Best-Selling Smartphones in April 2023

Published date: July 04, 2023

本节显示了最畅销的智能手机国防部els in April 2023 for 8 countries. This is a section of our comprehensive database based on Counterpoint’s tracking of mobile handsets (smartphone and featurephone)sell-throughvolumesbased on channel surveys and triangulation with other secondary sources across 50+ countries.

April 2023

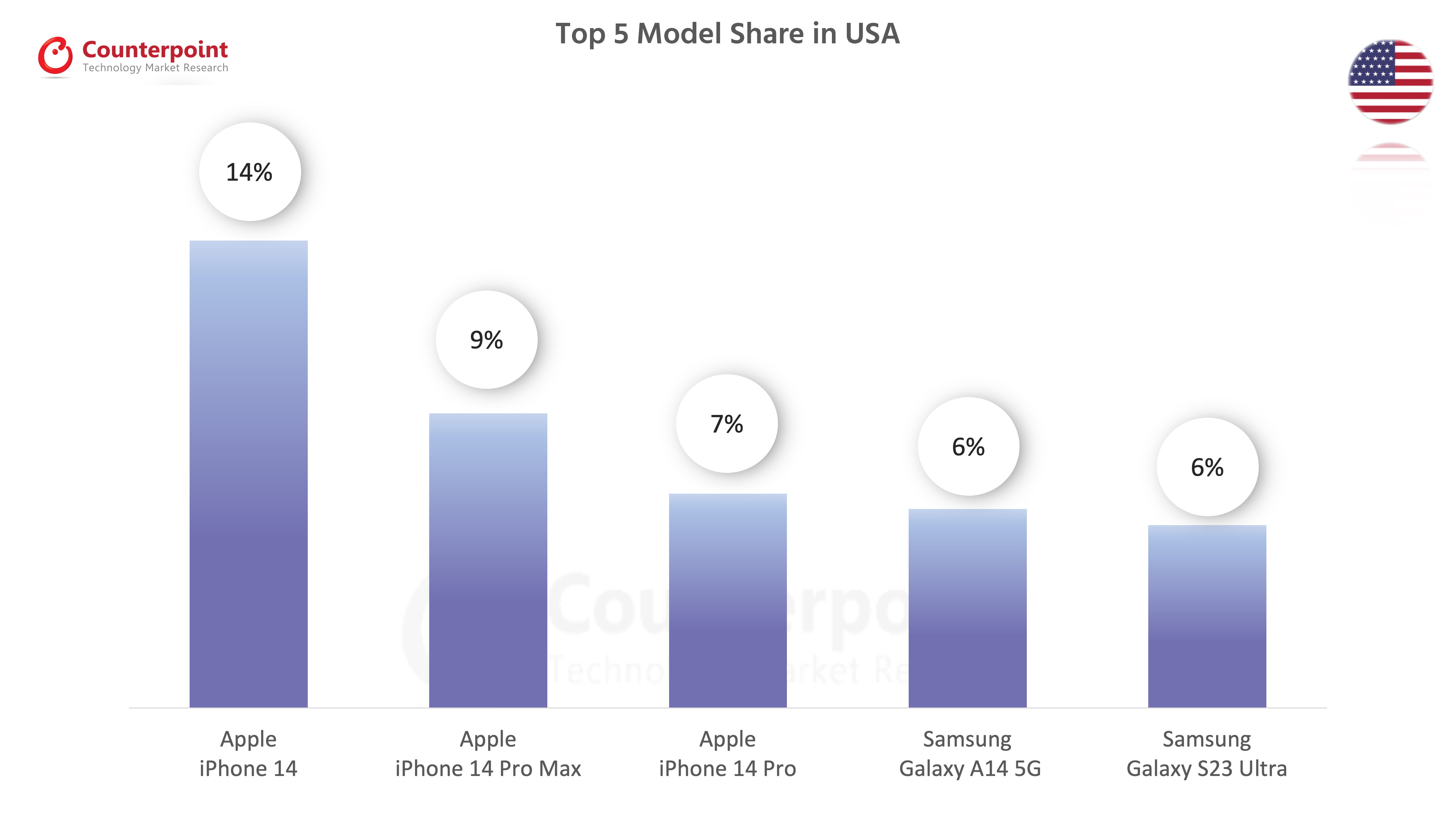

Best-Selling Smartphones in USA in April 2023

| Rank | Models | Sales Share |

| 1 | Apple iPhone 14 | 14% |

| 2 | Apple iPhone 14 Pro Max | 9% |

| 3 | Apple iPhone 14 Pro | 7% |

| 4 | Samsung Galaxy A14 5G | 6% |

| 5 | Samsung Galaxy S23 Ultra | 6% |

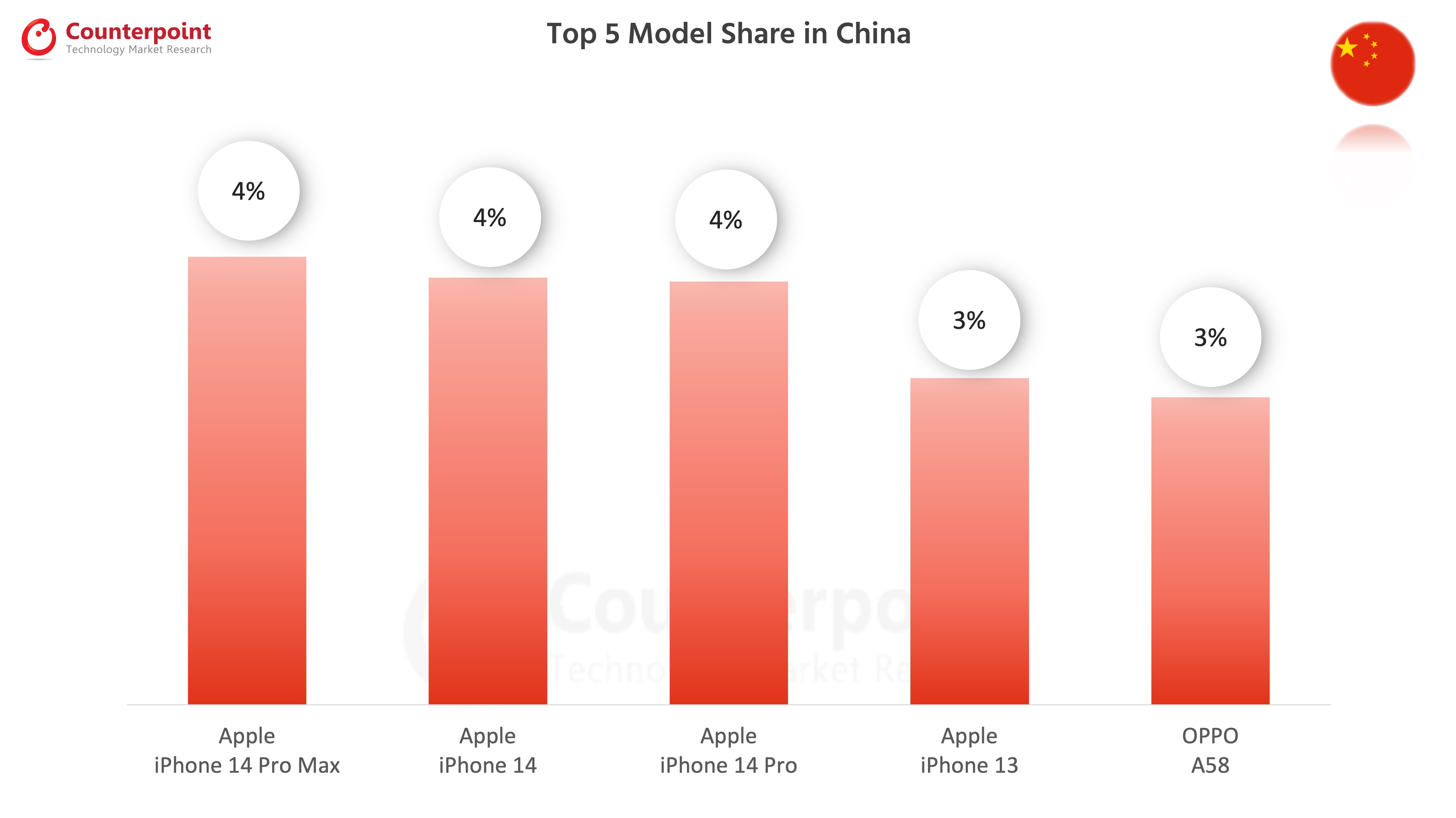

Best-Selling Smartphones in China in April 2023

| Rank | Models | Sales Share |

| 1 | Apple iPhone 14 Pro Max | 4% |

| 2 | Apple iPhone 14 | 4% |

| 3 | Apple iPhone 14 Pro | 4% |

| 4 | Apple iPhone 13 | 3% |

| 5 | OPPO A58 | 3% |

Best-Selling Smartphones in India in April 2023

| Rank | Models | Sales Share |

| 1 | OnePlus Nord CE 3 Lite | 4% |

| 2 | Samsung Galaxy A14 5G | 3% |

| 3 | Redmi 12C | 3% |

| 4 | realme C55 | 3% |

| 5 | Apple iPhone 13 | 3% |

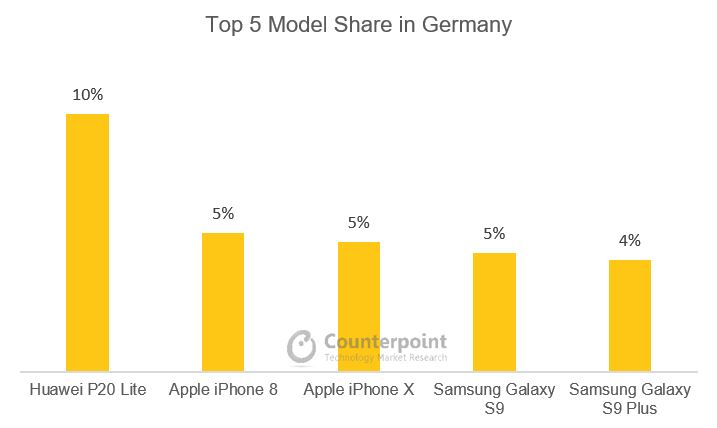

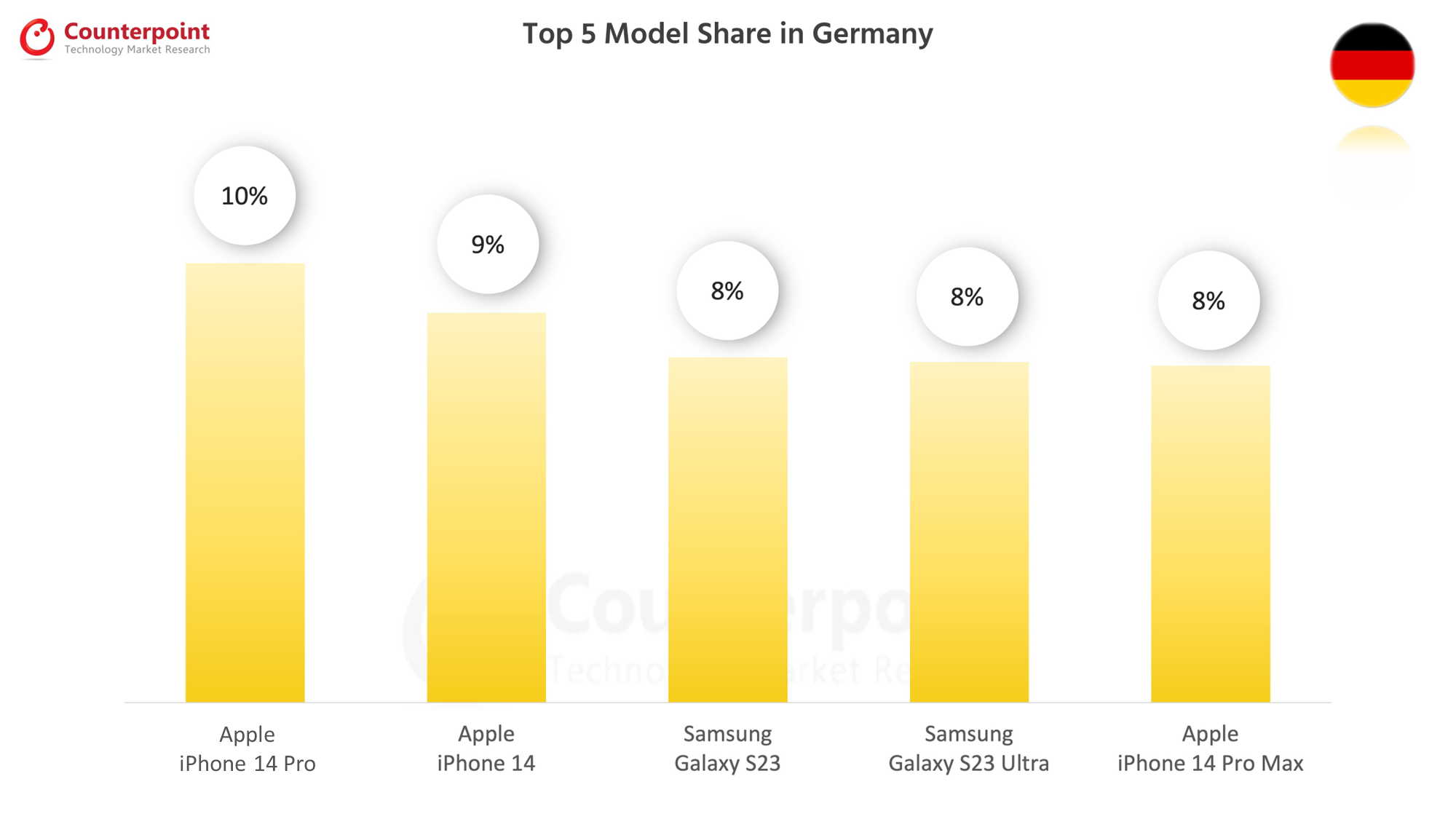

Best-Selling Smartphones in Germany in April 2023

| Rank | Models | Sales Share |

| 1 | Apple iPhone 14 Pro | 10% |

| 2 | Apple iPhone 14 | 9% |

| 3 | Samsung Galaxy S23 | 8% |

| 4 | Samsung Galaxy S23 Ultra | 8% |

| 5 | Apple iPhone 14 Pro Max | 8% |

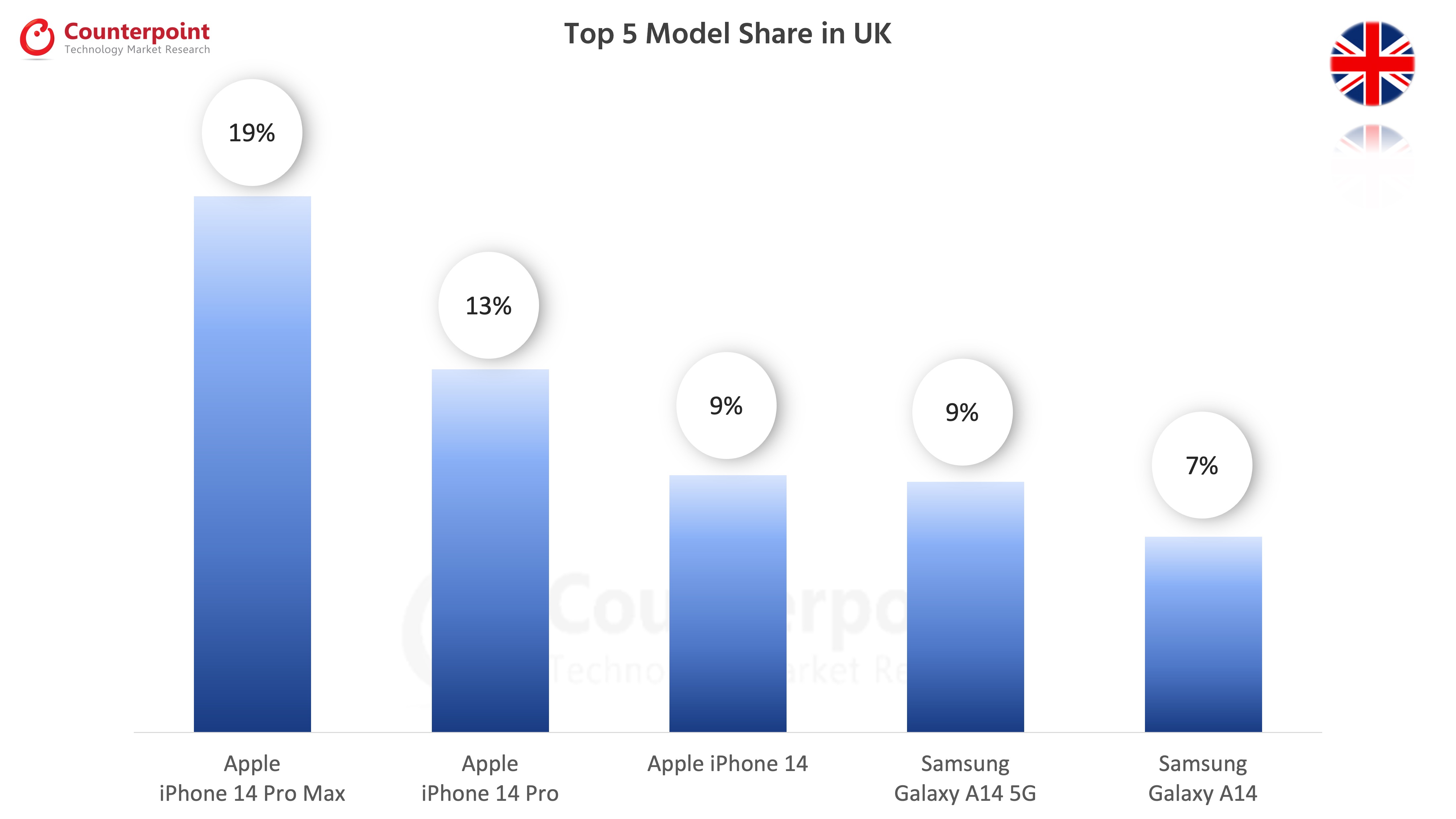

Best-Selling Smartphones in UK in April 2023

| Rank | Models | Sales Share |

| 1 | Apple iPhone 14 Pro Max | 19% |

| 2 | Apple iPhone 14 Pro | 13% |

| 3 | Apple iPhone 14 | 9% |

| 4 | Samsung Galaxy A14 5G | 9% |

| 5 | Samsung Galaxy A14 | 7% |

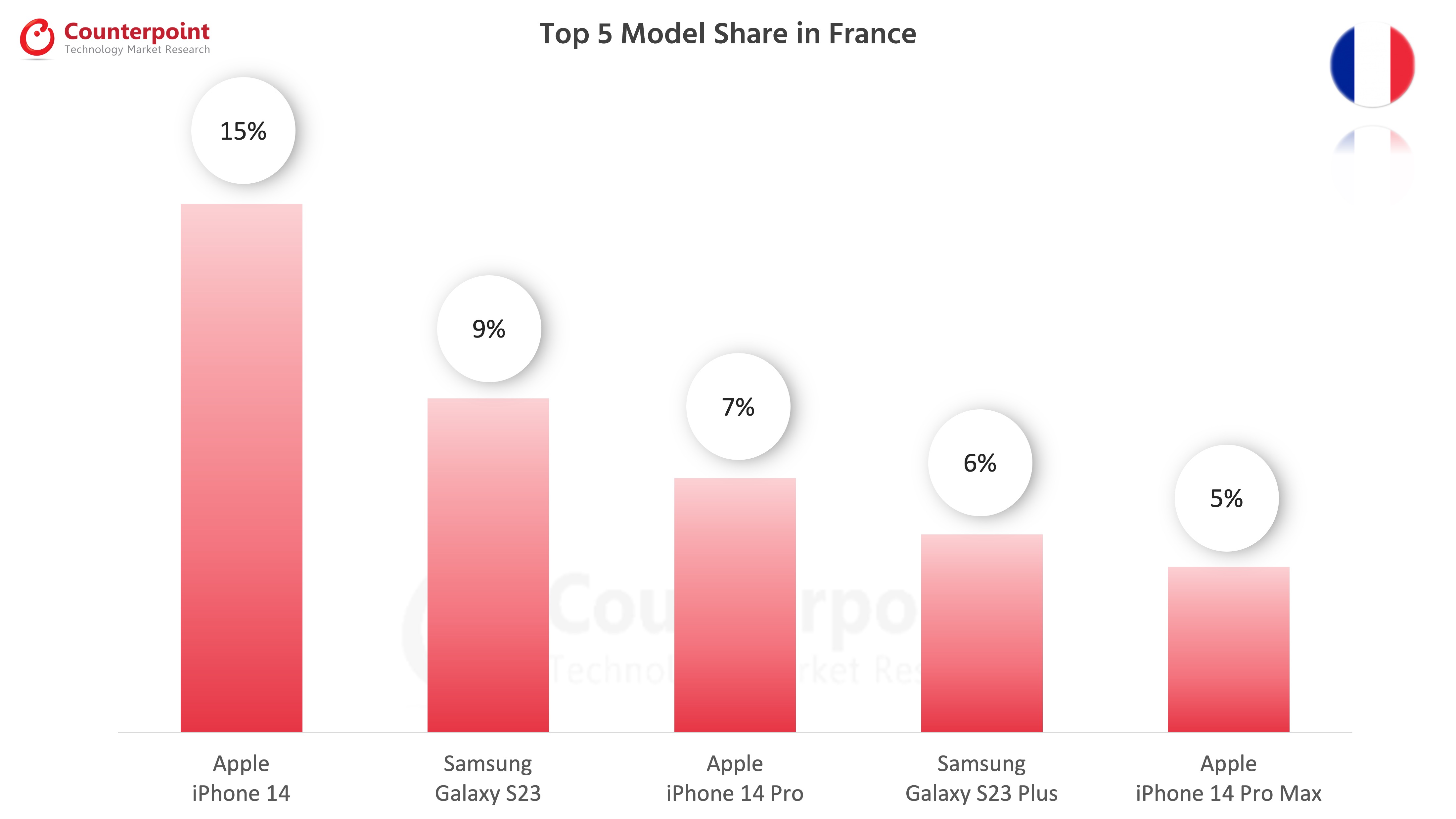

Best-Selling Smartphones in France in April 2023

| Rank | Models | Sales Share |

| 1 | Apple iPhone 14 | 15% |

| 2 | Samsung Galaxy S23 | 9% |

| 3 | Apple iPhone 14 Pro | 7% |

| 4 | Samsung Galaxy S23 Plus | 6% |

| 5 | Apple iPhone 14 Pro Max | 5% |

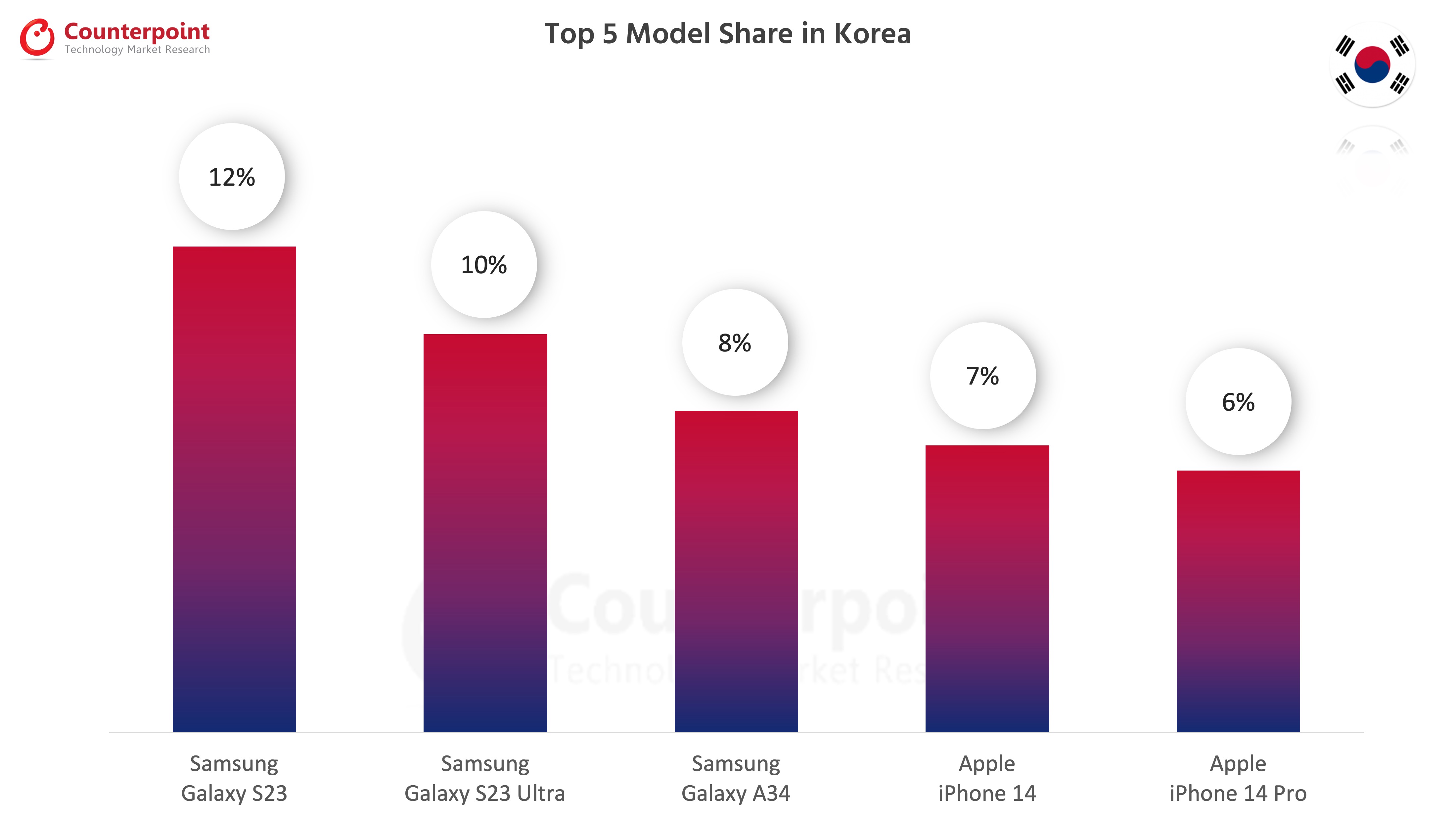

Best-Selling Smartphones in South Korea in April 2023

Best-Selling Smartphones in South Korea in April 2023

| Rank | Models | Sales Share |

| 1 | Samsung Galaxy S23 | 12% |

| 2 | Samsung Galaxy S23 Ultra | 10% |

| 3 | Samsung Galaxy A34 | 8% |

| 4 | Apple iPhone 14 | 7% |

| 5 | Apple iPhone 14 Pro | 6% |

![]()

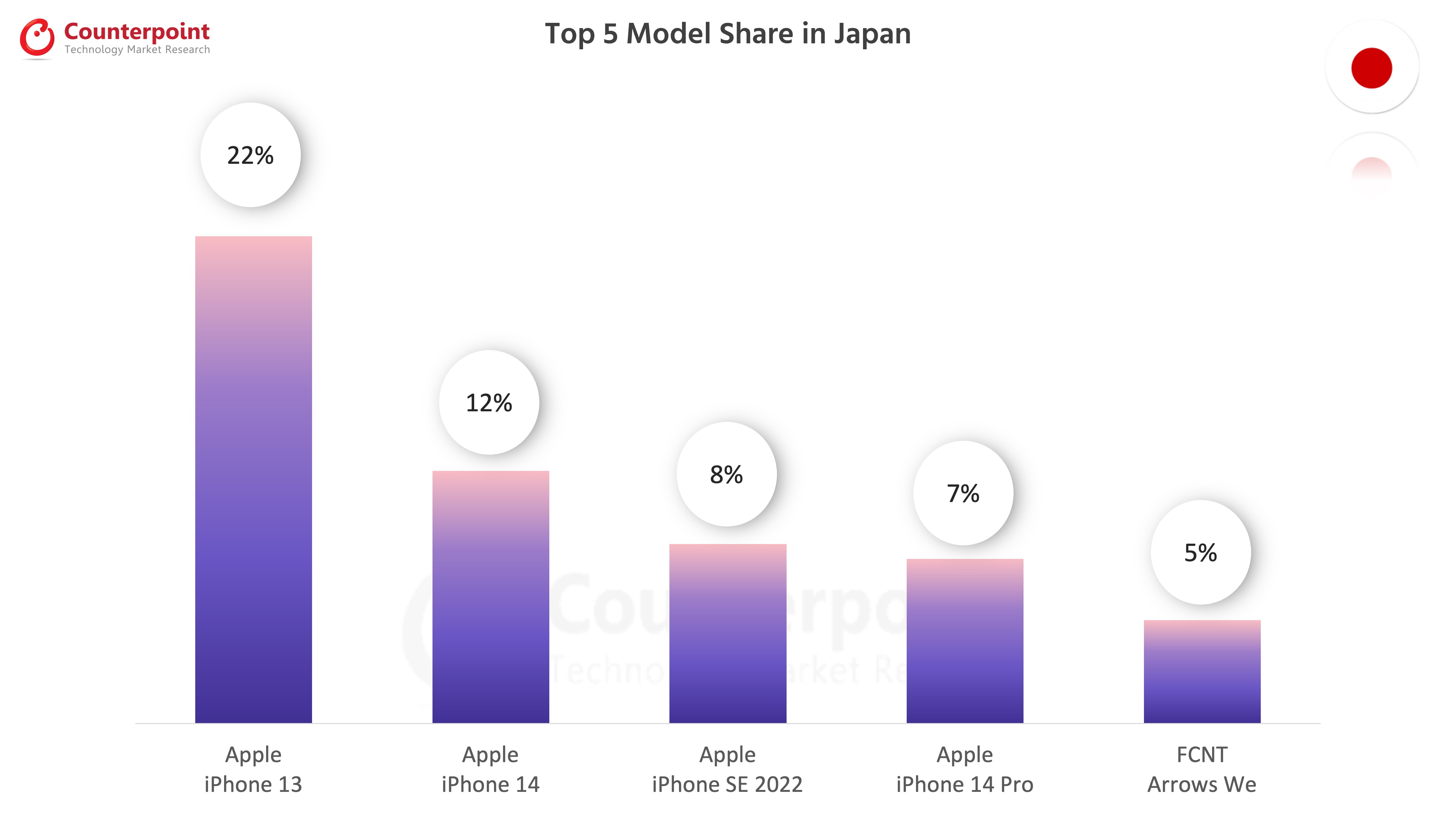

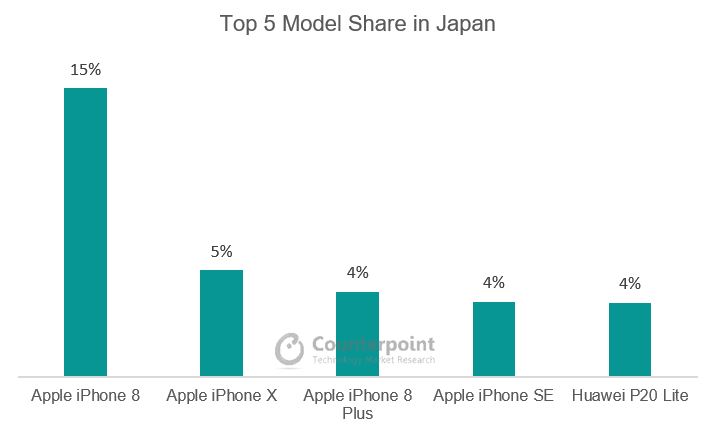

Best-Selling Smartphones in Japan in April 2023

| Rank | Models | Sales Share |

| 1 | Apple iPhone 13 | 22% |

| 2 | Apple iPhone 14 | 12% |

| 3 | Apple iPhone SE 2022 | 8% |

| 4 | Apple iPhone 14 Pro | 7% |

| 5 | FCNT Arrows We | 5% |

The top 5 smartphone model share numbers are from:

This data represents the top 5 smartphone model share for eight countries for the specific month.

For detailed insights on the data, please reach out to us atinfo(at)www.arena-ruc.com. If you are a member of the press, please contact us atpress(at)www.arena-ruc.comfor any media enquiries.

