- Europe’s in-car navigation sales saw a modest growth of 5% YoY in 2022.

- HERE continued to lead the European built-in car navigation market in 2022.

- Google’s automotive foray challenges the position of players like HERE and TomTom.

- New players like Mapbox and What3word are bringing unique aspects to in-vehicle navigation.

Beijing, New Delhi,London,San Diego, Buenos Aires, Hong Kong, Seoul – September 1, 2023

European in-car navigation sales saw a modest growth of 5% YoY in 2022, according to the latest research from Counterpoint’sGlobal Embedded Navigation Sales Tracker.越来越多的采用电动汽车(EVs) and advanced driver assistance (ADAS) features is driving the growth of built-in navigation systems in cars. Navigation helps EV drivers plan the optimal route by considering battery range and charging station locations. Besides, navigation helps ensure safety by giving drivers information about the weather, speed limits and traffic conditions.

In terms of sales volume, Germany, the UK and France are the leading countries in built-in car navigation. But in terms of the share of such cars in total car sales, Norway leads, followed by the Netherlands and Germany. Volkswagen Group, Stellantis and Renault-Nissan are the top three automotive groups in terms of built-in car navigation sales. EV players like Tesla, NIO and Xpeng offer navigation on all models.

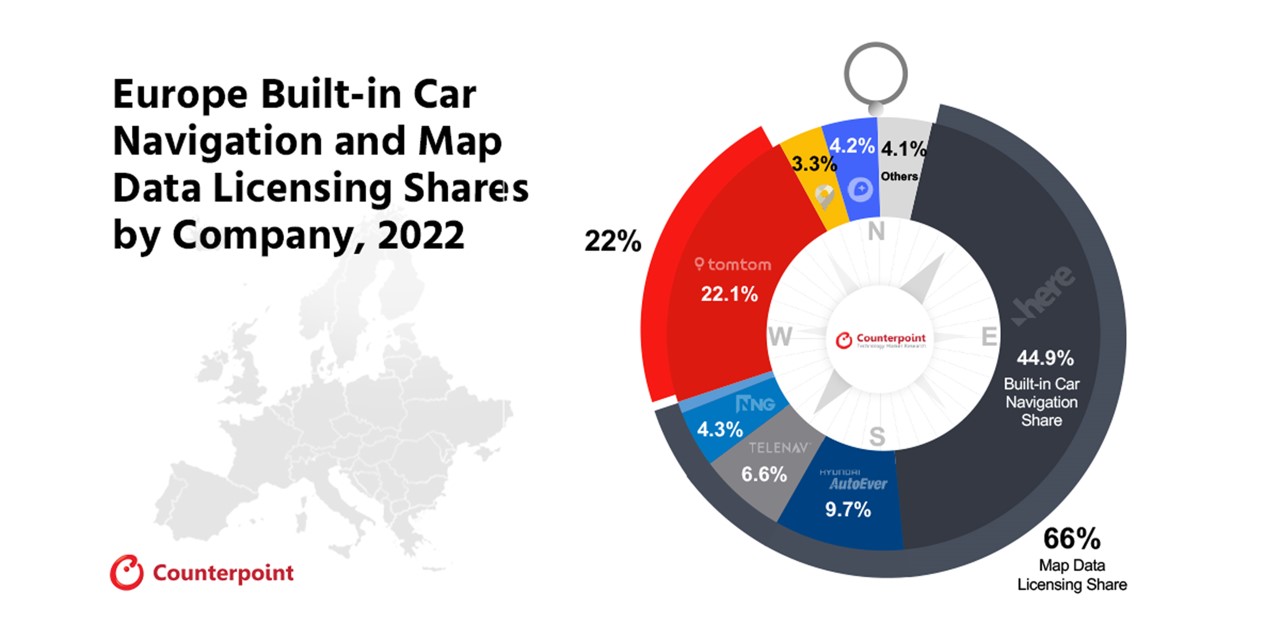

Commenting on market dynamics,Research Analyst Mohit Sharmasaid, “Almost 50% of cars sold in 2022 had built-in navigation. HERE is leading the European market in terms of both licensing its map data and offering navigation services.”

HERE, with a strong presence in the automotive industry, has a 44.9% share in Europe’s built-in car navigation market. The company licenses its map data to other companies to build applications and services. When taking this into account, HERE’s market share in Europe rises to almost two-thirds.

HERE offers its navigation services to OEMs like BMW and Mercedes. Chinese brands such as FAW Hongqi and SAIC, which are expanding their sales into Europe, have partnered with HERE for navigation data.

Commenting on HERE’s performance,Vice PresidentPeter Richardsonsaid, “HERE is well-positioned within the automotive sector by working in partnership with automakers to address their technological challenges, like those related to EVs and adoption of autonomous driving. HERE is one of the enablers for automakers in launching new technologies like Level 3 autonomous driving.”

TomTomis in the second position in the European market with a 22.1% share. Last year marked the company’s second pivotal year after 2009, when it decided to sell its navigation services to automakers directly after the decline of its GPS standalone device business. In 2022, the company announced a new map platform besides rebranding itself.

