Counterpoint Research Weekly Newsletter

Counterpoint is attending IDMC on September 13th – September 14th, 2023

Our analysts will be attending the India Display Manufacturing Conference (IDMC), 2023. You can schedule a meeting with them to discuss the latest trends in the technology, media and telecommunications sector and understand how our leadingresearchandservicescan help your business.

Here is the list of team members attending the event:

When:September 13th – September 14th

Where:BIEC, Bengaluru

Register for the eventhere。

About the event:

At IDMC, thought leaders from across the world will converge to share their insights and perspectives on the sector’s outlook and opportunities. This event will bring together prominent investors, business leaders in the global display industry, and leading Indian corporations.

Additionally, the event will feature an exhibition, unveiling the latest display products and trends, making it a gathering for anyone seeking to stay at the forefront of the industry.

Click here(or send us an email at contact@www.arena-ruc.com) to schedule a meeting with them

Beijing, Hong Kong, London, New Delhi, Boston, Seoul – September 8, 2023

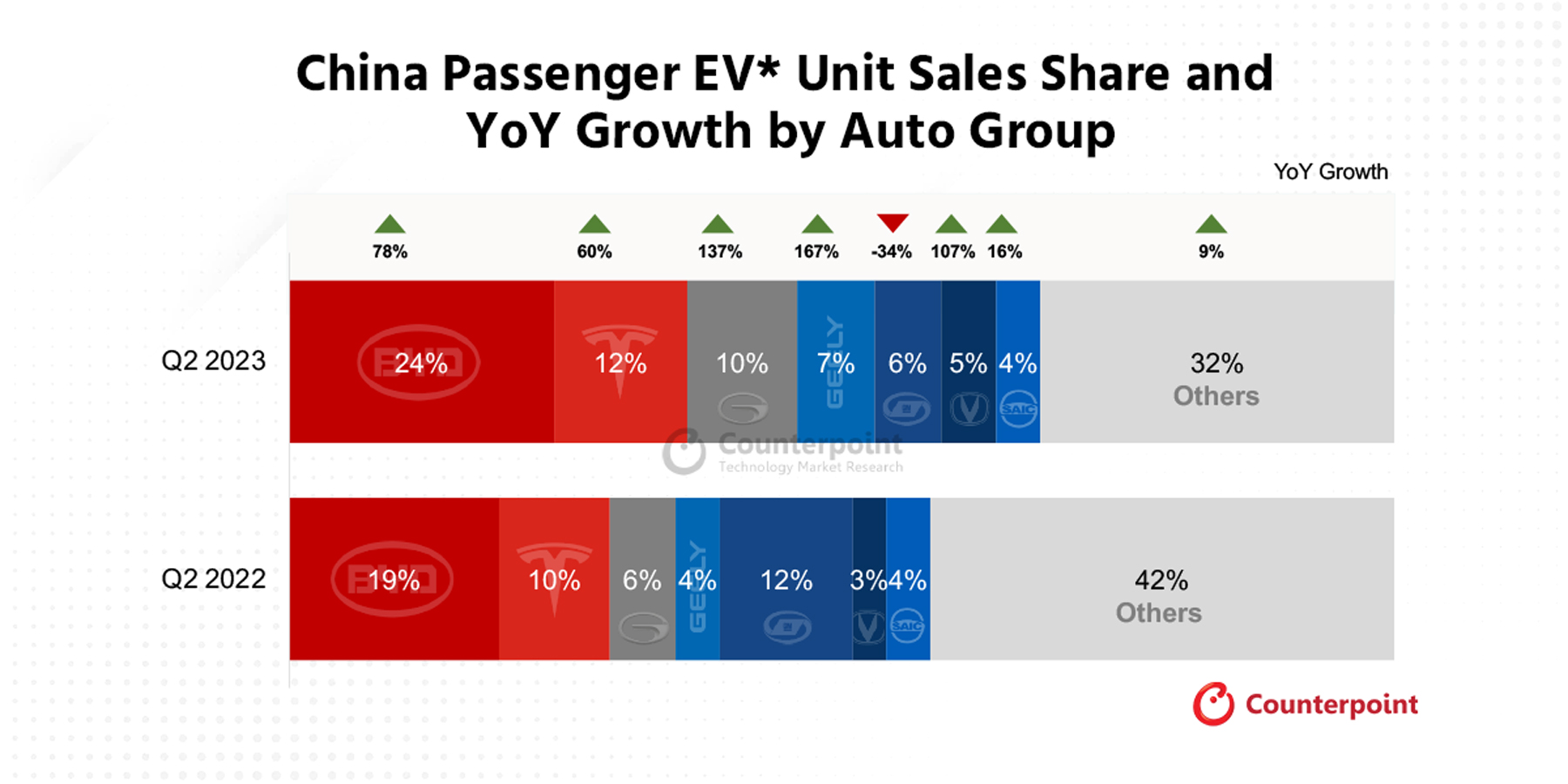

According to Counterpoint Research’s latestChina Passenger Electric Vehicle Tracker, Q2 2023battery electric vehicle (BEV) unit sales in the country grew only 37% YoY, lower than theglobal average of 50%, highlighting a slowdown in domestic growth as the frail Chinese economy impacted demand in the world’s biggest EV market.

BYD Auto and Tesla continued to dominate unfazed, accounting for more than one-third of domestic unit sales. But the market also saw GAC Group establish itself as a solid number three on the back of strong demand for its line of compact Aion sedan and hatchbacks as it aggressively reduced prices in the midst of a price war.

“We’re also seeing strong numbers from several mid-sized domestic players that are having success across a broad range of vehicles – from sub-compact city cars through to long-range luxury cruisers. But many automakers are struggling as the market eases,” notes Ethan Qi, Associate Director. “China’s a big market but there’s also a lot of small carmakers, so any kind of slowdown and you’re probably going to see some consolidation as weaker companies inevitably exit.”

China Passenger EV* Unit Sales Share and YoY Growth by Auto Group

Many Chinese OEMs are looking externally for growth and are gaining a foothold in markets like Europe and Asia. “If you exclude China, by far the biggest market for EVs globally is Western Europe. It’s not China, but growth has started to accelerate this quarter,” says Qi. “Right now it’s all about MG, the SAIC-owned British badge that’s spearheading Chinese growth in the region with its compact cars and SUVs. It’s filling a vacuum in the affordable segment, where traditional names are struggling to supply consumers with EVs in that $20,000 – $40,000 sweet spot. This is where Chinese brands have a lot of depth.”

Chinese OEM Overseas EV Sales and Market Share

BYD Auto is enjoying success across a diverse group of markets mainly in Asia, but it is gearing up for Europe growth with new models to be shipped into the region later this year.

伊凡Lam高级分析师、制造业、指出,“BYD has all the classic advantages of a Chinese tech company including scale and proximity to the supply chain. What makes them stand out even more is their vertical integration right through to the battery. This helps them dominate at home. And as they expand production outside China, it will also make them a serious threat to global competitors.”

“I wouldn’t be surprised if they’re able to grab a lot of share quickly because of the latent demand for affordable EVs in Europe. And a planned 2025 factory will only bolster their advantage over the long term,” muses Lam. “The maxim ‘If you can make it in China, you can make it anywhere’ really does apply here.”

