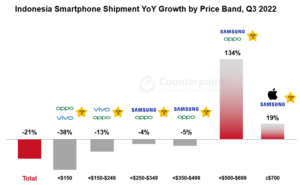

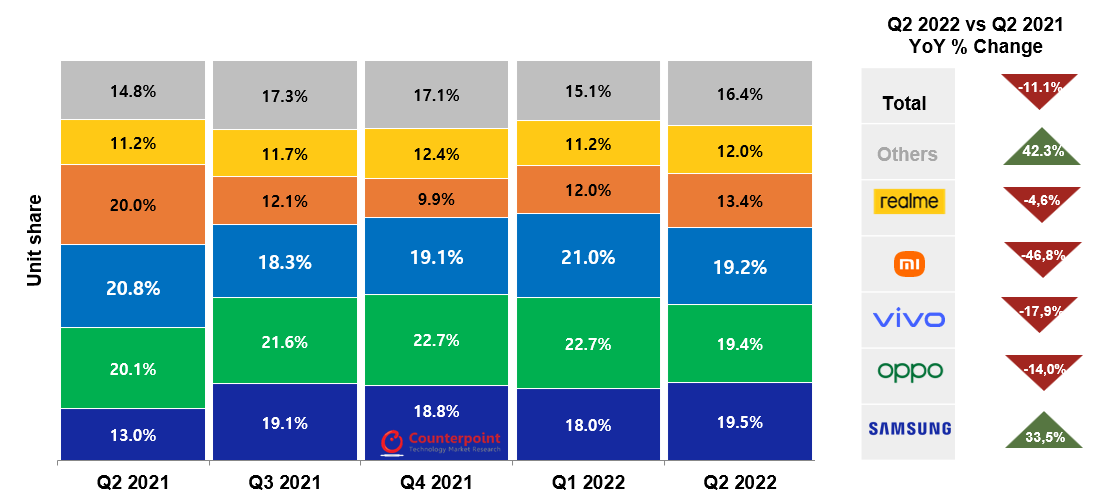

- Samsung led the market followed by OPPO and Xiaomi.

- Apple shipments surged 139% YoY.

