印度市场数据(Q1 2022 -智能手机出货量Q2 2023)

Published date: August 17, 2023

A repository of quarterly data for the India smartphone market share. This data is a part of a series of reports which track the mobile handset market:Smartphone and Feature Phone shipmentsevery quarter for more than 140 brands covering more than 95% of the totaldevice shipmentsin the industry.

Source:Market Monitor Service

Source:Market Monitor Service

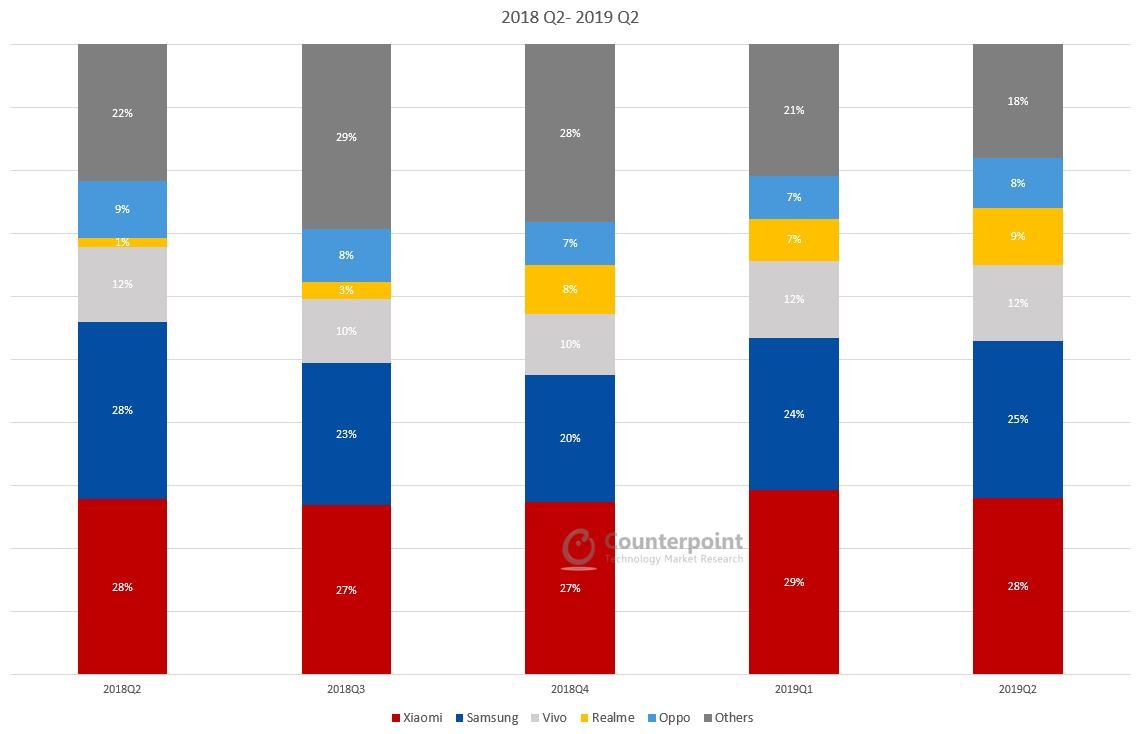

| India Smartphone Shipments Market Share (%) | ||||||

| Brands | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 |

| Samsung | 20% | 18% | 19% | 20% | 20% | 18% |

| vivo | 15% | 17% | 14% | 18% | 17% | 17% |

| Xiaomi | 23% | 19% | 21% | 18% | 16% | 15% |

| realme | 16% | 16% | 14% | 8% | 9% | 12% |

| OPPO | 9% | 11% | 10% | 11% | 12% | 11% |

| Others | 17% | 19% | 22% | 25% | 26% | 27% |

*Ranking is according to the latest quarter.

- India’s smartphone shipments declined 3% YoY in Q2 2023 (April-July). Though it was the fourth consecutive declining quarter, the magnitude of the decline reduced considerably.

- 5G smartphones’ contribution to total smartphone shipments reached a record of 50%.

- With an 18% share, Samsung led India’s smartphone market for the third consecutive quarter. It was also the top 5G brand.

- vivo maintained its second position. It was the only brand among the top five to experience YoY growth.

- 三星超越苹果成为最高溢价segment (>INR 30,000 or ~ $366) brand. Apple continued to lead the ultra-premium segment (>INR 45,000 or ~$549) with a 59% share.

- OnePlus was the fastest growing brand with 68% YoY growth, followed by Apple with 56% YoY growth .

Clickhereto read about India smartphone market in Q1 2023.

The smartphone market share numbers are from:

MOBILE DEVICES MONITOR – Q2 2023 (Vendor Region Countries)

This report is part of a series of reports which track the mobile handset market: Smartphone and Feature Phone shipments every quarter for more than 140 brands covering more than 95% of the total device shipments in the industry.

The deliverable includes

[three_fourth padding=”0 15px 0 0″]

• Single pivot format giving in-depth analysis of theglobal handset market

• Covers140+ brandsnow in comparison to 95 brands earlier

• Break out of3 key countriesin each region给进一步的细粒度视图区域

•18 countries viewas compared to six earlier

• Covers more than95% of the global handset shipments

• More visuals and analysis by country and by regions

[/three_fourth]

[one_fourth_last]

[/one_fourth_last]

This robust quarterly report with fact-based deep analysis covering multiple dimensions will help players across the handset value chain to holistically analyze the current state of the global handset market and plan ahead of the competition.

Related Posts:

Data on this page is updated every quarter

This data represents the Indian smartphone market share by quarter (from 2021-2023) by top OEMs. The Indian market is one of the fastest growing smartphone markets worldwide.

For detailed insights on the data, please reach out to us atcontact(at)www.arena-ruc.com. If you are a member of the press, please contact us atpress(at)www.arena-ruc.comfor any media enquiries.

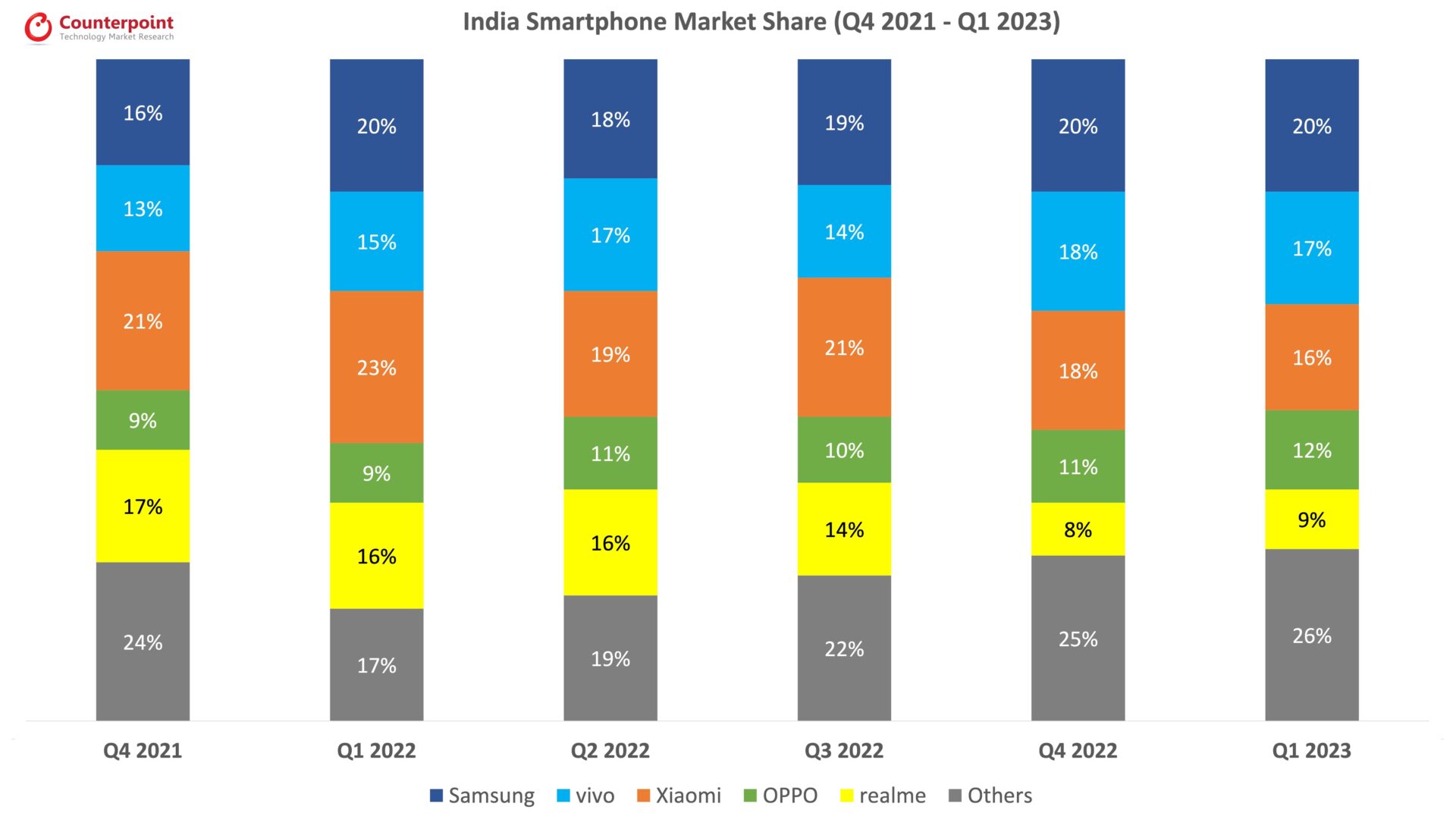

Q1 2023 Highlights

Published date: May 9, 2023

Highlights:

- Q1 2023 (January-March) was the third consecutive quarter to see a decline in India’s smartphone shipments.

- 5G smartphones’ contribution to total smartphone shipments reached a record of 43%.

- With a 20% share, Samsung led the Indian smartphone market for the second consecutive quarter. It was also the top 5G brand.

- vivo captured the second spot and became the leading brand in the affordable premium segment (INR 30,000-INR 45,000, ~$370-$550)

- Apple continued to lead the premium and ultra-premium segments, with strong growth in offline channels.

- OnePlus was the fastest growing brand, followed by Apple.5G smartphones in India captured a 32% share in 2022. Samsung became the top-selling 5G brand in 2022 with a 21% share.

Clickhereto read about India smartphone market in Q1 2023.

| India Smartphone Market Share (%) | ||||||

| Brands | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 |

| Samsung | 16% | 20% | 18% | 19% | 20% | 20% |

| vivo | 13% | 15% | 17% | 14% | 18% | 17% |

| Xiaomi | 21% | 23% | 19% | 21% | 18% | 16% |

| OPPO | 9% | 9% | 11% | 10% | 11% | 12% |

| realme | 17% | 16% | 16% | 14% | 8% | 9% |

| Others | 24% | 17% | 19% | 22% | 25% | 26% |

*Ranking is according to the latest quarter.

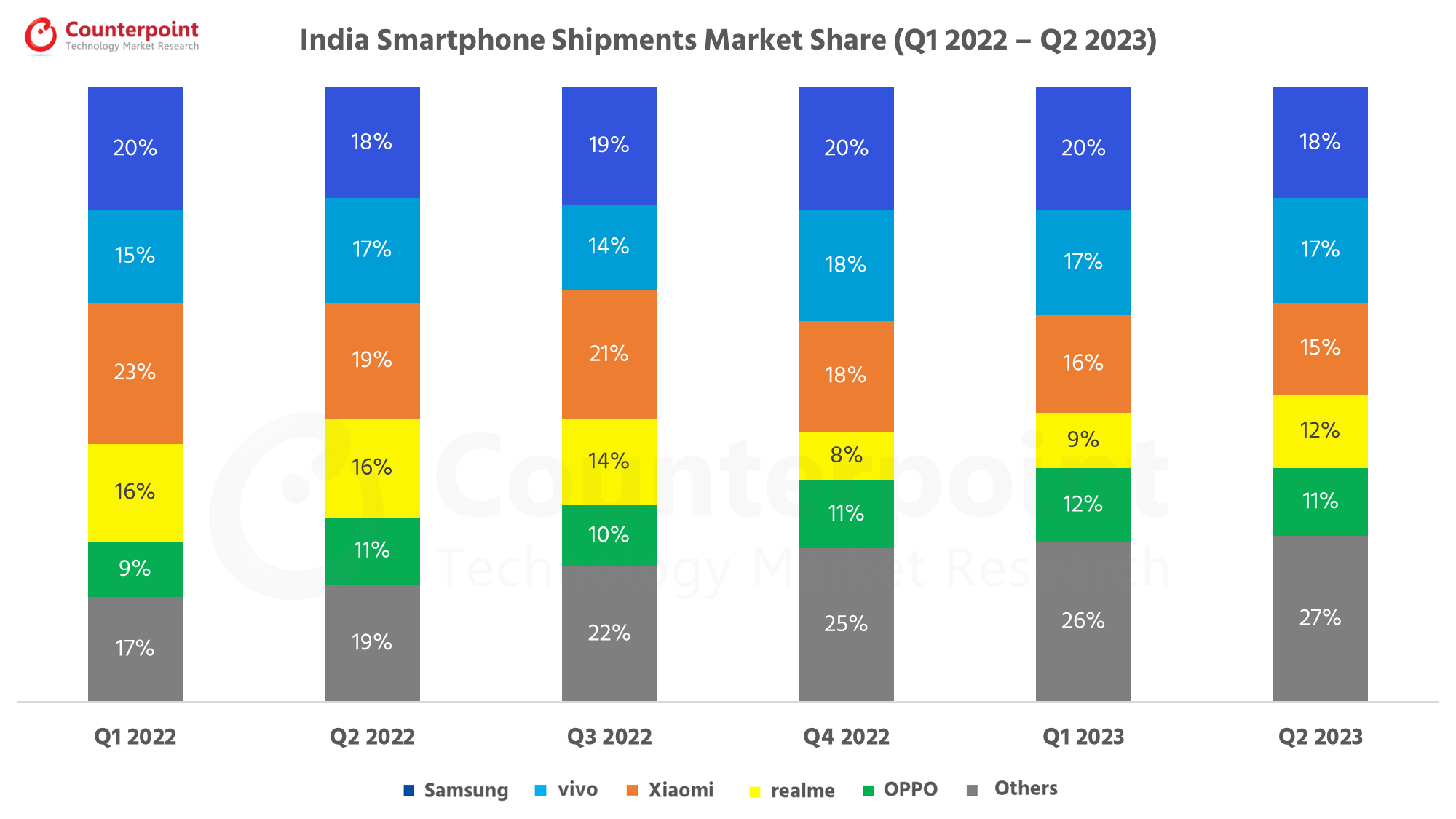

Q4 2022 Highlights

Published date: February 3, 2022

Highlights:

- Smartphone market in India declined 9% YoYto reach shipments over 152 million units in 2022.