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Follow Counterpoint Research

New Delhi,London,San Diego, Buenos Aires, Hong Kong, Beijing, Seoul – September 4, 2023

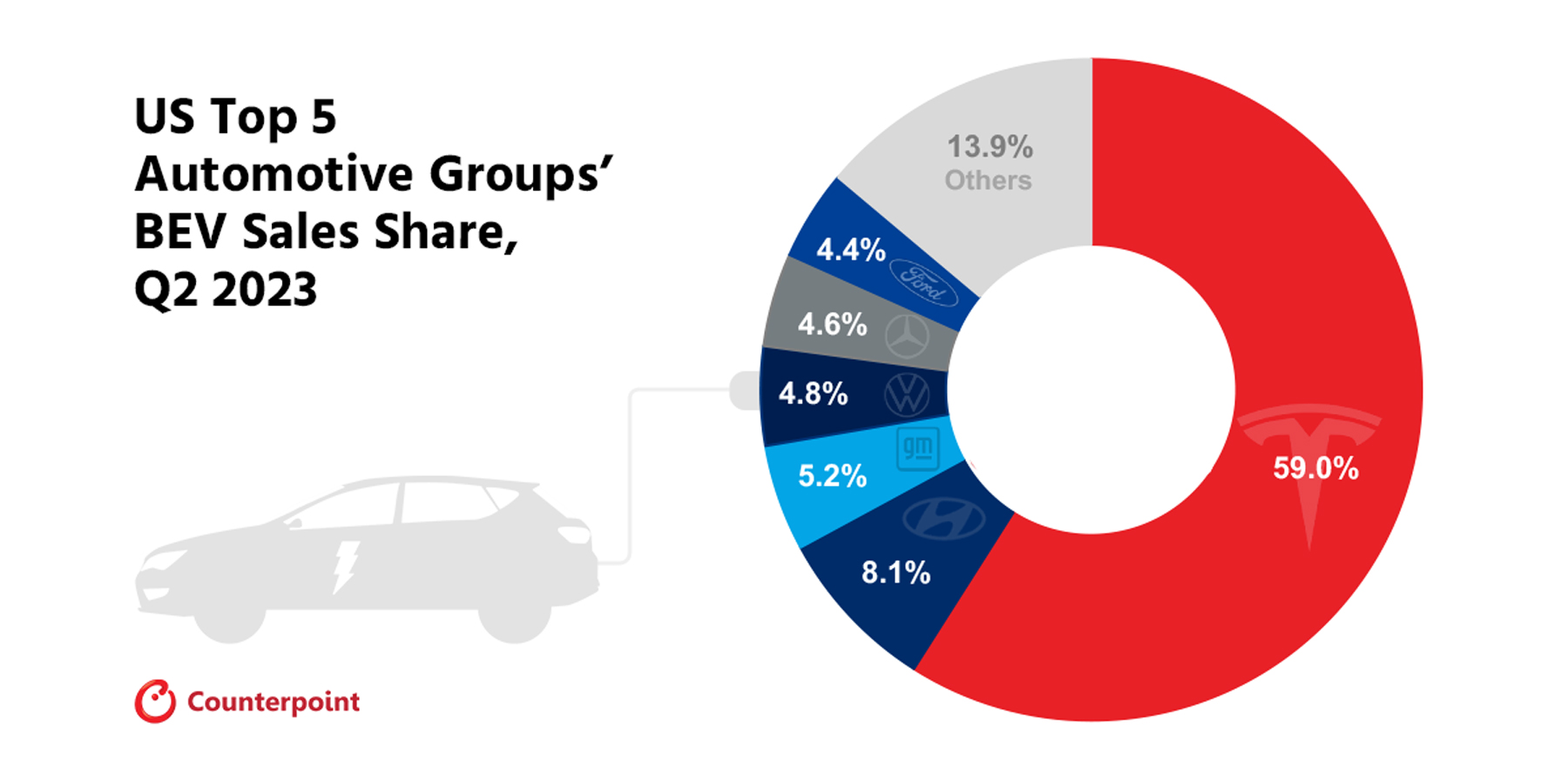

US passenger battery electric vehicle* (BEV) sales grew 57% YoY in Q2 2023, according to the latest research from Counterpoint’sUS Passenger Electric Vehicle Model Sales Tracker。The US maintained its status as the second-largest BEV market, a position it achieved by surpassing Germany in the previous quarter. BEVs constituted more than 7% of total passenger vehicle sales in the US in Q2. During H1 2023,Tesla’s tally exceeded the combined BEV sales of the next 14 automotive groups by 122,000 vehicles.

Commenting on the market dynamics,Research Analyst Abhik Mukherjeesaid, “Building on the existing momentum, the US automotive industry maintained its upward trajectory in Q2 2023. Total passenger vehicle sales surged by over 16% YoY. BEV sales are on the rise, driven by theEV tax creditand increasing environmental awareness among consumers. US-based brands likeTesla, GM, Ford, Rivian, LucidandKarmacaptured nearly three-quarters of total BEV sales. Among foreign-origin brands operating in the US, European manufacturers claimed the largest market share, followed by South Korean and Japanese brands. Total BEV sales by brands of foreign origin, such asHyundai Kia, Volkswagen Group, Mercedes-Benz, BMW, Volvo, Toyota, Subaru, JaguarandLand Rover,jumped by more than 100% YoY to nearly 81,000 units.”

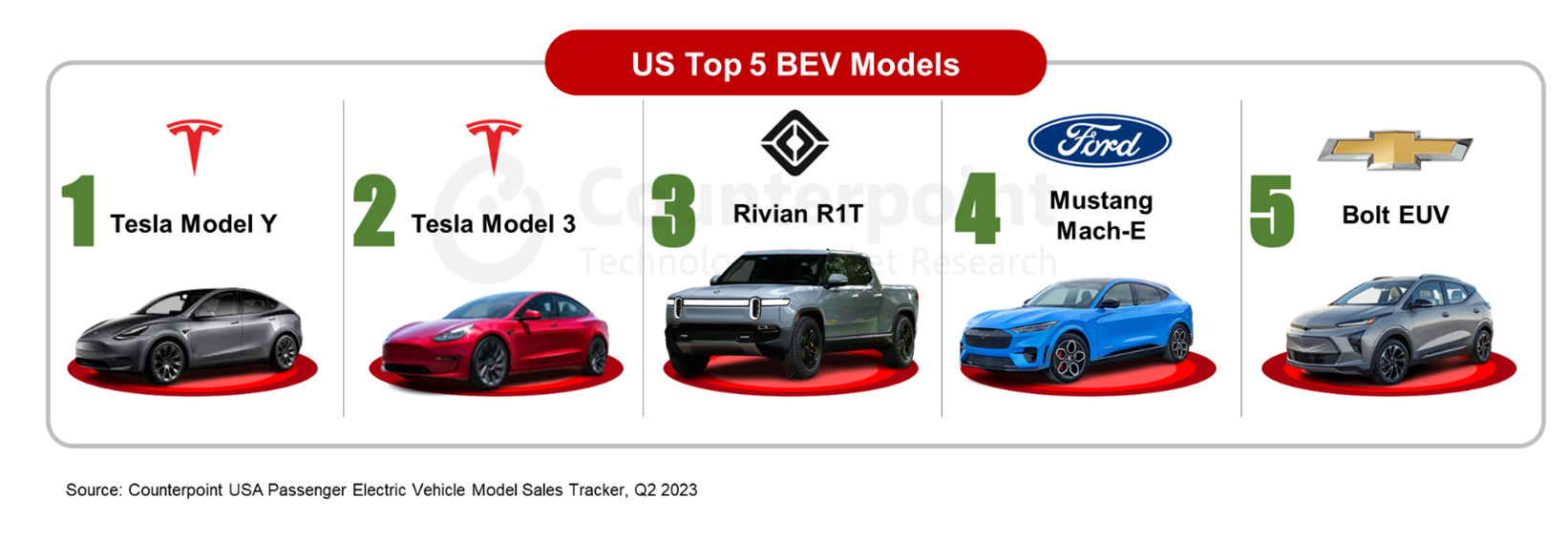

The top five best-selling BEV models in the US accounted for more than 60% of the market’s overall BEV sales during the quarter. Tesla’sModel YandModel 3together accounted for 55% of the BEV market. TheRivian R1Temerged as the third best-selling model during Q2 2023. This is the first time a Rivian model has secured a position in the top five since the introduction of its first vehicle in late 2021.

