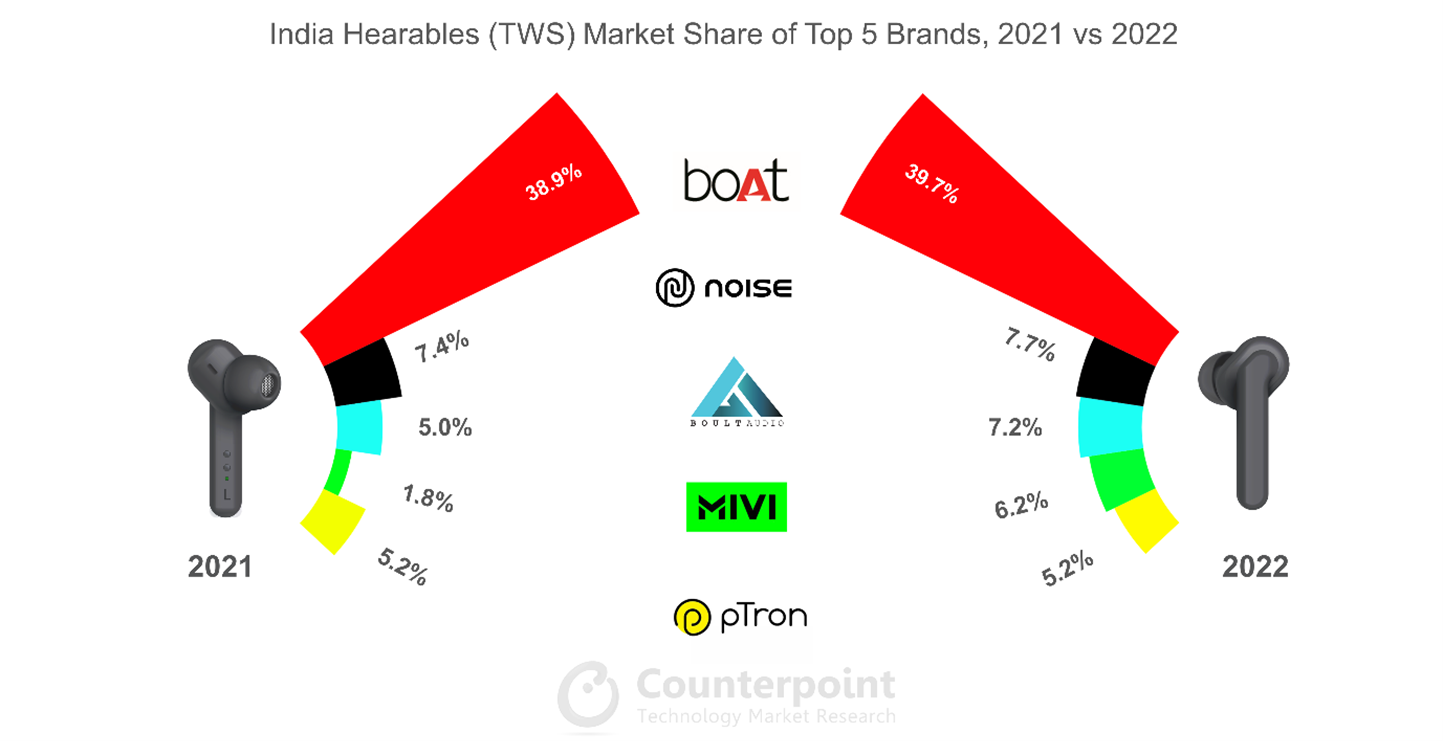

- Leading player boAt posted 89% YoY growth, contributing two-fifths of the total shipments.

- For the first time, the top five spots in the India TWS market were captured by local brands.

- Indian brands reached their highest ever share of 80%.

- Domestic manufacturing captured a 30% shipment share in 2022, compared to just2% in 2021.

- The average selling price dropped by 20% YoY in 2022.

New Delhi, Beijing, Hong Kong, Seoul, London, San Jose, Buenos Aires – February 21, 2023

India’s TWS marketshipments registered85% YoYgrowth in 2022, according to the latest research from Counterpoint’sIoT service. Increasinglocal manufacturinghelped drive the shipments, apart from timely sales events, frequent affordable offerings, and entry of new players.

Commenting onTWSbrands’ performance in 2022,Senior Research Analyst Anshika Jainsaid, “Four-fifths of the total market was captured by Indian brands, their highest-ever share. For the first time, the top five spots were taken by local brands, which captured two-thirds of the total TWS shipments in India. Moreover, the majority of the new entrants this year were local brands. Further, Mivi, with its entirely locally produced TWS portfolio, grew 544% YoY and grabbed a position in the top five for the first time.

Evidently, Chinese and global brands lost some of their share to the Indian players this year. Chinese brands captured a 13% share in 2022 driven by the good performance of OnePlus’ feature-rich devices Nord Buds and Nord Buds CE. realme and OPPO also supported the growth of Chinese brands. Global brands took an 8% share led by Apple, Samsung and JBL.”

Talking about the local production scenario,Associate Director Liz Leesaid, “Domestic manufacturing saw rapid growth, contributing 30% of the total shipments in 2022, compared to just 2% in 2021. Key homegrown brands boAt, Mivi and pTron ramped up their local manufacturing capabilities to account for 73% of the domestic shipment volume in 2022. Other key players like Noise, Truke, Boult Audio, Wings, Gizmore and Play also manufactured made-in-India devices for the first time this year. Moreover, this increase in the shipment share of local production largely led to a drop in the ASP (average selling price) by 20% in 2022. More new launches in the low-price band (INR 1,001-INR 2,000 or around $13-$25) also contributed to the drop.”

Source: India Hearables (TWS) Shipments, Model Tracker, 2021 vs 2022

Market Summary for 2022

- boAttook the lead for the third year in a row with89% YoYgrowth driven by increased penetration in domestic manufacturing, multiple affordable launches, and aggressive promotions. It capturedseven spotsin the rankings for top-10 best-selling models. TheAirdopes 131remained the top-selling model for the second consecutive year with a10% shareof the total TWS market shipments.

- Noiserose to the second spot with2x YoY品牌关注VS系列迎合the

- Boult Audiograbbed the third spot witha 7% shareand167% YoY growthdriven by aggressive marketing strategies and multiple new feature-rich offerings below INR 2,000 (<$25). It also entered the domestic manufacturing space for the first time in 2022. The majority of its volume was driven by the INR 1,001-INR 2,000 (or around $13-$25) retail price band. TheAirbass XPodswas the best-seller in its entire TWS portfolio.

- Mivigrew544% YoYthis year and took the fourth position in the rankings for top-five brands for the first time, driven by its full-fledged made-in-India TWS portfolio, a good number of launches and huge presence in the entry-level price band (

- PTronagain took the fifth spot with a5% shareof the total TWS shipments. In addition, it was the largest brand in the entry-level price band (

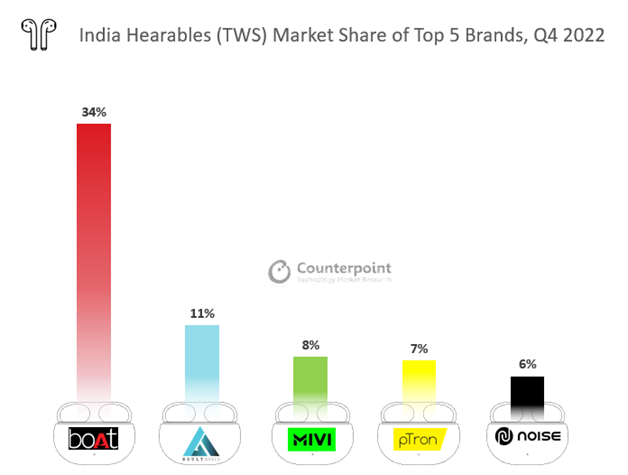

Source: India Hearables (TWS) Shipments, Model Tracker, Q4 2022

Market Summary for Q4 2022

- India’s TWS shipments saw44% YoY growthinQ4 2022driven by festive season sales and promotions and growing local production.

- boAtgrew 3% YoY to mark itstenth consecutive quarter of lead in Q4 2022, whileBoult Audiostoodsecond for the first time11%的市场份额。

- Thetop five TWS brandsin India were alllocal brands– boAt, Boult Audio, Mivi, Ptron and Noise. They accounted fortwo-thirds of the total shipments.

- In Q4 2022,Indian brandscaptured a record 84% share driven by boAt, Boult Audio, Mivi, Ptron and Noise.

- With a4% share,boAt Airdopes 131remained thetop modelfor the seventh consecutive quarter in Q4 2022.

- TheINR 1,001-INR 2,000 retail price band(or around $13-$25) continued to fuel the TWS demand in India during Q4 2022 with an increasedshareof 75%in the overall shipments.boAt mainly drovethe volume for this price band with a45% share,followed by Boult Audio, Mivi, Noise and Wings.

- Thepremium segment(>INR 5,000 or around >$60) captured a4% sharethis quarter, driven by Samsung followed by Apple and JBL.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Anshika Jain

Liz Lee

Anam Padha

Counterpoint Research

press(at)www.arena-ruc.com