John Deere, based in Moline, Illinois, is one of the world’s leading manufacturers ofagriculturaland construction machinery. Over the years, John Deere has undergone a remarkable transformation, evolving into a technology-driven company that harnesses cutting-edge advancements like machine learning,cloudcomputing, and automation to optimize the performance of its agricultural and constructionmachinery. The company has earned a stellar reputation forinnovationand excellence, reaching net sales and revenue of $52.6 billion in 2022.

John Deere’s drive to innovate – a growing population and the need for more food resources

John Deere is trying to solve a major future problem. By 2050, the size of the world’s population will exceed 10 billion, increasing global food demand by around 50%. The company’s goal is to work towards a fully autonomous production system that will be capable of taking care of crops at the individual plant level, by giving each plant proper nutrients, water, soil and more. This would allow farmers to maximize both yield and production of crops.

John Deere had its first tech summit in Austin, Texas, at the beginning of April to showcase its latest agricultural and construction innovations andtechnologies. The analyst community was able to witness its latest See and Spray technology which enables farmers to pinpoint weeds usingcomputervision and machine learning and eliminate them swiftly. John Deere also demonstrated its new ExactShot technology that will enable farmers to plant seeds and fertilize only the area right around the seed, which will save up to 60% in fertilizer, thus reducing costs for the farmer while also significantly limiting the environmental harm. All these latest technologies rely on John Deere’s “tech stack” that the company has built over the years. From GPS to field mapping that allow tractors to drive in straight lines and even take turnsautonomously, to its connectivity anddigitaltwin solutions for remote monitoring.

John Deere’s long-term strategy – Leap Ambitions

In 2022, John Deere launched its Leap Ambitions Framework to unlock a $150-billion incremental opportunity and to measure its SmartIndustrialStrategy – focusing on combining smart technology innovation with the company’s legacy ofmanufacturingexcellence.

- To expandthe number of connected machines to 1.5 million by 2026, a significant increase from the 500,000 connected machines in 2022.

- Demonstrate viable low/no carbon alternative power solutions by 2026.

- Aim for 10% of total revenue to be recurring by 2030.

The company’sstrategyinvolves increasing the number of acres that are connected via John Deere Operation Center, an online farm management system (farms using this system are known as engaged acres), to 500 million by 2026 from 329 million in 2022, with 75% of engaged acressustainablyengaged by 2030. In terms of its equipment strategy, the company will also ensure that 100% of new small agriculturalequipment启用连接,提供吗避署ctronicoptions, and deliver a fully autonomous battery-powered避署ctricagricultural tractor by 2026. Lastly, John Deere’s construction and forestry segment will deliver 20+ electric and hybrid-electric product models and increase the adoption of various technologies by 2026.

Connectivityplays a major role in John Deere’s goals and the company still has an RFP out for a satellite provider that can provide it with 5Mbps download and upload speeds with under 500ms latency. This would be a fallback solution in areas where cellular connectivity is weak or has dead spots and is critical for the company to ensure as all of its autonomoussolutionsneed connectivity to run.

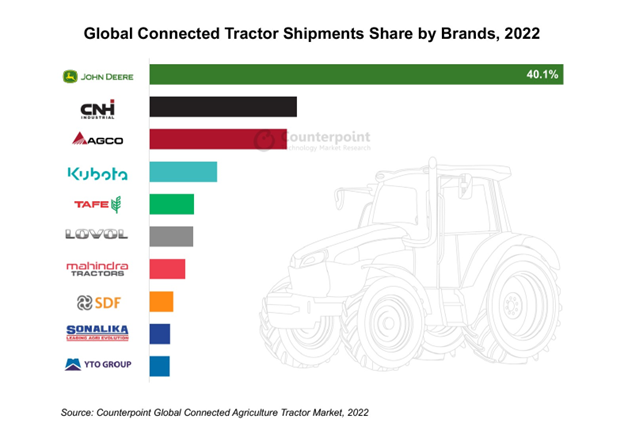

John Deere is a prominent player in the global tractor market. In fact, the company holds a leading position in the connected agriculture space.According to the latestConnected Agriculture trackerby Counterpoint Research, John Deere’s 40% shipment share was the largest in the connected tractors market as of the end of 2022.