Commenting on the market outlook,Research Director Jeff Fieldhacksaid, “If the current growth trajectory continues, annualBEVsales in the US will exceed1 million unitsby the end of 2023. However, rising inventories are expected to become a problem for automakers. EV-related investments by auto OEMs are rapidly growing across the North American continent. These investments, which cover EV production ramps, components and battery, and charging infrastructure, have already crossed$100 billion。Most EV brands are preparing to launch new models or update existing models from 2024 onwards. To address the inventory challenges, OEMs will either need to reduce prices or limit production, both of which will hurt their financial performance.”

Commenting on the market outlook,Research Director Jeff Fieldhacksaid, “If the current growth trajectory continues, annualBEVsales in the US will exceed1 million unitsby the end of 2023. However, rising inventories are expected to become a problem for automakers. EV-related investments by auto OEMs are rapidly growing across the North American continent. These investments, which cover EV production ramps, components and battery, and charging infrastructure, have already crossed$100 billion。Most EV brands are preparing to launch new models or update existing models from 2024 onwards. To address the inventory challenges, OEMs will either need to reduce prices or limit production, both of which will hurt their financial performance.”

*Sales refer to wholesale figures, i.e. deliveries from factories by the respective brand/company.

The comprehensive and in-depth ‘US Passenger Electric Vehicle Sales Tracker, Q1 2018-Q2 2023’is now available for purchase atreport.www.arena-ruc.com。

Feel free to reach us at press@www.arena-ruc.com for questions regarding our latest research and insights.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

FollowCounterpoint Research

press(at)www.arena-ruc.com

Related Posts

Beijing, New Delhi,London,San Diego, Buenos Aires, Hong Kong, Seoul – September 1, 2023

European in-car navigation sales saw a modest growth of 5% YoY in 2022, according to the latest research from Counterpoint’sGlobal Embedded Navigation Sales Tracker。越来越多的采用电动汽车(EVs) and advanced driver assistance (ADAS) features is driving the growth of built-in navigation systems in cars. Navigation helps EV drivers plan the optimal route by considering battery range and charging station locations. Besides, navigation helps ensure safety by giving drivers information about the weather, speed limits and traffic conditions.

In terms of sales volume, Germany, the UK and France are the leading countries in built-in car navigation. But in terms of the share of such cars in total car sales, Norway leads, followed by the Netherlands and Germany. Volkswagen Group, Stellantis and Renault-Nissan are the top three automotive groups in terms of built-in car navigation sales. EV players like Tesla, NIO and Xpeng offer navigation on all models.

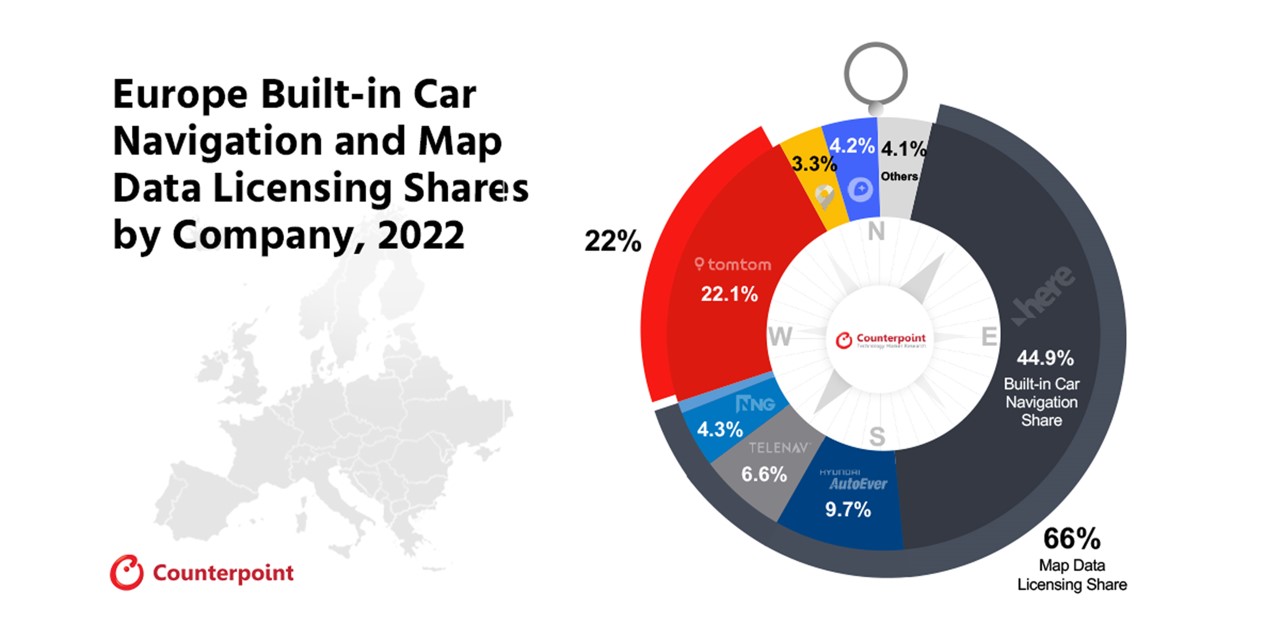

Commenting on market dynamics,Research Analyst Mohit Sharmasaid, “Almost 50% of cars sold in 2022 had built-in navigation. HERE is leading the European market in terms of both licensing its map data and offering navigation services.”

HERE在汽车工业,一个强大的存在y, has a 44.9% share in Europe’s built-in car navigation market. The company licenses its map data to other companies to build applications and services. When taking this into account, HERE’s market share in Europe rises to almost two-thirds.

HERE offers its navigation services to OEMs like BMW and Mercedes. Chinese brands such as FAW Hongqi and SAIC, which are expanding their sales into Europe, have partnered with HERE for navigation data.

Commenting on HERE’s performance,Vice PresidentPeter Richardsonsaid, “HERE is well-positioned within the automotive sector by working in partnership with automakers to address their technological challenges, like those related to EVs and adoption of autonomous driving. HERE is one of the enablers for automakers in launching new technologies like Level 3 autonomous driving.”

TomTomis in the second position in the European market with a 22.1% share. Last year marked the company’s second pivotal year after 2009, when it decided to sell its navigation services to automakers directly after the decline of its GPS standalone device business. In 2022, the company announced a new map platform besides rebranding itself.

TomTomhas long-standing partnerships with Stellantis, Renault and other car manufacturers. The company has also signed a fresh deal with Hyundai Motor Group for licensing its map data and traffic services to all brands of the group, including Genesis for the European market. Another notable win for TomTom is a partnership with the Foxconn-led MIH Consortium to increase its presence in next-generation smart mobility vehicles.

Google’sshare has increased to 3.3% two years after entering the in-car navigation market. However, its market share is 7.1% when including its map data licensing for navigation services. Sharma added, “Google’s entry into in-vehicle navigation services has enlivened the competition in the European market. For years, the market has seen the duopoly of legacy players HERE and TomTom. Google is trying to catch up with traditional navigation providers as it continues to expand its automotive offerings like EV routing and HD maps.”

