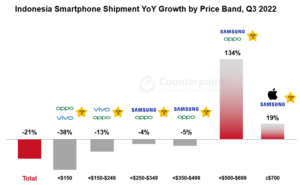

- The <$250 price band took the hardest hit.

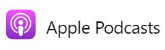

- OPPO led the market followed closely by Samsung and vivo.

- The $500-$699 price band grew 134%.

- 在线渠道出货20在第三季度同比增长8%22.

- 5G smartphone shipments increased 42% YoY.

Jakarta, London, Boston, Toronto, New Delhi, Beijing, Taipei, Seoul – November 14, 2022

With macroeconomic conditions showing no signs of improvement, Indonesia’s smartphone shipments declined 21% YoY in Q3 2022, according to Counterpoint’sMonthly Indonesia Smartphone Channel Share Tracker.High smartphone demand in Q3 2021 after the lifting of COVID-19 lockdowns resulted in higher shipments which made this quarter look even worse.

OPPOmanaged to regain the top spot in Q3 2022 driven by its A16 model family, A57 series and Reno series. Aggressive marketing and models spread across price bands also contributed to the good show.

Major OEMs cut their shipments as inventory piled up. In the $150-$249 band, Samsung’s dominance weakened, thereby placing vivo and OPPO as the main OEMs with a combined share of 51%. The <$150 price band was led by OPPO andvivowith a 34% share.Infinixhas increased its presence in this segment by introducing the Hot 12 series.

Source: Counterpoint Monthly Indonesia Channel Share Tracker, Q3 2022

Smartphones priced ≥$500 are unlikely to be affected by macroeconomic headwinds due to the consumer group’s capacity for discretionary expenditure. Therefore, OEMs have increased the options for this price band. OPPO with its Reno series once held the crown in the $500-$699 segment. In Q3 2022,Samsungand OPPO led the segment with a share of 63%.

Commenting on the price range dynamics,Senior Analyst Febriman Abdillahsaid, “The $500-$699 price segment can be an attractive market given its high growth in economically turbulent times. In Indonesia, OEMs are offering specifications like 8-12GB RAM, 256 ROM, 4000-6000mAh battery capacity and 5G capability. These in-demand specs can help in better targeting of consumers.” The OPPO Reno 8’s Portrait Expert mode claims enhancements in photography technology.realme’sGT Neo series has come up with a “speed” differentiator that improves smartphone gaming. Samsung’s Galaxy A73 5G was one of the top mid-range phones.

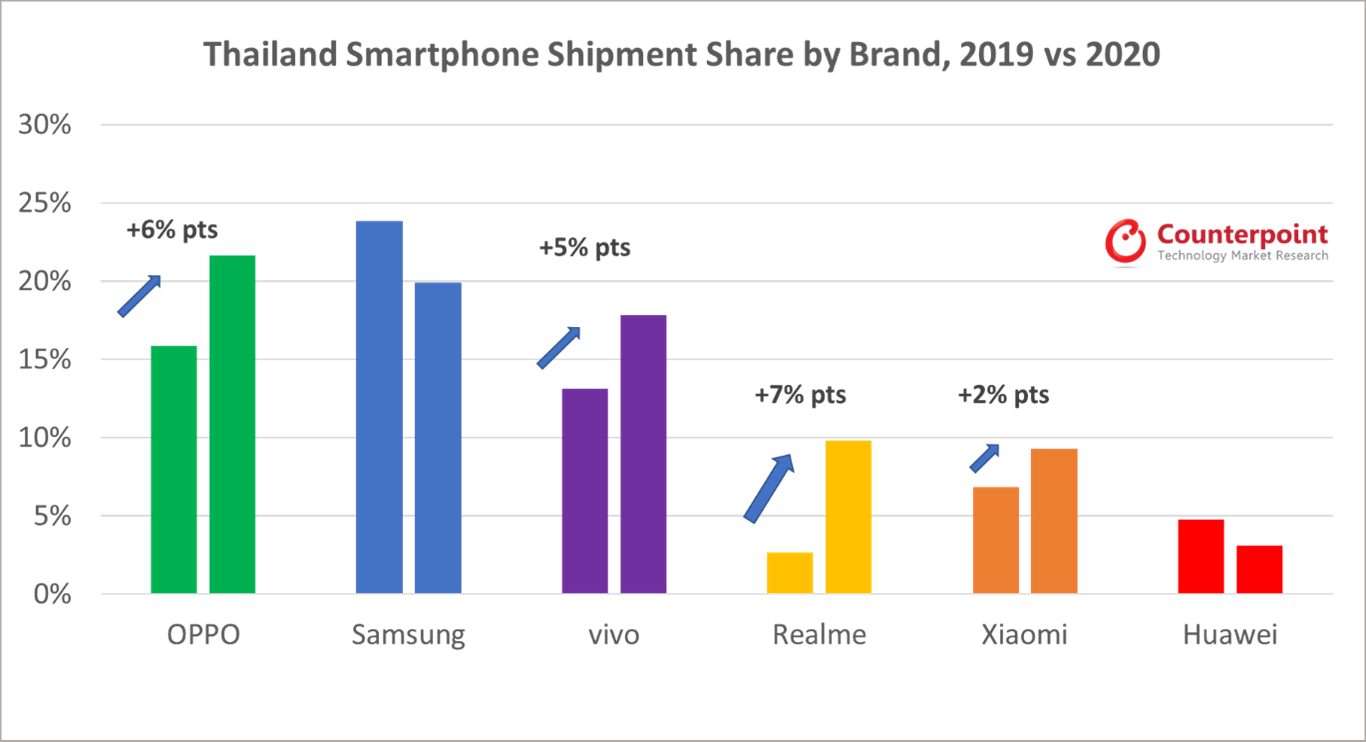

Smartphone online channels grew 8% YoY in Q3 2022 to reach 22% of overall shipments. Product availability is one of the key drivers that motivate consumers to visit online platforms. Aside from price promotions, cashbacks, free shipping and bonus points from e-finance providers, the opportunity to get the latest products throughpre-orderschemes is another attraction of the online channel. Among e-commerce players,Shopeemaintained its top spot followed byAkulaku,Lazada,TokopediaandBlibli.

In addition to marketplaces, OEMs have improved their own online channels, such asXiaomi, OPPO, realme and Samsung’s online stores. Virtual shopping stores like Samsung Experience Store could be a leap in the application of technology in connecting products with consumers. Here, 5G-ready phones can provide a better virtual experience.

5G smartphoneshare reached 25% in Q3 2022, which is a bit slower than Indonesia’s Southeast Asian neighbors. 5G smartphone shipments grew 42% YoY. This growth mostly came from the $250-$349 price band as most smartphones in the higher price band were already 5G-ready. In the $250-$349 band, Samsung and vivo led the 5G growth with the Galaxy A33 series, M33 series and vivo Y75.

Outlook

Entering Q4 2022, we expect progress in macroeconomic recovery, which may stir the smartphone market.Abdillahsaid, “There is optimism for a possible increase in demand for budget and mid-range smartphones during the shopping season. We may see further enhancements in specifications here for the new models. This may trigger demand by way of smartphone upgrades, especially when there is also a possibility of pent-up demand in Q4. The challenge will be how to attract consumers effectively. Consumers will have a wide choice of smartphone brands and models and will be more conscious of what features they need.”

Although the smartphone market declined in the last two quarters, there has been significant market movement towards online platforms. The smartphone ecosystem is getting better in terms of providing the latest and relevant product technology.

Feel free to contact us atpress@www.arena-ruc.comfor questions regarding our latest research and insights.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Febriman Abdillah

Glen Cardoza