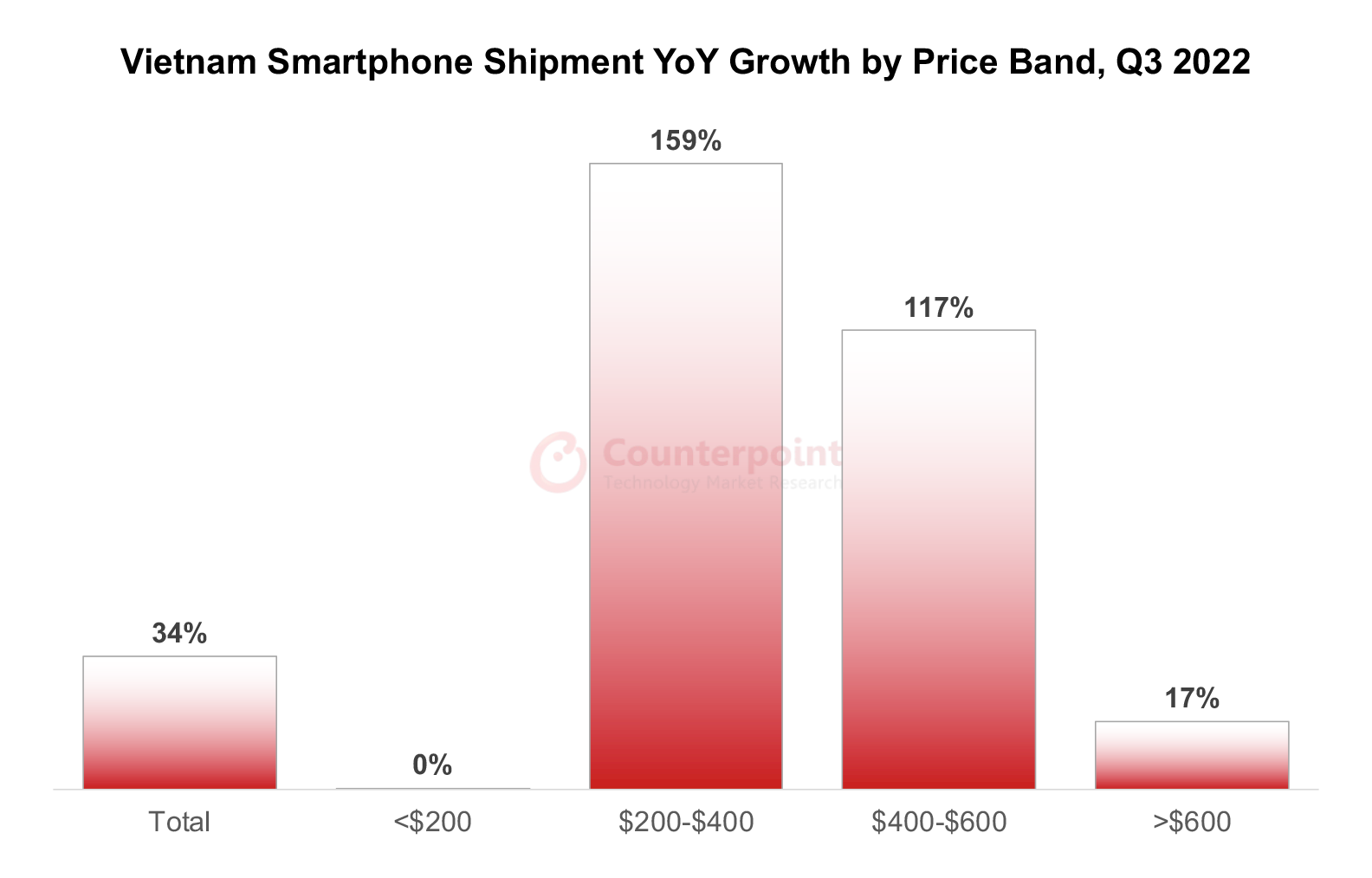

- $200-$400 price band shipments grew 159% YoY.

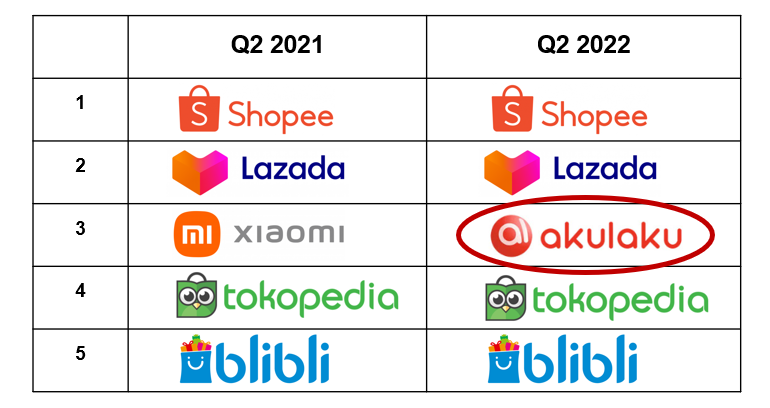

- Online channel shipments increased 67% YoY.

New Delhi, Jakarta, London, Boston, Toronto, Beijing, Taipei, Seoul – December 1, 2022

Vietnam’s smartphone shipments increased 34% YoY in Q3 2022, according to Counterpoint’s latestMonthly Vietnam Smartphone Channel Share Tracker. The results highlight the strong economic growth in the country during the quarter, driven by the increasing manufacturing activity and improving consumer sentiment, despite moderate inflationary pressures. The launch of new smartphone models along with increasing demand for budget and high-end models were also among the key factors responsible for the quarterly growth.

Apple’s shipments surged 139% YoY in Q3 2022 as more consumers in Vietnam bought premium smartphones. The iPhone 11, iPhone 13 and iPhone 13 Pro Max were among the most preferred models during the quarter. Apple distributors are opening more official stores in Vietnam, which is helping the brand reach more customers.

