Key Southeast Asian Countries’ Smartphone Shipments Cross Pre-pandemic Levels in 2021; Xiaomi, realme, Apple Achieve Highest Ever Volumes

- KeySoutheast Asiancountries’ (Indonesia, Thailand, Philippines and Vietnam) smartphone shipments were highest ever in a calendar year in 2021, reaching 96 million units and growing 5% YoY.

- Xiaomi, realme and Apple shipped their highest ever volumes in these countries.

- Xiaomihad a strong H1 2021 and even though it had a sluggish H2, the brand grew 17% YoY in 2021.

- Applesaw its highest ever growth of 68% YoY in 2021 due to the sales of iPhone 11 and iPhone 12 series and the launch ofiPhone13series.

- realmegrew 10% YoY in 2021 driven by the increase in shipments in Thailand and Philippines.

- 5G smartphoneshare was 18% in 2021, compared to 3% in 2020.

Hong Kong, London, Boston, Toronto, New Delhi, Beijing, Taipei, Seoul – February 10, 2022

Despite multiple COVID-19 resurgences, offline channel disruptions due to restrictions and sustained component shortages affecting OEMs, keySEAcountries (Indonesia,Thailand,PhilippinesandVietnam) saw a 5% YoY growth in smartphone shipments in 2021, according toCounterpoint Research’s SEA Monthly Smartphone Channel Share Tracker.At 96 million units, the 2021 shipments were the highest ever for a calendar year and more than the pre-pandemic levels. Q4 2021 volumes, however, remained flat due to supply issues for most OEMs.

Commenting on the region’s smartphone market,Senior Analyst Glen Cardozasaid, “Most of the SEA countries saw aCOVID-19resurgence more than once in 2021.Governmentsand industry players were eager to achieve normalcy in business, but social and economic activities suffered, which did not let the smartphone industry pick up in the second half. However,Samsungwas able to resolve shipment issues encountered mid-year to revive its sales and lead in the region.Xiaomicame up strong in Q1 and Q2, which solidified its base in most of the key economies, but it suffered more than others in H2 2021 due to supply constraints.OPPOandvivocontinued their launches across price tiers and accelerated their marketing campaigns towards the end of the year. Brands likerealmeand Infinix brought in affordable models to target users upgrading from entry-level devices.”

Source: Counterpoint Research Southeast Asia Monthly Smartphone Channel Share Tracker, December 2021

On ASPs (Average selling price) and 5G, Cardoza said, “In 2020, more than 55% of the shipments in keySEAcountries were for smartphones under the $150 price point. In 2021, this bracket held about 38% share. More consumers are opting for smartphones in the $151-$250 bracket. Besides,5Gwas mostly represented by just the top 2-3 brands in 2020. We now see the top five OEMs not only launching5Gmodels but also actively reducing their ASPs and working with operators to further the adoption of5Gin SEA.”

Commenting on the online-offline channel dynamics,Research Director Tarun Pathaksaid, “Online shareof shipments does not seem to be growing consistently across different countries in the region. Thailand and Philippines saw growth towards the end of H2 2021 while Indonesia andVietnamstill have some infrastructural and mindset miles to cover. To capture a larger mind space through offline channels, most brands are making sure that retail partnerships are well maintained to grow networks across countries. A careful balance between online and offline channel shipments is being worked out by brands. This is being complemented by their tie-ups with operators and retailers.”

Source: Counterpoint Research Southeast Asia Monthly Smartphone Channel Share Tracker, December 2021

Market Summary:

- Samsungsaw shipment challenges mid-year in 2021 but recuperated to lead in market share. Its manufacturing facilities in Vietnam got back to normalcy towards Q4 and the brand made sure that marketing campaigns were in focus for all its new launches. A series was key toSamsung’svolumes in the year.

