- After declining in Q1 2022, the global cellular IoT module market recovered in Q2 2022 despite macroeconomic headwinds and lockdowns in China, the largest IoT market.

- The quarter also saw a series of consolidations in the highly competitive IoT module space.

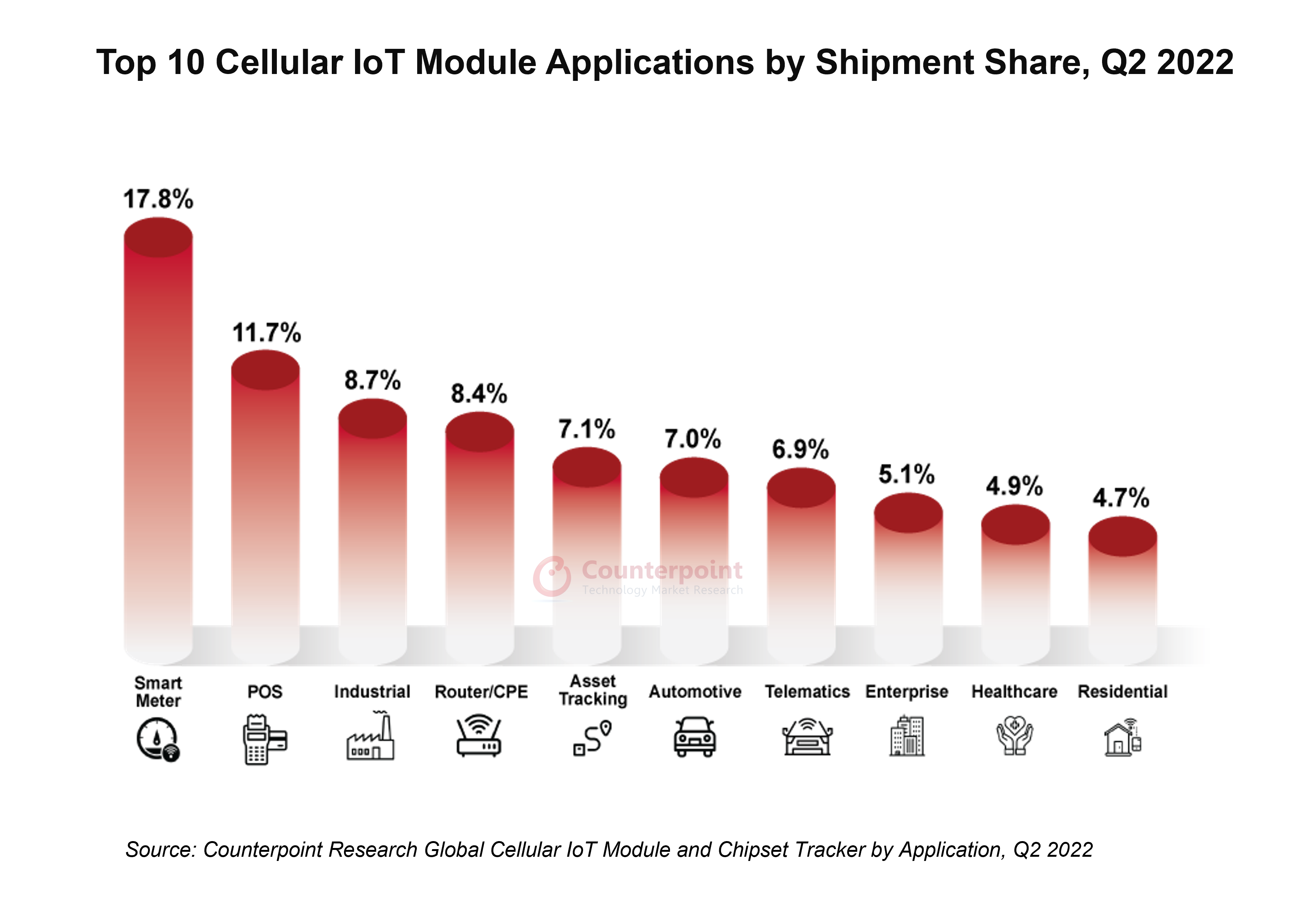

- Asset-tracking reached the highest share ever at 7% to break into the top five applications.

