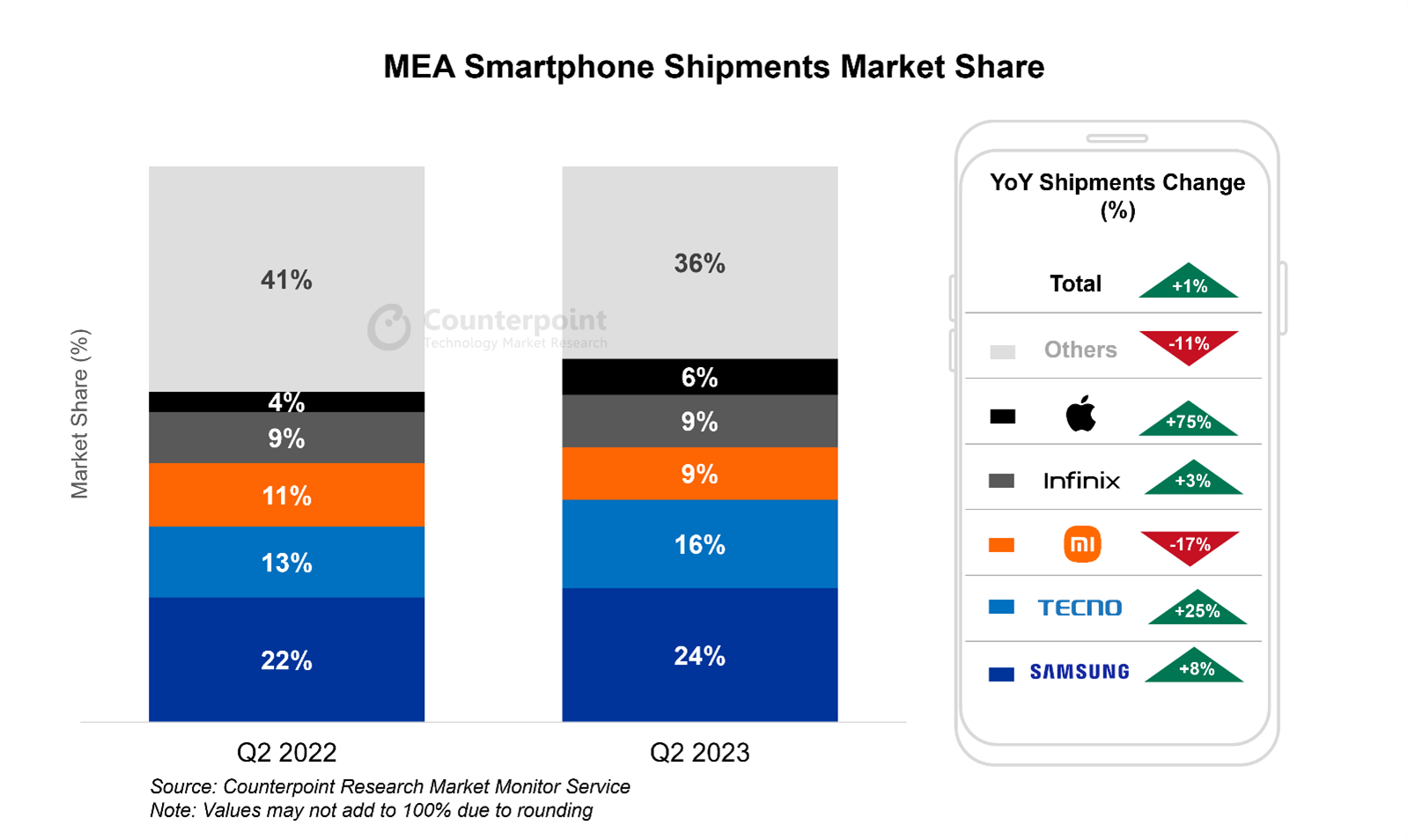

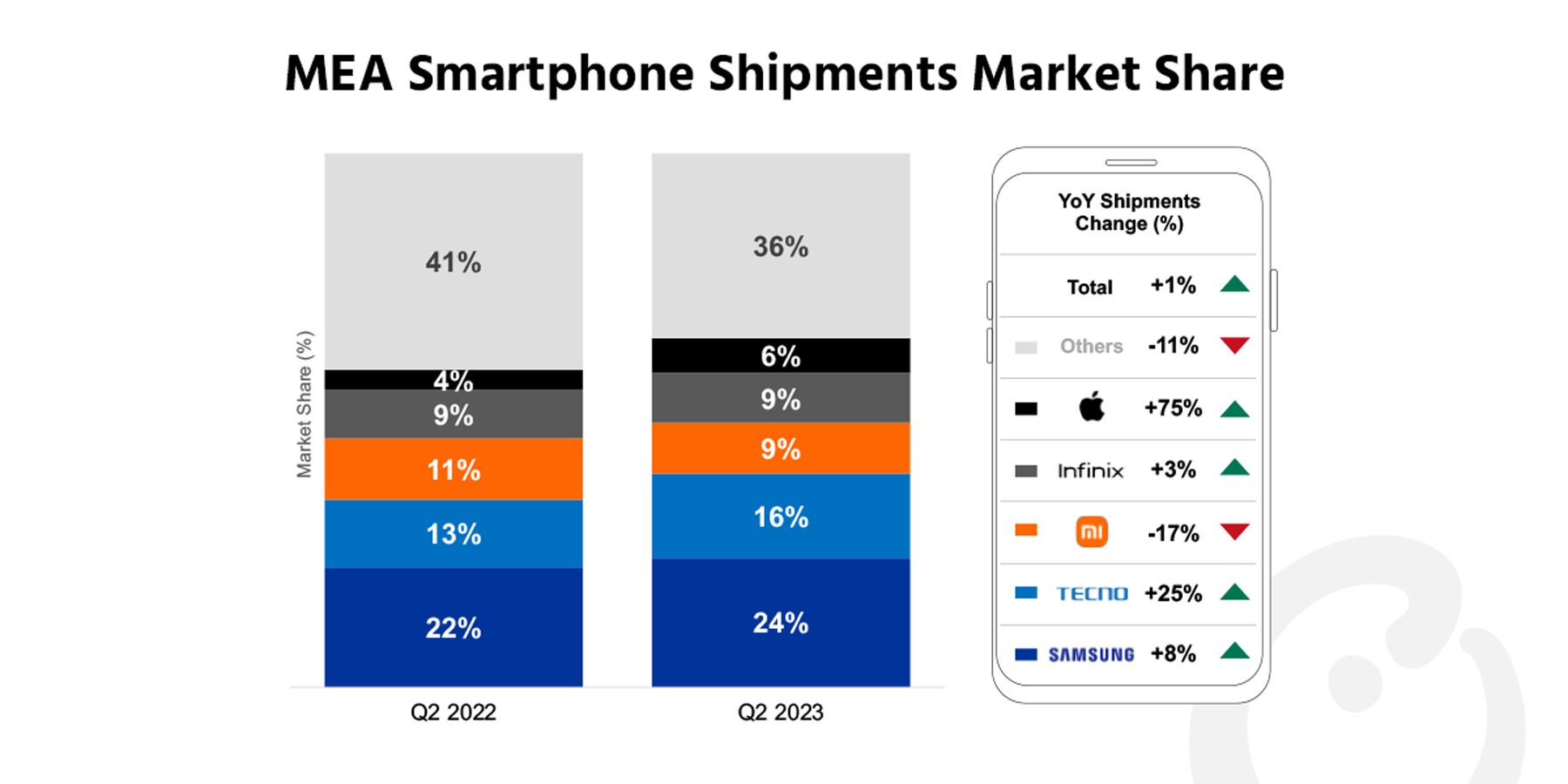

- MEA smartphone shipments increased 1% YoY and 7% QoQ in Q2 2023.

- 在这个季度消费者信心回升with falling inflation rates and stabilizing local currencies. These boosted demand for ‘big ticket’ items like smartphones.

- Samsung saw a rebound in its shipments and market share during the quarter.

- Transsion Group’s shipments grew 2% YoY, or an impressive 14% QoQ, in a typically weak quarter.

- 一个pple continued its steep rise, with shipments up 75% YoY in Q2.

London, Boston, Toronto, New Delhi, Hong Kong, Beijing, Taipei, Seoul – September 5, 2023

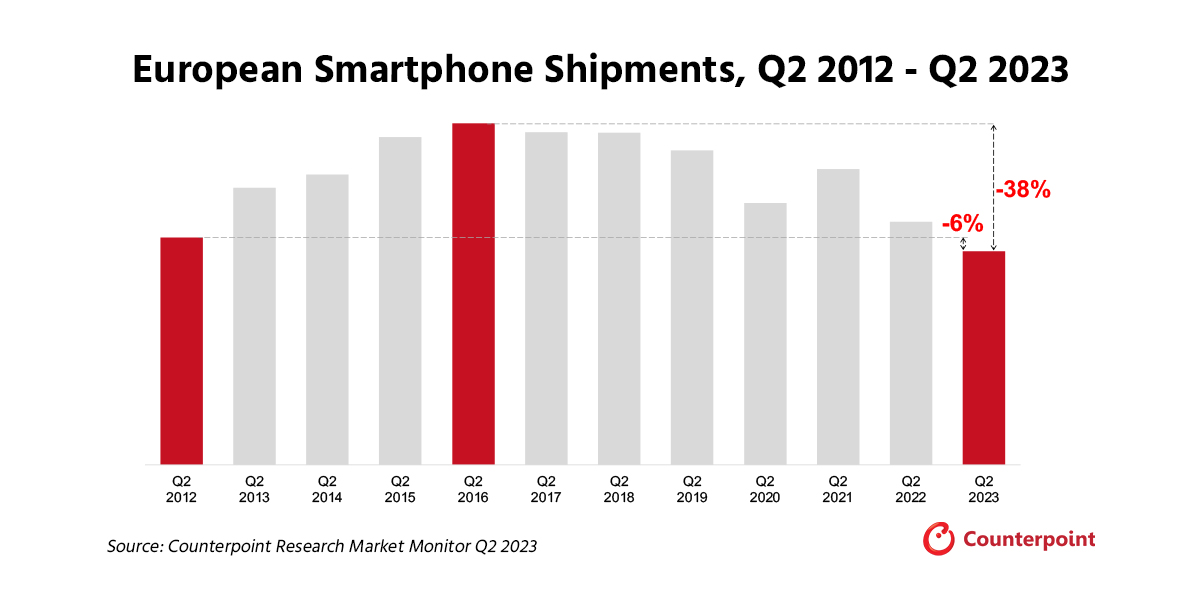

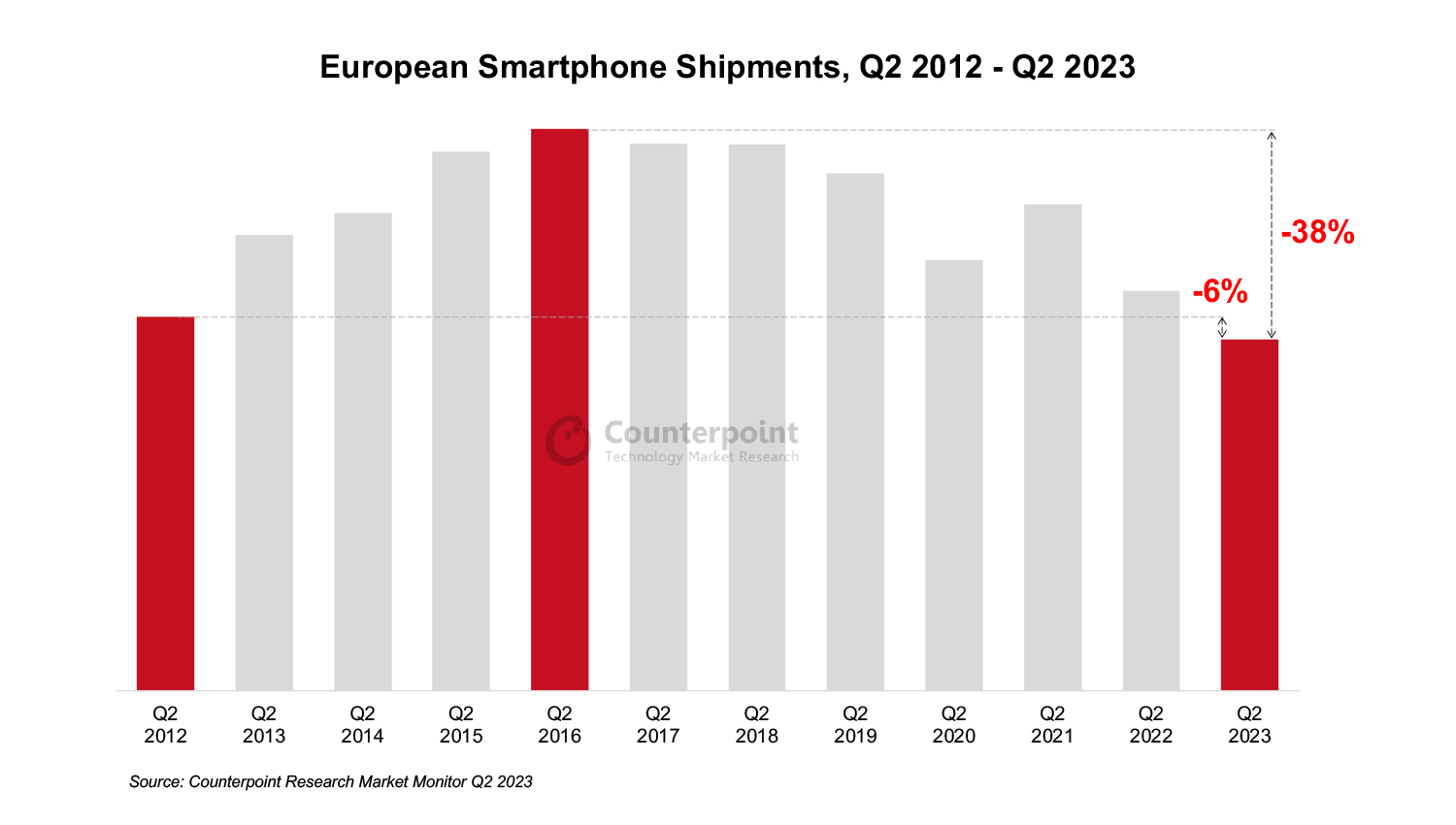

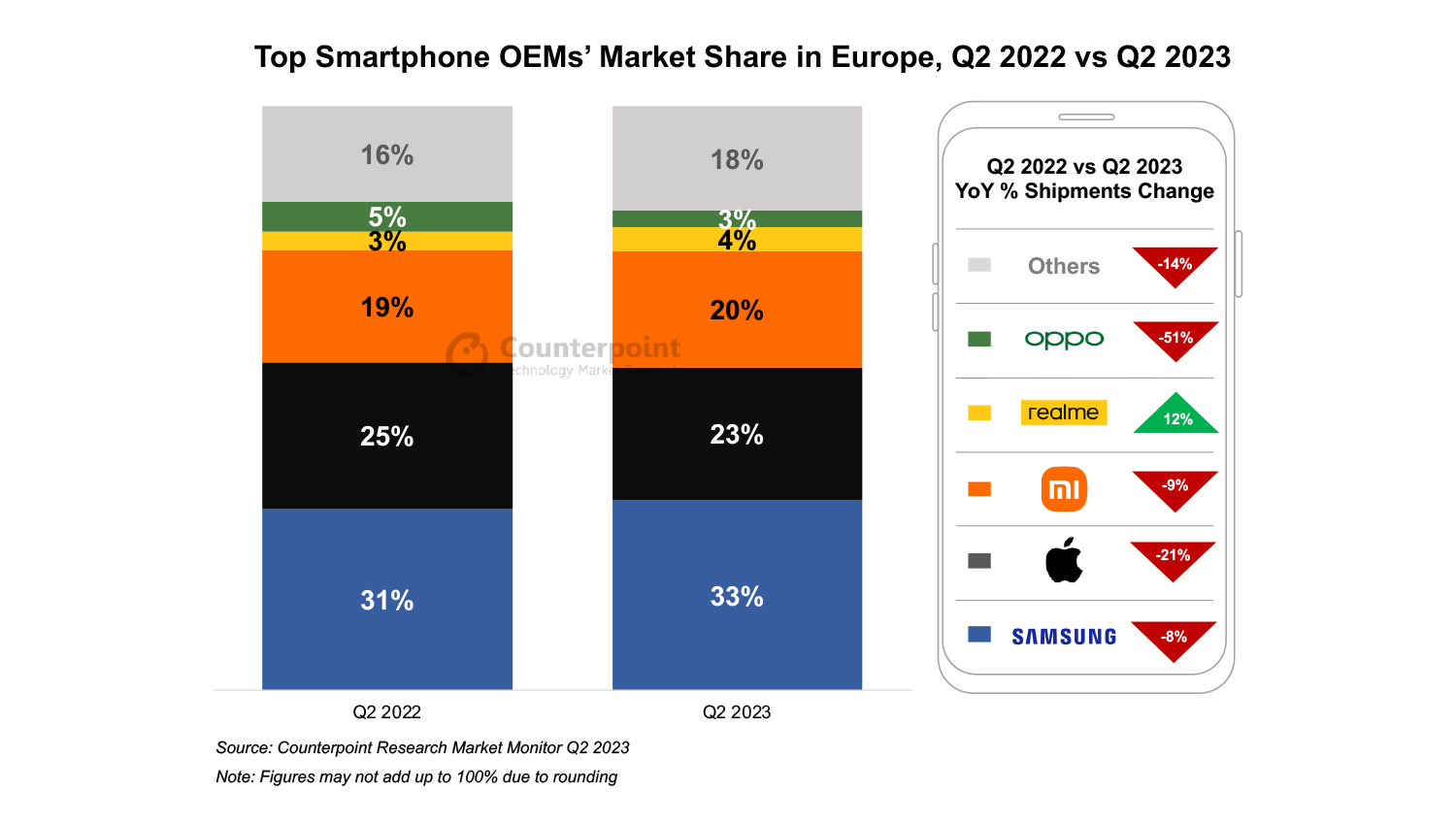

Smartphoneshipments in the Middle East and Africa (MEA) region increased 1% YoY and 7% QoQ in Q2 2023, according to the latest research from Counterpoint’sMarket Monitor Service.This was the MEA smartphone market’s first meaningful rebound in five quarters, or since the global inflation crisis started. Consumer sentiment improved materially during the quarter, as inflation rates fell and local currencies stabilized. This came as a welcome relief for embattled OEMs, which had been sitting on an alarming level of inventory in 2022. They utilized the opportunity to destock and return to a more normal pattern of inventory and product launches.

Commenting on the market’s performance,Senior Analyst Yang Wangsaid, “TheMEAregion seems to be the first to come out of the global downturn in thesmartphonemarket. Market activity picked up during the quarter on better macroeconomic environment and consumers could afford to be more optimistic about ‘big ticket’ item purchases. This was reflected in robustRamadanand Easter sales and throughout the quarter. The encouraging performances show once again that the MEA