- The premium segment (>INR 30,000 or ~$365) contributed 11% to shipments and 35% to market revenue in 2022, the highest ever.

- Samsung emerged as the leading brand in Q4 2022. Also, Samsung led the market in 2022 in terms of shipment value share with a 22% share, followed by Apple.

- In 2022, Xiaomi market share in India, however, in terms of shipment volume, was 20%. Closely following, Samsung market share in India during that same period was 19%.

- In Q4 2022, Samsung led the market, in terms of shipment volume, with a market share of 20%. Xiaomi slipped to third position in Q4 2022.

- vivo market share in India in Q4 2022 was 18% helping it capture second spot in terms of shipment volumes.

- 5G smartphones in India captured a 32% share in 2022. Samsung became the top-selling 5G brand in 2022 with a 21% share.

- Apple continued to lead the premium smartphone segment, with the iPhone 13 emerging as the top-selling model.

Clickhereto read about India smartphone market in Q4 2022.

| India Smartphone Market Share (%) | ||||||

| Brands | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 |

| Samsung | 17% | 16% | 20% | 18% | 19% | 20% |

| Xiaomi | 23% | 21% | 23% | 19% | 21% | 18% |

| vivo | 15% | 13% | 15% | 17% | 14% | 18% |

| OPPO | 10% | 9% | 9% | 11% | 10% | 11% |

| realme | 15% | 17% | 16% | 16% | 14% | 8% |

| Others | 20% | 24% | 17% | 19% | 22% | 25% |

*Ranking is according to the latest quarter.

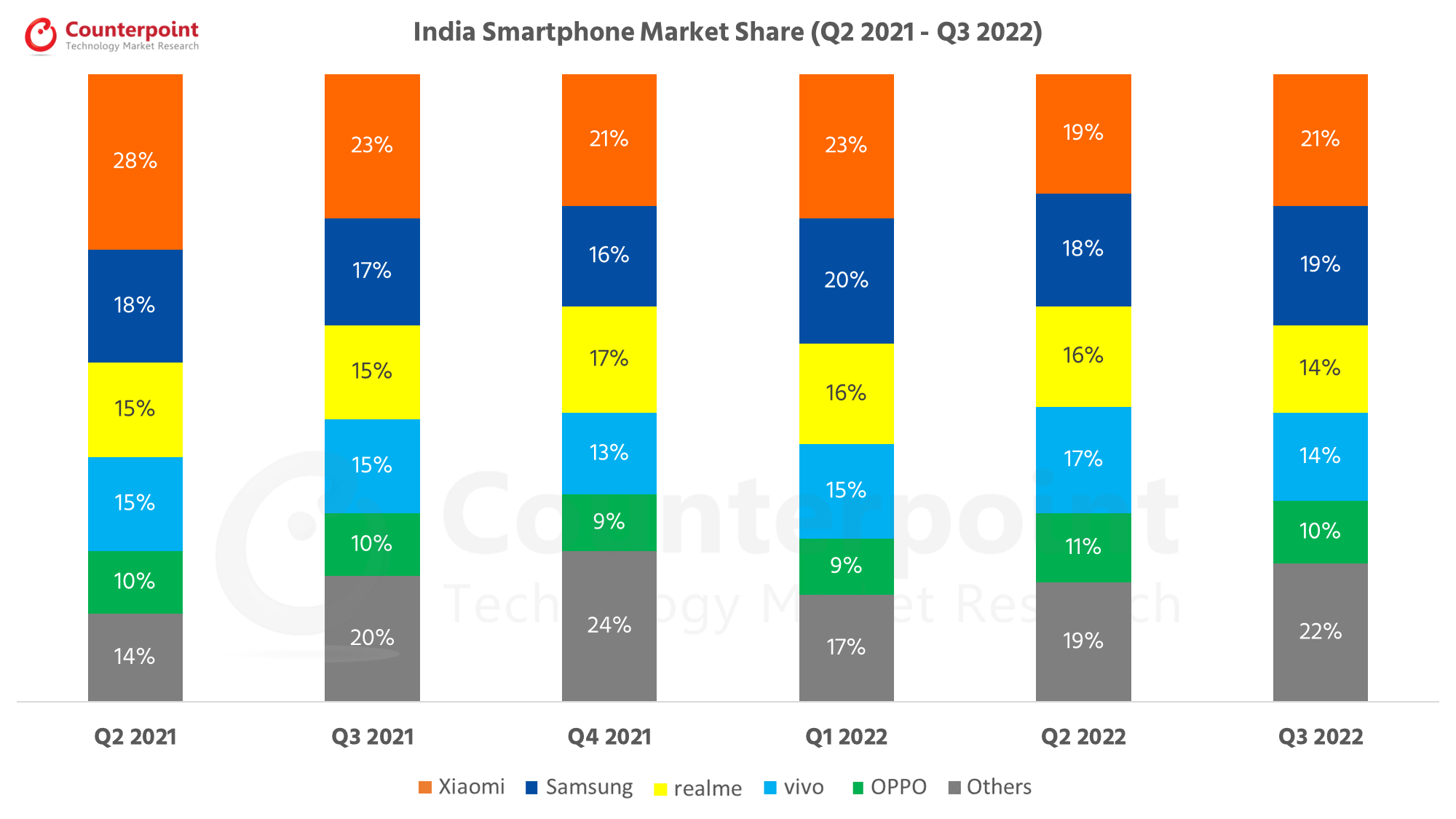

Q3 2022 Highlights

Published date: December 21, 2022

- India’s smartphone shipments declined 11% YoY in Q3 2022 to reach over 45 million units

- Xiaomi led the market with a 21% shipment share, closely followed by Samsung.

- One in three smartphones shipped during the quarter was a 5G smartphone. Samsung led the 5G smartphone segment with a 20% share, closely followed by OnePlus and vivo.

- Apple led the premium smartphone segment, followed by Samsung.

- For the first time ever, an iPhone (iPhone 13) topped the overall India smartphone quarterly shipment rankings.

Clickhereto read about India smartphone market in Q3 2022.

| India Smartphone Market Share (%) | ||||||

| Brands | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 |

| Xiaomi | 28% | 23% | 21% | 23% | 19% | 21% |

| Samsung | 18% | 17% | 16% | 20% | 18% | 19% |

| realme | 15% | 15% | 17% | 16% | 16% | 14% |

| vivo | 15% | 15% | 13% | 15% | 17% | 14% |

| OPPO | 10% | 10% | 9% | 9% | 11% | 10% |

| Others | 14% | 20% | 24% | 17% | 19% | 22% |

*Ranking is according to the latest quarter.

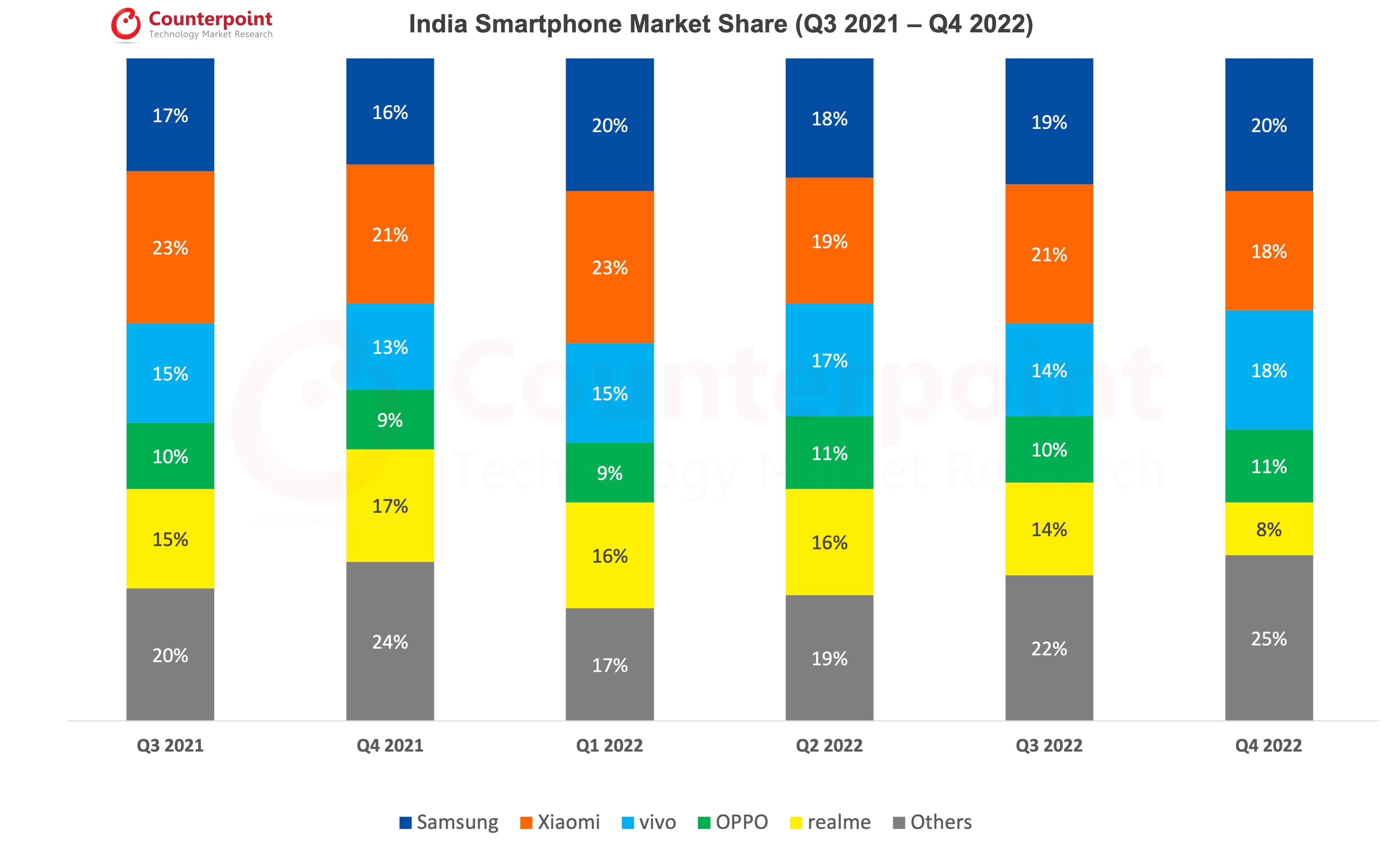

Q2 2022 Highlights

Published date: August 15, 2022

- India’s smartphone shipments grew 9% YoY but fell 5% QoQ to reach almost 37 million units in Q2 2022 (April-June)

- Xiaomi led the market in Q2 2022 with a 19% shipment share, closely followed by Samsung.

- India’s smartphone installed base crossed 600 million during the quarter.

- 5G smartphones contributed to 29% of overall shipments. Samsung led the 5G smartphone segment with a 25% share, followed by vivo and OnePlus.

- Three out of the top five smartphone models in Q2 2022 were from realme.

- Samsung led the premium smartphone market (>INR 30,000), closely followed by Apple.

Clickhereto read about India smartphone market in Q2 2022.

| India Smartphone Market Share (%) | ||||||

| Brands | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 |

| Xiaomi | 26% | 28% | 23% | 21% | 23% | 19% |

| Samsung | 20% | 18% | 17% | 16% | 20% | 19% |

| vivo | 16% | 15% | 15% | 13% | 15% | 17% |

| realme | 11% | 15% | 15% | 17% | 16% | 16% |

| OPPO | 11% | 10% | 10% | 9% | 9% | 11% |

| Others | 16% | 14% | 20% | 24% | 17% | 18% |

*Ranking is according to the latest quarter.