Shipments of majorChineseplayers likeXiaomi,realmeandOPPOalso grew during the quarter. Xiaomi was boosted by the POCO C40 series as Vietnam was the first country where the model was released. realme was driven by its C-series smartphones, while OPPO was helped by the A57 and the newly launched Reno8 series.

Source: Counterpoint Monthly Vietnam Channel Share Tracker, Q3 2022

Q3 2022 shipments in the <$200 retail price band remained flat YoY due to weaker shipments from Samsung. The segment was mostly driven by Xiaomi and realme. The $200-$400 band saw the biggest growth during the quarter as demand for mid-budget smartphones increased in the country. Brands have been launching most of their newer models in this range. In Q3, some of the popular models in the price segment were OPPO’s Reno8 4G and A96, Redmi’s Note 11 and vivo’s Y22s. Meanwhile, the strong growth in the $400-$600 price band was driven by Apple. Vietnam is one of the fastest growing markets for iPhones.

Commenting on the price range,Research Analyst Akash Jatwala说,“出货量在> 600美元同比增长了17%in Q3 2022 driven by Apple and Samsung. Vietnam has increasingly started to prefer premium smartphones and among them the iPhone 13 series and the Samsung Galaxy S22 are the most popular.”

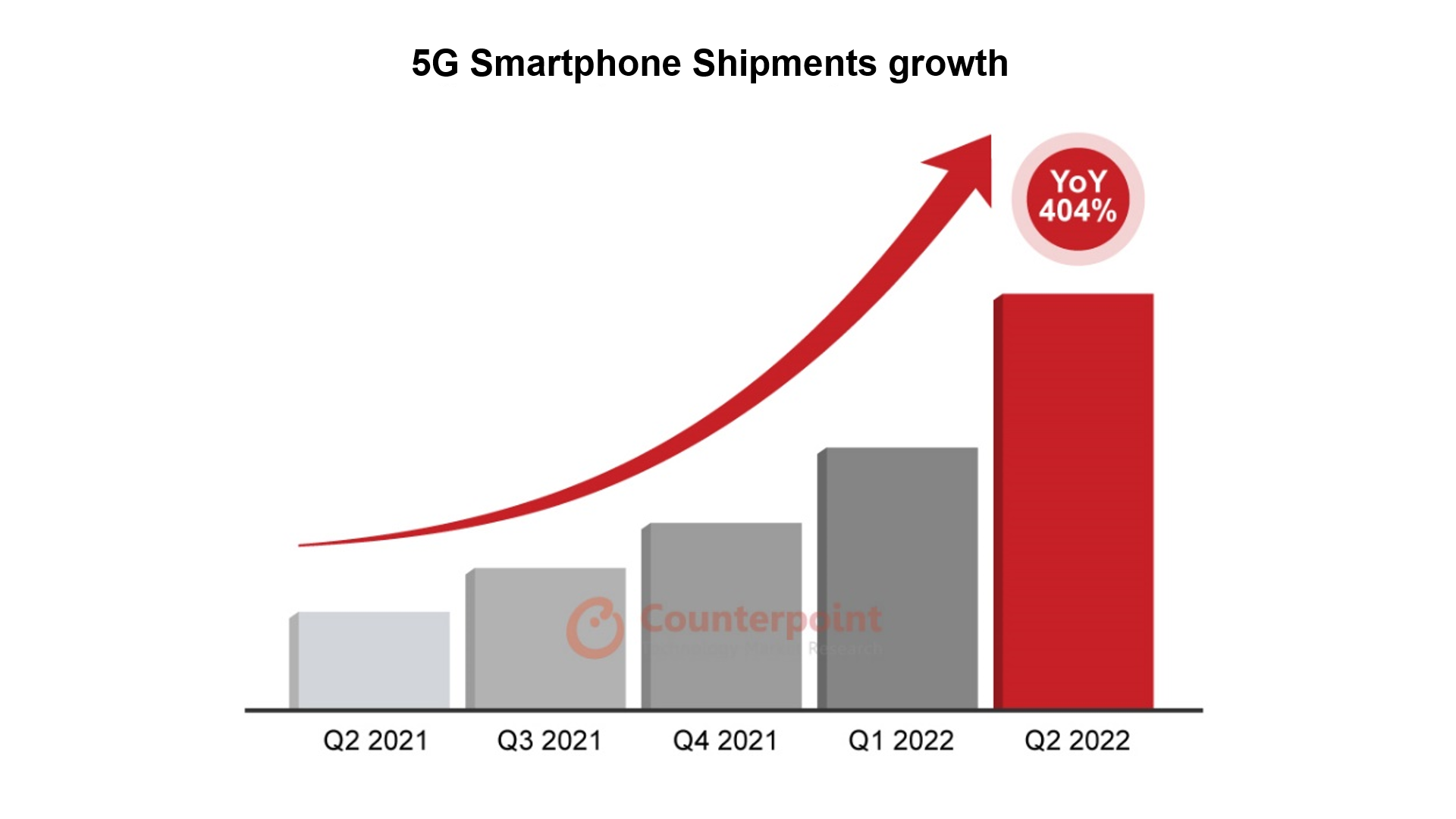

5G smartphoneshipments jumped 129% YoY in Q3 2022 and accounted for 34% of the overall shipments during the quarter as brands launched more of such models. 5G is not present in Vietnam yet but the technology might be commercially launched here in 2023, which could further boost economic activity in the country. However, there is no news regarding a spectrum auction and telcos are only just conducting trials with vendors in major provinces.

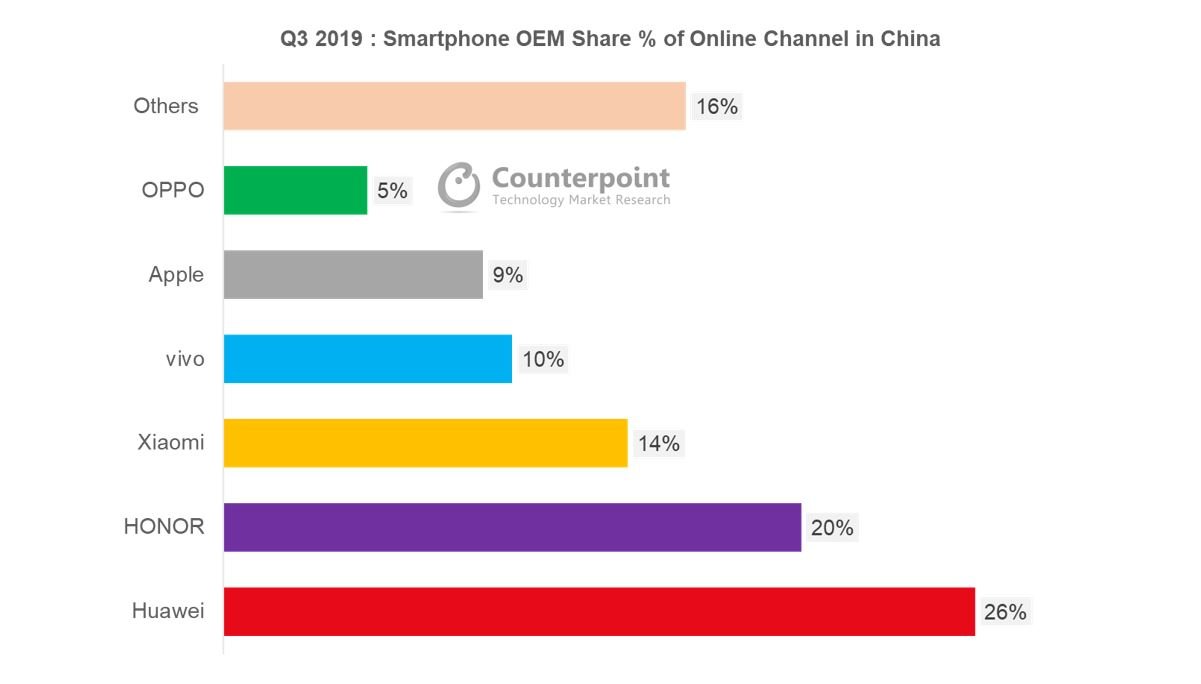

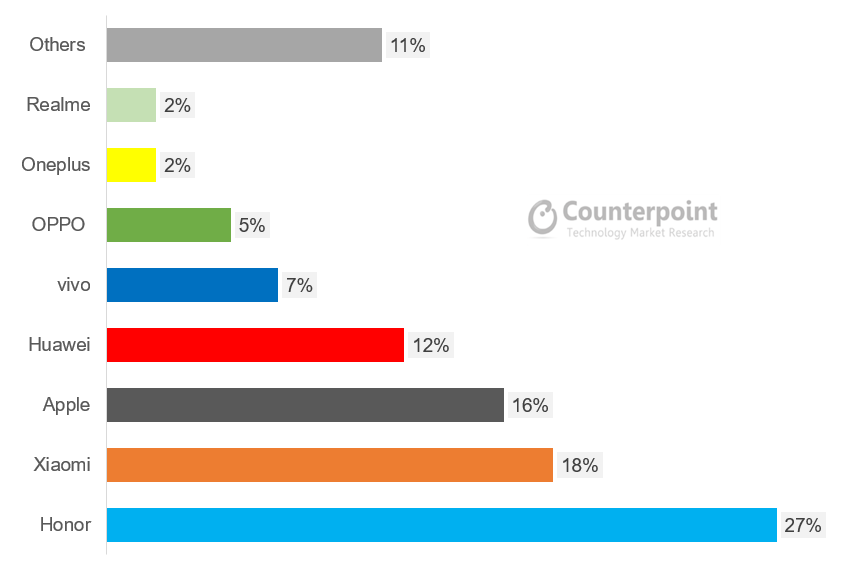

Online channels grew 67% YoY in Q3 2022 and contributed to 18% of Vietnam’s total shipments as customers were attracted by discounts, cashbacks and easier financing. Pre-orders along with replacement options and bundling of devices with TWS at a discounted price were some of the other appealing promotions from online channels.