region could be the last remaining untapped smartphonemarket.There is still significant potential for large segments of the population to upgrade to smartphones.” Looking at individual brands, Samsung, TECNO and一个pplewere the biggest winners.Samsung’s rebound can be attributed to the lower-pricedGalaxy一个series’ strong sales, while new 5G and premium-end models also did well.TECNO, and sister brandInfinixto some extent, performed very well due to better economic conditions, particularly for lower income groups, and aggressive market entries in the Middle East. TECNO andInfinix’ssuccesses, however, can be partly attributed to the cannibalization ofitel’s market share. Lastly,一个pplehad an outstanding quarter to round off a very strong iPhone 14 series cycle. TheOEMmanaged to increase penetration in key Middle East markets with the higher-priced Pro and Pro Max models getting good reception.

Looking at individual brands, Samsung, TECNO and一个pplewere the biggest winners.Samsung’s rebound can be attributed to the lower-pricedGalaxy一个series’ strong sales, while new 5G and premium-end models also did well.TECNO, and sister brandInfinixto some extent, performed very well due to better economic conditions, particularly for lower income groups, and aggressive market entries in the Middle East. TECNO andInfinix’ssuccesses, however, can be partly attributed to the cannibalization ofitel’s market share. Lastly,一个pplehad an outstanding quarter to round off a very strong iPhone 14 series cycle. TheOEMmanaged to increase penetration in key Middle East markets with the higher-priced Pro and Pro Max models getting good reception.

On the other hand,Xiaomiretreated 17% YoY as it faced strong competition from Samsung and Transsion brands in the mid-range. Outside of the top 10,OPPOandvivocontinued to slide as the availability of the brands’ stock contracted and market penetration activities shrank. However,realmemaintained positive momentum due to increasing product availability in new markets.

Commenting on pricing trends in the MEA smartphone market, Wang said, “The premium end is usually an afterthought for the MEA market, but the segment was an outperformer of Q2 2023. The sales of smartphones priced above $800 grew 93% YoY, largely due to Apple’s high-end models in the iPhone 14 series. The OEM’s share increased in key GCC markets, while it was seen making efforts to expand distribution channels in Africa. Apple’s success in the MEA region is another proof of the brand’s strong global appeal. As the process of urbanization and industrialization continues across the region, Apple can expect to remain one of the topOEMsin the region.”