TomTom has long-standing partnerships with Stellantis, Renault and other car manufacturers. The company has also signed a fresh deal with Hyundai Motor Group for licensing its map data and traffic services to all brands of the group, including Genesis for the European market. Another notable win for TomTom is a partnership with the Foxconn-led MIH Consortium to increase its presence in next-generation smart mobility vehicles.

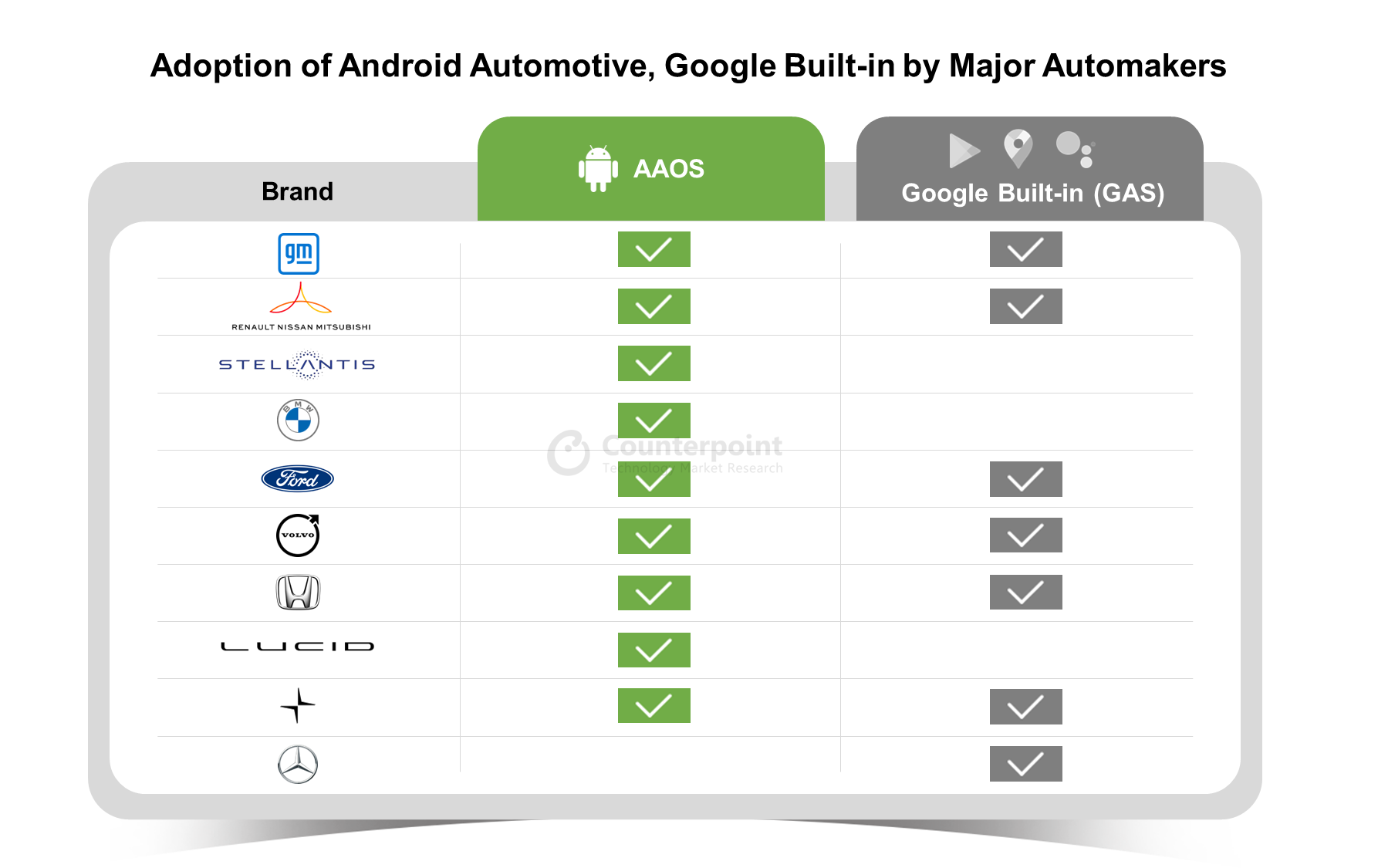

Google’sshare has increased to 3.3% two years after entering the in-car navigation market. However, its market share is 7.1% when including its map data licensing for navigation services. Sharma added, “Google’s entry into in-vehicle navigation services has enlivened the competition in the European market. For years, the market has seen the duopoly of legacy players HERE and TomTom. Google is trying to catch up with traditional navigation providers as it continues to expand its automotive offerings like EV routing and HD maps.”

Further, new players likeMapboxandWhat3wordare bringing unique aspects to in-vehicle navigation.

Source: Global In-Car Navigation Tracker, Q1 2021- Q4 2022

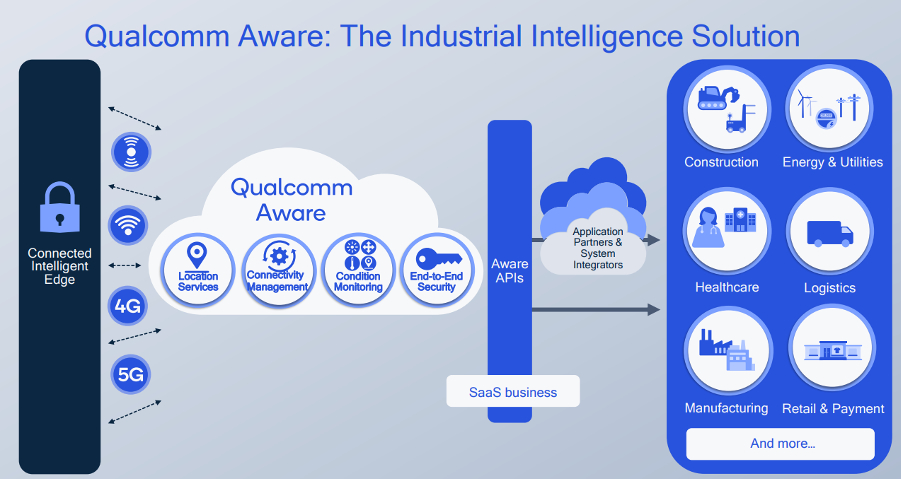

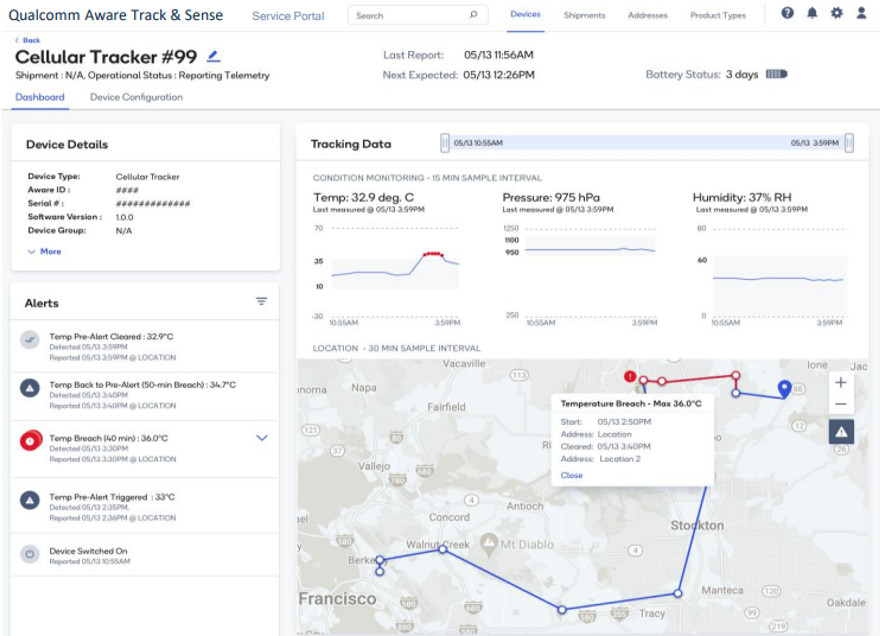

Commenting on the market forecast,Vice President Neil Shahsaid, “The in-car navigation market is expected to see a growth of 10%-15% in 2023 as most automakers will look to comply with new ISA regulation while moving towards electrification and more intelligent driving.” He further added, “Maps will play a crucial role in achieving highly automated driving (Level 4-Level 5) and we will see new collaborations flourishing not only between OEMs and map players but also between self-driving chip manufacturers like Qualcomm and map players.”

The comprehensive and in-depth ‘全球车载导航跟踪,Q1 2021 - 2022年第四季度’is now available for purchase atreport.www.arena-ruc.com.

Feel free to reach us at press(at)www.arena-ruc.com for questions regarding our latest research and insights.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Contact:

Counterpoint Research

Related Posts

- US EV Sales Up 79% YoY in Q1 2023 Helped by Tax Credit Subsidy

- Global EV Sales Up 32% YoY in Q1 2023 Driven by Price War

- Global Passenger Electric Vehicle Market Share, Q2 2021 – Q1 2023

- Google Puts Auto Expansion in Top Gear

- Connected Car Sales Grew 12% YoY in 2022 With Volkswagen Group in Lead

- Price Cuts Boost Tesla Revenue in Q1, Profit Slumps Compared to 2022

- Global Electric Vehicle Sales Crossed 10 Million in 2022; Q4 Sales up 53% YoY

- Berlin Factory Takes Tesla to Top Spot in Europe EV Sales as Chinese Brands Gain Ground

- EV Sales in US up 54.5% YoY in 2022; Tesla Market Share at 50.5%

- AI Voice Assistants to Push Success of Autonomous Driving, Software-defined Vehicle

- Tesla Leads US EV Market, Eclipsing Next 15 Brands Combined

- Thailand Leads Southeast Asia EV Market With 60% Share

- Mercedes Fends off VW in Europe EV Market

- BYD Widens Gap with Tesla in Q3 2022, Leads Global EV Market

- A Promising Yet Challenging Market for Self-driving SoCs

- China EV Charging Points Soar 56% YoY in 2021, 42% CAGR Seen for 2022-2026