本节显示了最畅销的智能手机国防部els in January 2022 for 8 countries

Jan 2023

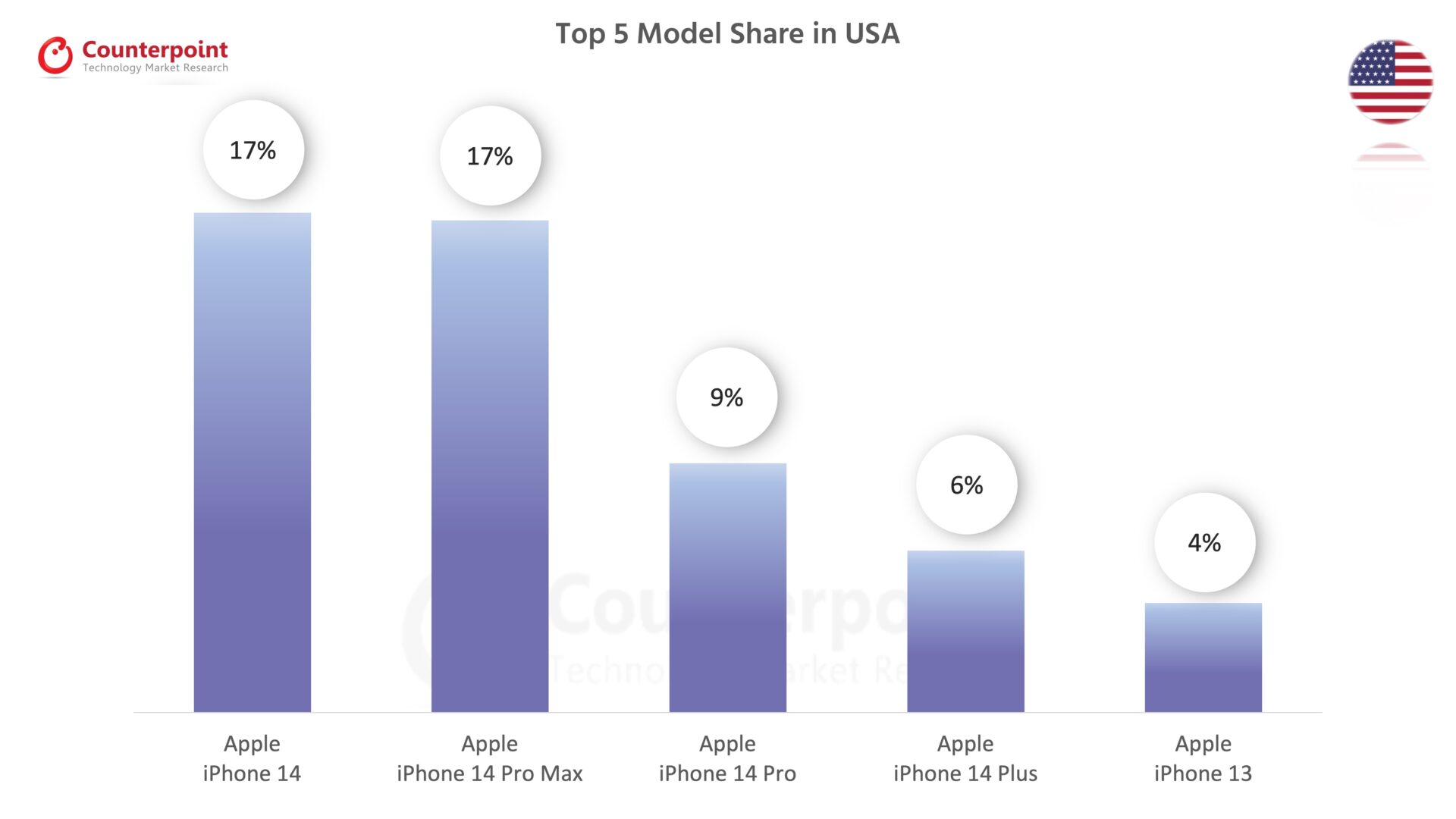

Best-Selling Smartphones in USA in Jan 2023

| Rank | Models | Sales Share |

| 1 | Apple iPhone 14 | 17% |

| 2 | Apple iPhone 14 Pro Max | 17% |

| 3 | Apple iPhone 14 Pro | 9% |

| 4 | Apple iPhone 14 Plus | 6% |

| 5 | Apple iPhone 13 | 4% |

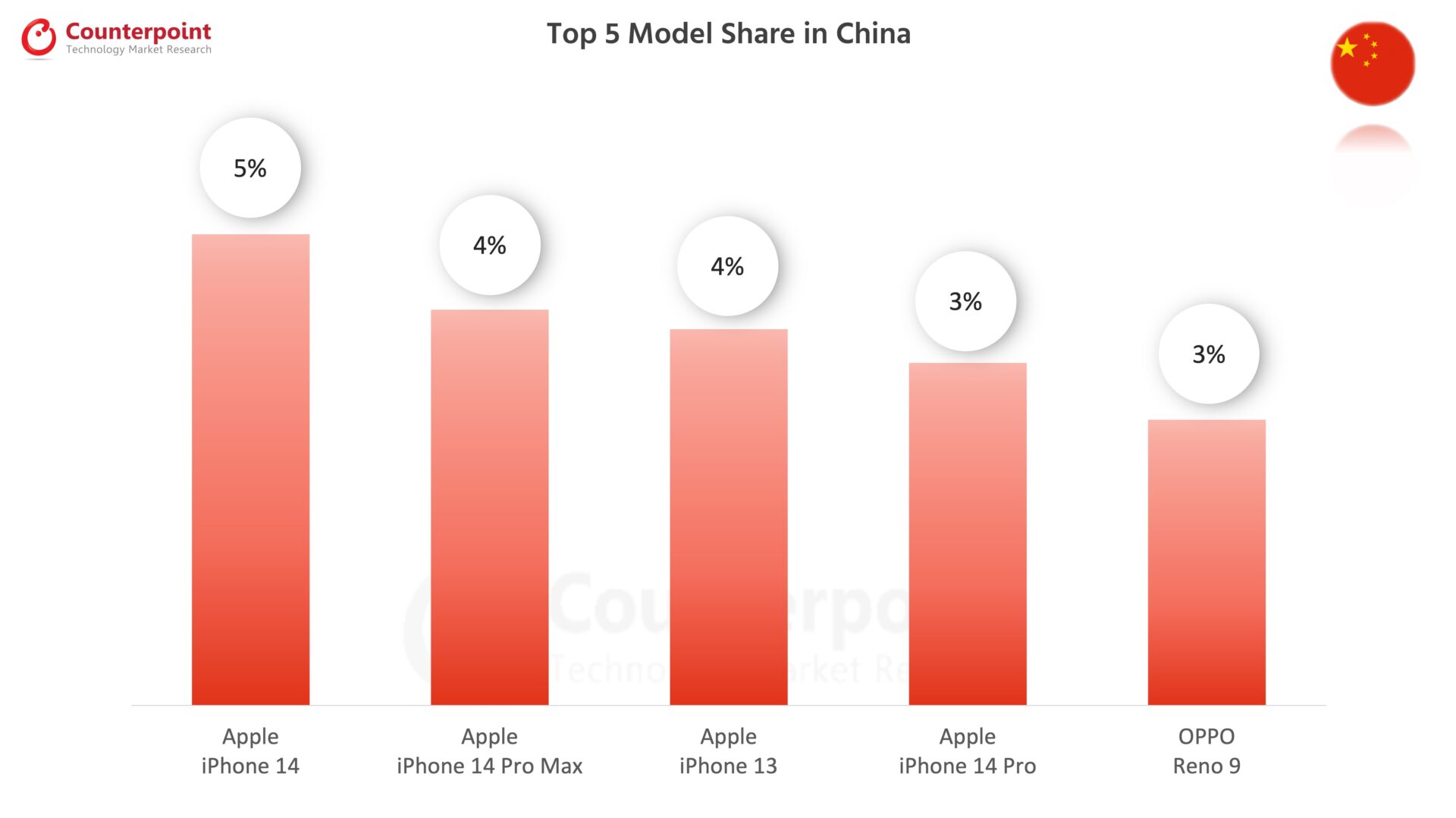

Best-Selling Smartphones in China in Jan 2023

| Rank | Models | Sales Share |

| 1 | Apple iPhone 14 | 5% |

| 2 | Apple iPhone 14 Pro Max | 4% |

| 3 | Apple iPhone 13 | 4% |

| 4 | Apple iPhone 14 Pro | 3% |

| 5 | OPPO Reno 9 | 3% |

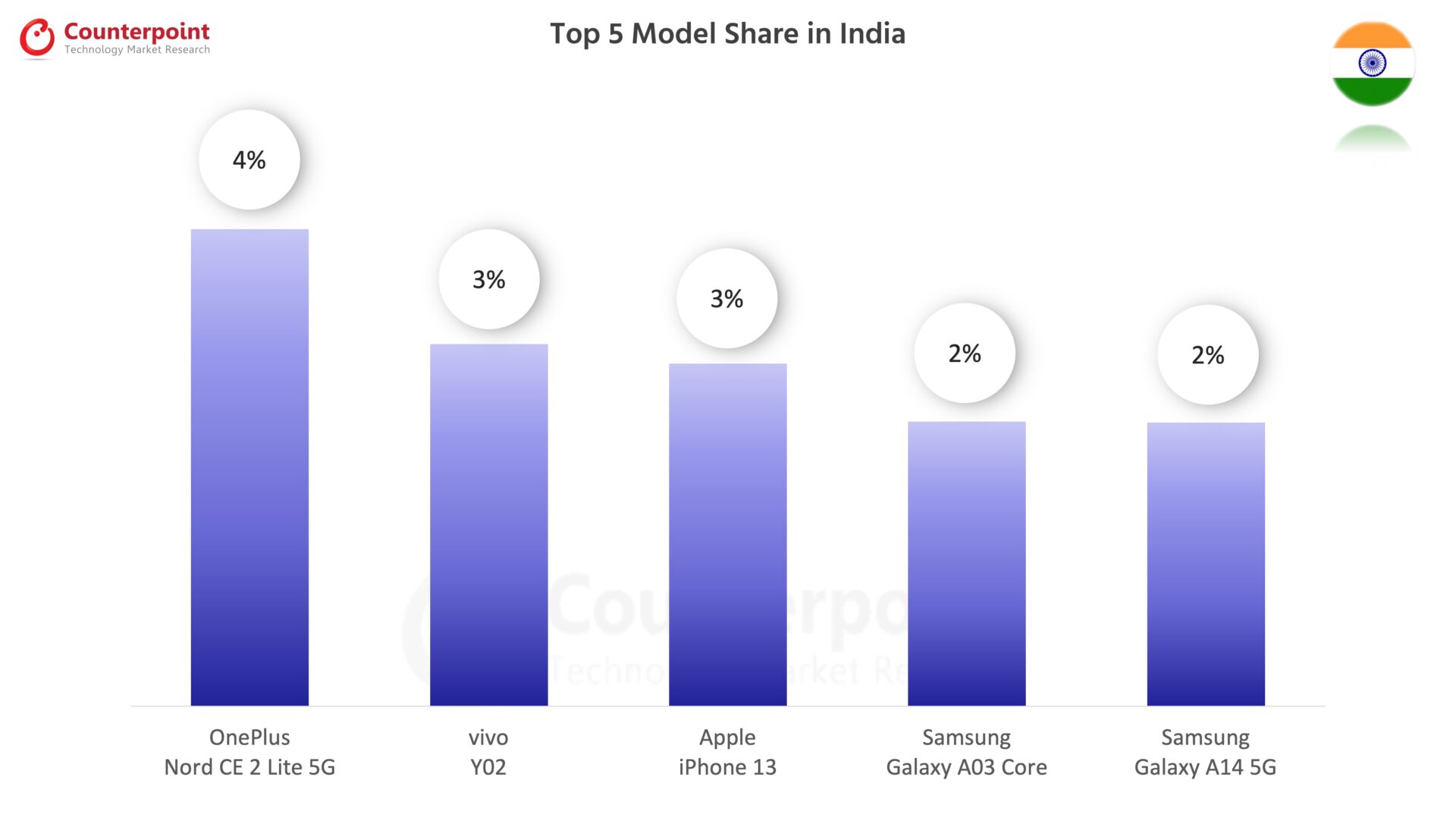

Best-Selling Smartphones in India in Jan 2023

| Rank | Models | Sales Share |

| 1 | OnePlus Nord CE 2 Lite 5G | 4% |

| 2 | vivo Y02 | 3% |

| 3 | Apple iPhone 13 | 3% |

| 4 | Samsung Galaxy A03 Core | 2% |

| 5 | Samsung Galaxy A14 5G | 2% |

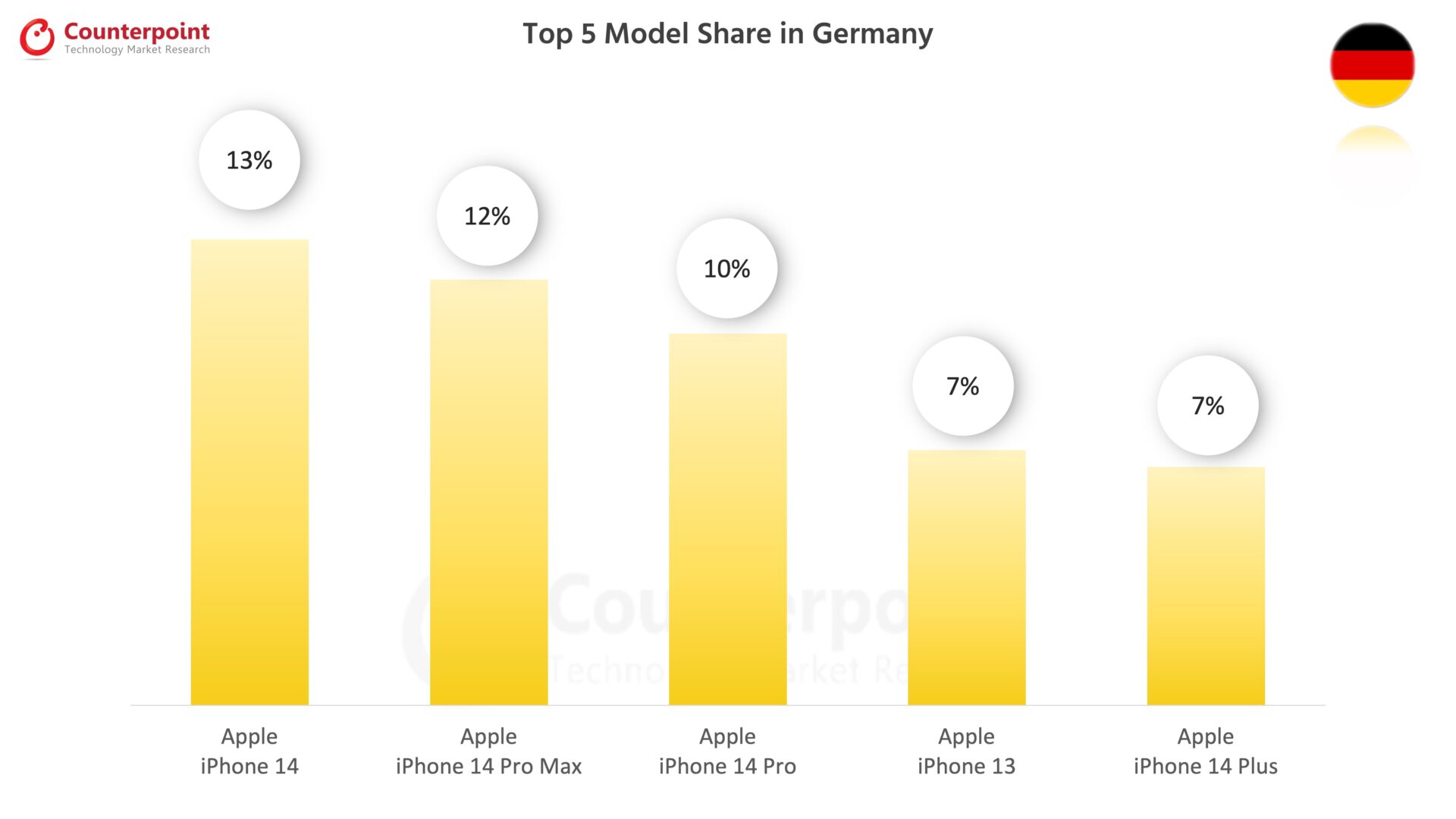

Best-Selling Smartphones in Germany in Jan 2023

| Rank | Models | Sales Share |

| 1 | Apple iPhone 14 | 13% |

| 2 | Apple iPhone 14 Pro Max | 12% |

| 3 | Apple iPhone 14 Pro | 10% |

| 4 | Apple iPhone 13 | 7% |

| 5 | Apple iPhone 14 Plus | 7% |

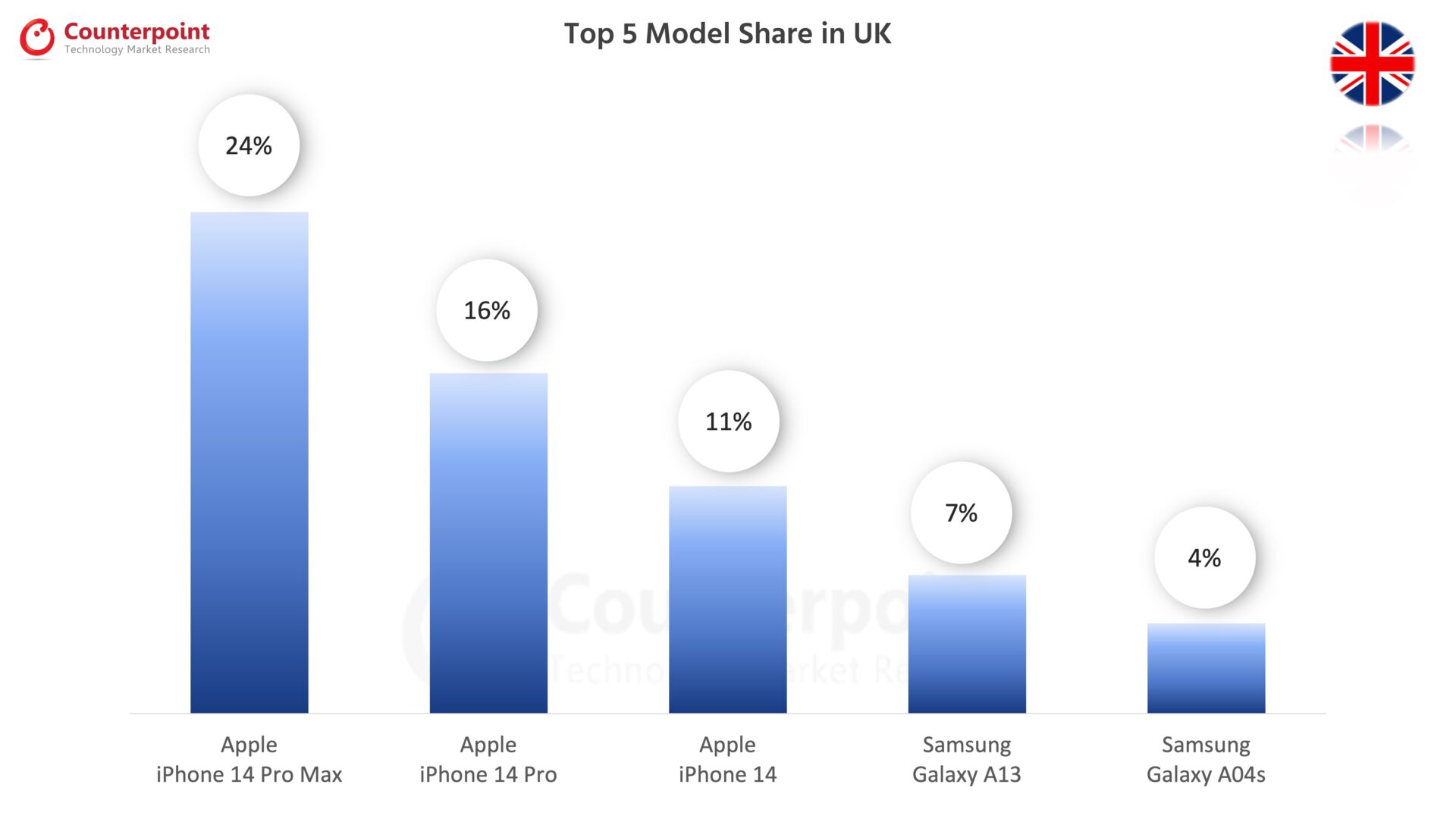

Best-Selling Smartphones in UK in Jan 2023

| Rank | Models | Sales Share |

| 1 | Apple iPhone 14 Pro Max | 24% |

| 2 | Apple iPhone 14 Pro | 16% |

| 3 | Apple iPhone 14 | 11% |

| 4 | Samsung Galaxy A13 | 7% |

| 5 | Samsung Galaxy A04s | 4% |

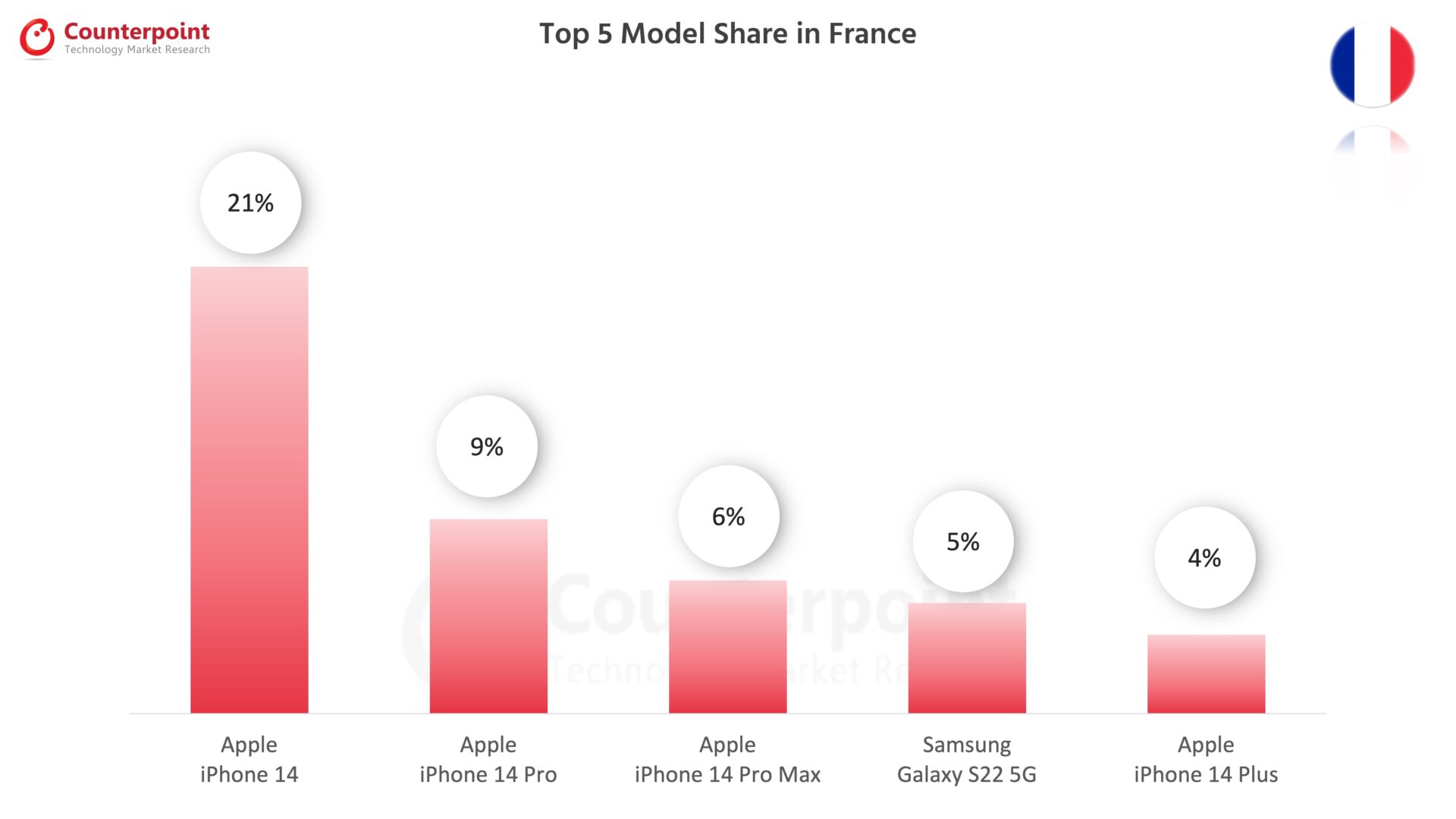

Best-Selling Smartphones in France in Jan 2023

| Rank | Models | Sales Share |

| 1 | Apple iPhone 14 | 21% |

| 2 | Apple iPhone 14 Pro | 9% |

| 3 | Apple iPhone 14 Pro Max | 6% |

| 4 | Samsung Galaxy S22 5G | 5% |

| 5 | Apple iPhone 14 Plus | 4% |

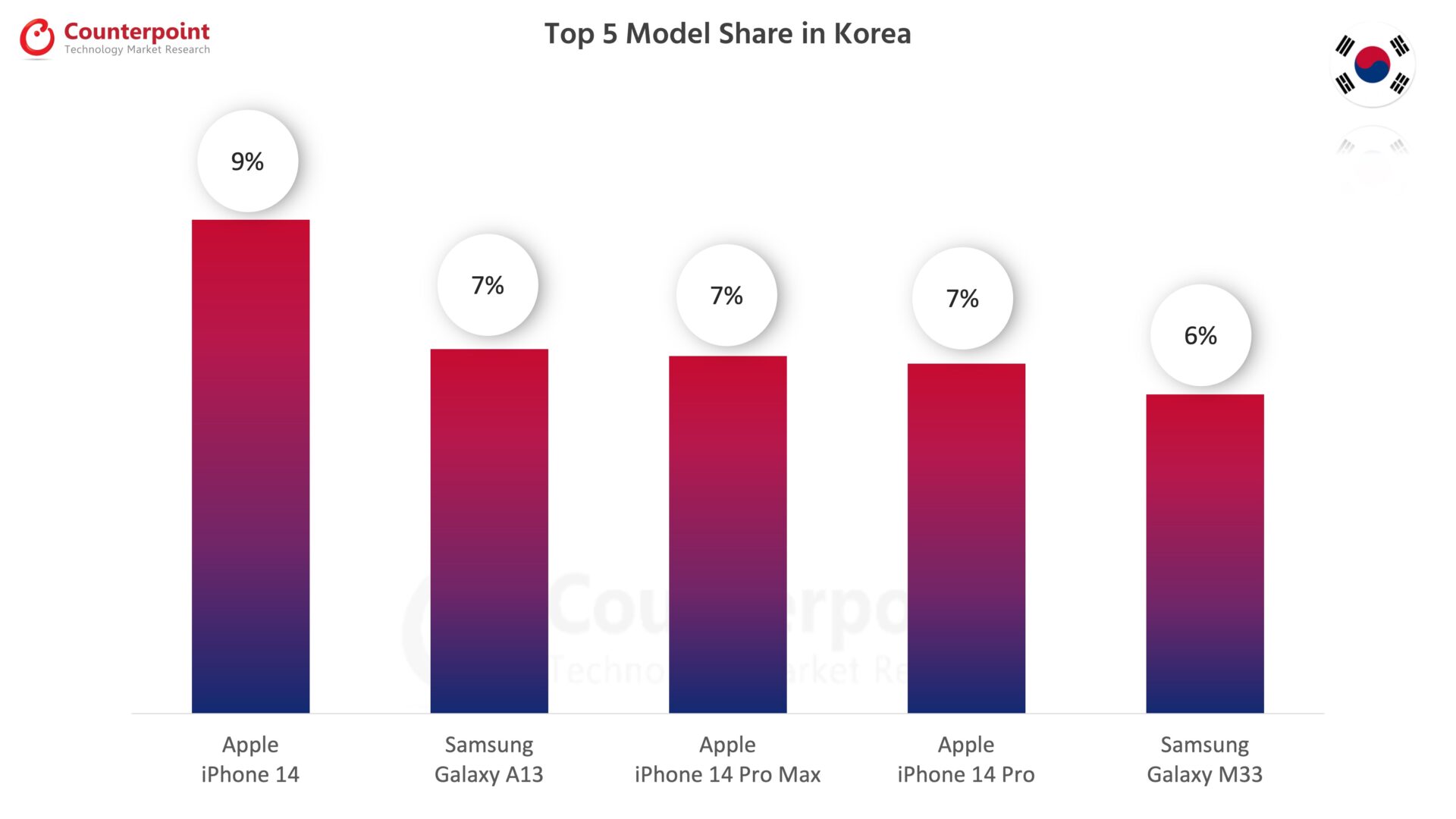

Best-Selling Smartphones in South Korea in Jan 2023

Best-Selling Smartphones in South Korea in Jan 2023

| Rank | Models | Sales Share |

| 1 | Apple iPhone 14 | 9% |

| 2 | Samsung Galaxy A13 | 7% |

| 3 | Apple iPhone 14 Pro Max | 7% |

| 4 | Apple iPhone 14 Pro | 7% |

| 5 | Samsung Galaxy M33 | 6% |

![]()

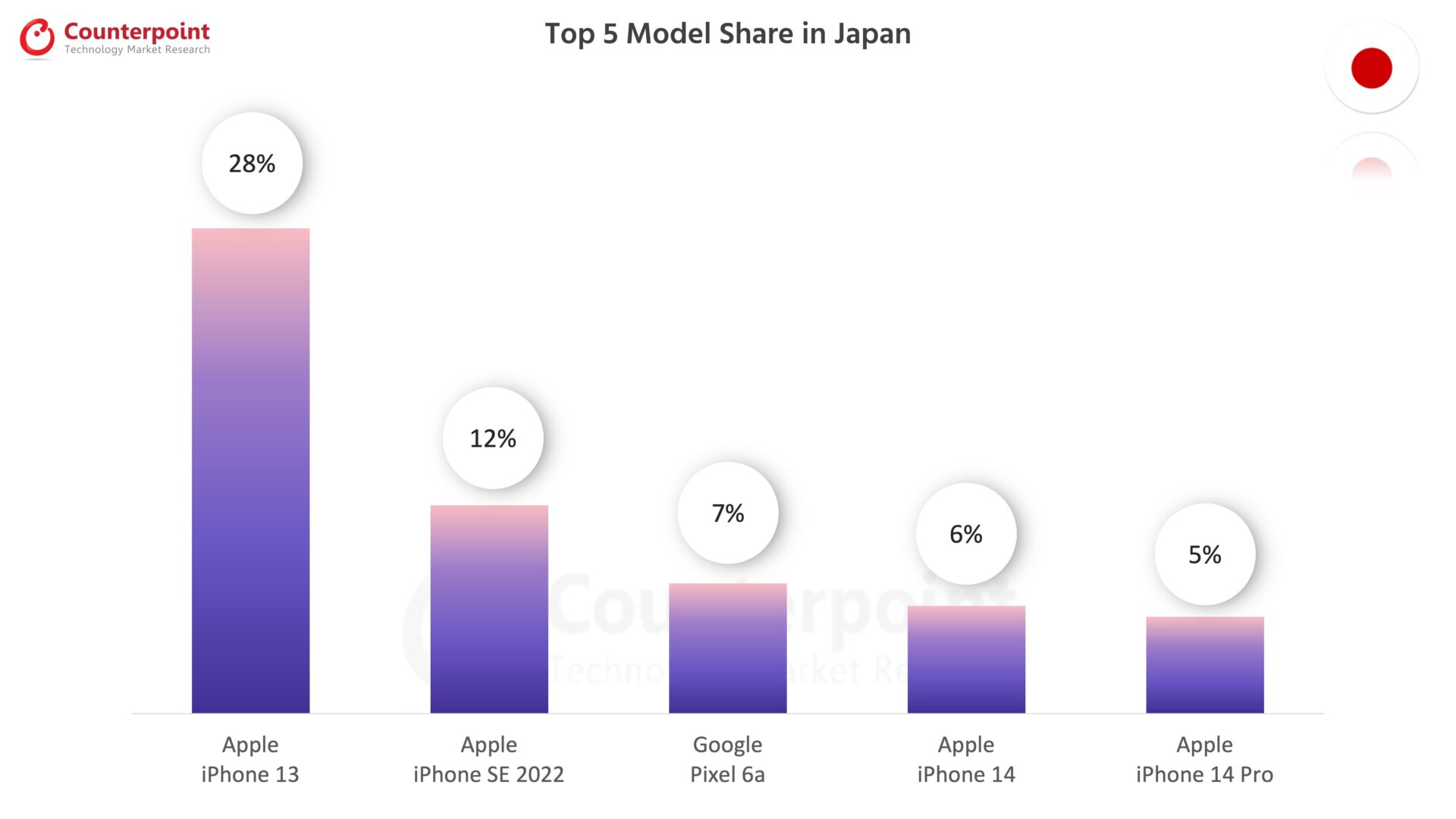

Best-Selling Smartphones in Japan in Jan 2023

| Rank | Models | Sales Share |

| 1 | Apple iPhone 13 | 28% |

| 2 | Apple iPhone SE 2022 | 12% |

| 3 | Google Pixel 6a | 7% |

| 4 | Apple iPhone 14 | 6% |

| 5 | Apple iPhone 14 Pro | 5% |

本节显示了最畅销的智能手机国防部els in Oct 2022 for 8 countries

Oct 2022

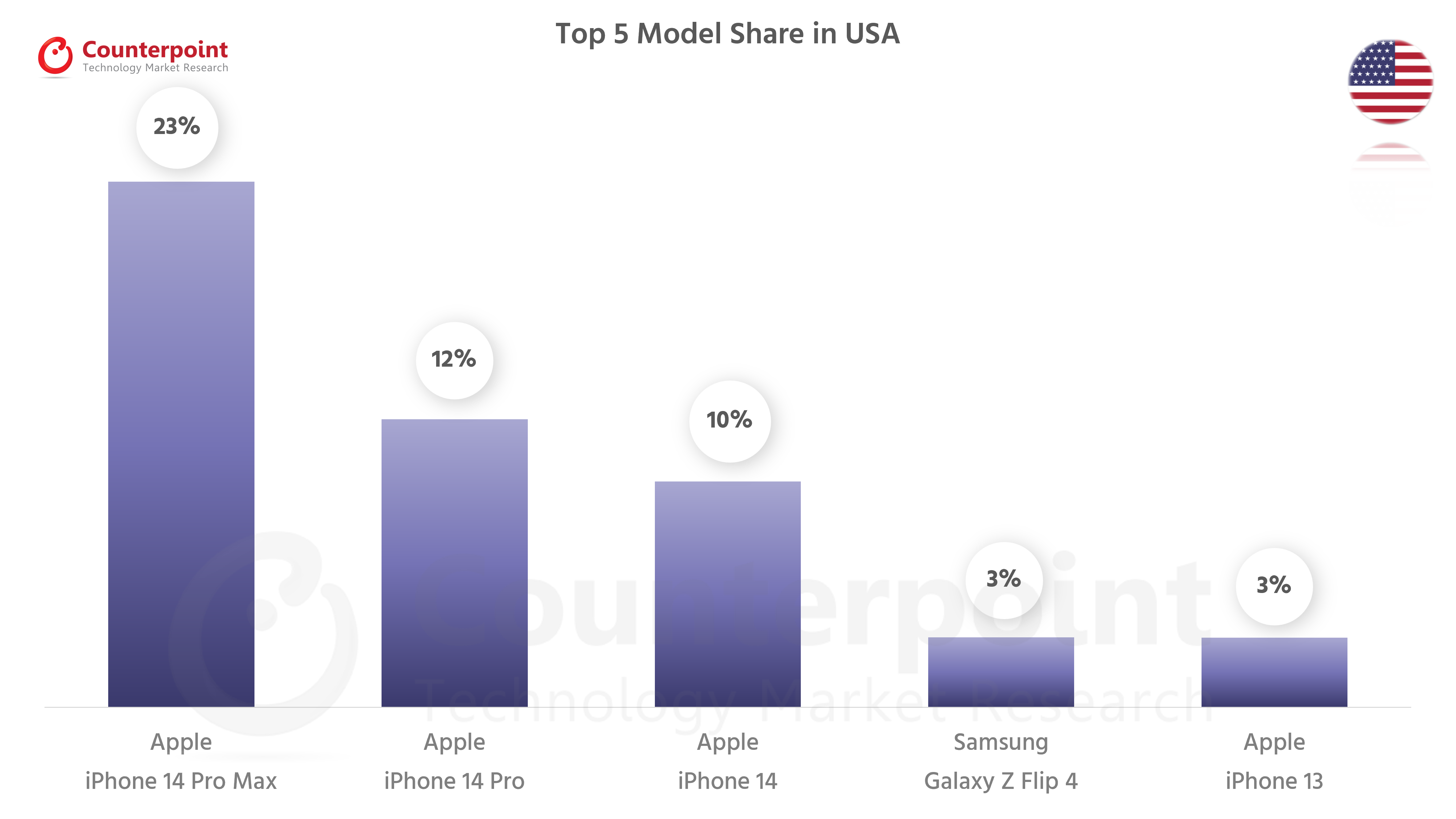

Best-Selling Smartphones in USA in Oct 2022

| Rank | Models | Sales Share |

| 1 | Apple iPhone 14 Pro Max | 23% |

| 2 | Apple iPhone 14 Pro | 12% |

| 3 | Apple iPhone 14 | 10% |

| 4 | Samsung Galaxy Z Flip 4 | 3% |

| 5 | Apple iPhone 13 | 3% |

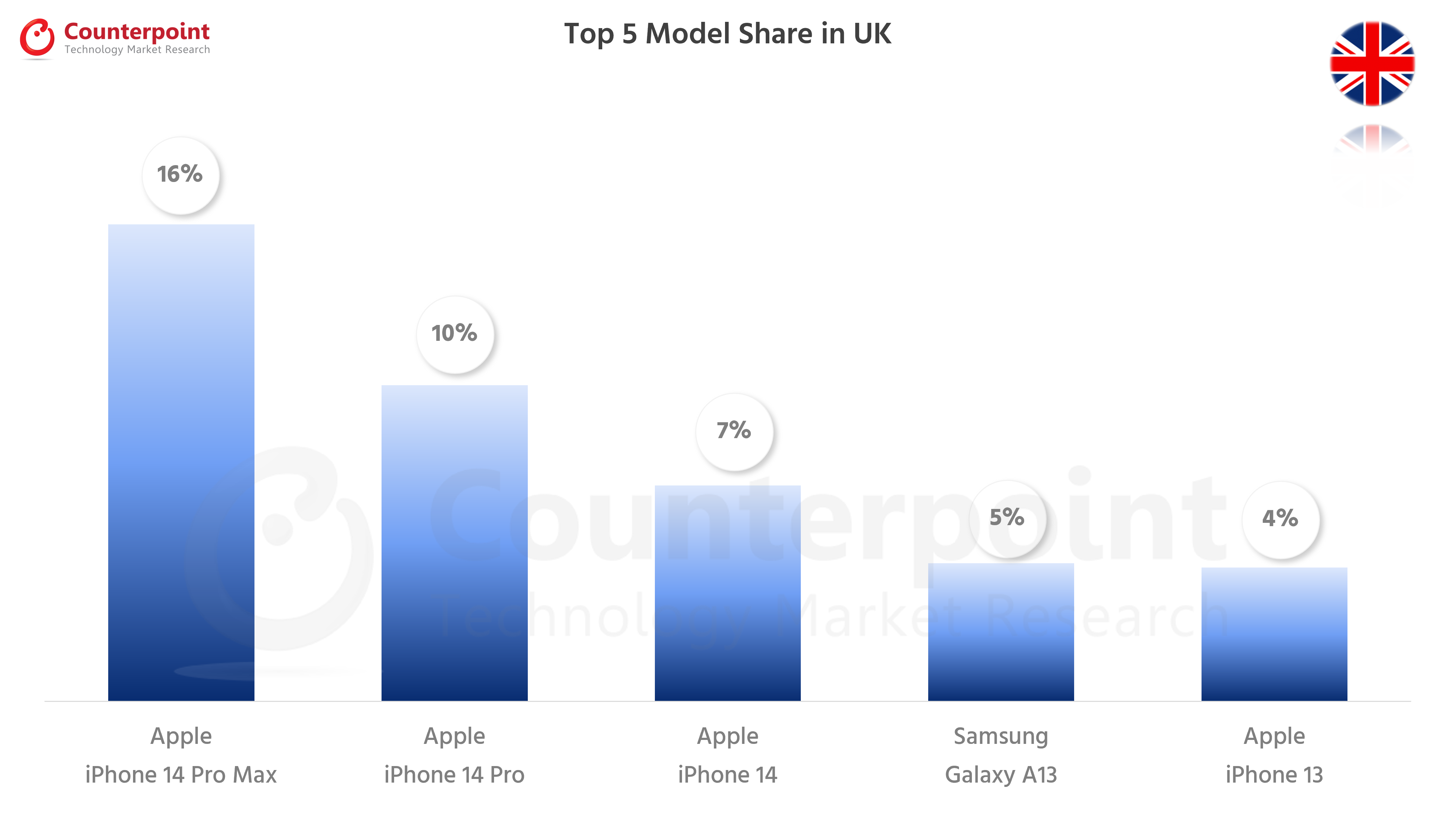

Best-Selling Smartphones in UK in Oct 2022

| Rank | Models | Sales Share |

| 1 | Apple iPhone 14 Pro Max | 16% |

| 2 | Apple iPhone 14 Pro | 10% |

| 3 | Apple iPhone 14 | 7% |

| 4 | Samsung Galaxy A13 | 5% |

| 5 | Apple iPhone 13 | 4% |

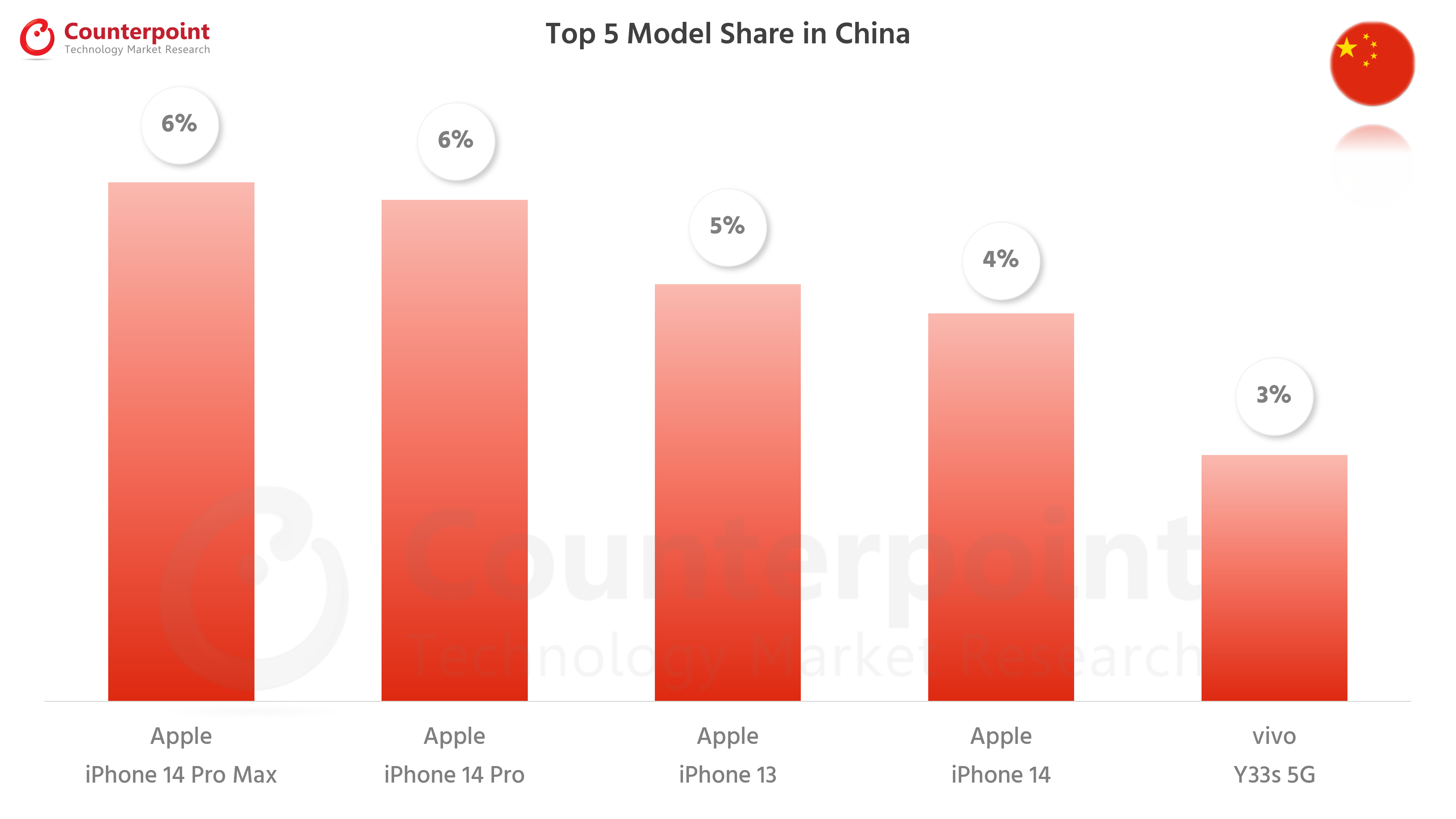

Best-Selling Smartphones in China in Oct 2022

| Rank | Models | Sales Share |

| 1 | Apple iPhone 14 Pro Max | 6% |

| 2 | Apple iPhone 14 Pro | 6% |

| 3 | Apple iPhone 13 | 5% |

| 4 | Apple iPhone 14 | 4% |

| 5 | vivo Y33s 5G | 3% |

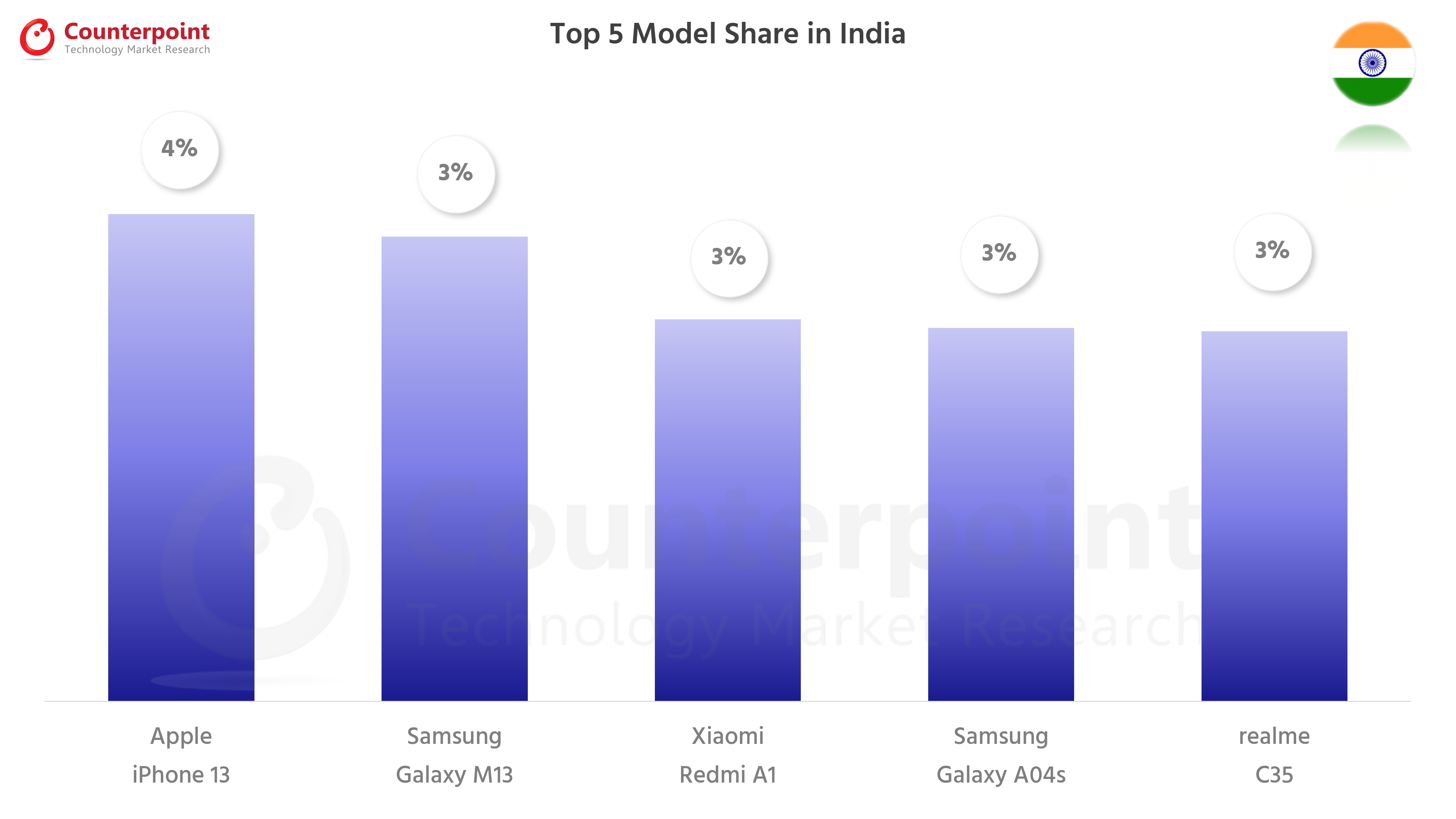

Best-Selling Smartphones in India in Oct 2022

| Rank | Models | Sales Share |

| 1 | Apple iPhone 13 | 4% |

| 2 | Samsung Galaxy M13 | 3% |

| 3 | Xiaomi Redmi A1 | 3% |

| 4 | Samsung Galaxy A04s | 3% |

| 5 | realme C35 | 3% |

Best-Selling Smartphones in France in Oct 2022

| Rank | Models | Sales Share |

| 1 | Apple iPhone 14 | 10% |

| 2 | Apple iPhone 14 Pro | 9% |

| 3 | Apple iPhone 14 Pro Max | 7% |

| 4 | Apple iPhone 13 | 5% |

| 5 | Apple iPhone 13 Pro Max | 5% |

Best-Selling Smartphones in South Korea in Oct 2022

Best-Selling Smartphones in South Korea in Oct 2022

| Rank | Models | Sales Share |

| 1 | Apple iPhone 14 Pro Max | 10% |

| 2 | Samsung Galaxy A13 | 8% |

| 3 | Apple iPhone 14 Pro | 8% |

| 4 | Samsung Galaxy M33 | 6% |

| 5 | Apple iPhone 14 | 6% |

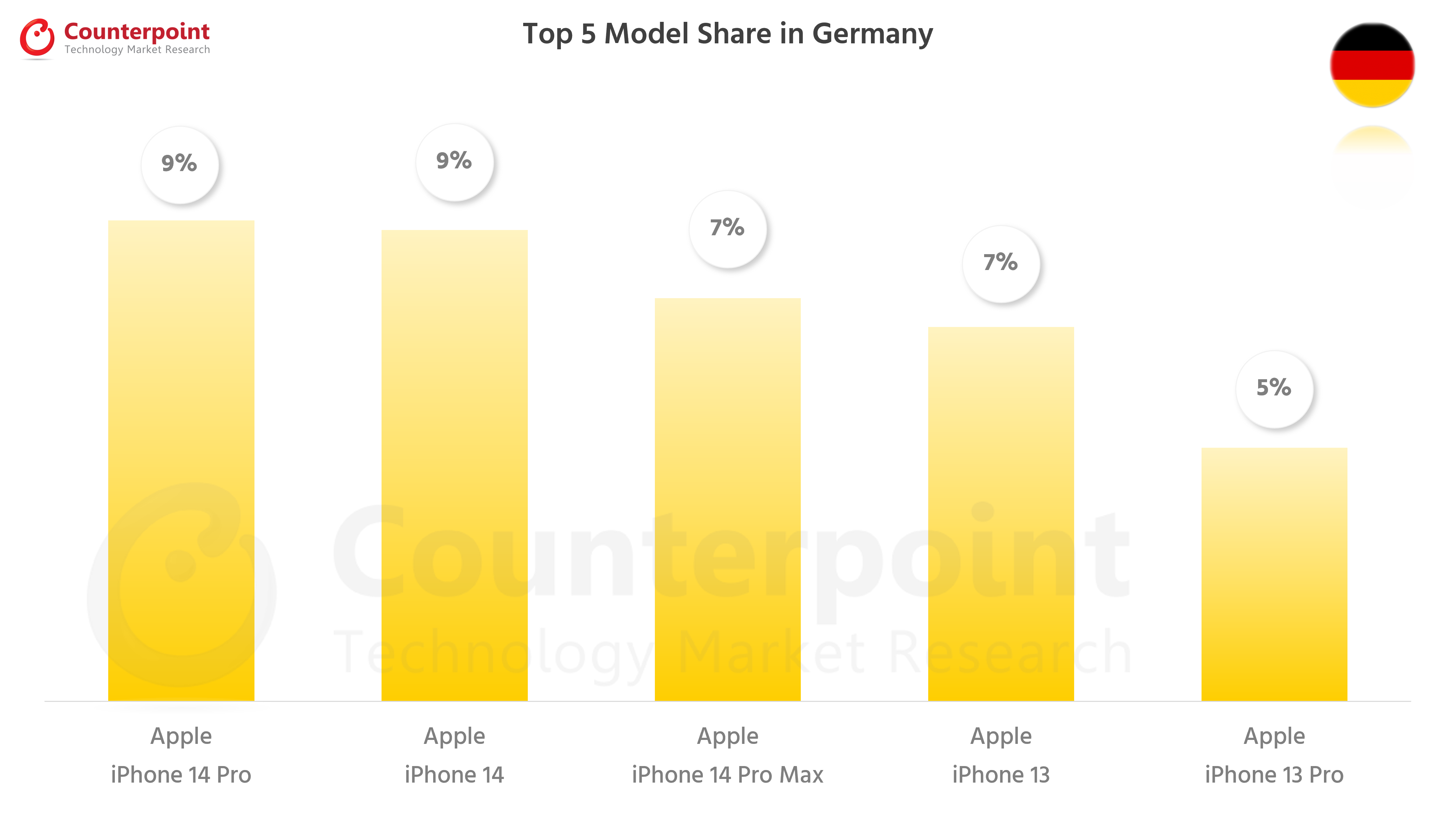

Best-Selling Smartphones in Germany in Oct 2022

| Rank | Models | Sales Share |

| 1 | Apple iPhone 14 Pro | 9% |

| 2 | Apple iPhone 14 | 9% |

| 3 | Apple iPhone 14 Pro Max | 7% |

| 4 | Apple iPhone 13 | 7% |

| 5 | Apple iPhone 13 Pro | 5% |

![]()

Best-Selling Smartphones in Japan in Oct 2022

| Rank | Models | Sales Share |

| 1 | Apple iPhone SE 2022 | 23% |

| 2 | Apple iPhone 13 | 14% |

| 3 | Apple iPhone 14 | 9% |

| 4 | Apple iPhone 14 Pro | 7% |

| 5 | Google Pixel 6a | 5% |

本节显示了最畅销的智能手机国防部els in July 2022 for 8 countries

Jul 2022

Published date: September 15, 2022

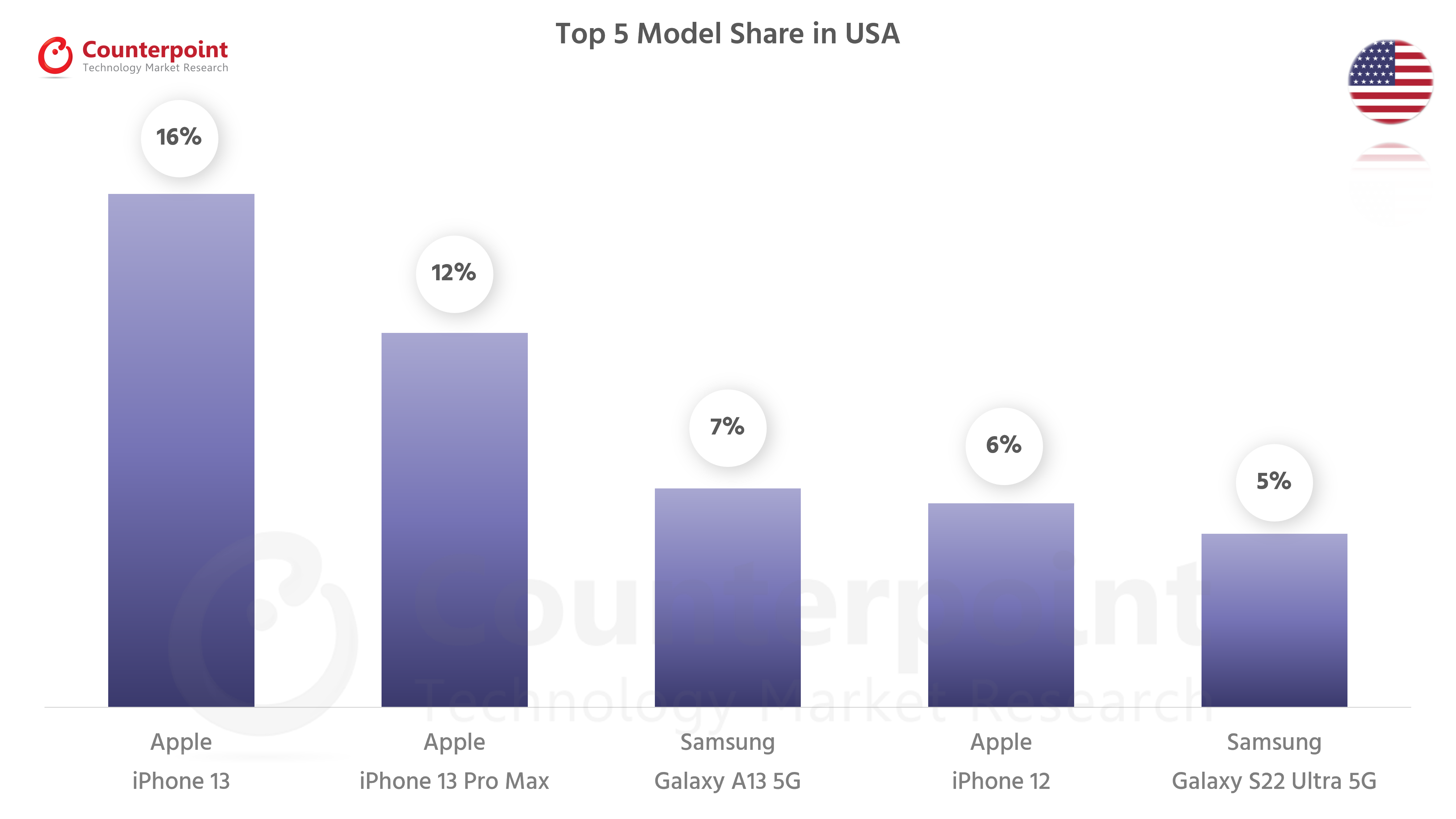

Best-Selling Smartphones in USA

| Rank | Models | Sales Share |

| 1 | Apple iPhone 13 | 16% |

| 2 | Apple iPhone 13 Pro Max | 12% |

| 3 | Samsung Galaxy A13 5G | 7% |

| 4 | Apple iPhone 12 | 6% |

| 5 | Samsung Galaxy S22 Ultra 5G | 5% |

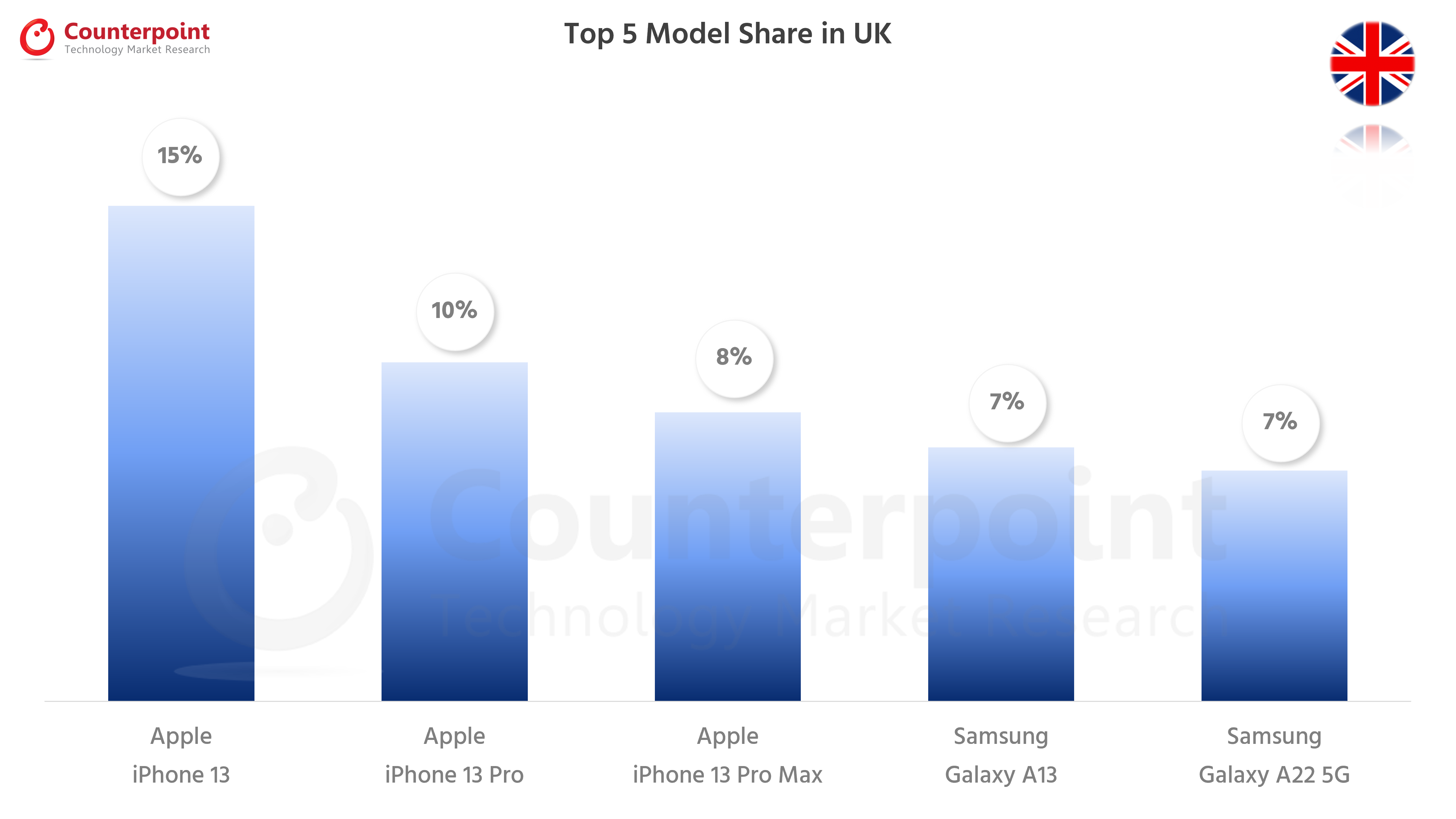

Best-Selling Smartphones in UK

| Rank | Models | Sales Share |

| 1 | Apple iPhone 13 | 15% |

| 2 | Apple iPhone 13 Pro | 10% |

| 3 | Apple iPhone 13 Pro Max | 8% |

| 4 | Samsung Galaxy A13 | 7% |

| 5 | Samsung Galaxy A22 5G | 7% |

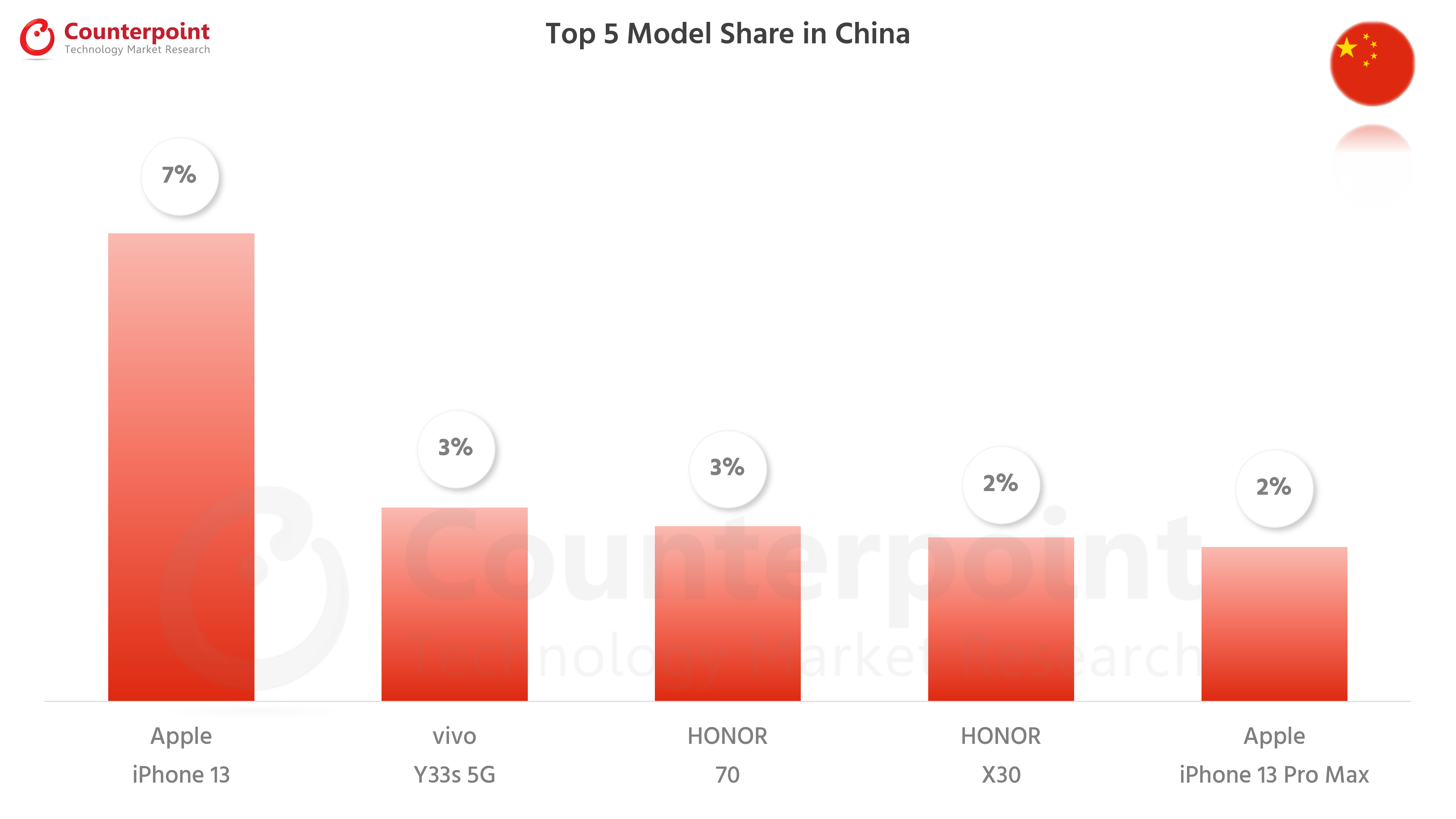

Best-Selling Smartphones in China

| Rank | Models | Sales Share |

| 1 | Apple iPhone 13 | 7% |

| 2 | vivo Y33s 5G | 3% |

| 3 | HONOR 70 | 3% |

| 4 | HONOR X30 | 2% |

| 5 | Apple iPhone 13 Pro Max | 2% |

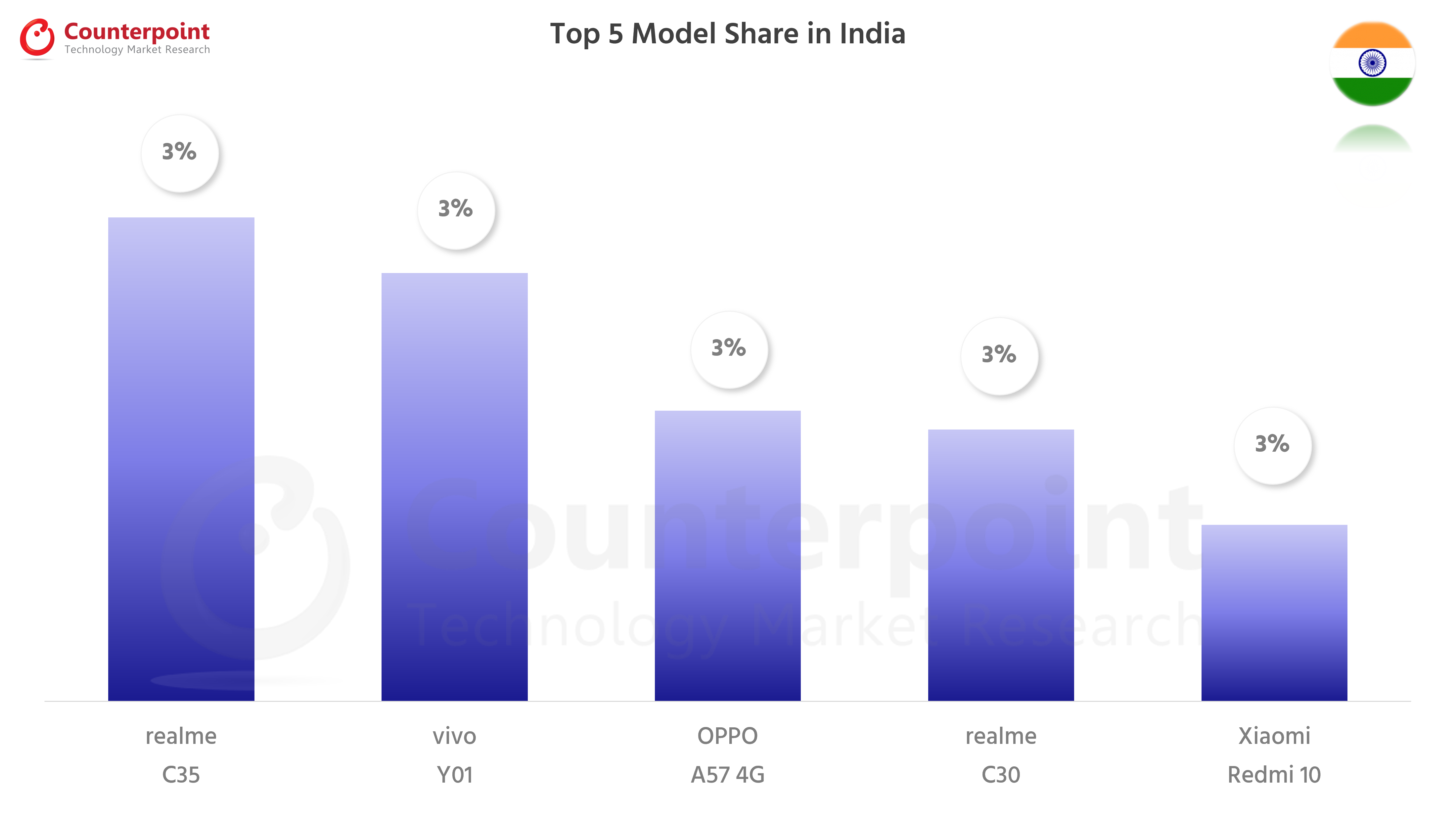

Best-Selling Smartphones in India

| Rank | Models | Sales Share |

| 1 | realme C35 | 3% |

| 2 | vivo Y01 | 3% |

| 3 | OPPO A57 4G | 3% |

| 4 | realme C30 | 3% |

| 5 | Xiaomi Redmi 10 | 3% |

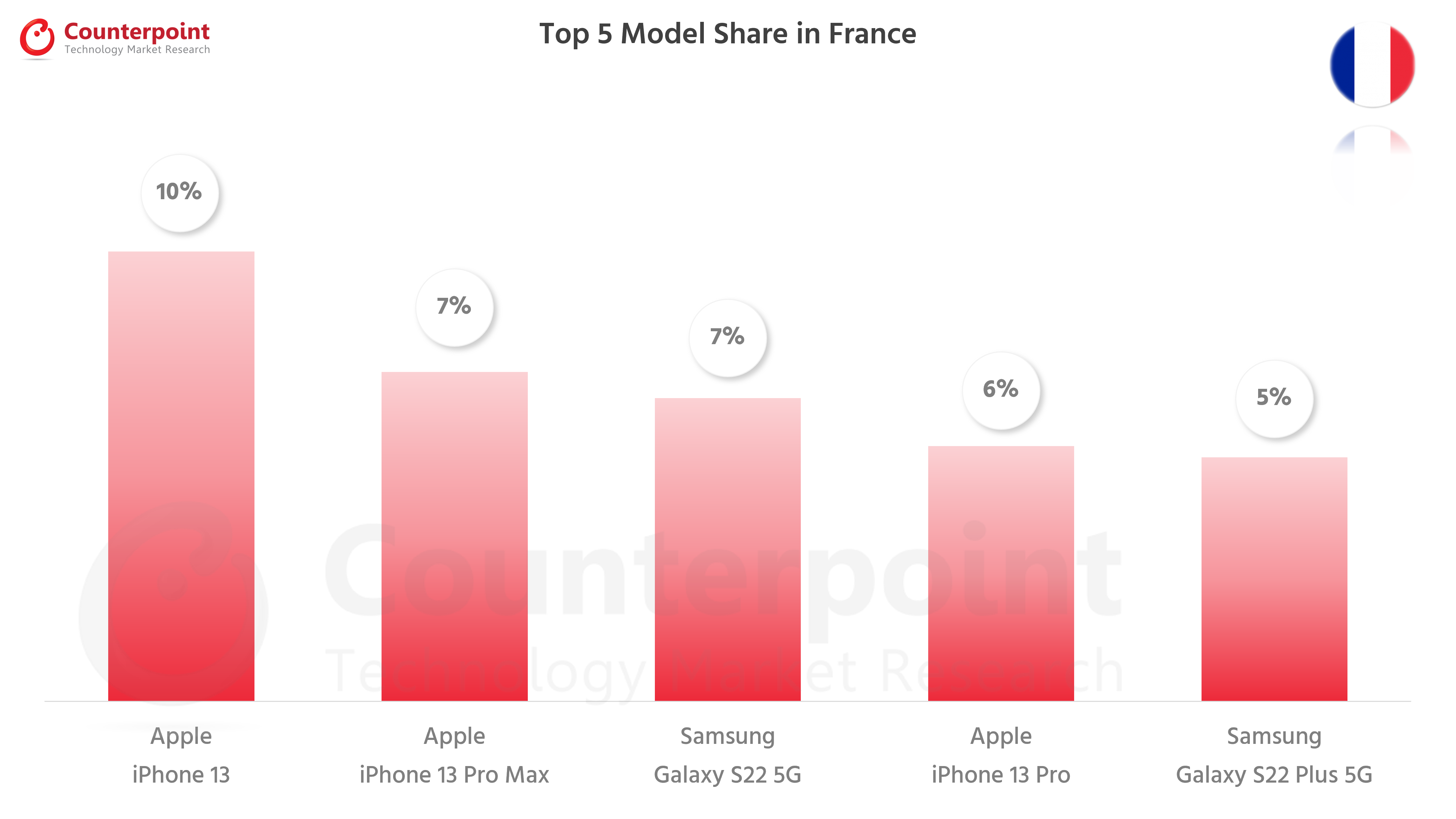

Best-Selling Smartphones in France

| Rank | Models | Sales Share |

| 1 | Apple iPhone 13 | 10% |

| 2 | Apple iPhone 13 Pro Max | 7% |

| 3 | Samsung Galaxy S22 5G | 7% |

| 4 | Apple iPhone 13 Pro | 6% |

| 5 | Samsung Galaxy S22 Plus 5G | 5% |

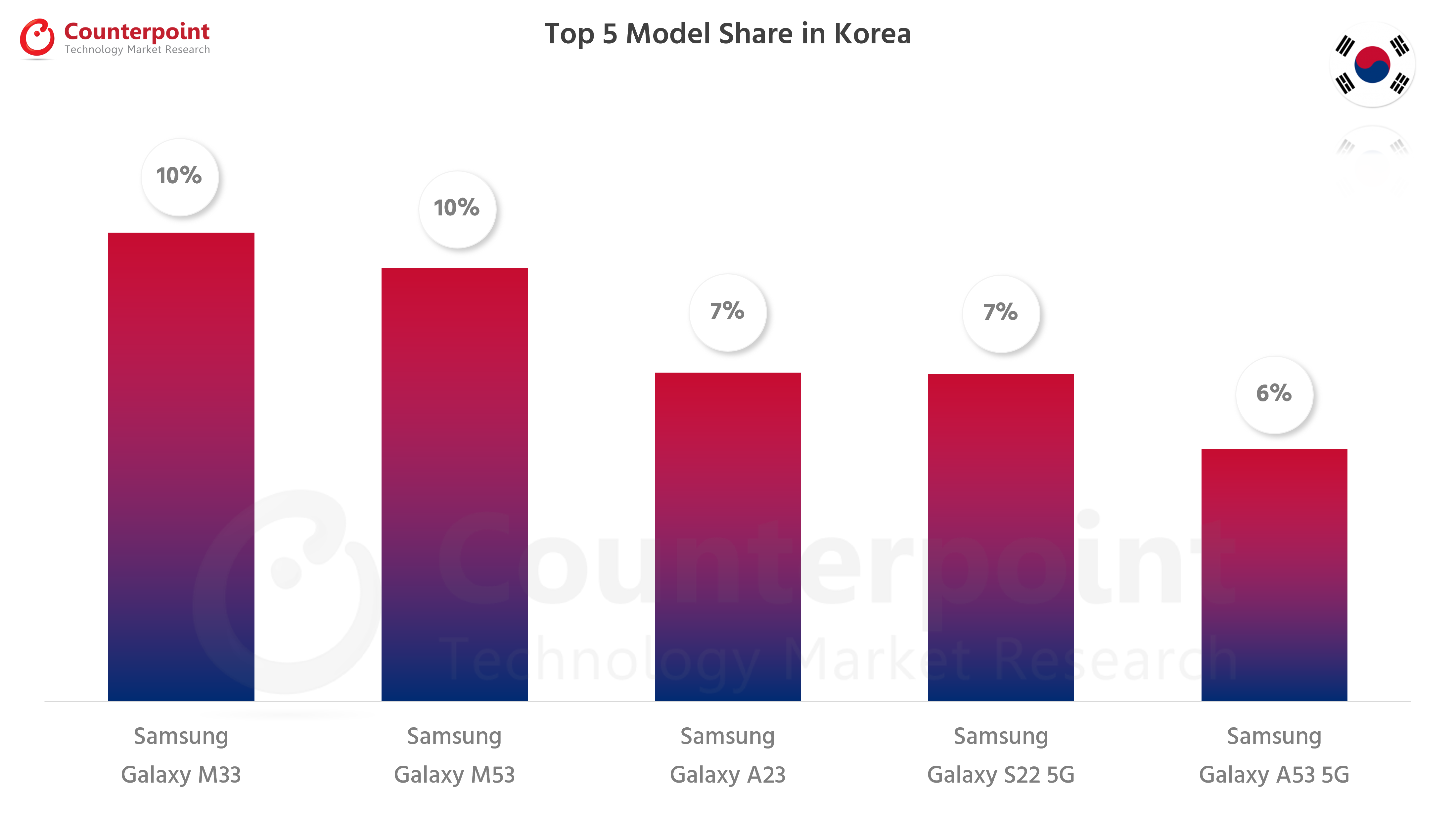

Best-Selling Smartphones in South Korea

Best-Selling Smartphones in South Korea

| Rank | Models | Sales Share |

| 1 | Samsung Galaxy M33 | 10% |

| 2 | Samsung Galaxy M53 | 10% |

| 3 | Samsung Galaxy A23 | 7% |

| 4 | Samsung Galaxy S22 5G | 7% |

| 5 | Samsung Galaxy A53 5G | 6% |

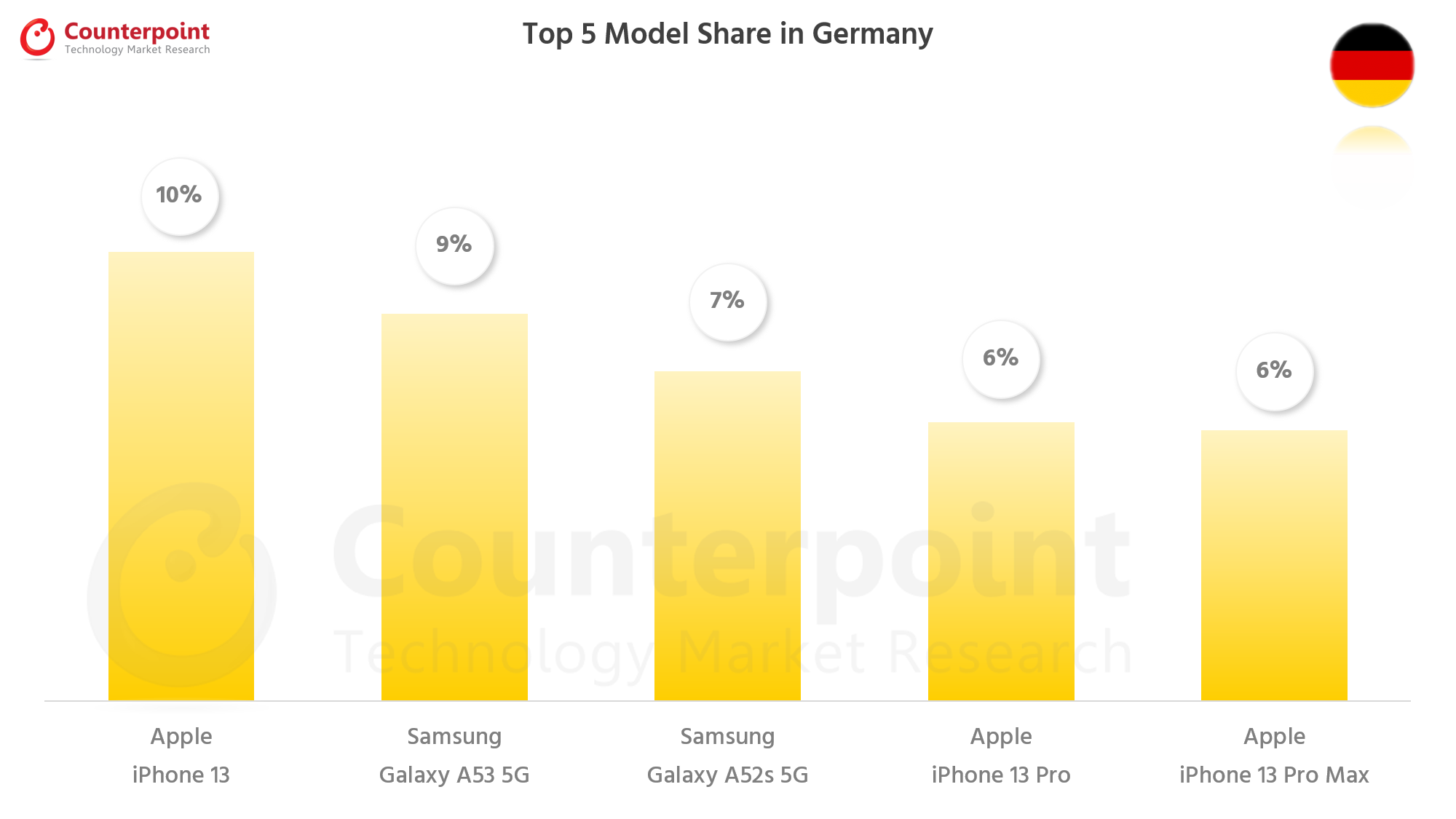

Best-Selling Smartphones in Germany

| Rank | Models | Sales Share |

| 1 | Apple iPhone 13 Pro Max | 10% |

| 2 | Samsung Galaxy A33 5G | 9% |

| 3 | Apple iPhone 13 Pro | 9% |

| 4 | Samsung Galaxy A53 5G | 9% |

| 5 | Apple iPhone 13 | 8% |

![]()

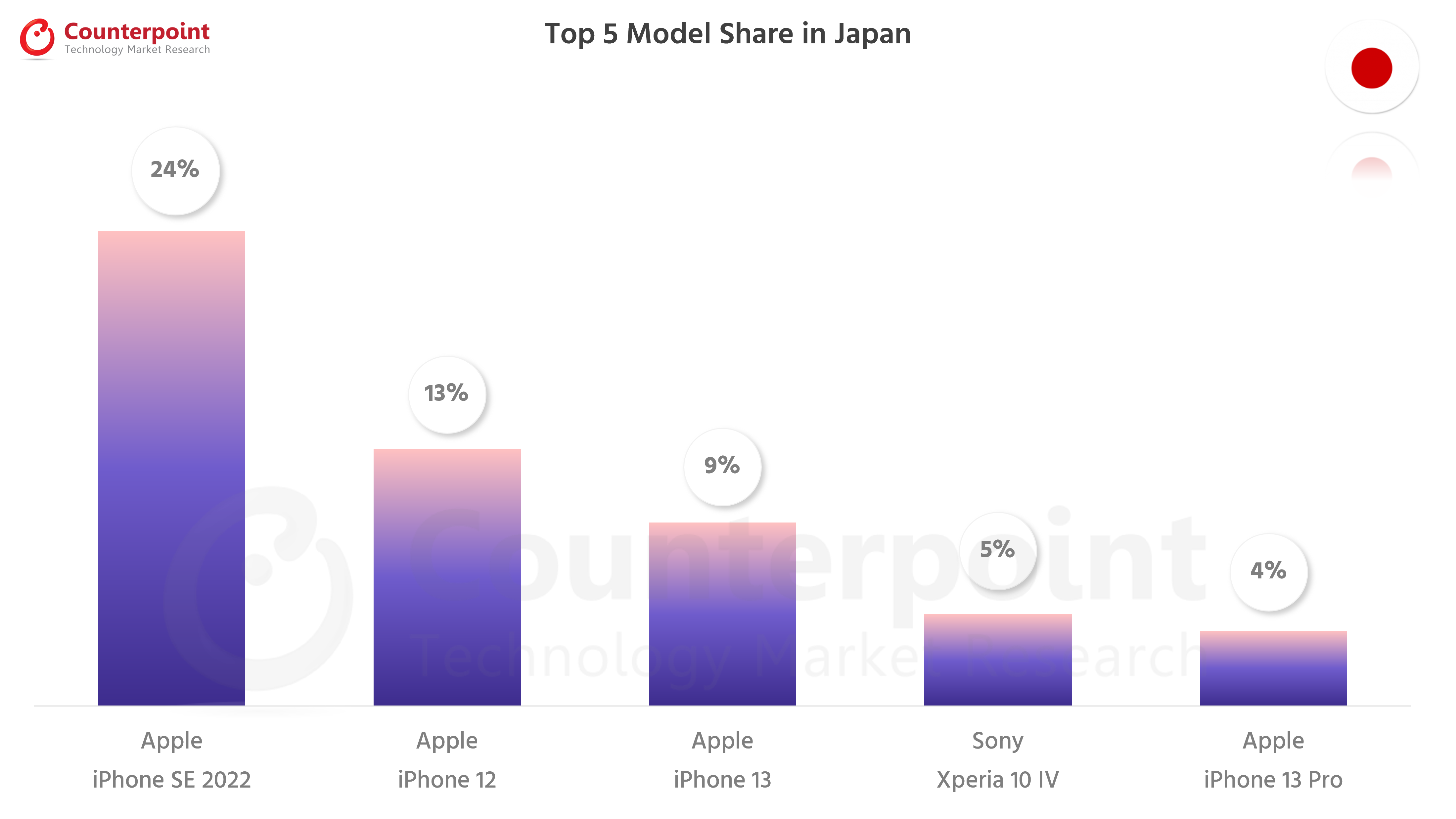

Best-Selling Smartphones in Japan

| Rank | Models | Sales Share |

| 1 | Apple iPhone SE 2022 | 24% |

| 2 | Apple iPhone 12 | 13% |

| 3 | Apple iPhone 13 | 9% |

| 4 | Sony Xperia 10 IV | 5% |

| 5 | Apple iPhone 13 Pro | 4% |

本节显示了最畅销的智能手机国防部els in April 2022 for 8 countries

Apr 2022

Published date: June 15, 2022

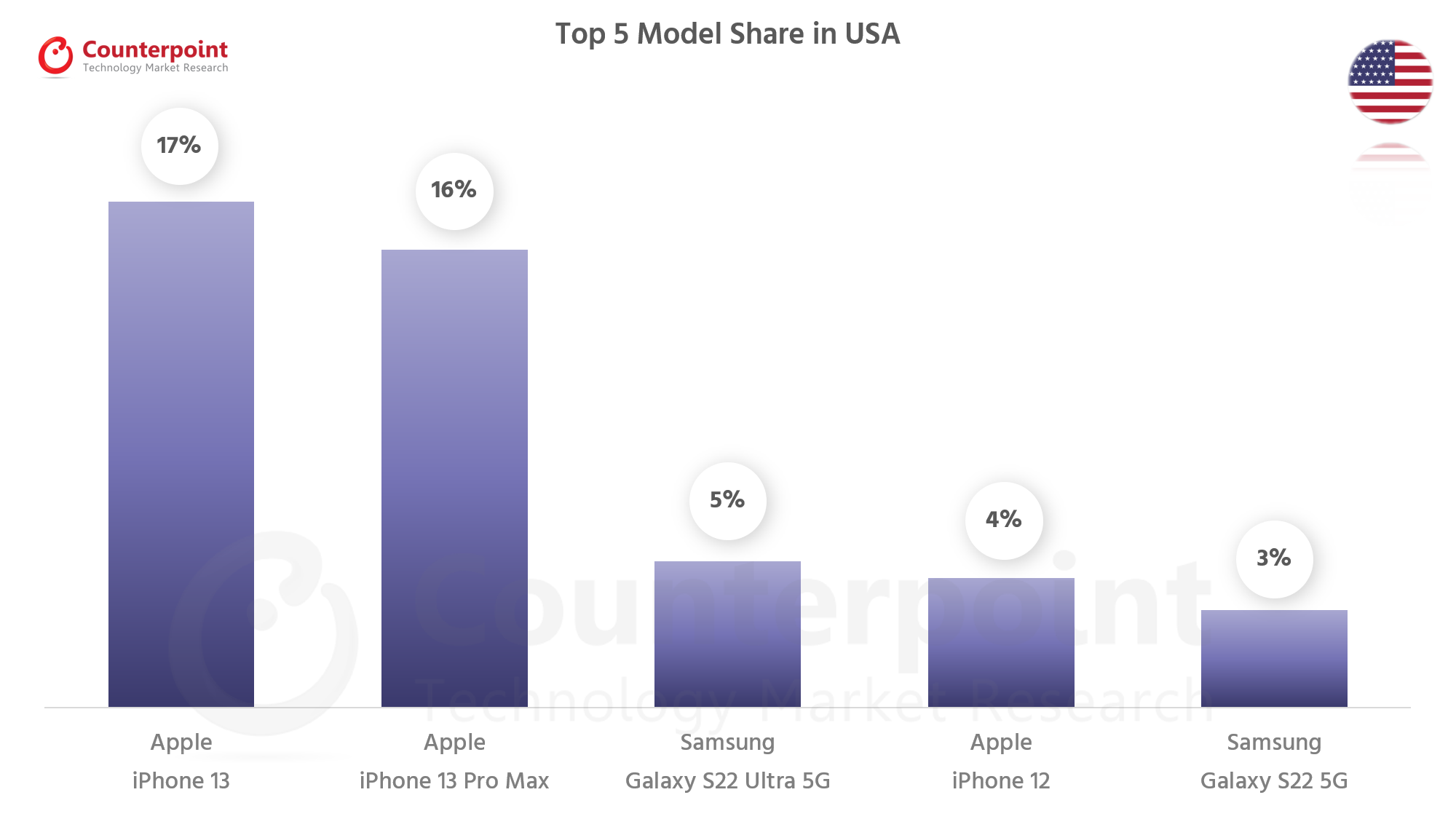

Best-Selling Smartphones in USA

| Rank | Models | Sales Share |

| 1 | Apple iPhone 13 | 17% |

| 2 | Apple iPhone 13 Pro Max | 16% |

| 3 | Samsung Galaxy S22 Ultra 5G | 5% |

| 4 | Apple iPhone 12 | 4% |

| 5 | Samsung Galaxy S22 5G | 3% |

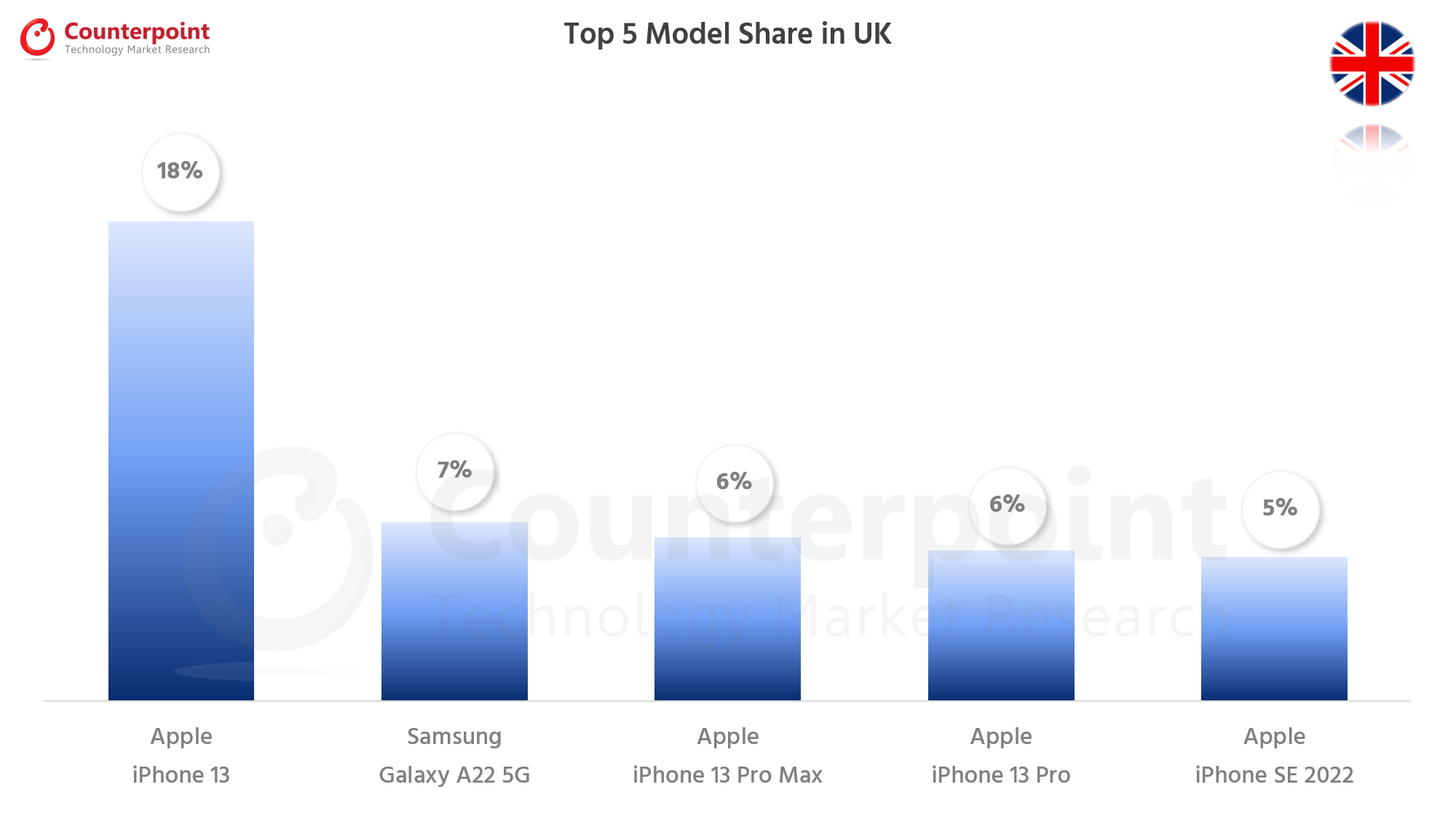

Best-Selling Smartphones in UK

| Rank | Models | Sales Share |

| 1 | Apple iPhone 13 | 18% |

| 2 | Samsung Galaxy A22 5G | 7% |

| 3 | Apple iPhone 13 Pro Max | 6% |

| 4 | Apple iPhone 13 Pro | 6% |

| 5 | Apple iPhone SE 2022 | 5% |

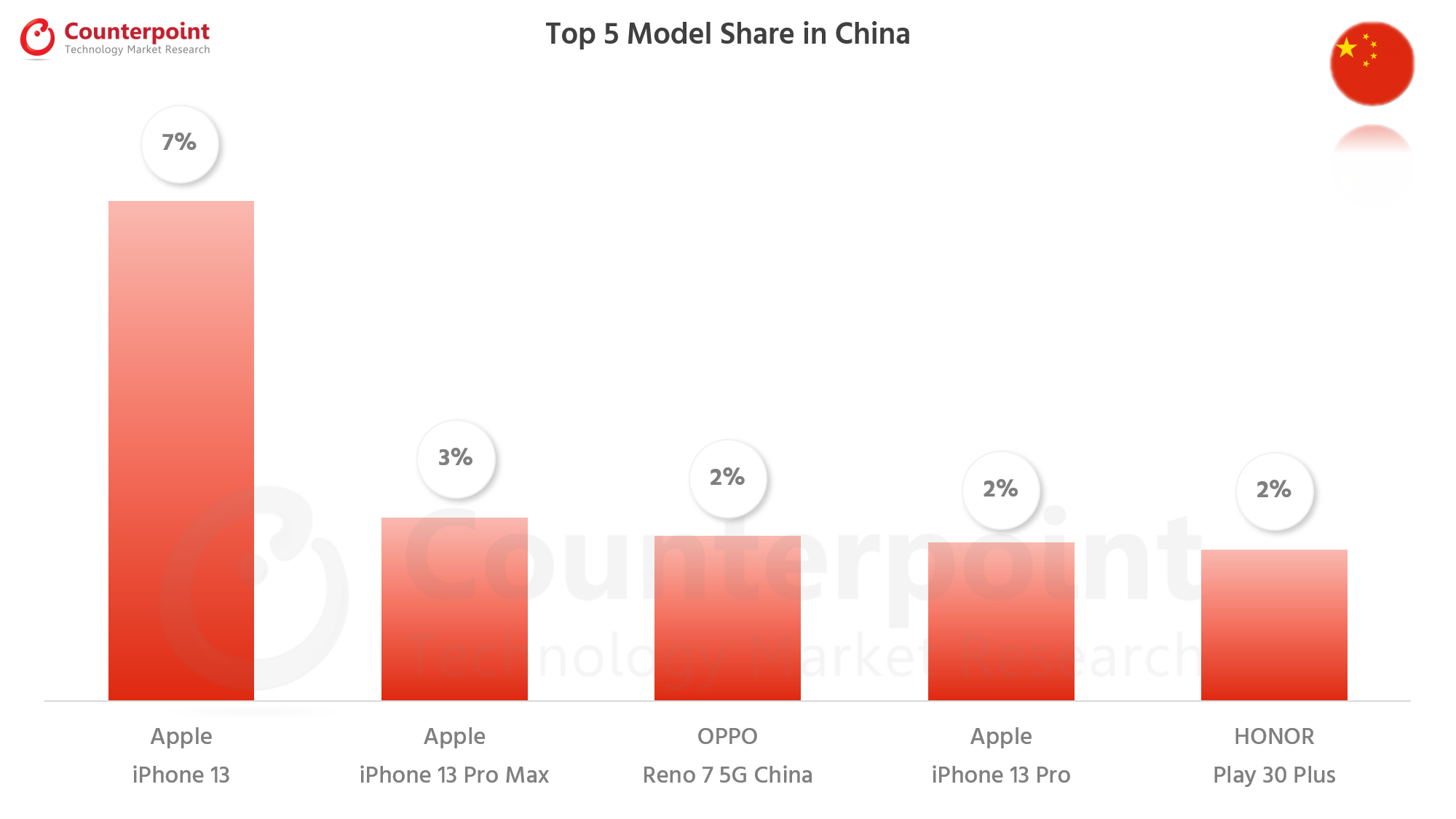

Best-Selling Smartphones in China

| Rank | Models | Sales Share |

| 1 | Apple iPhone 13 | 7% |

| 2 | Apple iPhone 13 Pro Max | 3% |

| 3 | OPPO Reno 7 5G China | 2% |

| 4 | Apple iPhone 13 Pro | 2% |

| 5 | HONOR Play 30 Plus | 2% |

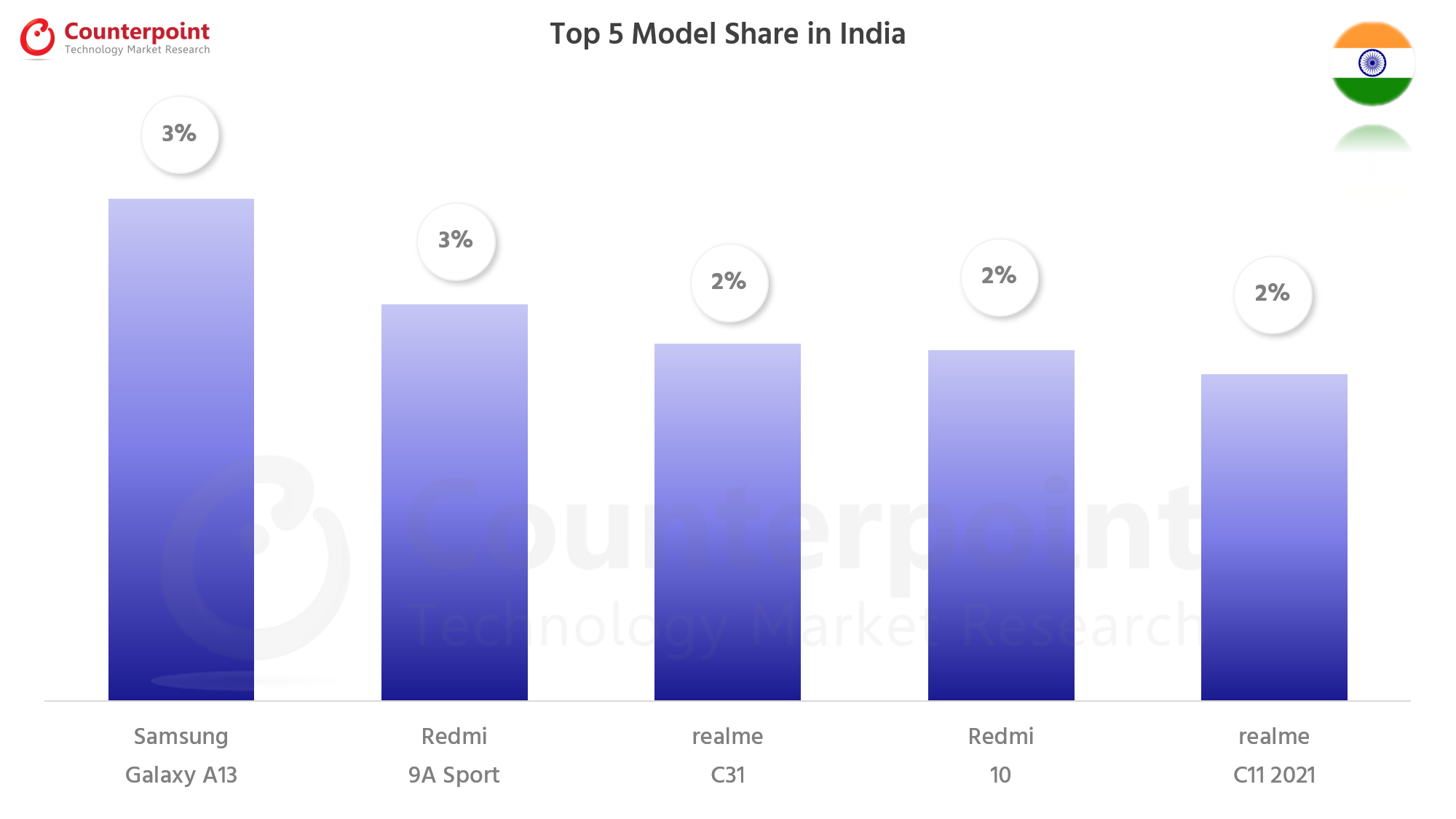

Best-Selling Smartphones in India

| Rank | Models | Sales Share |

| 1 | Samsung Galaxy A13 | 3% |

| 2 | Redmi 9A Sport | 3% |

| 3 | realme C31 | 2% |

| 4 | Redmi 10 | 2% |

| 5 | realme C11 2021 | 2% |

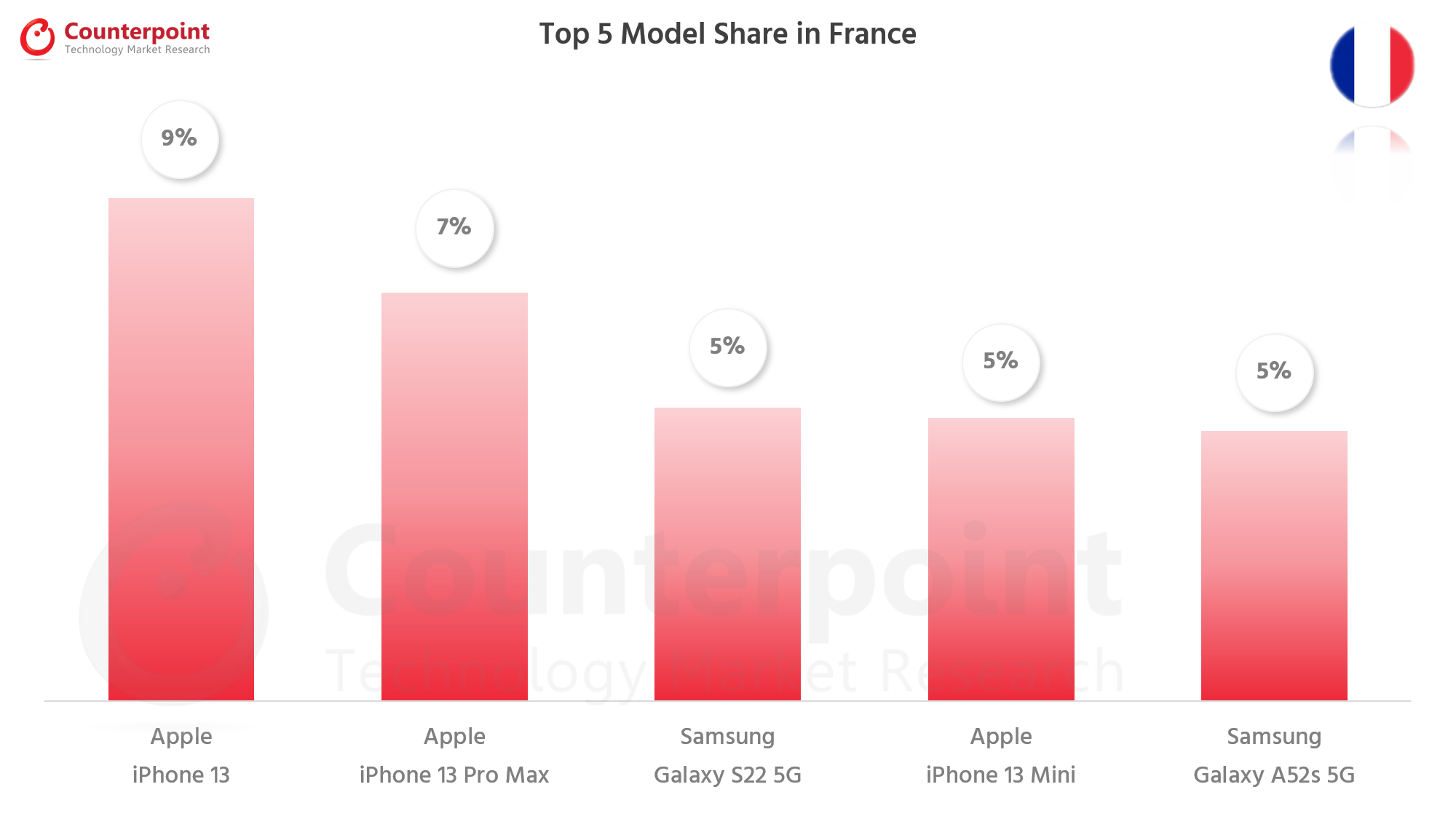

Best-Selling Smartphones in France

| Rank | Models | Sales Share |

| 1 | Apple iPhone 13 | 9% |

| 2 | Apple iPhone 13 Pro Max | 7% |

| 3 | Samsung Galaxy S22 5G | 5% |

| 4 | Apple iPhone 13 Mini | 5% |

| 5 | Samsung Galaxy A52s 5G | 5% |

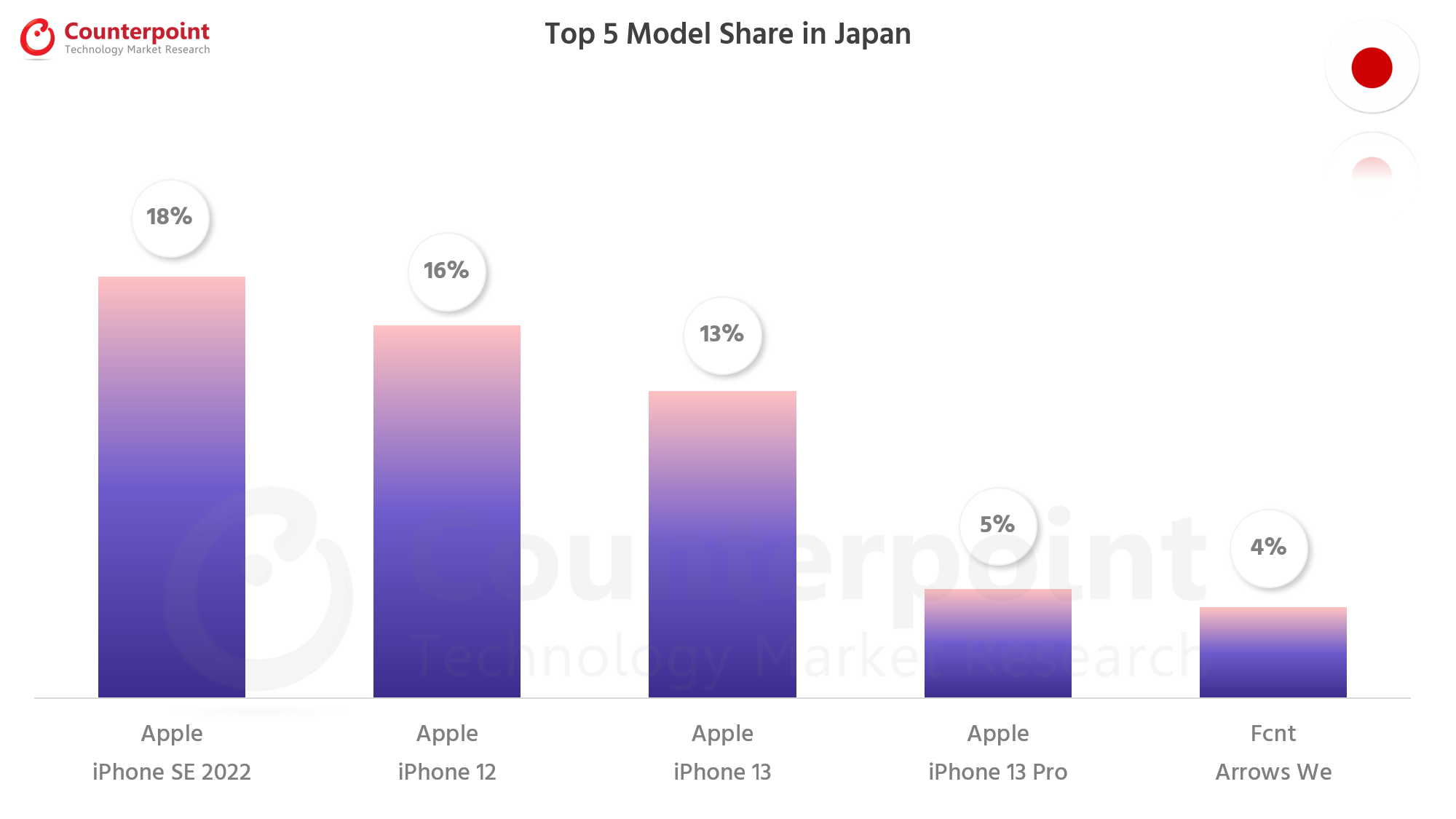

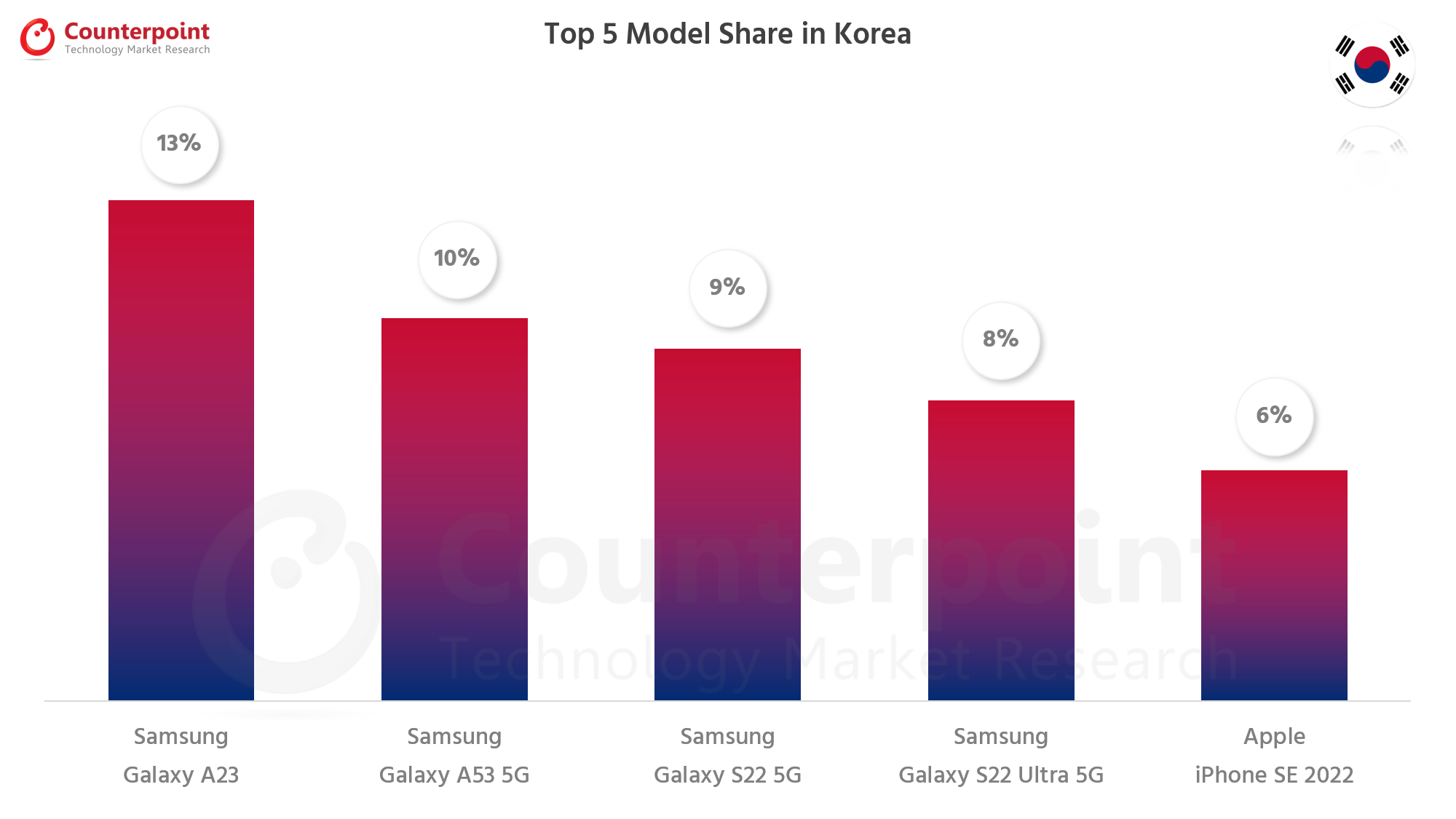

Best-Selling Smartphones in South Korea

Best-Selling Smartphones in South Korea

| Rank | Models | Sales Share |

| 1 | Samsung Galaxy A23 | 13% |

| 2 | Samsung Galaxy A53 5G | 10% |

| 3 | Samsung Galaxy S22 5G | 9% |

| 4 | Samsung Galaxy S22 Ultra 5G | 8% |

| 5 | Apple iPhone SE 2022 | 6% |

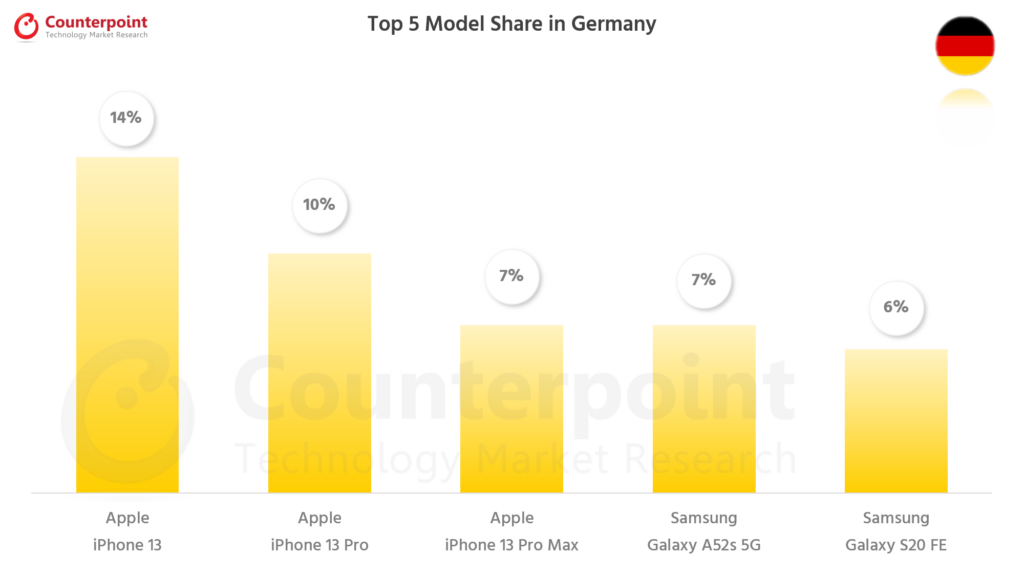

Best-Selling Smartphones in Germany

| Rank | Models | Sales Share |

| 1 | Apple iPhone 13 | 10% |

| 2 | Samsung Galaxy A53 5G | 9% |

| 3 | Samsung Galaxy A52s 5G | 7% |

| 4 | Apple iPhone 13 Pro | 6% |

| 5 | Apple iPhone 13 Pro Max | 6% |

![]()

Best-Selling Smartphones in Japan

| Rank | Models | Sales Share |

| 1 | Apple iPhone SE 2022 | 18% |

| 2 | Apple iPhone 12 | 16% |

| 3 | Apple iPhone 13 | 13% |

| 4 | Apple iPhone 13 Pro | 5% |

| 5 | Fcnt Arrows We | 4% |

本节显示了最畅销的智能手机国防部els in January 2022 for 8 countries

Jan 2022

Published date: March 15, 2022

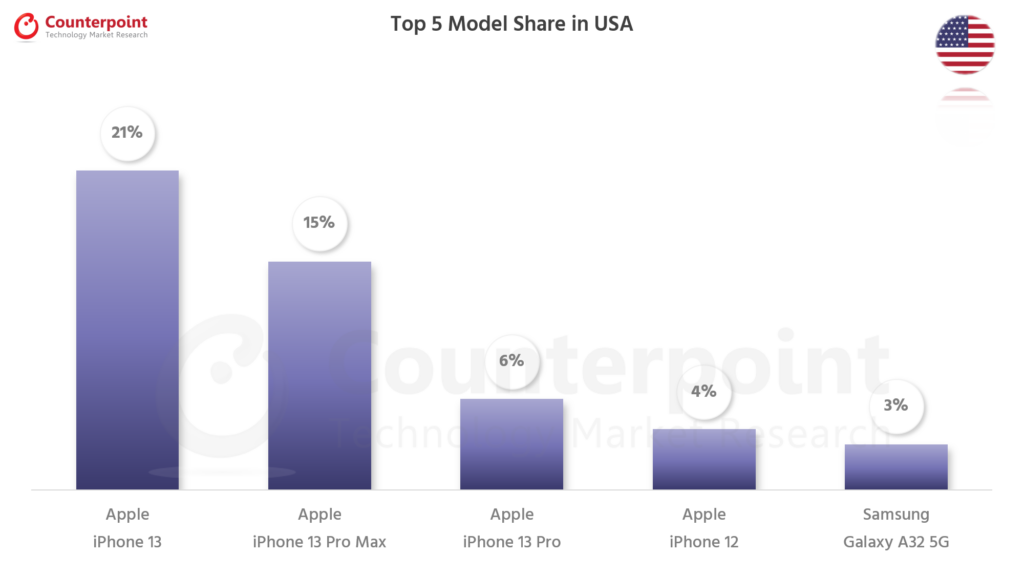

Best Selling Smartphones in USA

| Rank | Models | Sales Share |

| 1 | Apple iPhone 13 | 21% |

| 2 | Apple iPhone 13 Pro Max | 15% |

| 3 | Apple iPhone 13 Pro | 6% |

| 4 | Apple iPhone 12 | 4% |

| 5 | Samsung Galaxy A32 5G | 3% |

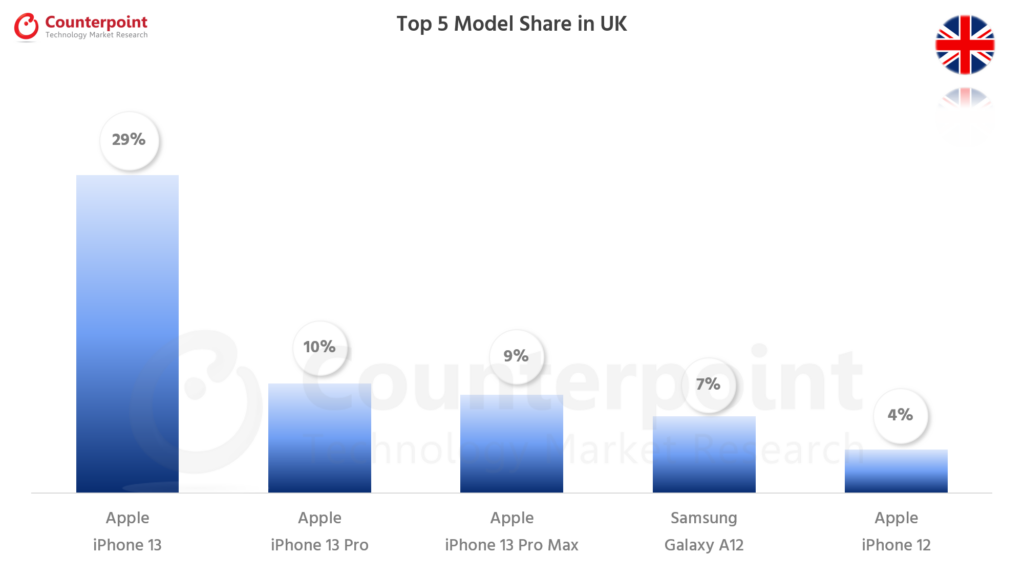

Best Selling Smartphones in UK

| Rank | Models | Sales Share |

| 1 | Apple iPhone 13 | 29% |

| 2 | Apple iPhone 13 Pro | 10% |

| 3 | Apple iPhone 13 Pro Max | 9% |

| 4 | Samsung Galaxy A12 | 7% |

| 5 | Apple iPhone 12 | 4% |

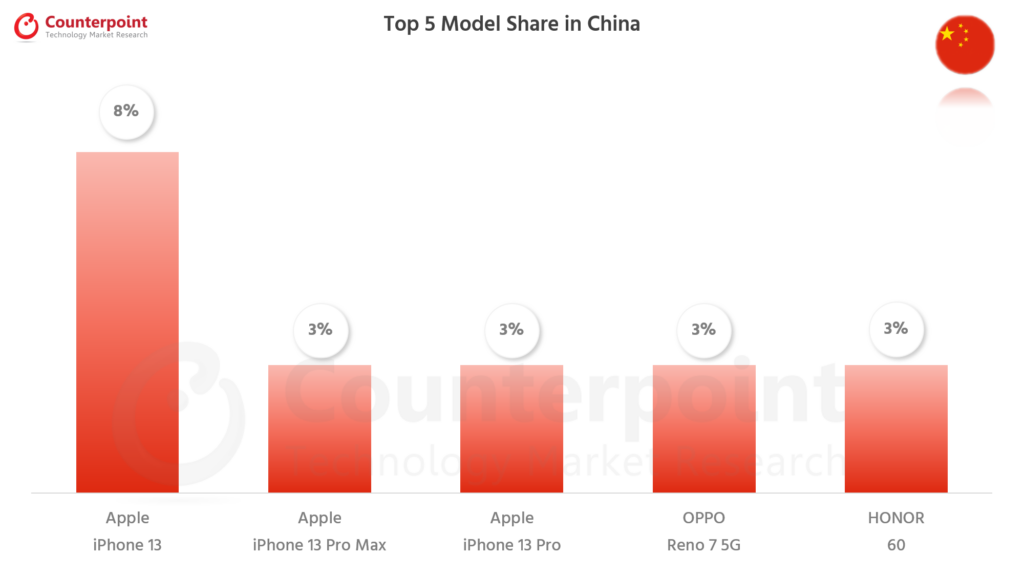

Best Selling Smartphones in China

| Rank | Models | Sales Share |

| 1 | Apple iPhone 13 | 8% |

| 2 | Apple iPhone 13 Pro Max | 3% |

| 3 | Apple iPhone 13 Pro | 3% |

| 4 | OPPO Reno 7 5G | 3% |

| 5 | HONOR 60 | 3% |

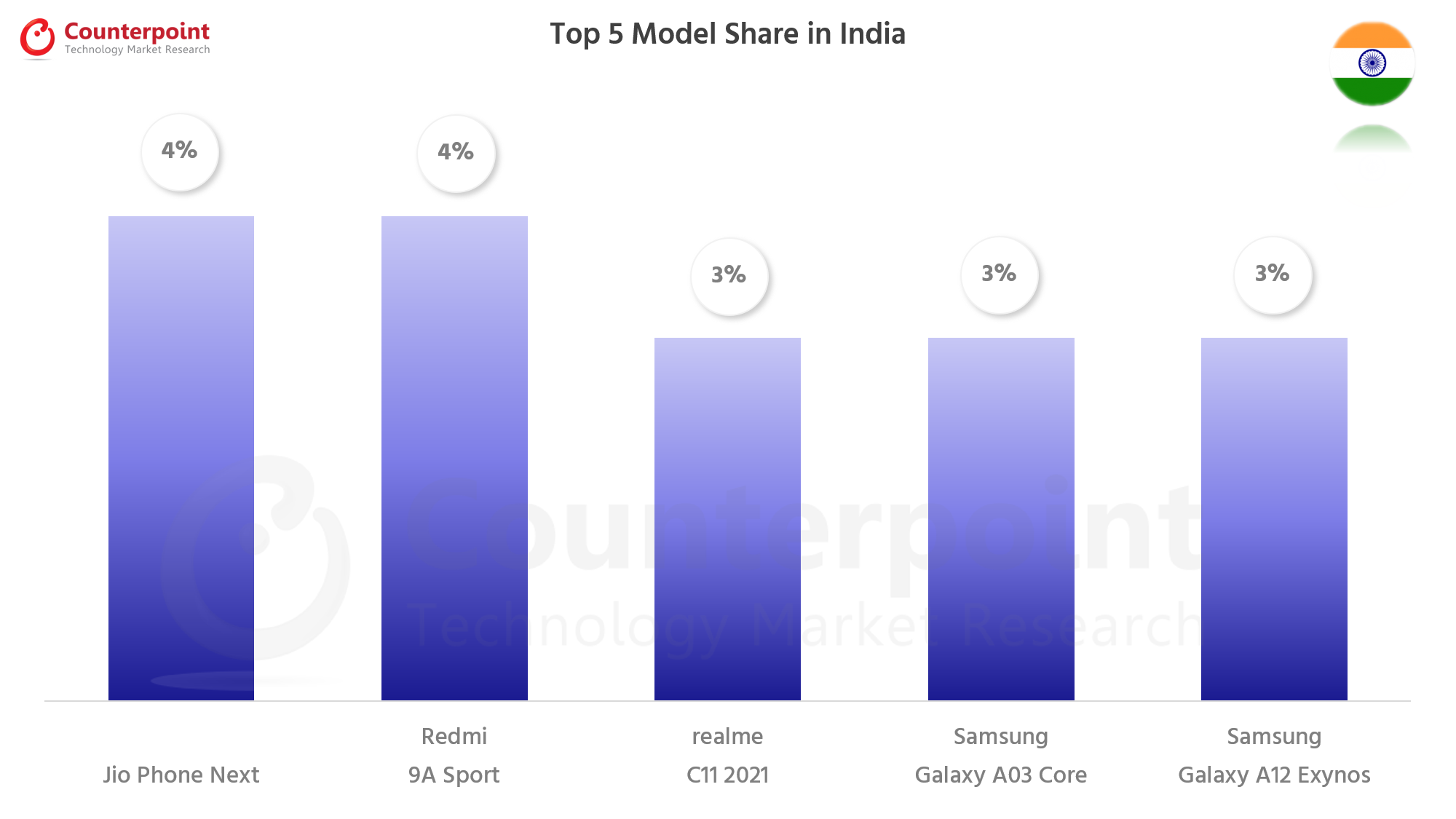

Best Selling Smartphones in India

| Rank | Models | Sales Share |

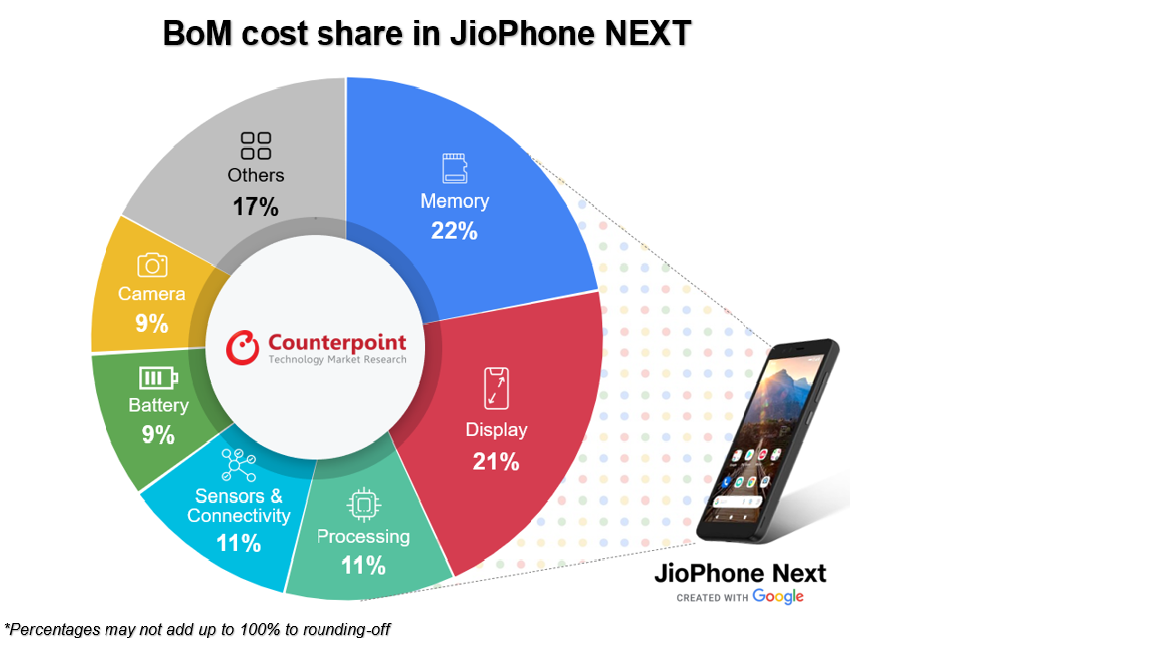

| 1 | Jio Phone Next | 4% |

| 2 | Redmi 9A Sport | 4% |

| 3 | realme C11 2021 | 3% |

| 4 | Samsung Galaxy A03 Core | 3% |

| 5 | Samsung Galaxy A12 Exynos | 3% |

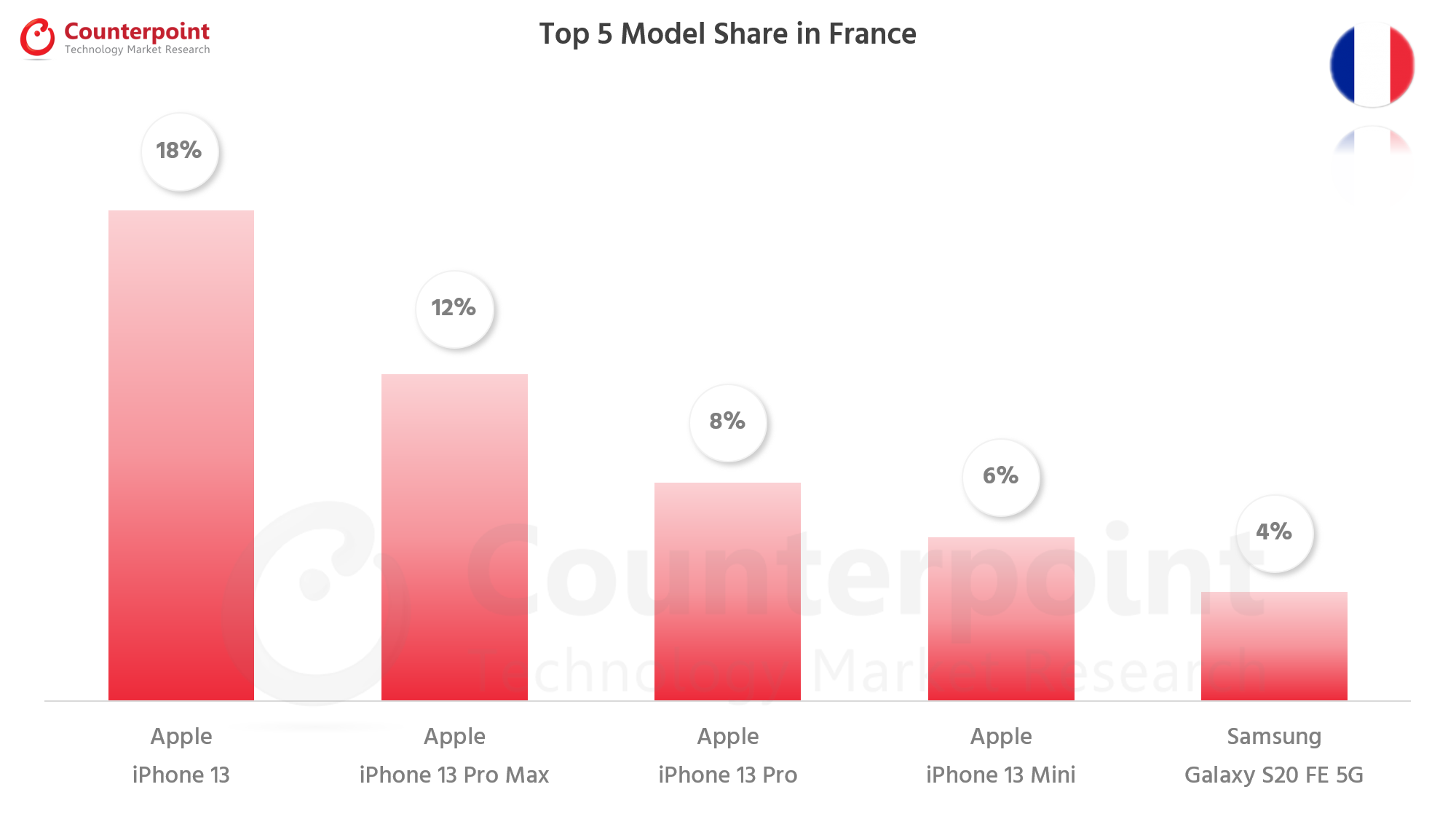

Best Selling Smartphones in France

| Rank | Models | Sales Share |

| 1 | Apple iPhone 13 | 18% |

| 2 | Apple iPhone 13 Pro Max | 12% |

| 3 | Apple iPhone 13 Pro | 8% |

| 4 | Apple iPhone 13 Mini | 6% |

| 5 | Samsung Galaxy S20 FE 5G | 4% |

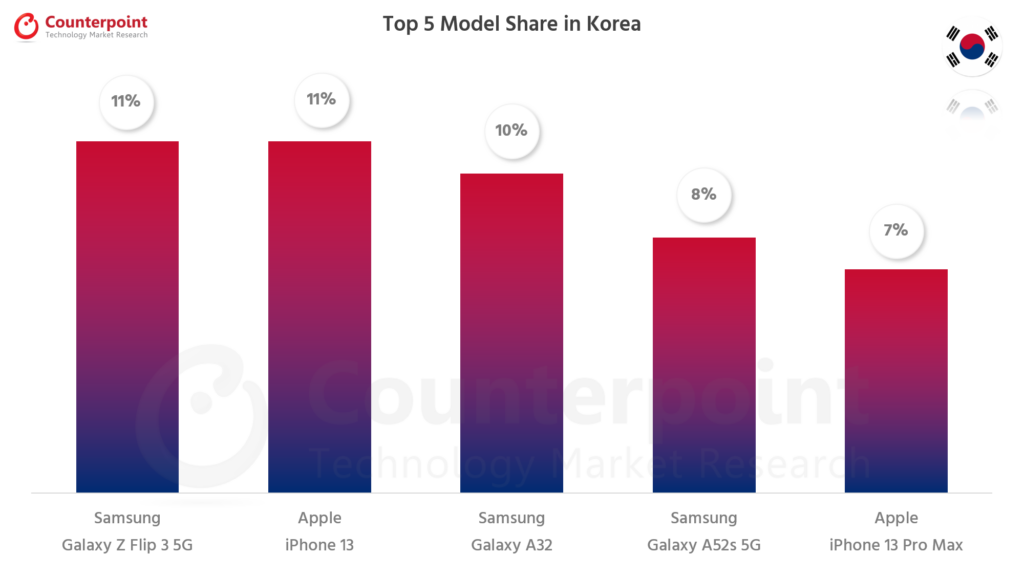

Best Selling Smartphones in South Korea

Best Selling Smartphones in South Korea

| Rank | Models | Sales Share |

| 1 | Samsung Galaxy Z Flip 3 5G | 11% |

| 2 | Apple iPhone 13 | 11% |

| 3 | Samsung Galaxy A32 | 10% |

| 4 | Samsung Galaxy A52s 5G | 8% |

| 5 | Apple iPhone 13 Pro Max | 7% |

Best Selling Smartphones in Germany

| Rank | Models | Sales Share |

| 1 | Apple iPhone 13 | 23% |

| 2 | Apple iPhone 13 Pro Max | 9% |

| 3 | Apple iPhone 13 Pro | 8% |

| 4 | Samsung Galaxy S20 FE | 6% |

| 5 | Samsung Galaxy A12 Nacho | 6% |

![]()

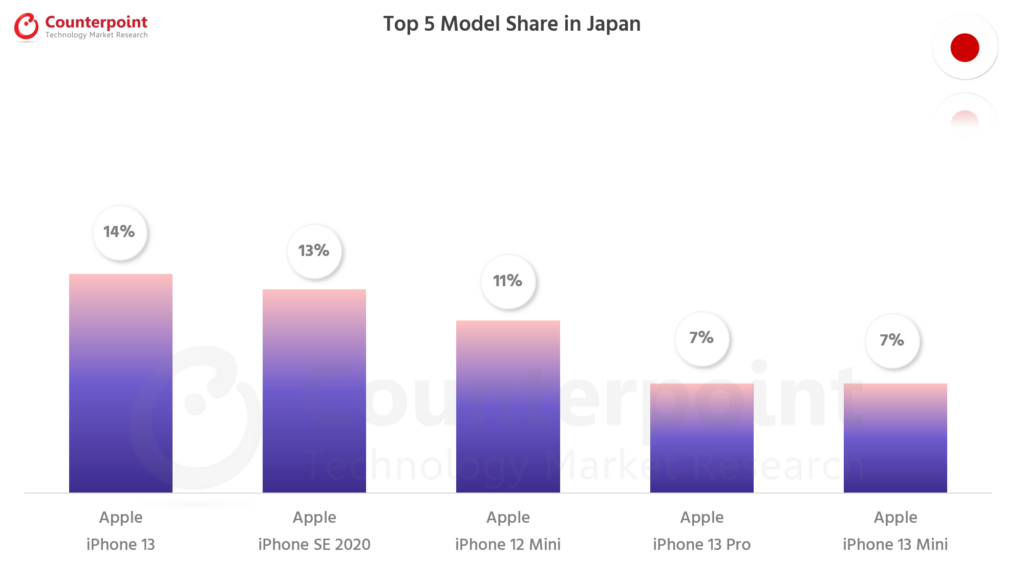

Best Selling Smartphones in Japan

| Rank | Models | Sales Share |

| 1 | Apple iPhone 13 | 14% |

| 2 | Apple iPhone SE 2020 | 13% |

| 3 | Apple iPhone 12 Mini | 11% |

| 4 | Apple iPhone 13 Pro | 7% |

| 5 | Apple iPhone 13 Mini | 7% |

Oct 2021

Published date: December 15, 2021

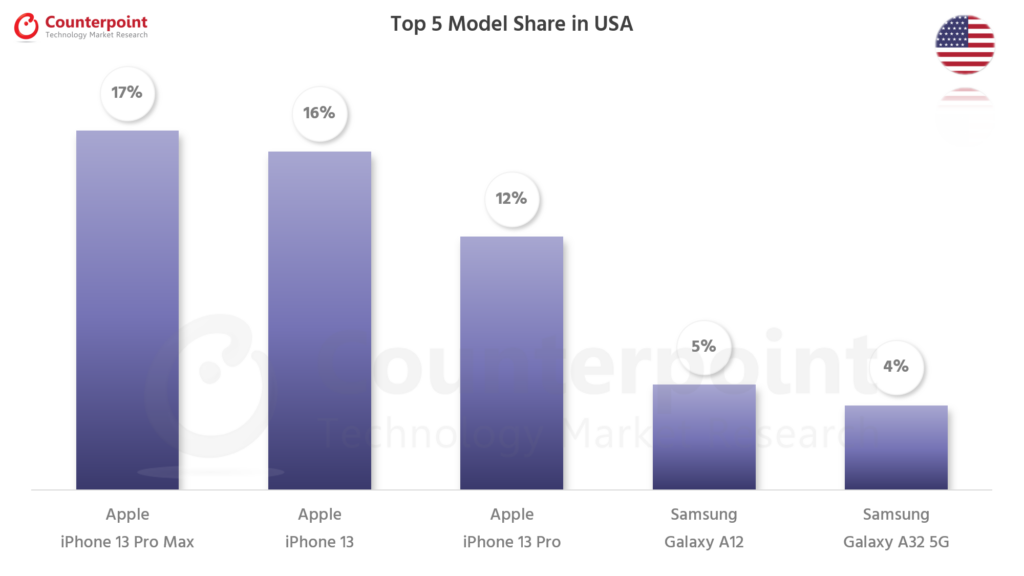

USA Model Share

| Rank | Model | % |

| 1 | Apple iPhone 13 Pro Max | 17% |

| 2 | Apple iPhone 13 | 16% |

| 3 | Apple iPhone 13 Pro | 12% |

| 4 | Samsung Galaxy A12 | 5% |

| 5 | Samsung Galaxy A32 5G | 4% |

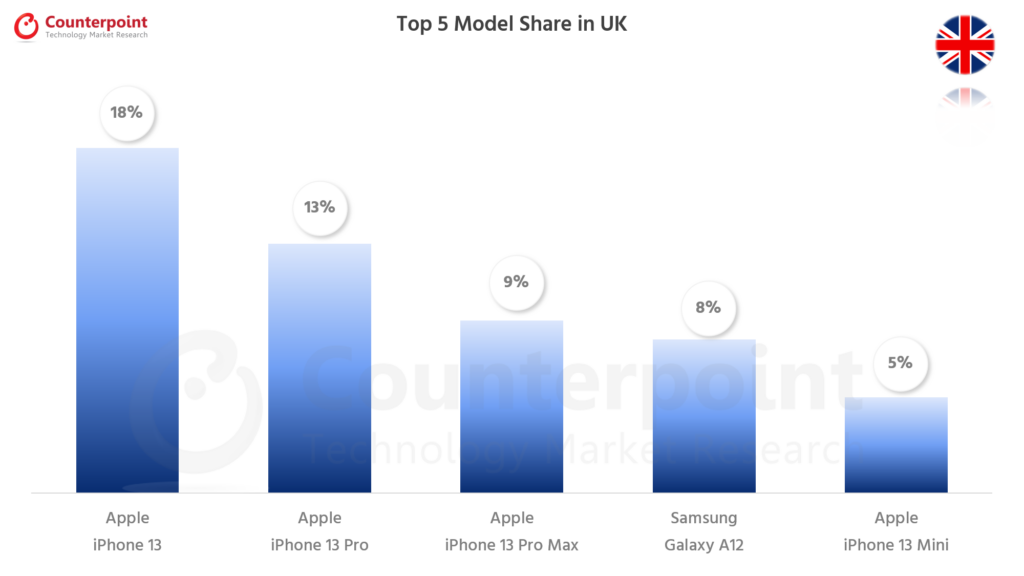

UK Model Share

UK Model Share

| Rank | Model | % |

| 1 | Apple iPhone 13 | 18% |

| 2 | Apple iPhone 13 Pro | 13% |

| 3 | Apple iPhone 13 Pro Max | 9% |

| 4 | Samsung Galaxy A12 | 8% |

| 5 | Apple iPhone 13 Mini | 5% |

China Model Share

| Rank | Model | % |

| 1 | Apple iPhone 13 | 7% |

| 2 | Apple iPhone 13 Pro Max | 4% |

| 3 | Apple iPhone 13 Pro | 3% |

| 4 | HONOR 50 | 3% |

| 5 | Apple iPhone 12 | 3% |

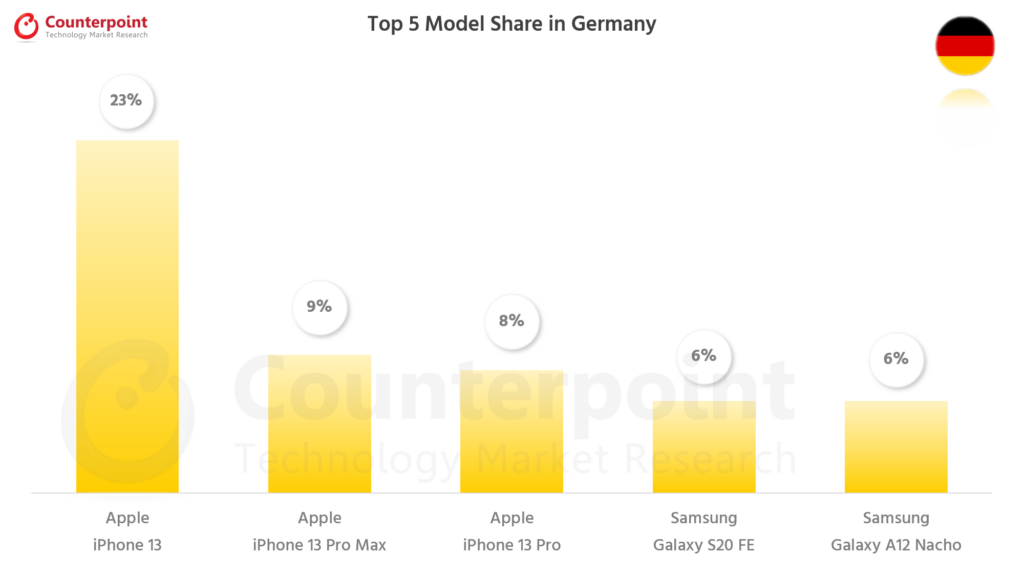

India Model Share

India Model Share

| Rank | Model | % |

| 1 | realme C11 2021 | 3% |

| 2 | OPPO A54 | 3% |

| 3 | Samsung Galaxy M12 | 3% |

| 4 | Redmi Note 10s | 3% |

| 5 | Redmi 9A | 3% |

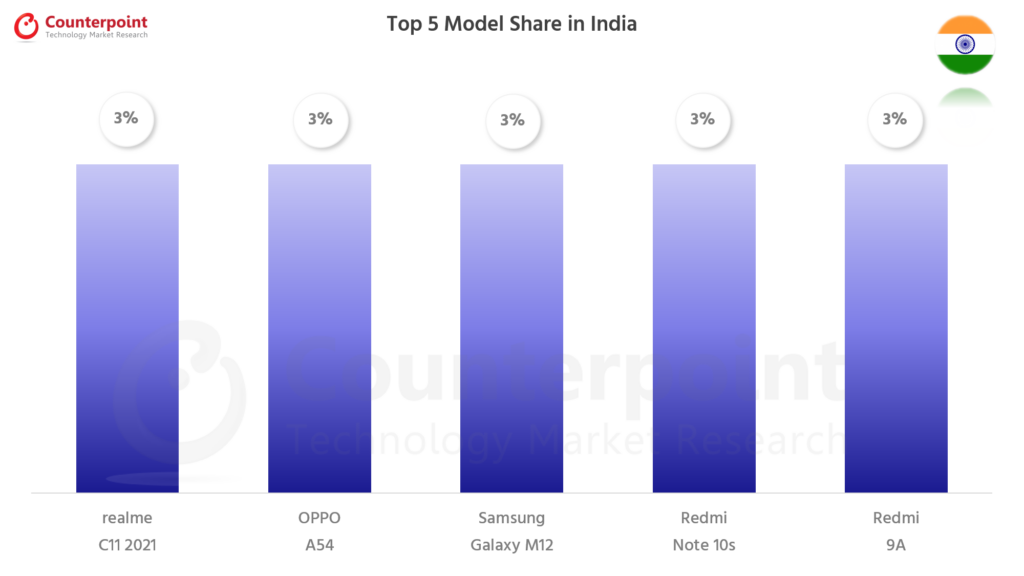

France Model Share

France Model Share

| Rank | Model | % |

| 1 | Apple iPhone 13 | 13% |

| 2 | Apple iPhone 13 Pro Max | 9% |

| 3 | Apple iPhone 13 Mini | 7% |

| 4 | Apple iPhone 13 Pro | 6% |

| 5 | Xiaomi Mi 11 | 4% |

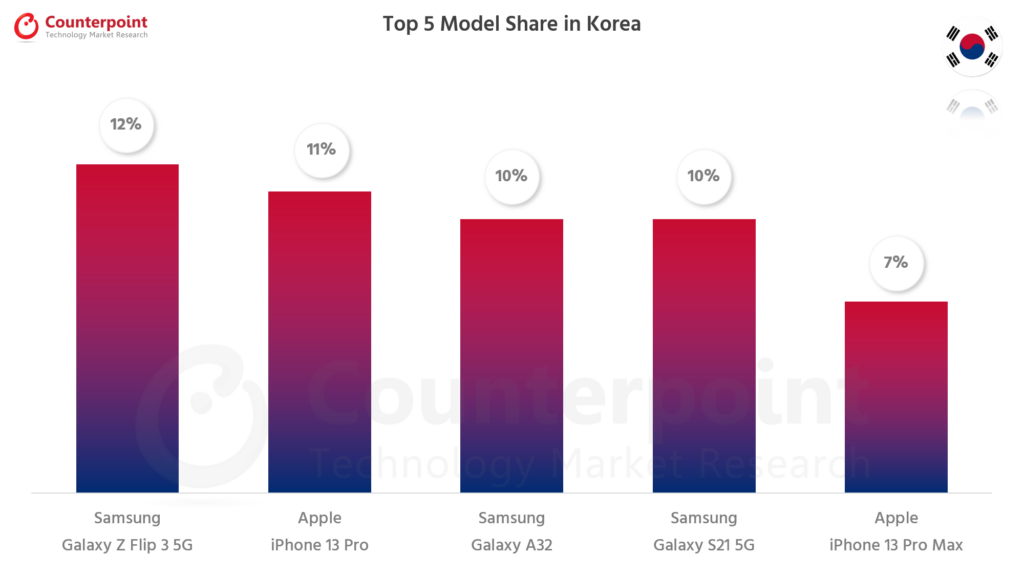

Korea Model Share

Korea Model Share

| Rank | Model | % |

| 1 | Samsung Galaxy Z Flip 3 5G | 12% |

| 2 | Apple iPhone 13 Pro | 11% |

| 3 | Samsung Galaxy A32 | 10% |

| 4 | Samsung Galaxy S21 5G | 10% |

| 5 | Apple iPhone 13 Pro Max | 7% |

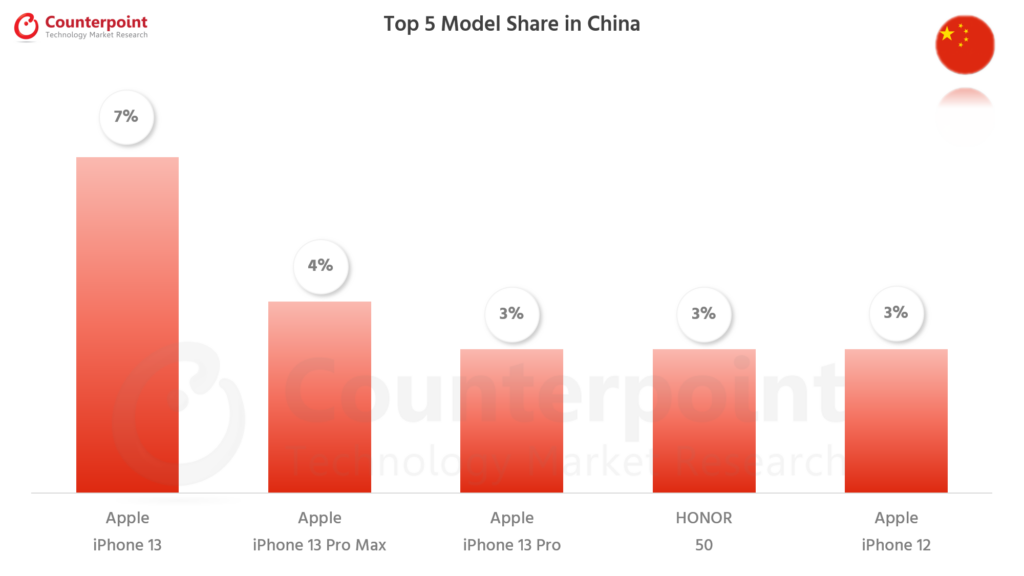

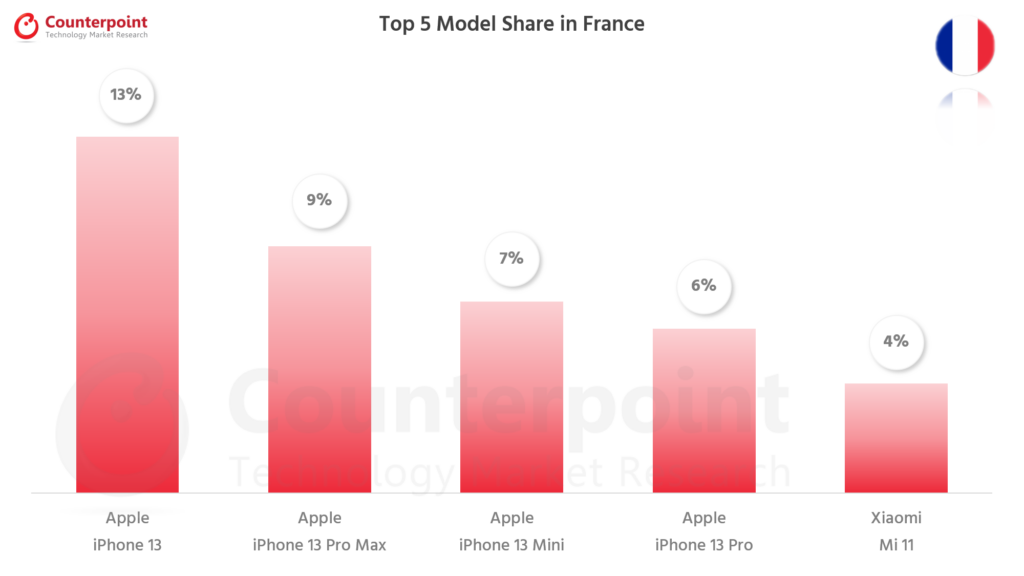

Germany Model Share

Germany Model Share

| Rank | Brand | % |

| 1 | Apple iPhone 13 | 14% |

| 2 | Apple iPhone 13 Pro | 10% |

| 3 | Apple iPhone 13 Pro Max | 7% |

| 4 | Samsung Galaxy A52s 5G | 7% |

| 5 | Samsung Galaxy S20 FE | 6% |

![]()

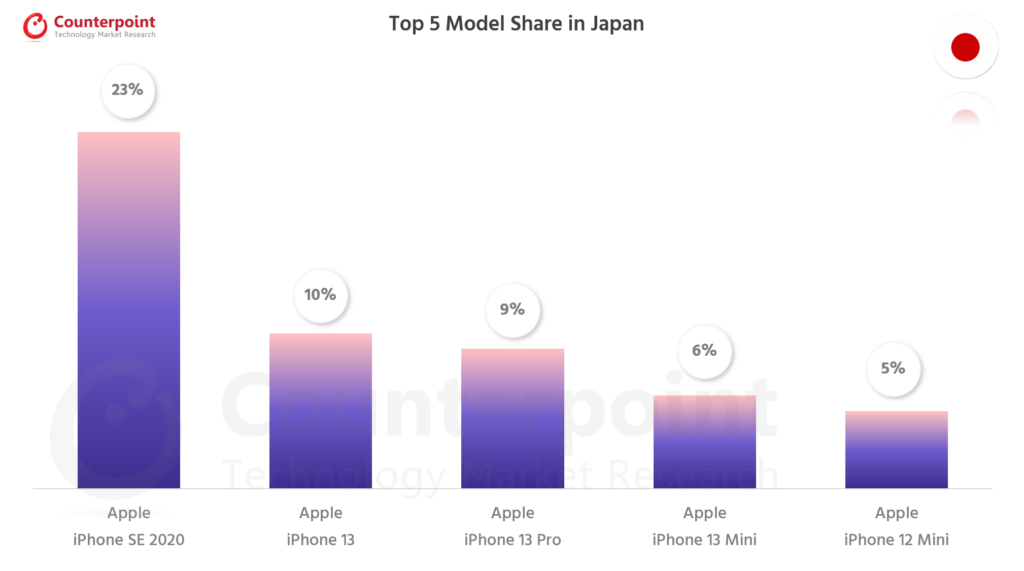

Japan Model Share

| Rank | Model | % |

| 1 | Apple iPhone SE 2020 | 23% |

| 2 | Apple iPhone 13 | 10% |

| 3 | Apple iPhone 13 Pro | 9% |

| 4 | Apple iPhone 13 Mini | 6% |

| 5 | Apple iPhone 12 Mini | 5% |

July 2021

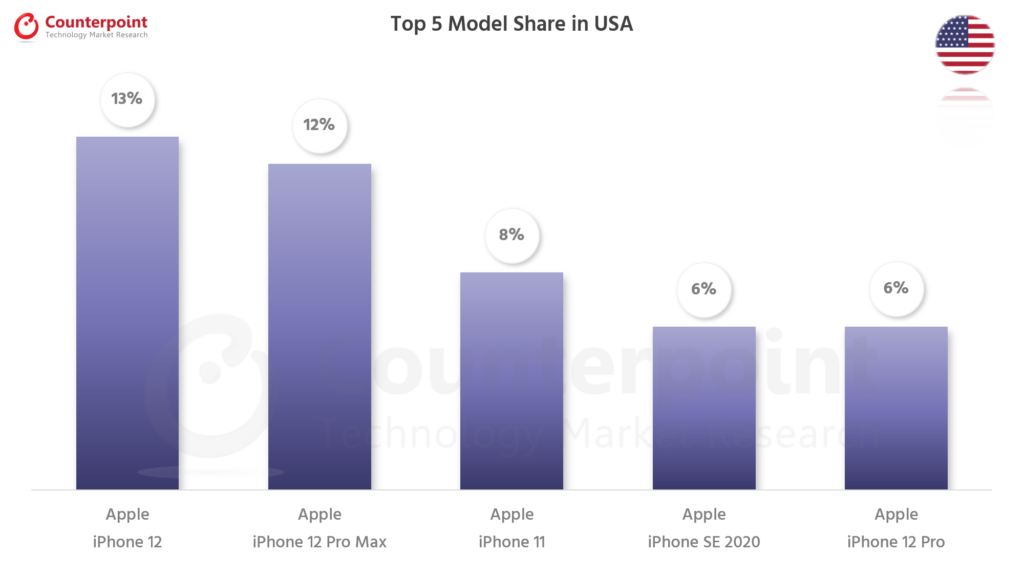

USA Model Share

| Rank | Model | % |

| 1 | Apple iPhone 12 | 13% |

| 2 | Apple iPhone 12 Pro Max | 12% |

| 3 | Apple iPhone 11 | 8% |

| 4 | Apple iPhone SE 2020 | 6% |

| 5 | Apple iPhone 12 Pro | 6% |

UK Model Share

UK Model Share

| Rank | Model | % |

| 1 | Apple iPhone 12 Pro Max | 13% |

| 2 | Apple iPhone 12 Pro | 12% |

| 3 | Samsung Galaxy A12 | 9% |

| 4 | Apple iPhone 12 | 8% |

| 5 | Samsung Galaxy A32 5G | 4% |

China Model Share

| Rank | Model | % |

| 1 | Apple iPhone 12 | 7% |

| 2 | HONOR 50 | 3% |

| 3 | OPPO Reno 6 5G | 3% |

| 4 | HONOR Play 20 | 3% |

| 5 | OPPO A55 5G | 3% |

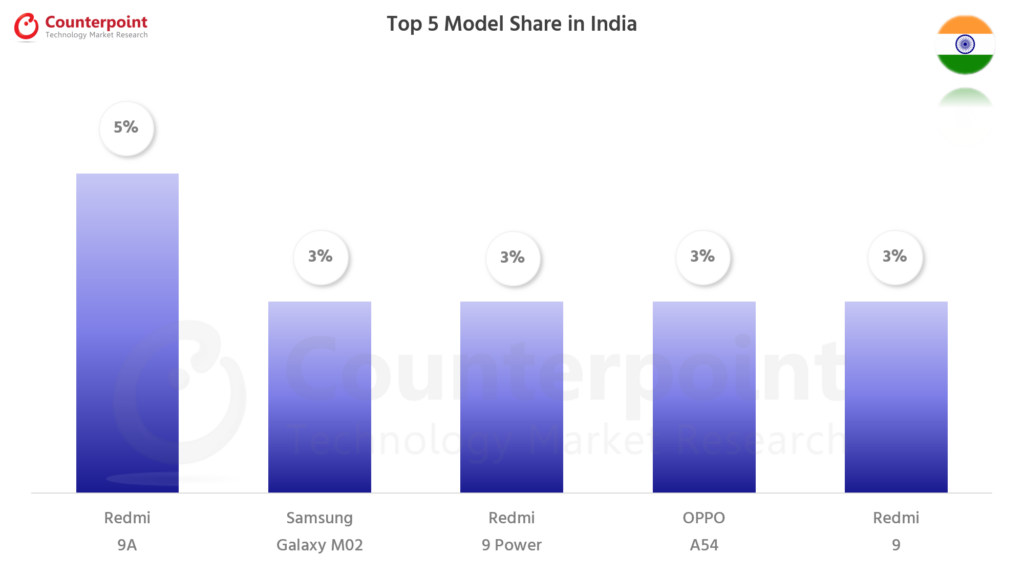

India Model Share

India Model Share

| Rank | Model | % |

| 1 | Redmi 9A | 5% |

| 2 | Samsung Galaxy M02 | 3% |

| 3 | Redmi 9 Power | 3% |

| 4 | OPPO A54 | 3% |

| 5 | Redmi 9 | 3% |

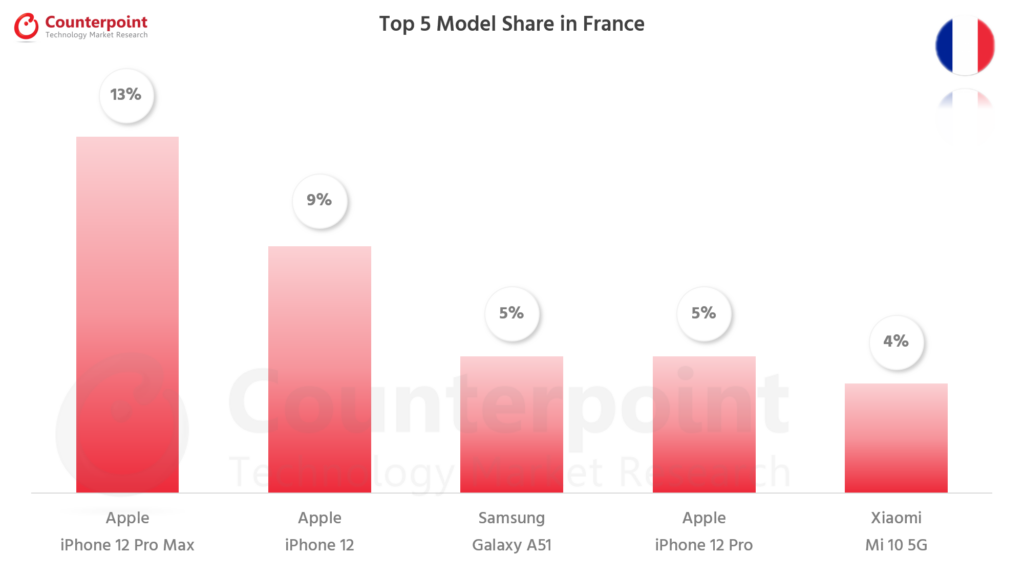

France Model Share

France Model Share

| Rank | Model | % |

| 1 | Apple iPhone 12 Pro Max | 13% |

| 2 | Apple iPhone 12 | 9% |

| 3 | Samsung Galaxy A51 | 5% |

| 4 | Apple iPhone 12 Pro | 5% |

| 5 | Xiaomi Mi 10 5G | 4% |

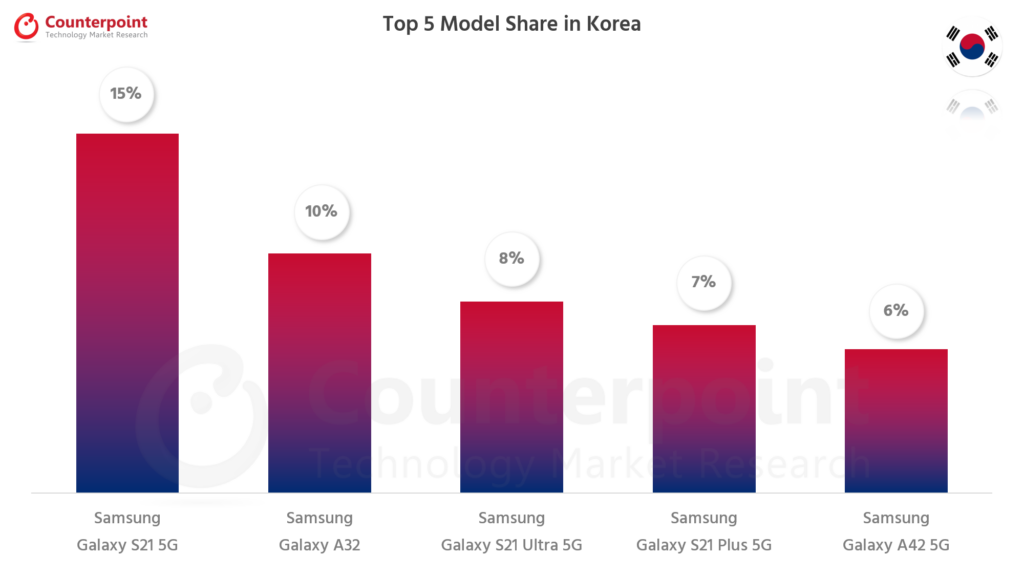

Korea Model Share

Korea Model Share

| Rank | Model | % |

| 1 | Samsung Galaxy S21 5G | 15% |

| 2 | Samsung Galaxy A32 | 10% |

| 3 | Samsung Galaxy S21 Ultra 5G | 8% |

| 4 | Samsung Galaxy S21 Plus 5G | 7% |

| 5 | Samsung Galaxy A42 5G | 6% |

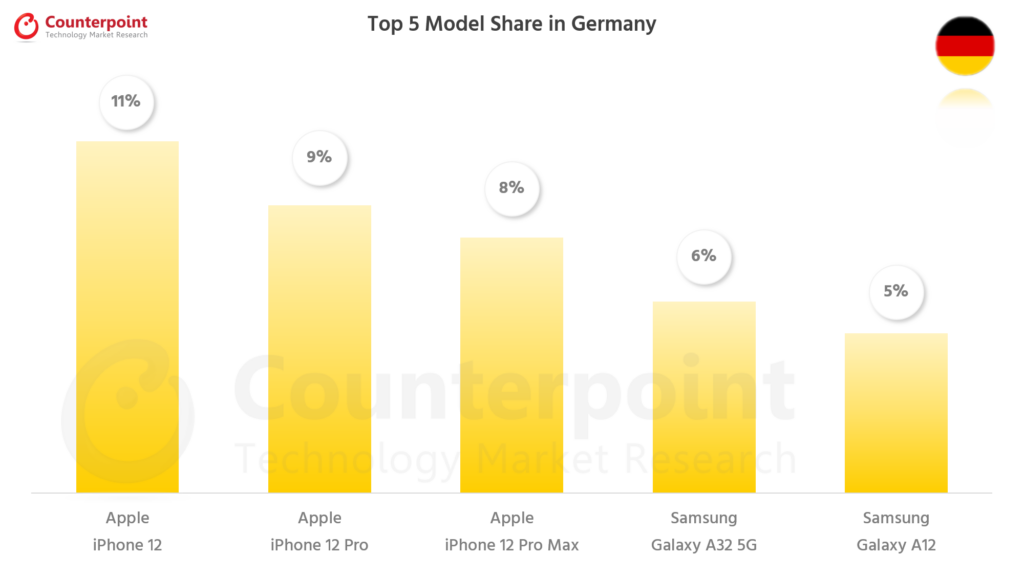

Germany Model Share

Germany Model Share

| Rank | Model | % |

| 1 | Apple iPhone 12 | 11% |

| 2 | Apple iPhone 12 Pro | 9% |

| 3 | Apple iPhone 12 Pro Max | 8% |

| 4 | Samsung Galaxy A32 5G | 6% |

| 5 | Samsung Galaxy A12 | 5% |

![]()

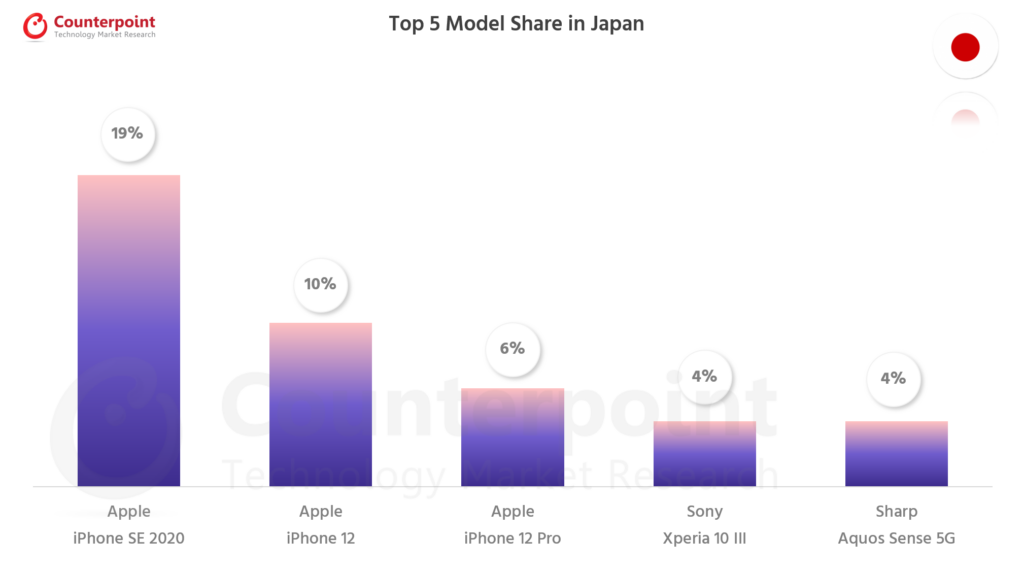

Japan Model Share

| Rank | Model | % |

| 1 | Apple iPhone SE 2020 | 19% |

| 2 | Apple iPhone 12 | 10% |

| 3 | Apple iPhone 12 Pro | 6% |

| 4 | Sony Xperia 10 III | 4% |

| 5 | Sharp Aquos Sense 5G | 4% |

April 2021

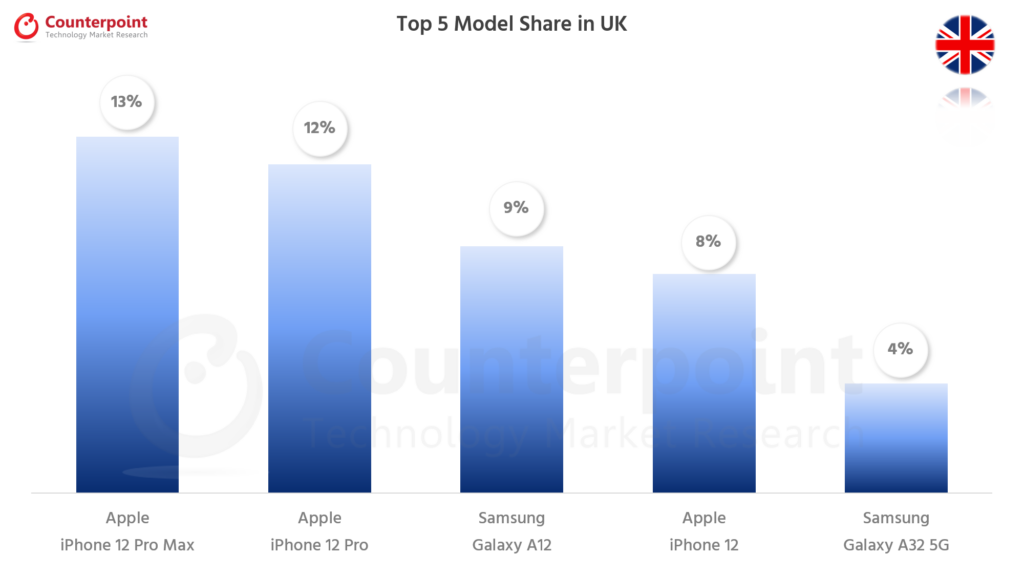

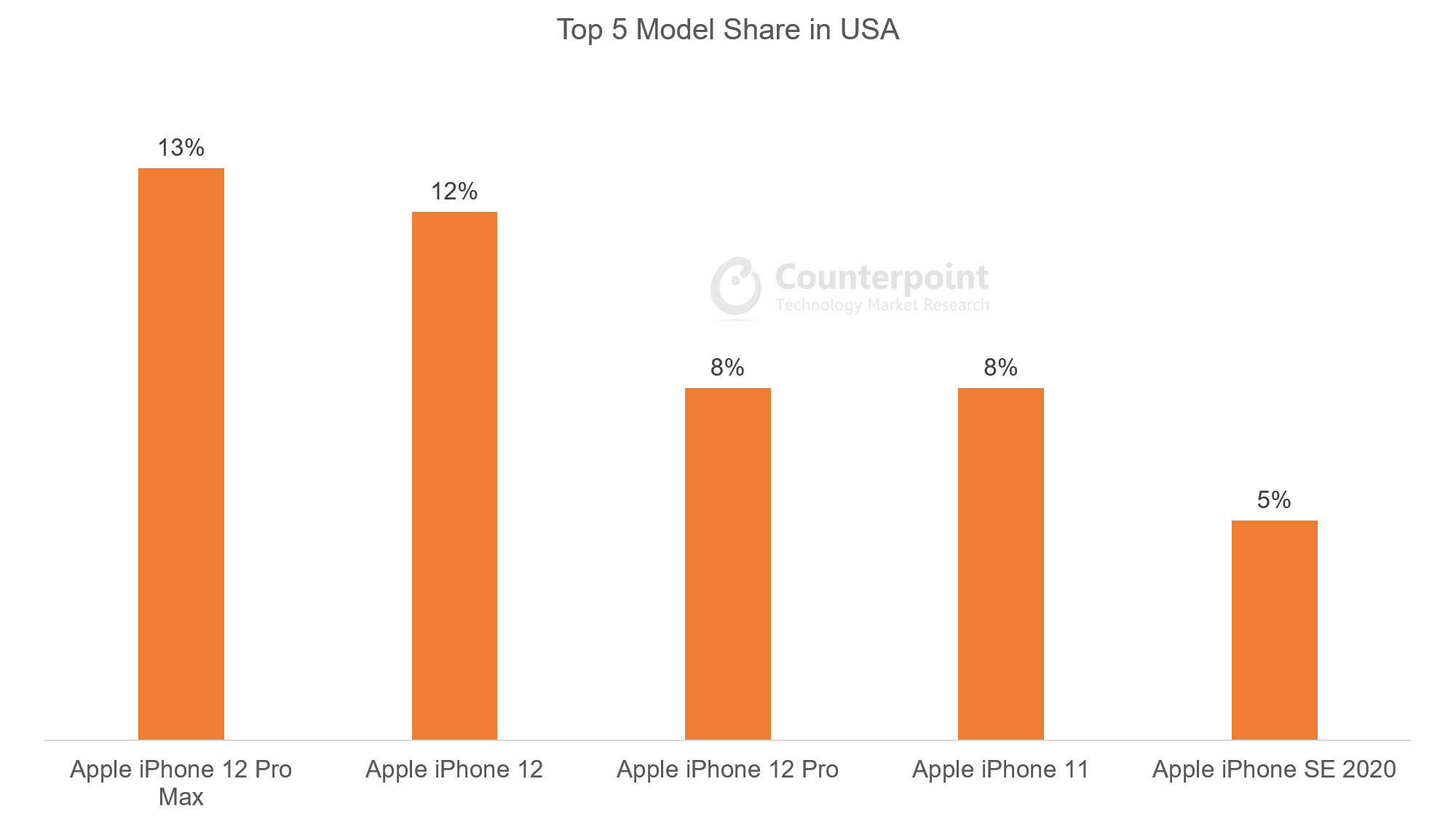

USA Model Share

| Rank | Model | % |

| 1 | Apple iPhone 12 Pro Max | 13% |

| 2 | Apple iPhone 12 | 12% |

| 3 | Apple iPhone 12 Pro | 8% |

| 4 | Apple iPhone 11 | 8% |

| 5 | Apple iPhone SE 2020 | 5% |

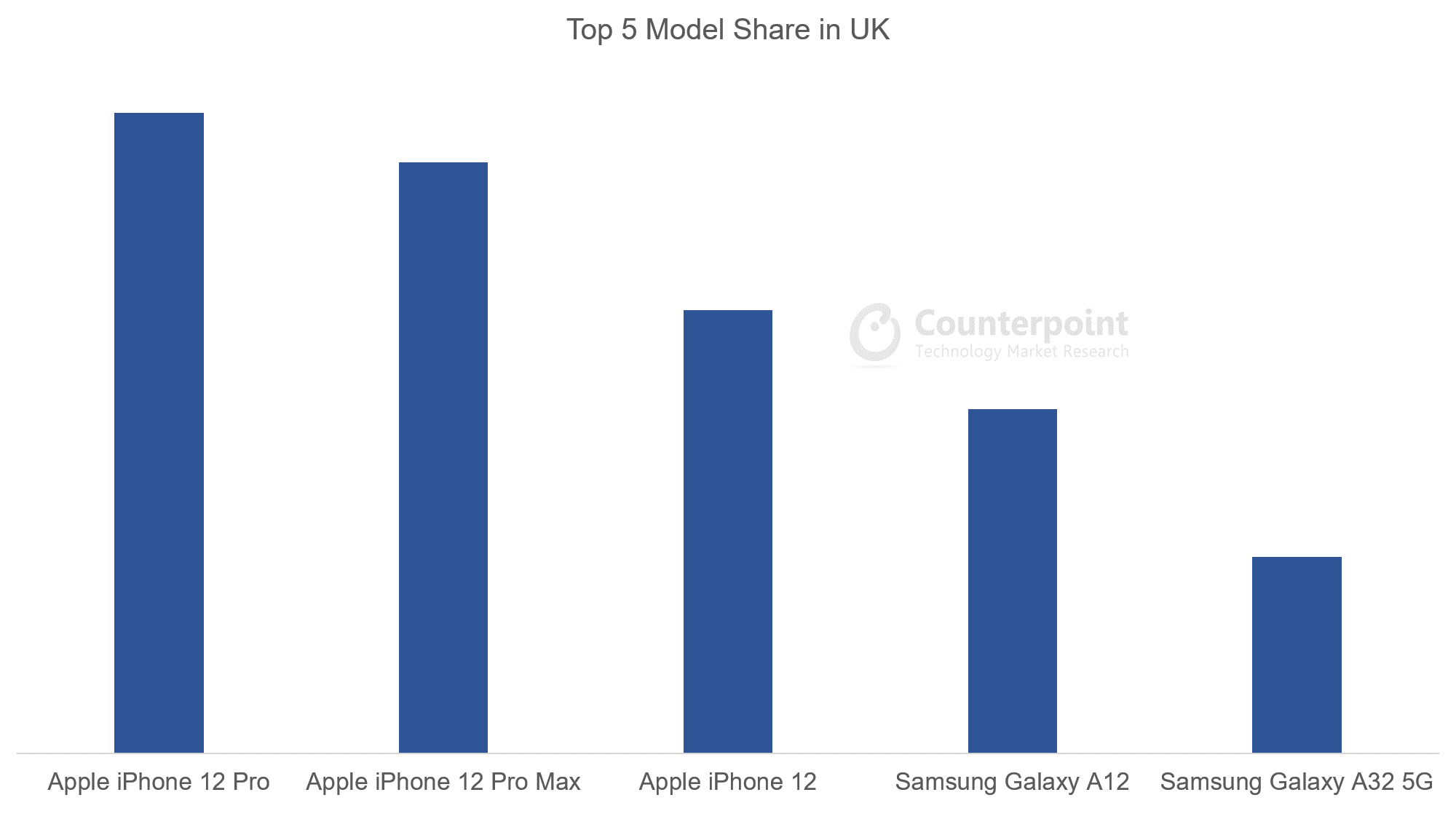

UK Model Share

UK Model Share

| Rank | Model | % |

| 1 | Apple iPhone 12 Pro | 13% |

| 2 | Apple iPhone 12 Pro Max | 12% |

| 3 | Apple iPhone 12 | 9% |

| 4 | Samsung Galaxy A12 | 7% |

| 5 | Samsung Galaxy A32 5G | 4% |

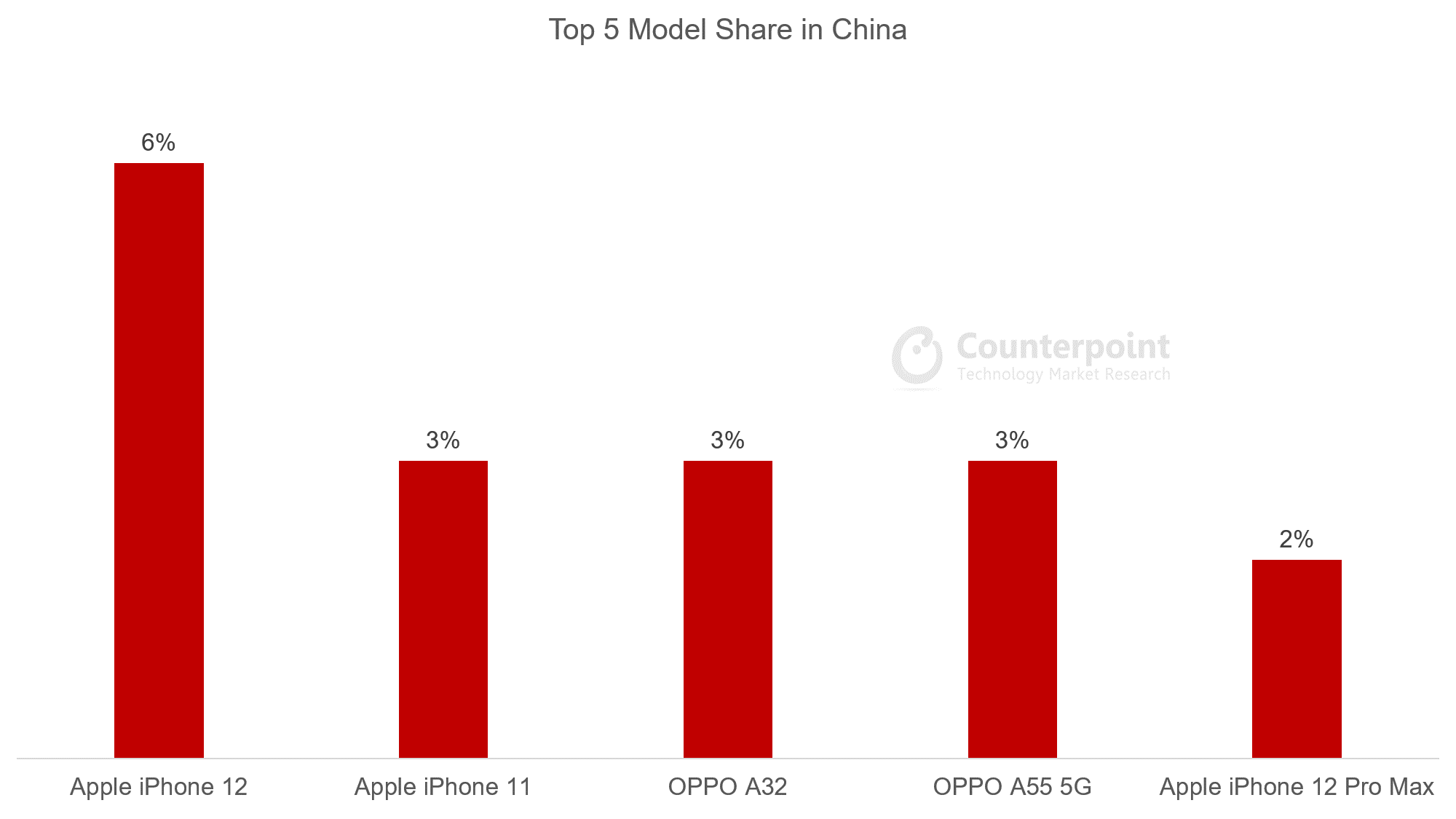

China Model Share

| Rank | Model | % |

| 1 | Apple iPhone 12 | 6% |

| 2 | Apple iPhone 11 | 3% |

| 3 | OPPO A32 | 3% |

| 4 | OPPO A55 5G | 3% |

| 5 | Apple iPhone 12 Pro Max | 2% |

India Model Share

India Model Share

| Rank | Model | % |

| 1 | Redmi 9A | 5% |

| 2 | Redmi Note 10 | 3% |

| 3 | Redmi 9 Power | 3% |

| 4 | Samsung Galaxy A12 | 3% |

| 5 | Redmi 9 | 3% |

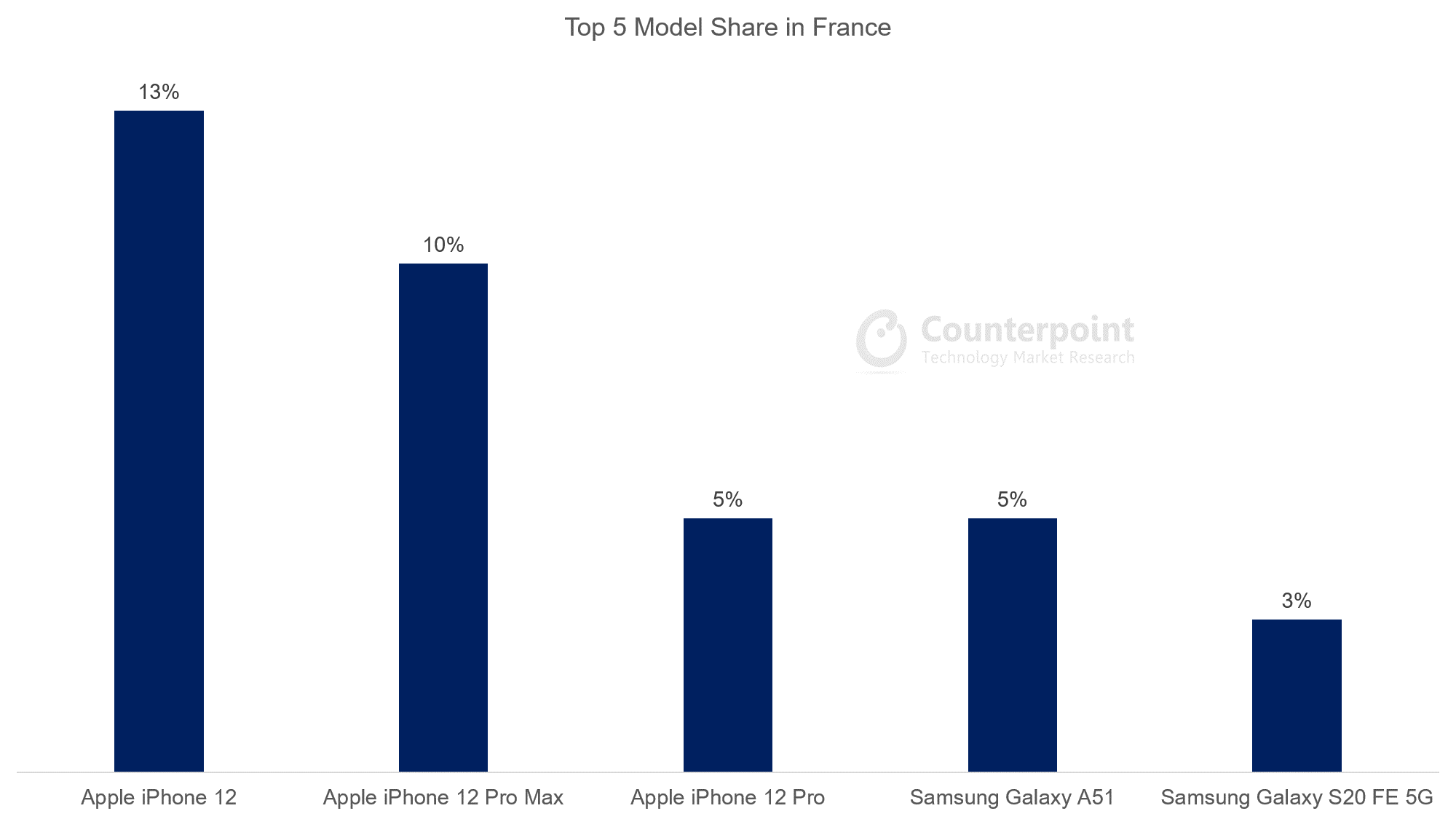

France Model Share

France Model Share

| Rank | Model | % |

| 1 | Apple iPhone 12 | 13% |

| 2 | Apple iPhone 12 Pro Max | 10% |

| 3 | Apple iPhone 12 Pro | 5% |

| 4 | Samsung Galaxy A51 | 5% |

| 5 | Samsung Galaxy S20 FE 5G | 3% |

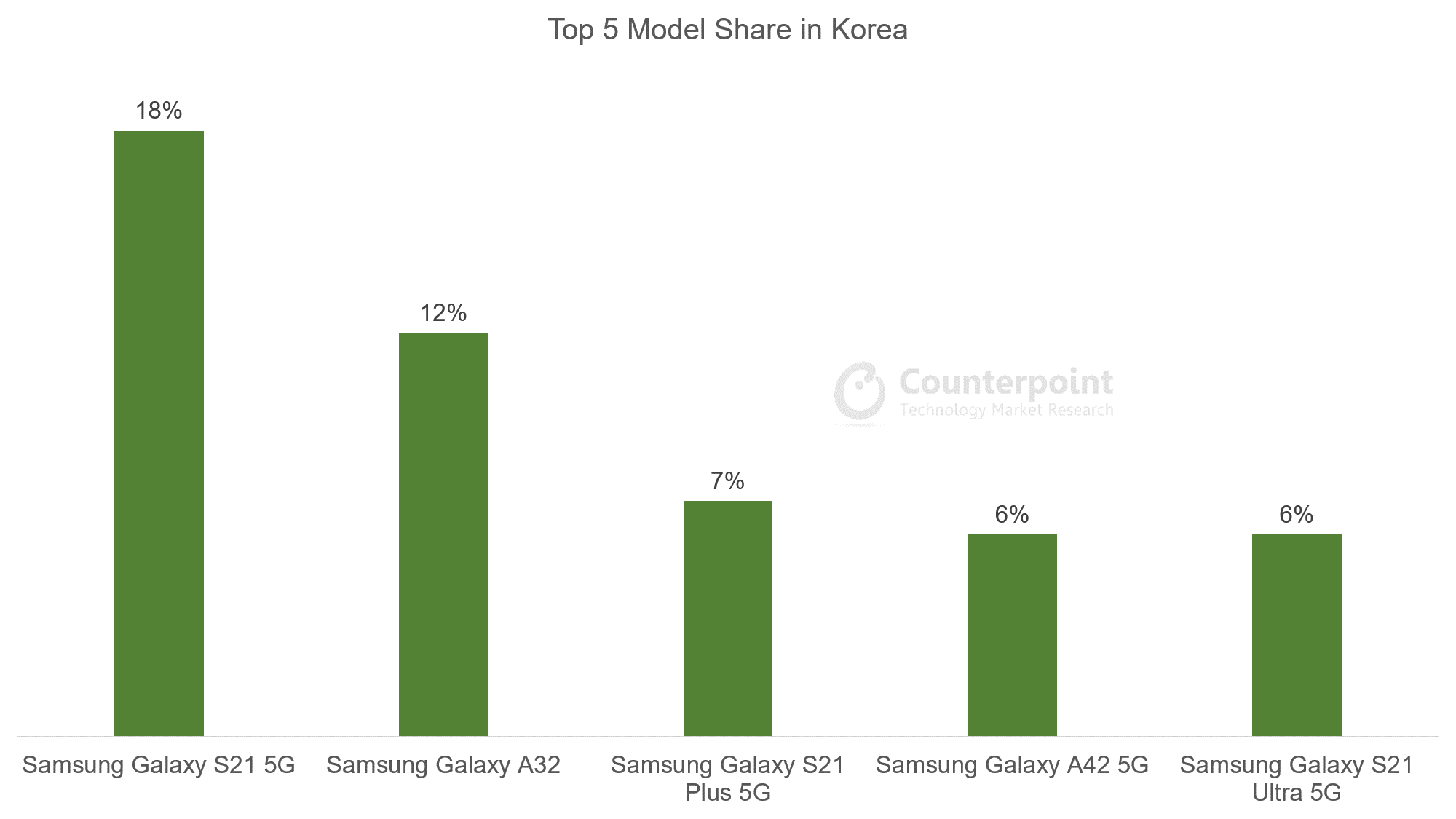

Korea Model Share

Korea Model Share

| Rank | Model | % |

| 1 | Samsung Galaxy S21 5G | 18% |

| 2 | Samsung Galaxy A32 | 12% |

| 3 | Samsung Galaxy S21 Plus 5G | 7% |

| 4 | Samsung Galaxy A42 5G | 6% |

| 5 | Samsung Galaxy S21 Ultra 5G | 6% |

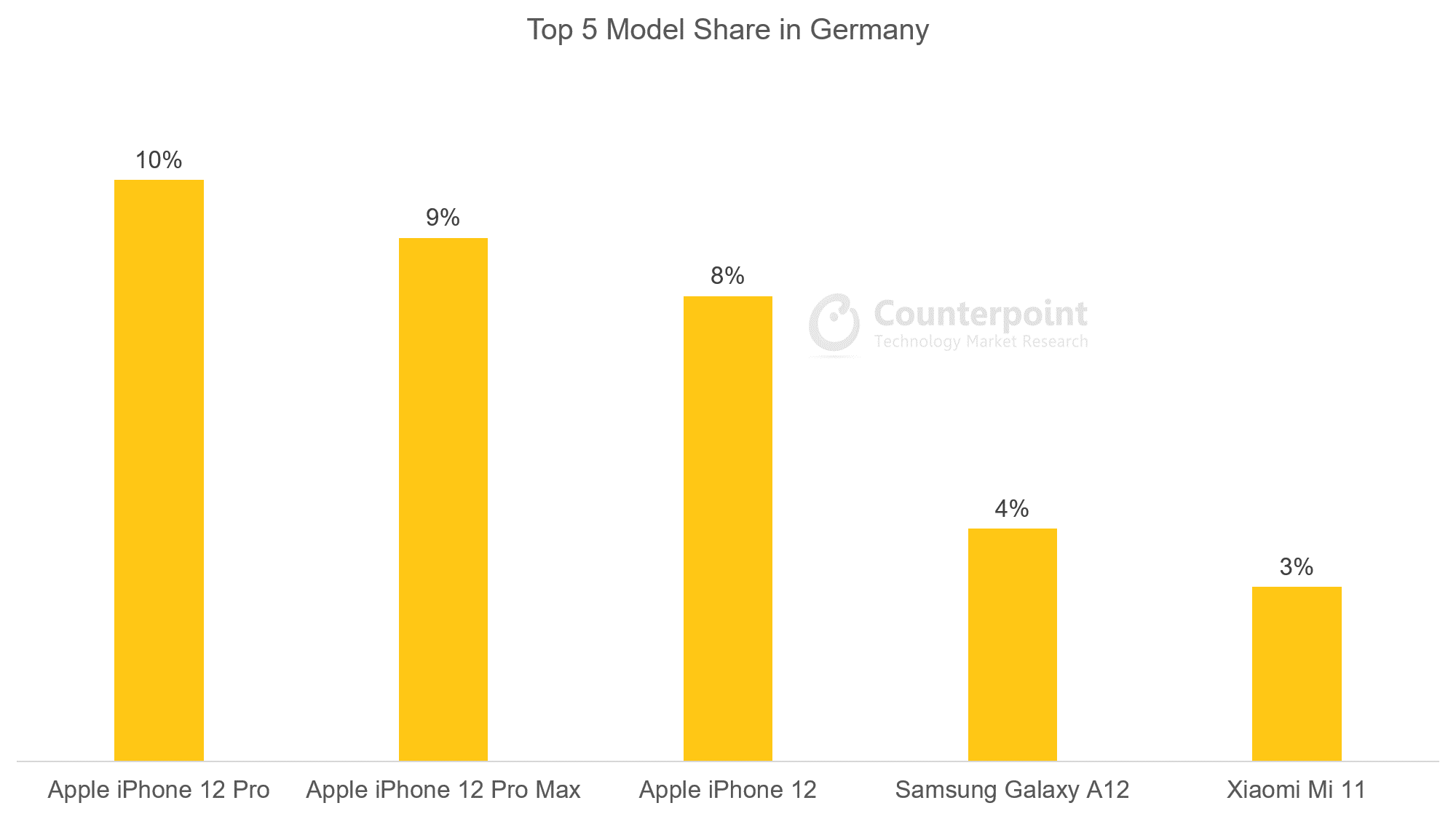

Germany Model Share

Germany Model Share

| Rank | Model | % |

| 1 | Apple iPhone 12 Pro | 10% |

| 2 | Apple iPhone 12 Pro Max | 9% |

| 3 | Apple iPhone 12 | 8% |

| 4 | Samsung Galaxy A12 | 4% |

| 5 | Xiaomi Mi 11 | 3% |

![]()

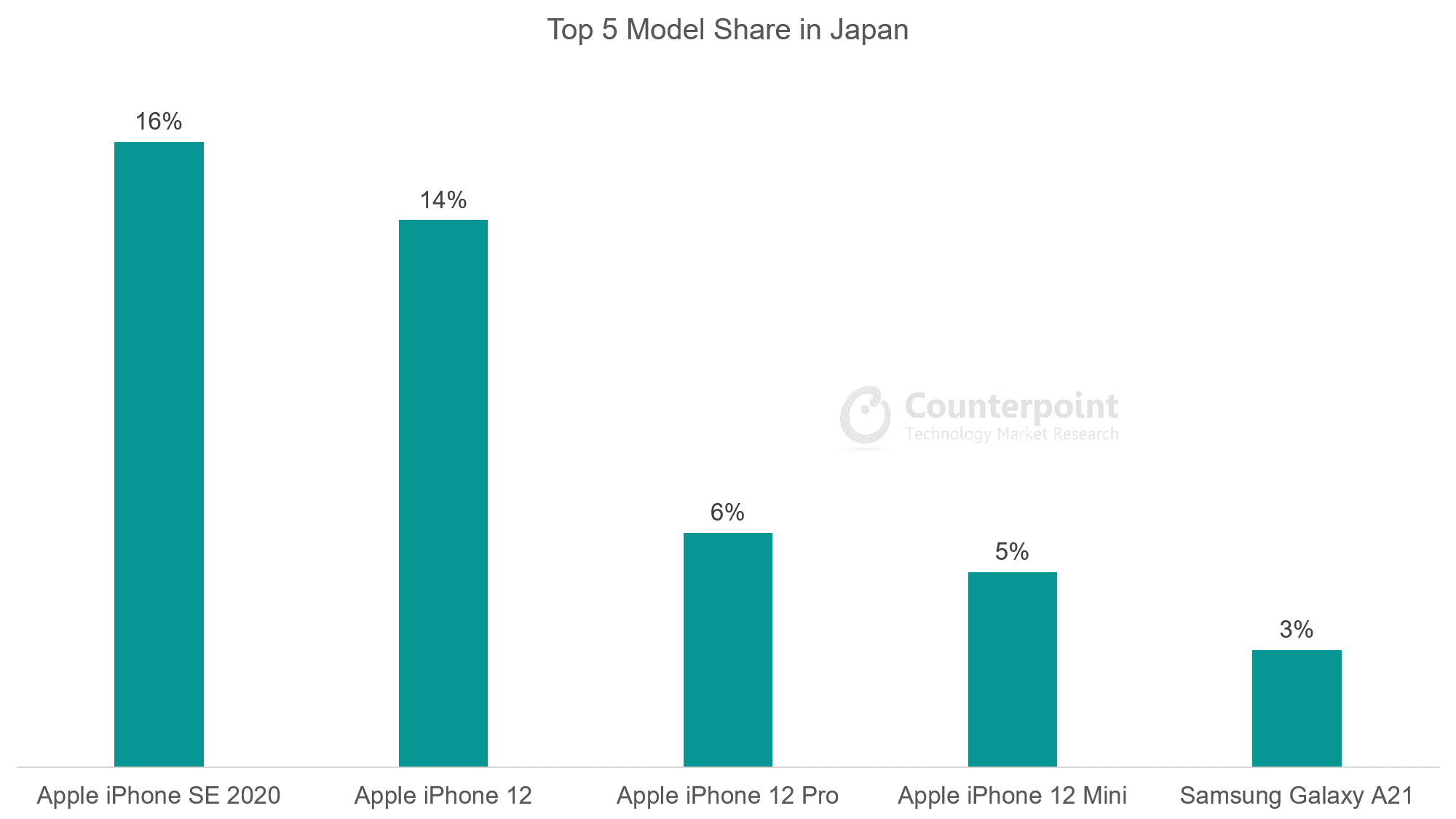

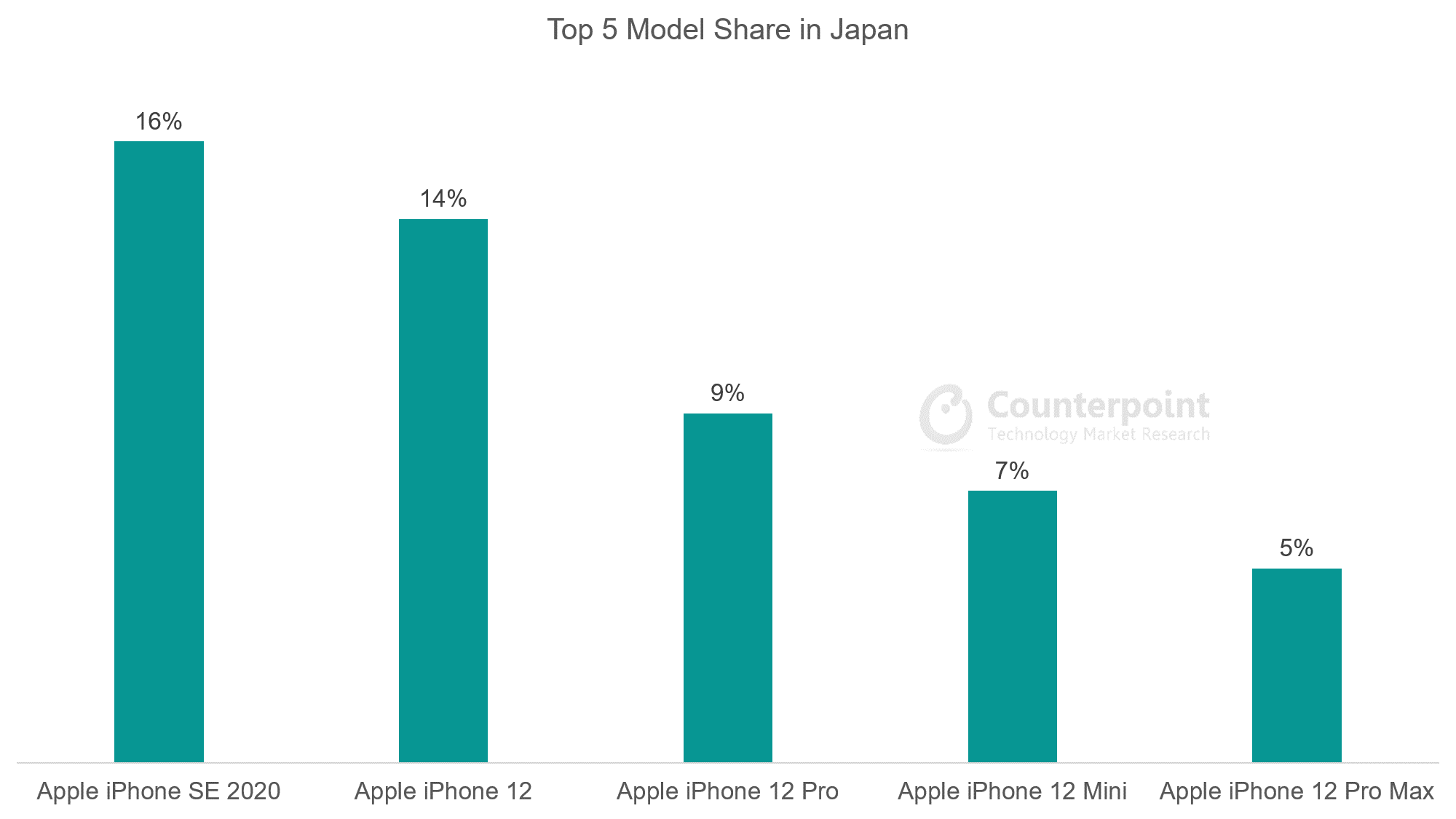

Japan Model Share

| Rank | Model | % |

| 1 | Apple iPhone SE 2020 | 16% |

| 2 | Apple iPhone 12 | 14% |

| 3 | Apple iPhone 12 Pro | 6% |

| 4 | Apple iPhone 12 Mini | 5% |

| 5 | Samsung Galaxy A21 | 3% |

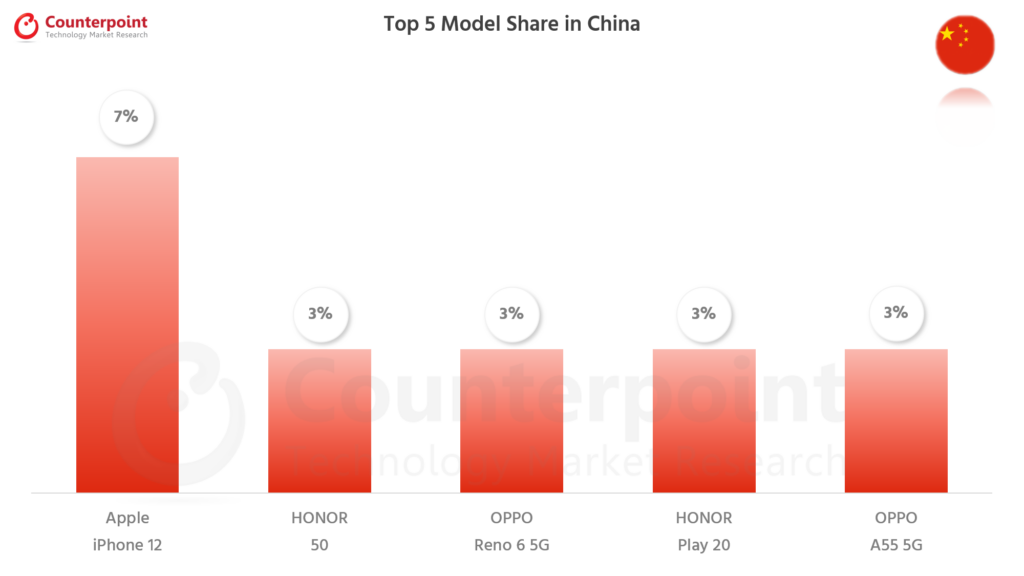

January 2021

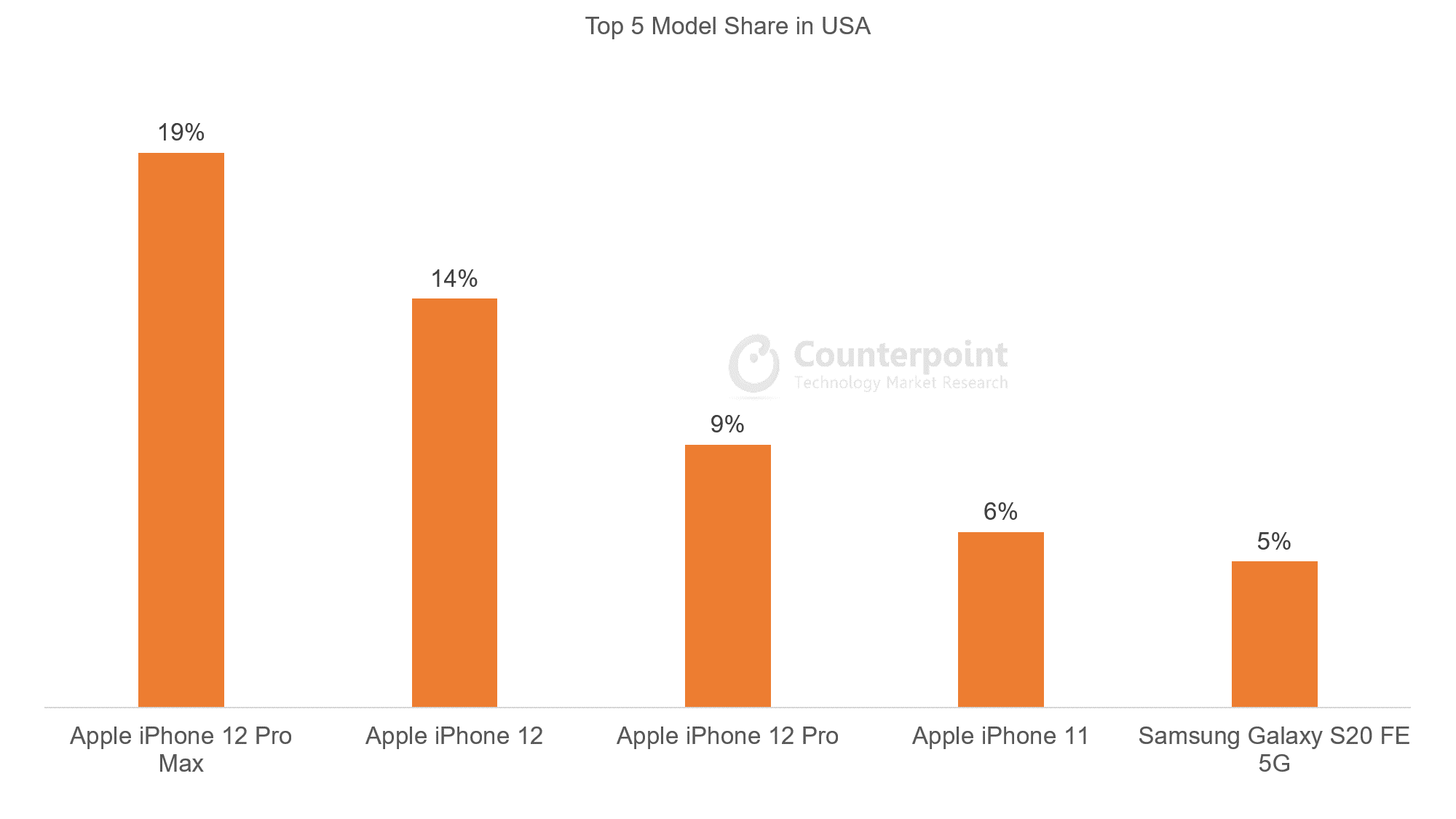

USA Model Share

| Rank | Model | % |

| 1 | Apple iPhone 12 Pro Max | 19% |

| 2 | Apple iPhone 12 | 14% |

| 3 | Apple iPhone 12 Pro | 9% |

| 4 | Apple iPhone 11 | 6% |

| 5 | Samsung Galaxy S20 FE 5G | 5% |

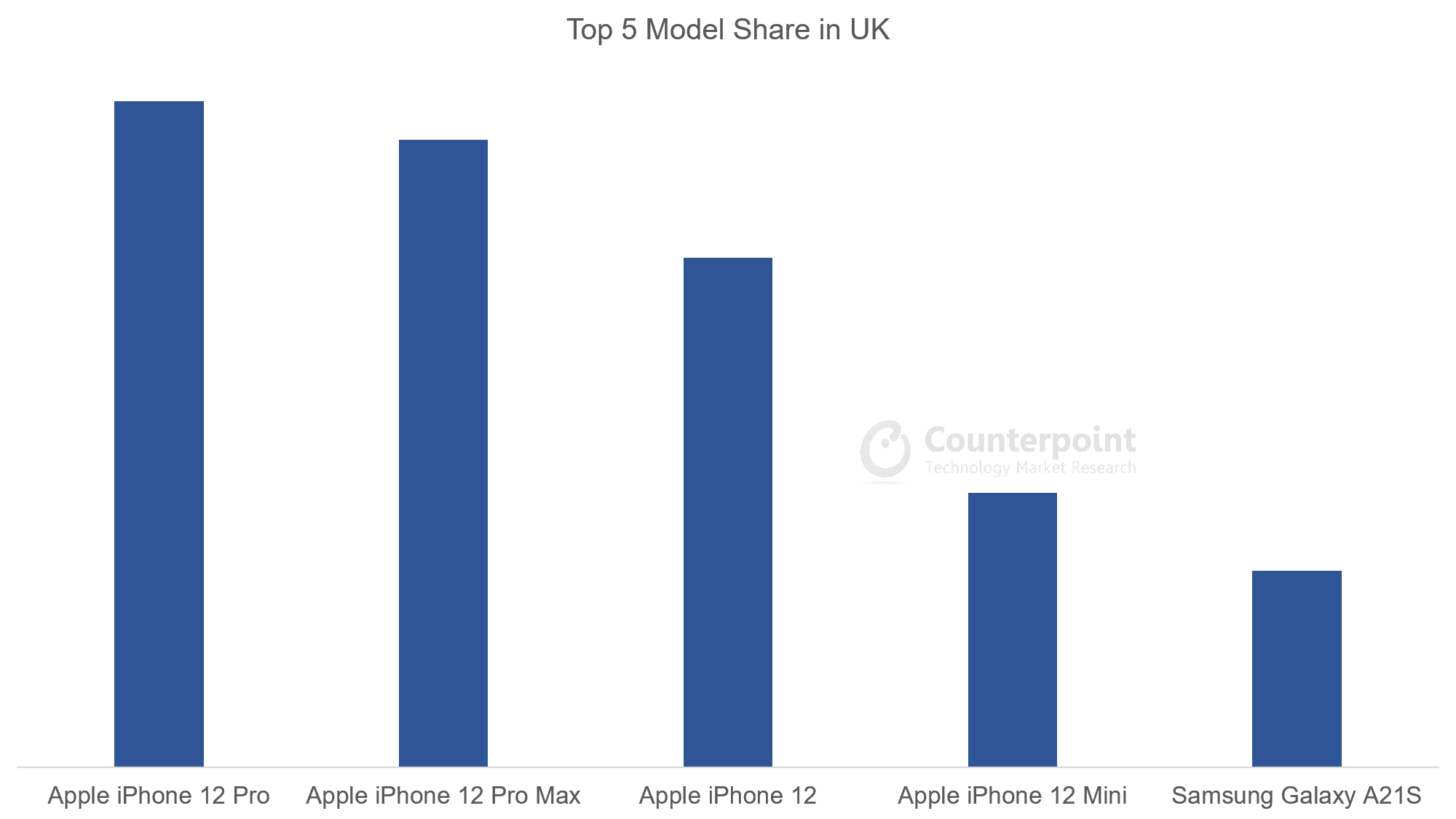

UK Model Share

UK Model Share

| Rank | Model | % |

| 1 | Apple iPhone 12 Pro | 17% |

| 2 | Apple iPhone 12 Pro Max | 16% |

| 3 | Apple iPhone 12 | 13% |

| 4 | Apple iPhone 12 Mini | 7% |

| 5 | Samsung Galaxy A21S | 5% |

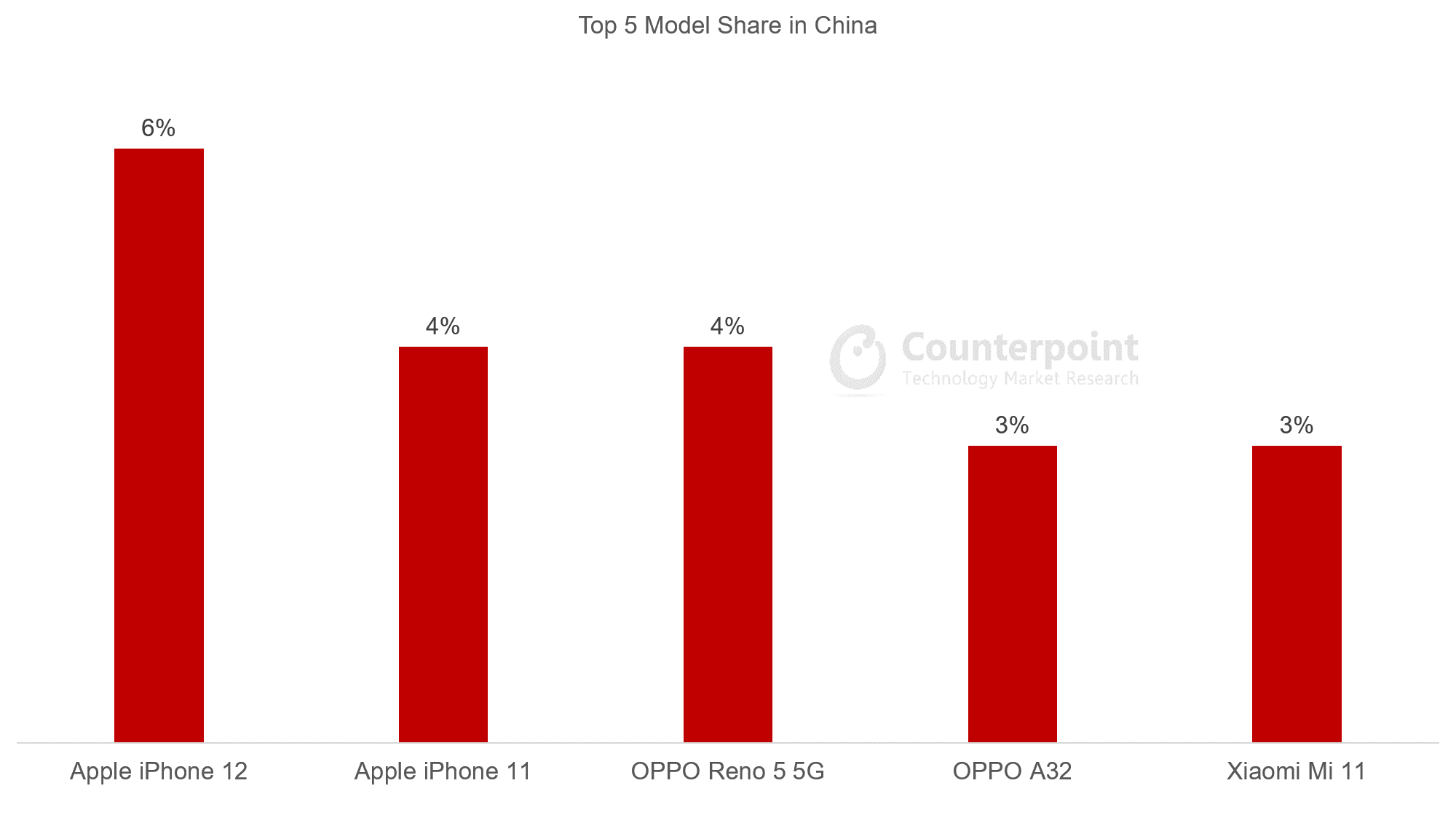

China Model Share

| Rank | Model | % |

| 1 | Apple iPhone 12 | 6% |

| 2 | Apple iPhone 11 | 4% |

| 3 | OPPO Reno 5 5G | 4% |

| 4 | OPPO A32 | 3% |

| 5 | Xiaomi Mi 11 | 3% |

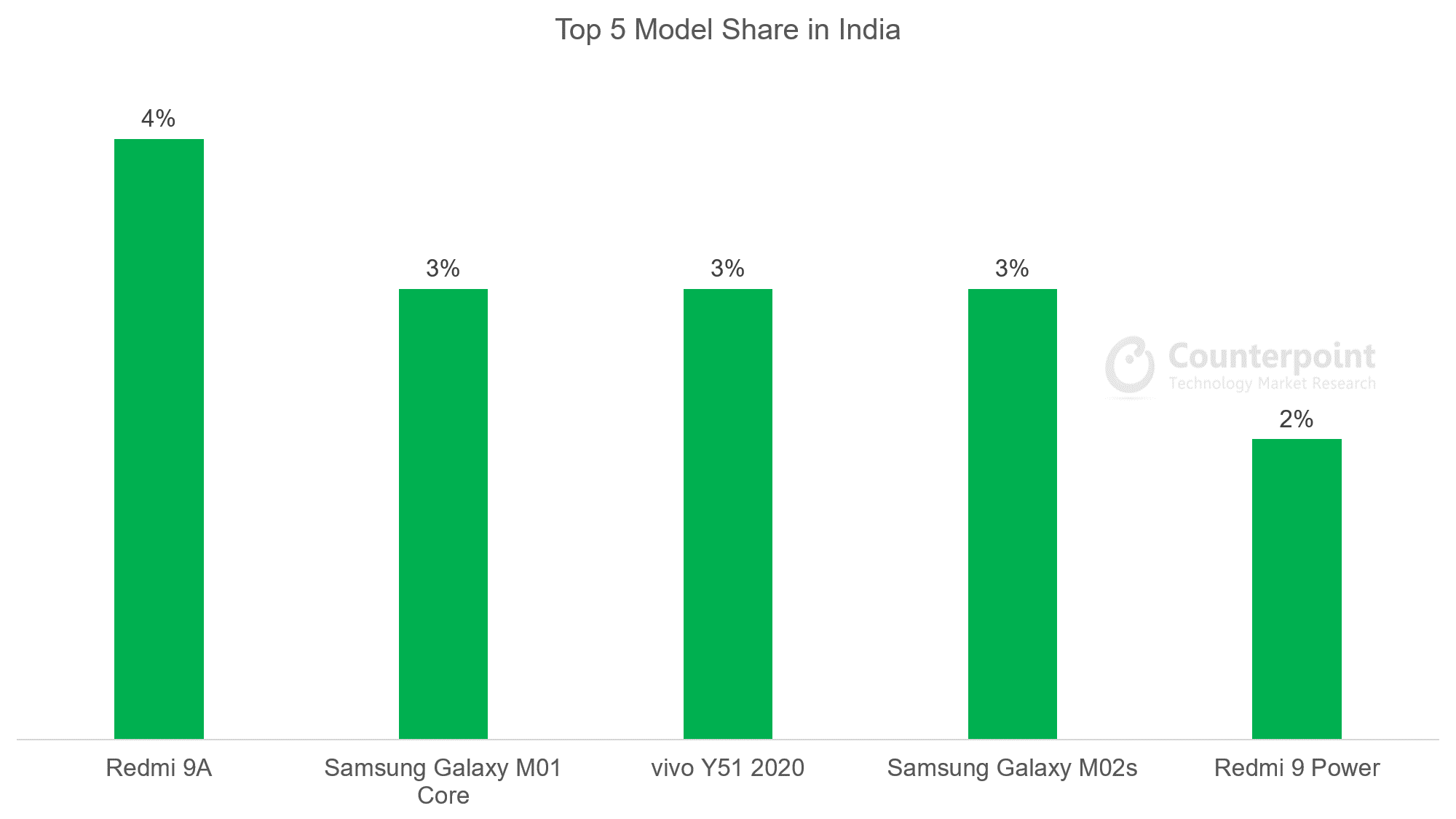

India Model Share

India Model Share

| Rank | Model | % |

| 1 | Redmi 9A | 4% |

| 2 | Samsung Galaxy M01 Core | 3% |

| 3 | vivo Y51 2020 | 3% |

| 4 | Samsung Galaxy M02s | 3% |

| 5 | Redmi 9 Power | 2% |

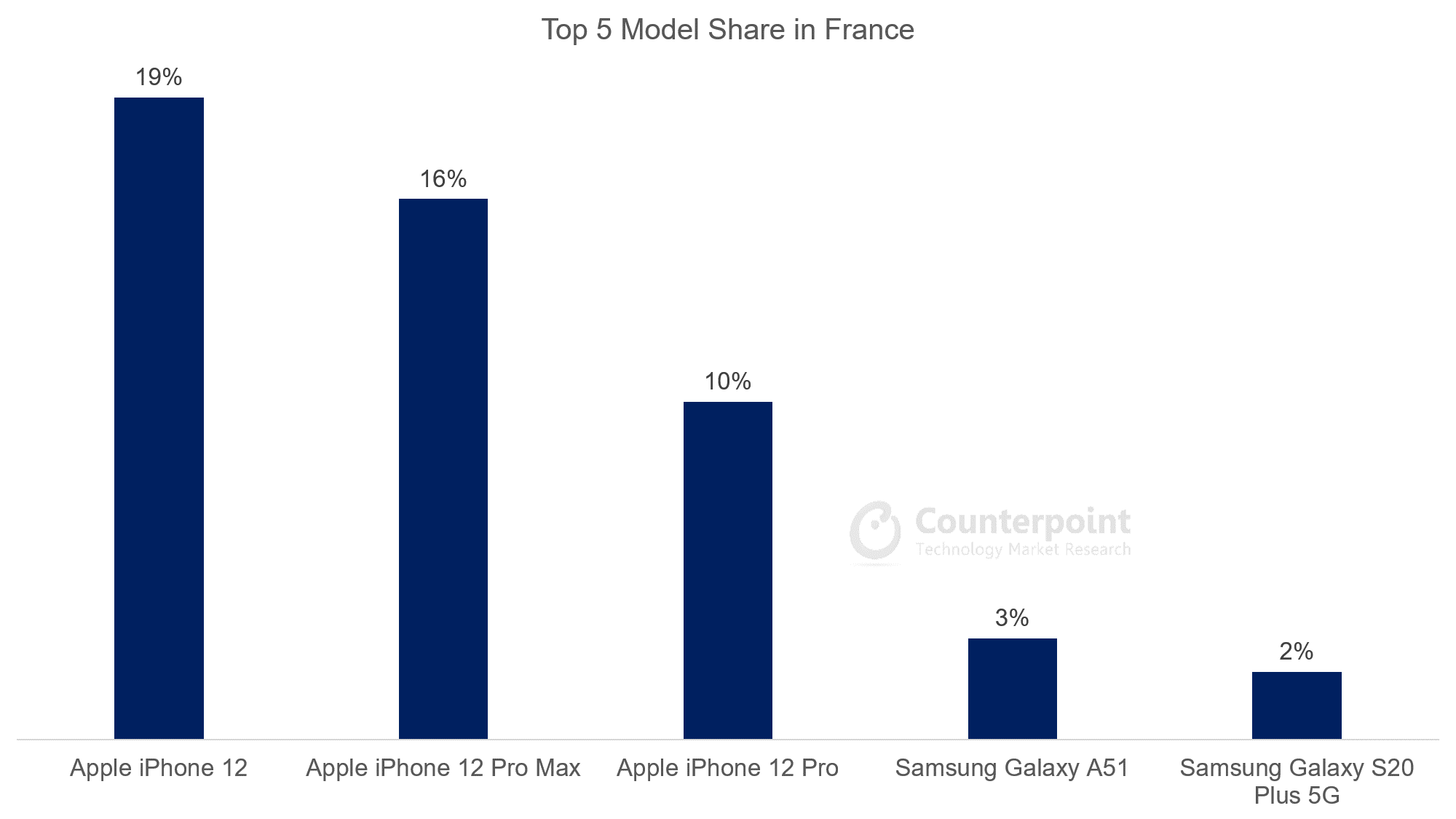

France Model Share

France Model Share

| Rank | Model | % |

| 1 | Apple iPhone 12 | 19% |

| 2 | Apple iPhone 12 Pro Max | 16% |

| 3 | Apple iPhone 12 Pro | 10% |

| 4 | Samsung Galaxy A51 | 3% |

| 5 | Samsung Galaxy S20 Plus 5G | 2% |

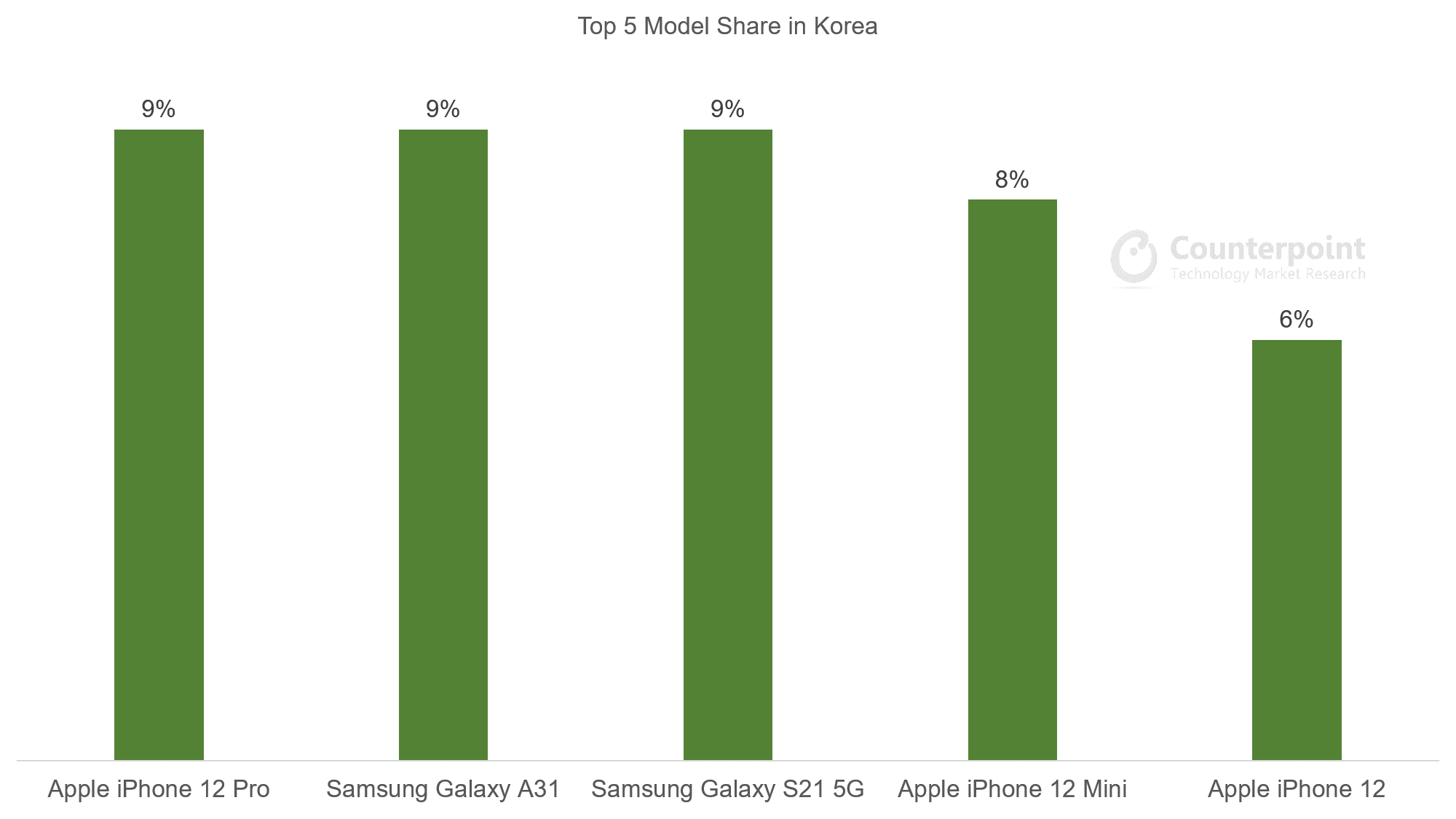

Korea Model Share

Korea Model Share

| Rank | Model | % |

| 1 | Apple iPhone 12 Pro | 9% |

| 2 | Samsung Galaxy A31 | 9% |

| 3 | Samsung Galaxy S21 5G | 9% |

| 4 | Apple iPhone 12 Mini | 8% |

| 5 | Apple iPhone 12 | 6% |

Germany Model Share

Germany Model Share

| Rank | Model | % |

| 1 | Apple iPhone 12 Pro | 15% |

| 2 | Apple iPhone 12 Pro Max | 14% |

| 3 | Apple iPhone 12 | 11% |

| 4 | Apple iPhone 12 Mini | 5% |

| 5 | Samsung Galaxy A41 | 3% |

![]()

Japan Model Share

| Rank | Model | % |

| 1 | Apple iPhone SE 2020 | 16% |

| 2 | Apple iPhone 12 | 14% |

| 3 | Apple iPhone 12 Pro | 9% |

| 4 | Apple iPhone 12 Mini | 7% |

| 5 | Apple iPhone 12 Pro Max | 5% |

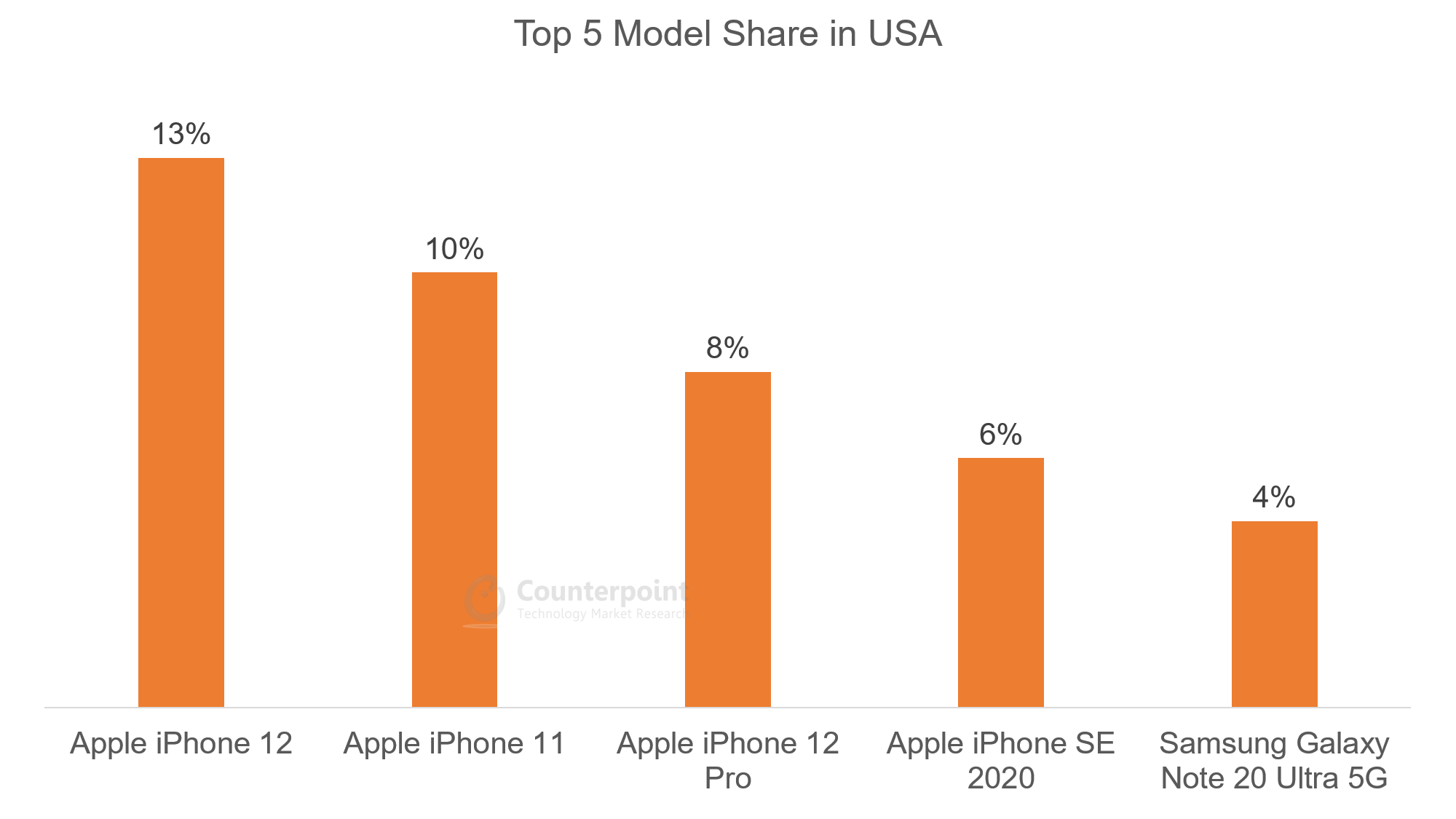

October 2020

USA Model Share

| Rank | Model | % |

| 1 | Apple iPhone 12 | 13% |

| 2 | Apple iPhone 11 | 10% |

| 3 | Apple iPhone 12 Pro | 8% |

| 4 | Apple iPhone SE 2020 | 6% |

| 5 | Samsung Galaxy Note 20 Ultra 5G | 4% |

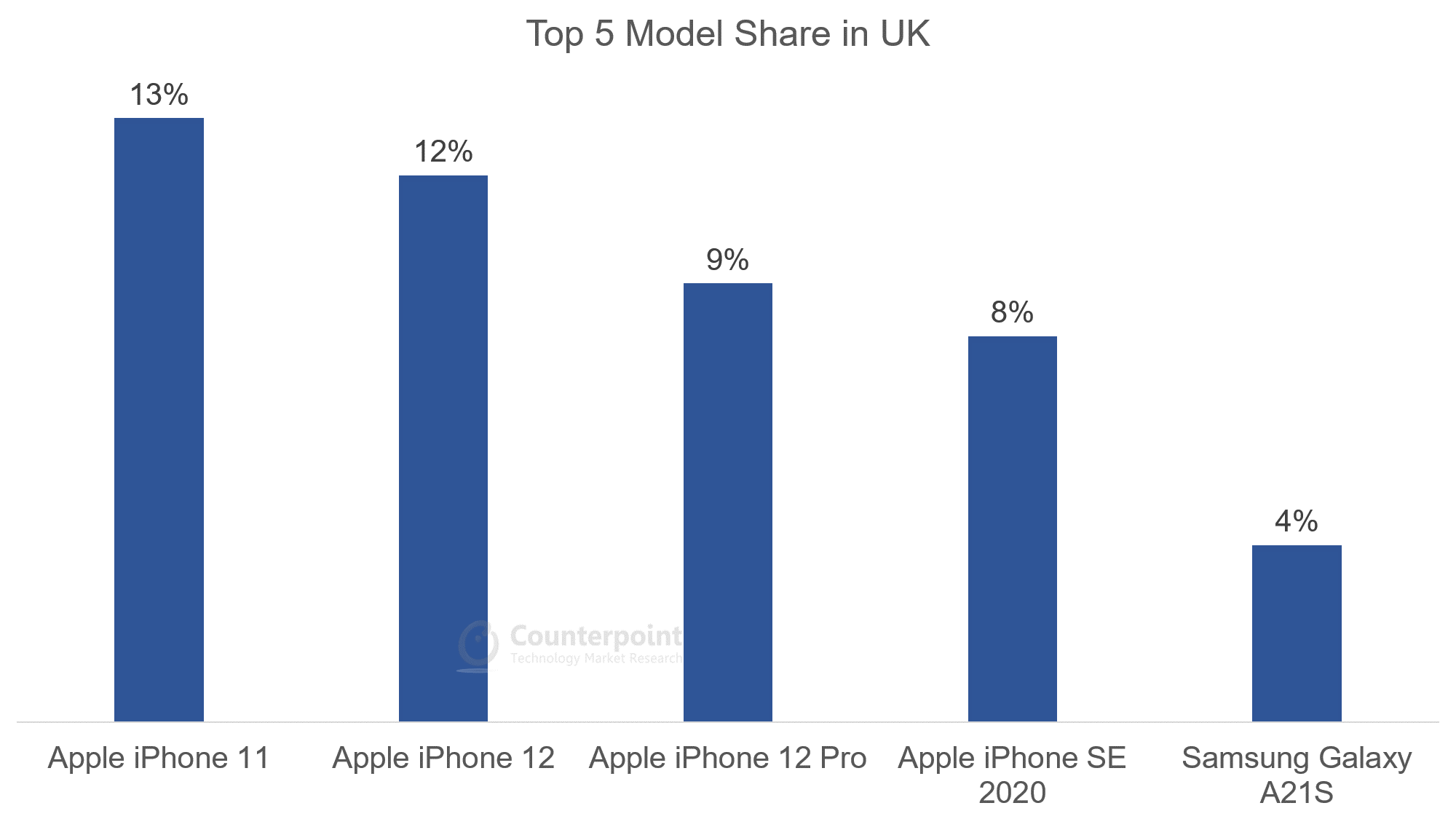

UK Model Share

UK Model Share

| Rank | Model | % |

| 1 | Apple iPhone 11 | 13% |

| 2 | Apple iPhone 12 | 12% |

| 3 | Apple iPhone 12 Pro | 9% |

| 4 | Apple iPhone SE 2020 | 8% |

| 5 | Samsung Galaxy A21S | 4% |

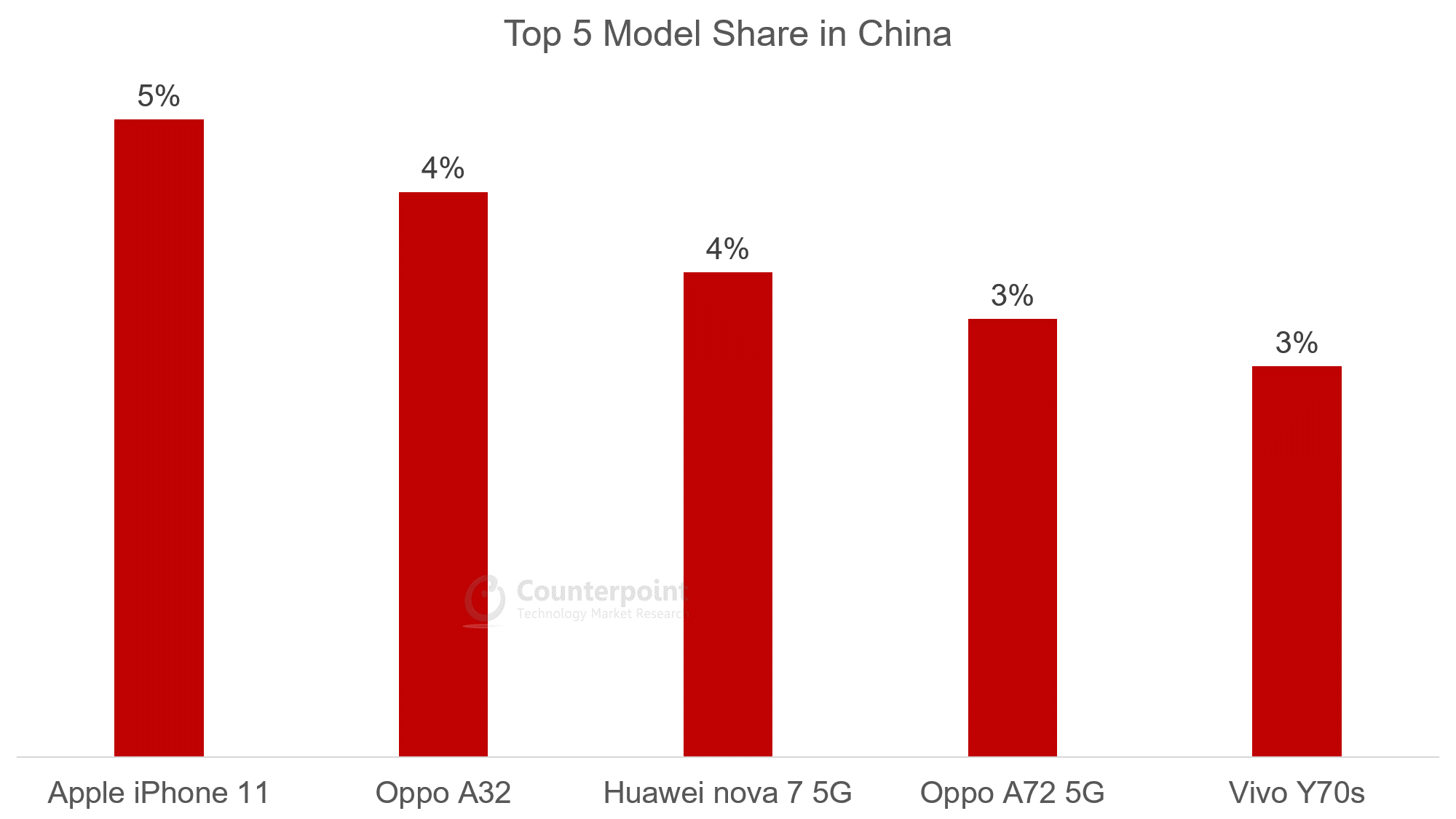

China Model Share

| Rank | Model | % |

| 1 | Apple iPhone 11 | 5% |

| 2 | Oppo A32 | 4% |

| 3 | Huawei nova 7 5G | 4% |

| 4 | Oppo A72 5G | 3% |

| 5 | Vivo Y70s | 3% |

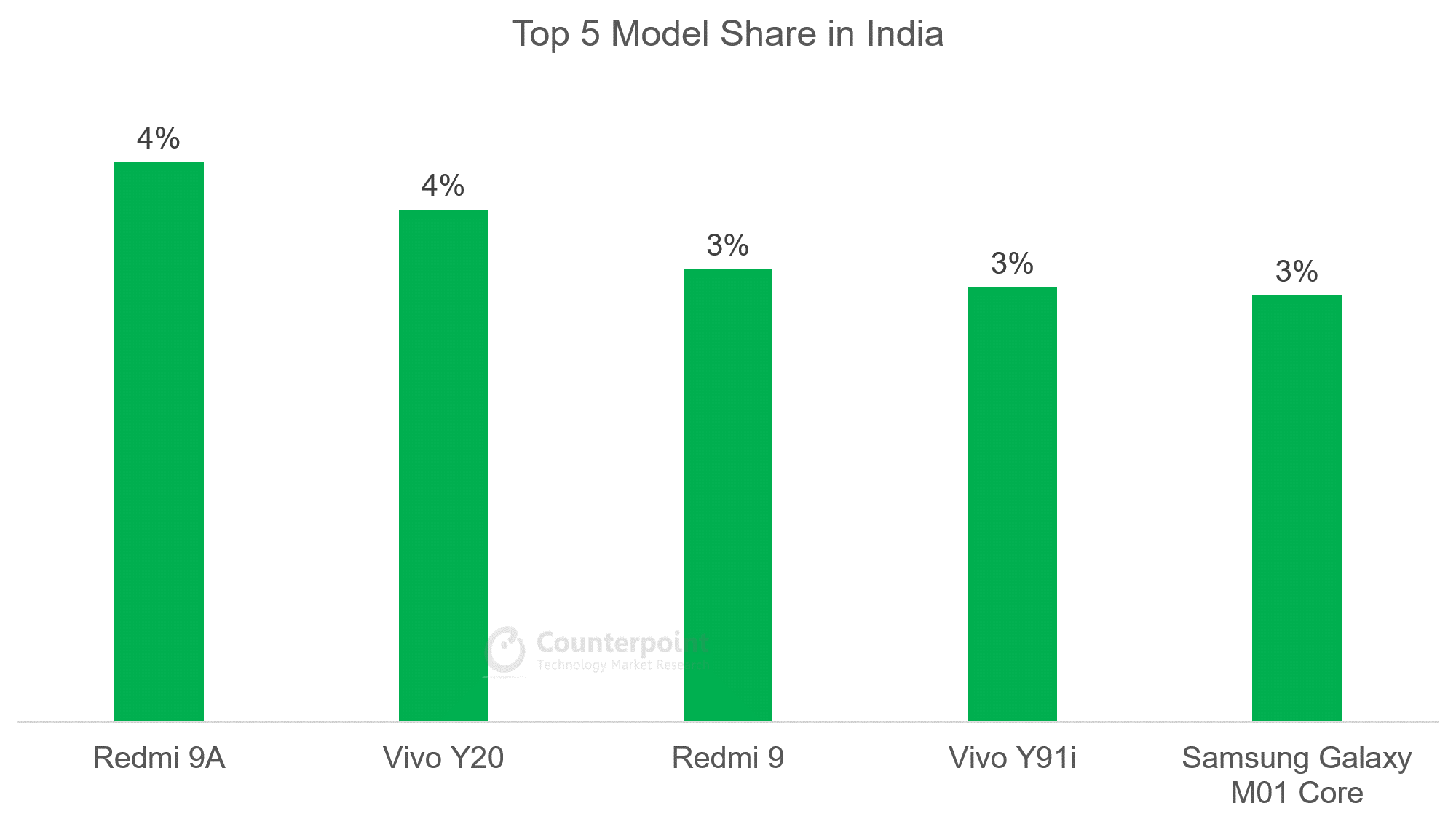

India Model Share

India Model Share

| Rank | Model | % |

| 1 | Redmi 9A | 4% |

| 2 | Vivo Y20 | 4% |

| 3 | Redmi 9 | 3% |

| 4 | Vivo Y91i | 3% |

| 5 | Samsung Galaxy M01 Core | 3% |

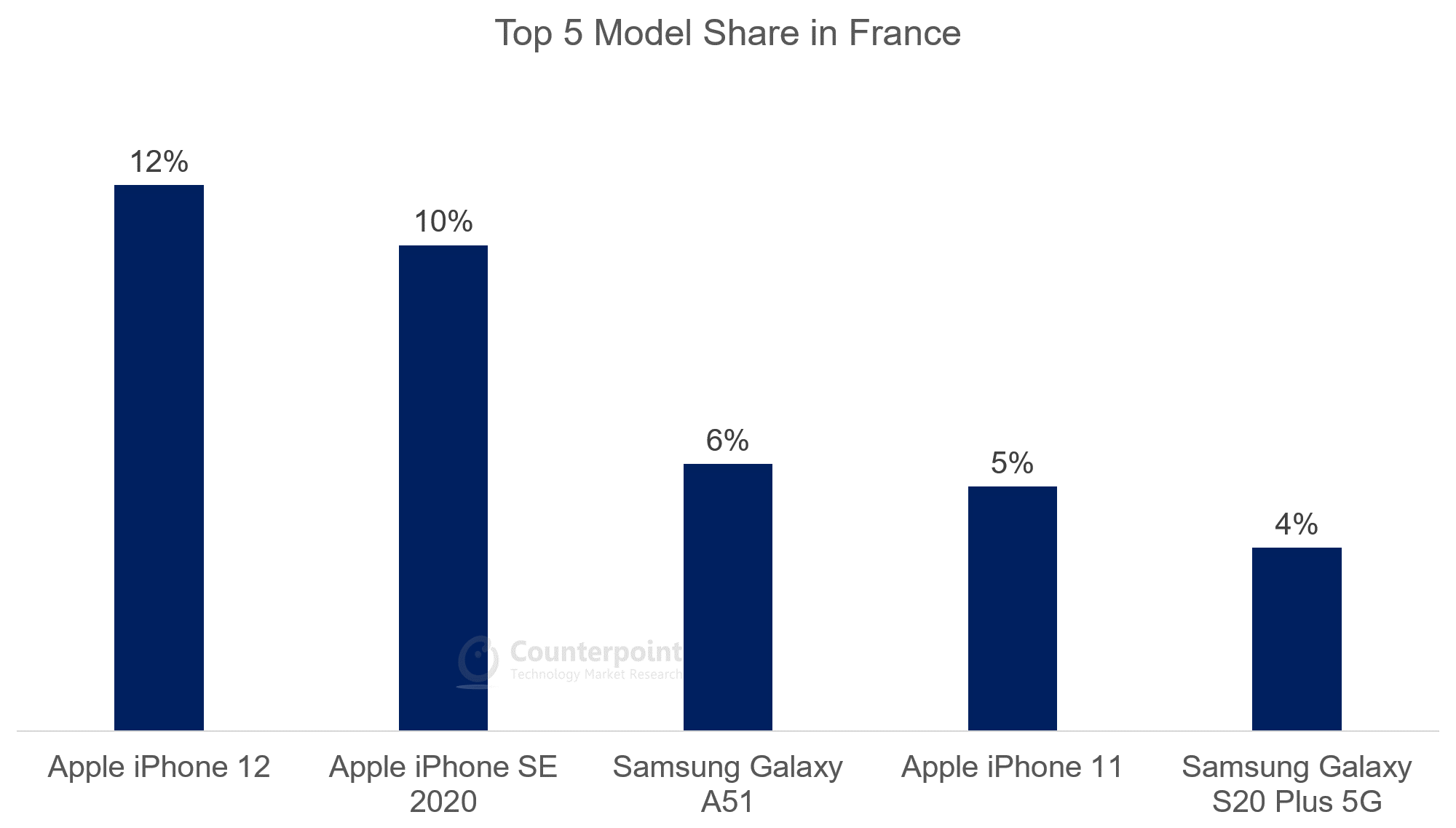

France Model Share

France Model Share

| Rank | Model | % |

| 1 | Apple iPhone 12 | 12% |

| 2 | Apple iPhone SE 2020 | 10% |

| 3 | Samsung Galaxy A51 | 6% |

| 4 | Apple iPhone 11 | 5% |

| 5 | Samsung Galaxy S20 Plus 5G | 4% |

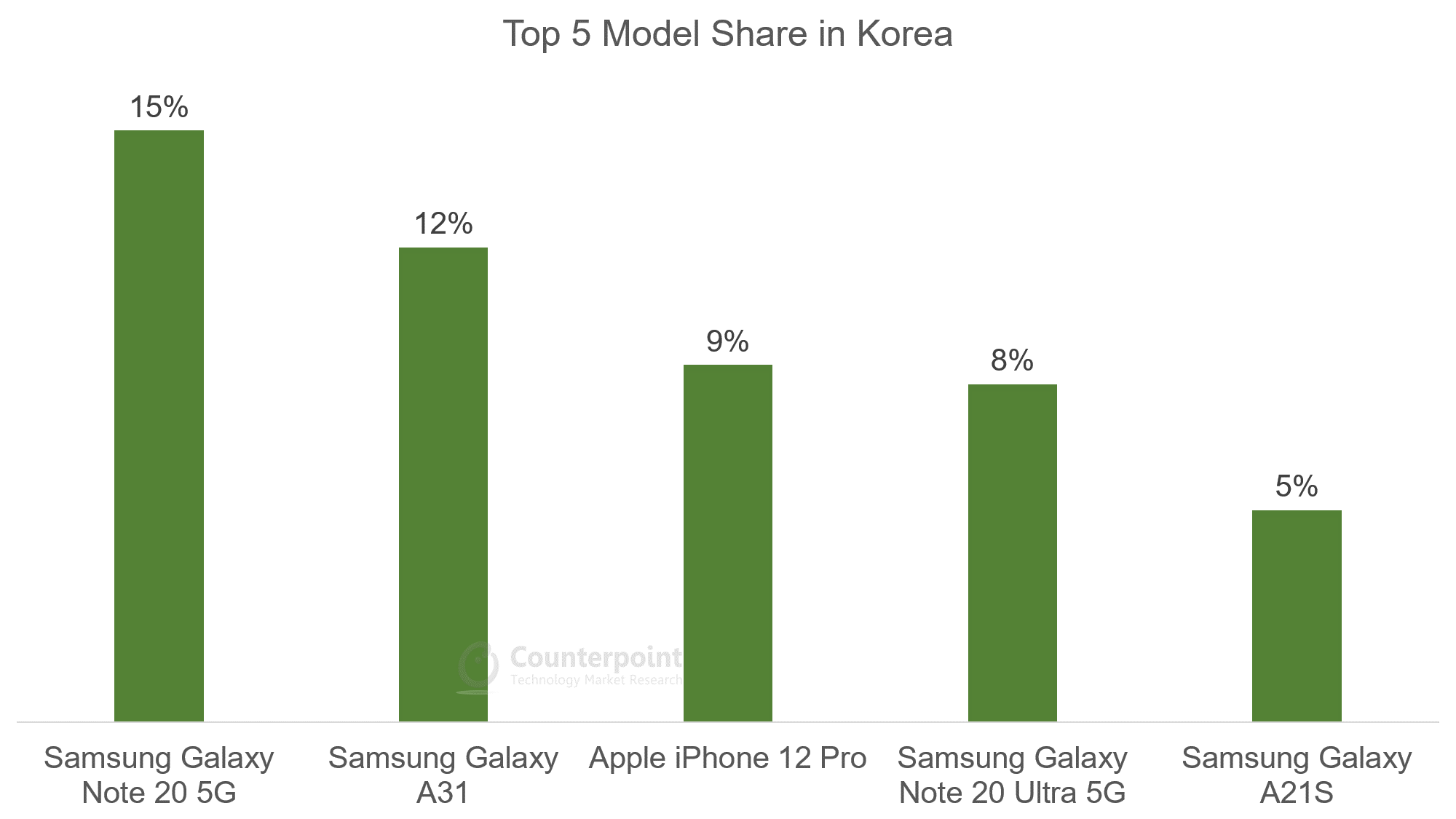

Korea Model Share

Korea Model Share

| Rank | Model | % |

| 1 | Samsung Galaxy Note 20 5G | 15% |

| 2 | Samsung Galaxy A31 | 12% |

| 3 | Apple iPhone 12 Pro | 9% |

| 4 | Samsung Galaxy Note 20 Ultra 5G | 8% |

| 5 | Samsung Galaxy A21S | 5% |

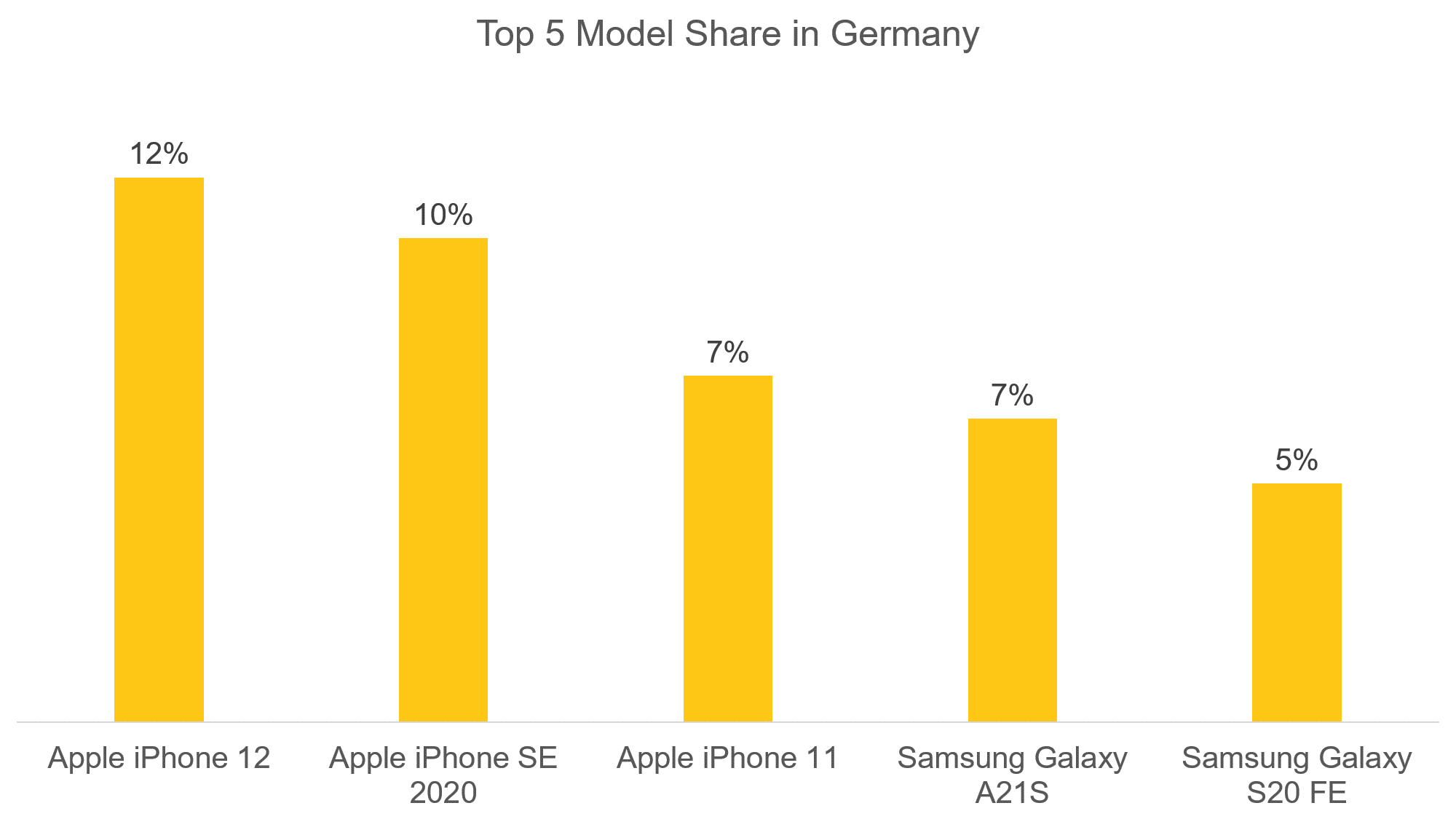

Germany Model Share

Germany Model Share

| Rank | Model | % |

| 1 | Apple iPhone 12 | 12% |

| 2 | Apple iPhone SE 2020 | 10% |

| 3 | Apple iPhone 11 | 7% |

| 4 | Samsung Galaxy A21S | 7% |

| 5 | Samsung Galaxy S20 FE | 5% |

![]()

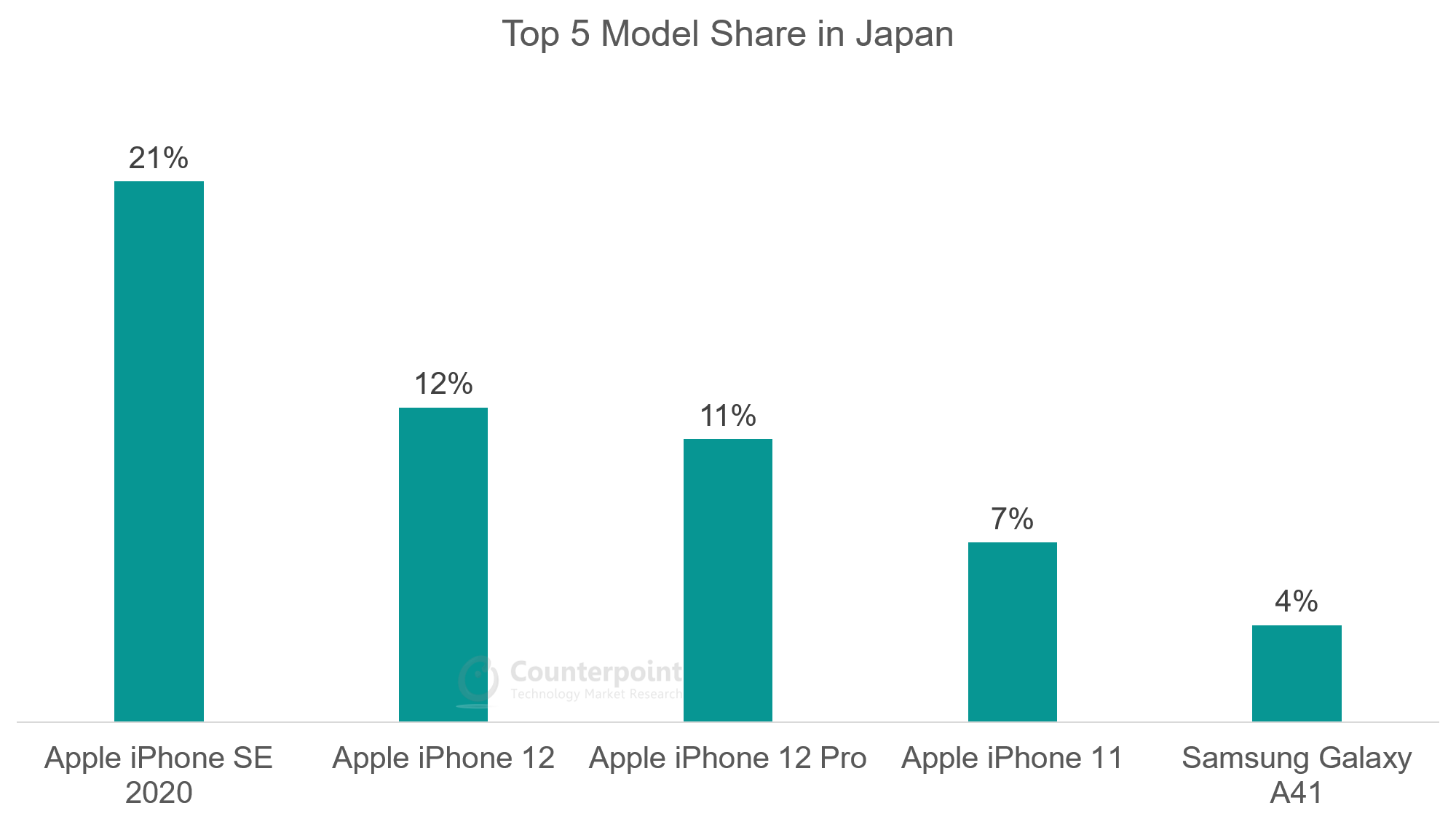

Japan Model Share

| Rank | Japan | % |

| 1 | Apple iPhone SE 2020 | 21% |

| 2 | Apple iPhone 12 | 12% |

| 3 | Apple iPhone 12 Pro | 11% |

| 4 | Apple iPhone 11 | 7% |

| 5 | Samsung Galaxy A41 | 4% |

July 2020

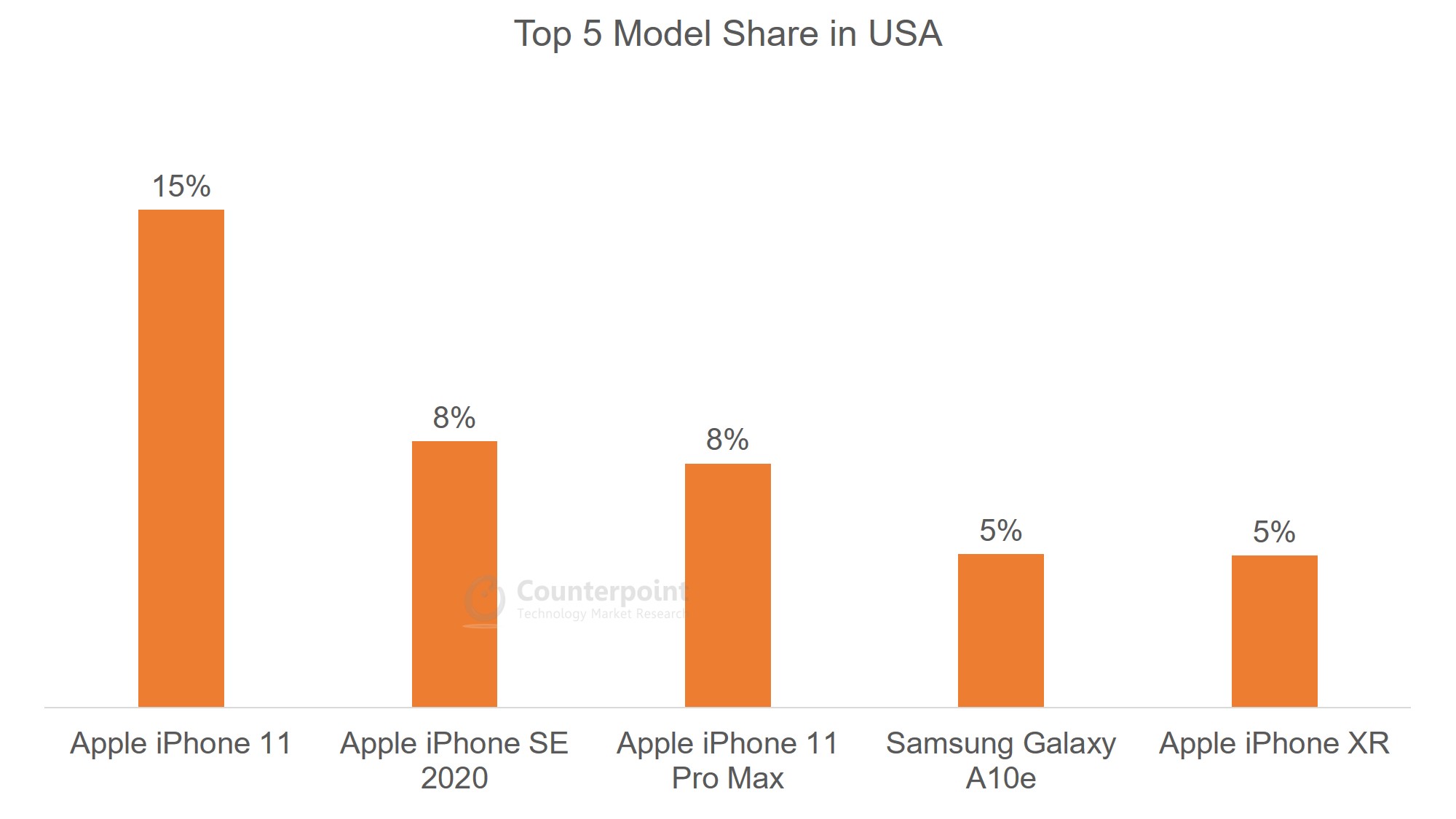

USA Model Share

| Rank | Model | % |

| 1 | Apple iPhone 11 | 15% |

| 2 | Apple iPhone SE 2020 | 8% |

| 3 | Apple iPhone 11 Pro Max | 8% |

| 4 | Samsung Galaxy A10e | 5% |

| 5 | Apple iPhone XR | 5% |

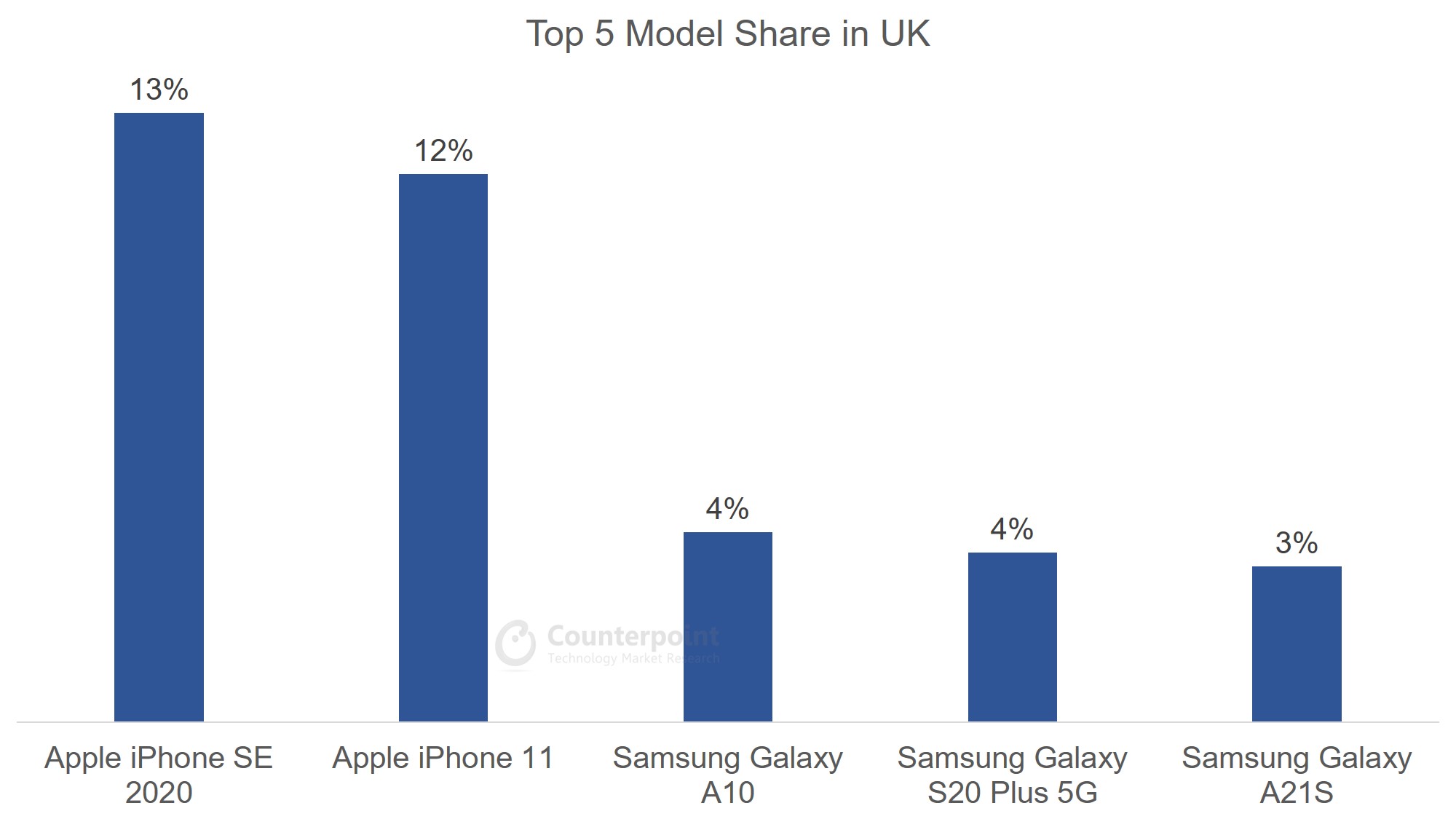

UK Model Share

UK Model Share

| Rank | Model | % |

| 1 | Apple iPhone SE 2020 | 13% |

| 2 | Apple iPhone 11 | 12% |

| 3 | Samsung Galaxy A10 | 4% |

| 4 | Samsung Galaxy S20 Plus 5G | 4% |

| 5 | Samsung Galaxy A21S | 3% |

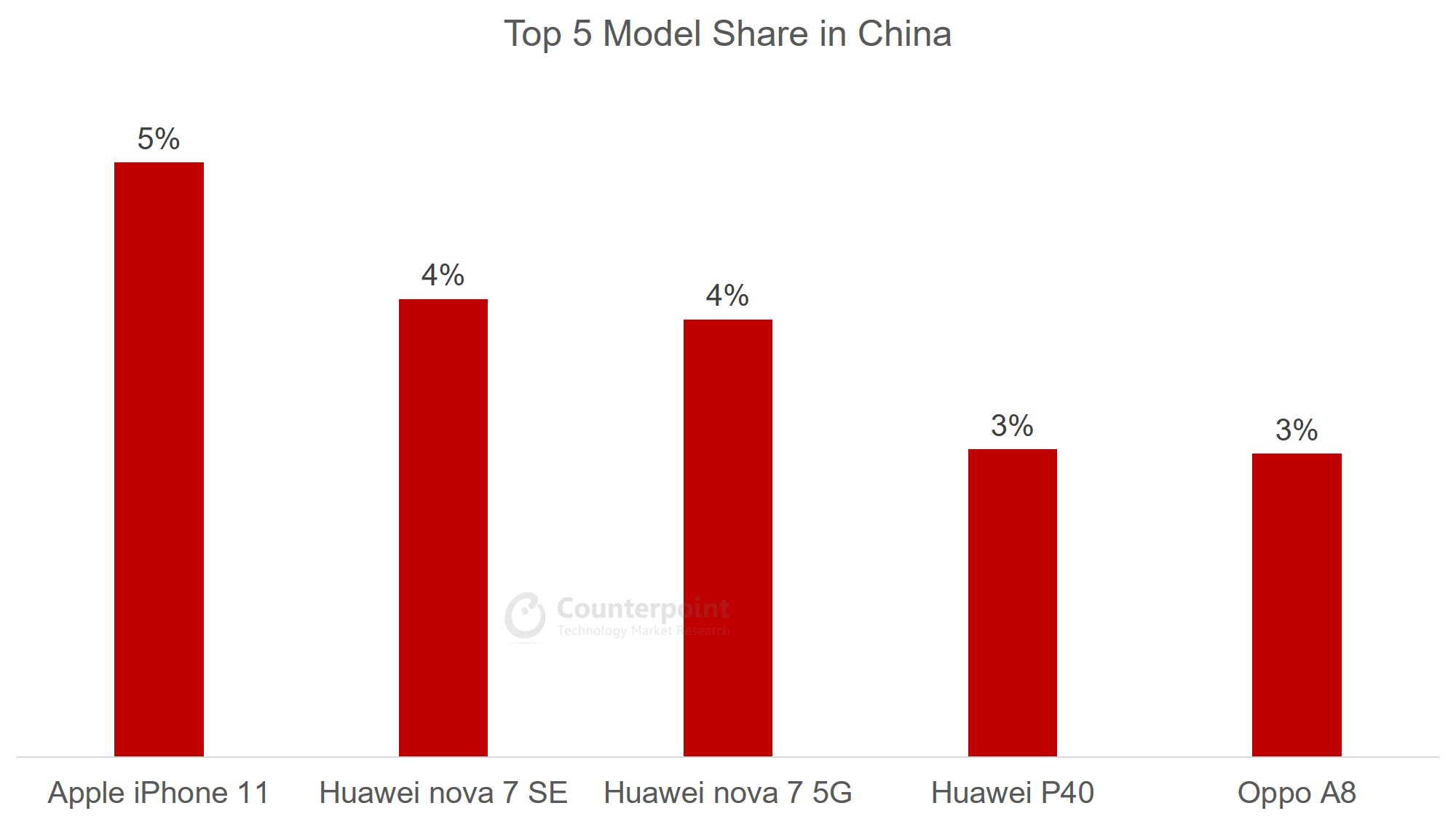

China Model Share

| Rank | Model | % |

| 1 | Apple iPhone 11 | 5% |

| 2 | Huawei nova 7 SE | 4% |

| 3 | Huawei nova 7 5G | 4% |

| 4 | Huawei P40 | 3% |

| 5 | Oppo A8 | 3% |

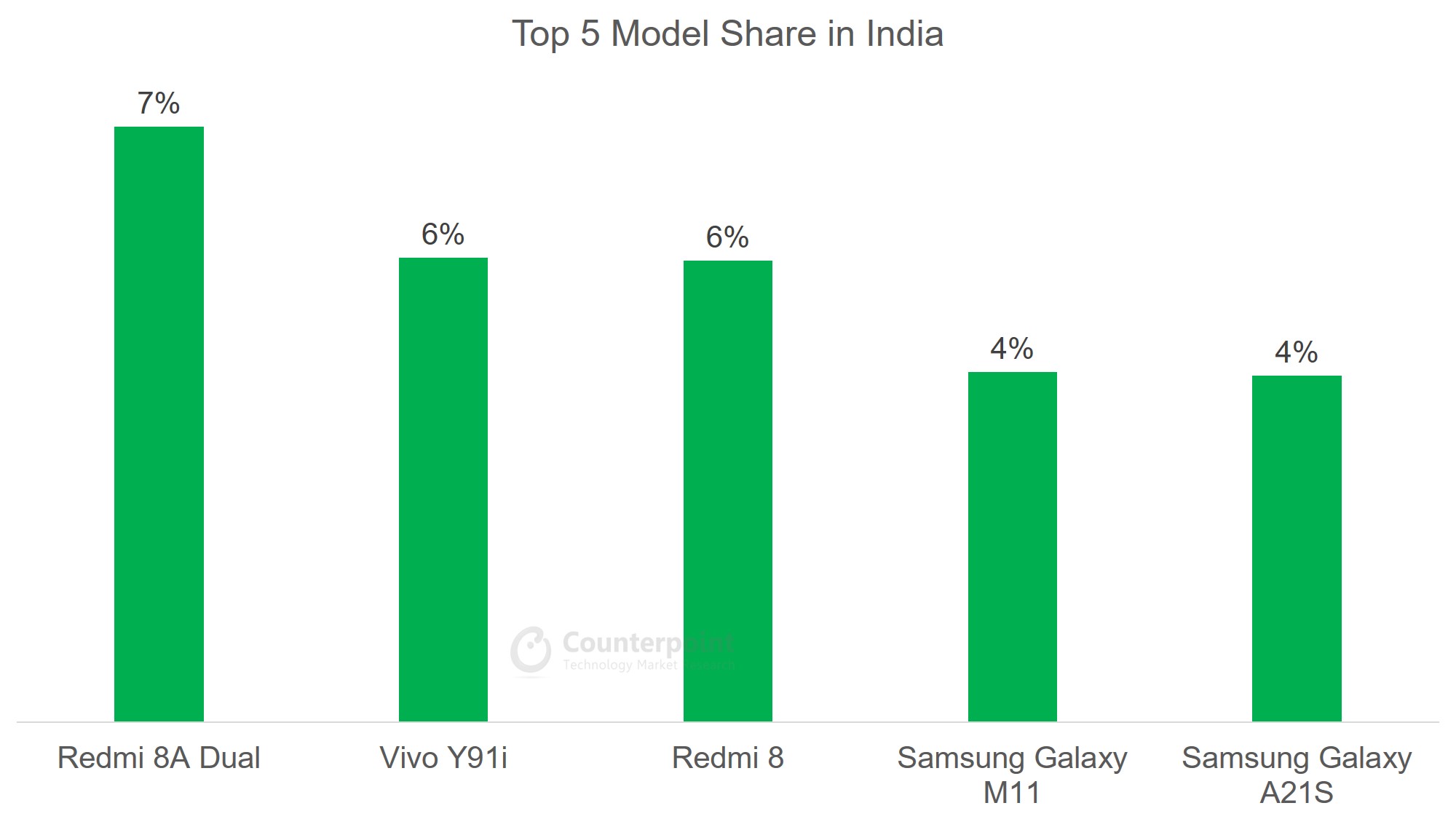

India Model Share

India Model Share

| Rank | Model | % |

| 1 | Redmi 8A Dual | 7% |

| 2 | Vivo Y91i | 6% |

| 3 | Redmi 8 | 6% |

| 4 | Samsung Galaxy M11 | 4% |

| 5 | Samsung Galaxy A21S | 4% |

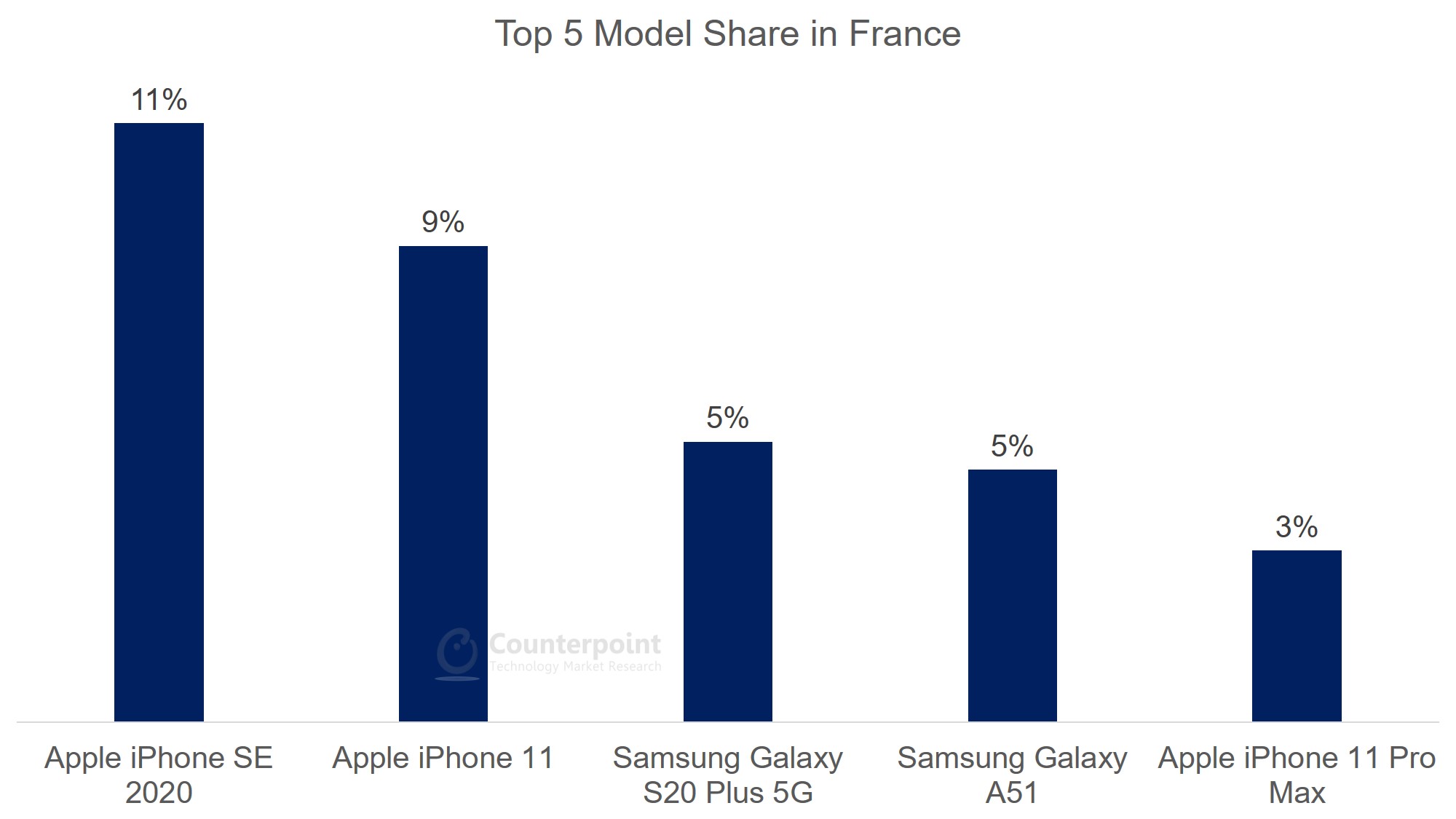

France Model Share

France Model Share

| Rank | Model | % |

| 1 | Apple iPhone SE 2020 | 11% |

| 2 | Apple iPhone 11 | 9% |

| 3 | Samsung Galaxy S20 Plus 5G | 5% |

| 4 | Samsung Galaxy A51 | 5% |

| 5 | Apple iPhone 11 Pro Max | 3% |

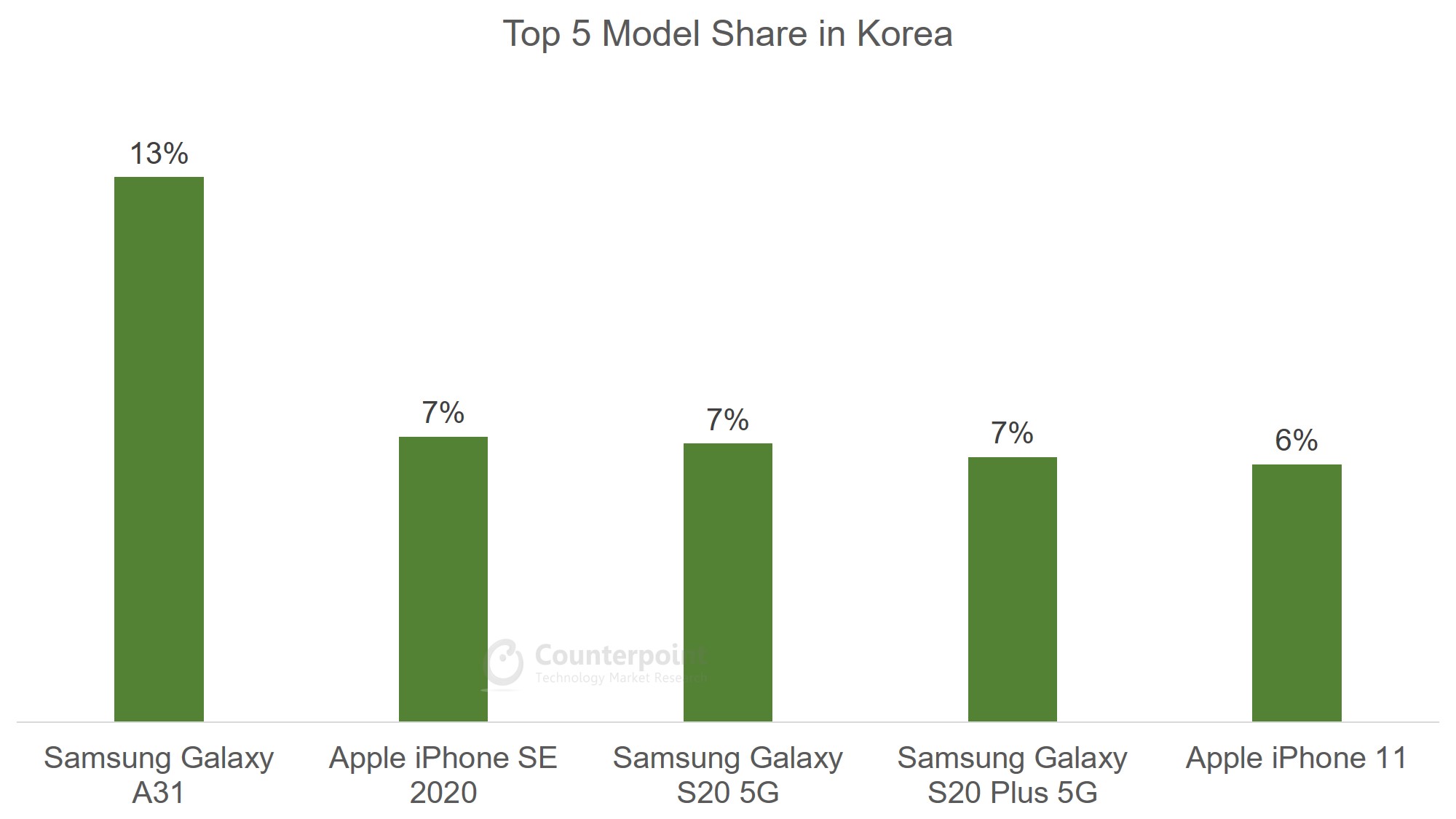

Korea Model Share

Korea Model Share

| Rank | Model | % |

| 1 | Samsung Galaxy A31 | 13% |

| 2 | Apple iPhone SE 2020 | 7% |

| 3 | Samsung Galaxy S20 5G | 7% |

| 4 | Samsung Galaxy S20 Plus 5G | 7% |

| 5 | Apple iPhone 11 | 6% |

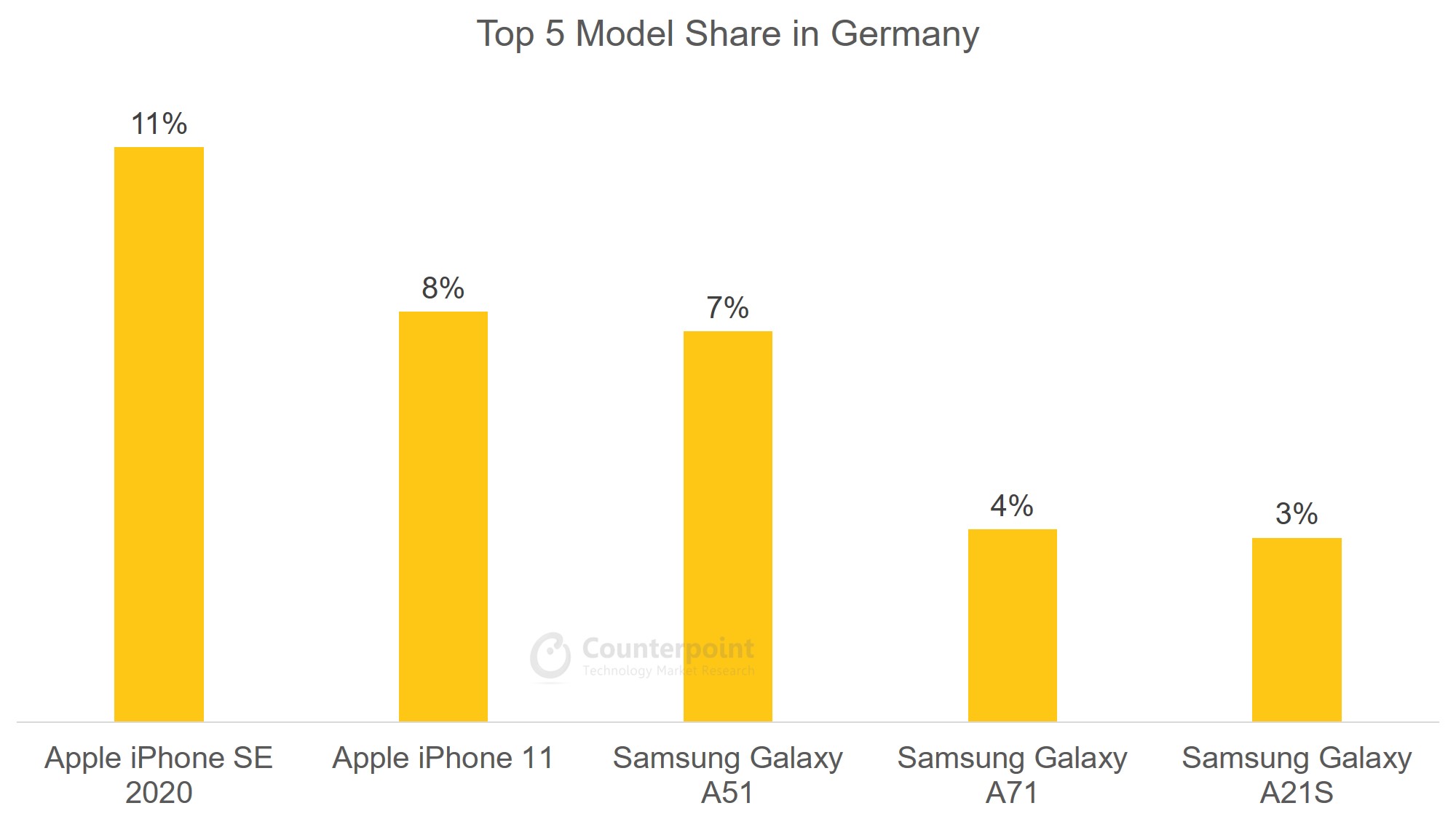

Germany Model Share

Germany Model Share

| Rank | Model | % |

| 1 | Apple iPhone SE 2020 | 11% |

| 2 | Apple iPhone 11 | 8% |

| 3 | Samsung Galaxy A51 | 7% |

| 4 | Samsung Galaxy A71 | 4% |

| 5 | Samsung Galaxy A21S | 3% |

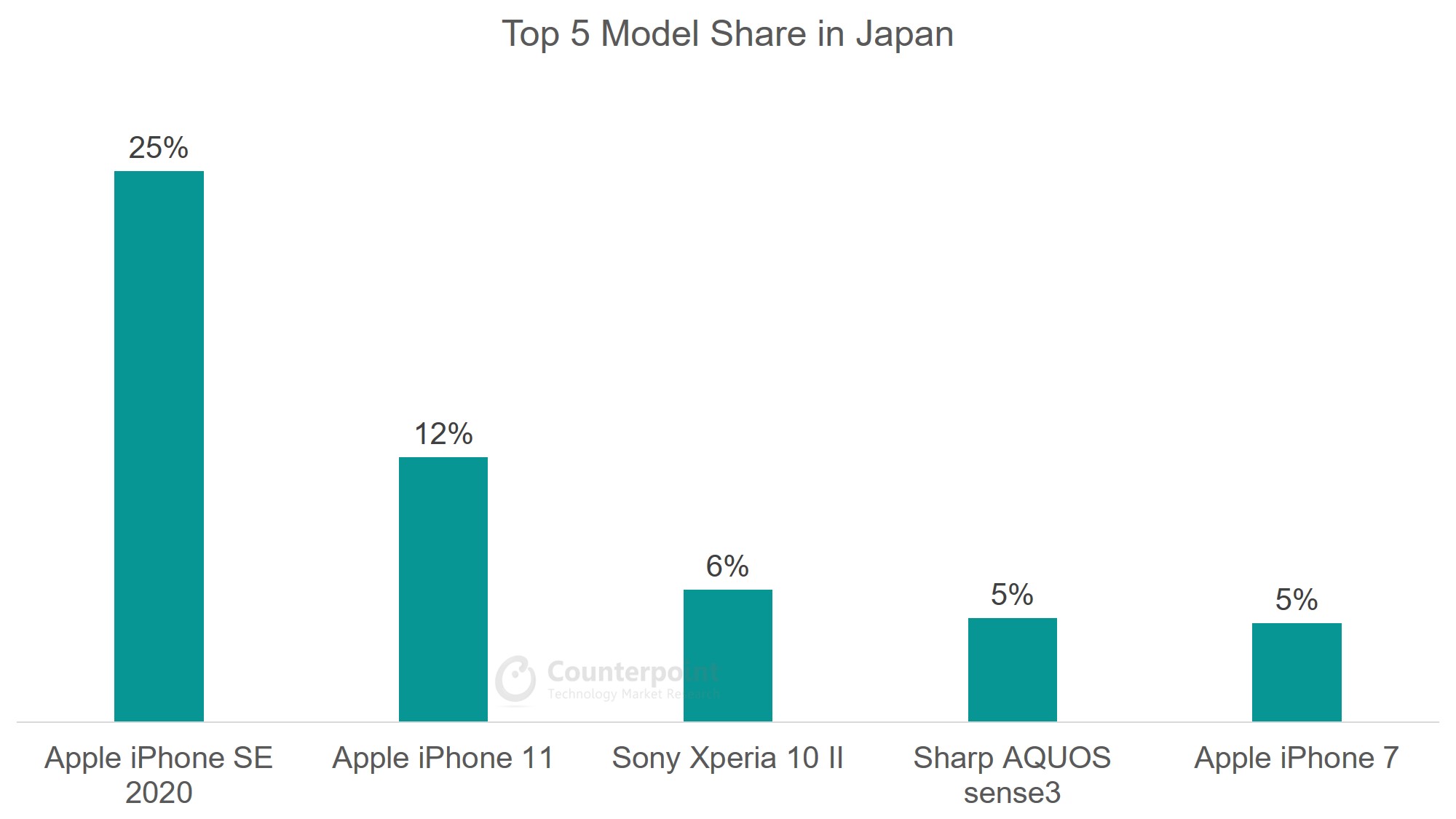

![]()

Japan Model Share

| Rank | Model | % |

| 1 | Apple iPhone SE 2020 | 25% |

| 2 | Apple iPhone 11 | 12% |

| 3 | Sony Xperia 10 II | 6% |

| 4 | Sharp AQUOS sense3 | 5% |

| 5 | Apple iPhone 7 | 5% |

April 2020

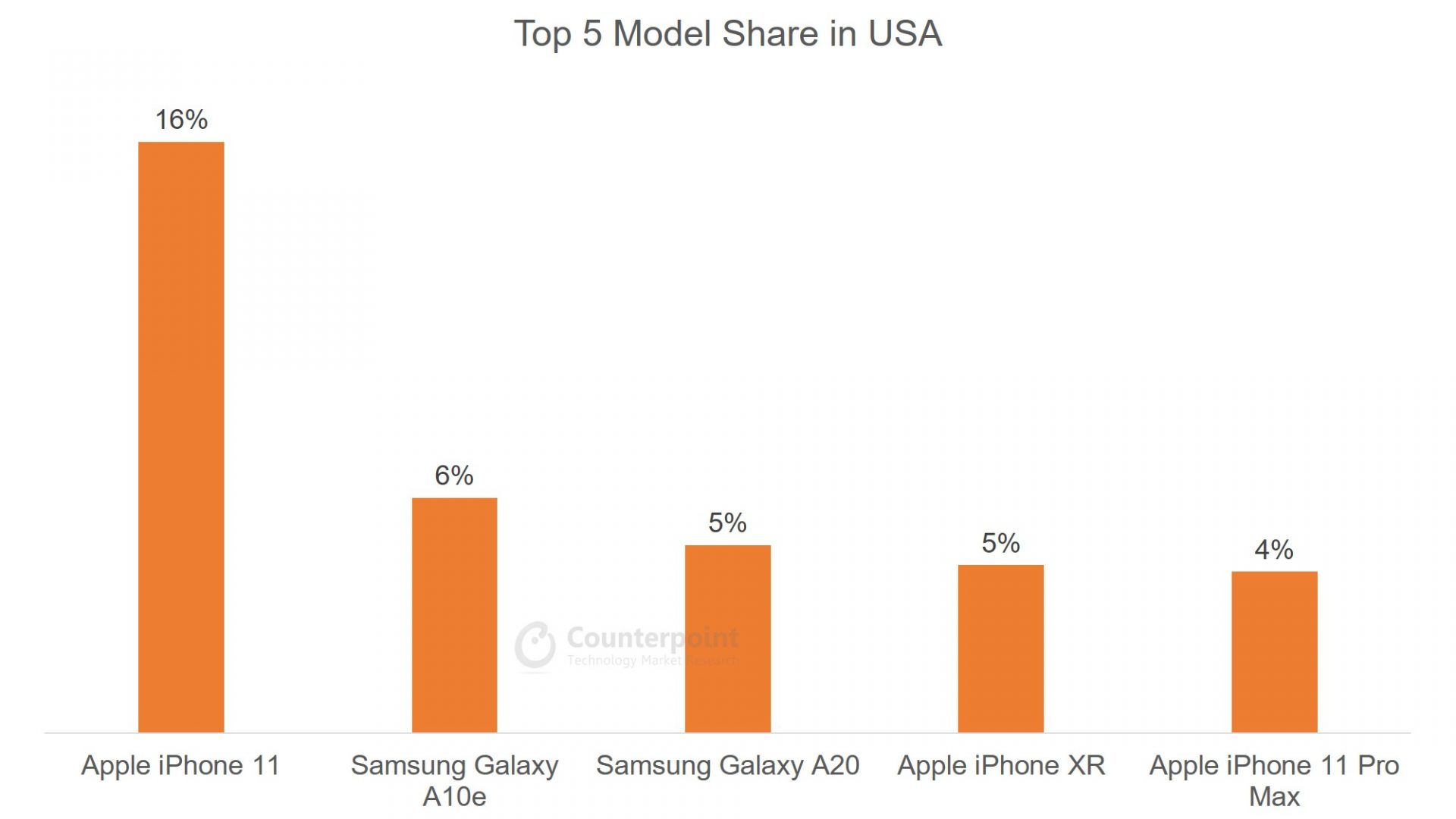

USA Model Share

| Rank | Model | % |

| 1 | Apple iPhone 11 | 16% |

| 2 | Samsung Galaxy A10e | 6% |

| 3 | Samsung Galaxy A20 | 5% |

| 4 | Apple iPhone XR | 5% |

| 5 | Apple iPhone 11 Pro Max | 4% |

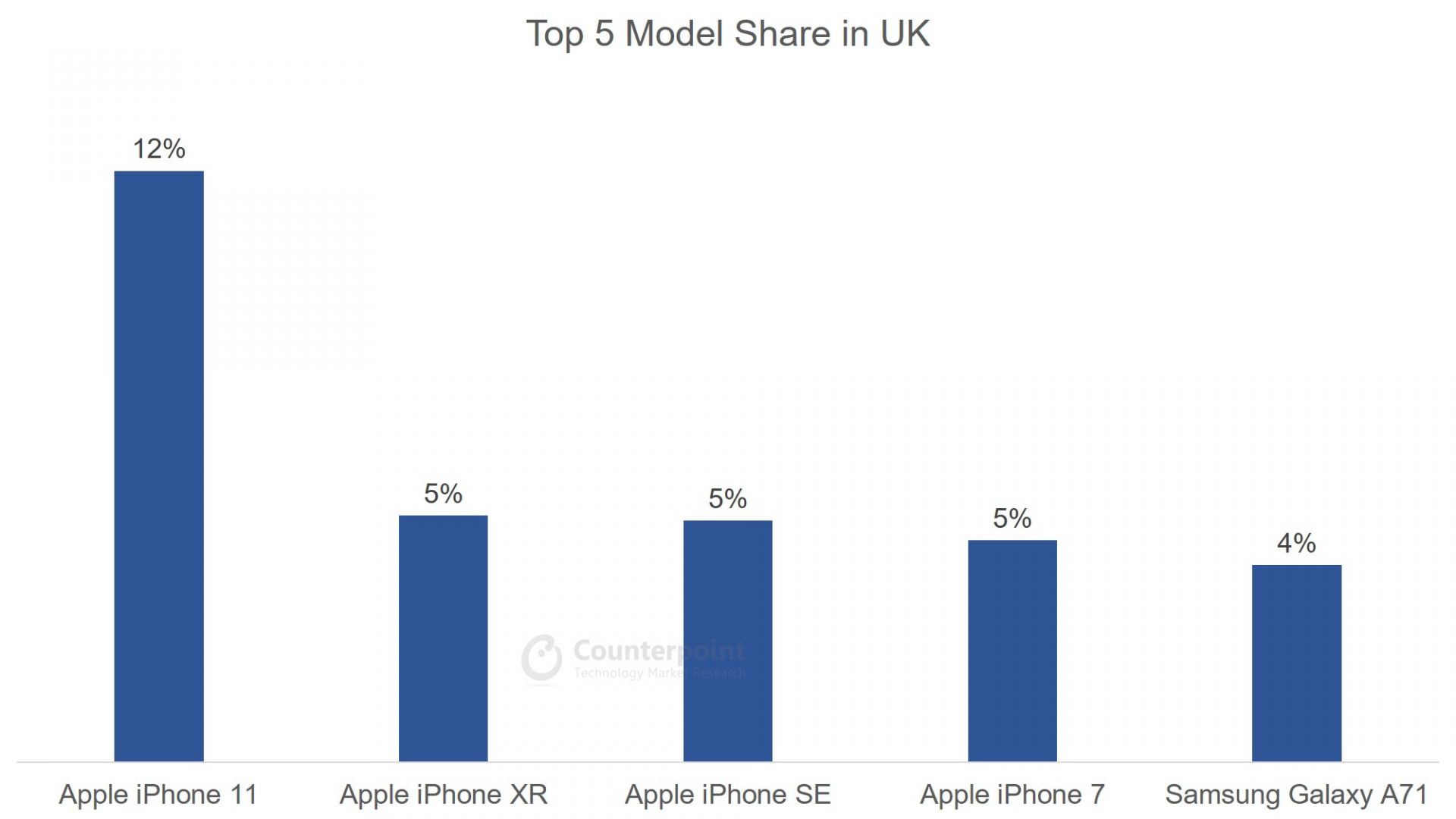

UK Model Share

UK Model Share

| Rank | Model | % |

| 1 | Apple iPhone 11 | 12% |

| 2 | Apple iPhone XR | 5% |

| 3 | Apple iPhone SE | 5% |

| 4 | Apple iPhone 7 | 5% |

| 5 | Samsung Galaxy A71 | 4% |

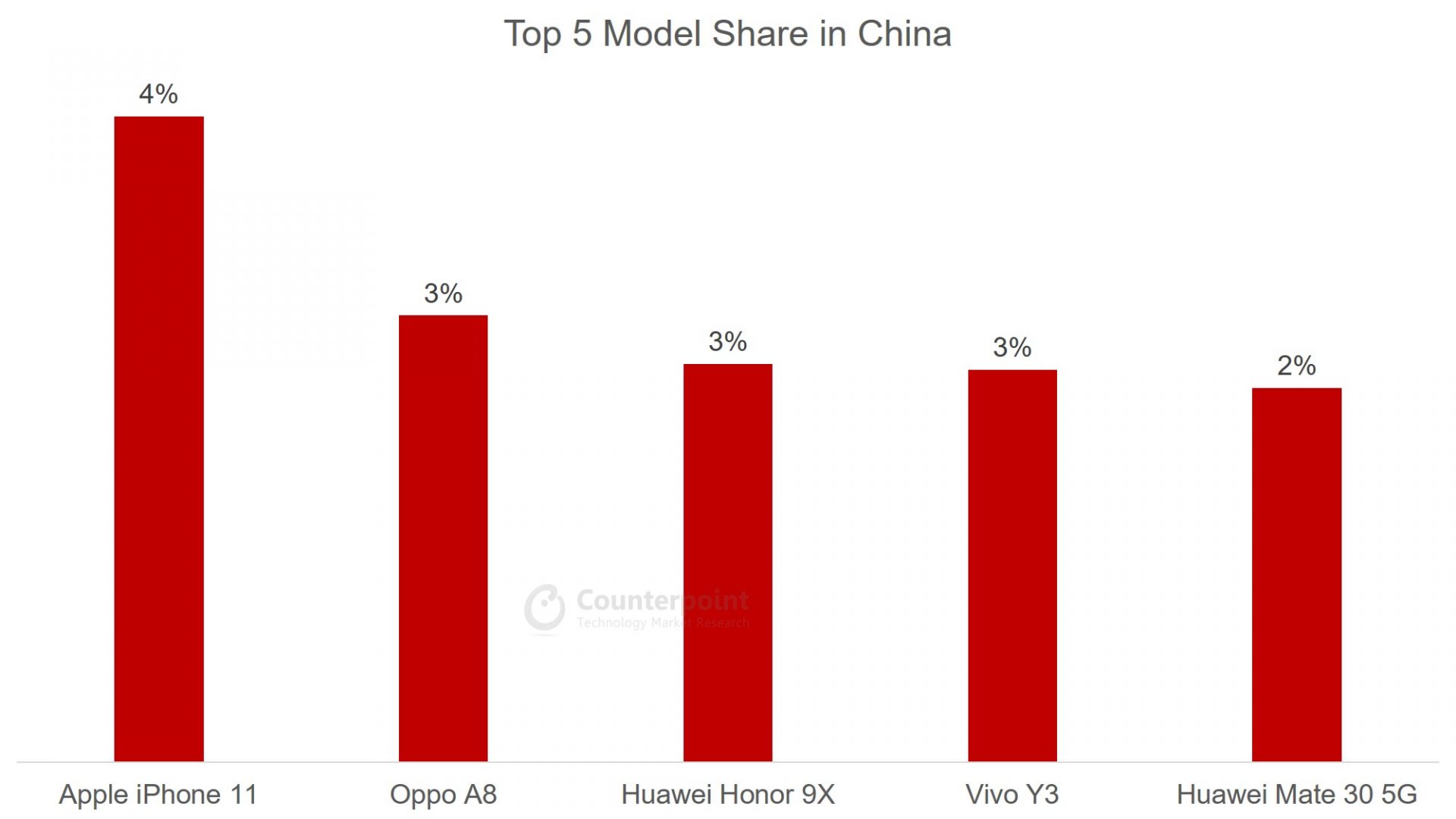

China Model Share

| Rank | Model | % |

| 1 | Apple iPhone 11 | 4% |

| 2 | Oppo A8 | 3% |

| 3 | Huawei Honor 9X | 3% |

| 4 | Vivo Y3 | 3% |

| 5 | Huawei Mate 30 5G | 2% |

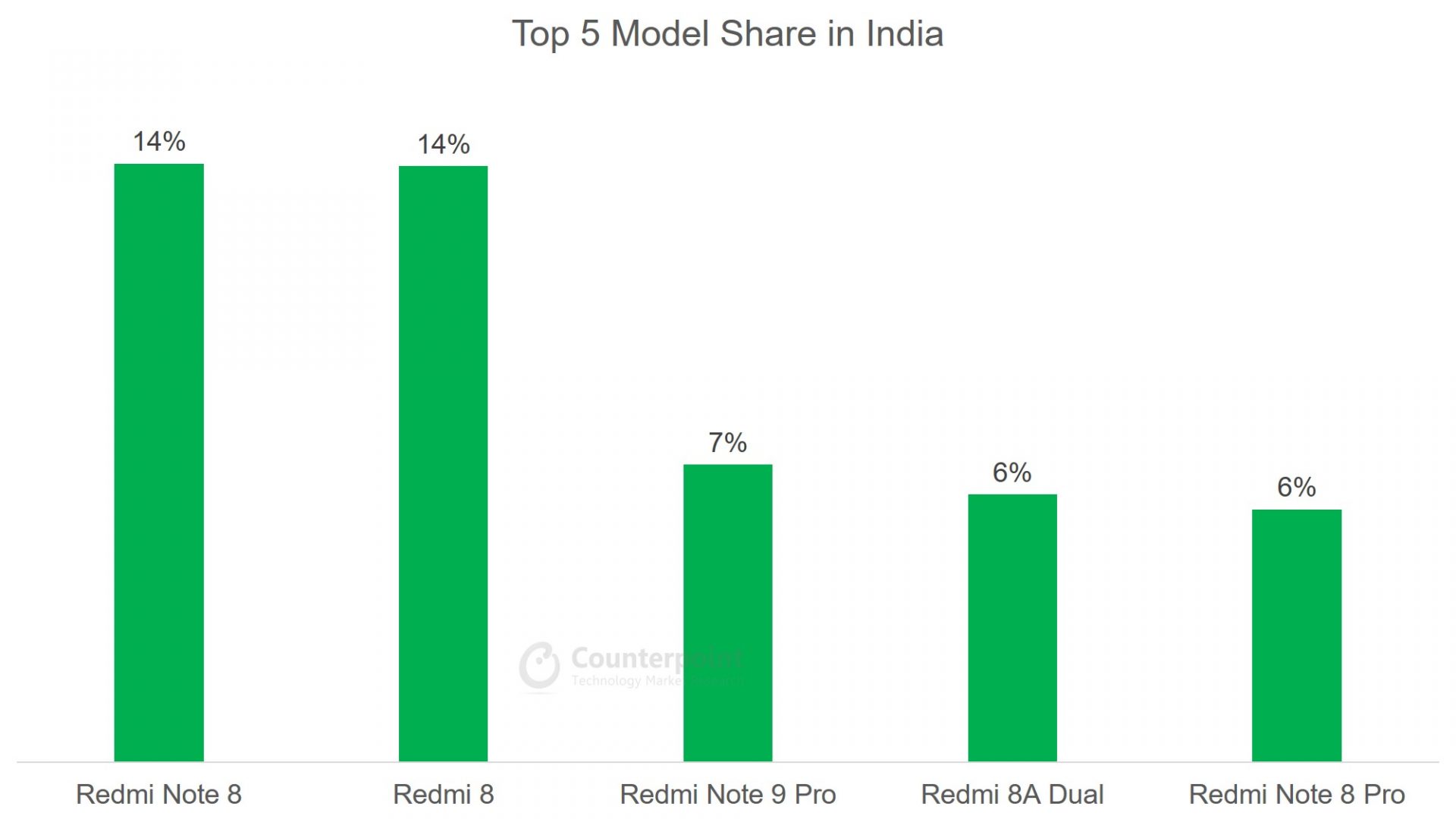

India Model Share

India Model Share

| Rank | Model | % |

| 1 | Redmi Note 8 | 14% |

| 2 | Redmi 8 | 14% |

| 3 | Redmi Note 9 Pro | 7% |

| 4 | Redmi 8A Dual | 6% |

| 5 | Redmi Note 8 Pro | 6% |

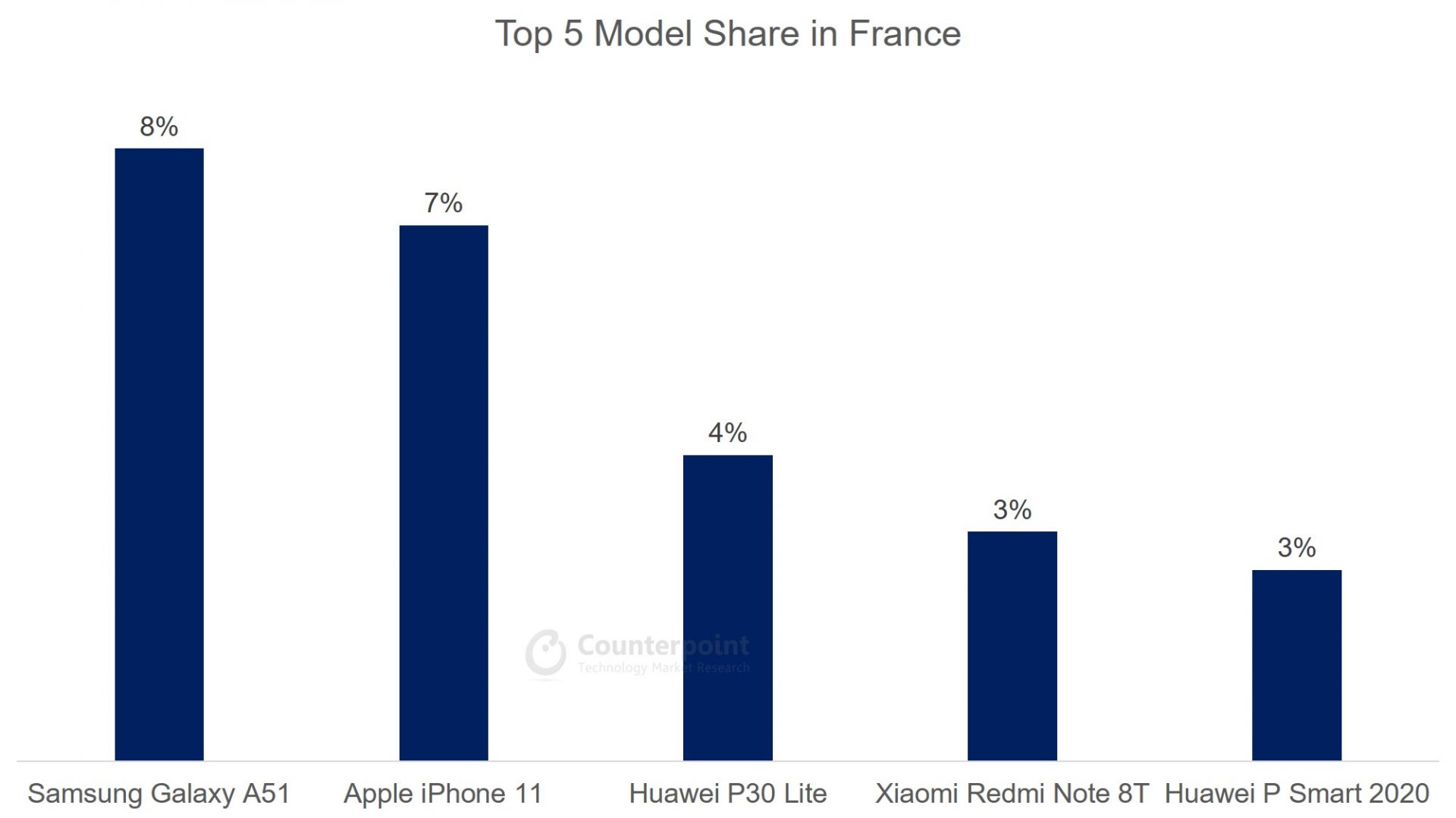

France Model Share

France Model Share

| Rank | Model | % |

| 1 | Samsung Galaxy A51 | 8% |

| 2 | Apple iPhone 11 | 7% |

| 3 | Huawei P30 Lite | 4% |

| 4 | Xiaomi Redmi Note 8T | 3% |

| 5 | Huawei P Smart 2020 | 3% |

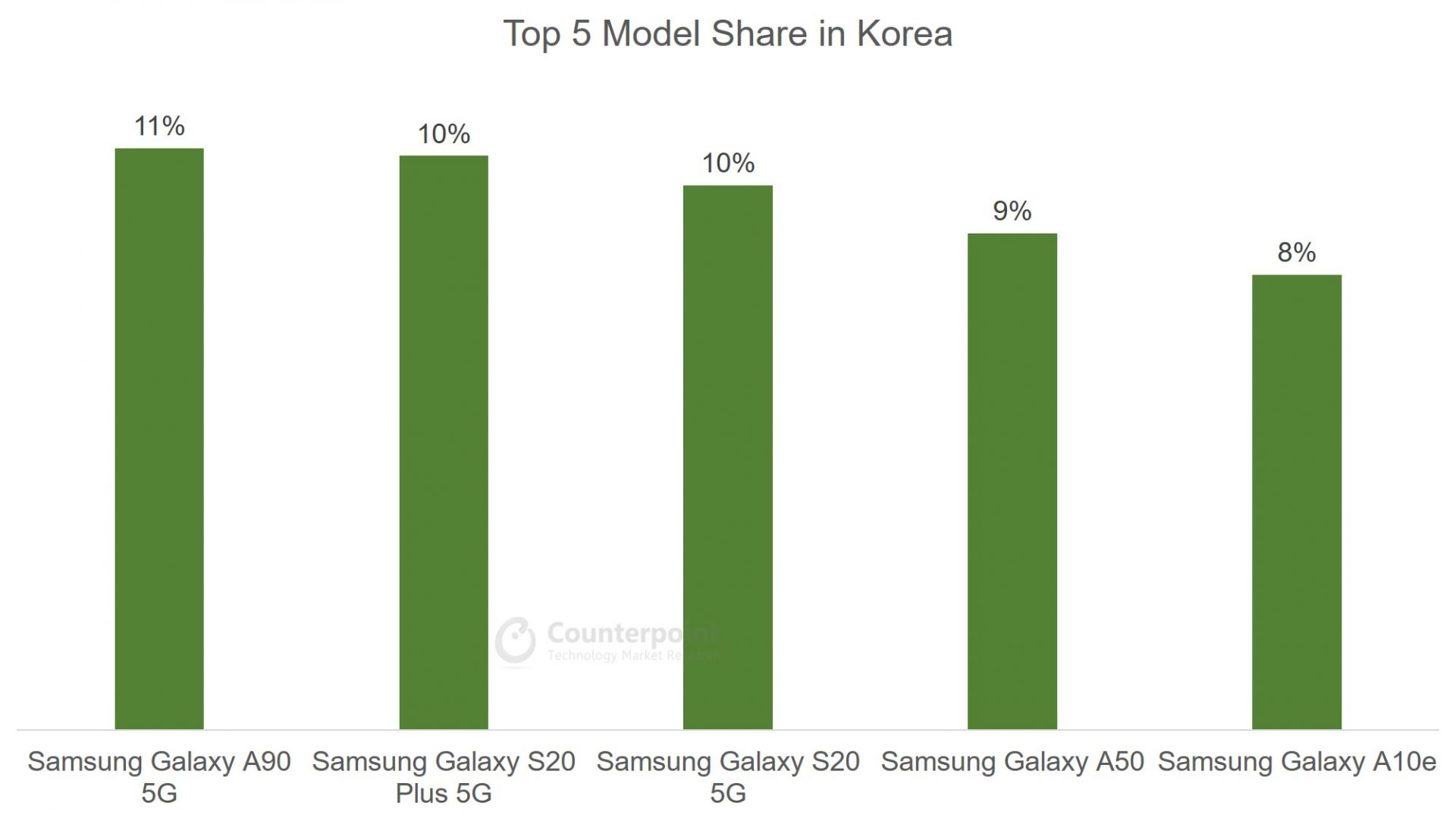

Korea Model Share

Korea Model Share

| Rank | Model | % |

| 1 | Samsung Galaxy A90 5G | 11% |

| 2 | Samsung Galaxy S20 Plus 5G | 10% |

| 3 | Samsung Galaxy S20 5G | 10% |

| 4 | Samsung Galaxy A50 | 9% |

| 5 | Samsung Galaxy A10e | 8% |

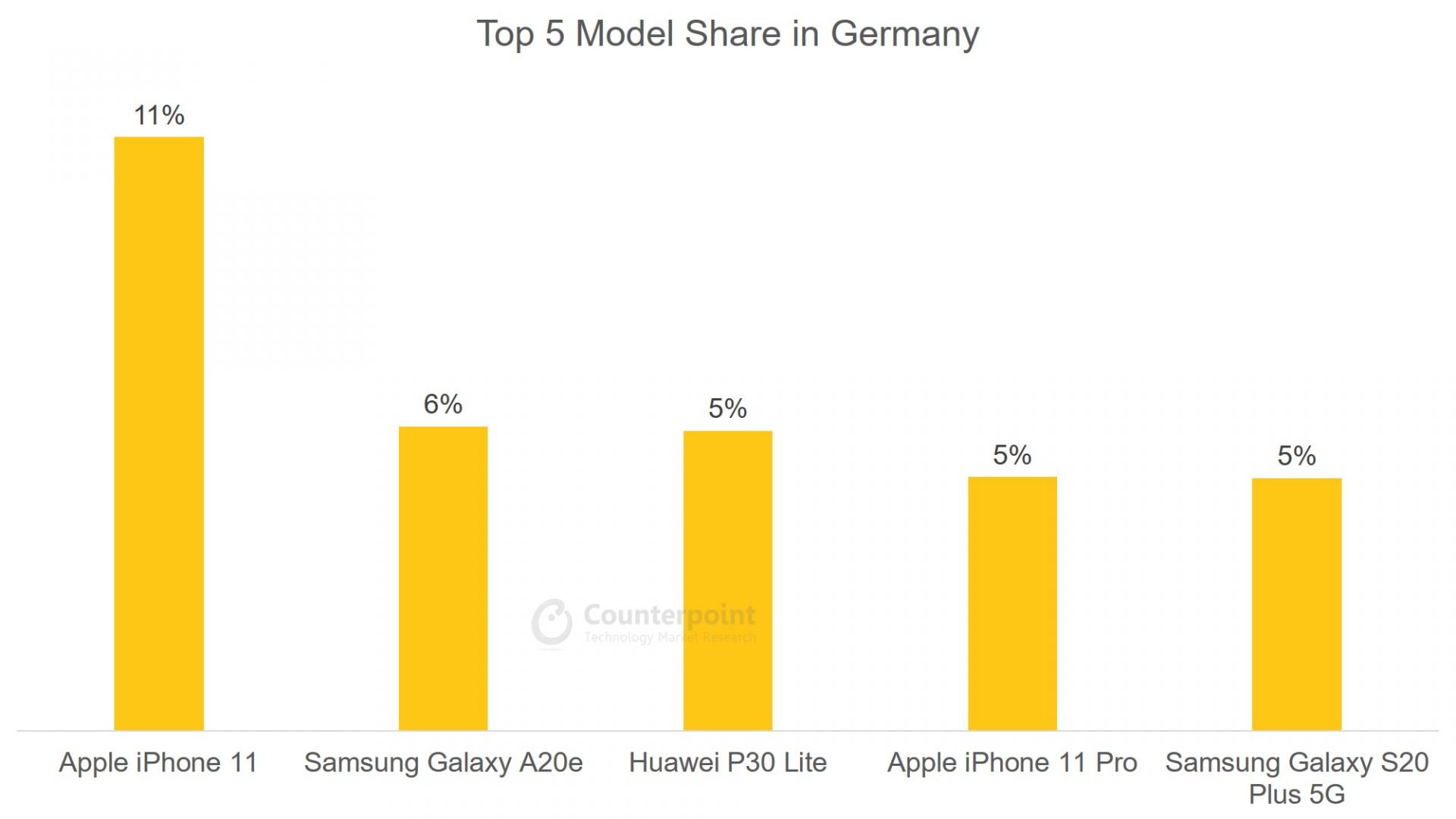

Germany Model Share

Germany Model Share

| Rank | Model | % |

| 1 | Apple iPhone 11 | 11% |

| 2 | Samsung Galaxy A20e | 6% |

| 3 | Huawei P30 Lite | 5% |

| 4 | Apple iPhone 11 Pro | 5% |

| 5 | Samsung Galaxy S20 Plus 5G | 5% |

![]()