Counterpoint Research’s market-leadingMarket Monitor,MarketPulseandModel Salesservices for mobile handsets are available for subscribing clients.

Feel free to contact us at press@www.arena-ruc.com for questions regarding our in-depth research and insights.

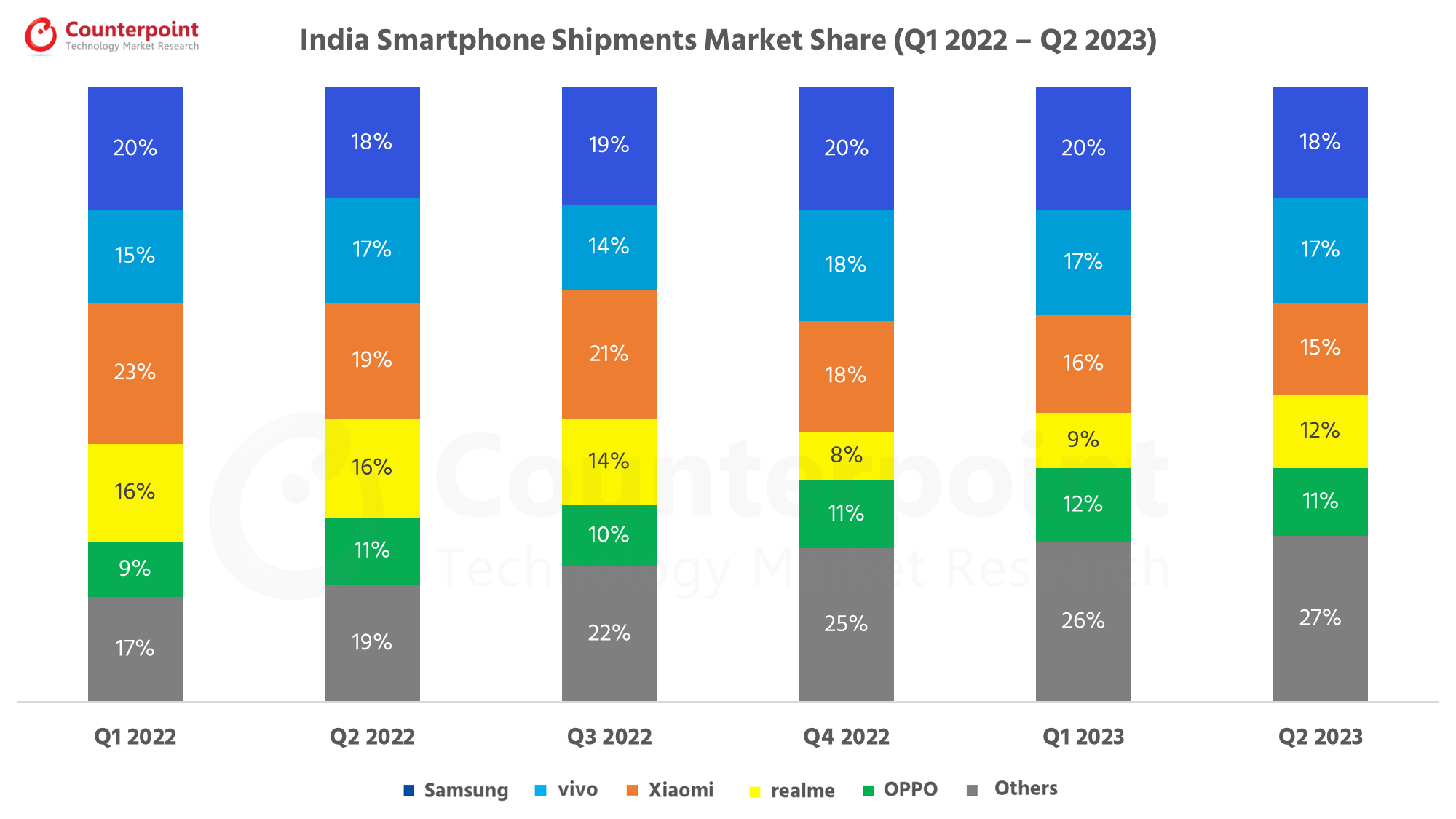

You can also visit ourData Section(updated quarterly) to view the smartphone market share forWorld,USA,ChinaandIndia.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

Source:

Source: