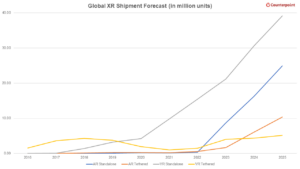

The India-based startup, AjnaLens, is one of the Indian players in the XR (Extended Reality) space joining theMetaverserevolution. Founded in 2014, the co-founders have IIT and engineering backgrounds. Designing and manufacturing in India, AjnaLens offers AR (Augmented Reality), VR (Virtual Reality), andMixed Realitysolutions with applications across different sectors from skill training to enterprise and even the Indian defense sector.

We recently got to spend some time at the AjnaLens office in Mumbai to talk with the co-founders, understand the product offerings, and experience the solutions in action.

The company’s mission & services

The key mission of AjnaLens is to focus on upskilling the workforce and bridging the digital divide. The company has joined hands with Tata Technologies to upgrade 150 ITIs (Industrial Training Institutes) in Karnataka, India; to upskill over 9000 students using a VR-based simulator.

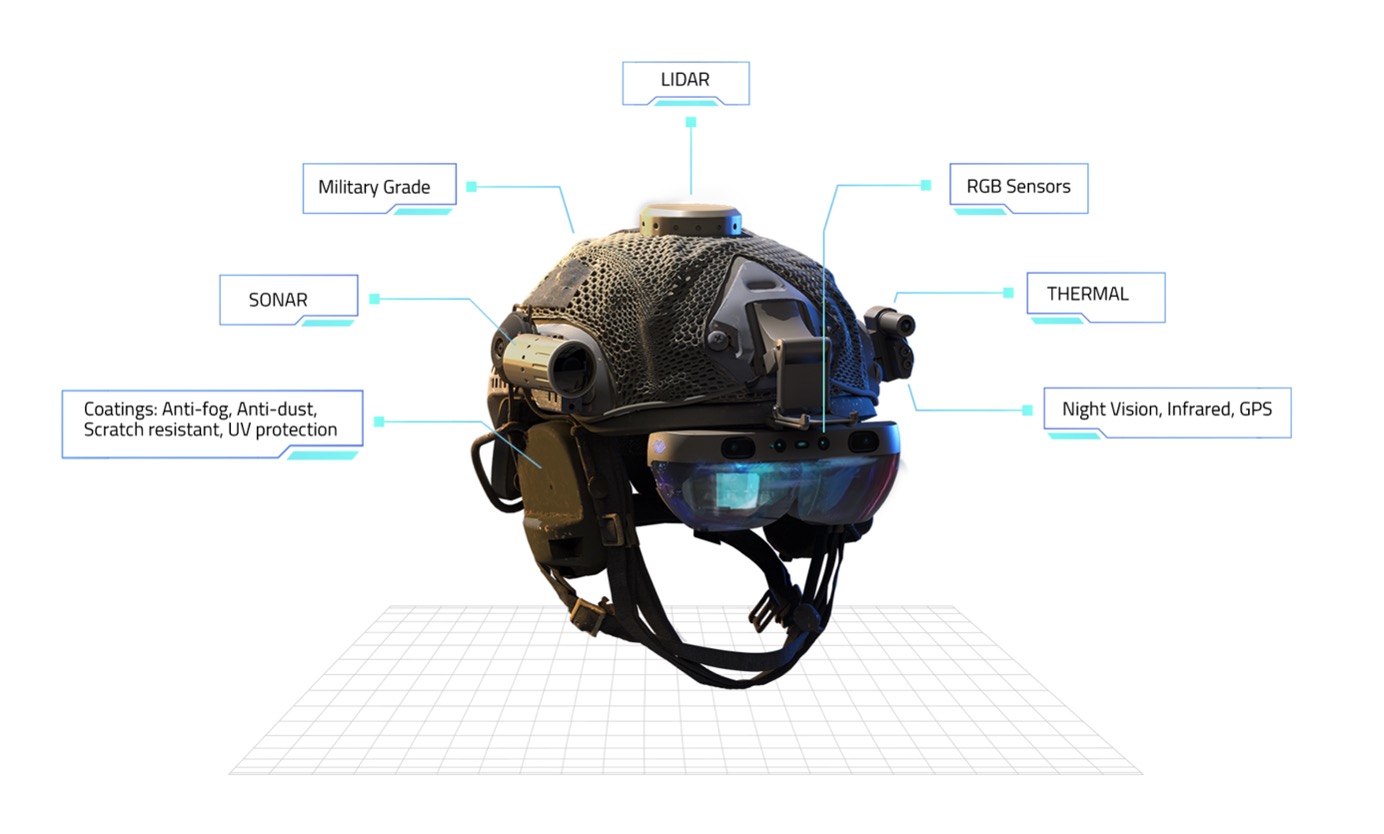

AjnaLens also leverages technologies such as artificial intelligence and mixed reality to upgrade defense weapon systems and tanks to help increase the effectiveness of combat missions. The mixed reality glasses can be mounted on soldiers’ helmets, enabling them to efficiently carry out surveillance and security.

