BYD Widens Gap with Tesla in Q3 2022, Leads Global EV Market

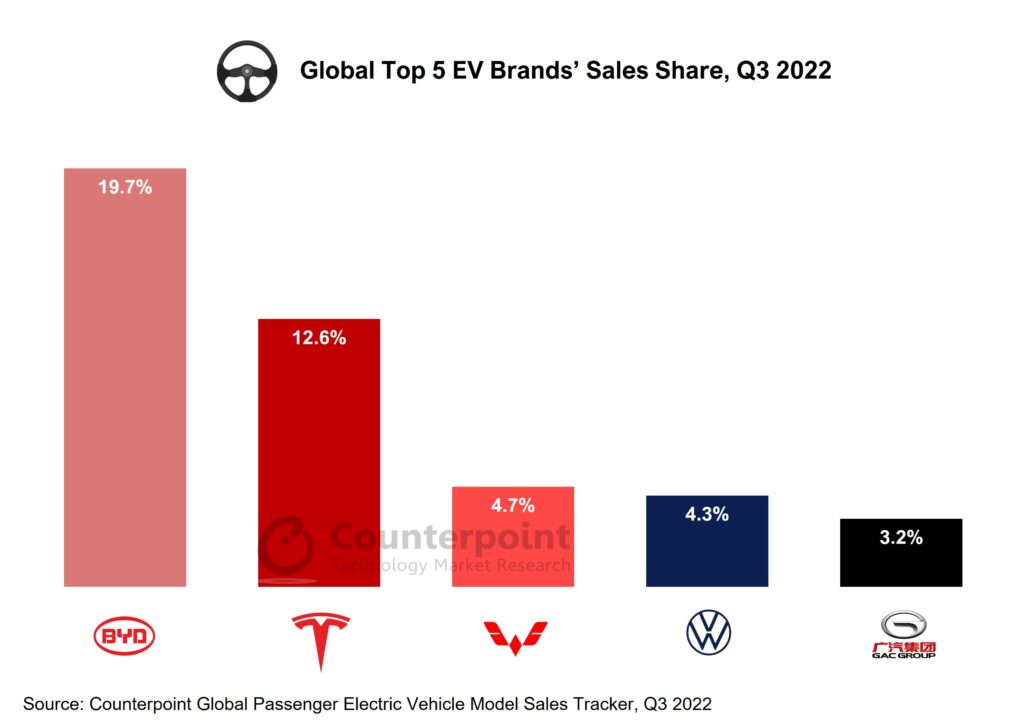

- Three of the top five best-selling EV brands in Q3 2022 were from China.

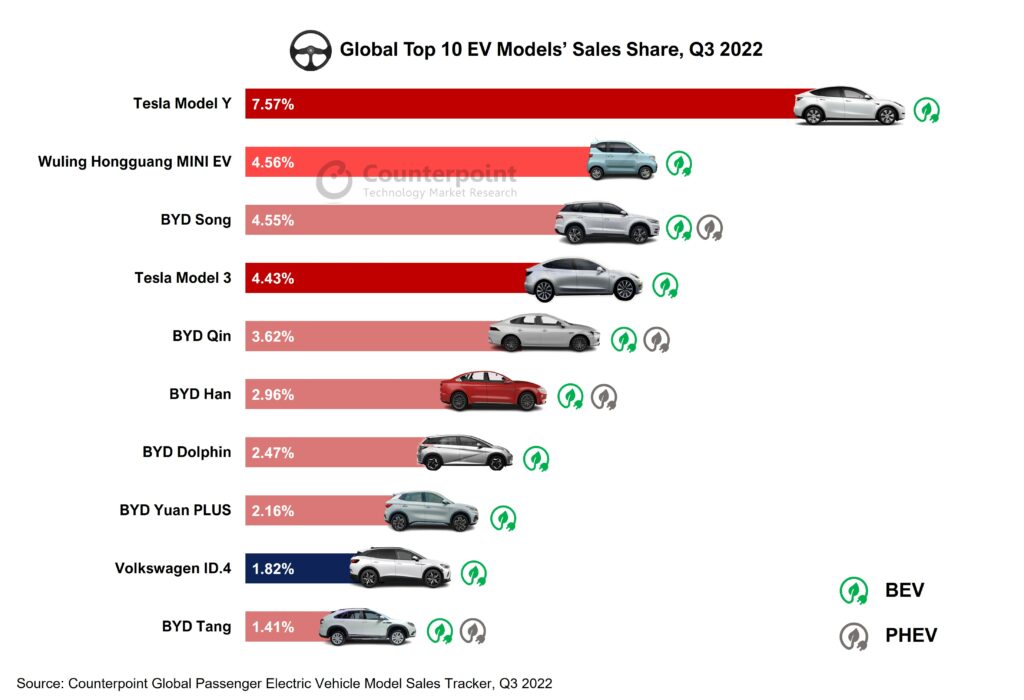

- top 10 EV models accounted for more than 35% of global EV sales.

- EVs constituted over 15% of the world’s passenger vehicle sales in Q3 2022.