Competitive advantages – Pushing in innovation connectivity and sustainability

John Deere’s competitive advantage rests on a foundation of innovation, connectivity and sustainability. The company’s rapidly growing connected machine portfolio, strong focus on automation and EVs, expanding electric product lineup, and an unparalleled dealer network make it a leader in an increasingly technology-driven agricultural landscape.

- Connected machine portfolio:约翰迪尔公司53%的产品可以连接到ternet and the integration ofcellular连接在这些连接产品公关的82%opels farming into a new era of data-driven decision-making. This connected ecosystem enables real-time monitoring, remote diagnostics and predictive maintenance, ultimately boosting efficiency and productivity for farmers.

- Focusing on automation and EVs:Automationhas been a key driver for John Deere’s product portfolio, enabling farmers to be more efficient and to do more with fewer resources. It is also making electric-powered choices available for all the different types of equipment. From tractors to small agriculture and turf equipment, the company’s focus on避署ctrificationis a strategic move that not only aligns with environmental concerns but also anticipates future regulatory shifts and consumer preferences.

- Extensive dealer network and retrofit services:

John Deere’s vast network of over 2,000 dealer locations across the US and Canada solidifies its competitive edge. With separate dealer groups catering to agriculture and construction/forestry, the company ensures tailored expertise for each sector. Furthermore, John Deere’s commitment to retrofit services and product upgrades demonstrates the company’s dedication to maximizing the longevity and value of its equipment. The substantial contribution of retrofits and upgrades, amounting to 18% of total equipment sales in 2022, highlights the company’s innovative approach to customer satisfaction.

Partnerships continue to be a strong driver for John Deere’s success

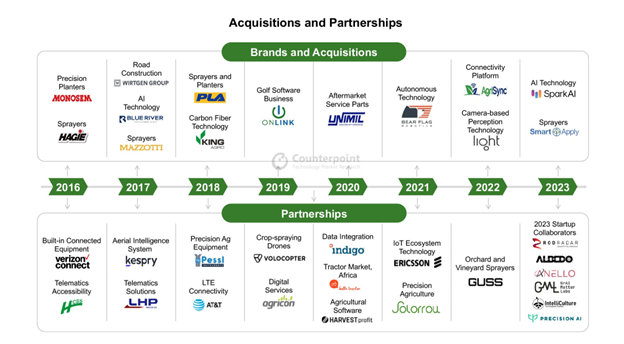

Overall, John Deere is making strides to further agricultural technology in a very steady and strategic manner. The company has been making the right investments. It now has more than 3,400 engineers, and has acquired companies like Blue River and Spark AI, and most recently Smart Apply, to help scale its tech solutions.

Below, we have shared some of John Deere’s most notable partnerships and brand acquisitions, which all synch up strongly with the company’s overall product development and strategy over time:

Conclusion

John Deere’s strength lies in its ability to execute diligently as it is the market share leader in the agriculture space, moving the market along at a pace that is comfortable for most customers. We expect John Deere to continue education efforts through its upcoming tech summits or future CES-level type sponsorships as it tries to establish itself as a household name in the tech space. John Deere has ambitious plans, but it has a strong roadmap to deliver on its leap ambitions and strategy. The company’s partnerships and brand acquisitions through the years further emphasize its commitment to innovation and growth.

Source: Counterpoint Research IoT Practice – Devices, December 2022

Source: Counterpoint Research IoT Practice – Devices, December 2022 Source: Counterpoint Research IoT Practice – Connectivity, December 2022

Source: Counterpoint Research IoT Practice – Connectivity, December 2022 Source: Counterpoint Research IoT Practice – Cloud Platforms, December 2022