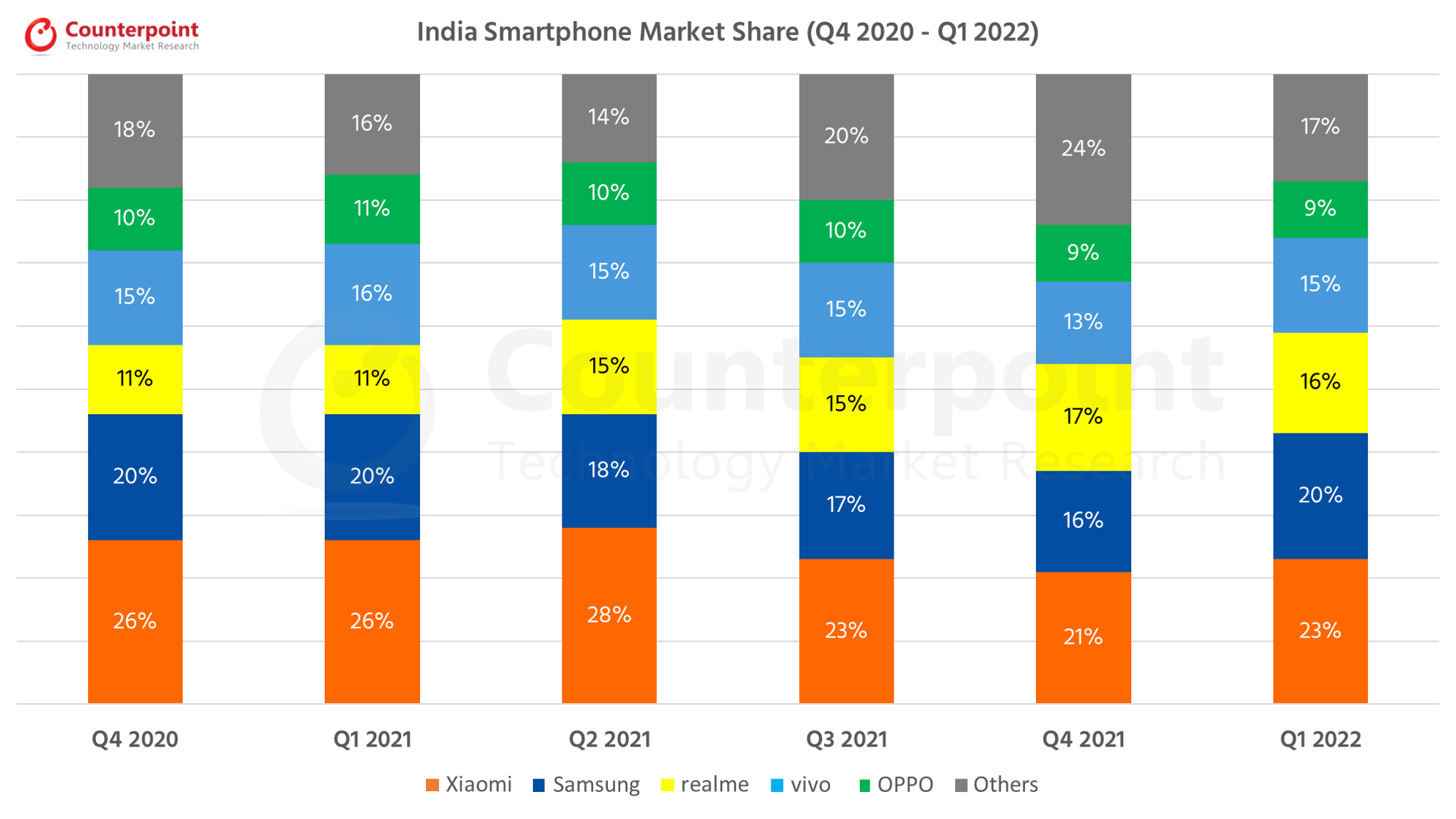

Q1 2022 Highlights

Published date: May 15, 2022

- India’s smartphone shipments declined 1% YoY to reach over 38 million units in Q1 2022

- Xiaomi led the market in Q1 2022 (January-March) with a 23% shipment share. The brand reached its highest ever retail ASP, registering 24% YoY growth

- Samsung captured the second spot and was the top 5G smartphone brand in Q1 2022. The brand also led the affordable premium (INR 30,000- INR 45,000) segment.

- Among the top five brands, realme was the fastest growing and captured the third spot.

- OnePlus’ Nord CE 2 5G was the top 5G smartphone model in Q1 2022

- Apple led the premium smartphone market (>INR 30,000) followed by Samsung.

Clickhereto read about India smartphone market in Q1 2022.

| India Smartphone Market Share (%) | ||||||

| Brands | Q4 2020 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

Q1 2022 |

| Xiaomi | 26% | 26% | 28% | 23% | 21% | 23% |

| Samsung | 20% | 20% | 18% | 17% | 16% | 20% |

| realme | 11% | 11% | 15% | 15% | 17% | 16% |

| vivo | 15% | 16% | 15% | 15% | 13% | 15% |

| OPPO | 10% | 11% | 10% | 10% | 9% | 9% |

| Others | 18% | 16% | 14% | 20% | 24% | 17% |

*Ranking is according to the latest quarter.

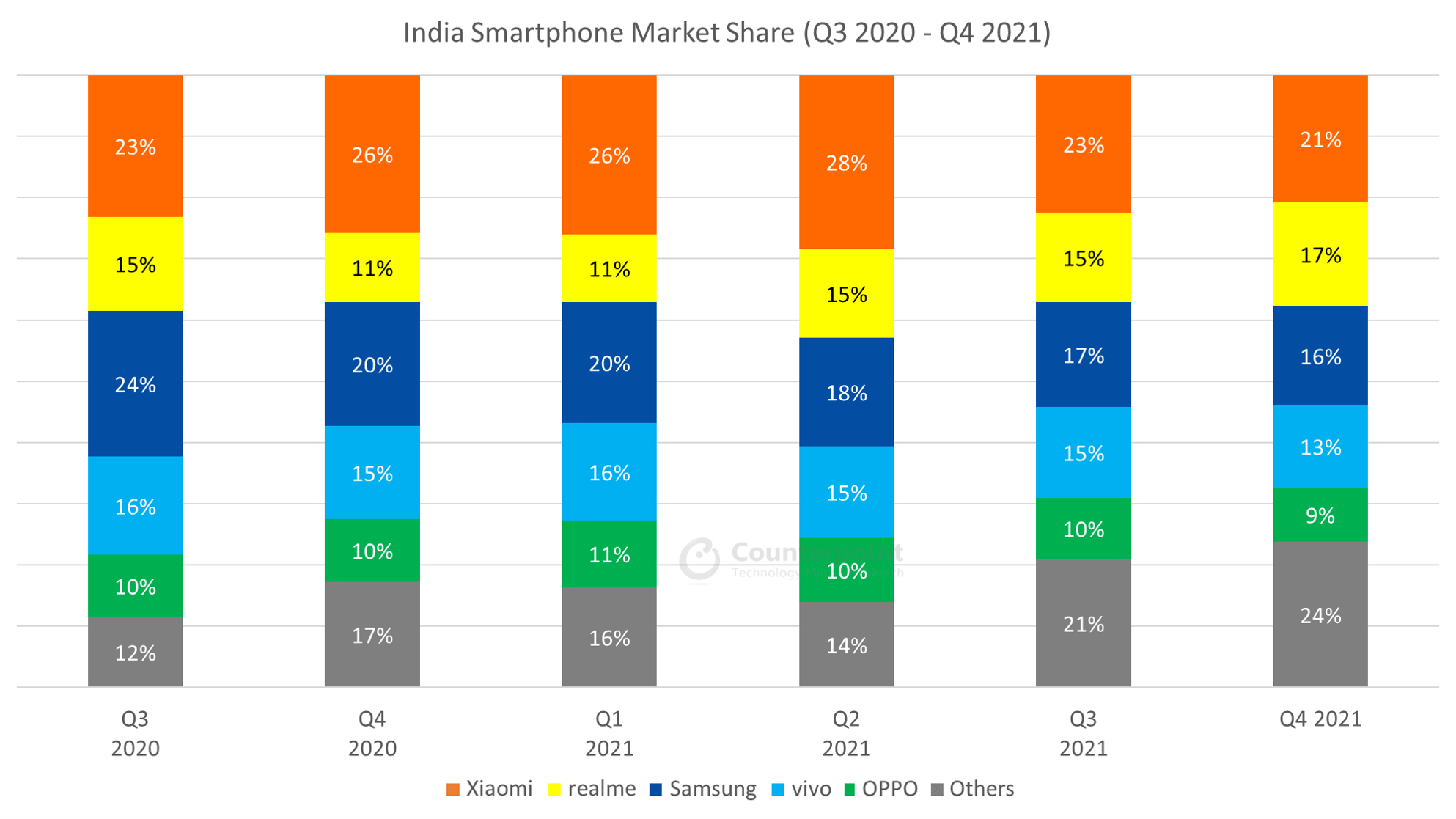

Q4 2021 Highlights

Published date: February 15, 2022

- India’s smartphone market revenue crossed $38 billion in 2021 with 27% YoY growth.

- Xiaomi led the market with a 24% shipment share. The brand also reached its highest ever share in the premium segment (>INR 30,000, ~$400) with 258% YoY growth.

- Samsung registered its highest ever retail ASP in 2021. The brand led the INR 20,000-INR 45,000 (~$267-$600) price segment with a 28% share.

- OnePlus registered its highest ever shipments in India in 2021 and led the affordable premium segment (INR 30,000-INR 45,000, ~$400-$600).

- 5G shipments registered 555% YoY growth in 2021. vivo led the 5G smartphone shipments in 2021 with a 19% share.

- Among the top five brands in 2021, realme was the fastest growing brand. It captured the second position in Q4 2021 for the first time.

| India Smartphone Market Share (%) | ||||||

| Brands | Q3 2020 |

Q4 2020 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

| Xiaomi | 23% | 26% | 26% | 28% | 23% | 21% |

| realme | 15% | 11% | 11% | 15% | 15% | 17% |

| Samsung | 24% | 20% | 20% | 18% | 17% | 16% |

| vivo | 16% | 15% | 16% | 15% | 15% | 13% |

| OPPO | 10% | 10% | 11% | 10% | 10% | 9% |

| Others | 12% | 17% | 16% | 14% | 21% | 24% |

*Ranking is according to the latest quarter.

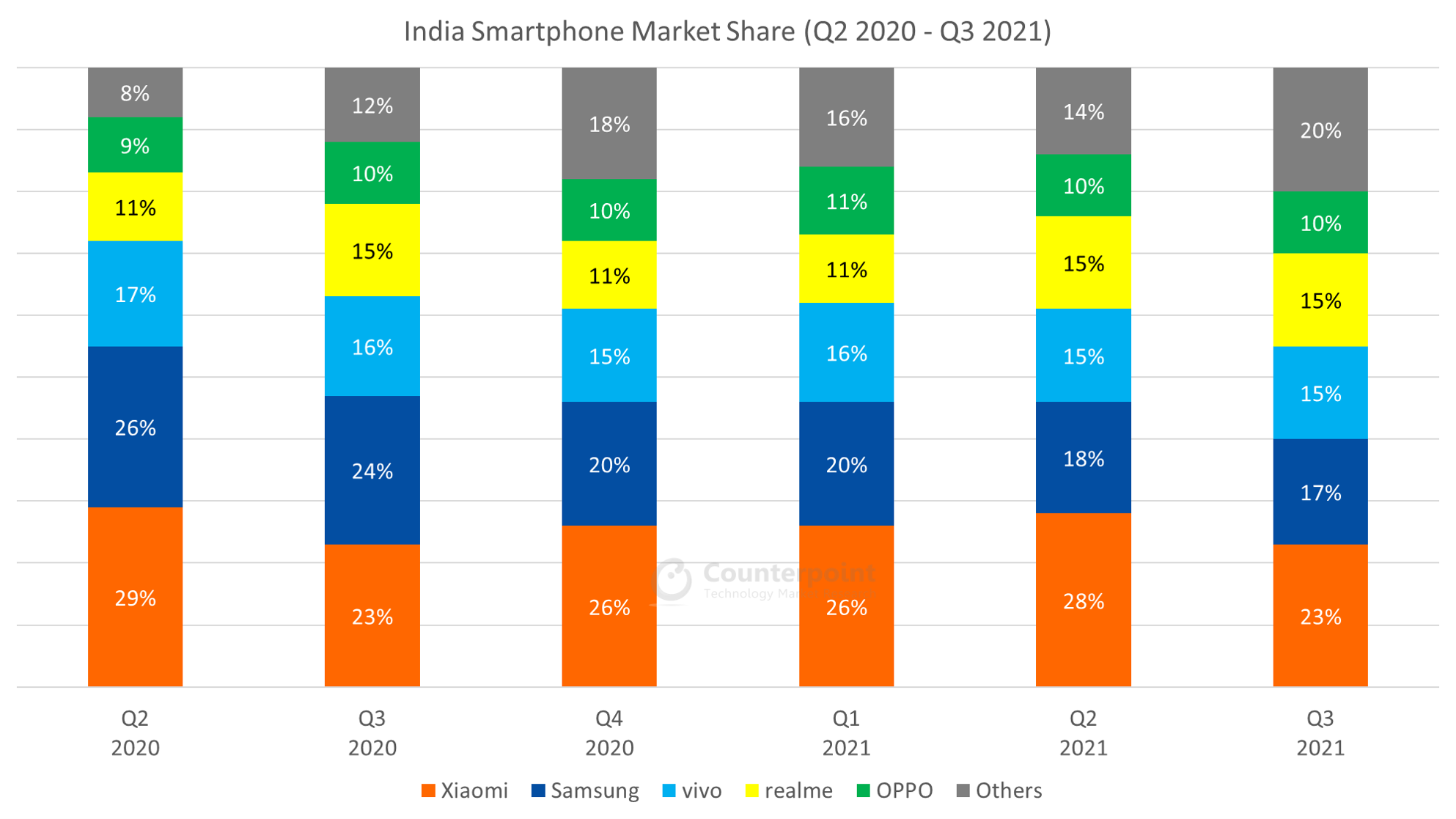

Q3 2021 Highlights

Published date: November 15, 2022

- Xiaomi led the market in Q3 2021 with a 22% shipment share. Three out of the top five models during the quarter were from Xiaomi

- Samsung led the mid-to upper-tier price segment (INR 10,000 – INR 30,000) with a 22% market share.

- OnePlus registered its highest ever shipments in India. Nord series cumulative shipments crossed 3 million units.

- 5G smartphone shipments crossed the 10-million mark for the first time, vivo leads.

- realme led the 5G segment in the sub-INR 20,000 price tier with the highest ever shipments.

- Apple led the premium segment (>INR 30,000) with 45% share.

| India Smartphone Market Share (%) | ||||||

| Brands | Q2 2020 |

Q3 2020 |

Q4 2020 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

| Xiaomi | 29% | 23% | 26% | 26% | 28% | 23% |

| Samsung | 26% | 24% | 20% | 20% | 18% | 17% |

| vivo | 17% | 16% | 15% | 16% | 15% | 15% |

| realme | 11% | 15% | 11% | 11% | 15% | 15% |

| OPPO | 9% | 10% | 10% | 11% | 10% | 10% |

| Others | 8% | 12% | 18% | 16% | 14% | 20% |

*Ranking is according to the latest quarter.

Q2 2021 Highlights

- India’s smartphone market registered its highest ever shipments in H1 2021.

- Xiaomi led the market in Q2 2021 with a 28% shipment share. The brand registered its highest-ever ASP (average selling price) in a single quarter due to the strong performance of the Mi 11 series.

- Samsung captured the second spot with an 18% share while vivo captured the third spot with a 15% share.

- realme became the fastest brand to reach 50 million cumulative smartphone shipments in India.

- OnePlus led the premium market (>INR 30,000) with a 34% share.

| India Smartphone Market Share (%) | ||||||

| Brands | 2020 Q1 | 2020 Q2 | 2020 Q3 | 2020 Q4 | 2021 Q1 | 2021 Q2 |

| Xiaomi | 31% | 29% | 23% | 26% | 26% | 28% |

| Samsung | 16% | 26% | 24% | 20% | 20% | 18% |

| vivo | 17% | 17% | 16% | 15% | 16% | 15% |

| realme | 14% | 11% | 15% | 11% | 11% | 15% |

| OPPO | 12% | 9% | 10% | 10% | 11% | 10% |

| Others | 10% | 8% | 12% | 18% | 16% | 14% |

*Ranking is according to the latest quarter.

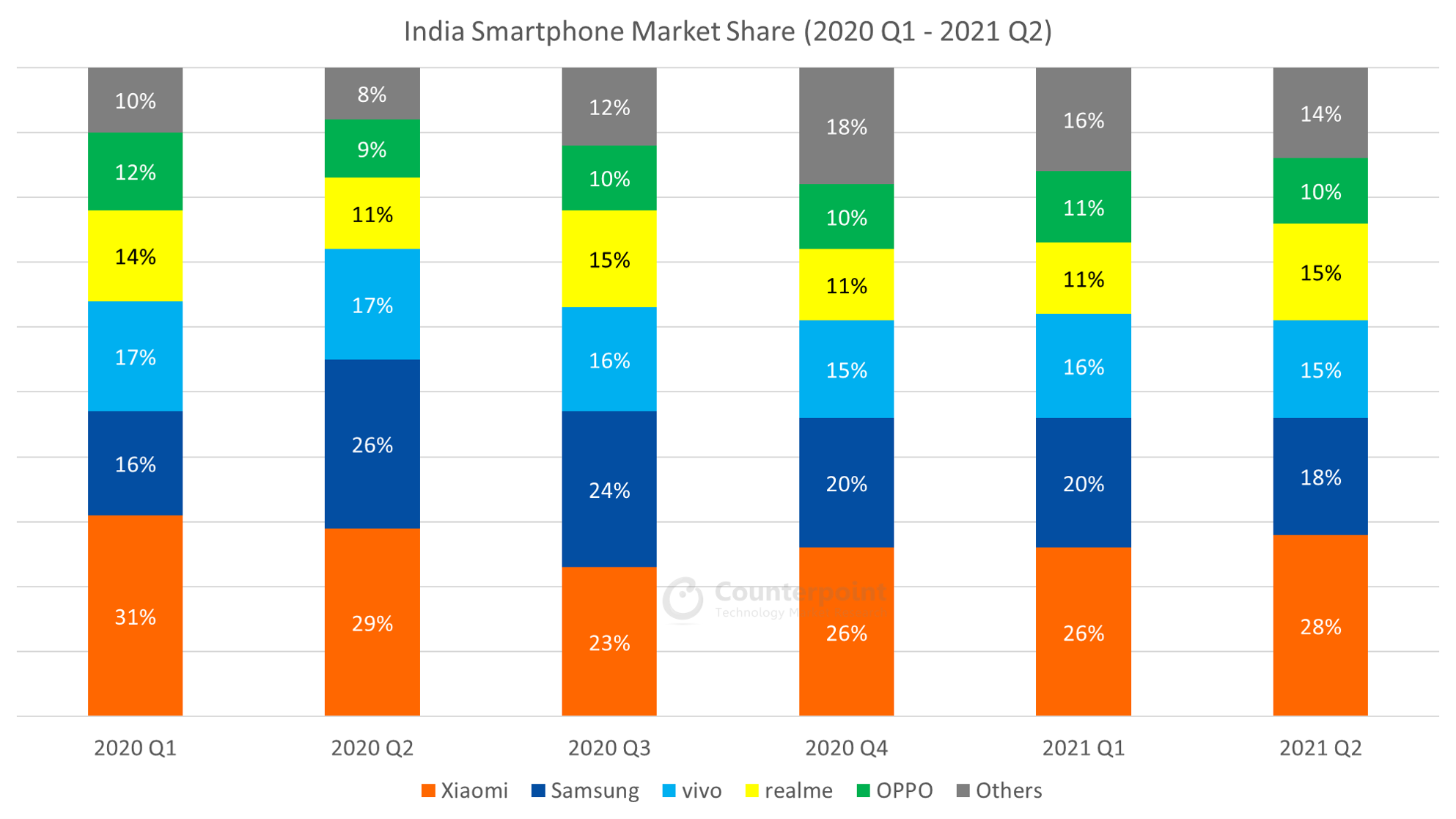

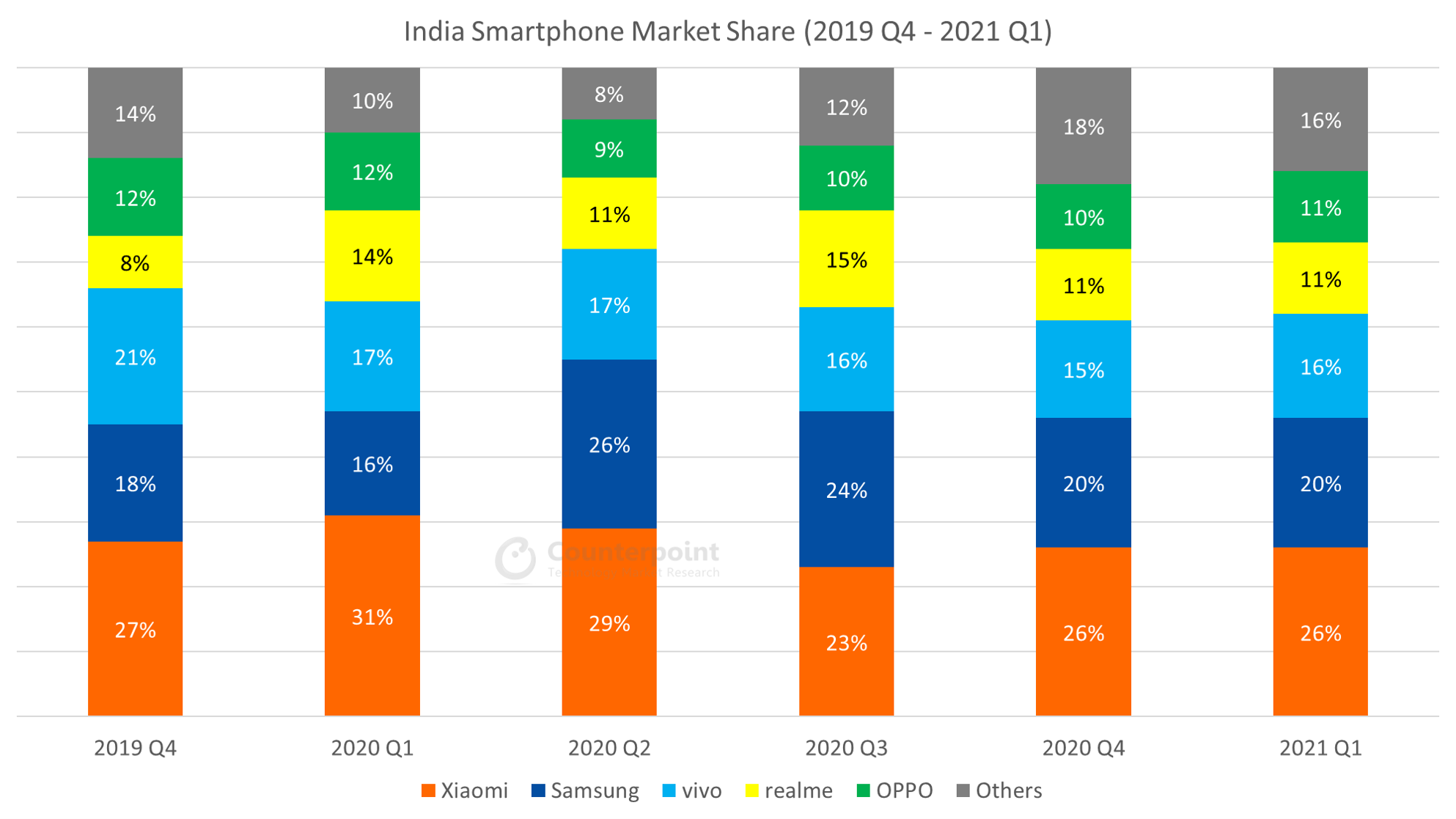

Q1 2021 Highlights

- India’s smartphone shipmentsgrew 23% YoY to reach over 38 million unitsin Q1 2021. These were the highest ever first-quarter shipments.

- New product launches, promotions and financial schemes, as well as pent-up demand coming from 2020, drove the smartphone market in Q1 2021.

- Xiaomi led the market in Q1 2021 with a 26% shipment share. Five out of the top 10 smartphone models in the country were from Xiaomi.

- Among the top five brands, Samsung grew the highest at 52% YoY.

- OnePlus led the 5G smartphone shipments with a 33% share.

- realme had the cheapest 5G offering in Q1 2021.

| India Smartphone Market Share (%) | ||||||

| Brands | 2019 Q4 | 2020 Q1 | 2020 Q2 | 2020 Q3 | 2020 Q4 | 2021 Q1 |

| Xiaomi | 27% | 31% | 29% | 23% | 26% | 26% |

| Samsung | 18% | 16% | 26% | 24% | 20% | 20% |

| vivo | 21% | 17% | 17% | 16% | 15% | 16% |

| Realme | 8% | 14% | 11% | 15% | 11% | 11% |

| Oppo | 12% | 12% | 9% | 10% | 10% | 11% |

| Others | 14% | 10% | 8% | 12% | 18% | 16% |

*Ranking is according to the latest quarter.

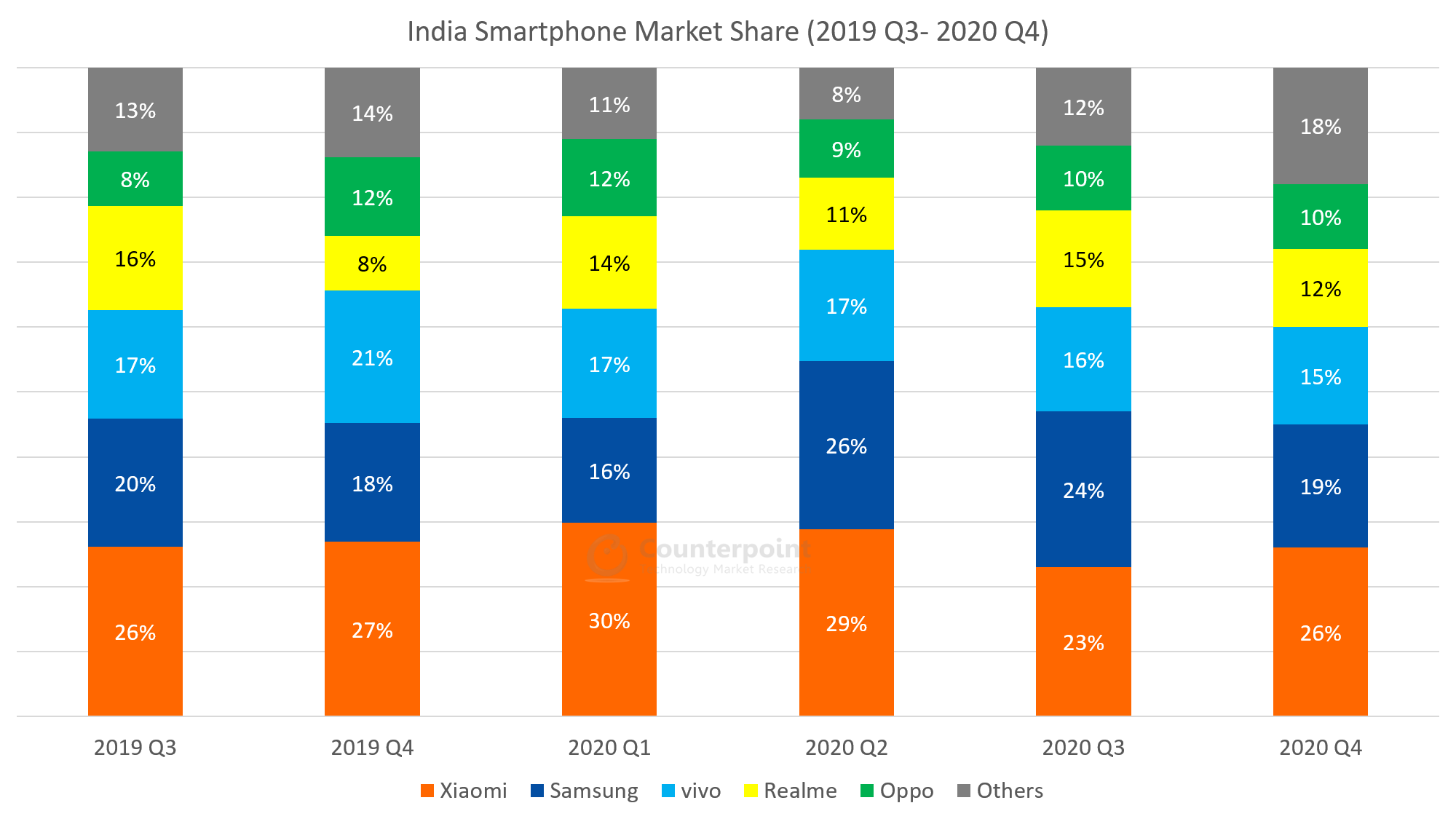

Q4 2020 Highlights

- The Indian smartphone market registered a modest 4% decline in the pandemic-hit year.

- The market crossed 100 million units in the second half of 2020 for the first time ever.

- Xiaomi led the market with a 26% shipment share in 2020, followed by Samsung at 21%.

- Among the top five brands, realme grew the highest at 22% YoY in 2020.

- Apple witnessed its best ever quarter in Q4 2020, selling more than 1.5 million units.

| India Smartphone Market Share (%) | ||||||

| Brands | 2019 Q3 | 2019 Q4 | 2020 Q1 | 2020 Q2 | 2020 Q3 | 2020 Q4 |

| Xiaomi | 26% | 27% | 30% | 29% | 23% | 26% |

| Samsung | 20% | 18% | 16% | 26% | 24% | 19% |

| vivo | 17% | 21% | 17% | 17% | 16% | 15% |

| Realme | 16% | 8% | 14% | 11% | 15% | 12% |

| Oppo | 8% | 12% | 12% | 9% | 10% | 10% |

| Others | 13% | 14% | 11% | 8% | 12% | 18% |

*Ranking is according to the latest quarter.

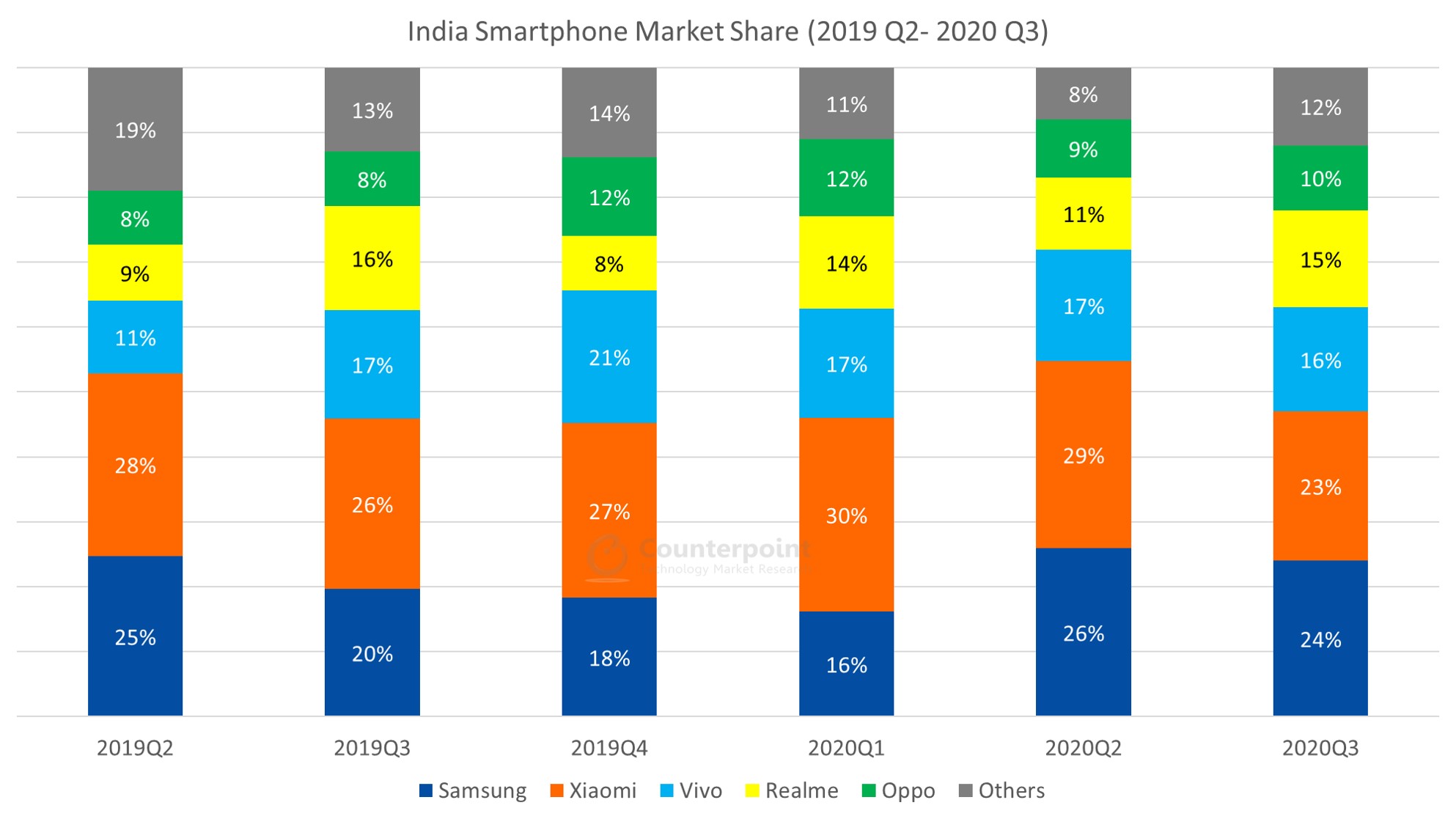

Q3 2020 Highlights

- The smartphone shipments registered 9% YoY growth to over 53 million units. This is the highest-ever shipment in a quarter for India

- Samsung led the Indian smartphone market with 24% shipment share

- Vivo and realme both grew at 4% YoY.

- Transsion Groupbrands (Itel, Infinix and Tecno) regained theirmarket sharein Q3 2020, registering 73% YoY growth.

| India Smartphone Market Share (%) | ||||||

| Brands | 2019 Q2 |

2019 Q3 |

2019 Q4 |

2020 Q1 |

2020 Q2 |

2020 Q3 |

| Samsung | 25% | 20% | 18% | 16% | 26% | 24% |

| Xiaomi | 28% | 26% | 27% | 30% | 29% | 23% |

| Vivo | 11% | 17% | 21% | 17% | 17% | 16% |

| Realme | 9% | 16% | 8% | 14% | 11% | 15% |

| Oppo | 8% | 8% | 12% | 12% | 9% | 10% |

| Others | 19% | 13% | 14% | 11% | 8% | 12% |

*Ranking is according to the latest quarter.

Q2 2020 Highlights

- Pent-Up Smartphone Demand after April, May Lockdown Pushes the June 2020 Volumes to Pre-COVID Levels & the Smartphone User Base in India Beyond the Half a Billion Mark.

- The smartphone market declined 51% YoY in Q2 2020 as April was a washout.

- Xiaomi led the Indian Smartphone Market with a 29% shipment share.

- Samsung recovered the fastest, capturing the second spot in the smartphone market with 26%. reaching its highest share in the past two years.

- Online channel share reached the highest ever, contributing almost 45% of sales.

- During the quarter the unique smartphone userbase surpassed 500 million.

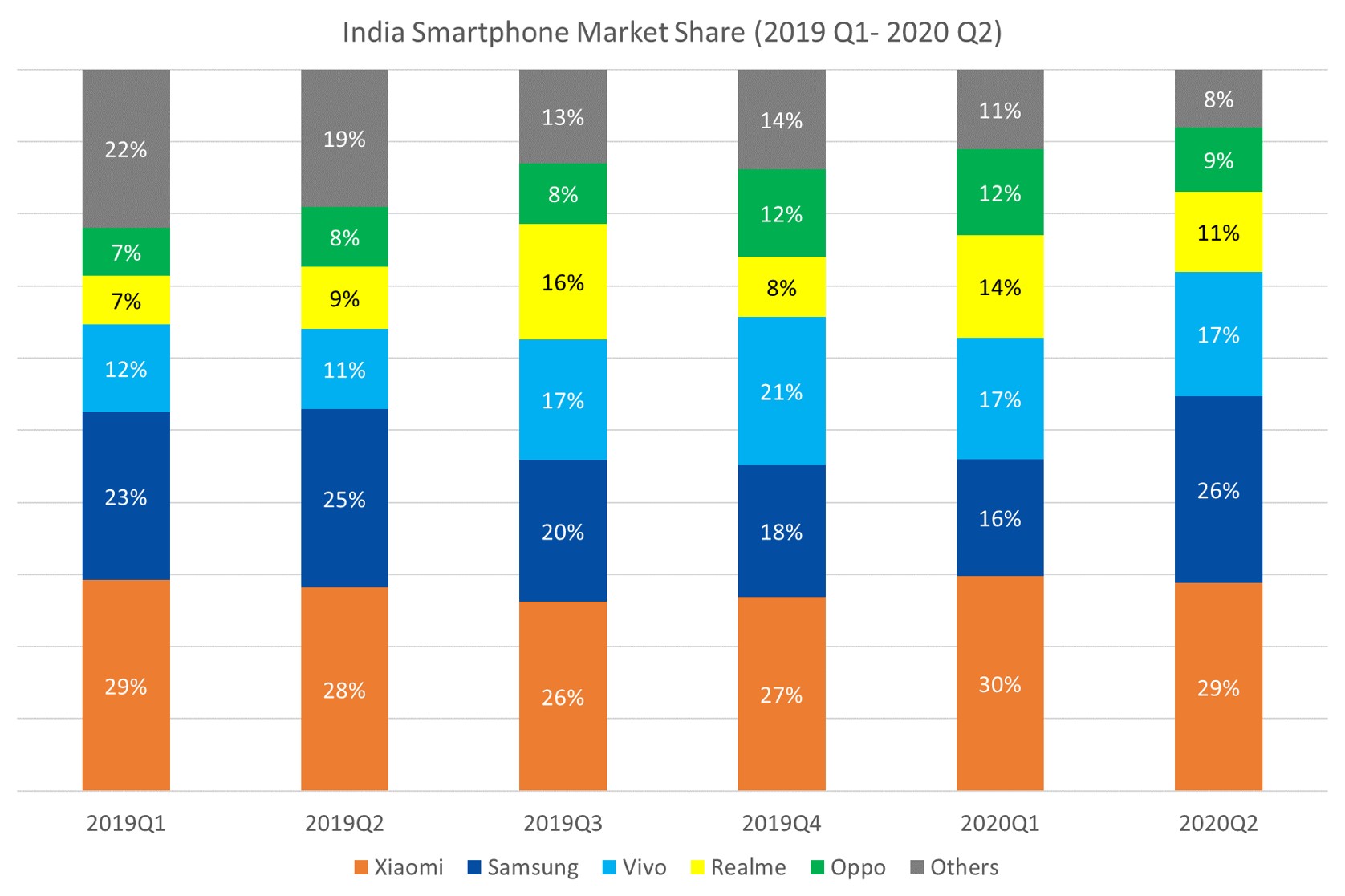

| India Smartphone Market Share (%) | ||||||

| Brands | 2019Q1 | 2019Q2 | 2019Q3 | 2019Q4 | 2020Q1 | 2020Q2 |

| Xiaomi | 29% | 28% | 26% | 27% | 30% | 29% |

| Samsung | 23% | 25% | 20% | 18% | 16% | 26% |

| Vivo | 12% | 11% | 17% | 21% | 17% | 17% |

| Realme | 7% | 9% | 16% | 8% | 14% | 11% |

| Oppo | 7% | 8% | 8% | 12% | 12% | 9% |

| Others | 22% | 19% | 13% | 14% | 11% | 8% |

*Ranking is according to the latest quarter.

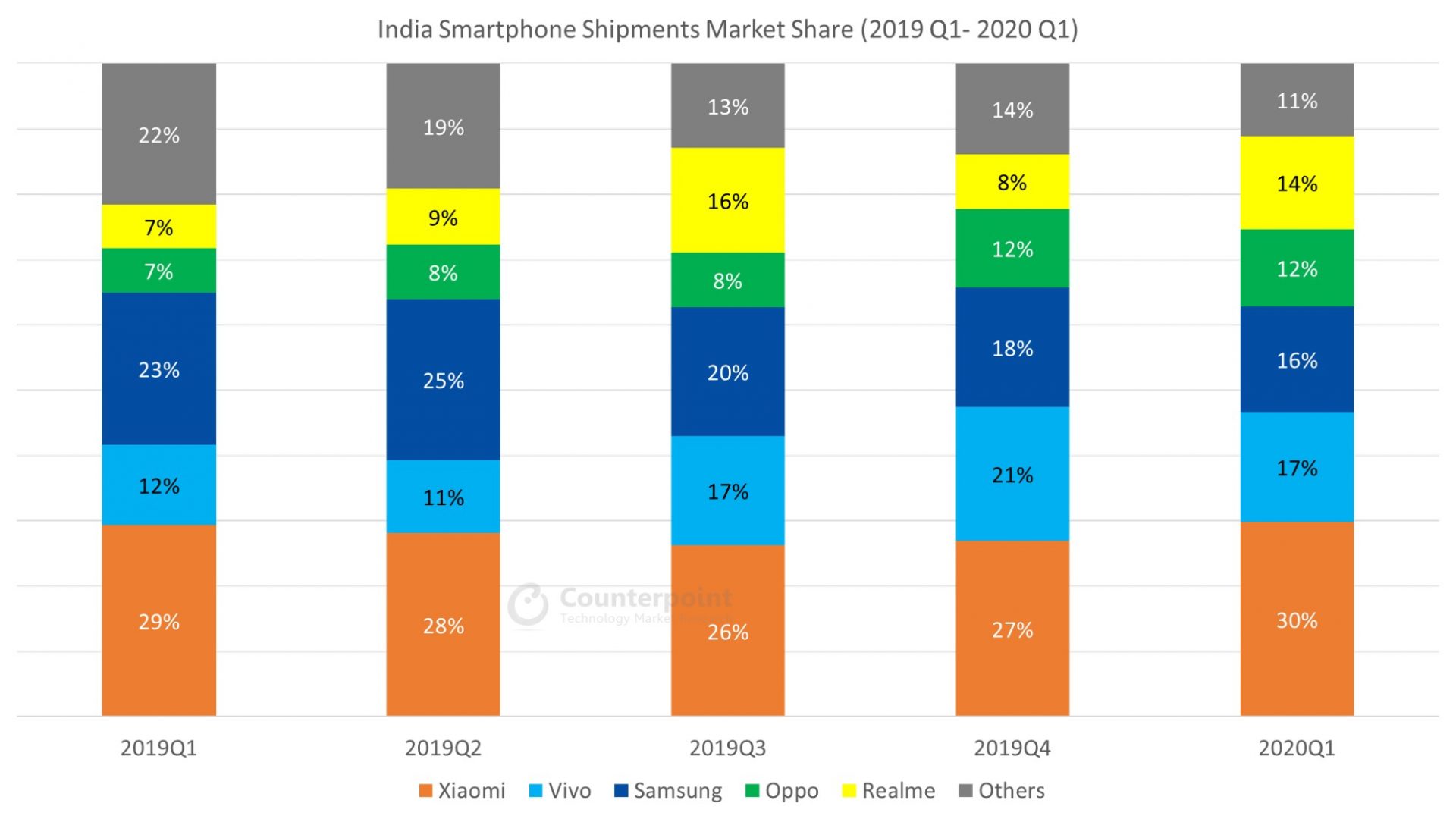

Q1 2020 Highlights

- Xiaomileads the India smartphone market witha 6% YoY growth in Q1 2020 to reach its highest ever market share since Q1 2018.

- Vivo grew 40% YoY in Q1 2020driven by strong performance Y series models.

- Samsung’sshipmentswere driven by its upgraded A and M series (A51, A20s, A30s, and M30s). Samsung managed to hold 3rdposition in Q1 2020 due to launches across several price tiers, especially in the affordable premium segment (S10 Lite, Note 10 Lite).

- realme grew 119% YoY in Q1 2020driven by the newly launched 5i and C3.

- OPPOshipments grew 83% in Q1 2020, due to demand for itsbudget segment devices, A5 2020 and A5s,as well as a good performance for the recently launchedA31andA9 2020in the offline segment.

- Transsion Groupbrands (Itel, Infinix, and Tecno) reached itshighest ever market sharein Q1 2020 registering 78% YoY growth.

- OnePlus’growing presence in the ultra-premium segment (>INR 45000, $600) will help it to expand within the same segment with its new 8 Pro series.

- Apple增长强劲的78%由强大的出货量of iPhone 11 and multiple discounts on platforms like Flipkart and Amazon. In the ultra-premium segment (>INR 45000,~$600 ) it was the leading brand with a market share of 55%.

- Pocodebuted as an Independent brand, got off to a good start by capturing a 2% market share during its first entire month of operations in March 2020. It was also among the top five brands in the INR 15-20K (~$200-$260) price segment.

- AGSThike was announced during the quarter which we expect will have an impact on OEMs margins and new launches. A strong dollar and the GST hike will be detrimental to the mobile industry. Due to the hike, most of the OEMs have already increased smartphone prices.

| India Smartphone Market Share (%) | |||||

| Brands | 2019 Q1 | 2019 Q2 | 2019 Q3 | 2019 Q4 | 2020 Q1 |

| Xiaomi | 29% | 28% | 26% | 27% | 30% |

| Vivo | 12% | 11% | 17% | 21% | 17% |

| Samsung | 23% | 25% | 20% | 18% | 16% |

| Realme | 7% | 9% | 16% | 8% | 14% |

| Oppo | 7% | 8% | 8% | 12% | 12% |

| Others | 22% | 19% | 13% | 14% | 11% |

*Ranking is according to the latest quarter.

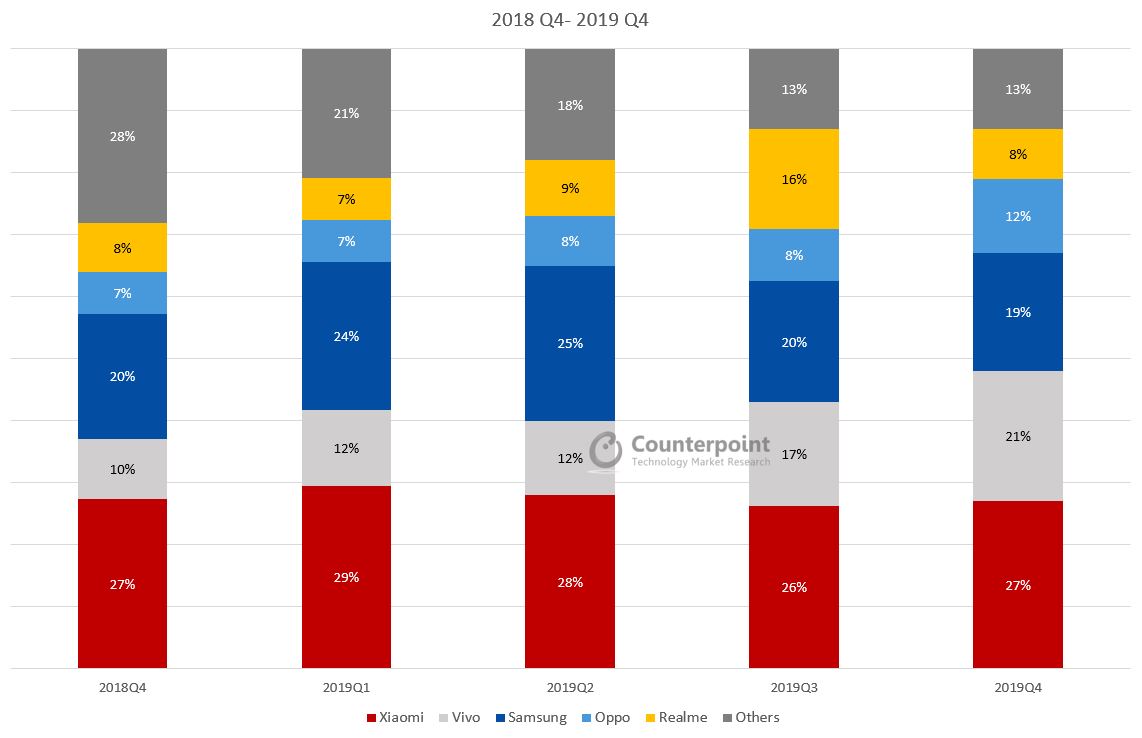

Q4 2019 Highlights

- The India smartphone market grew 7% YoYin both Q4 2019 and in 2019 due to the expansion of Chinese brands with their aggressive pricing and promotional strategy.

- Xiaomi grew 7% YoY in Q4 2019 and 5% YoY in 2019driven by expansion in offline channels and the strong performance of its Redmi Note series.

- Vivo grew 76% YoY in 2019and 132% YoY in Q4 2019 driven good performance of its budget segment series.

- Samsungshipmentsremained almost flat YoY in 4Q19, while it has shown a 5% YoY decline in 2019 as a whole. Samsung shipments were driven by its upgraded A and M series (A50s, A30s, M30s and A20s).

- OPPO shipments almost doubled YoY in Q4 2019, due to demand for itsbudget segment device A5sand the good performance of its recently launched devicesA9 2020andA5 2020in the offline segment.

- realmegrew 255% in Indiain 2019. The growth of realme was driven by an aggressive go-to-market strategy that involved launching several industry-first features with a strong design language. This is resonating well among young consumers seeking value-for-money devices.

- Transsion Group(Itel, Infinix, and Tecno) reached itshighest ever market sharein Q4 2019. Transsion remained strong in tier 3, tier 4 cities and rural India.Itelwas thenumber onesmartphone brandin the entry-level sub-INR 4,000(US$ 60) price segment, while Tecno and Infinix showcased YoY growth in INR 6000-INR 10000 (US$ 86-US$ 142) segment by bringing aggressive features at lower price-points like 6.6-inch displays, 20:9 aspect ratio, 5000 mAH battery, etc.

- Applewasone of the fastest-growing brandsin Q4 2019 driven bymultiple price cuts on its XR device,thanks to local manufacturing in India.

| India Smartphone Market Share (%) | 2018 Q4 |

2019 Q1 |

2019 Q2 |

2019 Q3 |

2019 Q4 |

| Xiaomi | 27% | 29% | 28% | 26% | 27% |

| Vivo | 10% | 12% | 12% | 17% | 21% |

| Samsung | 20% | 24% | 25% | 20% | 19% |

| Oppo | 7% | 7% | 8% | 8% | 12% |

| Realme | 8% | 7% | 9% | 16% | 8% |

| Others | 28% | 21% | 18% | 13% | 13% |

*Ranking is according to latest quarter.

Clickhereto read about India smartphone market in Q4 2019.

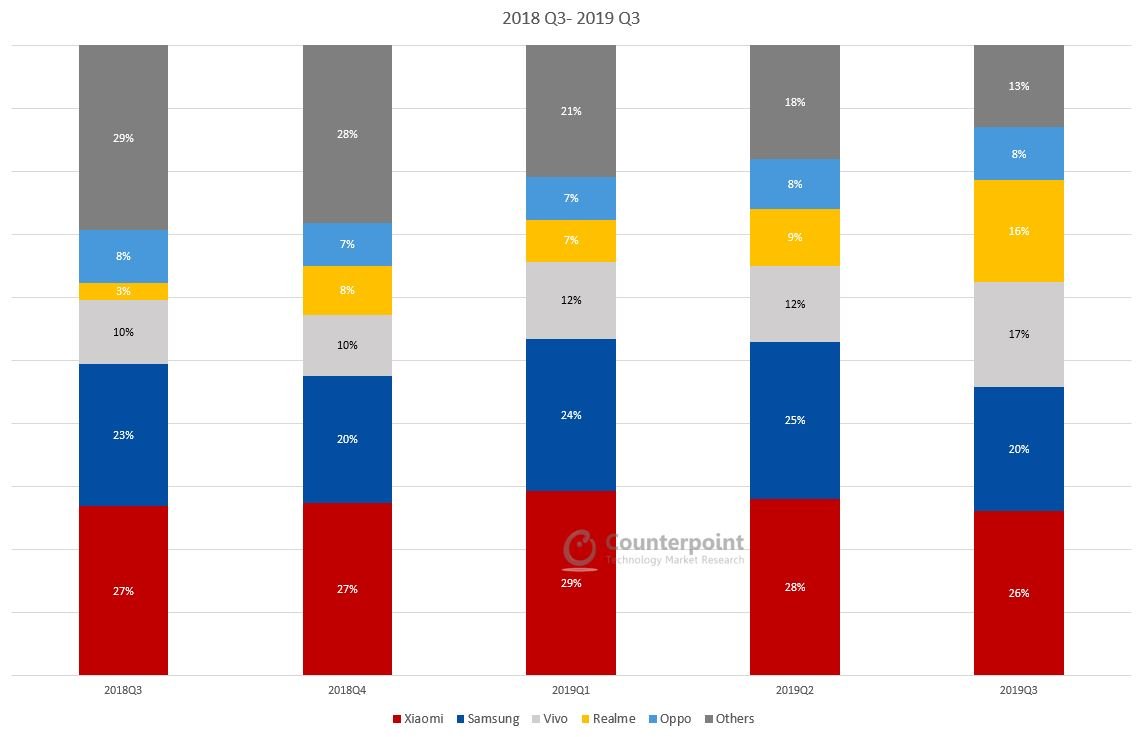

Q3 2019 Highlights

- Xiaomi recorded in highest ever shipmentswith a 26% share. Its shipments grew 7% YoY driven by good performance of its models in the online segment.

- Samsung shipmentsdeclined by 4% YoY,however, it has shown3% growth QoQdriven by its budget segment device Galaxy A2 Core and its upgradedA series and M series (A30s, M30s, A10s, A50s and M10s).

- Vivo reached its highest ever sharein the India smartphone market driven by good performance of its mid-segment series (vivo S1 and Y17) andincreased focus towards the online segmentwith its recently launched devices U10, Z1X and Z1 Pro.

- Realme also recorded its highest ever shipmentsand is the fastest growing brand registering a 6X growth as compared to last year when it entered the Indian market.

- OPPO grew 12% YoY, due to demand for itsbudget segment device A5sand steady performance of itsF11 series.

| India Smartphone Market Share (%) | 2018 Q3 |

2018 Q4 |

2019 Q1 |

2019 Q2 |

2019 Q3 |

| Xiaomi | 27% | 27% | 29% | 28% | 26% |

| Samsung | 23% | 20% | 24% | 25% | 20% |

| Vivo | 10% | 10% | 12% | 12% | 17% |

| Realme | 3% | 8% | 7% | 9% | 16% |

| Oppo | 8% | 7% | 7% | 8% | 8% |

| Others | 29% | 28% | 21% | 18% | 13% |

*Ranking is according to latest quarter.

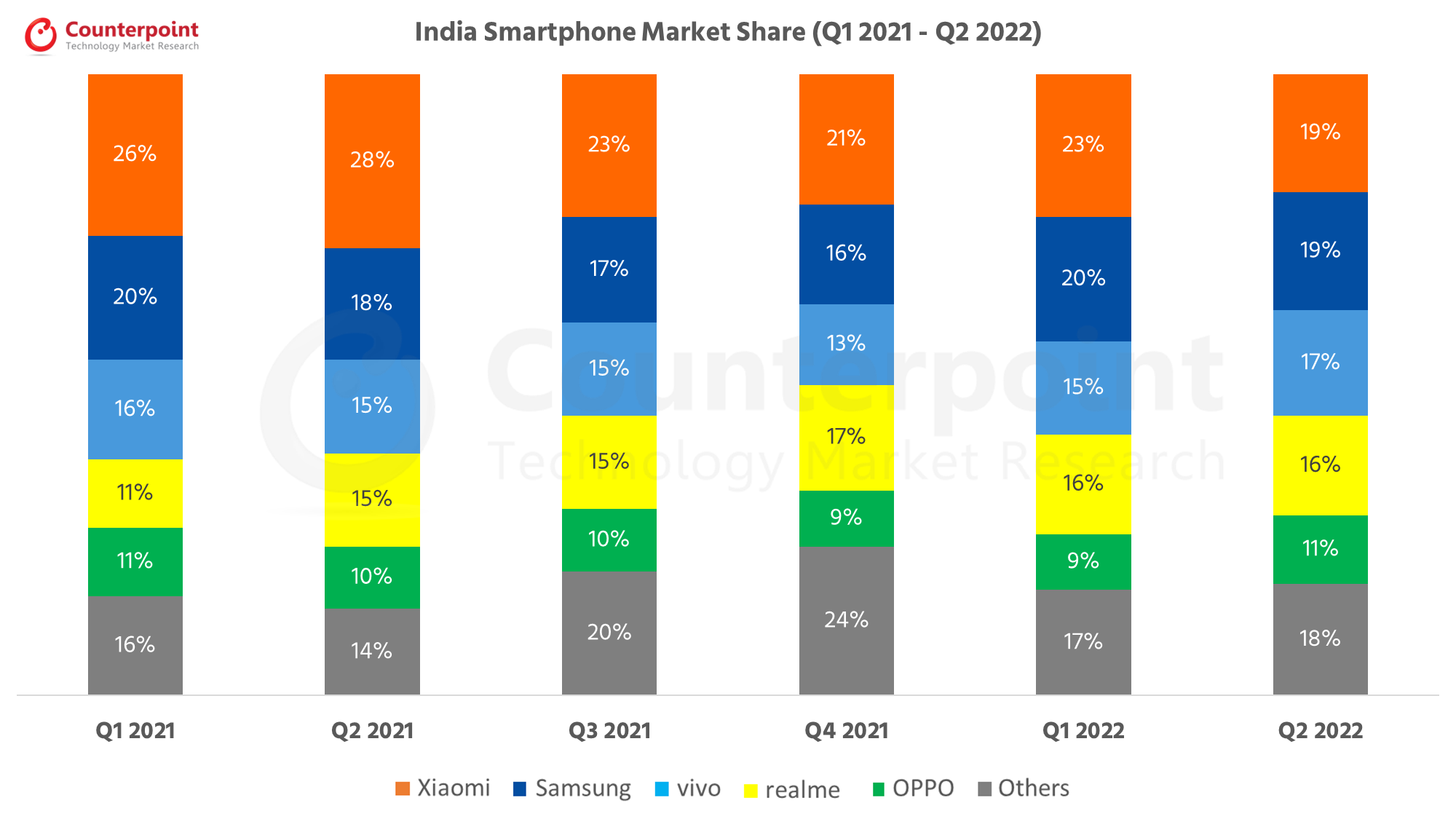

Q2 2019 Highlights

- Xiaomi captured the top spot in Q2 2019with a 28% share. Its shipments grew 6% YoYdriven by portfolio expansion andaggressive offline expansionin the budget segment.

- Samsung shipmentsdeclined by 7% YoY, however, it has shown30% growth QoQdriven by refreshedA series and M series,price cutsof older J series andhigher channel incentivesduringIPL season.

- OPPOdeclined 3% YoY, however it has shown53% QoQ growthdue to new launches, consistent performance of its F11 series and increased shipments towards the budget segment (A5s and A1K).

- This is thethird consecutive quarterthatRealmehas been within thetop 5 brandsdriven bystrong performance of Realme C2 and Realme 3 Proand various discount offers rolled out on online platforms.

- Huawei’s trade banalsoimpacted India marketas its shipments declined YoY, However, the brand continues to be in the top ten smartphone brands category.

| India Smartphone Market Share (%) | 2018 Q2 |

2018 Q3 |

2018 Q4 |

2019 Q1 |

2019 Q2 |

| Xiaomi | 28% | 27% | 27% | 29% | 28% |

| Samsung | 28% | 23% | 20% | 24% | 25% |

| Vivo | 12% | 10% | 10% | 12% | 12% |

| Realme | 1% | 3% | 8% | 7% | 9% |

| Oppo | 9% | 8% | 7% | 7% | 8% |

| Others | 22% | 29% | 28% | 21% | 18% |

*Ranking is according to latest quarter.

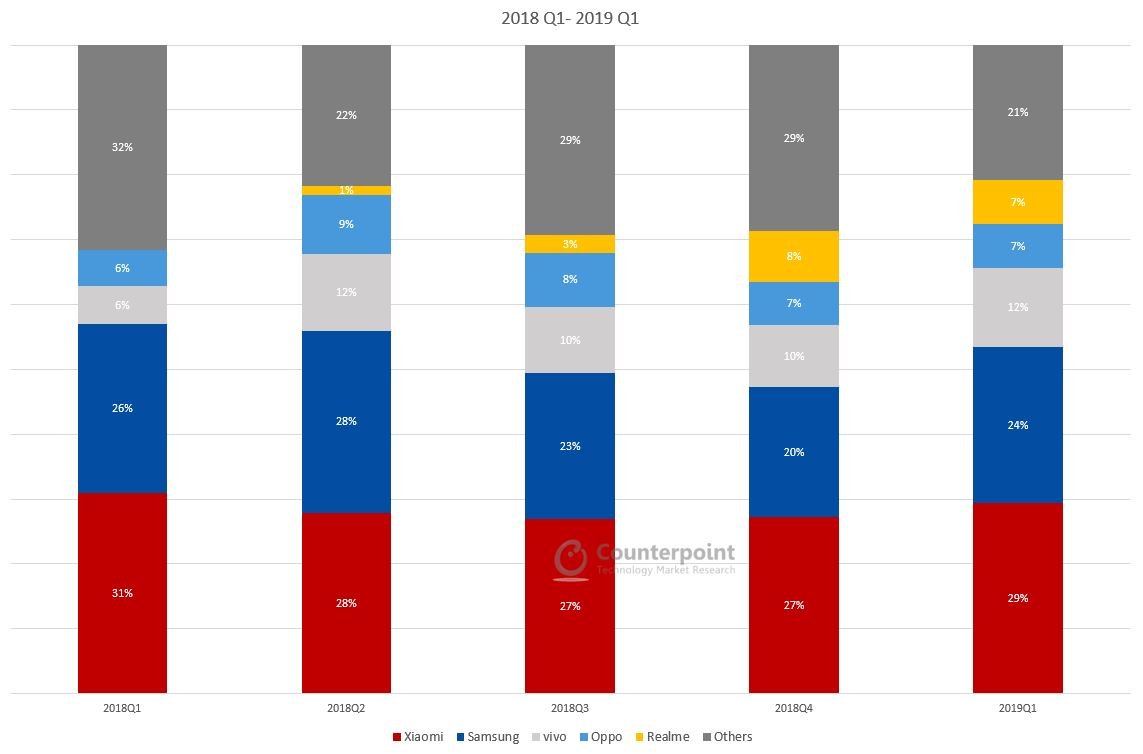

Q1 2019 Highlights

- The market share of Chinese brands in the Indian smartphone market reached a record 66% during Q1 2019.

- Xiaomi remained the smartphone market leader in Q1 2019with a 29% share, though its shipments declined by 2% YoY.

- Samsung’s recorded a strong sell-in of premiumGalaxy S10 serieswhich drove overall ASP for Samsung.

- Volumes for the Chinese brands grew 20% year-on-year (YoY) mainly due to the growth of Vivo, Realme, and OPPO.

| India Smartphone Market Share (%) | 2018Q1 | 2018Q2 | 2018Q3 | 2018Q4 | 2019Q1 |

| Xiaomi | 31% | 28% | 27% | 27% | 29% |

| Samsung | 26% | 28% | 23% | 20% | 24% |

| vivo | 6% | 12% | 10% | 10% | 12% |

| Realme | – | 1% | 3% | 8% | 7% |

| Oppo | 6% | 9% | 8% | 7% | 7% |

| Others | 31% | 22% | 29% | 28% | 21% |

*Ranking is according to latest quarter.