- Smart meter, POS and industrial were the top three applications in this quarter.

- NB-IoT and 4G Cat 1 were the most preferred technologies for cellular IoT applications.

S迭戈,布宜诺斯艾利斯,伦敦, New Delhi, Hong Kong, Beijing, Seoul – September 20, 2022

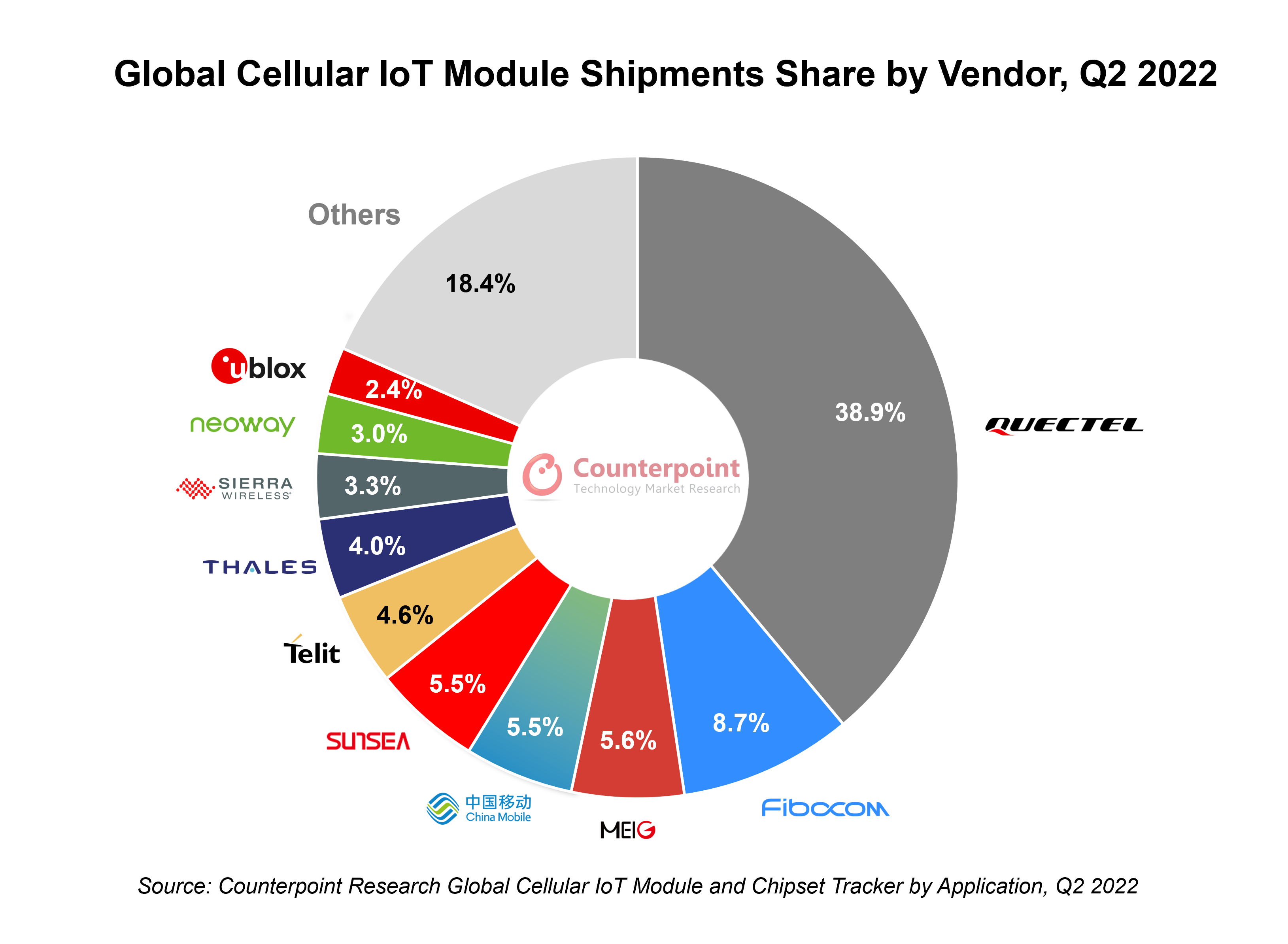

Global cellular IoT module shipments grew 20% YoY in Q2 2022, according to the latest research from Counterpoint’sGlobal Cellular IoT Module and Chipset Tracker by Application. The global cellular IoT module market continued to recover despite a tighter supply chain, COVID-19 lockdowns in China and macroeconomic headwinds. The growth was driven by the ongoing digital transformation involvingpotential applicationsaround critical infrastructure and logistics catered by some key fast-growing low-tier cellular technologies such as Cat-1 and NB-IoT. Further, module players modified their product offerings, striking partnerships across the value chain, from newer connectivity solution providers to acquiring some key competitors, as the IoT industry enters a very exciting growth phase.

China保留它的位置,成为世界上最大的物联网arket, contributing to more than half of the demand despite the lockdowns. The country’s cellular IoT module market recovered slightly from previous months this year, driven by lockdown-triggered applications like smart locks, surveillance systems and routers. The North American and western European markets grew steadily and held their second and third positions respectively in the global cellular IoT module market. Again,Indiawas the fastest growing IoT module market (+264% YoY), albeit growing on a lower base, driven by smart meter, telematics, POS and automotive applications.