Further, new players likeMapboxandWhat3wordare bringing unique aspects to in-vehicle navigation.

Source: Global In-Car Navigation Tracker, Q1 2021- Q4 2022

Commenting on the market forecast,Vice President Neil Shahsaid, “The in-car navigation market is expected to see a growth of 10%-15% in 2023 as most automakers will look to comply with new ISA regulation while moving towards electrification and more intelligent driving.” He further added, “Maps will play a crucial role in achieving highly automated driving (Level 4-Level 5) and we will see new collaborations flourishing not only between OEMs and map players but also between self-driving chip manufacturers like Qualcomm and map players.”

The comprehensive and in-depth ‘全球车载导航跟踪,Q1 2021 - 2022年第四季度’is now available for purchase atreport.www.arena-ruc.com。

Feel free to reach us at press(at)www.arena-ruc.com for questions regarding our latest research and insights.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Contact:

Counterpoint Research

Related Posts

Global Passenger Electric Vehicle Market Share, Q3 2021 – Q2 2023

Global Passenger Electric Vehicle Market Share, Q3 2021 – Q2 2023Published date: August 31, 2023

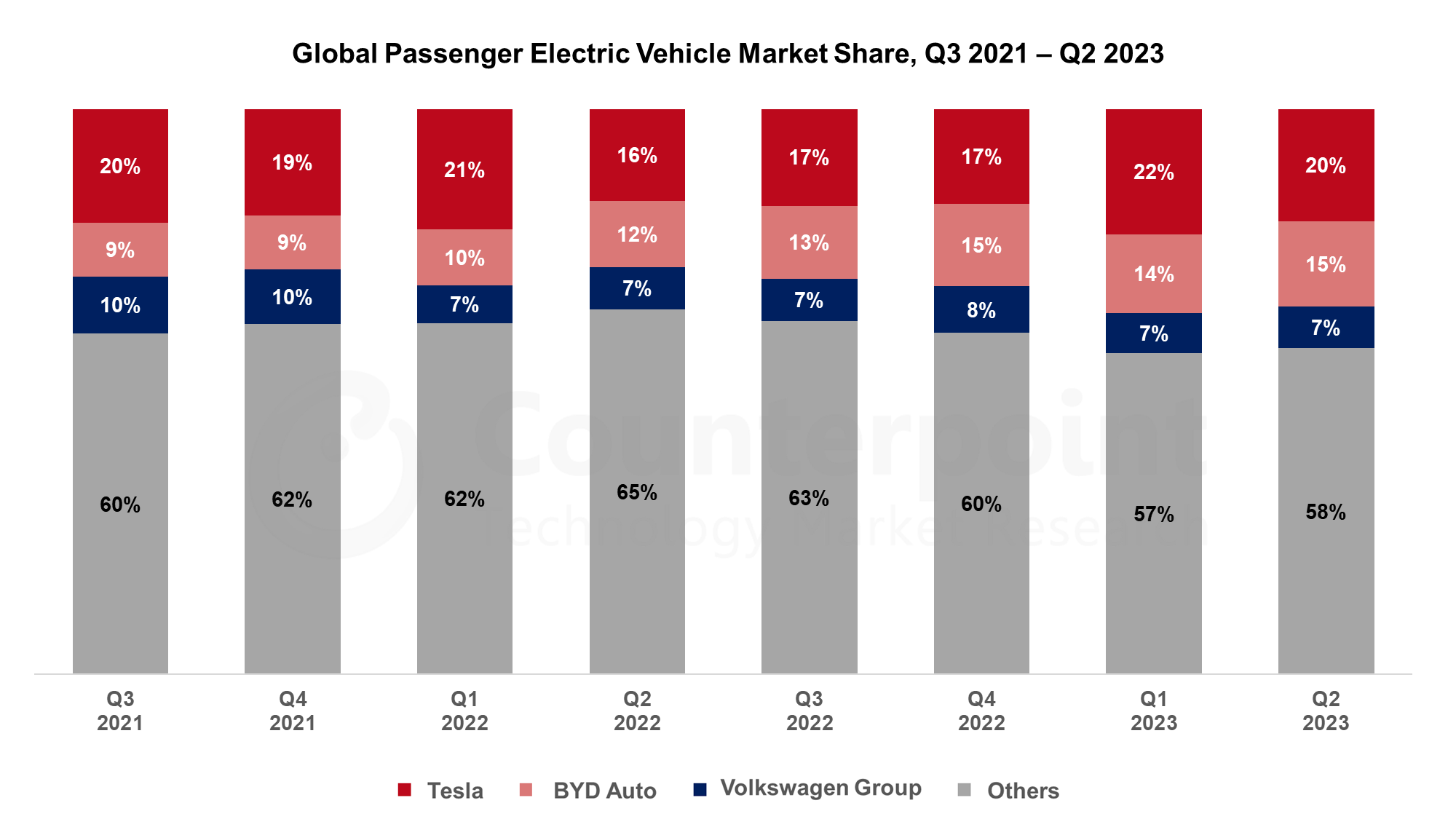

This page depicts our quarterly data forglobal electric vehicle salesmarket share from Q3 2021 to Q2 2023.

| Global Passenger Electric Vehicle* Market Share, Q3 2021 – Q2 2023 | ||||||||

| Auto Group | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 |

| Tesla | 20% | 19% | 21% | 16% | 17% | 17% | 22% | 20% |

| BYD Auto | 9% | 9% | 10% | 12% | 13% | 15% | 14% | 15% |

| Volkswagen Group | 10% | 10% | 7% | 7% | 7% | 8% | 7% | 7% |

| Others | 60% | 62% | 62% | 65% | 63% | 60% | 57% | 58% |

Source:Global Passenger Electric Vehicle Model Sales Tracker: Q1 2018 – Q2 2023

DOWNLOAD:

(Use the buttons below to download the complete chart)![]()

![]()

Tesla: Tesla sales soared by 83% YoY during Q2 2023. Tesla Model Y accounted for 64% of Tesla’s global sales. Model Y retained its title as the ‘best-selling’ passenger car model globally.

BYD Auto: During Q2 2023, BYD Auto’s BEV sales grew by 96% YoY, faster than Tesla. BYD Yuan Plus (or Atto 3) was the best-selling BYD model followed by BYD Dolphin and BYD Seagull. BYD Seagull was introduced in April 2023 during the Shanghai auto expo. BYD Seagull also ranked #9 among the top 10 best-selling BEV models globally. BYD exported over 35,000 EVs during Q2 2023. Almost two-thirds of its exported BEVs were sold in Thailand, Israel and Australia.

Volkswagen Group: BEV sales of VW group grew by 48% YoY during Q2 2023. VW ID.4, Audi Q4-etron and VW ID.3 are the top 3 best-selling models of the group, accounting for nearly 50% of the group’s total BEV sales.

* Our present analysis takes Pure Battery EVs (BEVs) into account. We have removed Plug-in Hybrid EVs (PHEVs) from our analysis to avoid confusion.

For our detailed research on the global EV sales market in Q2 2023, clickhere。

For a more detailed electric vehicle model sales tracker, click below:

This report tracks the global passenger vehicle sales* by brand and by model across 23 regions (China, USA, Germany, UK, France, Spain, Japan, India, Italy, South Korea, Thailand, Indonesia, Vietnam, Brazil, Argentina, Russia, Malaysia, Philippines, Singapore, ROE, LATAM, MEA and Oceania) quarterly. The report will help to understand regional trends, brand dynamics and type of EV penetration. The period covered in this report is from Q1 2018 to Q2 2023.

*Sales here refers to wholesale figures, i.e., deliveries out of factories by respective brands/companies.

*Under electric vehicles, the report only considers battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). Hybrid electric vehicles and fuel cell vehicles (FCVs) are not included.

[one_fourth padding=”0 15px 0 0″]

[/one_fourth]

[three_fourth_last padding=”0 0 0 0″]

Table of Contents:

• Definition

• Pivot Table

• Flatfile

[/three_fourth_last]

Note: Numbers based on passenger vehicles only. For EVs, we consider only BEVs and PHEVs. Hybrid EVs and fuel cell vehicles (FCVs) are not included in this study.

Ford continues to demonstrate its understanding of the opportunity that it needs to address with the migration of its business model to subscription and the recruitment of Peter Stern fromAppleto run its Integrated Services division.

The company is taking a leaf out ofTesla’sbook and will offer its BlueCruise advanced driver assistance products on a subscription-only basis. This is not as counterintuitive as it sounds as new car buyers will be able to purchase the service for three years with an upfront payment of $2,100. Since it will be marketed as an option in the usual way, it is unlikely to change the purchase experience of new car buyers very much. Furthermore, as so manyvehiclesare purchased on leasing schemes, there is a good chance that the buyer of the new vehicle would have changed the vehicle before the three-year period has elapsed.

This is how Ford seeks to introduce users to the idea of subscription, but there remain some features that will never work on a subscription basis. Two of these areMercedes’idea of asking customers to pay $1,200 per year to improve the driving performance of theirEVsandBMW’sidea of asking customers to pay $180 per year for heated seats. This is a very common strategy employed by consumer electronics companies and has also been used to good effect byTesla。

However, the vehicle-buying public has been paying one-off fees for hardware options for decades and I suspect that there is going to be a lot of resistance to paying $15 a month to keep one’s bottom warm in winter. Hence, the right approach is to charge for the options exactly as they have been for years and to offer subscriptions for services rather than products.

Advanced driverassistancesits right in the middle as it requires extra hardware to be present but is almost entirely driven by software which will need constant updating. Furthermore, much like a chauffeur that needs to be paid on a monthly basis, it is not a very large conceptual jump to be seen as a service rather than a hardware option.

Tesla has already prepared themarketfor this and so Ford has a pretty good chance of winning adoption with this model. Ford has also recruited Peter Stern who spent six years at Apple (Time Warner before that) running its subscription services.

The idea here is obviously to ensure that when it comes toDigitalLife in the vehicle, Ford is ready with an appealing option for each activity with which the user will engage. This will go from a media consumption offering to transport-related services such as smart parking, which saves the user from driving round and round looking for a parking spot.

The market for digital services in the vehicle could be very large indeed especially as consumer spending on vehicle transportation declines over the next 20 years. Ford is again doing the right thing in attempting to address this market, but it will need to ensure that its user experience remains relevant in the vehicle as Apple and Google will be only too happy to sell their services and those of third parties via their user experiences instead.

This is the key challenge that all OEMs face over the next 20 years and Ford remains one of the few automakers outside of Tesla that appear to understand what is happening to their industry and seem to be addressing it in the right way.

(This is a version of a blog that first appeared on Radio Free Mobile. All views expressed are Richard’s own.)

[rev_slider alias=”mediatek-earnings”][/rev_slider]

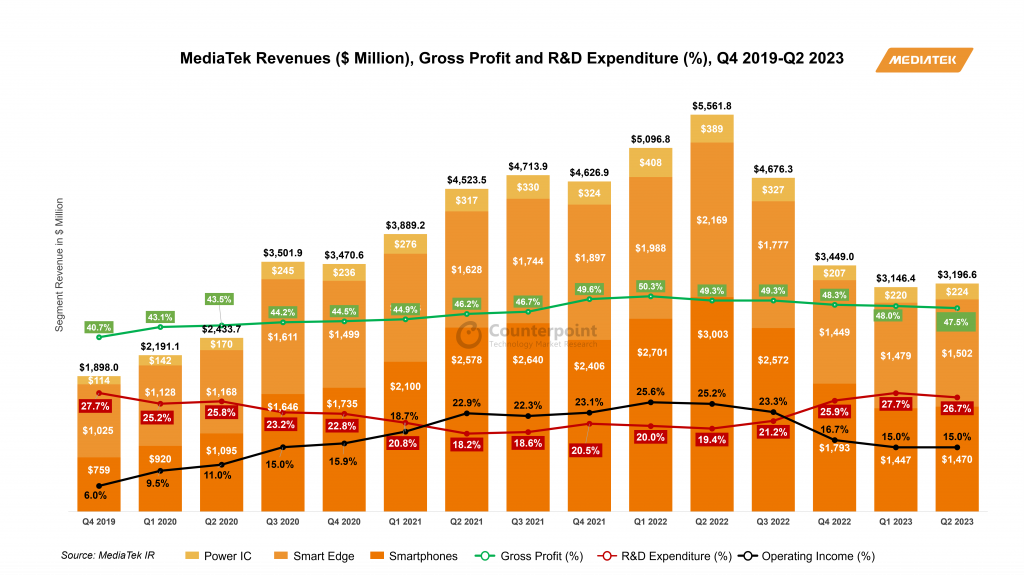

MediaTek’srevenues were slightly up sequentially but down 43% annually in Q2 2023. Inventory has gradually come down to a relatively normal level, but the demand forsmartphoneswill remain slow due to the global macroeconomic situation and therefurbishedsmartphonemarket. Against this backdrop, MediaTek is diversifying its portfolio by focusing on theauto, smart edge and customASIC segments。The company is estimated to take over two years to get material revenues from these segments.

AI and ASIC Opportunity

CEO:“As for ASIC, we recently see growing enterprise ASIC business opportunities in AI and datacenter markets. With our strong IP and SoC integration capabilities, we aim to continue to grow this business in the future.”

Parv Sharma’s analyst take: “With the growth in generative AI, the demand for edge AI processing has accelerated. Being one of the top players in edge devices, MediaTek is well-positioned to benefit from this shift. The company will focus on winning enterprise ASIC projects but catching up with major players like Broadcom and Marvell will take time, as customers typically work with existing suppliers for repeat projects.”

Growing focus on auto and partnership with NVIDIA

CEO:“We’re very excited about the recently announced partnership between MediaTek and NVIDIA to develop a full-scale product roadmap for the automotive industry. We believe our industry-leading low-power processors and 5G, WiFi connectivity solutions, combined with NVIDIA’s strong capability in software and AI cloud, will help us become highly competitive in the future connected software-defined vehicles market and shorten our time to market to accelerate our growth.”

Shivani Parashar’s analyst take: “MediaTek launched Dimensity Auto to focus on cockpit and connectivity solutions. With its partnership with NVIDIA, the company aims to develop a full-scale product roadmap for the automotive industry. Auto design cycles are long so it will take some time (2026-2027) for the company to increase revenues from this segment. Overall, we can say the auto segment will become a long-term revenue growth driver for MediaTek.”

