- More than 75% of the cameras sold in Q1 2023 were below INR3,000, with INR1,500-INR2,000 most popular (28%).

- Indian brands now command two-thirds of the Indian smart security camera market.

- CP Plus, Xiaomi and EZVIZ ranked first, second and third, respectively, in Q1 2023.

- Three of the top five best-selling models were from CP Plus

New Delhi, Beijing, Hong Kong, Boston, Toronto, London, Taipei, Seoul – June 14, 2023

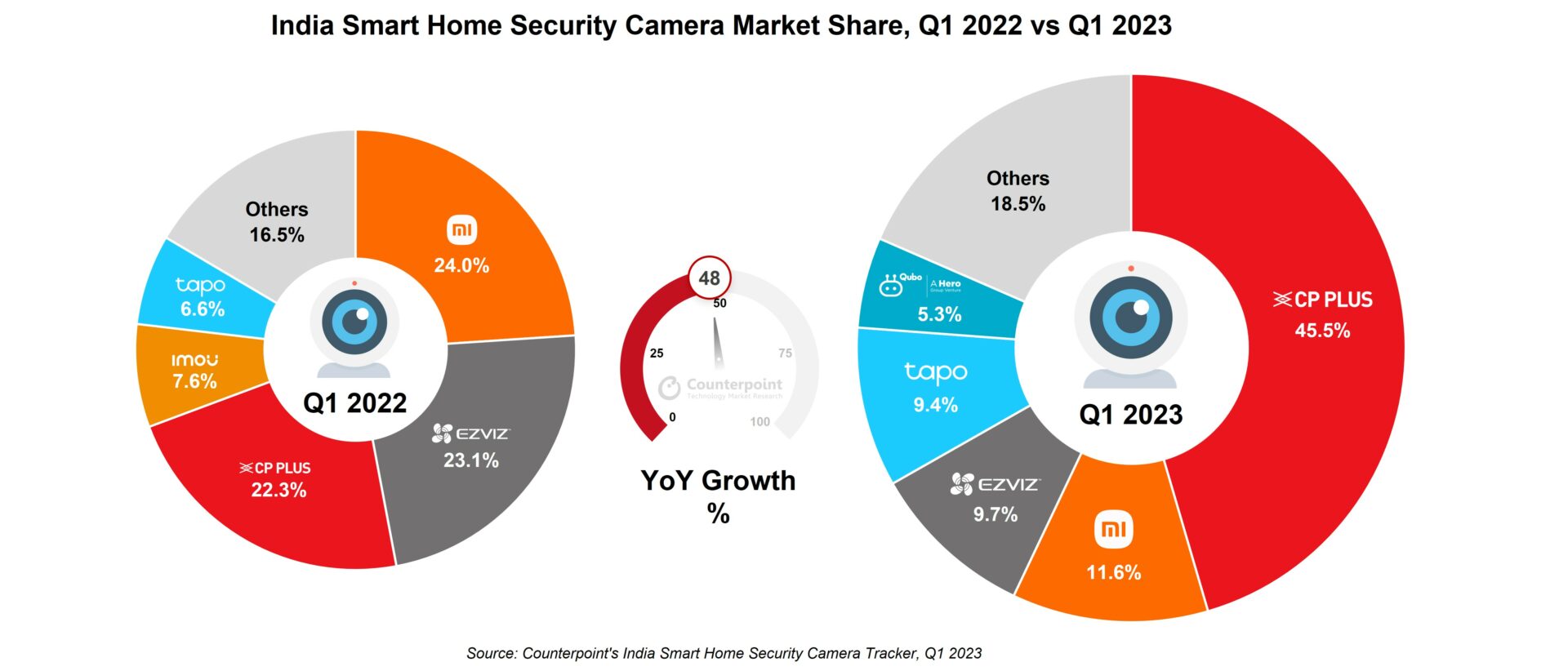

India’s smart home security camera shipments grew 48% YoY in Q1 2023 (January-March), according to the latest research from Counterpoint’sSmart Home IoT Service. During the period, there was a strong increase in demand for home surveillance products as offices began reopening for working professionals. In Q1 2023, the average selling price of smart security cameras declined considerably YoY, with theINR1,500-INR 2,000 price rangeemerging as the most popular.