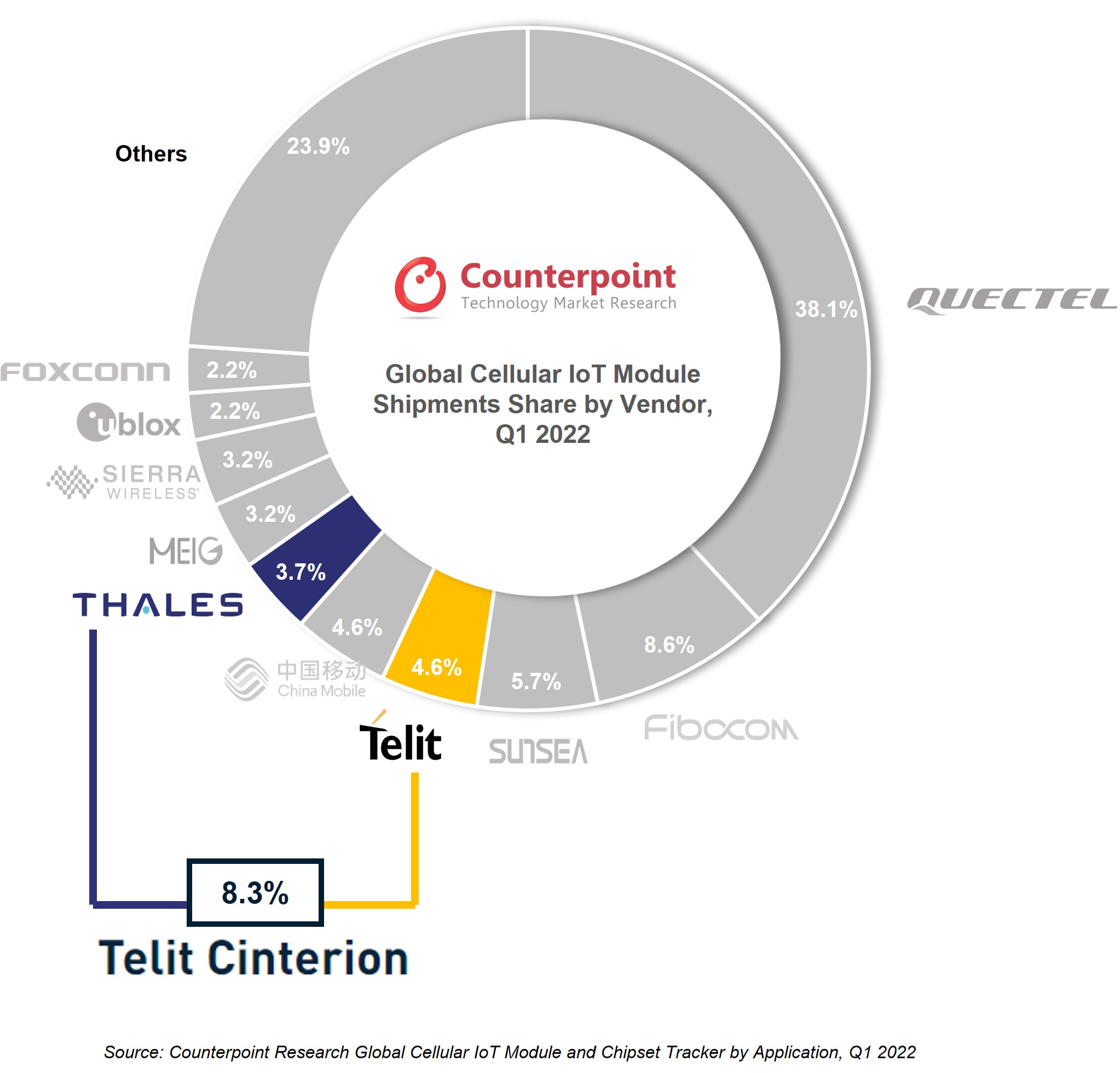

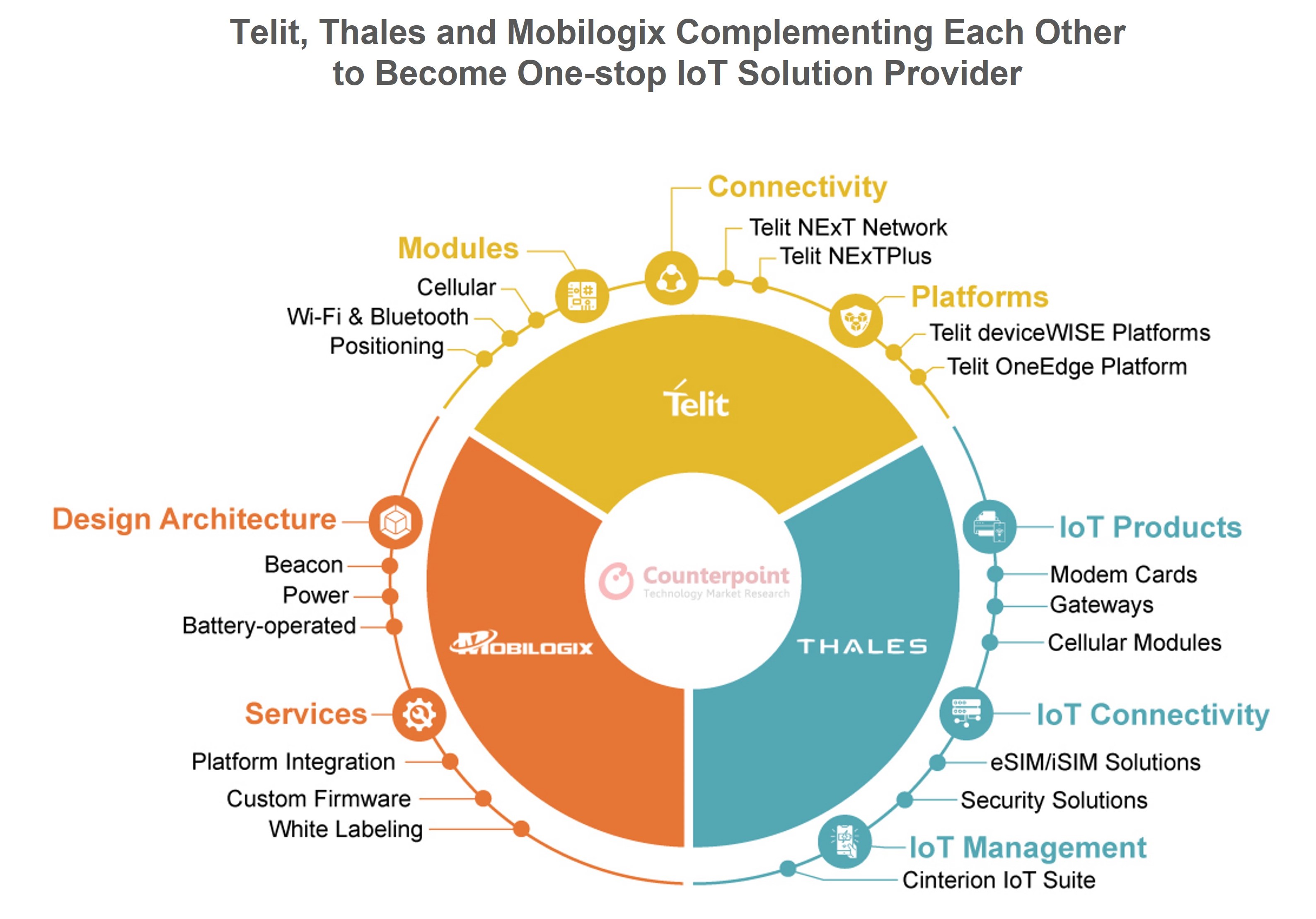

Commenting on the market dynamics,SeniorResearch AnalystSoumen Mandalsaid, “The IoT module market is going through a critical phase where the Chinese brands have become bigger, making it very difficult for international brands to grow in silos. As a result, we have seen the first wave of market consolidation withTelitacquiring Thales’ cellular IoT module business as well as acquiring IoT solutions design house Mobilogix. Also, during the quarter,Semtech, one of the big component vendors and the key chipset provider for the proprietary LoRa-based IoT network, acquired leading cellular IoT and router vendor Sierra Wireless to build an end-to-end wireless IoT portfolio. This kickstarts an exciting phase where the Western vendors are trying to become more ‘integrated’ to capture more value across the value chain, even though the IoT market is a blue-ocean opportunity.”

Mandal added, “With six out of the top 10 IoT module vendors being fromChina和with the rising geopolitical competition and data privacy concerns, international players see an opportunity to consolidate and carve out a dichotomy in this segment. Further, having a robust portfolio and post-sales support is the key. Telit, Thales, u-blox and Sierra Wireless improving their offerings over the last 12 months has been a step in the right direction. With consolidation, these vendors can garnerscale和some competitive edge to at least compete well on pricing and value against the competition”

Note: Figures may not add up to 100% due to rounding

Market summary

The top three players accounted for more than half of the market. Interestingly,Quectel’s shipment share was equal to that of the remaining players in the top 10 list.

- Quectel:Quectel’s module shipments increased 47% YoY, further increasing its gap with the remaining players. During the quarter, Quectel launched 4G Cat 4smart modulesSC200E and SG150H, based on Qualcomm and UNISOC chipsets respectively. Furthermore, Quectel unveilediSIM-supported LPWA module BG773A-GL with the help of Kigen, through which it will be able to target M2M applications such as POS, smart metering, asset tracking and wearable devices.

- Fibocom: The second largest module vendor, Fibocom, saw 12% YoY growth in its module shipments. Nearly 60% of its module shipments came from the China market. Fibocom has already entered partnerships with Qualcomm, MediaTek, UNISOC, Sequans and Autotalks to increase its share in international markets. This can help Fibocom bridge some of its wide gap with Quectel in the international IoT module market.

- MeiG:After a slow Q1 2022 due to China lockdowns, MeiG registered growth which helped it to enter the top three IoT module ranks globally. While focusing onhigher-end IoTmodule applications, MeiG is expanding into the fast-growing 4G Cat 1 bis market, targeting applications such as POS, industrial, asset tracking, smart meter and enterprise. MeiG is also diversifying its supplier portfolio. It has partnered with fast-growing 4G chipset vendor ASR for the 4G Cat 4 module market, especially for the highly competitive China market and other low-cost international markets.