Though the defense was just a byproduct, it is now most of their business. This military-grade Mixed Reality helmet also includes features like GPS for navigation, night vision, LIDAR, Sonar, and thermal scanners.

There are three core product applications:

• AR-glasses for enterprise

• Mixed Reality glasses for the military

• XR Station forVRtraining purposes

AjnaLens also has its own app marketplace where it can customize apps based on specific client needs. The marketplace also allows third-party app developers to submit and publish their apps. Using Android OS as a base, AjnaLens has filed for over 15 national & international patents in augmented reality, and its algorithms are its secret sauce for powering and integrating the entire system.

The upskilling challenge for industries

One of the biggest challenges facing industries is training the workforce with new skills and capabilities. The post-COVID-19 hybrid and remote working is making training even more challenging. But with VR and metaverse, these challenges can be more easily overcome.

In VR training, like that offered by AjnaLens, workers are instantly teleported to the job site (or workshop). It is one of the most effective ways to develop new skills and train the workforce. Scientific research has proven that VR training is more completely and readily absorbed by the brain than traditional classroom-type training.

VR training can offer several benefits, but the two important aspects are that it offers realistic simulations and the ability to teach even hard skills. And what better example than a flight simulator where challenging emergency scenarios can be recreated for pilot training?

WATCH: AjnaLens VR Training – Teleporting Trainees to Job Site

AjnaLens VR for training institutes: Immersive & interactive way of learning

- The AjnaLens team offered us a demo of its VR solution for training institutes, and we were left impressed.

- The VR headset, AjnaLite 2, is tethered to a dedicated VR workstation called Ajna XR Station, and the software is scalable across different use cases; institutes just need to load the training modules.

- Currently, it supports a variety of jobs such as welding, painting, fire, and safety training.

- With this 360-degree immersive environment, students or workers can learn skills like painting for automobiles and aviation.

- Upon completing the tasks, students get instant grades and they can practice for an unlimited time until they perfect the processes.

- As there is no need to have actual paint and car doors to learn painting, it allows organizations to greatly reduce overall training costs.

- For those who wear specs, the VR glasses have an adjustable dial to adjust the lens power.

- The display is bright, and crisp and did not cause any eye-fatigue issues during our limited usage.

- The VR glasses and equipment like a spray gun and the welding gun have trackers to track your movement.

We were impressed with the painting job demo, and the precision of details with the angle of spray and distance.

AjnaLens AR glasses for enterprise

- AjnaLens还拴在AR眼镜和环境aware (see-through) type features.

- These are lightweight glasses that have a 2K display, speaker, and camera.

- It has a 50-degree field of view and can be used to create a virtual space from the connected device.

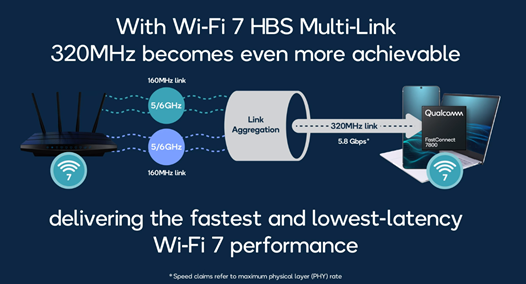

- These glasses are powered by tethering to a Qualcomm Snapdragon 845 SoC or above-powered smartphone, or a laptop or tablet using a Type-C cable.

- There is no processing on the glasses, it only has MCUs for the camera, tracking, sensors, and audio.

- This virtual space can have holograms and avatars, digital twins, web browsers, CAD designs, and Office apps.

- Users can also take virtual team calls over platforms like Microsoft Teams or Zoom.

- We did give it a try and it was quite comfortable to wear.

- The display was bright enough, and color reproduction was good too.

Overall, we were left impressed with the demos we saw at AjnaLens’ office, and with this hybrid work culture and remote assistance use cases, there is room to grow and expand beyond India. AjnaLens is one of the companies in the XR space to watch out for.

Other takeaways from Qualcomm’s quarter ended June 27:

Other takeaways from Qualcomm’s quarter ended June 27: