Price Cuts Boost Tesla Revenue in Q1, Profit Slumps Compared to Last Year

- 200万年vehicle deliveries are achievable in 2023 if the macroeconomic situation doesn’t worsen.

- Gross profit was down 17% YoY to $4.5 billion due to price cuts, raw material inflation, exchange rate impacts and other factors.

- 3.9 GWh of energy storage was shipped during Q1 2023, Tesla’s highest yet.

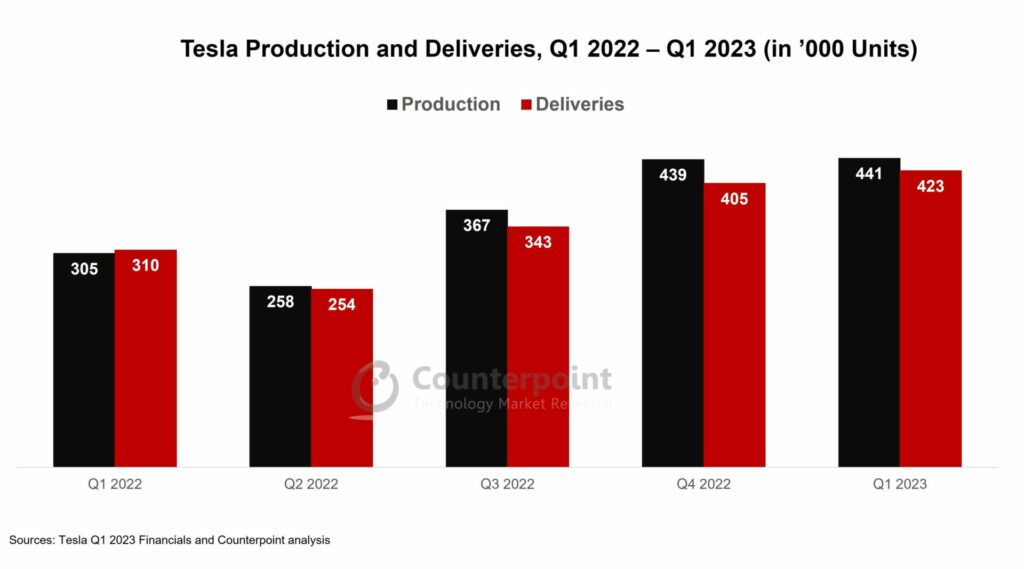

Tesla’s Q1 2023 deliveries stood at422,875 vehiclesglobally and registered a total revenue of$23.3 billion, a YoY increase of almost 25%. WithTeslaannouncing price cuts for its models starting from January, vehicle deliveries also saw a36% YoY boost. Tesla’s sales increased significantly across the US and China, accounting for 40% and 33% of its global deliveries, respectively. Almost 98% of Tesla’s sales came from the Model Y and Model 3. During Q1, the Model Y became thebest-selling carinEuropeand thebest-selling non-pickupvehicle in theUS. The Model 3’s sales also increased significantly in Europe, with almost 29,000 of them being sold in the continent during Q1. As the Berlin factory only produces the Model Y, all the Model 3s sold in Europe were imported from China.