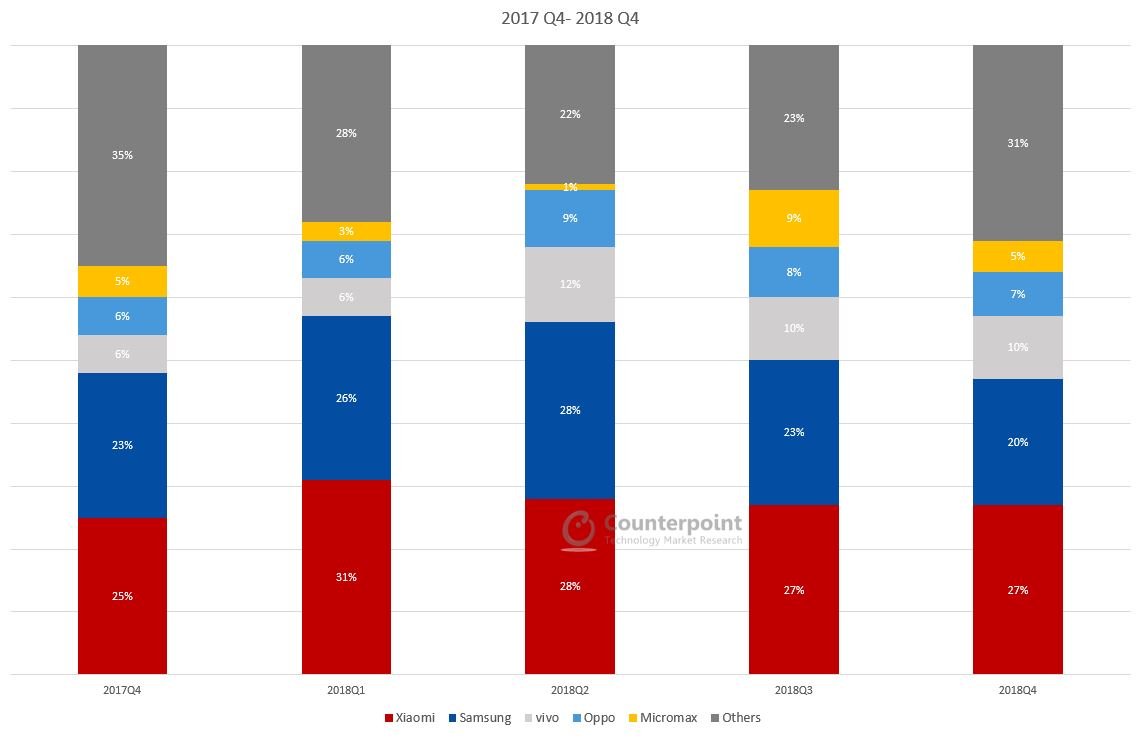

Q4 2018 Highlights

- India’s overall mobile phone shipments grew 11% and smartphone shipments grew 10% with feature phones growing faster (11%) than smartphones during 2018

- In terms of revenue, the market grew even faster with a growth rate of 19% during the year with Samsung, Xiaomi, vivo, OPPO and Apple being the market leaders by revenue.

- Jio was the overall market leader across all handset types in 2018, with a market share of 21%.

- Samsung has been holding the pole position by shipments in the smartphone market since 2012 when it dethroned Nokia. It was also the category leader in feature phones since 2015.

| India Smartphone Market Share (%) | 2017Q4 | 2018Q1 | 2018Q2 | 2018Q3 | 2018Q4 |

| Xiaomi | 25% | 31% | 28% | 27% | 27% |

| Samsung | 23% | 26% | 28% | 23% | 20% |

| vivo | 6% | 6% | 12% | 10% | 10% |

| Oppo | 6% | 6% | 9% | 8% | 7% |

| Micromax | 5% | 3% | 1% | 9% | 5% |

| Others | 35% | 28% | 22% | 23% | 31% |

*Ranking is according to latest quarter.

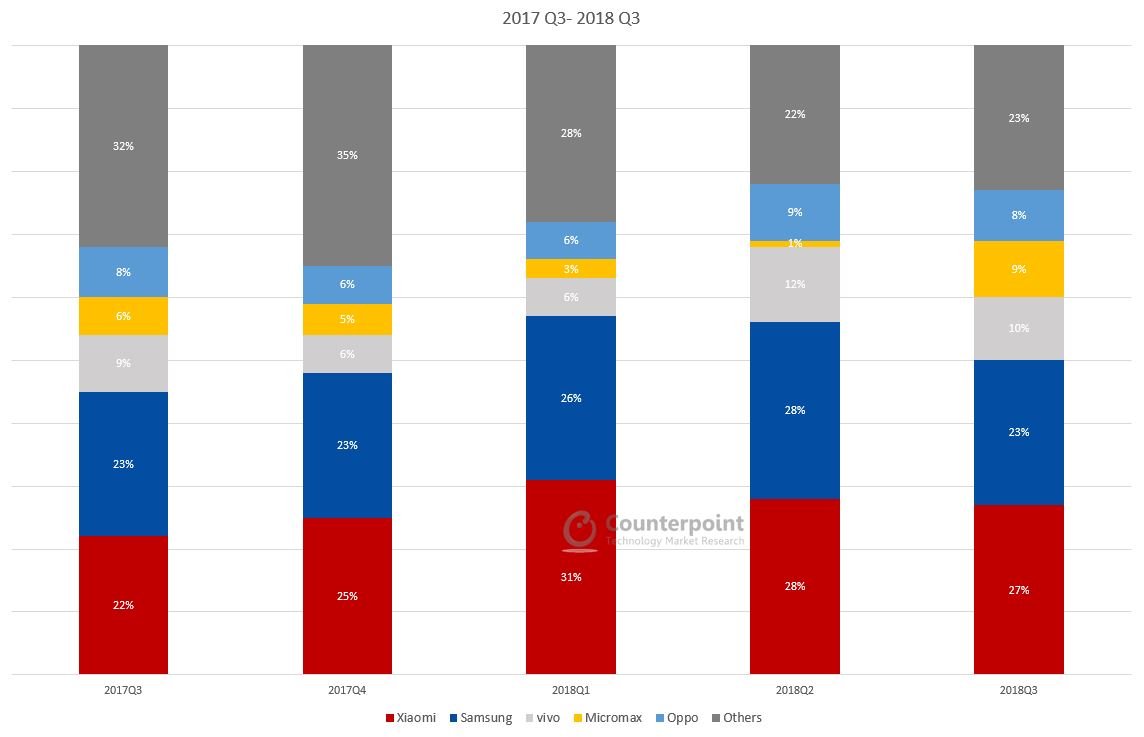

Q3 2018 Highlights

- Smartphonesegment contributed tohalf of the total handsetmarket during Q3 2018.

- Top five brands captured77% shareof the total smartphone market during the quarter.

- In the smartphone segment,Xiaomirecorded its highest ever shipments in India in a single quarter driven by the newRedmi 6 seriesand expansion in offline channels.

- Samsung record shipmentswere driven by J series. Demand for J6 and J8 remained strong. Apart from this it also launched the Android Go edition, Galaxy J2 core, giving it a much-needed offering in the sub $100 segment.

| India Smartphone Market Share (%) | 2017Q3 | 2017Q4 | 2018Q1 | 2018Q2 | 2018Q3 |

| Xiaomi | 22% | 25% | 31% | 28% | 27% |

| Samsung | 23% | 23% | 26% | 28% | 23% |

| vivo | 9% | 6% | 6% | 12% | 10% |

| Micromax | 6% | 5% | 3% | 1% | 9% |

| Oppo | 8% | 6% | 6% | 9% | 8% |

| Others | 32% | 35% | 28% | 22% | 23% |

*Ranking is according to latest quarter.

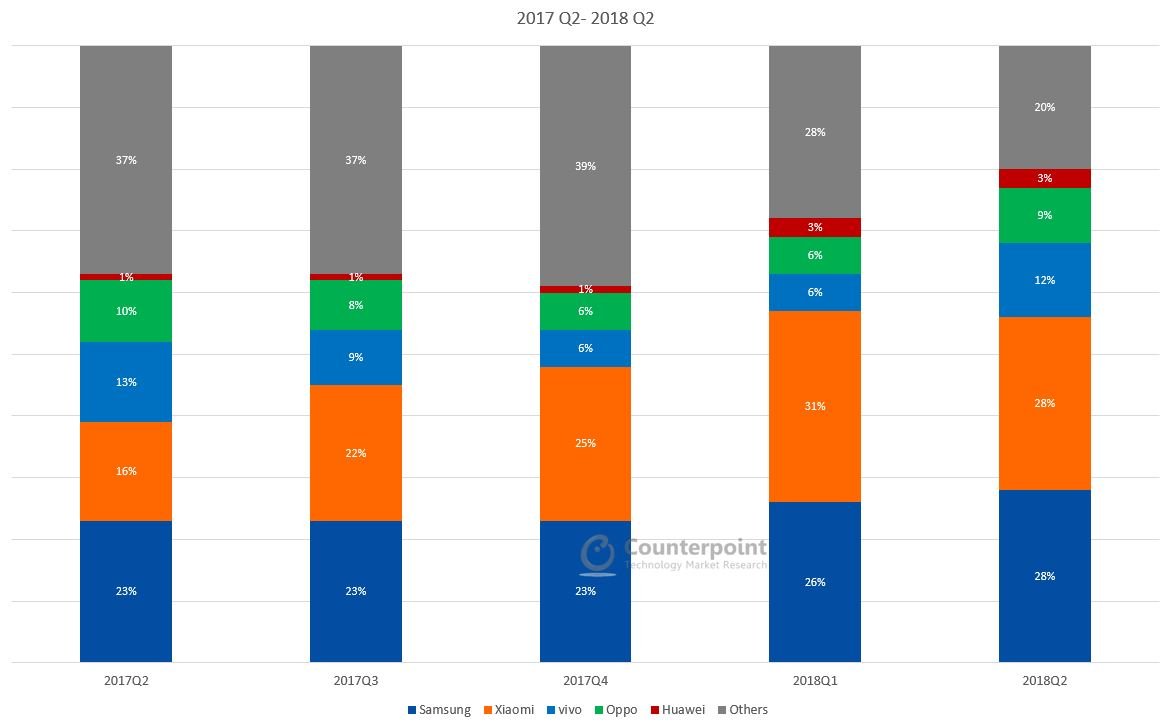

Q2 2018 Highlights

- Smartphonesegment contributed tohalf of the total handsetmarket during Q2 2018.

- Top five brands captured arecord 82% shareof the total smartphone market during the quarter

- Applehad a slow quarter as it underwent changes in its distribution strategy. Apart from this, its domestic assembling is yet to pick-up pace, which means the Cupertino giant is still relying on imports for its sales in India.

- Xiaomirecorded itshighest ever shipmentsinIndiaduring Q2 2018. The growth can be attributed to its strong product and supply chain strategy that has allowed it to launch products with a longer shelf-life than its competitors and that too in the important sub INR 10000 (

| India Smartphone Market Share (%) | 2017Q2 | 2017Q3 | 2017Q4 | 2018Q1 | 2018Q2 |

| Samsung | 23% | 23% | 23% | 26% | 28% |

| Xiaomi | 16% | 22% | 25% | 31% | 28% |

| vivo | 13% | 9% | 6% | 6% | 12% |

| Oppo | 10% | 8% | 6% | 6% | 9% |

| Huawei | 1% | 1% | 1% | 3% | 3% |

| Others | 37% | 37% | 39% | 28% | 20% |

*Ranking is according to latest quarter.

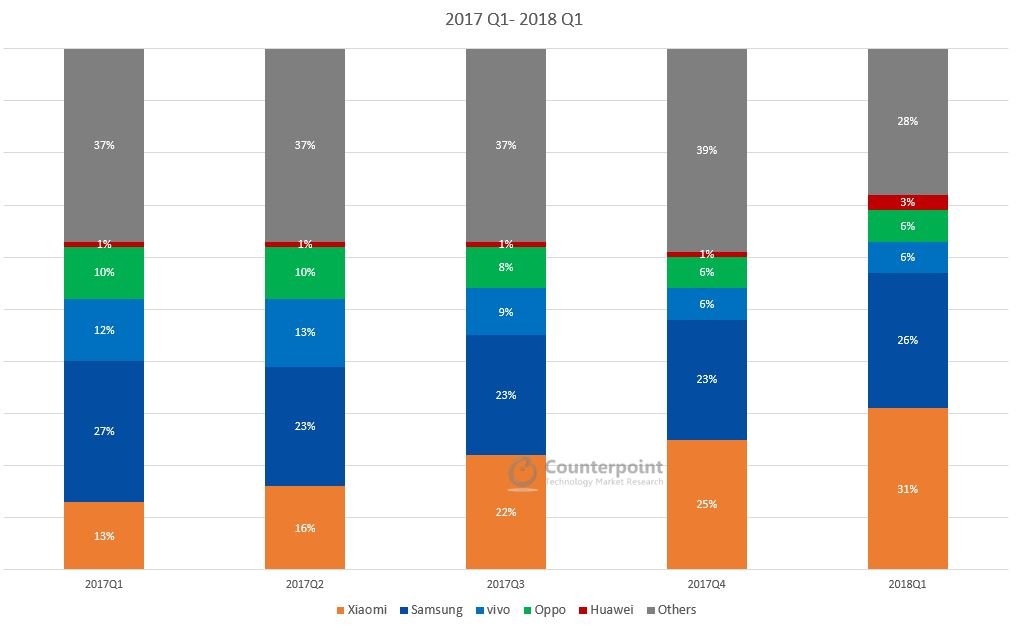

Q1 2018 Highlights

- The Indian mobile phone market grew by 48% YoY in Q1 2018 driven by strong demand from the featurephone segment. The smartphone market remained flat YoY.

- The performance of Chinese brands remained strong, accounting for 57% of the total smartphone market in Q1 2018, up from 53% during Q1 2017. This is the highest ever contribution by Chinese players in the Indian smartphone market.

- Huawei’s Honor brand captured the fifth position for the first time ever, in the Indian smartphone market due to the strong performance of Honor 9 Lite and Honor 7X across online channels.

| India Smartphone Market Share (%) | 2017Q1 | 2017Q2 | 2017Q3 | 2017Q4 | 2018Q1 |

| Xiaomi | 13% | 16% | 22% | 25% | 31% |

| Samsung | 27% | 23% | 23% | 23% | 26% |

| vivo | 12% | 13% | 9% | 6% | 6% |

| Oppo | 10% | 10% | 8% | 6% | 6% |

| Huawei | 1% | 1% | 1% | 1% | 3% |

| Others | 37% | 37% | 37% | 39% | 28% |