- China Mobile:China Mobile maintained its fourth position in the global cellular IoT module market by catering to its huge existing and prospective customer base and extensive cellular network. The operator partnered with Xinyi Semiconductor for focusing on lower-end applications. This has helped both to target 2G-to-4G transitioning IoT applications. China Mobile’s growing 5G footprint and partnerships across the value chain will help the world’s largest operator to rapidly scale its end-to-end 5G IoT solutions in the coming quarters.

- Sunsea:Sunsea (SIMCom + Longsung) has been consistently improving its performance over the last 10 quarters. Sunsea is following a strategy similar to that of other Chinese players to offerQualcomm-based solutions for the international market and MediaTek/UNISOC/ASR/Xinyi-based solutions for the homegrown China market. Sunsea added ASR as a partner besides Qualcomm to cater to the increasing demand and offer affordable pricing in China.

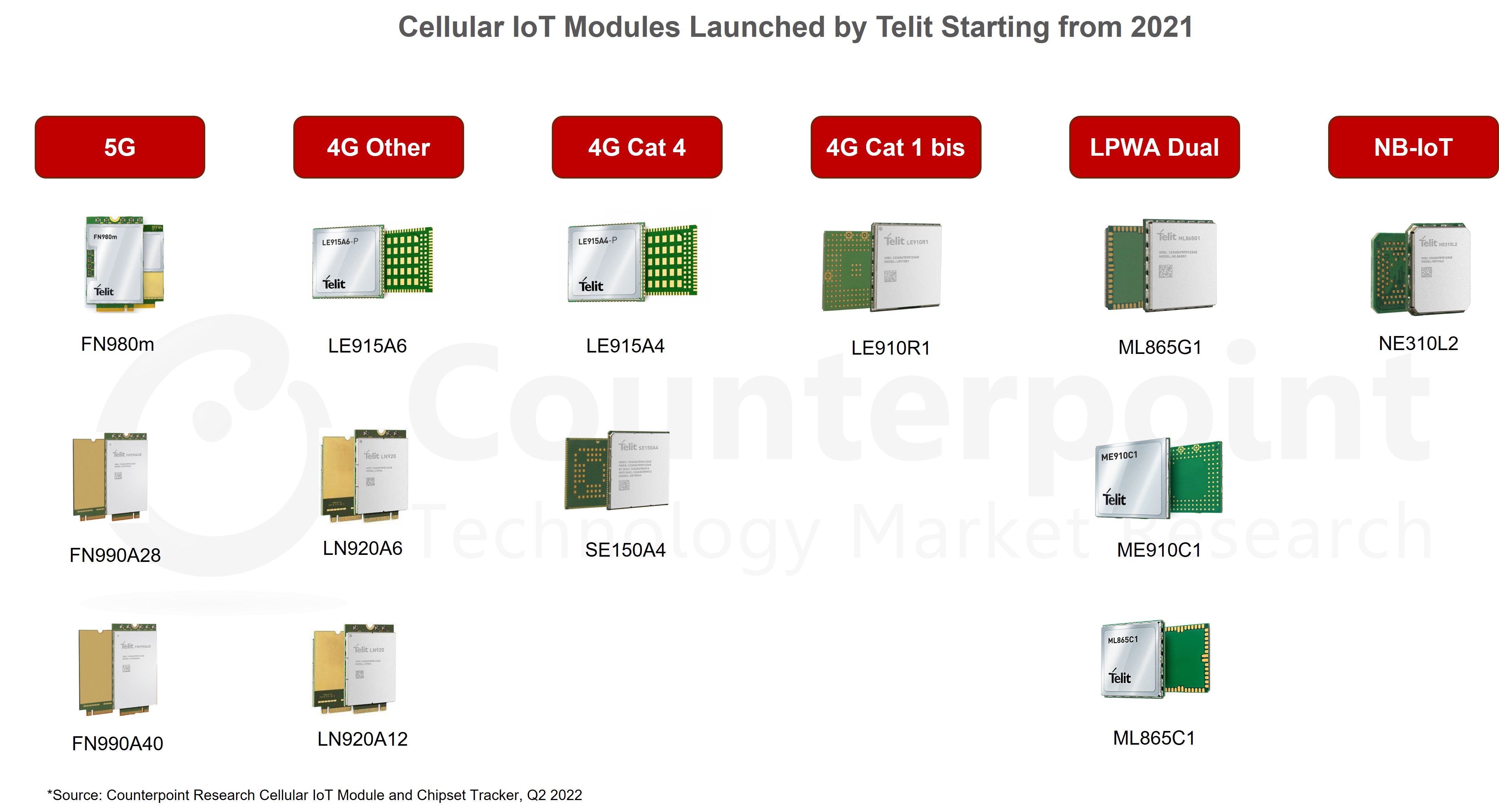

- Telit:Telit is the first non-China player in the global IoT module vendors’ rankings. Telit is focussing on LPWA-Dual Mode, 4G Cat 1 and LTE-M technologies to target applications such as industrial, healthcare, asset tracking, router/CPE and energy. The vendor has launched 4G Cat 1 bis industrial grade module LE910R1 with 2G fallback to target the APAC and EMEA markets. With the sunset of 2G and 3G technology, this module can be used as a substitute for low-to-mid-end applications. After the acquisition of Thales, Telit has the potential to emerge as the largest module vendor outside of China and eventually match Quectel in scale.

- Among other players,Neowayperformed well. It was the fastest growing in QoQ terms (+162%) among top vendors. Besides China, India is turning out to be an important market.

- u-bloxrecorded a strong quarter by remodeling and redesigning its products and clearing backlogs. The demand was strong for u-blox in industrial,automotive和healthcare applications.

