LG Electronics Revenue at New Record High in Q1 2022

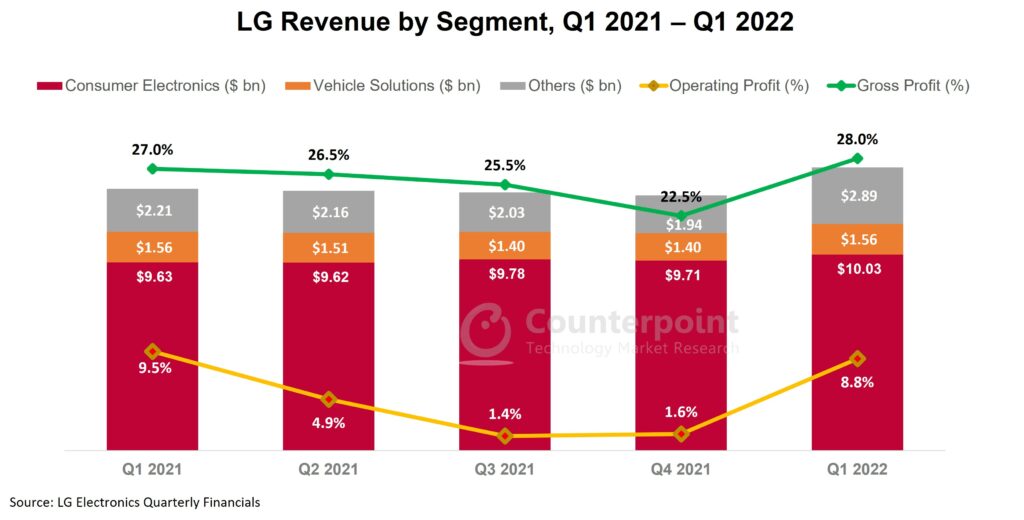

- Revenue reached a new record high of $14.48 billion during the quarter.

- Operating profit recovered to a respectable level.

- Other businesses registered the highest QoQ revenue growth of 51%.

In 2021, LG shut its智能手机业务,这是产生近6%的tal revenue. The closure of this segment has not affected the company much.LG’s revenue increased by more than 16% YoY in Q1 2022 to reach a new record high of $14.48 billion. 46% of this revenue was generated by strong demand for premium products across overseas markets. LGInnotek’s numbers are not included in this analysis.

Revenue from the vehicle solution business grew sequentially. Vehicle sales have been facing a tough time globally due to component shortages but LG is benefiting from the slight rebound. It has alsosigned dealswith leading auto OEMs like Mercedes-Benz, to whom it will provide ADAS andcockpitsolutions. Besides the electronics and vehicle solution segments, LG’s other businesses also witnessed growth in Q1 2022. There has been a sustainable growth in the sales of products for the B2B segment. Moreover, LG’s energy-related solutions (LG Chem) business, which has been included in other segments, contributed to a steep revenue rise. Price hikes of certain high-demand products also contributed to the high revenue generation during Q1 2022.

The revenue could have been more in the absence of the latest COVID-19 lockdowns in China and the Russia-Ukraine war. Also, therestricted supplyof a few key raw materials and increased logistics costs negatively impacted the production.

Q1 2022 Financial Highlights

- Revenue from the consumer electronics segment stood at $10.03 billion, an increase of 3.2% QoQ. This segment contributed to nearly 69% of the total revenue.

- Revenue from the vehicle solutions segment stood at $1.56 billion, an increase of 13.3% QoQ. This segment contributed 10.8% of the total revenue. By strengthening business risk management and continuously improving the cost structure across products, LG reduced this segment’s losses by 33% in just two quarters.

- Revenue from other businesses reached $2.89 billion, an increase of 49% QoQ. This huge increase was due to the transfer of LG’s electric battery business to this segment from the vehicle solutions segment.

- LG格罗斯s profit reached $4.93 billion, a 28% QoQ increase. Gross profit was down during the last quarter due to supply chain disruptions following COVID-19 and increased raw material prices.

MarketOutlook

LG Electronics’ future looks promising with the adoption of newer and advanced technologies across segments. Technologies like Plug-in for Intelligence Equipment (PIE) and Machine-learning based Vision Inspection system (MAVIN) are helping the company to minimize material loss and logistic delays. All these developments will have a positive impact on the coming quarter’s financials.

In the vehicle solutions segment, we expect to see a rise in business as demand forsmart cartechnology combined with increased demand forin-vehicle connectivityis increasing. Being a leader in this segment, LG will leverage its position by forming various JVs and partnerships that will boost its future revenue generation from this segment. Apart from providing hardware solutions for automotive, LG is also entering the automotive software solutions space with its recent acquisition of TISAX and Cybellum.

Apart from the electronics and vehicle solutions segments, developments in LG’s other segments like energy storage and sales have been noteworthy. Recent partnerships for energy solutions have provided the segment with the necessary boost. Moreover, the increasing demand for EVs will only help the energy solution segment to grow from this point onwards.