Price Hikes Slow Automotive Industry Recovery

全球汽车工业一直处于混乱状态since 2020. The industry and its supply chain were initially disrupted by COVID-19, and then bysupplychain chaos when the sector was unprepared for the demand rebound.

With the semiconductor shortage beginning to ease, 2022 was expected to be a better year, as indicated by increased sales during the initial months. But Russia’s invasion of Ukraine and fresh COVID waves in China have further delayed the industry’s recovery. Restricted supplies of critical raw materials procured from Ukraine andRussia导致新的供应链的影响,推高raw material prices including that of lithium, cobalt and nickel – the latter by 60% – as well as aluminium and, to some extent, steel. Furthermore, gases used in the production of semiconductors are also impacted – although the overall effect is unlikely to be immediately material. To cope with these cost increases, automakers across regions have reluctantly increased their vehicle prices, despite the likely impact on demand.

China

The Chinese automotive sector is contending with a double whammy – subsidy cuts and sharply increasing materials prices. The country’s government cut subsidies on NEVs (New Energy Vehicles) by 30% in 2022. This was long planned but will impact demand right at the point where escalating costs are increasing prices:

- Tesla increased the price of its cheapest Model Y by more than $2,000 in March. The recent inflationary pressure on raw materials and logistics forcedTeslato then make a further price increase, the second time within a week, which looks like bad planning or miscommunication as much as a forced price increase.

- Leading Chinese electric vehicle (EV) manufacturer BYD increased prices by $500-$1,000 depending on the model and specifications. BYD is developing and producing LFP batteries in-house but still increased prices twice this year.

- Xpeng, a rising ChineseEVstart-up, followed in the footsteps of larger OEMs to increase prices by $1,500-$3,000. Smaller OEMs may find it harder to control costs and compete with larger OEMs as they have less control over supply chains.

- Other important auto OEMs such as Chery, SAIC, Hozon Auto and Wuling Motor also announced price increases for NEVs.

- ORA has been forced to stop taking new orders due to a shortage of chips and other corecomponents.

US

The US recently released its EV policies which are designed to push up EV adoption rates. But the Ukraine crisis and geopolitical tension with China may hinder the country’s plans. The US imports a major portion of its rare earth metal requirement for vehicle production.

- To become self-sufficient and to keep theEVadoption progress on track, President Biden may include these rare earth metals under the Defence Production Act, which will enable the country’s mining industry to extract and refine these metals. Mining in the US has been restricted due to its environmental impact. Any resumption of broader domestic mining activity will eventually lead to price decreases, but this is not a quick fix.

- Automakers are increasing prices to deal with supply chain situations and simultaneously building inventories as a hedge against future supply chain shocks. The largest EV manufacturer in the world, Tesla, increased prices by $2,000-$12,500 depending on the model from the third week of March. Ford has made significant price increases across several models. The F-150 Raptor was subject to the biggest increase ($3,300).

Europe

The ongoing Ukraine crisis has forced European automakers to halt production lines as the supply of criticalauto partshas been severely hit. Moreover, in solidarity with Ukraine’s fight against Russia, automakers have withdrawn from Russia.

Auto OEMs such as Volkswagen, BMW and Porsche temporarily shut down plants to deal with the supply chain disruption. European automakers are dependent on Russia and Ukraine for the supply of raw materials for battery production, wire harness, neon gas and more. However, the level of dependence isn’t so high, which is one reason European automakers haven’t increased prices compared to other regions. There may be another reason, like profit margins, which are higher for European automakers and can absorb some of the extra costs.

- Inflation across Europe reached 7.5% in March 2022, up from 5.9% in February. Though no OEMs operating in Europe, except Tesla, have announced price increases so far, we expect them to do so soon. The rising prices of petrol and diesel in Europe have created a favourable market for EVs, so automakers don’t want to disrupt EV demand by increasing prices.

Japan

The Japanese government removed most-favoured-nation (MFN) treatment for Russia over its invasion of Ukraine. This increased import tariffs by 3% to 10%. The demand for aluminium for automotiveapplicationsis rising due to the growing demand for lighter-weight products in line with the shift towards electricmobility. For these reasons, the Japan Aluminium Association is also concerned about price hikes, which may slow down BEV adoption in Japan.

- German automakers Volkswagen and Mercedes-Benz raised prices by an average of 2% and 1% respectively. Jeep increased prices by 13% from March.

- Japanese automakers including Toyota and Honda are resisting price hikes for now, while Nissan is reducing optionalequipmentand vehicle grades to cope with increased costs. For example, it is eliminating manual transmissions and narrowing the combination of best-selling models.

India

India’s government had extended its Faster Adoption and Manufacturing of Electric vehicles-II (FAME-II) program by two years until March. This initiative is further supported by the Production Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) battery storage.Indiais trying to become a world-class manufacturing destination and more self-reliant in terms of production. As India’s automotive industry is dependent on other countries such as China and Japan for automotive parts, it is becoming difficult for automakers to control input costs.

- Indian automakers are also reacting to raw material price hikes by increasing car prices by at least 2%. KIA Motors has increased prices of all its vehicles. Maruti Suzuki, India’s largest passenger vehicle (PV) maker, has also increased the average price of its cars by 8.8% since January 2022. Toyota, Tata Motors, Hyundai and MG Motors have also increased prices for their vehicles across ranges. Even premium vehicle brands such as BMW India, Mercedes-Benz India and Audi India have announced at least a 3% increase in their vehicle prices.

- Due to the lowEVadoption, high prices of lithium and cobalt have not directly impacted the industry. The price hikes in India are mostly due to the rise in the price of steel. Steel is used in manufacturing vehicle chassis and body. Nickel-containing stainless steel is used in some drivetrain components.

- In addition to rising materials costs, fluctuating exchange rates and rising operational costs are other factors driving price increases.

Counterpoint’s Take:

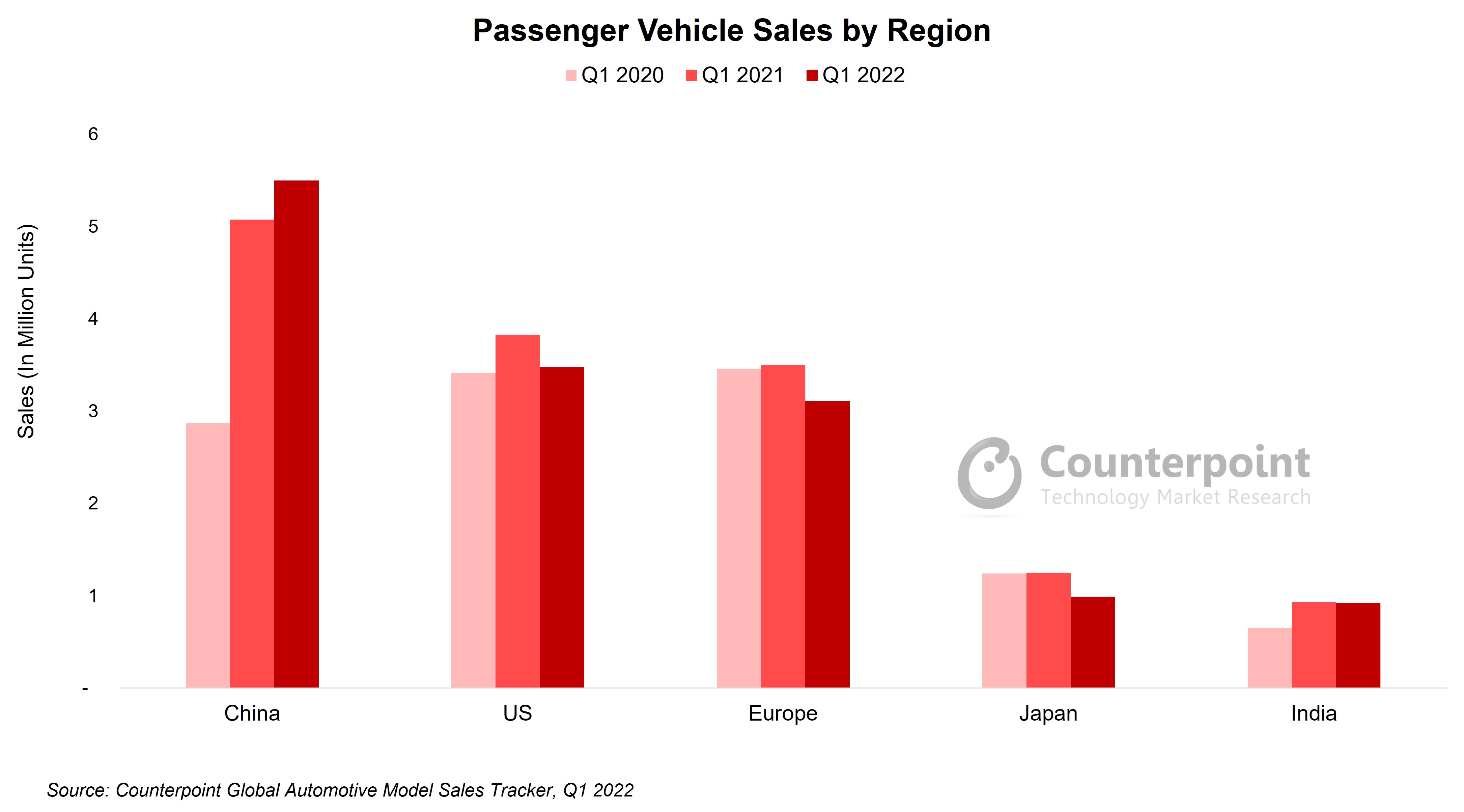

The recent cost increases have already affected the EV industry. 2021 saw EV sales rising by more than 200% but price increases are likely to put the brakes on a continuation of this fast growth. However, while EV sales will slow, sales of conventional ICE vehicles will see more significant declines due to the global fossil fuel price inflation. For 2022, we expect global passenger vehicle sales will be around 72 million, some 5 million units lower than our earlier projections.

联系d Posts

- Top 10 Automotive Announcements at CES 2022

- NXP Sees Record Revenues in 2021; Automotive Segment Leads the Way

- T-Mobile Investing to Pull in 5G Applications

- Ukraine Crisis Derails Automotive Recovery

- 特斯拉艾天:从汽车和芯片的机器人

- Global Cellular IoT Module Revenue Grows 58% YoY in Q4 2021; 5G, 4G Cat 1 Modules Fastest Growing

- Global POS Shipments to Reach 270 Million by 2025 at 19% CAGR

- Global Telematics Control Unit Shipments Grew 13% YoY in 2021

- How Connected Vehicle Data is Shaping the Automotive Industry

- Global Connected Car Tracker, Q1 2019 – Q4 2021

- Global Automotive NAD Module and Chipset Tracker, Q1 2018 – Q4 2021

- Global Connected Car Installed Base, 2021

- Global Cellular IoT Module and Chipset Tracker by Application, Q1 2018 – Q4 2021

- Smart Mobility Intelligence Tracker, February 2022 Edition

- Global Connected Car Forecast, Q1 2019 – 2026F