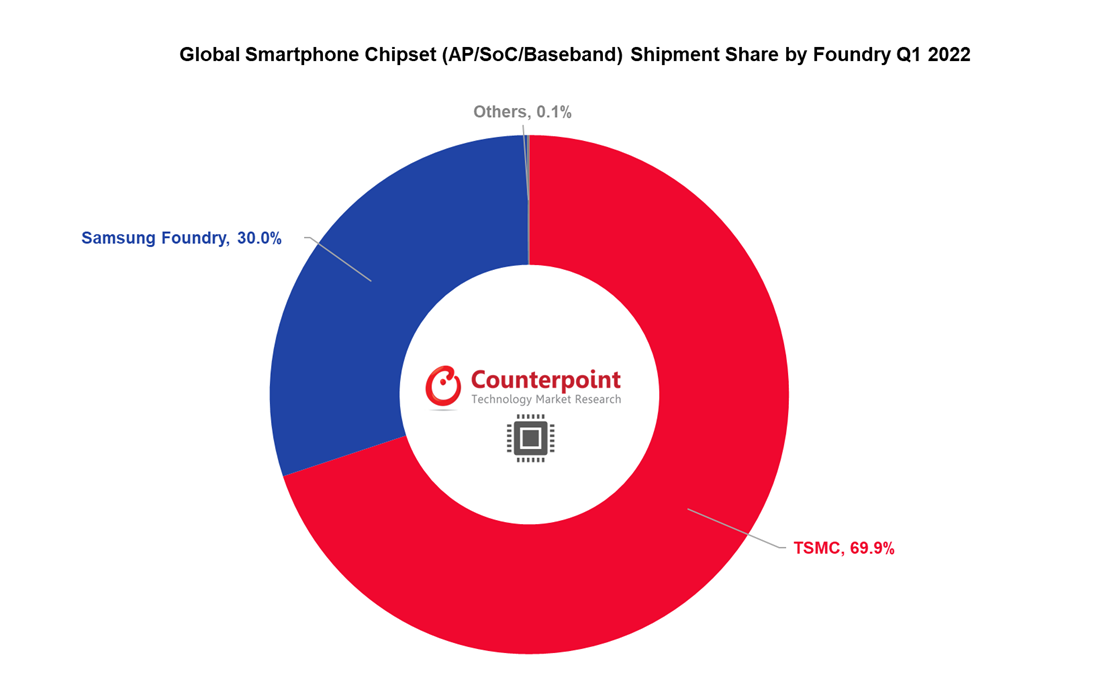

TSMC Captures 70% Share of the Smartphone AP/SoC and Baseband Shipments in Q1 2022

New Delhi, London, Hong Kong, San Diego, Seoul – July 6, 2022

Global smartphone chipset (SoC/AP+Baseband) shipment declined 5% YoY in Q1 2022 due to seasonality, weaker demand in China amid lockdowns and over shipping from some chipset vendors in Q4 2021, according to theCounterpoint’s Foundry and Chipset Tracker. However, this decline was offset by strong growth in the chipset revenues which grew a healthy 23% YoY in Q1 2022, as the chipset mix shifted towards costlier 5G smartphones. TSMC, the world’s largest foundry, captured nearly 70% share of manufacturing the key chipsets going into the smartphones from the completeSystem-on-Chip (SoC) to discrete Application Processors (AP)and cellular modems. Samsung Foundry was the second-largest foundry behind TSMC capturing a 30% share of the global smartphone chipsets.

Source:Counterpoint’s Foundry and AP/SoC service

Note: Total shipments include the AP/SoC and discrete baseband

Commenting on the foundry landscape for smartphone segment, Senior Research Analyst, Parv Sharma, said, “Foundries are extremely highCAPEX, cutting-edge technology businesses which have led to a duopoly for manufacturing advanced chipsets for smartphones. TSMC and Samsung Foundry together control the entire smartphone chipset market and TSMC is more than double Samsung in terms of manufacturing scale and market share. TSMC CAPEX spending is much higher than the competitors. It will invest$100 billion between 2021-2023in 5/4nm and 3nm chip fabrication facilities,WFE, 3D packaging, and ramp up for 5/4nm and 28nm to meet the growing demand. Thus enabling TSMC to capture a large share in the advanced nodes.

TSMCbased smartphone chipsets declined 9% annually in Q1 2022. Due to Qualcomm choosing Samsung Foundry for manufacturing X60 baseband and annual decline in the MediaTek smartphone chipset shipments. However, Qualcomm dual sourcing strategy will add more volumes towards TSMC in 2022. Also the ramp-up of the 4nm flagships from Qualcomm, Apple and MediaTek will enable TSMC to further gain share in smartphone chipsets in 2022.

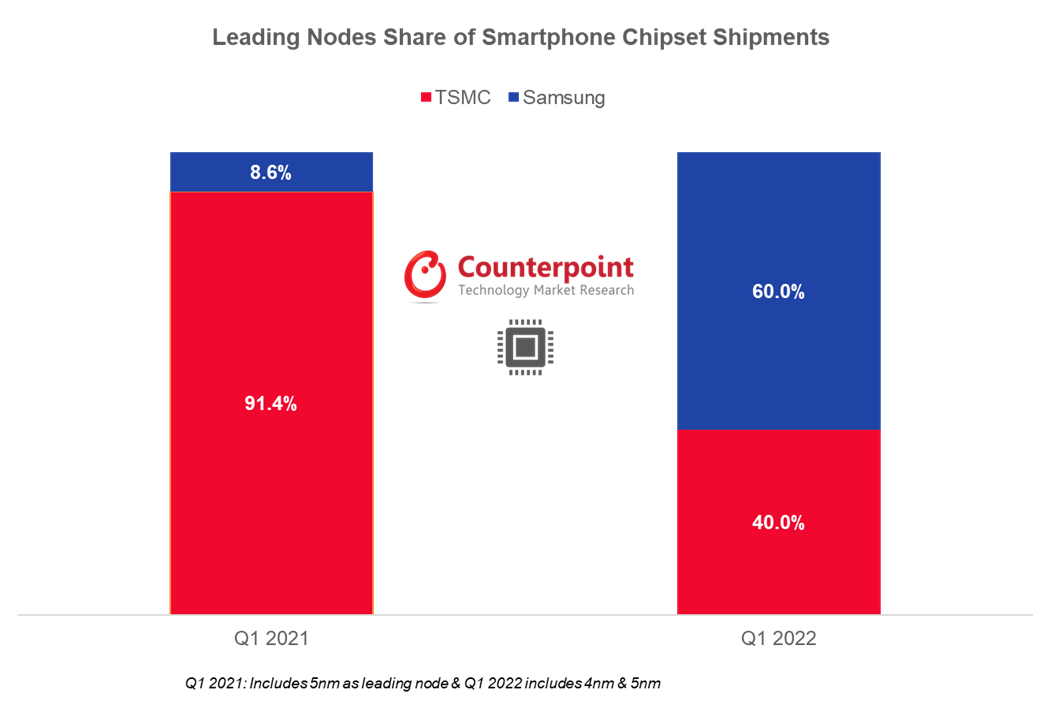

Of the total smartphone chipsets onadvanced nodes(4nm, 5nm, 6nm and 7nm), TSMC captured 65%. TSMC entered mass production for its leading 4nm process node withMediaTek’s Dimensity 9000 SoC in Q1 2022. TSMC’s 4nm node-based smartphone chipset shipments are expected to grow further thanks toQualcomm’sdual sourcing strategy for its future 4nm based Snapdragon 8+ Gen 1 SoC.”

Source:Counterpoint’s Foundry and AP/SoC service

Commenting on Samsung Foundry’s performance, Senior Analyst Jene Park, said, “Samsung Foundry captured around 30% share of the global smartphone chipset shipments thanks to Qualcomm and Samsung Semiconductor’s internal Exynos chipset division. Despite relatively lower yield rates for the leading 4nm process node, Samsung Foundry led the leading nodes (4nm & 5nm) smartphone chipset shipments with a healthy 60% share followed by TSMC which captured a 40% share in Q1 2022. The 4nm shipments at Samsung Foundry were driven byQualcomm Snapdragon 8 Gen 1which has gained more than 75% share in the Samsung Galaxy S22 series in just one quarter. Samsung Foundry also benefitted from refreshed mid-tier 5nm based 5G chipset Exynos 1280 for its higher volumeGalaxy A53 and A33smartphones.

However, the uncertain global macroeconomic climate,potential inventory correctionsand dual-sourcing from Qualcomm could put pressure on Samsung Foundry’s market share overall as well as leading nodes.”

Full report

Global Smartphone AP-SOC Revenue & Forecast Tracker by Model – Q1 2022

here.

Contacts:

Parv沙玛

Jene Park

Dale Gai

Follow Counterpoint Research

出版社(在)www.arena-ruc.com