Global Smartphone Shipments Market Data (Q3 2021 – Q2 2023)

Published Date: August 17, 2023

A repository of quarterly data for the global smartphone market. This data is a part of a series of reports which track the mobile handset market:Smartphone and Feature Phone shipmentsevery quarter for more than 140 brands covering more than 95% of the totaldevice shipmentsin the industry.

Source:Market Monitor Service

Source:Market Monitor Service

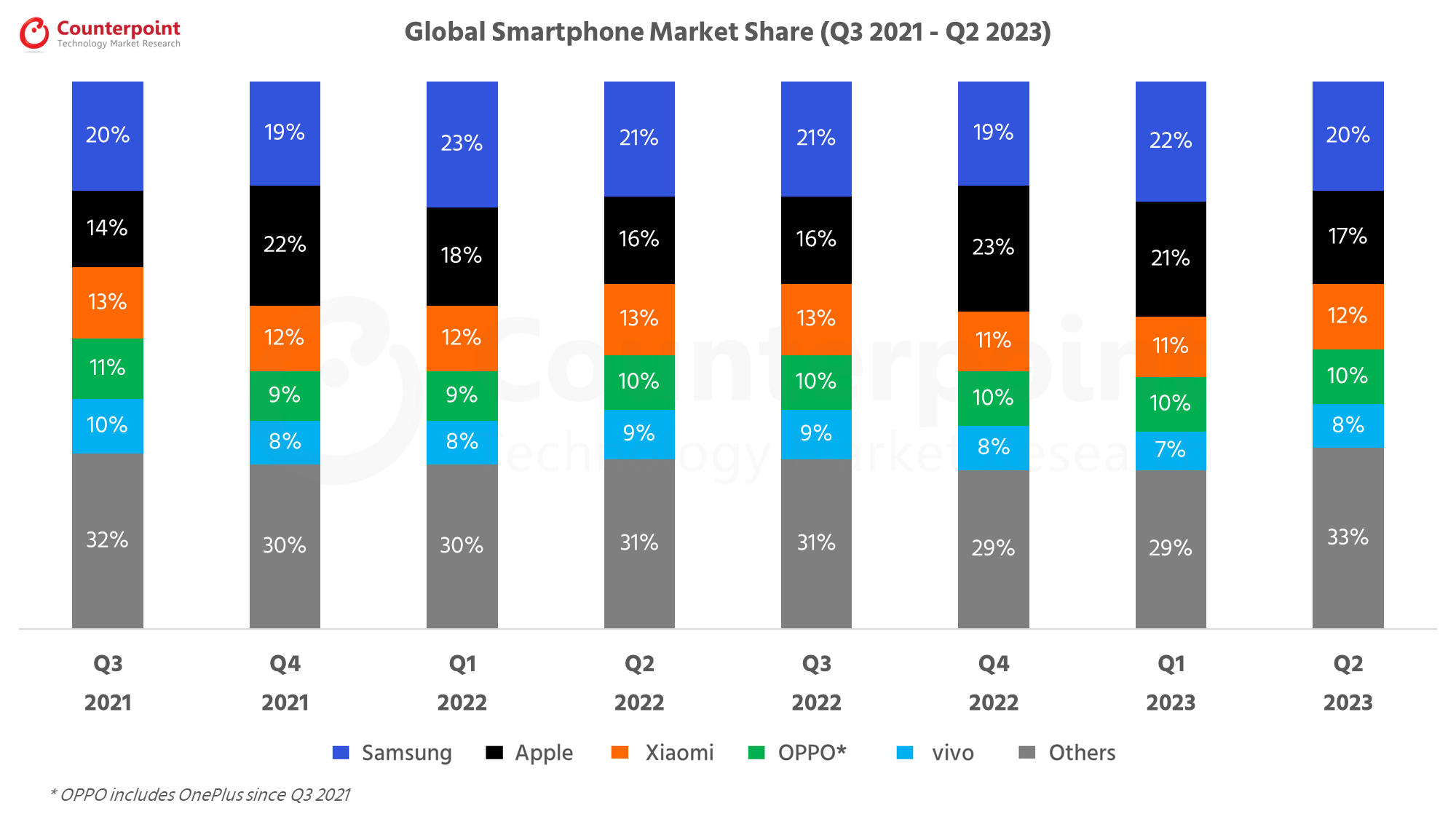

| Global Smartphone Shipments Market Share (%) | ||||||||

| Brands | Q3 2021 |

Q4 2021 |

Q1 2022 |

Q2 2022 |

Q3 2022 |

Q4 2022 |

Q1 2023 |

Q2 2023 |

| Samsung | 20% | 19% | 23% | 21% | 21% | 19% | 22% | 20% |

| Apple | 14% | 22% | 18% | 16% | 16% | 23% | 21% | 17% |

| Xiaomi | 13% | 12% | 12% | 13% | 13% | 11% | 11% | 12% |

| OPPO* | 11% | 9% | 9% | 10% | 10% | 10% | 10% | 10% |

| vivo | 10% | 8% | 8% | 9% | 9% | 8% | 7% | 8% |

| Others | 32% | 30% | 30% | 31% | 31% | 29% | 29% | 33% |

| Global Smartphone Shipments (Millions) | ||||||||

| Brands | Q3 2021 |

Q4 2021 |

Q1 2022 |

Q2 2022 |

Q3 2022 |

Q4 2022 |

Q1 2023 |

Q2 2023 |

| Samsung | 69.3 | 69.0 | 74.5 | 62.5 | 64.3 | 58.3 | 60.6 | 53.5 |

| Apple | 48.0 | 81.5 | 59.0 | 46.5 | 49.2 | 70.0 | 58.0 | 45.3 |

| Xiaomi | 44.4 | 45.0 | 39.0 | 39.5 | 40.5 | 33.2 | 30.5 | 33.2 |

| OPPO* | 38.1 | 33.9 | 30.9 | 28.2 | 29.5 | 29.6 | 28.4 | 28.0 |

| vivo | 33.7 | 29.3 | 24.8 | 25.5 | 26.0 | 23.4 | 20.8 | 21.4 |

| Others | 108.5 | 112.7 | 98.1 | 92.3 | 92.4 | 89.4 | 81.9 | 86.6 |

| Total Market | 342.0 | 371.4 | 326.4 | 294.5 | 301.9 | 303.9 | 280.2 | 268.0 |

*OPPO includes OnePlus since Q3 2021

**Ranking is according to the latest quarter.

Global smartphone market share Q2 2023 highlights:

- The global smartphone market declined by 9% YoY to reach 268 million units in Q2 2023.

- Samsung retained its position as the top smartphone player in Q2 2023, as Apple saw cyclical decline.

- Among the top five brands, Apple experienced the least YoY shipment decline. Among the top 10 brands, Tecno and Infinix, part of the Transsion Group, saw double digit annual growth.

- In terms of regional performance, Middle East and Africa (MEA) exhibited the only annual shipment growth while North America experienced the highest decline.

- The top 5 brands contributed to almost 80% of the total 5G shipments in Q2 2023.

For our detailed research on the global smartphone market in Q2 2023, clickhere.

The global smartphone market share numbers are from:

MOBILE DEVICES MONITOR – Q2 2023 (Vendor Region Countries)

This report is part of a series of reports which track the mobile handset market: Smartphone and Feature Phone shipments every quarter for more than 140 brands covering more than 95% of the total device shipments in the industry.

The deliverable includes

• Single pivot format giving in-depth analysis of theglobal handset market

• Covers140+ brandsnow in comparison to 95 brands earlier

• Break out of3 key countriesin each regionto give a further granular view of the regions

•18 countries viewas compared to six earlier

• Covers more than95% of the global handset shipments

• More visuals and analysis by country and by regions

This robust quarterly report with fact-based deep analysis covering multiple dimensions will help players across the handset value chain to holistically analyze the current state of the global handset market and plan ahead of the competition.

Related Posts:

*Data on this page is updated every quarter

This data represents the global smartphone market share by quarter (from 2021-2023) by top OEMs. Global smartphone shipments by market share and millions of units are provided.

For detailed insights on the data, please reach out to us atsales(at)www.arena-ruc.com. If you are a member of the press, please contact us atpress(at)www.arena-ruc.comfor any media enquiries.

Q1 2023 Highlights

Published Date: May 9, 2023

Highlights:

- The global smartphone market declined by 14% YoY and 7% QoQ to record 280.2 million unit shipments in Q1 2023.

- Samsung replaced Apple as the top smartphone player in Q1 2023, driven by its mid-tier A Series and the recently launched S23 series.

- Apple’s YoY shipment decline was the least among the top five brands. Consequently, it recorded its highest-ever Q1 share of 21%.

- Global smartphone revenues declined by 7% YoY to around $104 billion. Apple, Samsung, Xiaomi increased their Average Selling Prices YoY.

For our detailed research on the global smartphone market in Q1 2023, clickhere.

| Global Smartphone Shipments Market Share (%) | ||||||||

| Brands | Q2 2021 |

Q3 2021 |

Q4 2021 |

Q1 2022 |

Q2 2022 |

Q3 2022 |

Q4 2022 |

Q1 2023 |

| Samsung | 18% | 20% | 19% | 23% | 21% | 21% | 19% | 22% |

| Apple | 15% | 14% | 22% | 18% | 16% | 16% | 23% | 21% |

| Xiaomi | 16% | 13% | 12% | 12% | 13% | 13% | 11% | 11% |

| OPPO* | 10% | 11% | 9% | 9% | 10% | 10% | 10% | 10% |

| vivo | 10% | 10% | 8% | 8% | 9% | 9% | 8% | 7% |

| Others | 31% | 32% | 30% | 30% | 31% | 31% | 29% | 29% |

| Global Smartphone Shipments(in Millions) | ||||||||

| Brands | Q2 2021 |

Q3 2021 |

Q4 2021 |

Q1 2022 |

Q2 2022 |

Q3 2022 |

Q4 2022 |

Q1 2023 |

| Samsung | 57.6 | 69.3 | 69.0 | 74.5 | 62.5 | 64.3 | 58.3 | 60.6 |

| Apple | 48.9 | 48.0 | 81.5 | 59.0 | 46.5 | 49.2 | 70.0 | 58.0 |

| Xiaomi | 52.5 | 44.4 | 45.0 | 39.0 | 39.5 | 40.5 | 33.2 | 30.5 |

| OPPO* | 33.6 | 38.1 | 33.9 | 30.9 | 28.2 | 29.5 | 29.6 | 24.0 |

| vivo | 32.5 | 33.7 | 29.3 | 24.8 | 25.5 | 26.0 | 23.4 | 21.2 |

| Others | 98.0 | 108.5 | 112.7 | 98.1 | 92.3 | 92.4 | 89.4 | 85.9 |

| Total Market | 323.1 | 342.0 | 371.4 | 326.4 | 294.5 | 301.9 | 303.9 | 280.2 |

*OPPO includes OnePlus since Q3 2021

**Ranking is according to the latest quarter.

Frequently asked question (FAQs):

• What’s the global market size for smartphones?

The global smartphone market shipments declined to reach 280.2 million units in Q1 2023.

• What is the global market for mobile phones?

The 2022 global smartphone shipments declined to 1.2 billion units, the lowest since 2013.

• Who dominates the smartphone market?

Apple dominated the smartphone market in 2022 by achieving its highest-ever global shipments, revenue and operating profit share.

• How fast is the smartphone market growing?

The global smartphone shipments declined by 12% in 2022.

Q4 2022 Highlights

Published Date: February 8, 2023

Highlights:

- Theglobal smartphone marketdeclined by 18% YoY to reach 304 million units in Q4 2022.

- 苹果取代了三星智能手机playe顶部r in Q4 2022, driven by the recent launch of the iPhone 14 series.

- Apple market sharefor Q4 2022 was 23% followed by Samsung market share of 19%.

- The 2022 global smartphone shipments declined by 12% to 1.2 billion units, the lowest since 2013.

- Global smartphone revenues declined by 9% to $409 billion, the lowest since 2017.

- Apple achieved its highest-ever global smartphone shipment, revenue and operating profit share in 2022.

For our detailed research on the global smartphone market in Q4 2022, clickhere.

| Global Smartphone Shipments Market Share (%) | ||||||||

| Brands | Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

Q1 2022 |

Q2 2022 |

Q3 2022 |

Q4 2022 |

| Apple | 17% | 15% | 14% | 22% | 18% | 16% | 16% | 23% |

| Samsung | 22% | 18% | 20% | 19% | 23% | 21% | 21% | 19% |

| Xiaomi | 14% | 16% | 13% | 12% | 12% | 13% | 13% | 11% |

| OPPO* | 11% | 10% | 11% | 9% | 9% | 10% | 10% | 10% |

| vivo | 10% | 10% | 10% | 8% | 8% | 9% | 9% | 8% |

| Others | 26% | 31% | 32% | 30% | 30% | 31% | 31% | 29% |

| Global Smartphone Shipments(in Millions) | ||||||||

| Brands | Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

Q1 2022 |

Q2 2022 |

Q3 2022 |

Q4 2022 |

| Apple | 59.5 | 48.9 | 48.0 | 81.5 | 59.0 | 46.5 | 49.2 | 70.0 |

| Samsung | 76.6 | 57.6 | 69.3 | 69.0 | 74.5 | 62.5 | 64.3 | 58.3 |

| Xiaomi | 48.5 | 52.5 | 44.4 | 45.0 | 39.0 | 39.5 | 40.5 | 33.2 |

| OPPO* | 38 | 33.6 | 38.1 | 33.9 | 30.9 | 28.2 | 29.5 | 29.6 |

| vivo | 35.5 | 32.5 | 33.7 | 29.3 | 24.8 | 25.5 | 26.0 | 23.4 |

| Others | 96.8 | 98.0 | 108.5 | 112.7 | 98.1 | 92.3 | 92.4 | 89.4 |

| Total Market | 354.9 | 323.1 | 342.0 | 371.4 | 326.4 | 294.5 | 301.9 | 303.9 |

*OPPO includes OnePlus since Q3 2021

**Ranking is according to the latest quarter.

Q3 2022 Highlights

Published Date: December 20, 2022

- The global smartphone market declined by 12% YoY even as it grew by 2% QoQ to reach 301 million units in Q3 2022.

- While quarterly growth in Apple and Samsung pushed the global smartphone market above 300 million units, a level it failed to reach last quarter, political and economic instability drove negative consumer sentiment.

- Apple was the only top-five smartphone brand to grow YoY, with shipments increasing 2% YoY, growing market share by two percentage points to 16%.

- Samsung’s shipments declined by 8% YoY but grew 5% QoQ to 64 million.

- Xiaomi, OPPO* and vivo, recovered slightly after receiving heavy beatings due to lockdowns in China in Q2, and as they captured more of the market ceded by Apple and Samsung’s exit from Russia.

| Global Smartphone Shipments Market Share (%) | ||||||||

| Brands | Q4 2020 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

Q1 2022 |

Q2 2022 |

Q3 2022 |

| Samsung | 16% | 22% | 18% | 20% | 19% | 23% | 21% | 21% |

| Apple | 21% | 17% | 15% | 14% | 22% | 18% | 16% | 16% |

| Xiaomi | 11% | 14% | 16% | 13% | 12% | 12% | 13% | 13% |

| OPPO* | 9% | 11% | 10% | 11% | 9% | 9% | 10% | 10% |

| vivo | 8% | 10% | 10% | 10% | 8% | 8% | 9% | 9% |

| Others | 35% | 26% | 31% | 32% | 30% | 30% | 31% | 31% |

| Global Smartphone Shipments(in Millions) | ||||||||

| Brands | Q4 2020 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

Q1 2022 |

Q2 2022 |

Q3 2022 |

| Samsung | 62.5 | 76.6 | 57.6 | 69.3 | 69.0 | 74.5 | 62.5 | 64.3 |

| Apple | 81.9 | 59.5 | 48.9 | 48.0 | 81.5 | 59.0 | 46.5 | 49.2 |

| Xiaomi | 43.0 | 48.5 | 52.5 | 44.4 | 45.0 | 39.0 | 39.5 | 40.5 |

| OPPO* | 34.0 | 38 | 33.6 | 38.1 | 33.9 | 30.9 | 28.2 | 29.5 |

| vivo | 33.4 | 35.5 | 32.5 | 33.7 | 29.3 | 24.8 | 25.2 | 26.0 |

| Others | 139.8 | 96.8 | 98.0 | 108.5 | 112.7 | 98.1 | 92.3 | 92.4 |

| Total Market | 394.6 | 354.9 | 323.1 | 342.0 | 371.4 | 326.4 | 294.5 | 301.9 |

*OPPO includes OnePlus since Q3 2021

**Ranking is according to the latest quarter.

Q2 2022 Highlights

Published Date: August 16, 2022

• The global smartphone market growth saw a decline of 9% YoY and 10% QoQ to 294.5 million units in Q2 2022.

• Global smartphone market share carries on consolidation, with top three brands commanding 50% share for three consecutive quarters.

• This was the first time quarterly shipments dropped below 300 million units since Q2 2020 during the early part of the COVID-19 pandemic.

• Samsung was the only top-five smartphone brand to grow YoY, increasing shipments by 8% YoY and growing market share by three percentage points to 21%.

• Apple market share declined by 5% YoY in Q2 2022, although its share increased in a diminished market.

•iPhone运输市场份额继续边upwards, with Apple reaching its highest Q2 2022 shipment share ever

• The Android vs iOS market share battle, traditionally contested by Apple in the US, Europe and Japan, is intensifying in markets like China, which is becoming a significant driver of iOS installed based globally.

• Xiaomi, OPPO* and vivo, hit by China lockdowns, suffered double digit YoY declines in their respective shipments.

| Global Smartphone Shipments Market Share (%) | ||||||||

| Brands | Q3 2020 |

Q4 2020 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

Q1 2022 |

Q2 2022 |

| Samsung | 22% | 16% | 22% | 18% | 20% | 19% | 23% | 21% |

| Apple | 11% | 21% | 17% | 15% | 14% | 22% | 18% | 16% |

| Xiaomi | 13% | 11% | 14% | 16% | 13% | 12% | 12% | 13% |

| OPPO* | 8% | 9% | 11% | 10% | 11% | 9% | 9% | 10% |

| vivo | 8% | 8% | 10% | 10% | 10% | 8% | 8% | 9% |

| Others | 38% | 35% | 26% | 31% | 32% | 30% | 30% | 31% |

| Global Smartphone Shipments(in Millions) | ||||||||

| Brands | Q3 2020 |

Q4 2020 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

Q1 2022 |

Q2 2022 |

| Samsung | 80.4 | 62.5 | 76.6 | 57.6 | 69.3 | 69.0 | 74.5 | 62.5 |

| Apple | 41.7 | 81.9 | 59.5 | 48.9 | 48.0 | 81.5 | 59.0 | 46.5 |

| Xiaomi | 46.5 | 43.0 | 48.5 | 52.5 | 44.4 | 45.0 | 39.0 | 39.5 |

| OPPO* | 31.0 | 34.0 | 38.0 | 33.6 | 38.1 | 33.9 | 30.9 | 28.2 |

| vivo | 31.0 | 33.4 | 35.5 | 32.5 | 33.7 | 29.3 | 24.8 | 25.5 |

| Others | 135.0 | 139.8 | 96.8 | 98.0 | 108.5 | 112.7 | 98.2 | 92.3 |

| Total Market | 365.6 | 394.6 | 354.9 | 323.1 | 342.0 | 371.4 | 326.4 | 294.5 |

*OPPO includes OnePlus since Q3 2021

**Ranking is according to the latest quarter.

Q1 2022 Highlights

Published Date: May 16, 2022

• The global smartphone market declined by 7% YoY and 12% QoQ to 328 million units in Q1 2022.

• While Samsung’s shipments declined 3% YoY, it was the only top-five smartphone brand to grow QoQ. Its market share rose to 23% from 19% last quarter, resulting in Samsung taking the top spot from Apple in Q1 2022.

• Apple’s shipments declined by 1% annually to reach 59 million units in Q1 2022. This was after an expected seasonal quarterly shipment decline of 28%.

• Xiaomi, OPPO* and vivo’s component struggles continued, causing a quarterly and annual decline in their respective shipments.

| Global Smartphone Shipments Market Share (%) | ||||||||

| Brands | Q2 2020 |

Q3 2020 |

Q4 2020 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

Q1 2022 |

| Samsung | 20% | 22% | 16% | 22% | 18% | 20% | 19% | 23% |

| Apple | 14% | 11% | 21% | 17% | 15% | 14% | 22% | 18% |

| Xiaomi | 10% | 13% | 11% | 14% | 16% | 13% | 12% | 12% |

| OPPO* | 9% | 8% | 9% | 11% | 10% | 11% | 9% | 9% |

| vivo | 8% | 8% | 8% | 10% | 10% | 10% | 8% | 8% |

| Others | 39% | 38% | 35% | 26% | 31% | 32% | 30% | 30% |

| Global Smartphone Shipments (in Millions) | ||||||||

| Brands | Q2 2020 |

Q3 2020 |

Q4 2020 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

Q1 2022 |

| Samsung | 54.2 | 80.4 | 62.5 | 76.6 | 57.6 | 69.3 | 69.0 | 74.5 |

| Apple | 37.5 | 41.7 | 81.9 | 59.5 | 48.9 | 48.0 | 81.5 | 59.0 |

| Xiaomi | 26.5 | 46.5 | 43.0 | 48.5 | 52.5 | 44.4 | 45.0 | 39.0 |

| OPPO | 24.5 | 31.0 | 34.0 | 38.0 | 33.6 | 38.1 | 33.9 | 30.9 |

| vivo | 22.5 | 31.0 | 33.4 | 35.5 | 32.5 | 33.7 | 29.3 | 24.8 |

| Others | 110.9 | 135.0 | 139.8 | 96.8 | 98.0 | 108.5 | 112.7 | 98.1 |

| Total Market | 276.1 | 365.6 | 394.6 | 354.9 | 323.1 | 342.0 | 371.4 | 326.4 |

*OPPO includes OnePlus since Q3 2021

**Ranking is according to the latest quarter.

Why is the smartphone market declining in Q1 2022?

The global smartphone market growth saw a decline of 7% YoY, shipping 328 million units in Q1 2022 caused by the ongoing component shortages, as well as COVID resurgence at the beginning of the quarter and the Russia-Ukraine war towards the end. The global smartphone market also, as expected, had a seasonal decline of 12% QoQ. The component supply crunch was felt more severely by major Chinese OEMs such as Xiaomi, OPPO* and vivo as compared with Samsung, which seems to have overcome component shortages that affected its supply last year, as evidenced by higher-than-expected growth in its shipments despite a late flagship launch.

Consequently, Samsung regained the top spot from Apple which had emerged as the biggest smartphone vendor globally in Q4 2021 thanks to its latest iPhone 13 series.

Which country has the highest market share of smartphones globally?

With its share at around 22.5% of the global smartphone shipments in Q1 2022,Chinaremains the world’s biggest smartphone market. This is down from around 25.6% in Q1 2021 as China’s economy grew slower than expected due to COVID-related lockdowns and shipment volumes declined by over 19% YoY. While China’s share of global smartphone market growth (shipments) remains flat QoQ thanks to a small peak in demand during Chinese New Year and as the global smartphone market declined QoQ due to seasonality, in terms of absolute shipments, China saw a quarterly decline of over 12%.

HONOR has emerged as the biggest smartphone player in China, chipping into vivo and OPPO*’s shares and stepping into the position previously held by Huawei from which it recently separated. Although vivo did not succeed in regaining the top position due to HONOR’s rise at a time when it is itself facing component shortages, it did recover somewhat thanks to its newly launched mid-end S12 series that is popular with younger customers and the affordable the Y series which showed strong performance in the quarter.

Q4 2021 Highlights

Published Date: February 16, 2022

• Global smartphone market growth saw an increase of 4% YoY to reach 1.39 billion units in 2021. Q4 2021 shipments declined 6% YoY to reach 371 million units.

• Samsung led the global smartphone market in 2021 with annual shipments of 272 million units.

• Apple, Xiaomi, OPPO^ and vivo recorded their highest-ever annual shipments.

• The top five brands gained share due to a significant decline by Huawei, and LG’s exit from the market.

• Apple surpassed Samsung to take the number one spot in Q4 2021 with smartphone shipments increasing by 70% QoQ to 81.5 million units in Q4 2021, despite remaining flat YoY.

• Apple recorded their highest-ever annual shipments of 237.9 million units in 2021 driven by successful launch of iPhone 13 series and consistent performance of iPhone 12 series.

| Global Smartphone Shipments Market Share (%) | ||||||||

| Brands | Q1 2020 |

Q2 2020 |

Q3 2020 |

Q4 2020 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

| Apple | 14% | 14% | 11% | 21% | 17% | 15% | 14% | 22% |

| Samsung | 20% | 20% | 22% | 16% | 22% | 18% | 20% | 19% |

| Xiaomi | 10% | 10% | 13% | 11% | 14% | 16% | 13% | 12% |

| OPPO* | 8% | 9% | 8% | 9% | 11% | 10% | 11% | 9% |

| vivo | 7% | 8% | 8% | 8% | 10% | 10% | 10% | 8% |

| Others | 41% | 39% | 38% | 35% | 26% | 31% | 32% | 30% |

| Global Smartphone Shipments (in Millions) | ||||||||

| Brands | Q1 2020 |

Q2 2020 |

Q3 2020 |

Q4 2020 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

| Apple | 40.0 | 37.5 | 41.7 | 81.9 | 59.5 | 48.9 | 48.0 | 81.5 |

| Samsung | 58.6 | 54.2 | 80.4 | 62.5 | 76.6 | 57.6 | 69.3 | 69.0 |

| Xiaomi | 29.7 | 26.5 | 46.5 | 43.0 | 48.5 | 52.5 | 44.4 | 45.0 |

| OPPO* | 22.3 | 24.5 | 31.0 | 34.0 | 38.0 | 33.6 | 38.1 | 33.9 |

| vivo | 21.6 | 22.5 | 31.0 | 33.4 | 35.5 | 32.5 | 33.7 | 29.3 |

| Others | 122.8 | 110.9 | 135.0 | 139.8 | 96.8 | 98.0 | 108.5 | 112.7 |

| Total Market | 295.0 | 276.1 | 365.6 | 394.6 | 354.9 | 323.1 | 342.0 | 371.4 |

*OPPO includes OnePlus since Q3 2021

**Ranking is according to the latest quarter.

Apple Market Share: Q4 2021

| Apple Market Share (iPhone Shipments in Millions) | ||||||||

| Quarter | Q1 2020 |

Q2 2020 |

Q3 2020 |

Q4 2020 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

| Ship-ments (in Mn) | 40.0 | 37.5 | 41.7 | 81.9 | 59.5 | 48.9 | 48.0 | 81.5 |

Q3 2021 Highlights

Published Date: November 16, 2021

• The global smartphone market growth saw an increase of 6% QoQ but declined by 6% YoY in Q3 2021, clocking global shipments of 342 million units, down from 365.6 million in Q3 2020.

• Samsung retained the number one spot in Q3 2021 with smartphone shipments increasing by 20% QoQ to 69.3 million units in Q3 2021.

• Xiaomi shipped 44.4 million units in Q3 2021, down 5% YoY and 15% QoQ as it was severely hit by the ongoing component shortages.

• vivo grew 8% YoY and 3% QoQ to reach 33.7 million units. vivo continued to lead China’s smartphone market with 17.3 million units in Q3 2021.

• realme achieved its highest-ever shipment performance with 16.2 million units in Q3 2021. The record quarter came at a time when component shortages were at their peak.

• Global handset market wholesale revenue grew 10% YoY and 6% QoQ in Q3 2021 to reach over $103 billion.

| Global Smartphone Shipments Market Share (%) | ||||||||

| Brands | Q4 2019 |

Q1 2020 |

Q2 2020 |

Q3 2020 |

Q4 2020 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

| Samsung | 18% | 20% | 20% | 22% | 16% | 22% | 18% | 20% |

| Apple | 18% | 14% | 14% | 11% | 21% | 17% | 15% | 14% |

| Xiaomi | 8% | 10% | 10% | 13% | 11% | 14% | 16% | 13% |

| OPPO | 8% | 8% | 9% | 8% | 9% | 11% | 10% | 11% |

| vivo | 8% | 7% | 8% | 8% | 8% | 10% | 10% | 10% |

| Others | 40% | 41% | 39% | 38% | 35% | 26% | 31% | 32% |

| Global Smartphone Shipments | ||||||||

| Brands | Q4 2019 |

Q1 2020 |

Q2 2020 |

Q3 2020 |

Q4 2020 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

| Samsung | 70.4 | 58.6 | 54.2 | 80.4 | 62.5 | 76.6 | 57.6 | 69.3 |

| Apple | 72.3 | 40.0 | 37.5 | 41.7 | 81.9 | 59.5 | 48.9 | 48.0 |

| Xiaomi | 32.9 | 29.7 | 26.5 | 46.5 | 43.0 | 48.5 | 52.5 | 44.4 |

| OPPO | 30.7 | 22.3 | 24.5 | 31.0 | 34.0 | 38.0 | 33.6 | 38.1 |

| vivo | 31.5 | 21.6 | 22.5 | 31.0 | 33.4 | 35.5 | 32.5 | 33.7 |

| Others | 163.4 | 122.8 | 110.9 | 135.0 | 139.8 | 96.8 | 98.0 | 108.5 |

| Total Market | 401.1 | 295.0 | 276.1 | 365.6 | 394.6 | 354.9 | 323.1 | 342.0 |

*Ranking is according to the latest quarter.

Q2 2021 Highlights

Published Date: August 16, 2021

• Global smartphone market grew 19% YoY but declined by 7% QoQ as 323 million units were shipped, led by Samsung.

• Xiaomi eclipses 52 million smartphones, becoming the world’s second-largest smartphone brand for the first time ever.

• Samsung retained the number one spot with shipments reaching 58 million units in Q2 2021, however, its market share declined to 18% as compared to 22% in Q1 2021 as its shipments declined by 24% QoQ.

• realme grew by 135% YoY and 17% QoQ, crossing cumulative shipments of 100 million smartphones since its entry into the smartphone market.

• Global smartphone shipment revenues grew by 25% YoY to $96 billion in Q2 2021 setting a second-quarter record.

| Global Smartphone Shipments Market Share (%) | ||||||||

| Brands | Q3 2019 |

Q4 2019 |

Q1 2020 |

Q2 2020 |

Q3 2020 |

Q4 2020 |

Q1 2021 |

Q2 2021 |

| Samsung | 21% | 18% | 20% | 20% | 22% | 16% | 22% | 18% |

| Xiaomi | 8% | 8% | 10% | 10% | 13% | 11% | 14% | 16% |

| Apple | 12% | 18% | 14% | 14% | 11% | 21% | 17% | 15% |

| OPPO | 9% | 8% | 8% | 9% | 8% | 9% | 11% | 10% |

| vivo | 8% | 8% | 7% | 8% | 8% | 8% | 10% | 10% |

| Others | 42% | 40% | 41% | 39% | 38% | 35% | 26% | 31% |

| Global Smartphone Shipments | ||||||||

| Brands | Q3 2019 |

Q4 2019 |

Q1 2020 |

Q2 2020 |

Q3 2020 |

Q4 2020 |

Q1 2021 |

Q2 2021 |

| Samsung | 78.2 | 70.4 | 58.6 | 54.2 | 80.4 | 62.5 | 76.6 | 57.9 |

| Xiaomi | 31.7 | 32.9 | 29.7 | 26.5 | 46.2 | 43.0 | 48.5 | 52.5 |

| Apple | 44.8 | 72.3 | 40.0 | 37.5 | 41.7 | 81.9 | 59.5 | 48.9 |

| OPPO | 32.3 | 31.4 | 22.3 | 24.5 | 31.0 | 34.0 | 38.0 | 33.6 |

| vivo | 31.3 | 31.5 | 21.6 | 22.5 | 31.0 | 33.4 | 35.5 | 32.5 |

| Others | 161.7 | 162.6 | 122.8 | 110.9 | 135.3 | 139.8 | 96.8 | 97.7 |

| Total Market |

380.0 | 401.1 | 295.0 | 276.1 | 365.6 | 394.6 | 354.9 | 323.1 |

*Ranking is according to the latest quarter.

Q1 2021 Highlights

Published Date: May 16, 2021

• Global smartphone shipment revenue crossed the $100 billion mark for the first time for a March-ending quarter to reach $113 billion.

• Global shipments grew 20% YoY, reaching 354 million units, led by OPPO, vivo, Xiaomi and Apple.

• Samsung regained its top spot as the world’s biggest OEM, with shipments reaching 76.8 million units in Q1 2021.

• Apple iPhone active installed base reached a new high this quarter.

| Global Smartphone Shipments Market Share (%) | ||||||||

| Brands | Q2 2019 |

Q3 2019 |

Q4 2019 |

Q1 2020 |

Q2 2020 |

Q3 2020 |

Q4 2020 |

Q1 2021 |

| Samsung | 21% | 21% | 18% | 20% | 20% | 22% | 16% | 22% |

| Apple | 10% | 12% | 18% | 14% | 14% | 11% | 21% | 17% |

| Xiaomi | 9% | 8% | 8% | 10% | 10% | 13% | 11% | 14% |

| OPPO | 9% | 9% | 8% | 8% | 9% | 8% | 9% | 11% |

| vivo | 8% | 8% | 8% | 7% | 8% | 8% | 8% | 10% |

| Huawei# | 16% | 18% | 14% | 17% | 20% | 14% | 8% | 4% |

| realme | 1% | 3% | 2% | 2% | 2% | 4% | 4% | 4% |

| Others | 24% | 21% | 23% | 22% | 16% | 20% | 23% | 18% |

| Global Smartphone Shipments | ||||||||

| Brands | Q2 2019 |

Q3 2019 |

Q4 2019 |

Q1 2020 |

Q2 2020 |

Q3 2020 |

Q4 2020 |

Q1 2021 |

| Samsung | 76.3 | 78.2 | 70.4 | 58.6 | 54.2 | 80.4 | 62.5 | 76.6 |

| Apple | 36.5 | 44.8 | 72.3 | 40.0 | 37.5 | 41.7 | 81.9 | 59.5 |

| Xiaomi | 32.3 | 31.7 | 32.9 | 29.7 | 26.5 | 46.2 | 43.0 | 48.5 |

| OPPO | 30.6 | 32.3 | 31.4 | 22.3 | 24.5 | 31.0 | 34.0 | 38.0 |

| vivo | 27.0 | 31.3 | 31.5 | 21.6 | 22.5 | 31.0 | 33.4 | 35.5 |

| Huawei# | 56.6 | 66.8 | 56.2 | 49.0 | 54.8 | 50.9 | 33.0 | 15.0 |

| realme | 5.0 | 10.2 | 7.8 | 7.2 | 6.4 | 14.8 | 14.0 | 12.8 |

| Others | 92.8 | 84.7 | 98.6 | 66.6 | 49.7 | 69.6 | 92.8 | 69.0 |

| Total Market |

357.1 | 380.0 | 401.1 | 295.0 | 276.1 | 365.6 | 394.6 | 354.9 |

*Ranking is according to the latest quarter.

#Huawei includes HONOR in all quarters except Q1 2021 reflecting the separation of the two brands.

Q4 2020 Highlights

Published Date: February 16, 2021

• The global smartphone market continued to recover in Q4 2020, rebounding 8% QoQ to 395.9 million units.

• Apple’s 8% YoY and 96% QoQ growth helped it lead the market in Q4 2020.

• Samsung slipped to the second spot with 62.5 million units in Q4 2020, However, it led the overall market in CY 2020.

• For the first time, OPPO and vivo surpassed Huawei to capture the fourth and fifth spots respectively, Huawei slipped to the sixth spot.

• realme emerged as the fastest growing brand in CY 2020 with 65% YoY growth.

| Global Smartphone Shipments Market Share (%) | ||||||||

| Brands | Q1 2019 |

Q2 2019 |

Q3 2019 |

Q4 2019 |

Q1 2020 |

Q2 2020 |

Q3 2020 |

Q4 2020 |

| Apple | 12% | 10% | 12% | 18% | 14% | 14% | 11% | 21% |

| Samsung | 21% | 21% | 21% | 18% | 20% | 20% | 22% | 16% |

| Xiaomi | 8% | 9% | 8% | 8% | 10% | 10% | 13% | 11% |

| OPPO | 8% | 9% | 9% | 8% | 8% | 9% | 8% | 9% |

| vivo | 7% | 8% | 8% | 8% | 7% | 8% | 8% | 8% |

| Huawei# | 17% | 16% | 18% | 14% | 17% | 20% | 14% | 8% |

| realme | 1% | 1% | 3% | 2% | 2% | 2% | 4% | 4% |

| Others | 24% | 24% | 21% | 23% | 22% | 16% | 20% | 23% |

| Global Smartphone Shipments | ||||||||

| Brands | Q1 2019 |

Q2 2019 |

Q3 2019 |

Q4 2019 |

Q1 2020 |

Q2 2020 |

Q3 2020 |

Q4 2020 |

| Apple | 42.0 | 36.5 | 44.8 | 72.3 | 40.0 | 37.5 | 41.7 | 81.9 |

| Samsung | 72.0 | 76.3 | 78.2 | 70.4 | 58.6 | 54.2 | 80.4 | 62.5 |

| Xiaomi | 27.8 | 32.3 | 31.7 | 32.9 | 29.7 | 26.5 | 46.2 | 43.0 |

| OPPO | 25.7 | 30.6 | 32.3 | 31.4 | 22.3 | 24.5 | 31.0 | 34.0 |

| vivo | 23.9 | 27.0 | 31.3 | 31.5 | 21.6 | 22.5 | 31.0 | 33.4 |

| Huawei# | 59.1 | 56.6 | 66.8 | 56.2 | 49.0 | 54.8 | 50.9 | 33.0 |

| realme | 2.8 | 5.0 | 10.2 | 7.8 | 7.2 | 6.4 | 14.8 | 14.0 |

| Others | 87.7 | 92.8 | 84.7 | 98.6 | 66.6 | 49.7 | 69.6 | 92.8 |

*Ranking is according to the latest quarter.

#Huawei includes HONOR.

Q3 2020 Highlights

- Samsung regained the top spot, shipping 80.4 million units with 48% QoQ and 3% YoY growth with the highest ever shipment in the last three years.

- Realme shipment grew 132% QoQ, becoming the world’s fastest brand to hit 50 million shipments since inception.

- Xiaomi grew 75% QoQ contributing 13% in total smartphone shipment. Notably, this was also the first time when Xiaomi surpassed Apple to capture the third spot.

- The market share for BBK Group (OPPO, Vivo, Realme, and OnePlus) has increased from 20% in Q2 to 22% in Q3 2020. The group is close to becoming the largest smartphone manufacturer group globally with three of its brands in the top 10.

| Global Smartphone Shipments Market Share (%) | ||||||||

| Brands | Q4 2018 |

Q1 2019 |

Q2 2019 |

Q3 2019 |

Q4 2019 |

Q1 2020 |

Q2 2020 |

Q3 2020 |

| Samsung | 18% | 21% | 21% | 21% | 18% | 20% | 20% | 22% |

| Huawei# | 15% | 17% | 16% | 18% | 14% | 17% | 20% | 14% |

| Xiaomi | 6% | 8% | 9% | 8% | 8% | 10% | 10% | 13% |

| Apple | 17% | 12% | 10% | 12% | 18% | 14% | 14% | 11% |

| OPPO | 8% | 8% | 9% | 9% | 8% | 8% | 9% | 8% |

| vivo | 7% | 7% | 8% | 8% | 8% | 7% | 8% | 8% |

| realme | – | 1% | 1% | 3% | 2% | 2% | 2% | 4% |

| Others | 26% | 24% | 24% | 21% | 23% | 22% | 16% | 20% |

| Global Smartphone Shipments | ||||||||

| Brands | Q4 2018 |

Q1 2019 |

Q2 2019 |

Q3 2019 |

Q4 2019 |

Q1 2020 |

Q2 2020 |

Q3 2020 |

| Samsung | 69.8 | 72.0 | 76.3 | 78.2 | 70.4 | 58.6 | 54.2 | 80.4 |

| Huawei# | 59.7 | 59.1 | 56.6 | 66.8 | 56.2 | 49.0 | 54.8 | 50.9 |

| Xiaomi | 25.6 | 27.8 | 32.3 | 31.7 | 32.9 | 29.7 | 26.5 | 46.2 |

| Apple | 65.9 | 42.0 | 36.5 | 44.8 | 72.3 | 40.0 | 37.5 | 41.7 |

| OPPO | 31.3 | 25.7 | 30.6 | 32.3 | 31.4 | 22.3 | 24.5 | 31.0 |

| vivo | 26.5 | 23.9 | 27.0 | 31.3 | 31.5 | 21.6 | 22.5 | 31.0 |

| realme | – | 2.8 | 5.0 | 10.2 | 7.8 | 7.2 | 6.4 | 14.8 |

| Others | 115.8 | 87.7 | 92.8 | 84.7 | 98.6 | 66.6 | 48.6 | 69.6 |

*Ranking is according to the latest quarter.

#Huawei includes HONOR.

Q2 2020 Highlights

- The share of the top 10 brands reached 88% compared to 80% last year. Brands outside of the top 10 declined 55% YoY. The impact of COVID-19 was more severe on smaller brands that tend to have lower online presence and that tend to cater more to the entry-level segments.

- 华为继续推动在中国和超越amsung to lead the global smartphone market. Huawei’s shipments declined only 3% YoY globally as it grew 11% YoY in China.

- Samsungdeclined 29% YoY as its core markets including LATAM, India, the USA and Europe were struggling from the effects of the pandemic and lockdowns.

- realmewas the only major brand achieving double-digit annual growth. realme grew 11% YoY in the quarter as several markets in Europe and India recovered in June. realme was also the fastest-growing brand in the quarter and was number 7th in terms of sales.