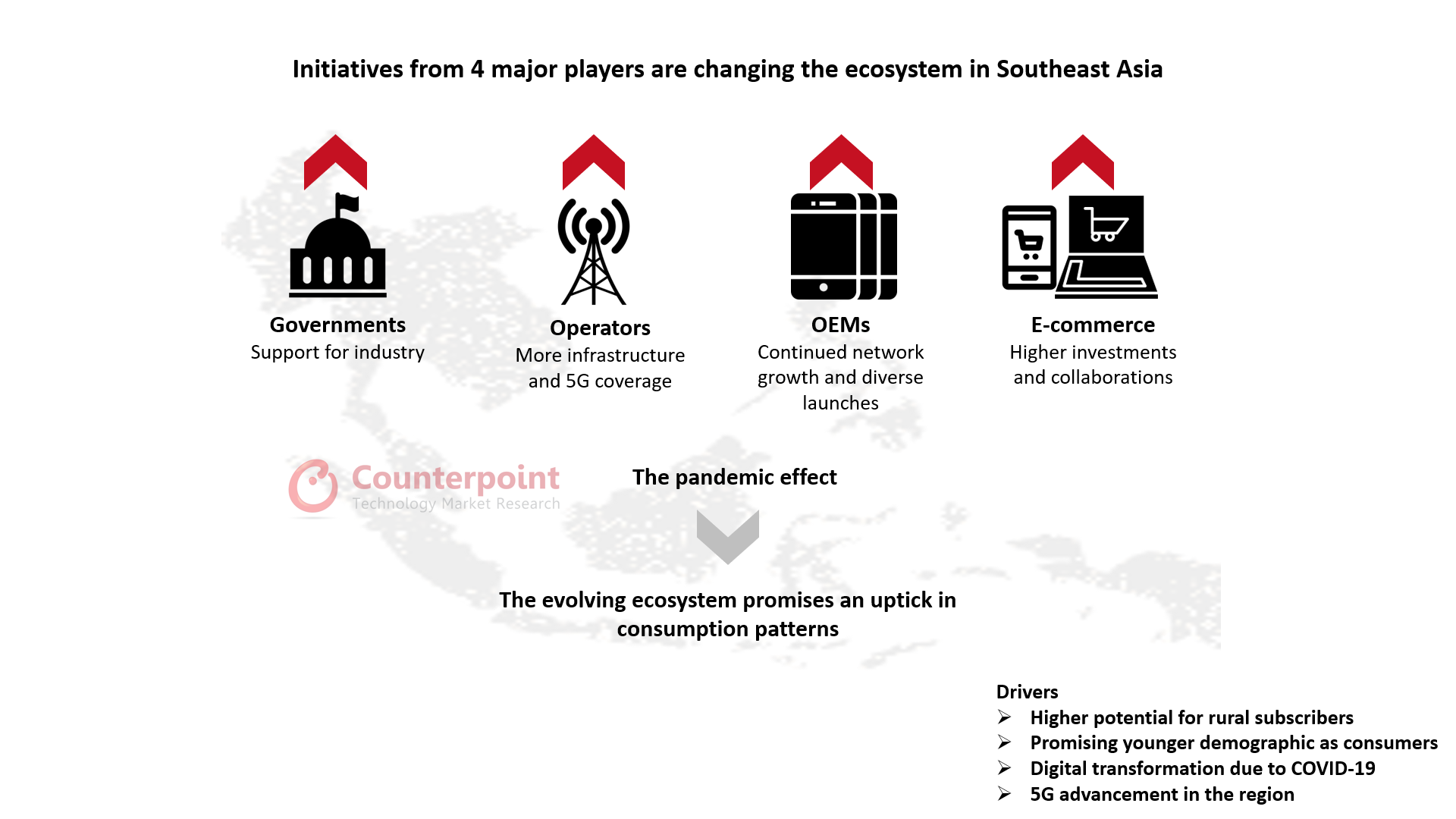

On the issue of smartphone manufacturing, OEMs are increasing investments in the country and looking into newer areas to diversify. Apple is set to start manufacturing iPads, Apple Watches and MacBooks in Vietnam, and Google is also planning the same for its Pixel smartphones. Manufacturing activities have helped Vietnam in creating jobs and increasing economic growth, which in turn has increased consumers’ buying power. As OEMs are increasingly preferring Vietnam as a manufacturing hub, more companies are likely to expand their presence in the country, which in turn will foster economic growth.

Outlook

For Q4 2022, we are optimistic about the Vietnamese smartphone market. We expect shipments to grow in the final quarter. This is based on Vietnam’s reported growth in GDP during Q3 2022, an increase in manufacturing activity and a moderate rise in inflation.

In Q4 2022, smartphone shipments in Vietnam are likely to receive a boost from the iPhone 14 series and new model launches from various brands across different price ranges. Increasing consumer spending in the lead up to the Lunar New Year will also help in driving shipments.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Akash Jatwala

Follow Counterpoint Research

press@www.arena-ruc.com

Source: Counterpoint Monthly Indonesia Channel Share Tracker, Q2 2022.

Source: Counterpoint Monthly Indonesia Channel Share Tracker, Q2 2022.

Research Analyst Tanvi Sharmasaid, “Businesses tried to increase the pace of their digital efforts to keep up with the continued expansion of cashless payments and e-commerce. Smartphone brands offered heavy discounts and exclusive schemes in the 9.9 Super Brand Day Sale. Besides, consumers were seen rapidly moving towards 5G-enabled smartphones.”

Research Analyst Tanvi Sharmasaid, “Businesses tried to increase the pace of their digital efforts to keep up with the continued expansion of cashless payments and e-commerce. Smartphone brands offered heavy discounts and exclusive schemes in the 9.9 Super Brand Day Sale. Besides, consumers were seen rapidly moving towards 5G-enabled smartphones.”