Customer and channel inventories come down

CEO:“We observed that customer and channel inventories across major applications have gradually reduced to a relatively normal level. Recent demand from our customers has shown certain level of stabilization. However, our customers are still managing their inventory cautiously as global consumer electronics end market demand remains soft. For the near-term, we expect our business to gradually improve in the second half of the year”

Shivani Parashar’s analyst take: “According to our supply chain checks, inventory levels are coming down and will get back to normal in the second half of 2023. OEMs will start restocking but will be cautious due to weak consumer demand and global macroeconomic conditions.” Result summary

Result summary

Related posts

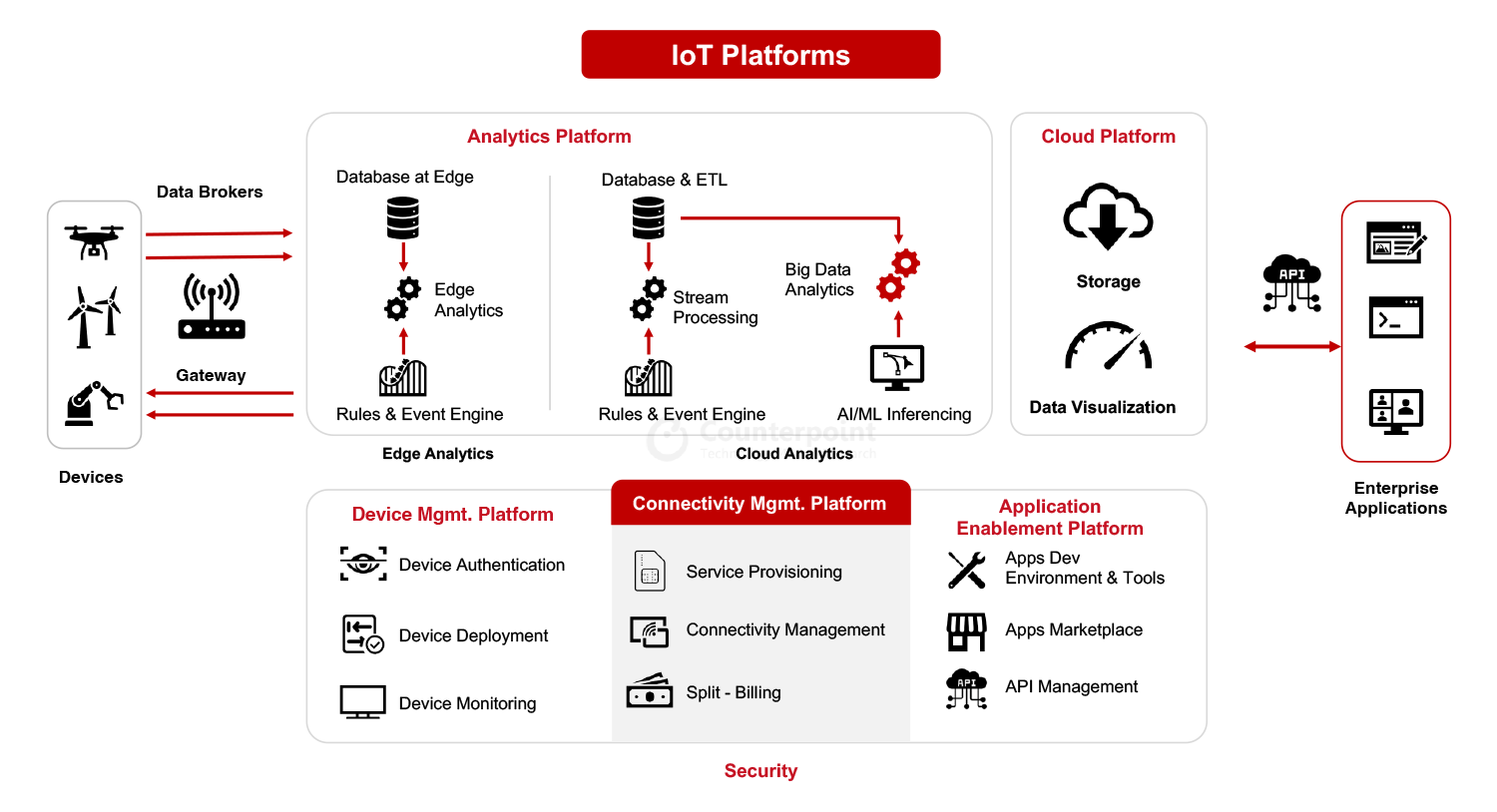

Over the last few years, the demand for seamless connectivity has grown exponentially in theautomotivesector. With the rise ofconnectedcars and the integration of various IoT devices, the automotive sector faces the challenge of managing and monetizing connectivity effectively. This is where connectivity management platforms (CMPs) play a crucial role, and among the key components that contribute to their success, split billing stands out as a pivotal feature.

What is a Connectivity Management Platform (CMP)?

在深入研究分账单之前,让我们现代人理解d what CMPs are and how they have evolved. CMPs are centralized systems that facilitate the management, control and monetization of data connectivity services in connected vehicles. These platforms empower automotive manufacturers and service providers to offer innovative connected services to drivers and passengers while efficiently managing data consumption.

As seen in the chart below, CMP is a component of widerIoTplatforms that include a Device Management Platform (DMP), Analytics Platform and Applications Enablement Platform (AEP). Together, these platforms power large-scale IoT applications.

Many connectivity management platforms integrate split billing functionality to cater to the diverse billing requirements of multiple stakeholders in theIoTecosystem and the automotive industry in particular. Currently, there are many CMPs, such as Cisco, Aeris, CubicTelecomand Wireless Logic, which have the capability to provide split billing.

Challenges in Connectivity Managementfor Automotive:

In the past, vehicle connectivity was predominantly limited to basic telematics services and hence the split billing was not so much of a concern. However, the rapid advancement oftechnologyhas transformed the automotive landscape. Today, connected cars are equipped with sophisticated infotainment systems, navigation tools, real-time diagnostics, and a multitude of sensors that enhance safety, convenience, and the overall driving experience. In the future, the need for connectivity in cars would be very different with autonomous vehicles and V2X communication.

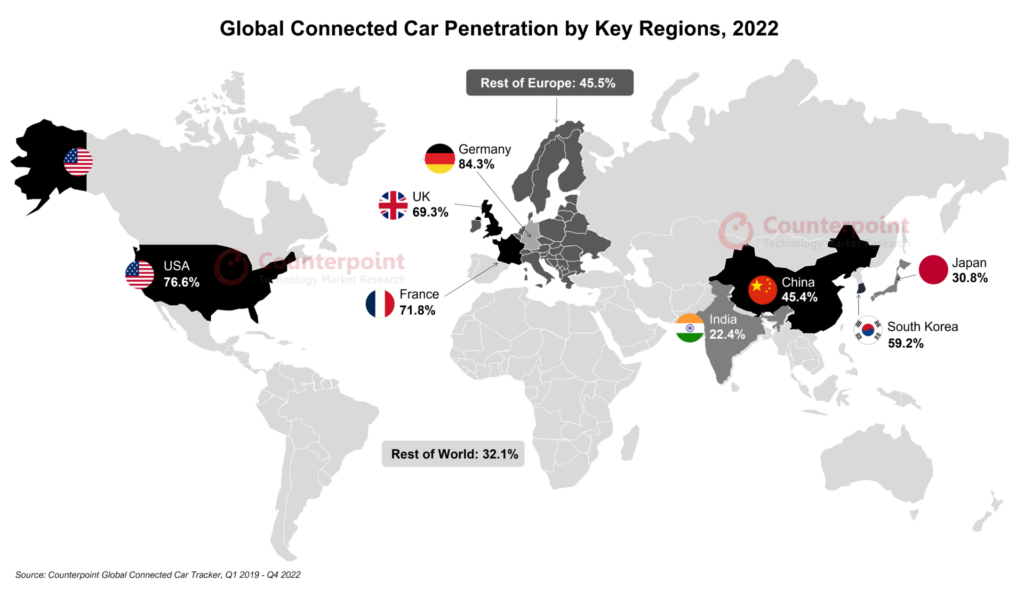

2022 was a pivotal year for connected cars. According to Counterpoint Research analysis, connected cars surpassed 50% of car sales for the first time with the US, Europe and China as the key markets.