- Apple iPhone shipments grew 3% YoY and revenues grew 2% YoY. The company saw sustained momentum of the iPhone 11 and a great sales start of the iPhone SE. All regions saw revenue growth.

| Global Smartphone Shipments Market Share (%) | ||||||||

| Brands | Q3 2018 |

Q4 2018 |

Q1 2019 |

Q2 2019 |

Q3 2019 |

Q4 2019 |

Q1 2020 |

Q2 2020 |

| Huawei# | 14% | 15% | 17% | 16% | 18% | 14% | 17% | 20% |

| Samsung | 19% | 18% | 21% | 21% | 21% | 18% | 20% | 20% |

| Apple | 12% | 17% | 12% | 10% | 12% | 18% | 14% | 14% |

| Xiaomi | 9% | 6% | 8% | 9% | 8% | 8% | 10% | 10% |

| OPPO | 9% | 8% | 8% | 9% | 9% | 8% | 8% | 9% |

| vivo | 8% | 7% | 7% | 8% | 8% | 8% | 7% | 8% |

| Lenovo## | 3% | 3% | 3% | 3% | 3% | 3% | 2% | 3% |

| Others | 26% | 26% | 24% | 24% | 21% | 23% | 22% | 16% |

| Global Smartphone Shipments | ||||||||

| Brands | Q3 2018 |

Q4 2018 |

Q1 2019 |

Q2 2019 |

Q3 2019 |

Q4 2019 |

Q1 2020 |

Q2 2020 |

| Huawei# | 52.0 | 59.7 | 59.1 | 56.6 | 66.8 | 56.2 | 49.0 | 54.8 |

| Samsung | 72.3 | 69.8 | 72.0 | 76.3 | 78.2 | 70.4 | 58.6 | 54.2 |

| Apple | 46.9 | 65.9 | 42.0 | 36.5 | 44.8 | 72.3 | 40.0 | 37.5 |

| Xiaomi | 33.3 | 25.6 | 27.8 | 32.3 | 31.7 | 32.9 | 29.7 | 26.5 |

| OPPO | 33.9 | 31.3 | 25.7 | 30.6 | 32.3 | 31.4 | 22.3 | 24.5 |

| vivo | 30.5 | 26.5 | 23.9 | 27.0 | 31.3 | 31.5 | 21.6 | 22.5 |

| Lenovo## | 11.0 | 10.1 | 9.5 | 9.5 | 10.0 | 11.7 | 5.9 | 7.5 |

| Others | 110.9 | 115.8 | 87.7 | 92.8 | 84.7 | 98.6 | 66.6 | 48.6 |

*Ranking is according to the latest quarter.

#Huawei includes HONOR.

##Lenovo includes Motorola.

Q1 2020 Highlights

- The global smartphone market declined its fastest ever, down 13% YoY in Q1 2020.

- This is the first time since Q1 2014, that the smartphone market has fallen below 300Mn units in a quarter.

- The COVID-19 pandemic has disrupted the signs of any recovery that the market started showing in Q4 2019.

- Samsungled the smartphone market during the quarter capturing one-fifth of the global smartphone shipments. The OEM declined 18% YoY during the quarter and is expected to see a steeper decline in Q2 2020.

- Huawei continued its push in China and surpassed Apple again during the quarter. The OEM declined 17% YoY during the quarter. Over half of the smartphone shipments for Huawei are now in China.

- Apple remained resilient even during the COVID-19 as iPhone shipments declined only 5% YoY during the quarter. The iPhone revenues were down 7% YoY for the same period. The impact on some European and Asian countries was mild.

- Xiaomi grew 7% YoY during the quarter. The OEM continued to lead theIndiasmartphone market reaching its highest ever market share (30%) since Q1 2018.

- Compared to other major OEMs, Vivo declined less (10% YoY) during the quarter. A strong performance in the Indian Smartphone Market partially offset declines in other markets.

| Global Smartphone Shipments Market Share (%) | ||||||||

| Brands | Q2 2018 |

Q3 2018 |

Q4 2018 |

Q1 2019 |

Q2 2019 |

Q3 2019 |

Q4 2019 |

Q1 2020 |

| Samsung | 19% | 19% | 18% | 21% | 21% | 21% | 18% | 20% |

| Huawei | 15% | 14% | 15% | 17% | 16% | 18% | 14% | 17% |

| Apple | 11% | 12% | 17% | 12% | 10% | 12% | 18% | 14% |

| Xiaomi | 9% | 9% | 6% | 8% | 9% | 8% | 8% | 10% |

| OPPO | 8% | 9% | 8% | 8% | 9% | 9% | 8% | 8% |

| vivo | 7% | 8% | 7% | 7% | 8% | 8% | 8% | 7% |

| realme | 0% | 0% | 0% | 1% | 1% | 3% | 3% | 2% |

| Others | 31% | 26% | 26% | 24% | 24% | 21% | 23% | 22% |

| Global Smartphone Shipments | ||||||||

| Brands | Q2 2018 |

Q3 2018 |

Q4 2018 |

Q1 2019 |

Q2 2019 |

Q3 2019 |

Q4 2019 |

Q1 2020 |

| Samsung | 71.5 | 72.3 | 69.8 | 72.0 | 76.3 | 78.2 | 70.4 | 58.6 |

| Huawei | 54.2 | 52.0 | 59.7 | 59.1 | 56.6 | 66.8 | 56.2 | 49.0 |

| Apple | 41.3 | 46.9 | 65.9 | 42.0 | 36.5 | 44.8 | 72.3 | 40.0 |

| Xiaomi | 32.0 | 33.3 | 25.6 | 27.8 | 32.3 | 31.7 | 32.9 | 29.7 |

| OPPO | 29.6 | 33.9 | 31.3 | 25.7 | 30.6 | 32.3 | 31.4 | 22.3 |

| vivo | 26.5 | 30.5 | 26.5 | 23.9 | 27.0 | 31.3 | 31.5 | 21.6 |

| realme | – | – | – | 2.8 | 5.0 | 10.2 | 7.8 | 7.2 |

| Others | 113.3 | 110.9 | 115.8 | 87.7 | 92.8 | 84.7 | 98.6 | 66.6 |

*Ranking is according to latest quarter.

#Huawei includes HONOR.

Q4 2019 Highlights

- Global mobile phone shipmentsreached 507 million units globally in Q4 2019 with a YoY decline of -1%.

- Global smartphone shipments reached 401 million units in Q4 2019 showing a 2% YoY growth as compared to Q4 2018.

- The top three brands,Samsung, Huawei and Apple, captured more than 50% of the smartphone market, with the rest of the market left for hundreds of other brands to compete fiercely.

- Samsung remained flat during 2019 Q4 while grew 2% YoY for CY 2019.Samsung has been oneof the leading players in 5G in 2019, shipping over 6.5 Million 5G capable devices in 2019.

- Apple iPhone shipments grew 10% YoY during the Q4 2019 even without a 5G variant.The iPhone 11 seriesreceived an excellent consumer response in all regions. The dual-camera and lower pricing of iPhone 11 helped propel sales.

- 和保持th realme继续增长势头e fastest growing brand during the quarter (163% YoY) as well as the year (453% YoY). The brand entered the top five in the Indian market for the full year, which contributed to its strong growth.

Source:Market Monitor Q4 2019

Source:Market Monitor Q4 2019

| Global Smartphone Shipments Market Share (%) | ||||||

| Brands | Q3 2018 |

Q4 2018 |

Q1 2019 |

Q2 2019 |

Q3 2019 |

Q4 2019 |

| Apple | 12% | 17% | 12% | 10% | 12% | 18% |

| Samsung | 19% | 18% | 21% | 21% | 21% | 18% |

| Huawei | 14% | 15% | 17% | 16% | 18% | 14% |

| Xiaomi | 9% | 6% | 8% | 9% | 8% | 8% |

| vivo | 8% | 7% | 7% | 8% | 8% | 8% |

| OPPO | 9% | 8% | 8% | 9% | 9% | 8% |

| Lenovo | 3% | 3% | 3% | 3% | 3% | 3% |

| Others | 26% | 26% | 24% | 24% | 21% | 23% |

| Global Smartphone Shipments | ||||||

| Brands | Q3 2018 |

Q4 2018 |

Q1 2019 |

Q2 2019 |

Q3 2019 |

Q4 2019 |

| Apple | 46.9 | 65.9 | 42.0 | 36.5 | 44.8 | 72.3 |

| Samsung | 72.3 | 69.8 | 72.0 | 76.3 | 78.2 | 70.4 |

| Huawei | 52.0 | 59.7 | 59.1 | 56.6 | 66.8 | 56.2 |

| Xiaomi | 33.3 | 25.6 | 27.8 | 32.3 | 31.7 | 32.9 |

| vivo | 30.5 | 26.5 | 23.9 | 27.0 | 31.3 | 31.5 |

| Oppo | 33.9 | 31.3 | 25.7 | 30.6 | 32.3 | 31.4 |

| Lenovo | 11.0 | 10.1 | 9.5 | 9.5 | 10.0 | 11.7 |

| Others | 99.9 | 105.7 | 81.0 | 88.2 | 84.9 | 94.7 |

*Ranking is according to latest quarter.

Q3 2019 Highlights

- The top three brands, Samsung, Huawei and Apple, together cornered almost half of the smartphone market, with the rest of the market left for hundreds of other brands to compete fiercely.

- Samsungcontinued its growth at 8.4%YoY, capturing over one-fifth of the global smartphone market. This is due to strong Note 10 and Galaxy A series sales.

- Huaweigrew a very healthy 28.5% YoY globally. It captured a record 40% market share in the Chinese smartphone market.

- Apple iPhone shipments were down 4%,and as a result revenues fell 11% YoY.

- Realme remained the fastest-growing brand for the second time.

- BBK Group (OPPO, Vivo, Realme, and OnePlus) is close to becoming the largest smartphone manufacturer groupglobally, accounting for over 20% of the global smartphone market and three of its brands in the top 10.

Source:MOBILE DEVICES MONITOR – Q3 2019 (Vendor Region Countries)

[Global Smartphone Share(%)]

| Global Smartphone Shipments Market Share (%) | 2018 Q3 |

2018 Q4 |

2019 Q1 |

2019 Q2 |

2019 Q3 |

| Samsung | 19% | 18% | 21% | 21% | 21% |

| Huawei# | 14% | 15% | 17% | 16% | 18% |

| Apple | 12% | 17% | 12% | 10% | 12% |

| Oppo | 9% | 8% | 8% | 9% | 9% |

| Xiaomi | 9% | 6% | 8% | 9% | 8% |

| vivo | 8% | 7% | 7% | 8% | 8% |

| Realme | 0% | 1% | 1% | 1% | 3% |

| Others | 29% | 28% | 26% | 26% | 21% |

[Global Smartphone Shipments (Millions of Units)]

| Global Smartphone Shipments | 2018Q3 | 2018Q4 | 2019Q1 | 2019Q2 | 2019Q3 |

| Samsung | 72.3 | 69.8 | 72.0 | 76.3 | 78.2 |

| Huawei# | 52.0 | 59.7 | 59.1 | 56.6 | 66.8 |

| Apple | 46.9 | 65.9 | 42.0 | 36.5 | 44.8 |

| Oppo | 33.9 | 31.3 | 25.7 | 30.6 | 32.3 |

| Xiaomi | 33.3 | 25.6 | 27.8 | 32.3 | 31.7 |

| vivo | 30.5 | 26.5 | 23.9 | 27.0 | 31.3 |

| Realme | 1.2 | 3.3 | 2.8 | 5.0 | 10.2 |

| Others | 109.7 | 112.6 | 87.7 | 92.8 | 84.7 |

#Huawei includes HONOR.

*Ranking is according to latest quarter.

Clickhereto read the about global smartphone market in Q3 2019.

Q2 2019 Highlights

- Samsung grew 7.1% YoY, capturing over one-fifth of the global smartphone market share.

- Huawei grew 4.6% YoY, but the US trade ban will its growth momentum, especially in the overseas market.

- Apple iPhone shipments fell 11%, and iPhone revenues fell 12% year-on-year.

- Realme entered the top 10 OEMs globally for the first time. It took Realme only a year to achieve this feat.

Source:Counterpoint ResearchMarket Monitor

[Global Smartphone Share(%)]

| Global Smartphone Shipments Market Share (%) | 2018 Q2 |

2018 Q3 |

2018 Q4 |

2019 Q1 |

2019 Q2 |

| Samsung | 20% | 19% | 18% | 21% | 21% |

| Huawei# | 15% | 14% | 15% | 17% | 16% |

| Apple | 11% | 12% | 17% | 12% | 10% |

| Xiaomi | 9% | 9% | 6% | 8% | 9% |

| Oppo | 8% | 9% | 8% | 8% | 9% |

| vivo | 7% | 8% | 7% | 7% | 8% |

| Lenovo** | 2% | 3% | 3% | 3% | 3% |

| Others | 31% | 28% | 26% | 24% | 24% |

[Global Smartphone Shipments (Millions of Units)]

| Global Smartphone Shipments | 2018 Q2 |

2018 Q3 |

2018 Q4 |

2019 Q1 |

2019 Q2 |

| Samsung | 71.5 | 72.3 | 69.8 | 72.0 | 76.3 |

| Huawei# | 54.2 | 52.0 | 59.7 | 59.1 | 56.6 |

| Apple | 41.3 | 46.9 | 65.9 | 42.0 | 36.5 |

| Xiaomi | 32.0 | 33.3 | 25.6 | 27.8 | 32.3 |

| Oppo | 29.6 | 33.9 | 31.3 | 25.7 | 30.6 |

| vivo | 26.5 | 30.5 | 26.5 | 23.9 | 27.0 |

| Lenovo** | 9.0 | 11.0 | 10.1 | 9.5 | 9.5 |

| Others | 100.2 | 99.9 | 105.7 | 81.0 | 85.2 |

#Huawei includes HONOR.

**Lenovo includes Motorola.

*Ranking is according to latest quarter.

Q1 2019 Highlights

- Overall smartphone shipment declined 5% in Q1 2019, Sixth consecutive quarter of shipments falling.

- Samsungrecorded an increase in revenue asGalaxy S10 flagship smartphones did better than Galaxy S9at the time of launch.

- Apple iPhone shipments declined year-over-year for the second consecutive quarter.

- Xiaomi smartphone shipments declined annually as it faces tough competition in the China market.

Source:Counterpoint Research Market Monitor

[Global Smartphone Share(%)]

| Global Smartphone Shipments Market Share (%) | 2018 Q1 |

2018 Q2 |

2018 Q3 |

2018 Q4 |

2019 Q1 |

| Samsung | 22% | 20% | 19% | 18% | 21% |

| Huawei# | 11% | 15% | 14% | 15% | 17% |

| Apple | 14% | 11% | 12% | 17% | 12% |

| Xiaomi | 8% | 9% | 9% | 6% | 8% |

| Oppo | 7% | 8% | 9% | 8% | 8% |

| vivo | 5% | 7% | 8% | 7% | 7% |

| Motorola | 2% | 2% | 3% | 2% | 3% |

| Others | 31% | 31% | 28% | 27% | 24% |

[Global Smartphone Shipments (Millions of Units)]

| Global Smartphone Shipments | 2018 Q1 |

2018 Q2 |

2018 Q3 |

2018 Q4 |

2019 Q1 |

| Samsung | 78.2 | 71.5 | 72.3 | 69.8 | 72.0 |

| Huawei# | 39.3 | 54.2 | 52.0 | 59.7 | 59.1 |

| Apple | 52.2 | 41.3 | 46.9 | 65.9 | 42.0 |

| Xiaomi | 28.1 | 32.0 | 33.3 | 25.6 | 27.8 |

| Oppo | 24.2 | 29.6 | 33.9 | 31.3 | 25.7 |

| vivo | 18.9 | 26.5 | 30.5 | 26.5 | 23.9 |

| Motorola | 7.6 | 8.3 | 10.6 | 9.5 | 8.9 |

| Others | 113.1 | 100.9 | 100.4 | 106.4 | 81.6 |

#Huawei includes HONOR.

*Ranking is according to latest quarter.

Q4 2018 Highlights

- Q4 2018 smartphone shipments declines 7%; Fifth consecutive quarter of smartphone decline

- For Q4 2018,Huawei, OPPO and vivocontinue to dominate with strong performances in China, India, Asia and parts of Europe. The trio have multiple regions to enter and grow moving forward into 2019.

- SamsungandApplesaw a tough quarter and tough 2018 as demand for their flagship phones have waned due to competition from affordable premium and more cutting-edge phones from Chinese brands such as Huawei and OnePlus.

- Xiaomireached a record fourth position for the full year after two years of setbacks thanks to immense growth in India. It has surpassed OPPO globally to take back the fourth position.

Source:Counterpoint Research Market Monitor

Source:Counterpoint Research Market Monitor

[Global Smartphone Share(%)]

| Global Smartphone Shipments Market Share (%) | 2017 Q4 |

2018 Q1 |

2018 Q2 |

2018 Q3 |

2018 Q4 |

| Samsung | 18% | 22% | 20% | 19% | 18% |

| Apple | 18% | 14% | 11% | 12% | 17% |

| Huawei | 10% | 11% | 15% | 14% | 15% |

| Oppo | 7% | 7% | 8% | 9% | 8% |

| vivo | 6% | 5% | 7% | 8% | 7% |

| Xiaomi | 7% | 8% | 9% | 9% | 6% |

| Motorola | 3% | 2% | 2% | 3% | 2% |

| Others | 31% | 31% | 28% | 26% | 27% |

[Global Smartphone Shipments (Millions of Units)]

| Global Smartphone Shipments | 2017 Q4 |

2018 Q1 |

2018 Q2 |

2018 Q3 |

2018 Q4 |

| Samsung | 74.4 | 78.2 | 71.5 | 72.3 | 69.8 |

| Apple | 77.3 | 52.2 | 41.3 | 46.9 | 65.9 |

| Huawei | 41.0 | 39.3 | 54.2 | 52.0 | 59.7 |

| Oppo | 30.7 | 24.2 | 29.6 | 33.9 | 31.3 |

| vivo | 24.0 | 18.9 | 26.5 | 30.5 | 26.5 |

| Xiaomi | 31.0 | 28.1 | 32.0 | 33.3 | 25.6 |

| Motorola | 10.9 | 7.6 | 8.3 | 10.6 | 9.5 |

| Others | 134.8 | 113.1 | 100.9 | 100.4 | 106.4 |

*Ranking is according to latest quarter.

Q3 2018 Highlights

- The top 10 players now capture 79% of the market leaving 600+ brands to compete for the remaining 21% of the market.

- iPhone helped Apple to record 3rdquarter revenue even as shipments remain flat YoY.

- Samsung continued to lead the smartphone market with 19% market share in the quarter.

Source:Counterpoint Research Market Monitor

[Global Smartphone Share(%)]

| Global Smartphone Shipments Market Share (%) | 2017 Q3 |

2017 Q4 |

2018 Q1 |

2018 Q2 |

2018 Q3 |

| Samsung | 21% | 18% | 22% | 20% | 19% |

| Huawei | 10% | 10% | 11% | 15% | 14% |

| Apple | 12% | 18% | 14% | 11% | 12% |

| Oppo | 8% | 7% | 7% | 8% | 9% |

| Xiaomi | 7% | 7% | 8% | 9% | 9% |

| vivo | 7% | 6% | 5% | 7% | 8% |

| Motorola | 3% | 3% | 2% | 2% | 3% |

| Others | 32% | 31% | 31% | 28% | 26% |

[Global Smartphone Shipments (Millions of Units)]

| Global Smartphone Shipments | 2017 Q3 |

2017 Q4 |

2018 Q1 |

2018 Q2 |

2018 Q3 |

| Samsung | 83.3 | 74.4 | 78.2 | 71.5 | 72.3 |

| Huawei | 39.1 | 41.0 | 39.3 | 54.2 | 52.0 |

| Apple | 46.7 | 77.3 | 52.2 | 41.3 | 46.9 |

| Oppo | 32.5 | 30.7 | 24.2 | 29.6 | 33.9 |

| Xiaomi | 28.5 | 31.0 | 28.1 | 32.0 | 33.3 |

| vivo | 28.6 | 24.0 | 18.9 | 26.5 | 30.5 |

| Motorola | 12.5 | 10.9 | 7.6 | 8.3 | 10.6 |

| Others | 127.6 | 134.8 | 113.1 | 101.0 | 100.4 |

*Ranking is according to latest quarter.

Q2 2018 Highlights

- Smartphone shipments declined 2% annually to 360 million units in Q2 2018.

- The top 10 brands accounted for 79% of the smartphone volumes in Q2 2018.

- Samsung led the smartphone market by volume with a market share of 20% in Q2 2018 even though it registered an annual decline of 11% due to weak sales of its flagship Galaxy S9 series smartphones.

- Huawei shipments grew 41% annually in Q2 2018. The company managed to be the fastest growing (21%) smartphone brand amid a declining China smartphone market and grew fully 71% overseas.

- Apple shipped 41.3 million iPhones during Q2 2018, up 1% compared to the same quarter last year. iPhone X remains the top seller for Apple during the quarter.

Source:Counterpoint Research Market Monitor

Source:Counterpoint Research Market Monitor

[Global Smartphone Share(%)]

| Global Smartphone Shipments Market Share (%) | 2017 Q2 |

2017 Q3 |

2017 Q4 |

2018 Q1 |

2018 Q2 |

| Samsung | 22% | 21% | 18% | 22% | 20% |

| Huawei | 11% | 10% | 10% | 11% | 15% |

| Apple | 11% | 12% | 18% | 14% | 11% |

| Xiaomi | 6% | 7% | 7% | 8% | 9% |

| Oppo | 8% | 8% | 7% | 7% | 8% |

| vivo | 7% | 7% | 6% | 5% | 7% |

| LG | 4% | 3% | 3% | 3% | 3% |

| Others | 31% | 32% | 31% | 30% | 27% |

[Global Smartphone Shipments (Millions of Units)]

| Global Smartphone Shipments | 2017 Q2 |

2017 Q3 |

2017 Q4 |

2018 Q1 |

2018 Q2 |

| Samsung | 80.4 | 83.3 | 74.4 | 78.2 | 71.5 |

| Huawei | 38.5 | 39.1 | 41.0 | 39.3 | 54.2 |

| Apple | 41.0 | 46.7 | 77.3 | 52.2 | 41.3 |

| Xiaomi | 23.1 | 28.5 | 31.0 | 28.1 | 32.0 |

| Oppo | 30.5 | 32.5 | 30.7 | 24.2 | 29.6 |

| vivo | 24.8 | 28.6 | 24.0 | 18.9 | 26.5 |

| LG | 13.3 | 13.9 | 13.9 | 11.4 | 9.8 |

| Others | 113.9 | 126.3 | 131.8 | 109.3 | 99.5 |

*Ranking is according to latest quarter.

Q1 2018 Highlights

- Smartphone shipments declined 3% annually reaching 360 million units in Q1 2018.

- 2018年一季度中国市场下降,影响了overall growth of some of the key Chinese brands including OPPO and vivo. Both saw a decline in the quarter as a result of the China market slowdown.

- Smartphone penetration fell to 76% of all the mobile phones shipped in the quarter. This was partly due to an increase in feature phone shipments by some key brands such as Nokia HMD and Reliance Jio who both saw YoY growth.

- Top 10 brands accounted for 76% of the smartphone volumes in Q1 2018.

Source:Counterpoint Research Market Monitor

Source:Counterpoint Research Market Monitor

[Global Smartphone Share(%)]

| Global Smartphone Shipments Market Share (%) | 2017 Q1 |

2017 Q2 |

2017 Q3 |

2017 Q4 |

2018 Q1 |

| Samsung | 22% | 22% | 21% | 18% | 22% |

| Apple | 14% | 11% | 12% | 18% | 14% |

| Huawei | 9% | 11% | 10% | 10% | 11% |

| Xiaomi | 4% | 6% | 7% | 7% | 8% |

| Oppo | 7% | 8% | 8% | 7% | 7% |

| vivo | 6% | 7% | 7% | 6% | 5% |

| LG | 4% | 4% | 3% | 3% | 3% |

| ZTE | 4% | 3% | 2% | 2% | 2% |

| Others | 30% | 28% | 30% | 29% | 28% |

[Global Smartphone Shipments (Millions of Units)]

| Global Smartphone Shipments | 2017 Q1 |

2017 Q2 |

2017 Q3 |

2017 Q4 |

2018 Q1 |

| Samsung | 80.0 | 80.4 | 83.3 | 74.4 | 78.2 |

| Apple | 50.8 | 41.0 | 46.7 | 77.3 | 52.2 |

| Huawei | 34.6 | 38.5 | 39.1 | 41.0 | 39.3 |

| Xiaomi | 13.4 | 23.1 | 28.5 | 31.0 | 28.1 |

| Oppo | 26.1 | 30.5 | 32.5 | 30.7 | 24.2 |

| vivo | 22.8 | 24.8 | 28.6 | 24.0 | 18.9 |

| LG | 14.8 | 13.3 | 13.9 | 13.9 | 11.4 |

| ZTE | 13.3 | 12.2 | 9.8 | 9.4 | 7.1 |

| Others | 115.4 | 101.8 | 116.5 | 122.5 | 102.2 |