Financial highlights

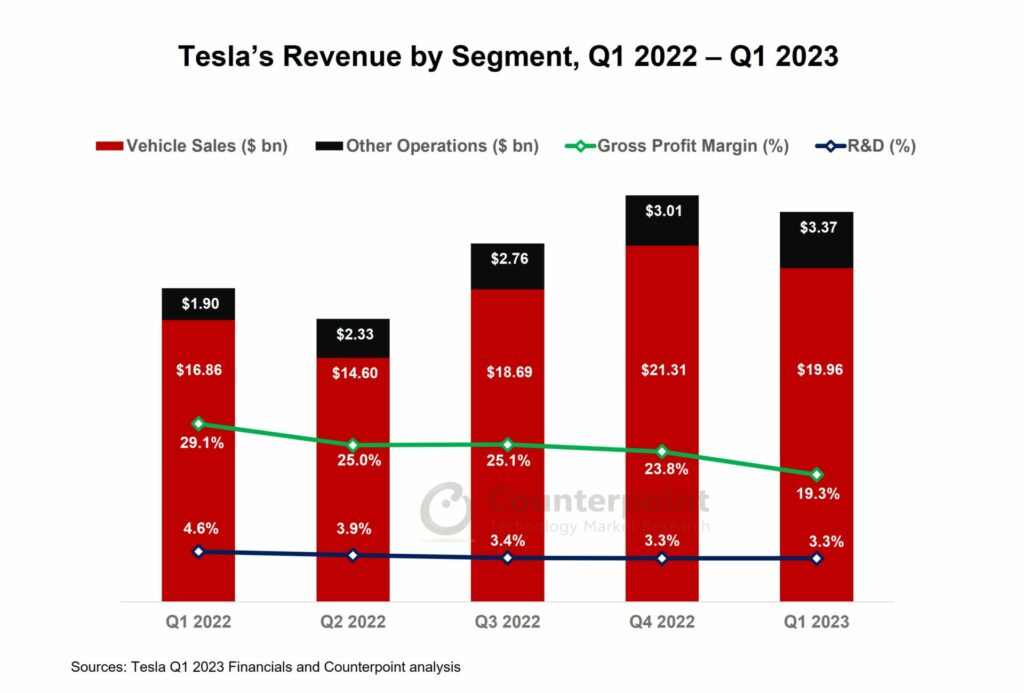

- Revenue from Tesla’sautomotive segmentstood at nearly$20 billion, an 18% YoY increase. Automotive sales accounted for almost 95% of the revenue but revenue from the sale of regulatory credits and vehicle leasing declined significantly.

- Tesla’srevenuefromother businesslines, such as energy deployment and services, increased by 78% YoY to$3.3 billion. During Q1, Tesla deployed a recordMegapack storage, totaling3.9 GWhand growing 360% YoY, the highest in a single quarter.

Although Tesla generated strong revenue in Q1,毛利下降by 17% YoY to $4.5 billion andnet profit declinedby 23% to $2.5 billion. High vehicle deliveries and growth in other business lines helped the revenue, but the lowered vehicle ASPs, high raw material costs due to inflation,increased logistics costs, costs associated with the ramping up of the 4680-cell production, lower-than-expected utilization of the Berlin factory and negative exchange rate impacts all played a role in the lowered profits compared to a year ago.

Although Tesla generated strong revenue in Q1,毛利下降by 17% YoY to $4.5 billion andnet profit declinedby 23% to $2.5 billion. High vehicle deliveries and growth in other business lines helped the revenue, but the lowered vehicle ASPs, high raw material costs due to inflation,increased logistics costs, costs associated with the ramping up of the 4680-cell production, lower-than-expected utilization of the Berlin factory and negative exchange rate impacts all played a role in the lowered profits compared to a year ago.- Tesla’s Q1 operating profit was 11.42%, a decline of 4.6% sequentially.Teslaclaims to have abetter positionthan its competitors who are still struggling through the challenges ofreducing EV unit costs. Tesla aims to leverage its position as a cost leader, which it has achieved through increased penetration of in-house designed controllers, batteries and drive units.

- Q1 R&D expenses were $771 million, 3.3% of total revenue. Tesla is developing a 360-degree ecosystem –特斯拉的操作系统. This will help the companyreduce dependencyon third-party software and cloud subscriptions for its day-to-day work, besides helping in thevertical integrationof software-based services and better cost control.

Outlook

Tesla’s strong position in the auto market has also helped its market outlook.Price cutshave made Tesla’s vehiclesmore affordableand with its Model Y and Model 3 becoming eligible for thetax credit subsidyin the US, we expectTesla to capture over 50% of the country’s EV market. In its earnings call, Tesla alsosignaled more price cuts. It also plans to open another factory in Shanghai to focus on the production of cells and batteries as part of its 100-GW cell factory capacity announced last year.

Tesla expects to start deliveries of its long-awaitedCybertruckinQ3 2023. The company is also working on its next-generation vehicle platform.

With a strong start, Tesla aims for1.8 million global deliveriesduring 2023, but200万年is achievable if themacroeconomicsituation does not deteriorate significantly.

Related posts

- Tesla Reports Record Revenue, Deliveries in Q4 2022

- Tesla’s stellar Q3 performance

- EV Sales in US up 54.5% YoY in 2022; Tesla Market Share at 50.5%

- Global Passenger Electric Vehicle Market Share, Q1 2021 – Q4 2022

- Electric Vehicles Gain Ground in Southeast Asia; Thailand Dominates Volumes

- One in Four Cars Sold in China in 2022 Was an EV With BYD Powering Country’s Outperformance

- Berlin Factory Takes Tesla to Top Spot in Europe EV Sales as Chinese Brands Gain Ground

- Global Electric Vehicle Sales Crossed 10 Million in 2022; Q4 Sales up 53% YoY

- AI Voice Assistants to Push Success of Autonomous Driving, Software-defined Vehicle

- One in Two Cars Sold Will Have Electric Powertrain by 2030

- AR Now High on Automotive Industry Radar