As vehicles become more connected, the complexity of managing connectivity increases. This gives rise to various difficulties for the automotive, including:

The Role of Split Billing:

In the context of Internet of Things (IoT) connectivity forautomobiles, split billing refers to a billing mechanism that allows for the separation and allocation of data usage costs between different entities involved in theIoTecosystem. This concept is particularly relevant when multiple parties share the data consumption and connectivity expenses of an IoT-enabled vehicle.

In an automobile scenario, various components may require internet connectivity for different purposes:

Split billing allows the data usage and associated costs to be divided among these parties based on their usage patterns and requirements. For example:

This approach helps create a fair and transparent billing structure, where each stakeholder pays only for the services they consume, rather than a single entity covering all data costs.

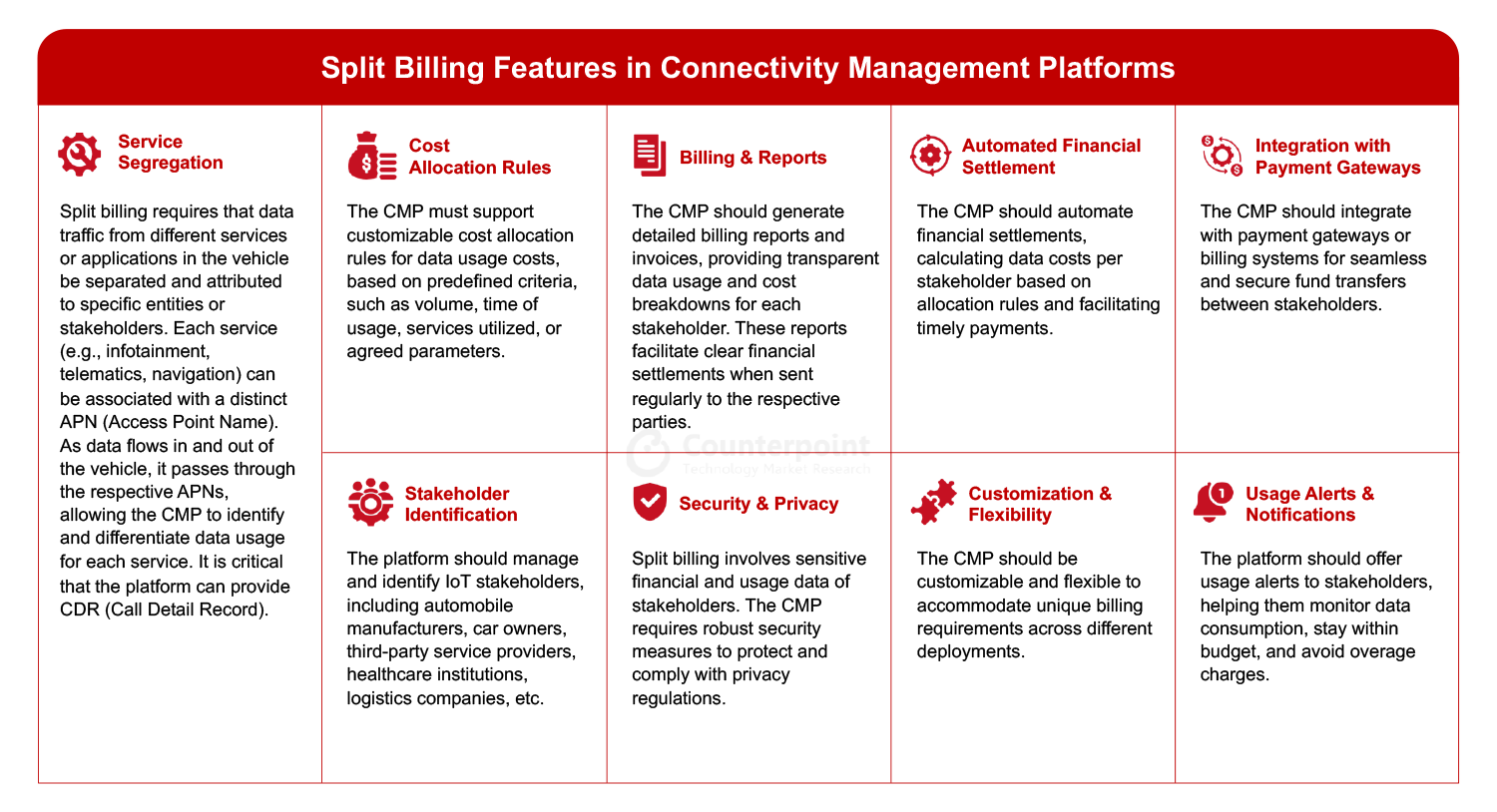

What does split billing mean for CMPs?

For CMPs, split billing refers to a specific functionality or feature that allows the platform to support the allocation and management of data usage costs among multiple parties or stakeholders in theIoTecosystem. This functionality enables CMPs to handle billing and cost-sharing for IoT connectivity services efficiently. The chart below summaries the key aspects and functionalities related to split billing in CMPs. Overall, split billing functionality in a CMP streamlines the financial aspects of IoT deployments, encourages collaboration between different entities, and ensures that each party pays only for the specific services they utilize, making IoT implementations more transparent and cost-effective.

Overall, split billing functionality in a CMP streamlines the financial aspects of IoT deployments, encourages collaboration between different entities, and ensures that each party pays only for the specific services they utilize, making IoT implementations more transparent and cost-effective.

In conclusion, the evolution of CMPs for split billing has been driven by the increasing complexity of connected services, advancements in data analytics and technology, and the growing demands for personalized billing and improved customer experiences. As the IoT landscape continues to evolve, CMPs will play an increasingly vital role in managing data connectivity and enabling fair and accurate billing for the multitude of services offered in the connected world.