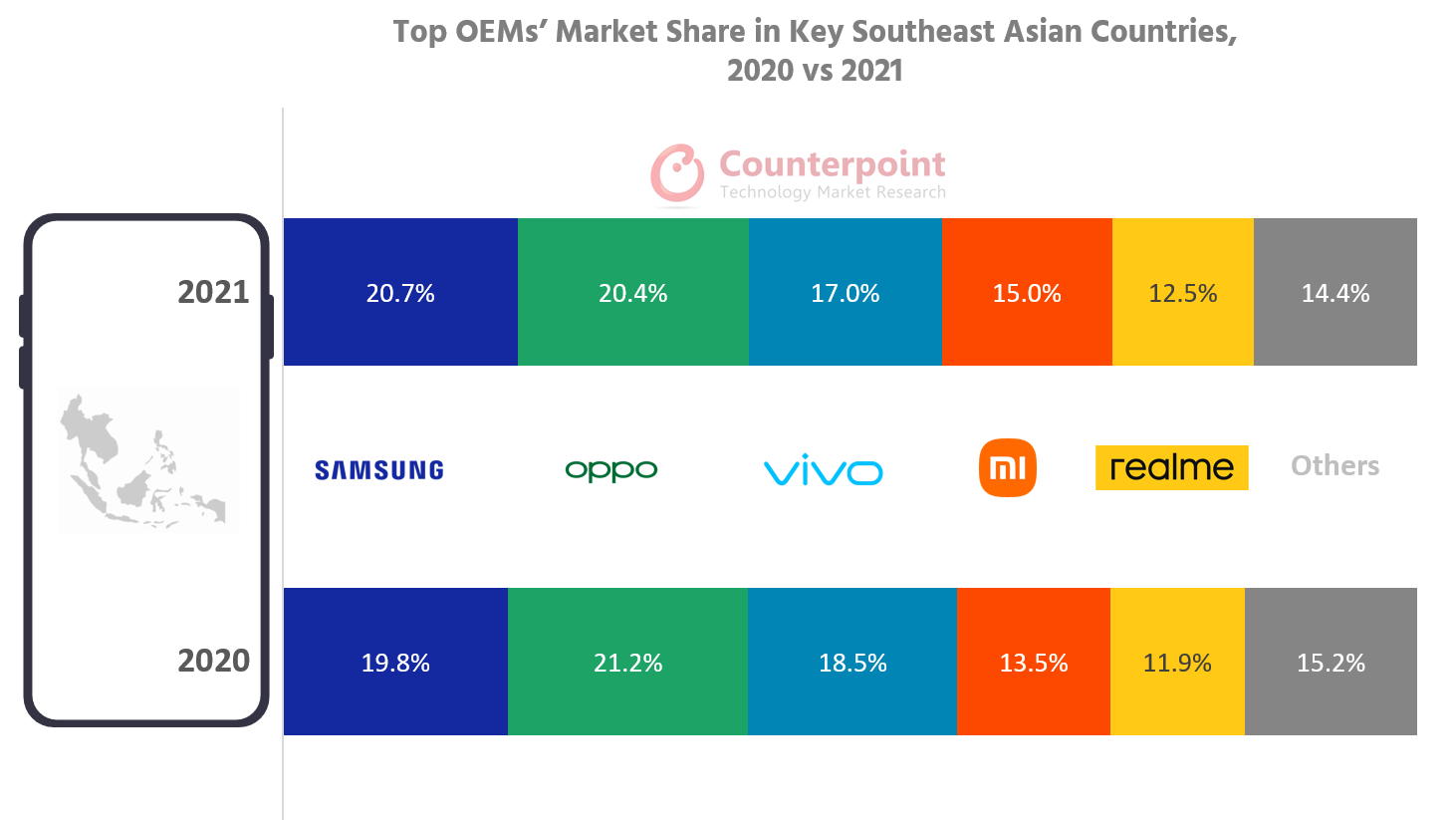

- Chinese brandsgrew more in 2021 and captured 71% of the market, led mostly by OPPO,Xiaomi, vivo,realmeand Infinix.

- OPPO’sstrong hold over the SEA continued in 2021 with consistent demand for its Reno series and A series smartphones. Consumers responded to its strong promotions and offers.

- vivo’sY series continued to perform well through 2021. The brand’s strong offline network strategy has helped over time.Marketing campaignsand endorsements have helped in increasing its exposure in these markets.

- Infinix,which was one of the highest gainers for the year, shows future promise but its volumes are comparatively still low.

- Even though there was a brief slowdown inAppleshipments in H2 2021, the brand sold more of the 11 and 12 series iPhones at the start of the year and towards the end as well. Thailand and Vietnam came up as the drivers for this premium brand.

- 而不是8%5G smartphoneshare in Q4 2020, 25% 5G share was seen in Q4 2021. This is bound to grow much higher in 2022.

- MediaTek,which led in chipsets in the region in 2020, extended this lead in 2021 by taking share fromQualcommand other brands. Brands likeUnisochold promise in reducing BoM cost for low-tier smartphones.

- Shopeecontinued to lead and increase its share in online smartphone shipments in the region in 2021. WhileLazadatried to recapture its sales, other e-commerce platforms likeJD(Indonesia and Thailand),Tokopedia(Indonesia) andBukalapak(Indonesia) slowly improved their festive sales, especially in Q4 2021.

- The key Southeast Asian countries showed resilience in 2021 despite multiple challenges. 2022 will see these countries increase their economic activities, which should, in turn, improve job situation, tourism and subsequently consumer buying sentiment. We are looking at a decent 5% YoY growth in the region’s smartphone shipments in 2022. 5G advancement, operator competition and consumer smartphone upgrades should make this possible.

Note:OPPO includes OnePlus shipments in this publication,Xiaomi includes POCO

Feel free to contact us at[email protected]for questions regarding our latest research and insights.

Background:

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Glen Cardoza

Tarun Pathak

Follow Counterpoint Research

press(at)www.arena-ruc.com