Weekly Newsletter

September 7, 2023

Guess Which EV Market Loves

Chevys, Mustangs and Pickups?

Sign Up for Our Newsletter Here

Receive our insightful weekly newsletter and stay ahead of the competition.

Weekly Newsletter

September 7, 2023

Guess Which EV Market Loves

Chevys, Mustangs and Pickups?

Sign Up for Our Newsletter Here

Receive our insightful weekly newsletter and stay ahead of the competition.

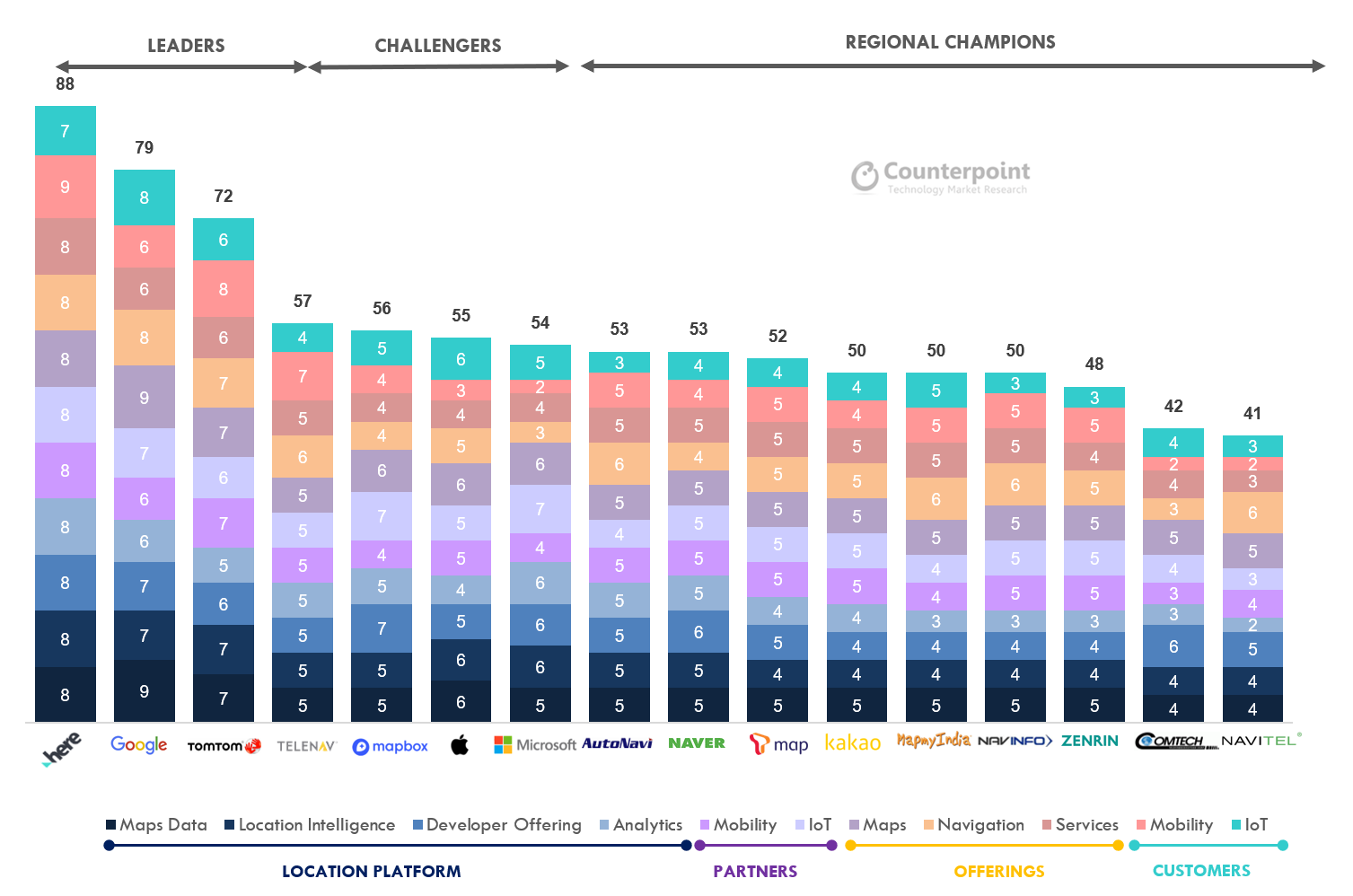

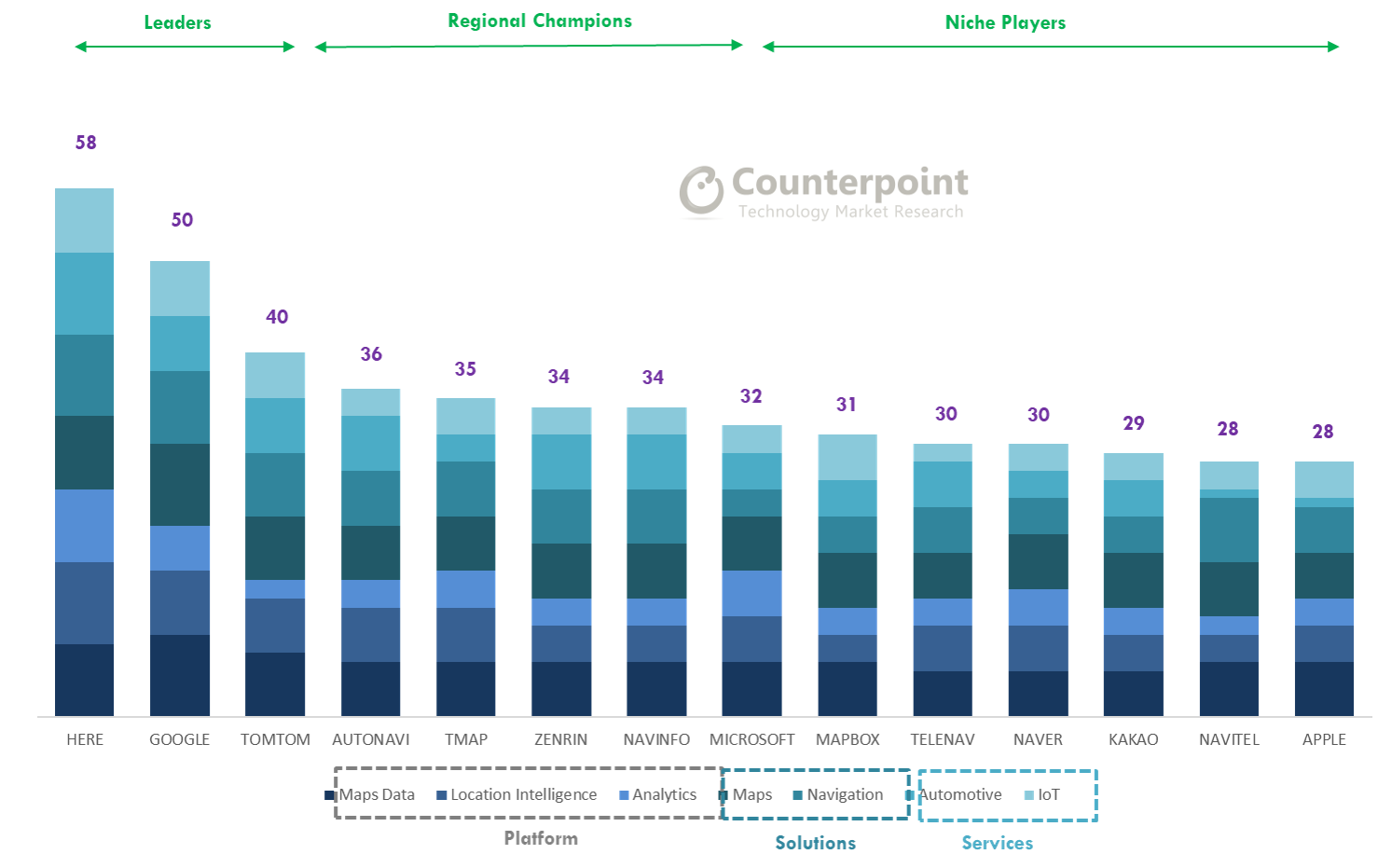

在这里, Google and TomTom continue to lead the location ecosystem effectiveness index, as of H1 2018. The market is evolving rapidly with key firms embracing data analytics and open partnership models to enable real-time location intelligence. Players such as Mapbox, Telenav are rapidly challenging the established platform with unique offerings.

San Diego, Buenos Aires, London, New Delhi, Hong Kong, Beijing, Seoul – July 26, 2018

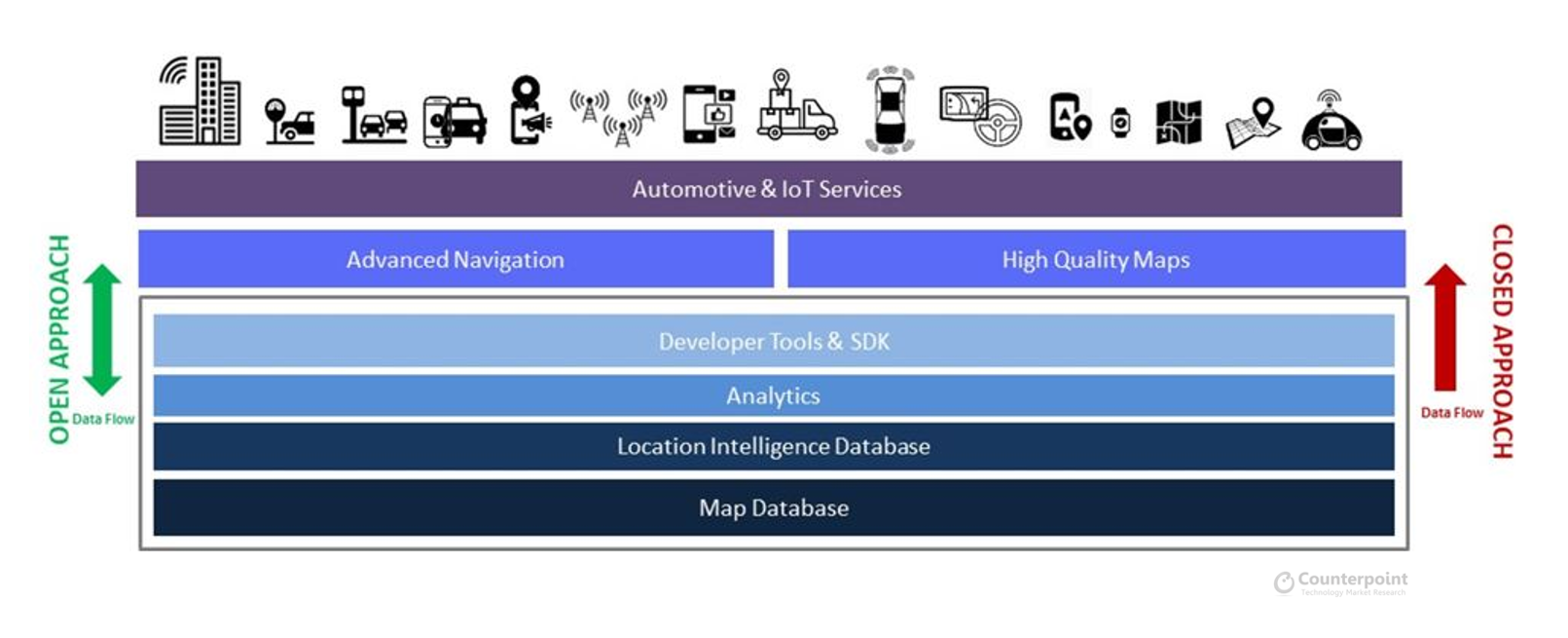

As per the latest report “Location Ecosystems H1 2018 Update” by Counterpoint Research, location platforms are evolving to become highlymodular,as mapping firms leveragecloudinfrastructure, advanceddevelopmenttoolsandopenpartnershipmodels. The industry is undergoing a huge transformation asmap providersare moving to a platform-centric approach beyond just selling maps and navigation solutions for use by auto makers and for device makers. New services and experiences are being enabled by combininglocation-centric intelligenceto the existing map data and leveraginganalyticsengines to process streams of real-time location intelligence. The new generation location platforms are formed by grouping modules of rich maps data, location intelligence, analytics and services.

Exhibit 1: Open Location Platform Approach A Winning Strategy

Exhibit 1: Open Location Platform Approach A Winning Strategy

The above approach enables them to easily drive multiple applications and solutions that require location intelligence. This platform approach is being adopted by some of the key players, allowing them to not only offer next generation richer, smarter advanced mapping and navigation services but also to cater to different vertical applications. We have evaluated these top mapping platform providers on different parameters as below:

Exhibit 2: Global Location Platform Index & Rankings

Commenting on the findings, Research Director, Neil Shah says, “HERE continues to lead the market, as significant work has been done on building a digital “Reality Index” which has made their mapping database more intelligent. Open Location Platformmodelis also unique compared to rivals, which has catalyzed customer and partnership growth. It has expanded its reach to huge markets like China where Google and TomTom are almost non-existent. Extending HERE’s strong position in mobility segment, the company has done significant work in building HD Maps and related services to power next generation autonomous driving systems. Further, acquisitions of indoor map providerMicellomakes it the top indoor maps provider globally. Further, newer initiatives such as HERE Mobility Marketplace is quite potent anddisruptive.”

Mr. Shah, further adds, “Googleis beginning to utilize and monetize its rich set of maps as a platform and is incorporating it in its ad-driven business model, but it falls behind HERE on key parameters, such as providing lucrative developer offerings in terms of API pricing and support, as well as embedding deeper data analytics to build newer services across different segments. Further, it also lacks key partnerships, has a weak customer rolodex beyond smartphones, and missing out on key enterprises.”

Research Director, Mr. Peter Richardson, highlights, “Google continues to lead in terms of access tobillions of active map users, which enriches map database through search, POI and basic navigation. It has been focusing on its mapping capabilities to have more detailed andpersonalized POI and LBS based monetization, however, many potential partners are not open enough to share valuable data and give Google a cut as they get bigger. This makes player such as HERE, Mapbox, TomTom more relevant as potential partners to license maps while not exposing data to someone like Google which could easily become their competitor.

Further, Mr. Richardson adds, “其他科技巨头——在这个空间Apple, has not made significant movement in this space in last one year until its recent intention ofrebuildingentire maps from ground-up.The key announcements at this year’s Apple WWDC 2018 include the launch ofMapKitas a web framework to enable emending maps into different web services. The MapKit JS brings Apple Maps to the website. This is a great move as an alternative to Google and other players dominating this space though overall quality of maps is still questionable which could limit the adoption.”

Commenting on third ranked location platform player, Senior Analyst, Hanish Bhatia, highlighted, “TomTom’sconsumer hardware business(mostly PNDs, wearables, etc), has witnessed significantdropfrom a peak of 60% contribution to revenue in 2014 to almost 30% in 2018. However,Telematicsbusiness remains abright spotwith telematics subscriber base closer to reaching a million subs milestone now. Also, their DSS (Data, Software & Services business is picking up, with key wins from connected car services from Korea brands. Apart from that, mapping API integration intoMicrosoft’sAzure IoTAzure平台地图打开了TomTom映射platform indirectly to millions of Microsoft developers.

Mr. Bhatia further adds, “TomTom’s near-to-mid-term strategy is to grow its telematics business and connected car services business. At the same time, it will focus to build HD Maps for autonomous vehicle opportunities & monetize the location data using APIs & services. In terms of regional champions, Autonavi, Navinfo leads in China, Naver, Kakao in Korea, Comtech, Telenav in North America, MapmyIndia gaining traction in India and Zenrin in Japan.”

The comprehensive – Global Location Platforms Evaluation & Analysis Report from our Emerging Tech Opportunities (ETO) service is available to subscribing clients and can bedownloaded here.

The report takes into account variety of metrics such as richness of database, location intelligence loopback, analytics engine, different location solutions, services, business model approach as well as customer, investor and partner traction across different verticals.

Analyst Contacts:

Neil Shah

+91 9930218469

neil@www.arena-ruc.com

Peter Richardson

+44 20 3239 6411

Hanish Bhatia

+91 9871849857

hanish@www.arena-ruc.com

Follow Counterpoint Research

Since the Apple Maps fiasco at the launch of iOS6 and a publicapologyby Tim Cook in 2012, which led to exit of Richard Williamson who used to be responsible for Apple Maps, Apple seemed to have diverted its attention elsewhere. However, SVP, Eddy Cue, revealed in an interview with Techcrunch that the company has been secretly working on rebuilding Apple Maps from the ground up. This has been supported by multiple sightings of Apple Maps vans actively capturing highly detailed street level information.

The world’s richest tech company, and one of the best when comes to software and hardware integration, has fallen behind in multiple key areas that will define the future of mobile and mobility experiences:

While,人工智能是房间里的大象(see here) and is set to unlock a plethora of intelligent experiences (and warrants a separate discussion),location is the gluethat drives the importantcontextual baseto power those experiences. In addition it helps users withmobilityin getting them from point A to Baccurately,quicklyandsafely. We have, over the years, consistently talked about the importance of location, the quality of mapping platforms, and how the entirelocation industry is shapingwith just a handful of leaders, such as在这里,GoogleandTomTom(see here).

我相信,苹果已经意识到问题的重要性uality maps and location services, and decided to rebuild Apple maps, literally, from the ground-up. However, this might be both a good and bad thing.