Source: Counterpoint Research IoT Practice – Cloud Platforms, December 2022

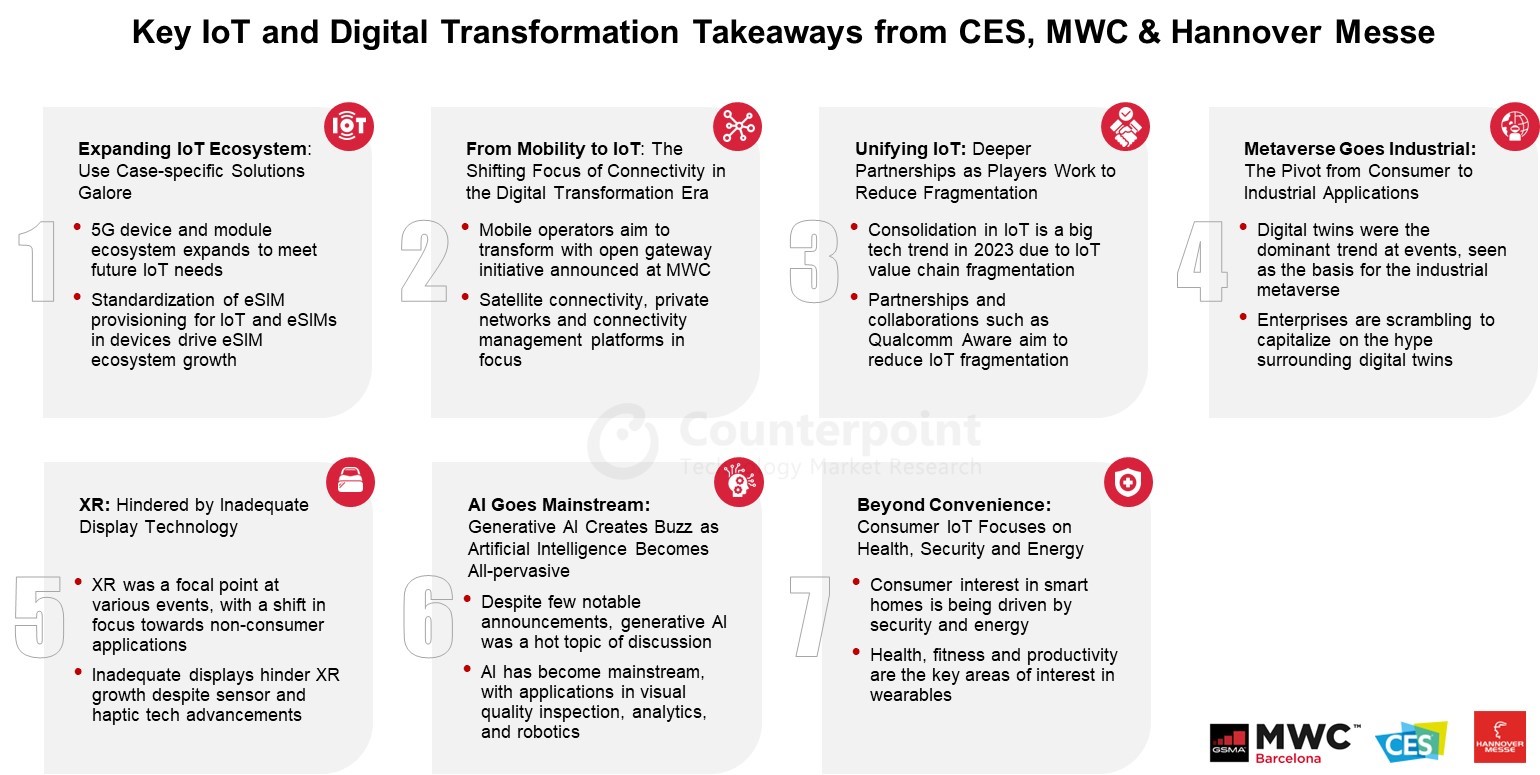

At Counterpoint Research, we believe that partnerships between various ecosystem players is the only way to achieve the promise of digital transformation. There is no one company that can solve all the challenges of digital transformation. “Partner or perish” is a clear choice and an initiative like the Siemens Xcelerator is a move in the right direction, though it may be still in its early days.

At Counterpoint Research, we believe that partnerships between various ecosystem players is the only way to achieve the promise of digital transformation. There is no one company that can solve all the challenges of digital transformation. “Partner or perish” is a clear choice and an initiative like the Siemens Xcelerator is a move in the right direction, though it may be still in its early days.