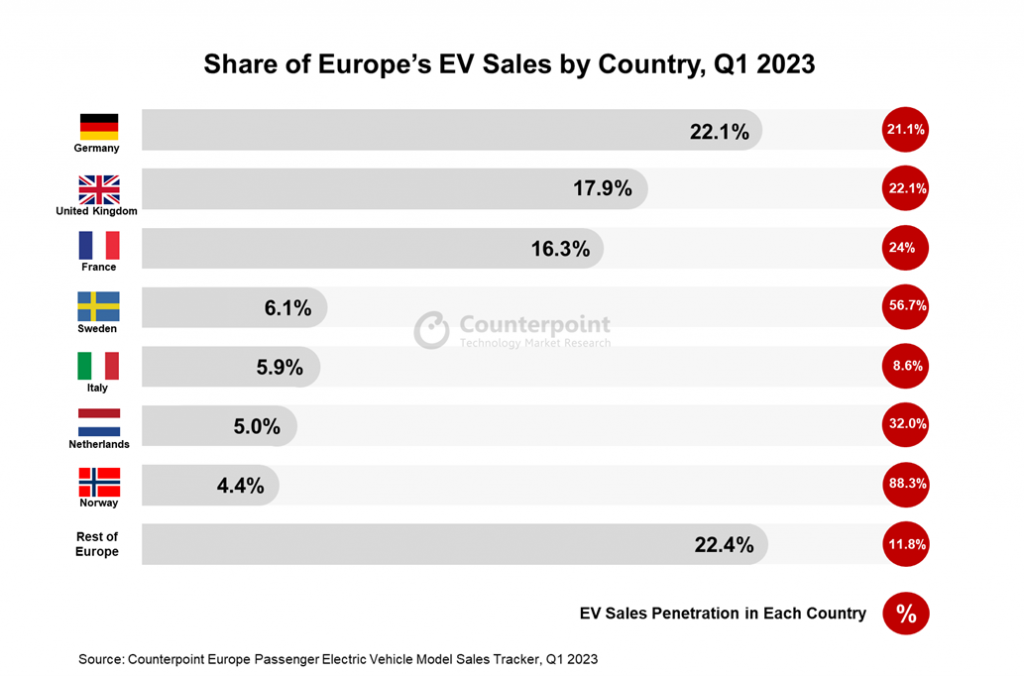

Europe’s passenger electric vehicle* (EV) sales increased by more than 13% YoY in Q1 2023, according to the latest research from Counterpoint’sEurope Passenger Electric Vehicle Model Sales Tracker. While overall passengercar salesin Europe are showing signs ofimprovement, they have not yet reached pre-COVID-19 levels. In terms ofoverall EV sales, Germany led the pack, closely followed by the UK, France, Italy, the Netherlands and Norway. Meanwhile, the share of EVs in total passenger vehicle sales was the highest in Norway and the Netherlands.

In Q1 2023,Battery EV(BEV) salesjumped 32% YoYwhile plug-in hybrid EV (PHEV) sales declined 13% YoY. Consequently, the EV share of total passenger vehicle salesdeclinedduring the quarter from that a year ago.

Meanwhile, there has beennotable progressin the European market for Hybrid EVs (HEV) and mild-hybrid EVs (MHEVs). This indicates that Europe is making efforts to tap into the lower-end EV market while simultaneously developing battery ecosystems and fostering a circular economy. These initiatives are being undertaken before placing a stronger emphasis on pure EV sales.

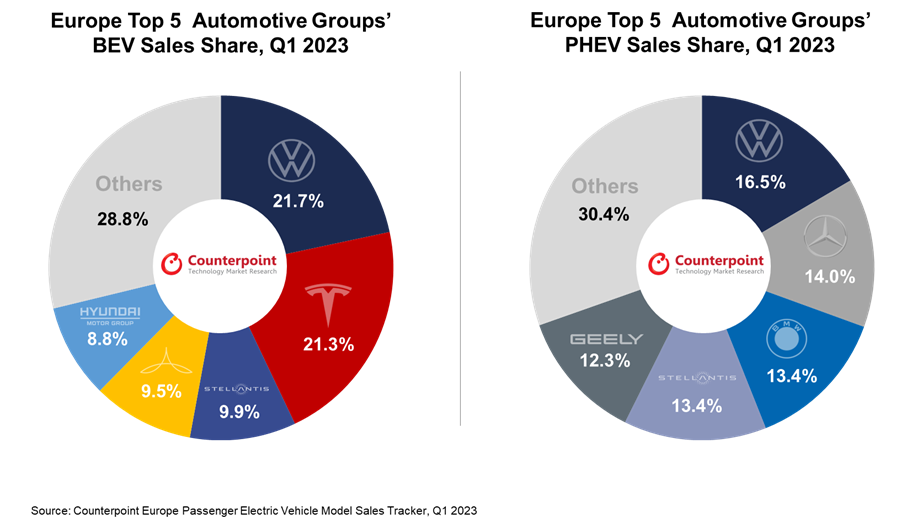

Commenting on the market dynamics,Senior Analyst Soumen Mandalsaid, “In Q1 2023, mostEuropean EV saleswere captured by the top five automotive groups – Volkswagen Group, Tesla, Stellantis, Mercedes-Benz and Hyundai-Kia. They accounted for nearlytwo-thirdsof the market share. When it comes to pure electric vehicles (BEVs),Teslaholds the second position, slightly behindVolkswagen. In the plug-in hybrid electric vehicle (PHEV) market, Volkswagen takes the lead, followed byMercedes-BenzandBMW.”

“Chinese EV manufacturersstruggled to increase their market share in Europe during the quarter. However,MG, BYD, NIO, ORAandAiwaysmanaged to improve their sales compared to the previous year. On the other hand,LYNK & CO,HongqiandXpengfaced challenges in the European market. Nevertheless, we expect Chinese automakers to be able to enhance their market share in the coming quarters by offering cost-effective vehicles with advanced features, as the EV market is expected to perform better.”

Thetop-selling EV modelduring Q1 2023 was theTesla Model Y, followed by theVolvo XC40,Tesla Model 3, Volkswagen ID.3, and Audi Q4 e-tron. These top five models account for nearly a quarter of the total shipments. The Tesla Model Ydominatesthe market across major European countries, demonstrating Tesla’s strong brand presence in the region, except in Spain where it faces more competition.

Discussing the market outlook,Research Vice President Peter Richardsonsaid, “The penetration of EVs in total passenger vehicle sales in Europe experienced adeclinethis quarter, dropping to 18.4% from 27.6% in Q4 2022. This is a significant shift compared to the previous trend of continuous QoQ growth. Except France, all major countries experienced this decline during Q1 2023.”

“Several factors contributed to this decline, including theunstable economic conditionsand the removal of EV subsidies by Norway. Germany, the largest EV market in Europe, experienced a decline as thelooming recessionandcautious consumer spendinghurt the EV market. These circumstances impacted the overall adoption of EVs in the region. However, since April, the European region has shown signs of recovery. As a result, we expect the share of EVs to rebound andsurpass 25%again by the end of this year.”

*Sales refer to wholesale figures, i.e. deliveries from factories by the respective brands/companies.

*The countries in this study include Austria, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Luxembourg, the Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, the UK and Ukraine.

*For EVs, we consider only BEVs and PHEVs. Hybrid EVs and fuel cell vehicles (FCVs) are not covered by this study.

The comprehensive and in-depth ‘Europe Passenger Electric Vehicle Sales Tracker, Q1 2018-Q1 2023’ is now available for purchase atreport.www.arena-ruc.com.