Commenting on the key connectivity technology trends in the IoT space,Associate DirectorMohit Agrawalsaid, “The top five technologies, including NB-IoT, 4G Cat 1, 4G Cat 4, 4G Cat 1 bis and LPWA-Dual Mode captured more than 80% of the shipments in this quarter. We are witnessing increasing shipments of 4G Cat 1 and 4G Cat 1 bis modules driven by the sunset of 2G and 3G technologies and higher demand in low-to-mid-end applications. Some module players are still shipping 2G modules to cater to specific low-cost applications in some emerging markets, like Africa, Asia and eastern Europe. The 5G IoT module shipments remain steady withpricesstill high and many projects still in pilot stages. It will take at least a couple of years to reach an inflection point. We expect the second half of 2023 to see a ramp-up for the 5G IoT modules with good pan-country5Gcoverage and scale.”

The top five applications in Q2 2022 – smart meter,POS, industrial, router/CPE and asset tracking – captured more than half of the totalIoT module市场。与前一个季度相比,有ant improvements were seen in the router/CPE and residential markets. Theautomotiveconnectivity market did not show much traction due to the poor performance of the automotive industry in China during this quarter.

For detailed research, refer to the following reports available for subscribing clients and individuals:

- Global Cellular IoT Module and Chipset Tracker, Q1 2019-Q2 2022

- Global Cellular IoT Module and Chipset Tracker by Application, Q1 2019-Q2 2022

Counterpoint tracks and forecasts on a quarterly basis 1,500+ IoT module SKUs’ shipment, revenue and ASP performance across 80+ IoT module vendors, 12+ chipset players, 18+ IoT applications and 10 major geographies.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Soumen Mandal

Mohit Agrawal

Counterpoint Research

Related Reports:

- Unpacking the 5GAIoTOpportunity

- Wi-Fi 6 Market Key Drivers, Challenges, Applications, Market Size, Outlook

- iSIM-based Cellular Device Shipments to Cross 7 Bn Units During 2021-2030

- Global Cellular IoT Module Forecast, 2019-2030

- Global Cellular IoT Chipset Forecast, 2019-2030

- Global Connected Car Installed Base, 2021

- Global Telematics Control Unit Tracker Q1 2019 – Q1 2022

- Global Automotive NAD Module and Chipset Forecast, 2018-2030

- Global Passenger Vehicle Forecast, 2018-2030F

- Quectel: Driving Towards Becoming a True IoT Company

- Automotive LiDAR Market Trend and Implications 2022