New Delhi,London,San Diego, Buenos Aires, Hong Kong, Beijing, Seoul – December 1, 2022

Global passenger electric vehicle* (EV) sales grew 71% YoY in Q3 2022, according to the latest research from Counterpoint’sGlobal Passenger Electric Vehicle Model Sales Tracker. In total EV sales, battery EVs (BEVs) accounted for almost 74% and plug-in hybrid EVs (PHEVs) the rest. China remained the market leader in EV sales, followed by Europe and the US. China’s EV sales increased by over 100% YoY to exceed 1.7 million units from just 0.88 million units in Q3 2021. BYD Auto continued to lead the global EV market during the quarter. The Chinese automaker also managed to widen its gap with the second-placed Tesla.

Commenting on the market dynamics,Senior Analyst Soumen Mandalsaid, “As semiconductor supplies ease, together with better availability of raw materials for batteries, global EV sales are increasing. Among nations, China is dominating the global EV market single-handedly. Three of the top five best-selling EV brands are from China. All three brands operate predominantly in China, highlighting theChinaEV market’s positive evolution.”

Market Summary

BYD Auto保持全球市场领导者,运输更多的than 537,000 EV units, an increase of 197% YoY. Its top three models – BYD Song, BYD Qin and BYD Han – contributed to over 56% of the company’s sales during the quarter. BYD’s overseas operations have been picking up fast; it sold almost 17,000 EV units across various regions including Europe, Latin America, Southeast Asia, Middle East and Africa, and Oceania in Q3 2022.

Tesla’s global sales grew 43% YoY in Q3 2022 to over 343,000 units.The companysaw increased demand for its vehicles in Europe this quarter. The smoothing production ramp in its Berlin factory helped deliver a record number of Model Ys in Germany this quarter. However, deliveries fell short of expectations due to logistics bottlenecks.

Wulinggrew by 31% YoY to hold the third rank in the global EV market. The brand’s Hongguang Mini EV model has remained the undisputed market leader since its release in the second half of 2020. Mini-electric car sales in China are high as they cost less, are eligible for subsidies and serve the purpose.

Volkswagen’s EV sales increased by 28% YoY to recover from their Q2 dip. The ID.4, ID.3 and ID.6 series had the top-selling Volkswagen models during the quarter. The company showed impressive results in China with its EV sales growing 79% YoY and 35% QoQ. Although the brand’s sales in Europe and the US recovered sequentially, neither region registered YoY growth.

GAC Motoremerged as the fifth top-selling brand, overtaking BMW and Mercedes-Benz. During Q3 2022, GAC sold more than 85,000 units to record a YoY growth of 145%. GAC spearheaded its Aion series, with the Aion Y as the top-selling model. The company operates only in China.

Chinese EV brandsare making strong and steady progress. BMW has been pushed to sixth place by GAC Motor. Other brands like NIO, Xpeng, Lynk & Co and Geometry have started building a strong global presence, whereas traditional European automakers like Audi, Volvo, Peugeot and Renault are struggling to keep up with the competition. Among the top 25 EV brands in Q3 2022, 14 were from China.

top 10 EV models accounted for more than 35% of global EV sales in Q3 2022. Tesla’s Model Y remained the best-selling EV model. Six out of the top 10 best-selling EV models were from BYD Auto.

Commenting on the market outlook,Research Vice President Peter Richardsonsaid, “EVs represent a growing share of global passenger vehicle sales. Currently, EVs account for more than 15% of global passenger vehicle sales. EVs are becoming the preferred choice for first-time car buyers across developed regions. This is also encouraging new players to enter the market. In addition, different battery chemistries that require little or no lithium are also being developed, with the new technologies promising similar or better efficiency compared to existing ones.”

*Sales refer to wholesale figures, i.e. deliveries from factories by the respective brands/companies.

*For EVs, we consider only BEVs and PHEVs. Hybrid EVs and fuel cell vehicles (FCVs) are not included in this study.

The comprehensive and in-depth ‘Global Passenger Electric Vehicle Sales Tracker, Q1 2018-Q3 2022’ is now available for purchase atreport.www.arena-ruc.com.

Feel free to reach us at[email protected]for questions regarding our latest research and insights.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Soumen Mandal

Neil Shah

Peter Richardson

Counterpoint Research

Related Reports:

- China Q2 EV Sales Almost Doubled YoY, Despite a Weak Quarter

- China EV Charging Points Soar 56% YoY in 2021; 42% CAGR Seen for 2022-2026

- One in Two Cars Sold Will Have Electric Powertrain by 2030

- ADAS Penetration Crosses 70% in US in H1 2022, Level 2 Share at 46.5%

- LiDAR Now High on Automotive Industry Radar

- Connected Car Sales Overtake Non-connected Cars in Q2 2022

- In Automotive Connectivity, Rolling Wireless Tops Module Market, Qualcomm Dominates Chipset Market in H1 2022

- A Promising Yet Challenging Market for Self-driving SoCs

- Ukraine Crisis Derails Automotive Recovery