Commenting on the trend,Research Analyst Varun Guptasaid, “Safety and security of homes have become a prime concern for most Indian households, which led to an increase in demand for smart security cameras and strong growth inshipmentsduring the quarter. The industry has integrated AI into the devices to provide capabilities such as intrusion detection and motion detection, making household surroundings more secure. These functions have become more accessible in lower-cost cameras, driving overall demand. The shipment share of the INR1,500-INR2,000 price band jumped to28%in Q1 2023 from3%in Q12022. A decline in cost of components, especially those of memory and Wi-Fi chipsets, have led to a decline in the overall ASP.”

Note: Figures may not add up to 100% due to rounding

Guptaadded, “The market remains consolidated. The top three brands took a combined market share of67%in Q1 2023, with home-grown company CP Plus taking the top spot. Chinese brands, such as Xiaomi and EZVIZ, faced strong competition in the market due to the growth of existing and emerging players. TP-Link also launched smart cameras via its sub-brand Vigi to offer differentiated products to Small and Medium Businesses. Smart security cameras are becoming more popular among small retailers and enterprises due to their ease of use and minimal cost of ownership.”

Commenting on the overall market,Senior Research Analyst Anshika Jainsaid, “Indian brands now command nearly two-thirds of the Indian smart security camera market, with more than60%of the products being manufactured in India. The market continues to perform well on online platforms and there has been a significant increase in the offline channels as well, with shipments exceeding40%for the second consecutive quarter in Q1 2023. This indicates steady growth in the offline retail channels.”

Market Summary

- CP Plusby Aditya Infotech cemented its leadership position with3x YoY出货量的增长在2023年第一季度,这帮助它pture a45%market share. It launched several cameras in Q1 2023, particularly in 3MP and 4MP sizes. CP Plus was the top domestic manufacturer of smart security cameras with a71%share. It has focused on making its products more affordable to consumers mostly via the offline retail market.

- Xiaomiranked second with a12%market share as its shipments fell29% YoYin Q1 2023 mostly due to higher inventory levels and seasonal decline.Xiaomi’s Home Security Camera 2i was its best-selling model and second-best-selling camera model in the overall market.

- EZVIZby Hikvision ended Q1 2023 at the third spot with a10%share. Its shipments declined38% YoYdue to the aggressive pricing by competitors. It has focused more on offering made-in-India cameras to consumers with the C6N as the brand’s best-selling model. EZVIZ offers a wide variety of products and primarily focuses on cameras priced at >INR3,000.

- Tapoby TP-Link doubled its shipments YoY and captured the fourth spot with a9%share. Although the brand has mostly focused on online retail channels, its visibility in the offline retail channels has also improved, especially in the large format stores. C210 was the brand’s bestseller in Q1 2023.

- Quboby Hero Electronix grew19% YoYand climbed to the fifth position with a5%market share. It has focused on offering affordable indoor cameras, especially in the INR2,000-INR2,500 price band, while also aiming to improve product visibility in the offline retail channels. The Smart Cam 360 indoor camera was the brand’s best-performing model.

Other Emerging Brands

- Imouby Dahua Technologies fell38% YoYmostly due to its lower popularity compared with other brands and poor visibility in the offline retail channels. Its Ranger series of cameras contributed to more than60%of its total shipments.

- Kentgrew marginally YoY in Q1 2023. It has focused on offline and online retail channels and has been a trusted water purifier brand for several years. All its cameras are manufactured in India, and we expect Kent to add more cameras to its portfolio this year.

- realmetook a spot in the top 10 list in Q1 2023. However, it suffered an18% YoYfall during the quarter, mostly due to a seasonal decline indemandfor its cameras.

- Airtelhas been one of the latest entrants in this space and is the only brand to offer cloud storage as a service. It aims to build on its existing brand presence to penetrate tier-1 and tier-2 cities.

- Zebronicsgrew significantly in Q1 2023 as it aims to offer affordable products to consumers and small retailers.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Varun Gupta

Anshika Jain

Folllow对比研究

Related Posts

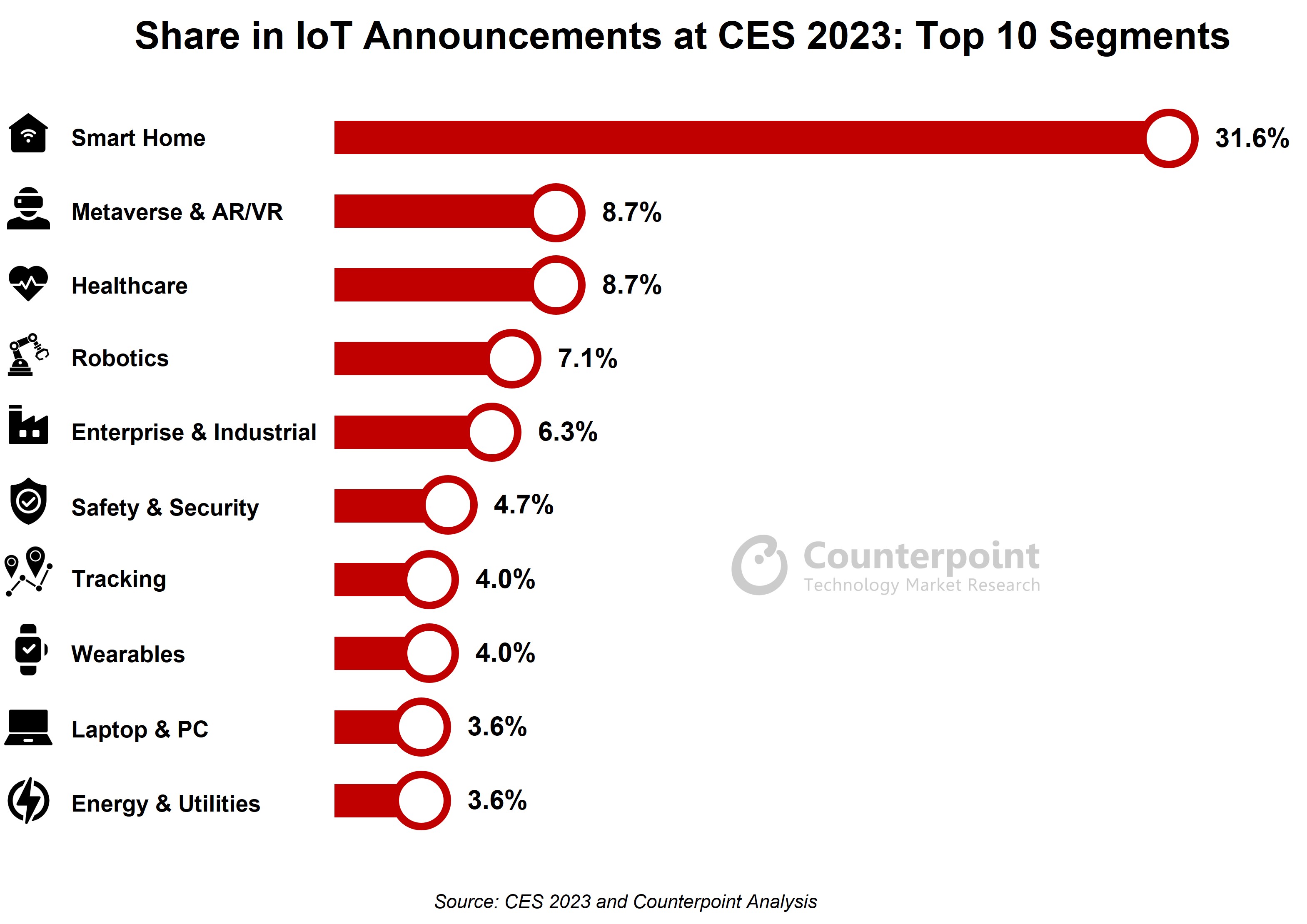

- CES 2023 IoT Announcements Analysis

- CES 2023 Emerging Devices

- Emerging Devices Shaping Future Consumer Tech Adoption

- Smart Home Market Witnessing Rapid Growth

- Consumer IoT Intelligence Tracker April 2023 Edition

- Bespoke Home 2022: Samsung’s Smart Home Strategy Gathers Pace

- Smart Home Market Report, 2021

- India Smart Home Security Camera Shipments Grew 76% YoY in 2022; CP Plus on Top

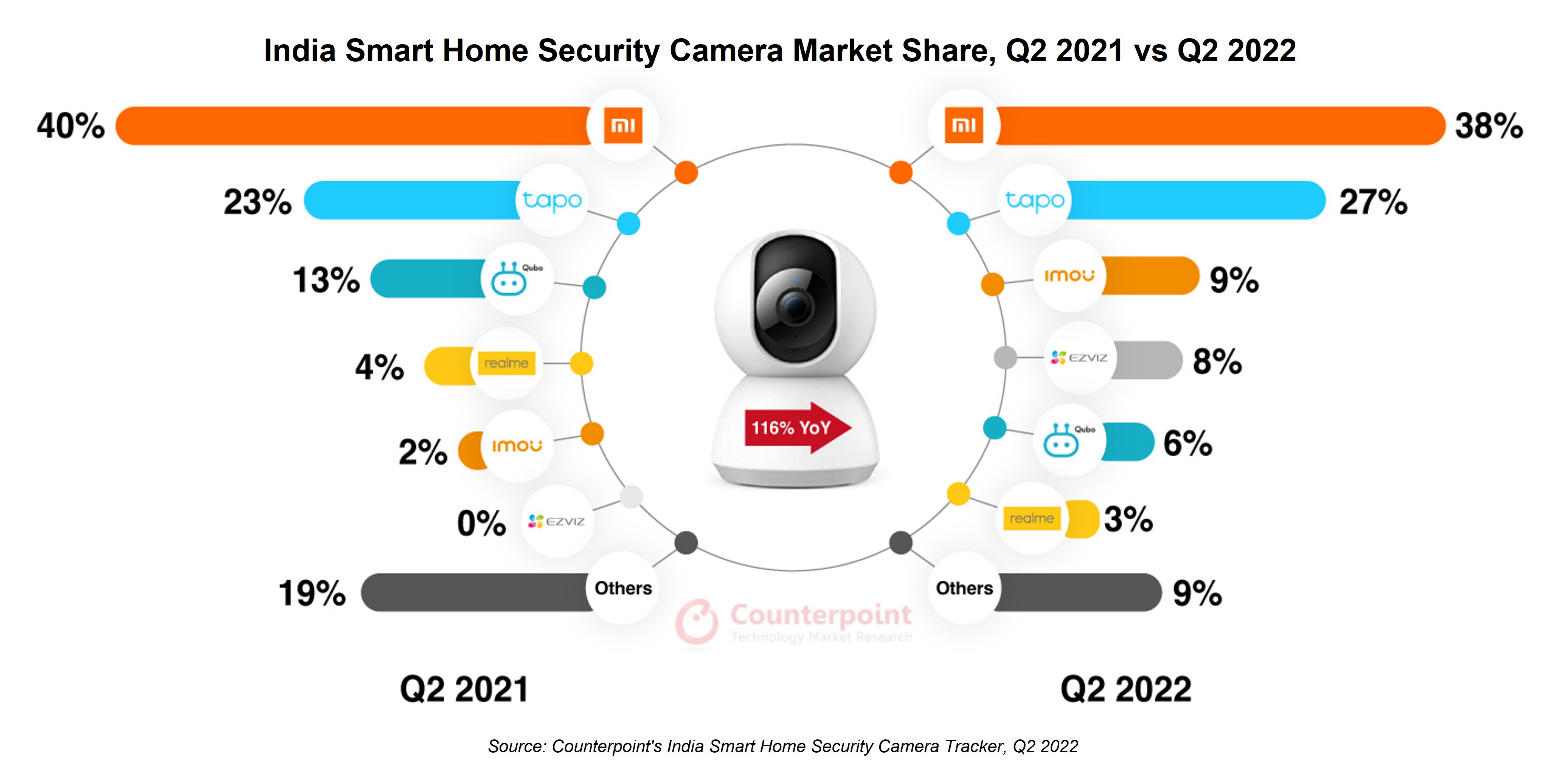

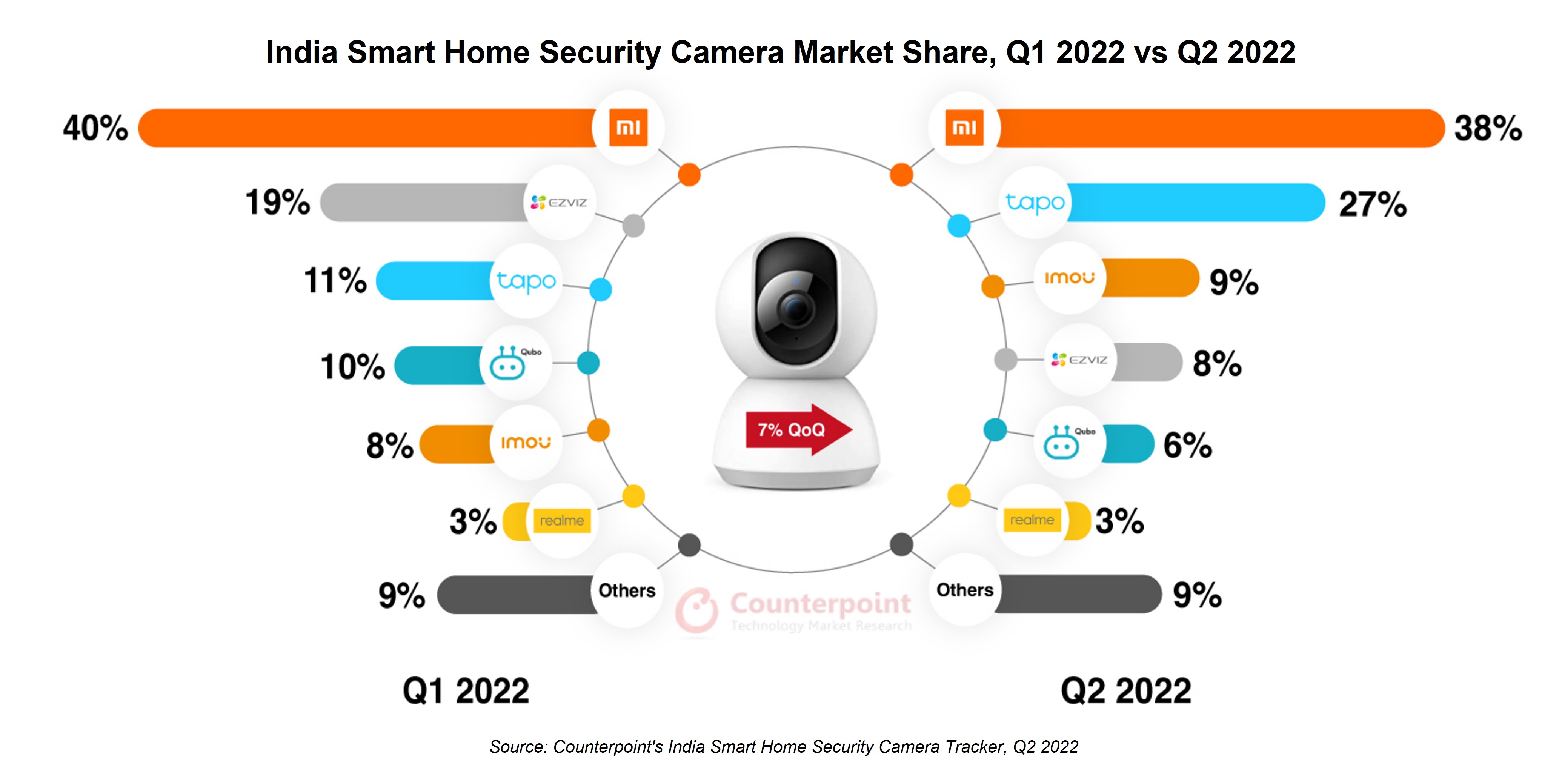

- India Smart Home Security Camera Market Grows 116% YoY in Q2 2022; Xiaomi, Tapo, Imou Lead

- India Robot Vacuum Cleaner Shipments Grow 24% YoY in H1 2022; Xiaomi Captures Top Spot

- Samsung IoT Strategy & Developments

- Xiaomi IoT Vendor Profile

- realme India Growth Story, 2021