Feel free to reach us at press@www.arena-ruc.com for questions regarding our latest research and insights.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Abhik Mukherjee

Soumen Mandal

Neil Shah

Peter Richardson

Follow Counterpoint Research

RelatedPosts

- US EV Sales Up 79% YoY in Q1 2023 Helped by Tax Credit Subsidy

- Global EV Sales Up 32% YoY in Q1 2023 Driven by Price War

- Global Passenger Electric Vehicle Market Share, Q2 2021 – Q1 2023

- Google Puts Auto Expansion in Top Gear

- Connected Car Sales Grew 12% YoY in 2022 With Volkswagen Group in Lead

- 降价增加特斯拉第一季度营收、利润下滑s Compared to 2022

- Global Electric Vehicle Sales Crossed 10 Million in 2022; Q4 Sales up 53% YoY

- Berlin Factory Takes Tesla to Top Spot in Europe EV Sales as Chinese Brands Gain Ground

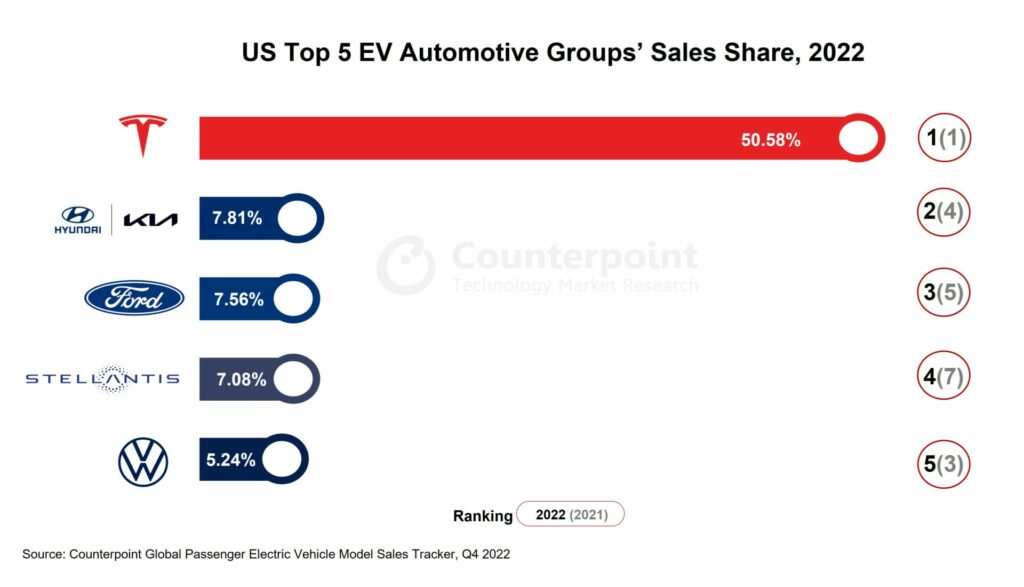

- EV Sales in US up 54.5% YoY in 2022; Tesla Market Share at 50.5%

- AI Voice Assistants to Push Success of Autonomous Driving, Software-defined Vehicle

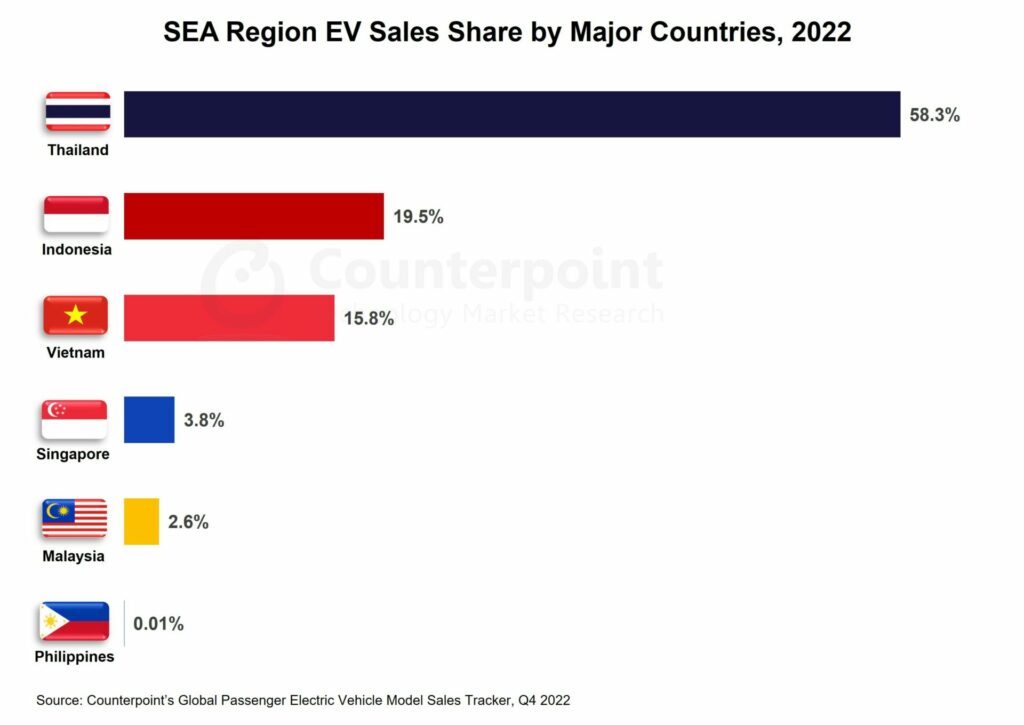

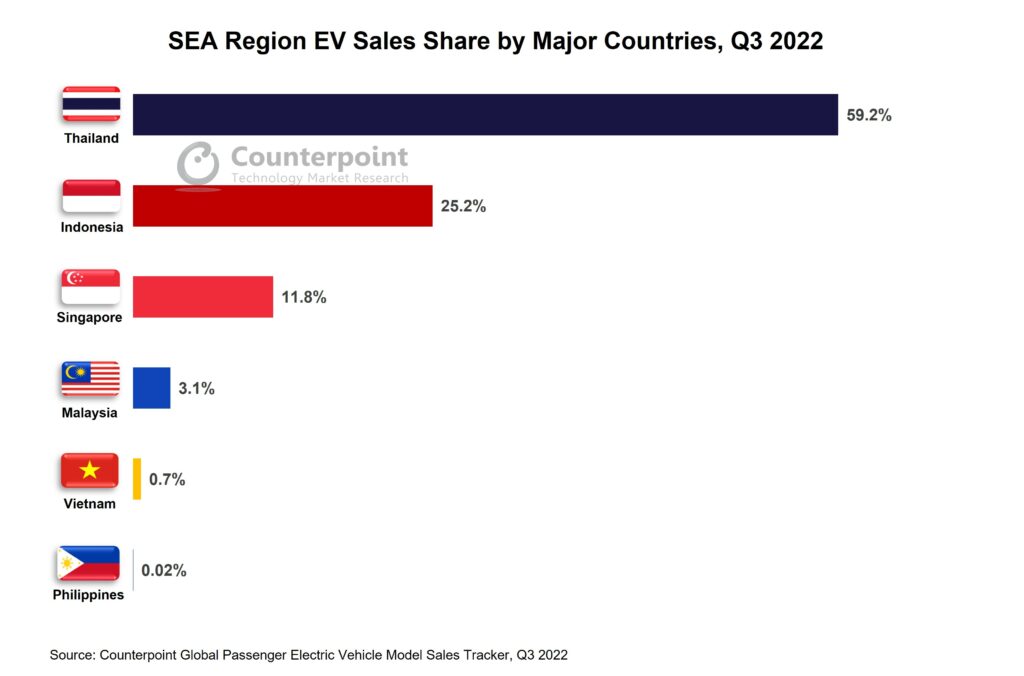

- Thailand Leads Southeast Asia EV Market With 60% Share

- Mercedes Fends off VW in Europe EV Market

- BYD Widens Gap with Tesla in Q3 2022, Leads Global EV Market

- A Promising Yet Challenging Market for Self-driving SoCs