- Apple announced the anticipated Apple Watch Series 9 and Watch Ultra 2 on September 12.

- Both watches will come with Apple’s new S9 SiP, powering several new features.

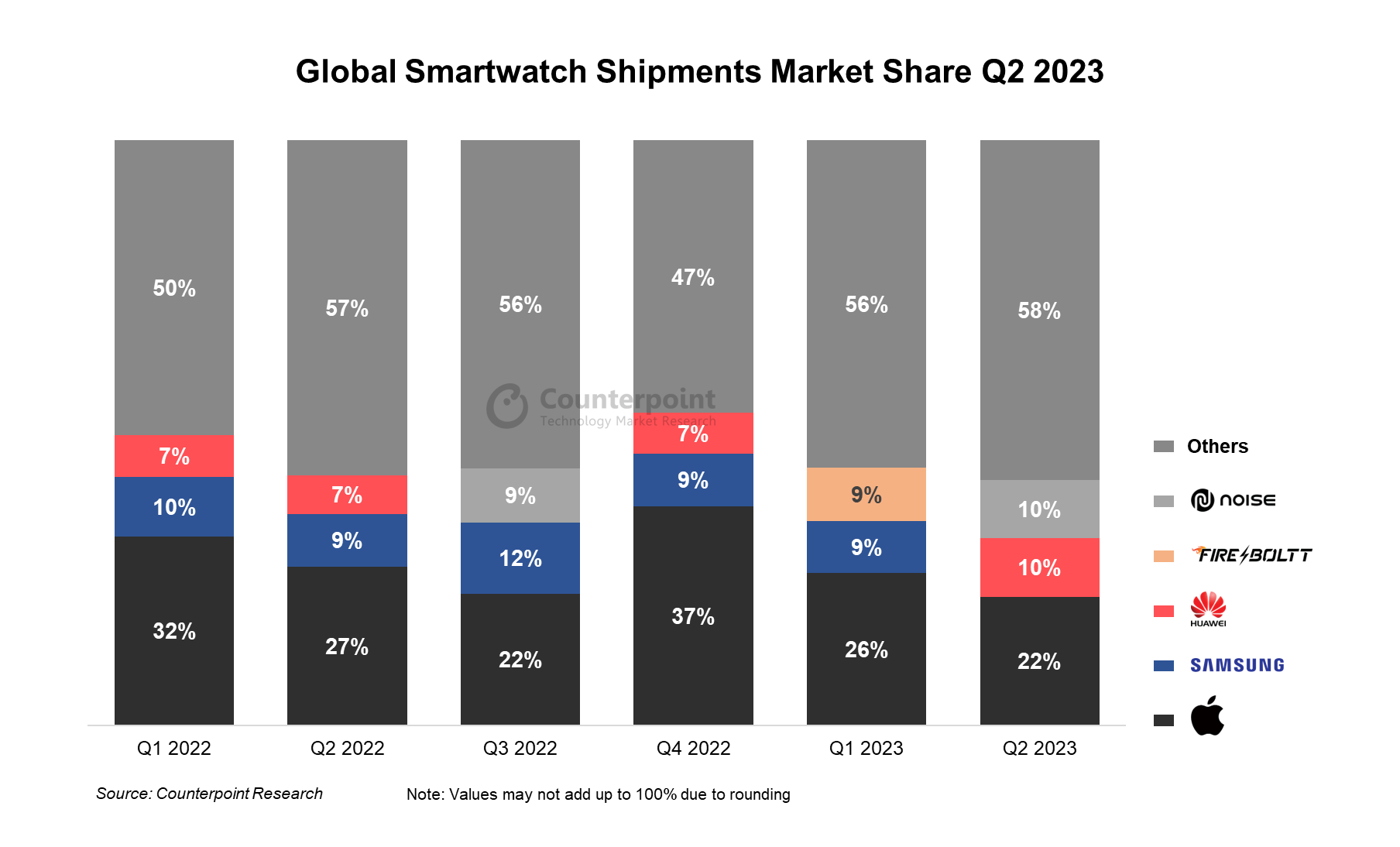

- The launch comes amid a slump in Apple Watch shipments over the last three quarters.

- While new features and hardware make the devices a notable upgrade over their predecessors, macroeconomic conditions may undermine the success of these devices.

Apple announced two new Watches – the Apple Watch Series 9 and the Watch Ultra 2 – at its launch event on Tuesday, September 12. The two devices feature several key updates over their predecessors that, on their own, are impressive. However, amid a slump in Apple Watch shipments, will the upgrades be enough to get buying consumers to the store?

Apple’s S9 SiP Brings New Features and Functionality

Central among the upgrades for both the Apple Watch S9 and the Apple Watch Ultra 2is theS9 SiP –the first new processor in an Apple Watch since the 2020 Apple Watch S6– which is a big deal. The new S9 SiP features over 60% more transistors, giving a 30% speed boost to its GPU. The chip also features a quad-core neural engine that is twice as fast as that on the Apple Watch Series 8, enabling improved on-device machine learning and AI functionality. Additionally, the S9 SiP features improved power efficiency, helping the Apple Watch S9 and Apple Watch Ultra 2 achieve a battery life of 18 hours and 36 hours, respectively.

The upgraded performance of the S9 SiP enables several new features on the Apple Watch Series 9 and Apple Watch Ultra 2. Notably, Siri will now operate on-device, making it faster and more reactive to users’ needs. The improved neural engine also makes dictation up to 25% more accurate, which should reduce the frustration users have when Siri misunderstands their requests. Users will also now be able to ask Siri to log health information or to reply to them with key health metrics. This should be helpful for when users are in the middle of a workout and are unable to look at their watch faces.

The updated neural engine also powers one of the event’s biggest Apple Watch announcements –the new double-tap gesture.Users can now double-tap their forefinger with their thumb on their watch-wearing hand to accept or decline calls, start and stop music, snooze alarms, and more. This feature will be very convenient for users whose other hand is occupied with another task. The neural engine processes data from the watch’s gyroscope, accelerometer, and heart-rate sensor to bring this feature to life. It’s also worth noting that the double-tap gesture is used for the Apple Vision Pro. It seems Apple is slowly introducing its consumers to the vocabulary of gestures that will drive its spatial computing devices.

Brighter Displays

Another upgrade to the Apple Watch Series 9 and Watch Ultra 2 was in their display technology. While the previous Apple Watch Series 8 and Watch Ultra featured displays of 1,000 nits and 2,000 nits of brightness at their brightest level. The Apple Watch Series 9 and Watch Ultra 2 feature up to 2,000 nits of brightness and 3,000 nits of brightness, respectively. This will make reading the display in bright outdoor settings much easier, which should be especially attractive to outdoors enthusiasts as well as athletes.

Sustainability Engineered into the Apple Watch S9 and Ultra 2

Apple engineered sustainability into the DNA of its new Apple Watches. From the materials used in the devices to shipping methods, Apple made a serious effort to reduce its carbon footprint. In fact, when paired with specific bands, the Apple Watch S9 and Ultra 2 are carbon neutral.Apple also announced that with recent measures, last year’s Apple Watch SE 2 is now carbon neutral with specific bands, making Apple’s entire lineup of latest watches carbon neutral. This sets a high bar for competitors who will feel the pressure to implement similar measures.

To achieve this feat, Apple moved to replace all cobalt in its Apple Watch batteries with recycled cobalt and moved to use 95% recycled materials for the casing of the Apple Watch Ultra 2. Additionally, Apple is shipping a higher number of units via ocean rather than air, which significantly lowers carbon emissions.

Pricing and Availability

尽管升级芯片,定价为新的应用程序le Watch S9 matches that of its predecessor, at $399 for the 41mm version and $429 for the 45mm version. The price for the cellular versions each cost $100 more. The Apple Watch Ultra 2 maintains the same price as its predecessor at $799. Consumers can trade-in their current smartwatch for up to $380 off through the Apple website.

Will the Apple Watch Series 9 and Watch Ultra 2 end the company’s Watch slump?

Apple’s smartwatch shipments have been in a slump. Since 2022, record levels of inflation caused consumers in North America and Western Europe to hold off on non-essential purchases, including smartwatches. This hurt Apple Watch sales, which were down 10% in Q2 2023 with YoY declines for three straight quarters. Due to this, Apple haslost sharein the global smartwatch market. Although macroeconomic conditions continue to impact consumers as they spend more on things like rent, mortgages, loan repayments, the updated chip in the Apple Watch S9 and Apple Watch Ultra 2 gives consumers a legitimate reason to upgrade from their Apple Watch S7 or earlier device. However, despite the upgraded hardware and new features, consumers’ budgets may be too strapped to make the upgrade. Therefore, promotions may play the deciding role in the success of Apple’s new devices.