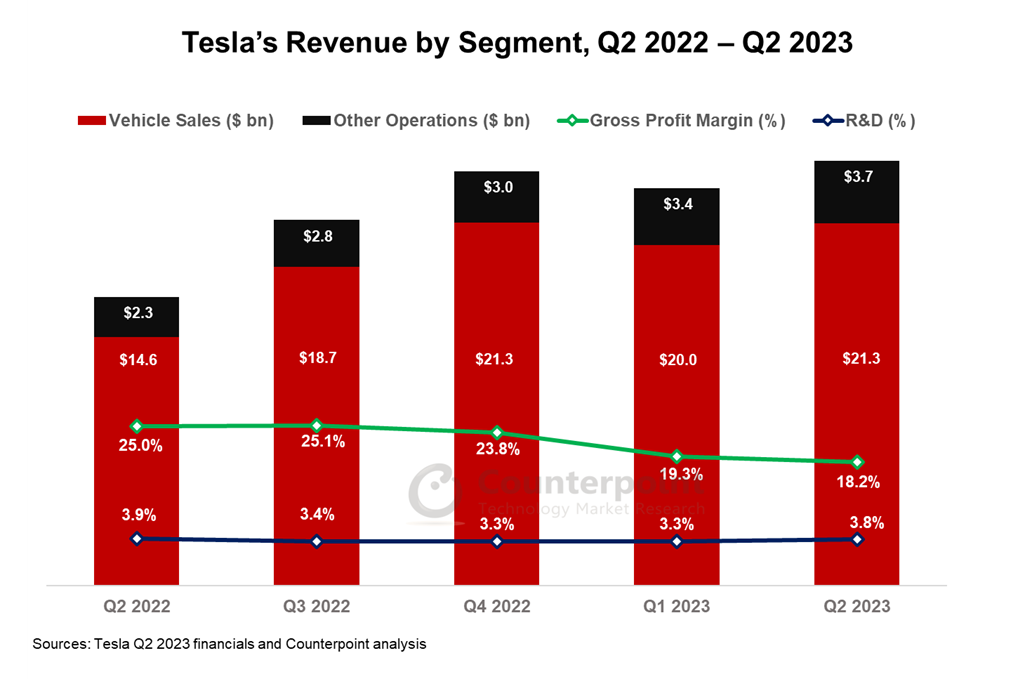

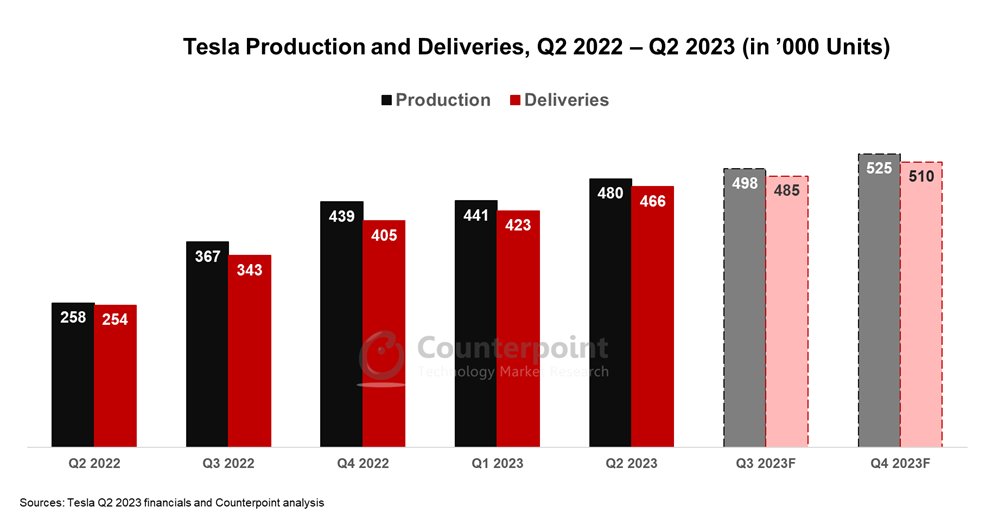

Teslaachieved remarkable results in Q2 2023, with its revenue growing 47% YoY to reach the record-breaking figure of nearly $25 billion. The company’s vehicle deliveries too hit a record at 466,915, growing 83% YoY. The US retained its position asTesla’s largest market, contributing to 37.6% of the total sales, whileChinaandEuropefollowed closely behind.Global price cutsfor the Model Y and Model 3, along with tax subsidies in the US and China, were two of the biggest drivers for Tesla’s Q2 sales.

Tesla CEO Elon Musk, during the earnings call, discussed a few key things like the long-awaited Cybertruck deliveries, Tesla’s advantage in competitive pricing of vehicles and the possibilities of attaining complete FSD:

CEO:“Demand is so – so far, off the hook, you can’t even see the hook. So, that’s really not an issue. I do want to emphasize that the Cybertruck has a lot of new technology in it. Like a lot… So, always very difficult to predict the – the ramp initially, but I think we’ll be making them in high volume next year, and we will be delivering the car this year.”

Soumen Mandal’s analyst take:“Musk is certainly hyping the Cybertruck, not that it needs to anymore, but there is also significant expectation setting with discussions on internal production and supply chain hurdles. Is this another Model Y? That’s a tough act to follow, but the Cybertruck does bring a slew of unique parts and processes. So, longer term, we expect to see another products flywheel off from it.”

CEO:“And we, you know — we just — we just course according to what the mood of the of the public is, you know. Buying a new car is a — it’s a big decision for vast majority of people. So, you know, anytime there’s economic uncertainty, people generally pause on new car buying, at least to see to see what happens.

And, you know — and then, obviously, another challenge is the — the interest rate environment. As interest rates rise, the affordability of anything bought with that decreases, so effectively increasing the price of the car. So, when interest rates rise dramatically, we actually have to reduce the price of the car because the — the interest payments increase the price of the car. So — and this is at least — at least up until recently was to believe the sharpest interest rate rise in history. So, we had to do something about that. And if someone’s got a crystal ball for the global economy, I really appreciate it. If I could borrow that crystal ball.”

Soumen Mandal’s analyst take:“Tesla’s strong supply chain and reduced cost of production due to low raw material cost, especially for lithium, has encouraged the company to reduce prices of its vehicles. Alongside what Musk described as ‘interest rate rises’, Tesla’s price reduction has made all variants of the Model 3 and Model Y eligible for IRA tax credit in the US, where it will benefit in the long term. So, macroeconomic policies and geopolitical relations play a crucial role in deciding such price reductions, incentives or discounts。”

CEO:“…我一直乐观的原因(在实现成功l self-driving] is what it tends to look like is the — we’ll make rapid progress with the new version of — of FSD. But — but then, it will curve over logarithmically. So — so, at first, like, a logarithmic curve looks like, you know, just sort of fairly straight upward line, diagonally up. And so, if you extrapolate that, then you — you have a great thing. But then because it’s actually logarithmic, it curves over. And then, there have been a series of logarithmic curves. Now, I know I’m the boy who cried FSD, but man, I think — I think we’ll be better than human by the end of this year.”

Abhik Mukherjee’sanalyst take:“Almost every auto OEMs are spending on autonomy. Tesla is also walking in the same direction and is building an in-house AI service that includes in-house real-time data sets, neural Net training, vehicle hardware and software. Tesla is expecting to reach perfect FSD soon and for this, it is also building a Dojo supercomputer. Early development of FSD will give Tesla amassivefirst-mover advantage over its competitors. We assume Tesla FSD might also get adopted by other automakers, like Tesla NACS is being adopted.”

CEO:“这不是关于获得更多份额。只是you can think of every car that we — that we sell or produce that — that — that has a full Autonomy capability as actually something that, in the future, may be worth as much as five times what it is today…If you’ve got an autonomous — if that vehicle is able to operate autonomously and — and use — be used in either dedicated or autonomous or partially autonomous like — like, Airbnb, like maybe sometimes you allow your car to be used by others, sometimes you want to use it exclusively, just like, you know, Airbnb, you know, doing Airbnb with a room in your house… So, I think it’s sort of it would be — I think it — it does make sense to sacrifice margins in favor of making more vehicles because we think, in the not-too-distant future, they will have a dramatic valuation increase. I think the Tesla fleet value increase to the point at which we can upload full self — you know, full self-driving and it’s approved by regulators, will be the single biggest step change in asset value maybe in history.”

Abhik Mukherjee’sanalyst take:“Although we are excited about autonomous vehicles, Tesla currently is a bit far from achieving perfect FSD. Incidents involving Tesla vehicles are frequently reported. Currently, Tesla FSD is only available in the US and it will need a lot of approvals from regulators to ensure 100% safety before it can be rolled out to other regions, especially in Europe where regulations are much stricter. Though achieving complete FSD could disrupt the market in future, currently Tesla must work to make its FSD software incident-free.”

With the current growth trajectory, we expect Tesla deliveries will reach around1.9 millionby the end of 2023. Its robust supply chain and vertically integrated production have given Tesla a competitive advantage.

Other growth opportunities are arising from the adoption ofTesla’s NACS charging standardby several OEMs including Ford, GM, Rivian, Volvo, Polestar and Nissan for the North American market. This allows these auto companies to leverage Tesla’s extensive network of charging stations across North America, enhancing the convenience and accessibility of electric vehicle charging for their customers. But it also gives Tesla the option to increase its revenue by charging licensing fees from OEMs adopting its proprietary NACS ports.