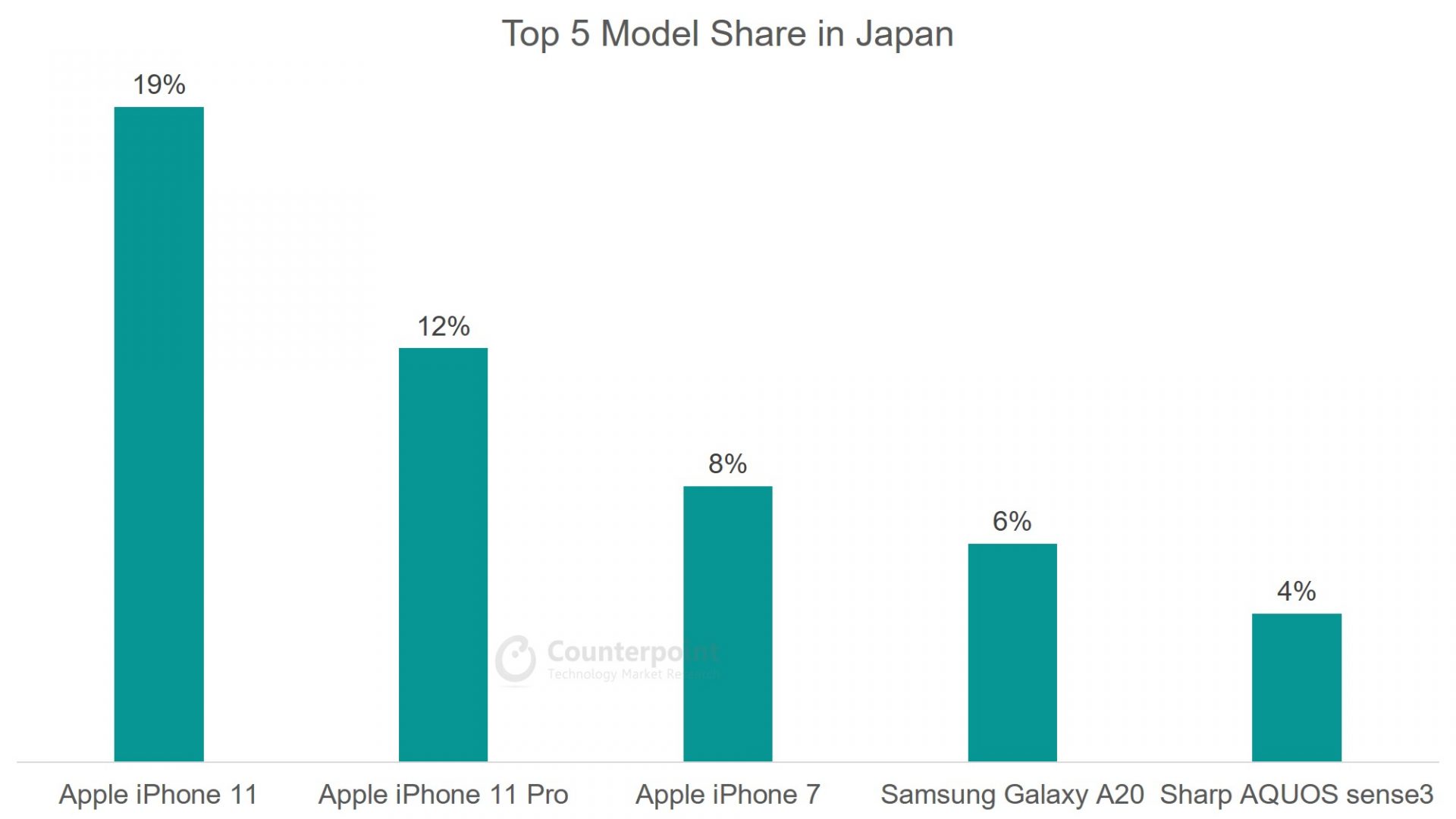

Japan Model Share

| Rank | Model | % |

| 1 | Apple iPhone 11 | 19% |

| 2 | Apple iPhone 11 Pro | 12% |

| 3 | Apple iPhone 7 | 8% |

| 4 | Samsung Galaxy A20 | 6% |

| 5 | Sharp AQUOS sense3 | 4% |

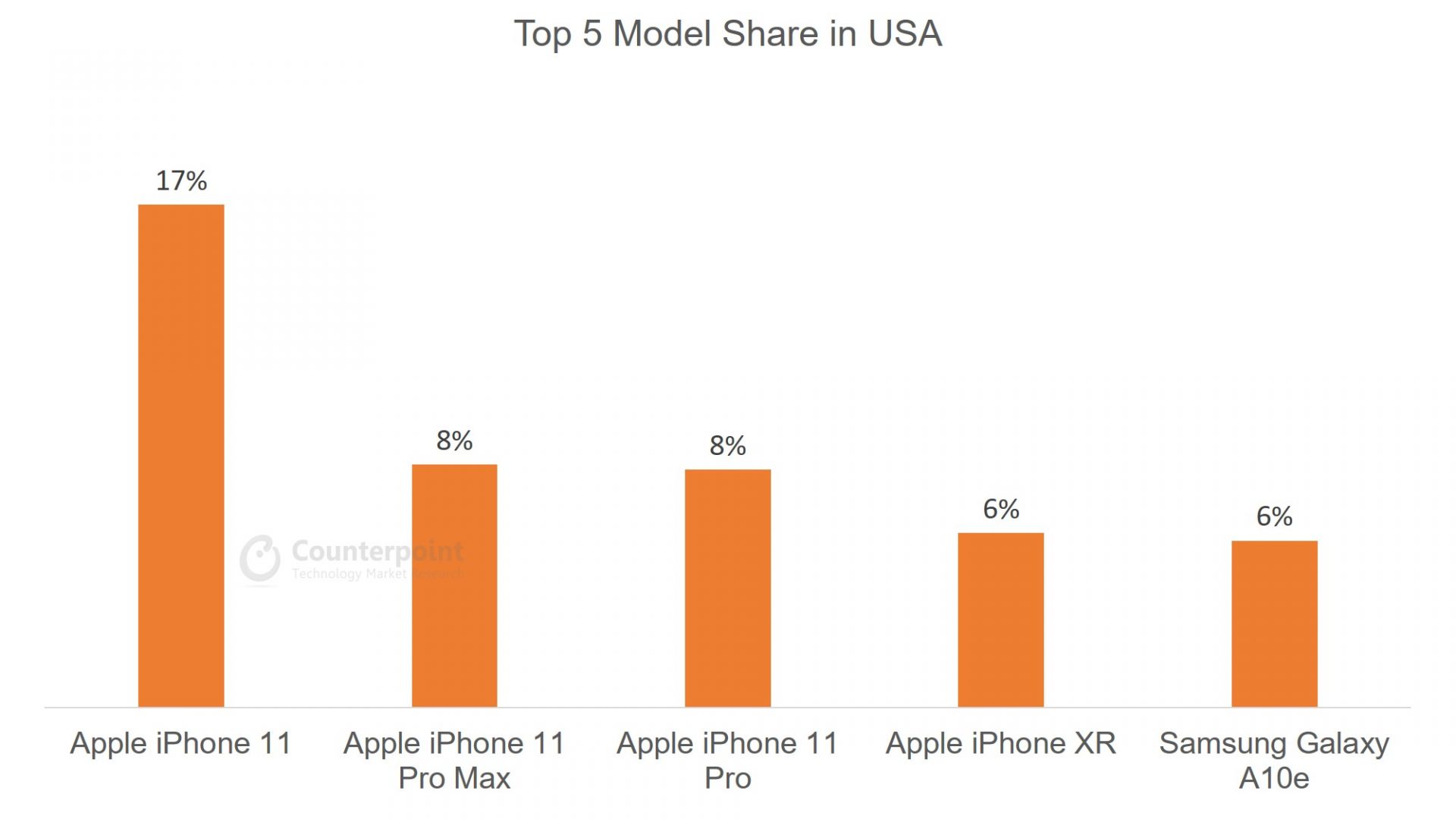

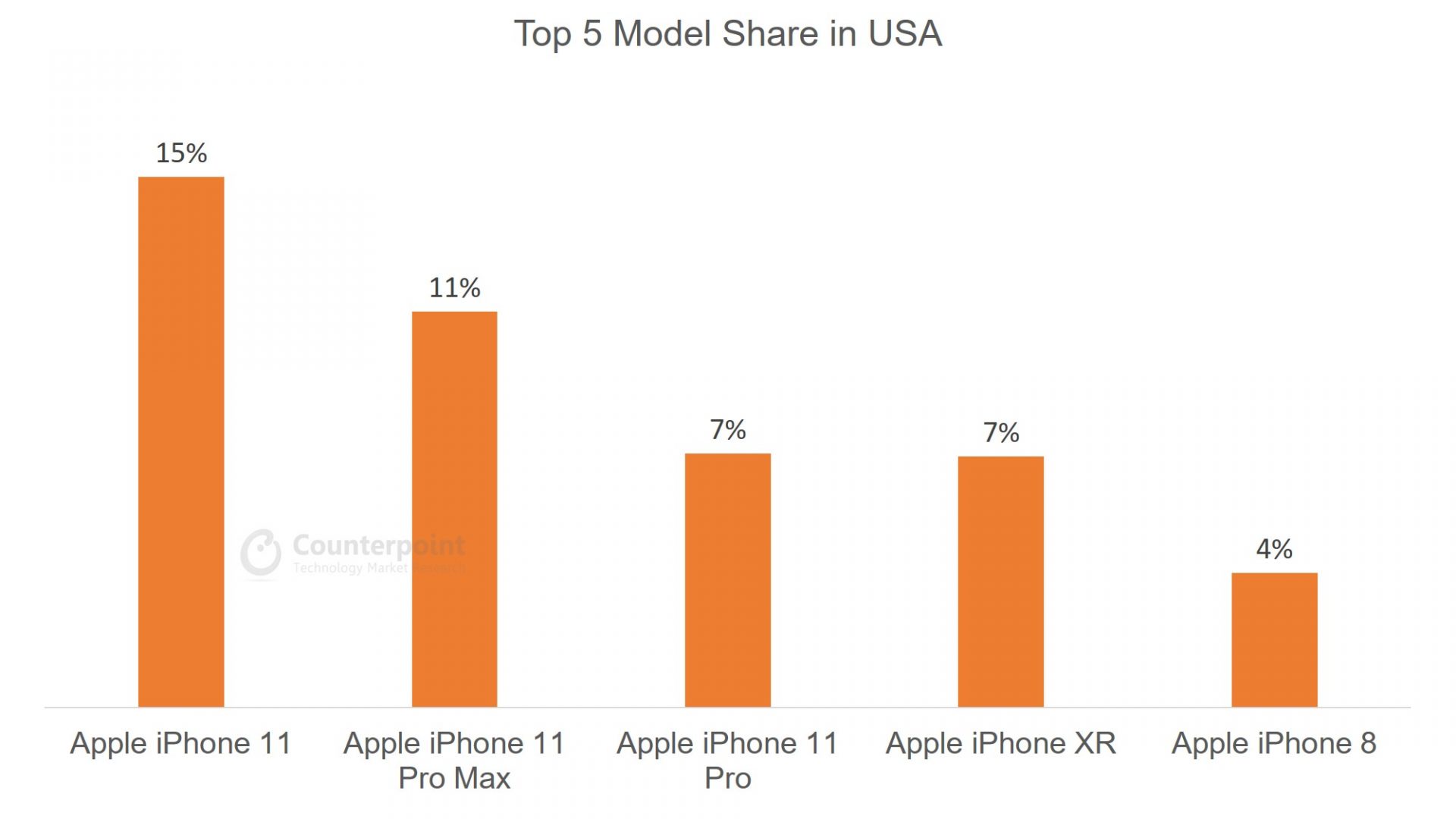

January 2020

USA Model Share

| Rank | Model | % |

| 1 | Apple iPhone 11 | 17% |

| 2 | Apple iPhone 11 Pro Max | 8% |

| 3 | Apple iPhone 11 Pro | 8% |

| 4 | Apple iPhone XR | 6% |

| 5 | Samsung Galaxy A10e | 6% |

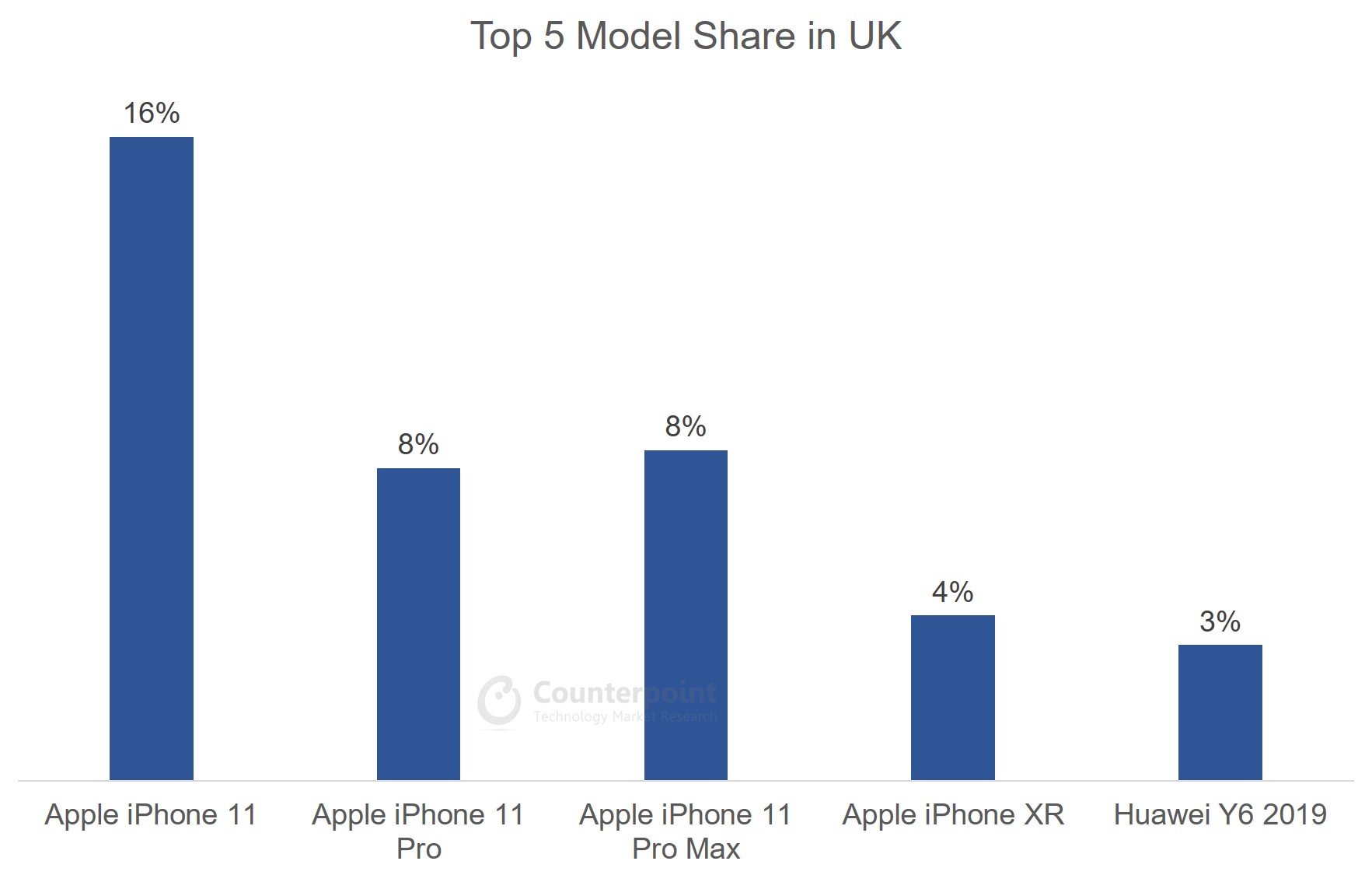

UK Model Share

UK Model Share

| Rank | Model | % |

| 1 | Apple iPhone 11 | 16% |

| 2 | Apple iPhone 11 Pro | 8% |

| 3 | Apple iPhone 11 Pro Max | 8% |

| 4 | Apple iPhone XR | 4% |

| 5 | Huawei Y6 2019 | 3% |

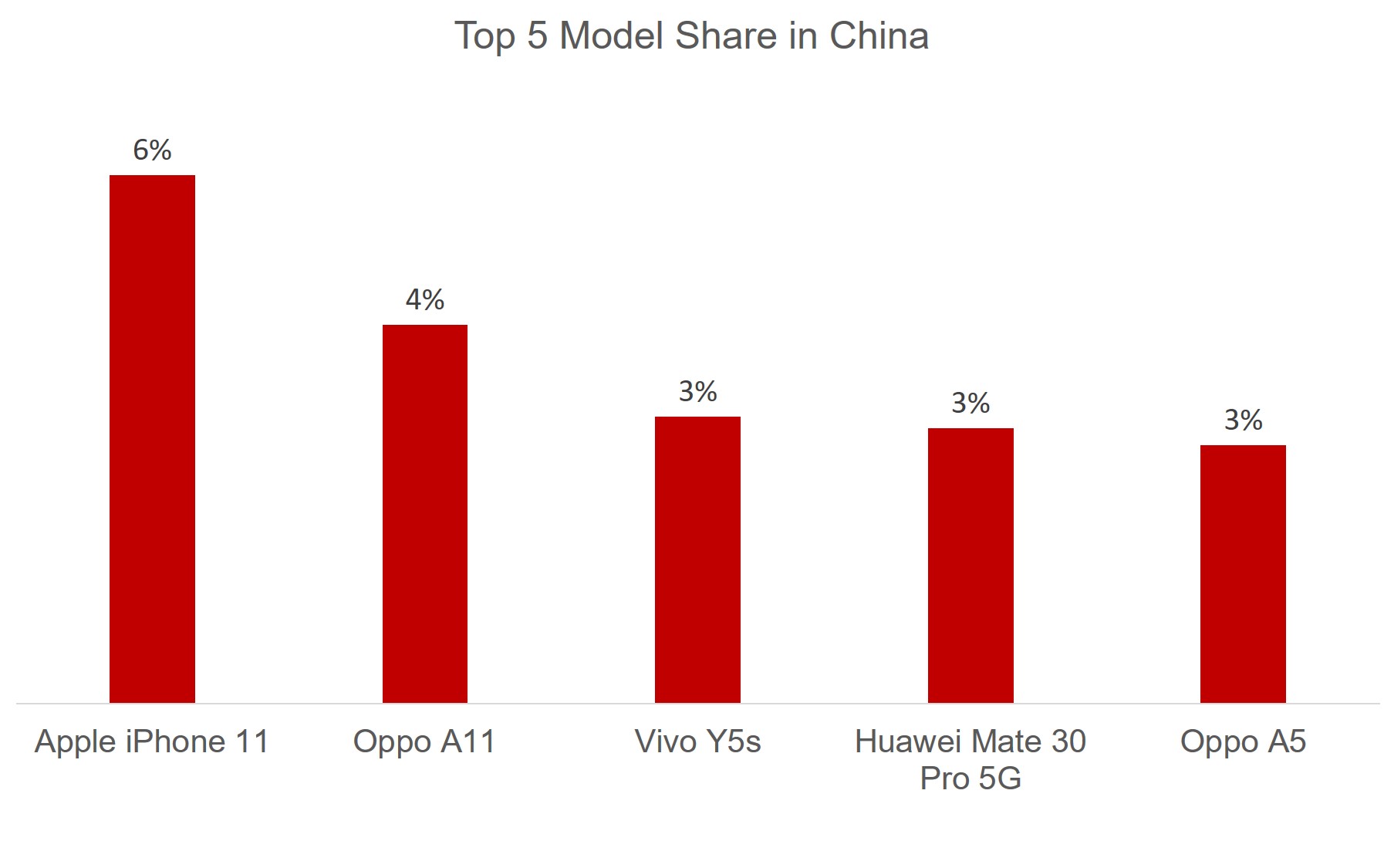

China Model Share

China Model Share

| Rank | Model | % |

| 1 | Apple iPhone 11 | 6% |

| 2 | Oppo A11 | 4% |

| 3 | Vivo Y5s | 3% |

| 4 | Huawei Mate 30 Pro 5G | 3% |

| 5 | Oppo A5 | 3% |

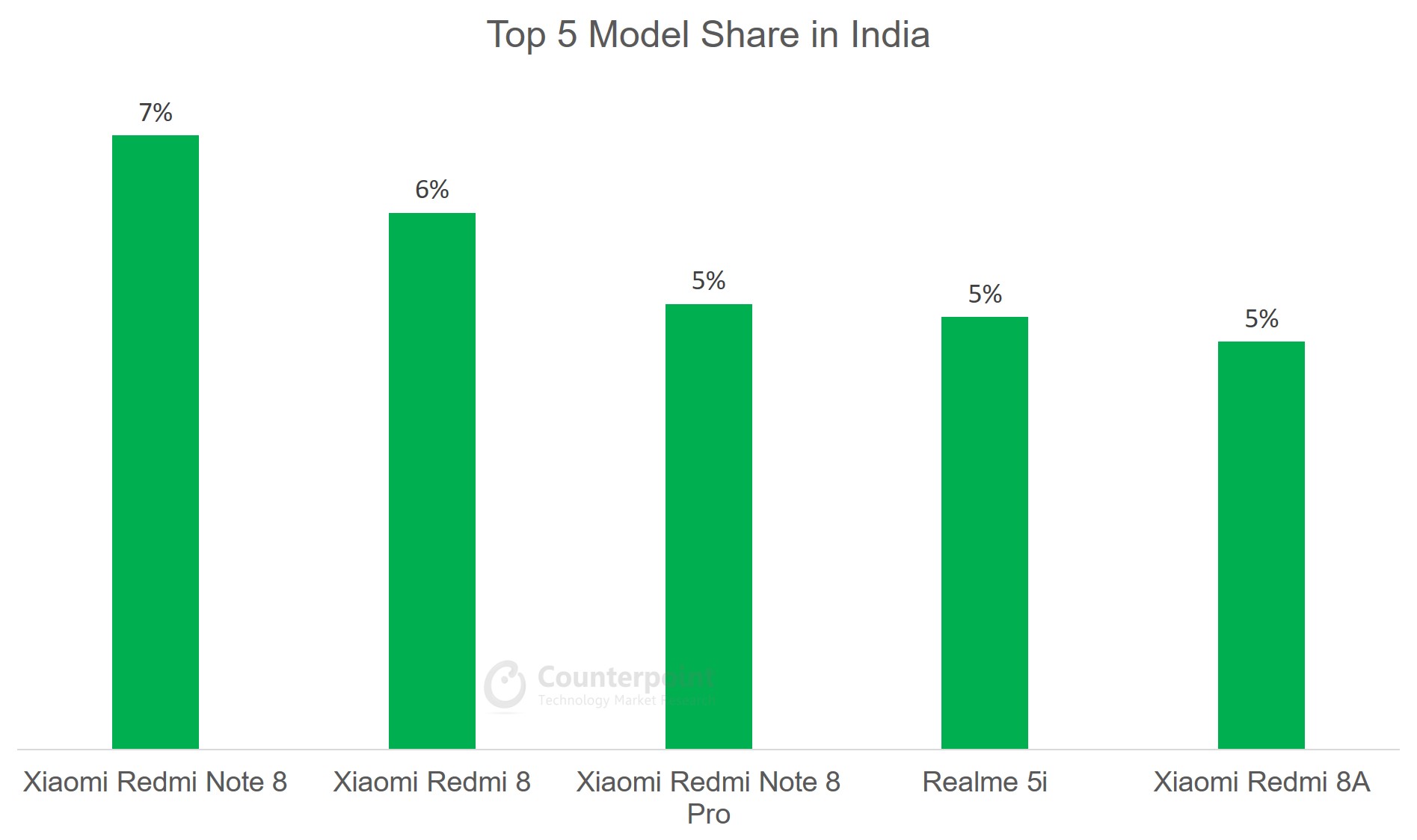

India Model Share

India Model Share

| Rank | Model | % |

| 1 | Xiaomi Redmi Note 8 | 7% |

| 2 | Xiaomi Redmi 8 | 6% |

| 3 | Xiaomi Redmi Note 8 Pro | 5% |

| 4 | Realme 5i | 5% |

| 5 | Xiaomi Redmi 8A | 5% |

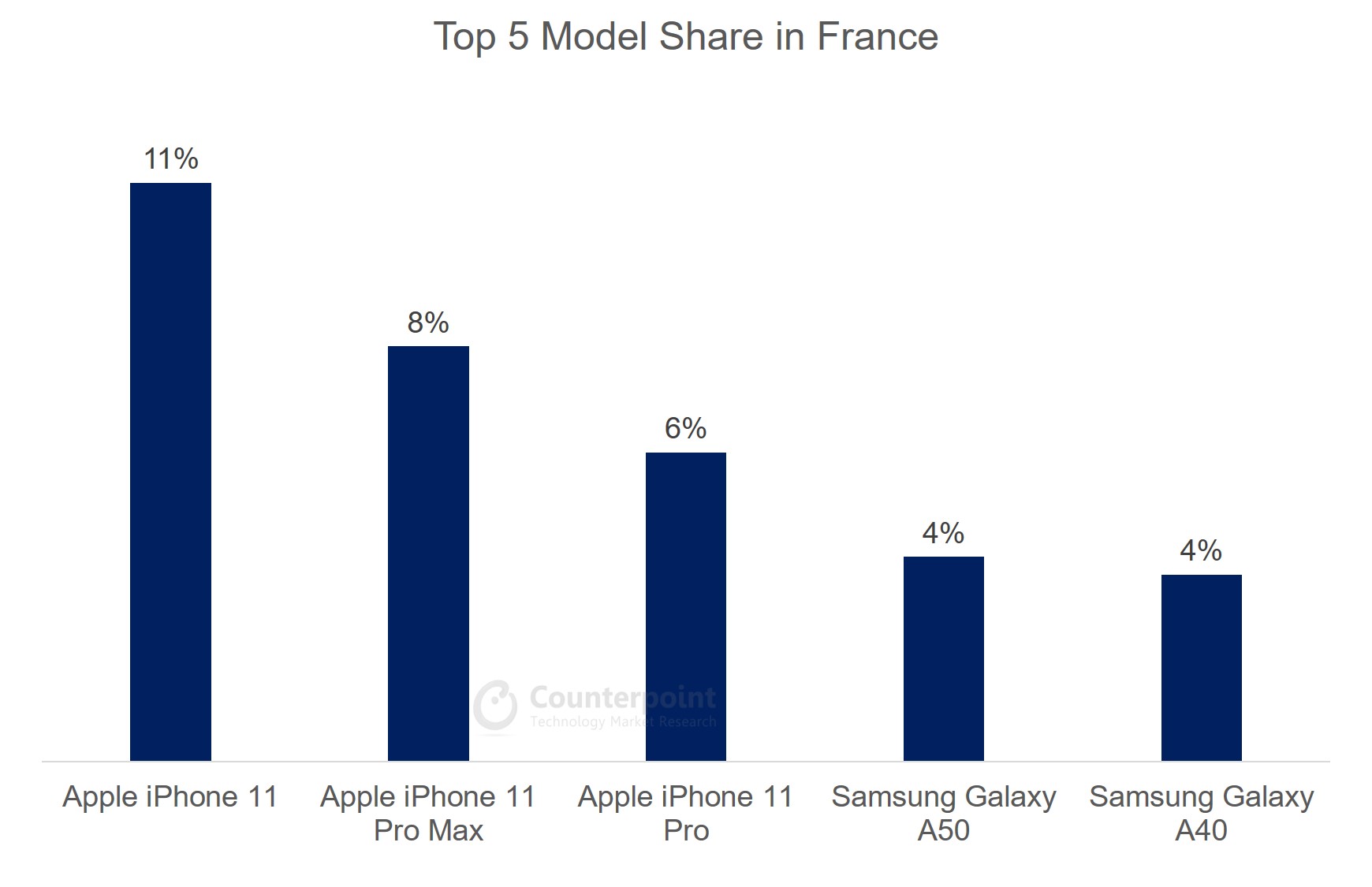

France Model Share

France Model Share

| Rank | Model | % |

| 1 | Apple iPhone 11 | 11% |

| 2 | Apple iPhone 11 Pro Max | 8% |

| 3 | Apple iPhone 11 Pro | 6% |

| 4 | Samsung Galaxy A50 | 4% |

| 5 | Samsung Galaxy A40 | 4% |

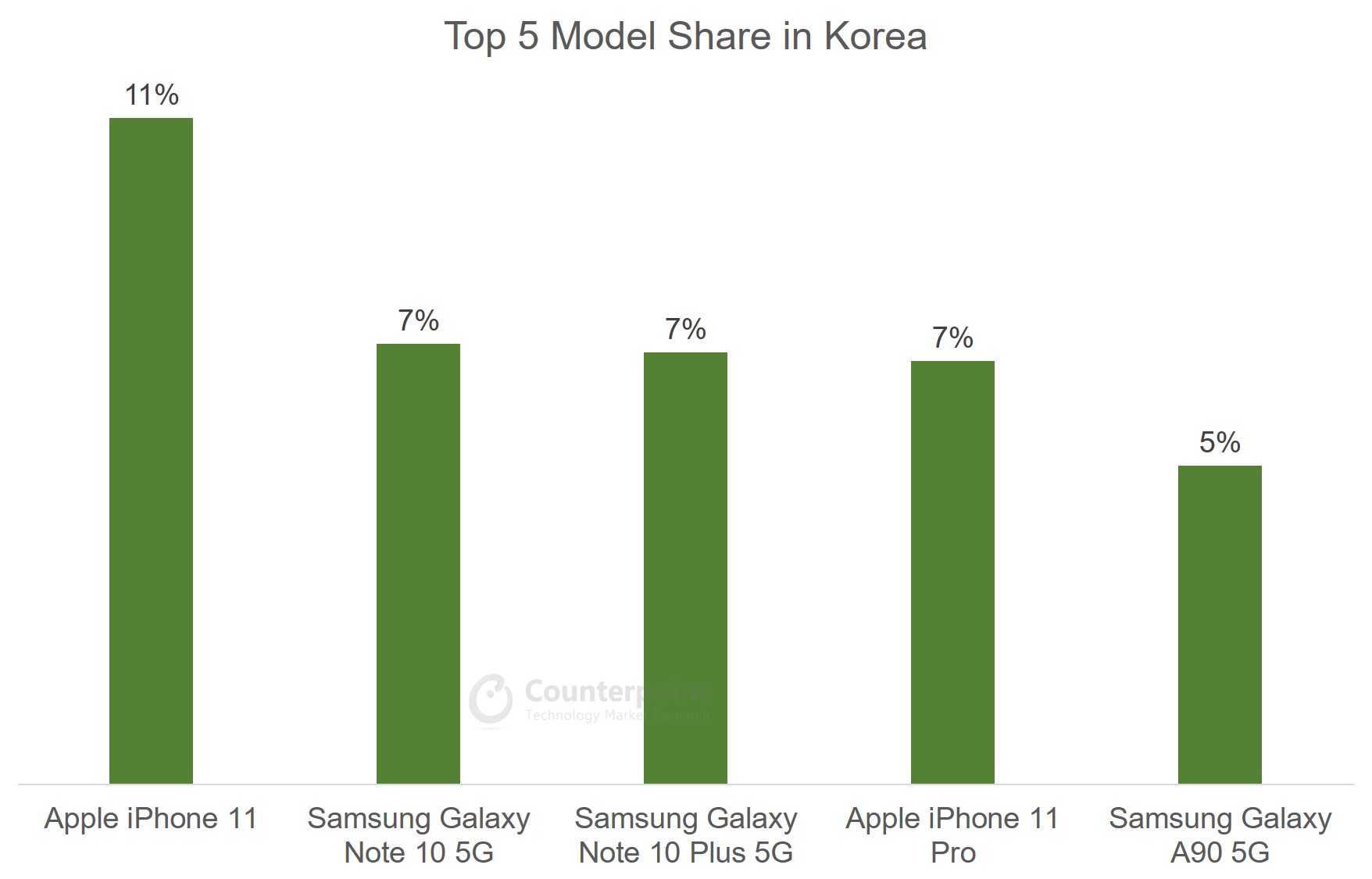

Korea Model Share

Korea Model Share

| Rank | Model | % |

| 1 | Apple iPhone 11 | 11% |

| 2 | Samsung Galaxy Note 10 5G | 7% |

| 3 | Samsung Galaxy Note 10 Plus 5G | 7% |

| 4 | Apple iPhone 11 Pro | 7% |

| 5 | Samsung Galaxy A90 5G | 5% |

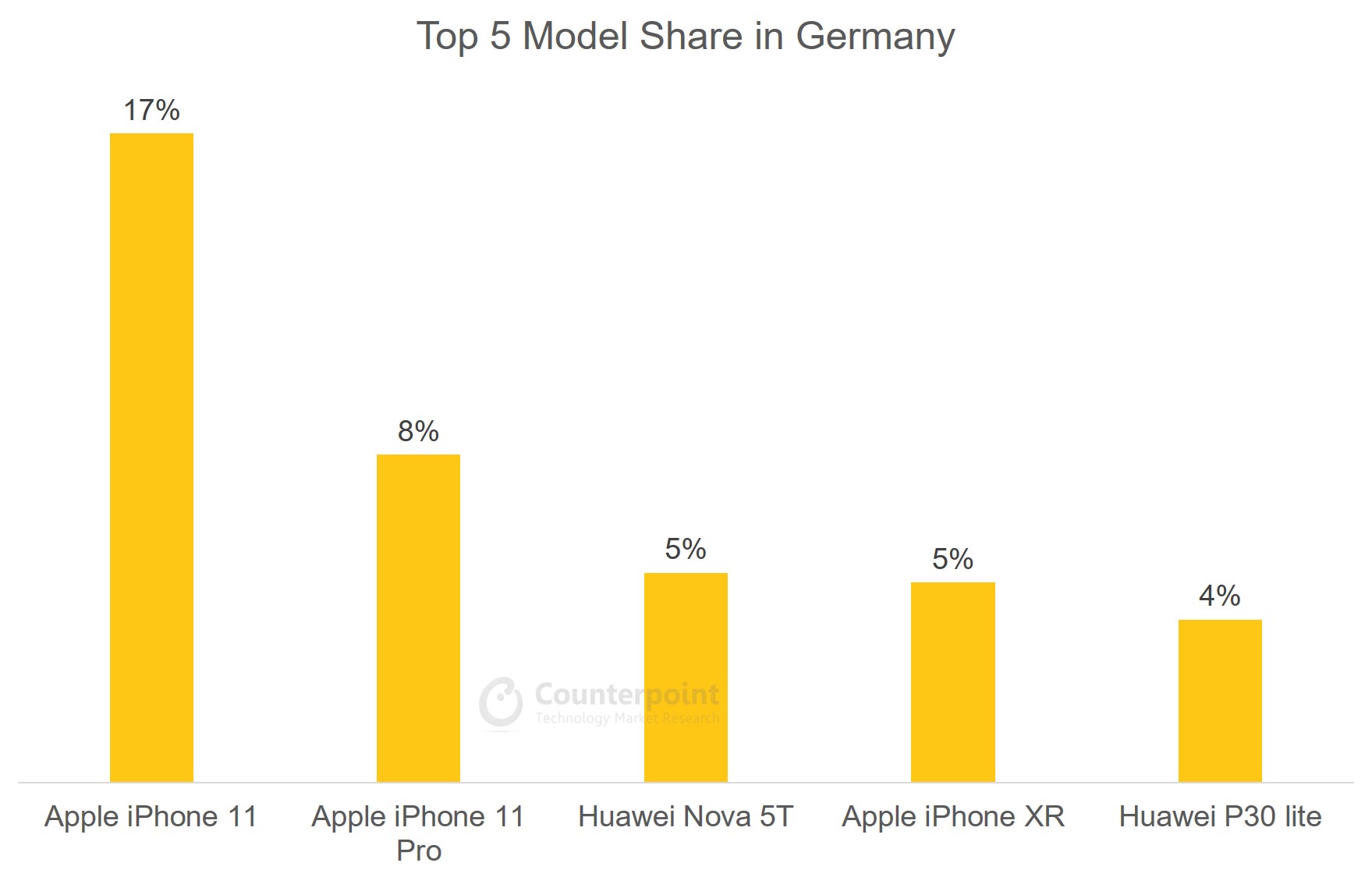

Germany Model Share

Germany Model Share

| Rank | Model | % |

| 1 | Apple iPhone 11 | 17% |

| 2 | Apple iPhone 11 Pro | 8% |

| 3 | Huawei Nova 5T | 5% |

| 4 | Apple iPhone XR | 5% |

| 5 | Huawei P30 lite | 4% |

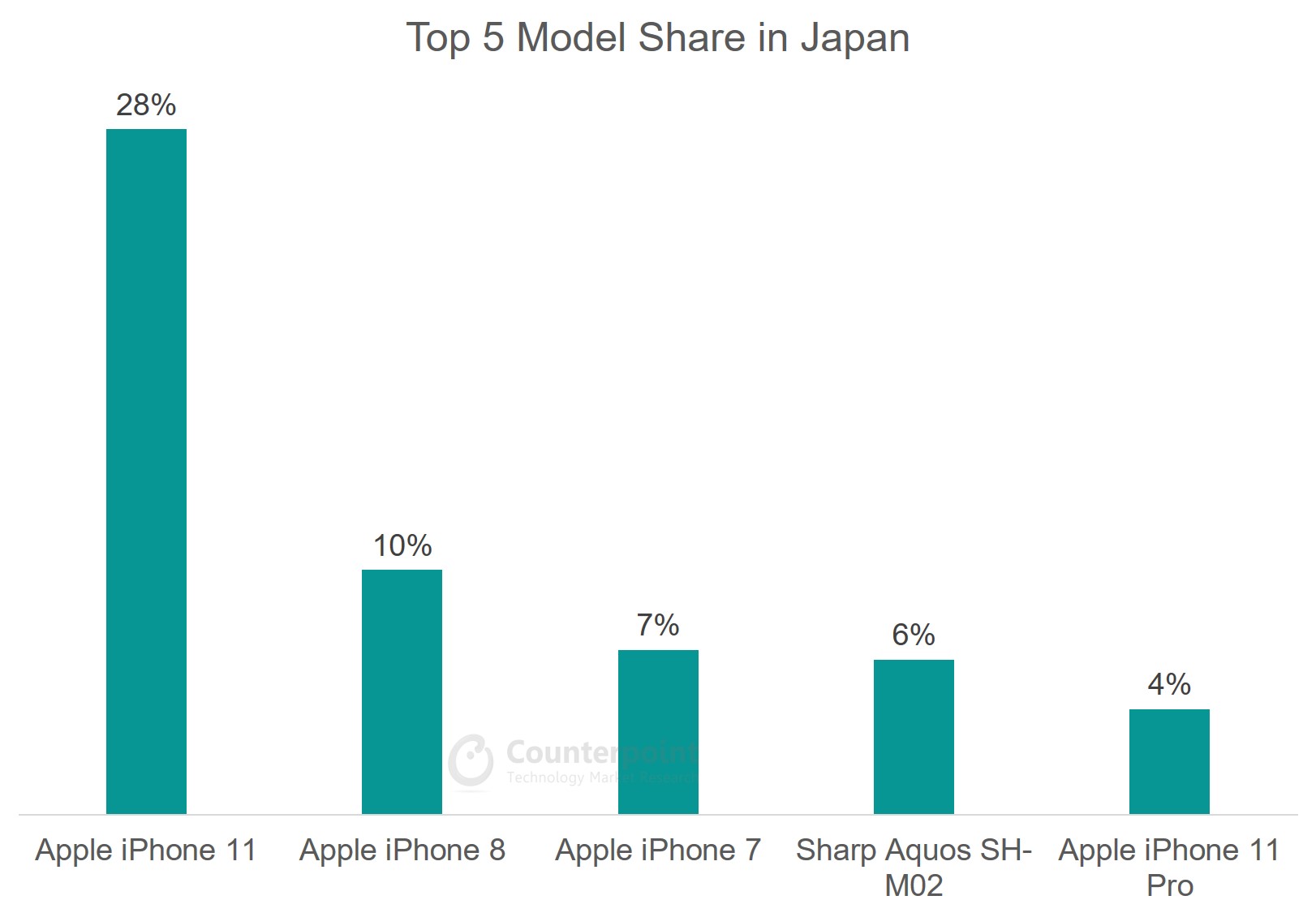

Japan Model Share

Japan Model Share

| Rank | Japan | % |

| 1 | Apple iPhone 11 | 28% |

| 2 | Apple iPhone 8 | 10% |

| 3 | Apple iPhone 7 | 7% |

| 4 | Sharp Aquos SH-M02 | 6% |

| 5 | Apple iPhone 11 Pro | 4% |

Oct 2019

USA Model Share

| Rank | Model | % |

| 1 | Apple iPhone 11 | 15% |

| 2 | Apple iPhone 11 Pro Max | 11% |

| 3 | Apple iPhone 11 Pro | 7% |

| 4 | Apple iPhone XR | 7% |

| 5 | Apple iPhone 8 | 4% |

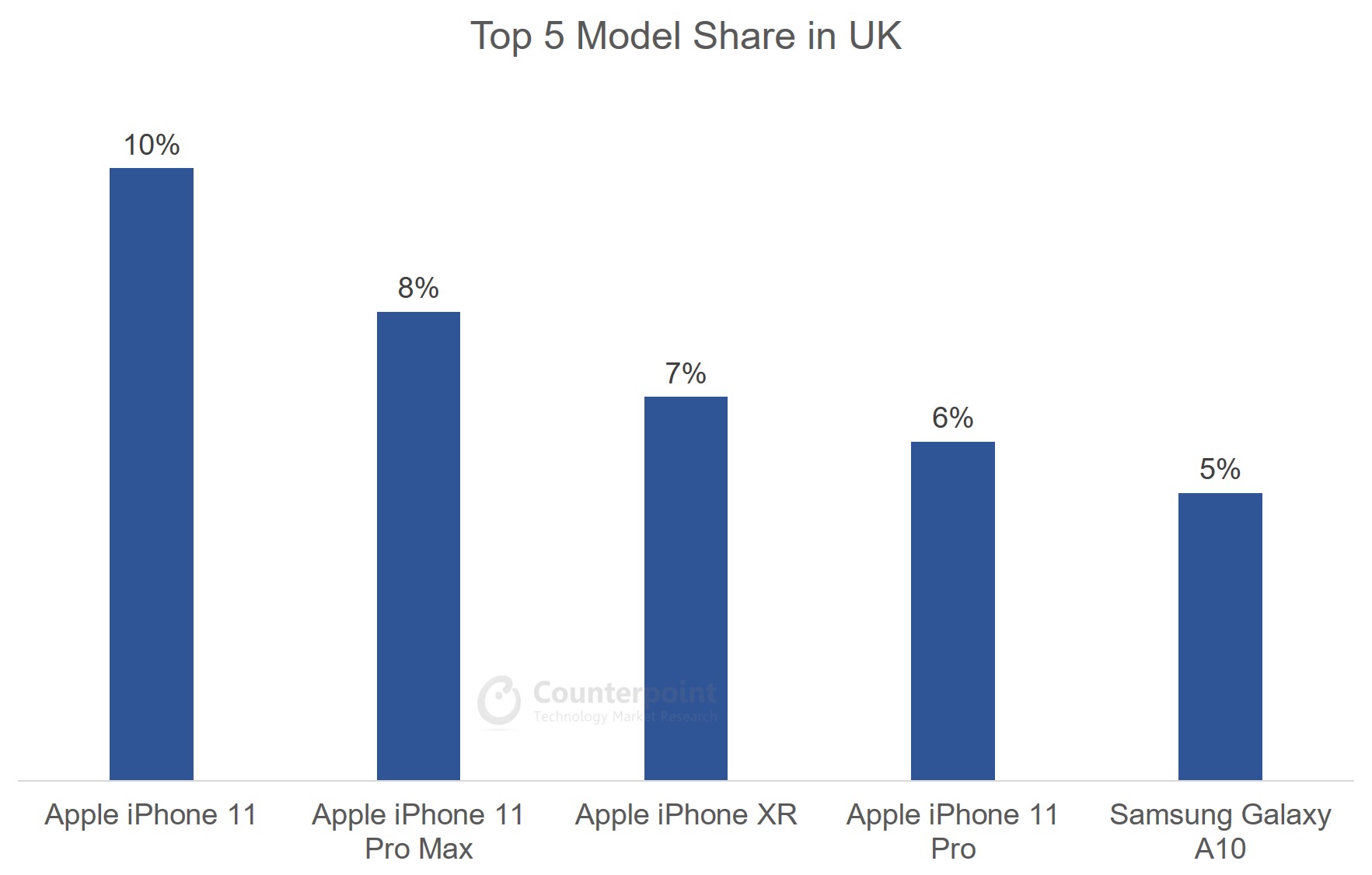

UK Model Share

UK Model Share

| Rank | Model | % |

| 1 | Apple iPhone 11 | 10% |

| 2 | Apple iPhone 11 Pro Max | 8% |

| 3 | Apple iPhone XR | 7% |

| 4 | Apple iPhone 11 Pro | 6% |

| 5 | Samsung Galaxy A10 | 5% |

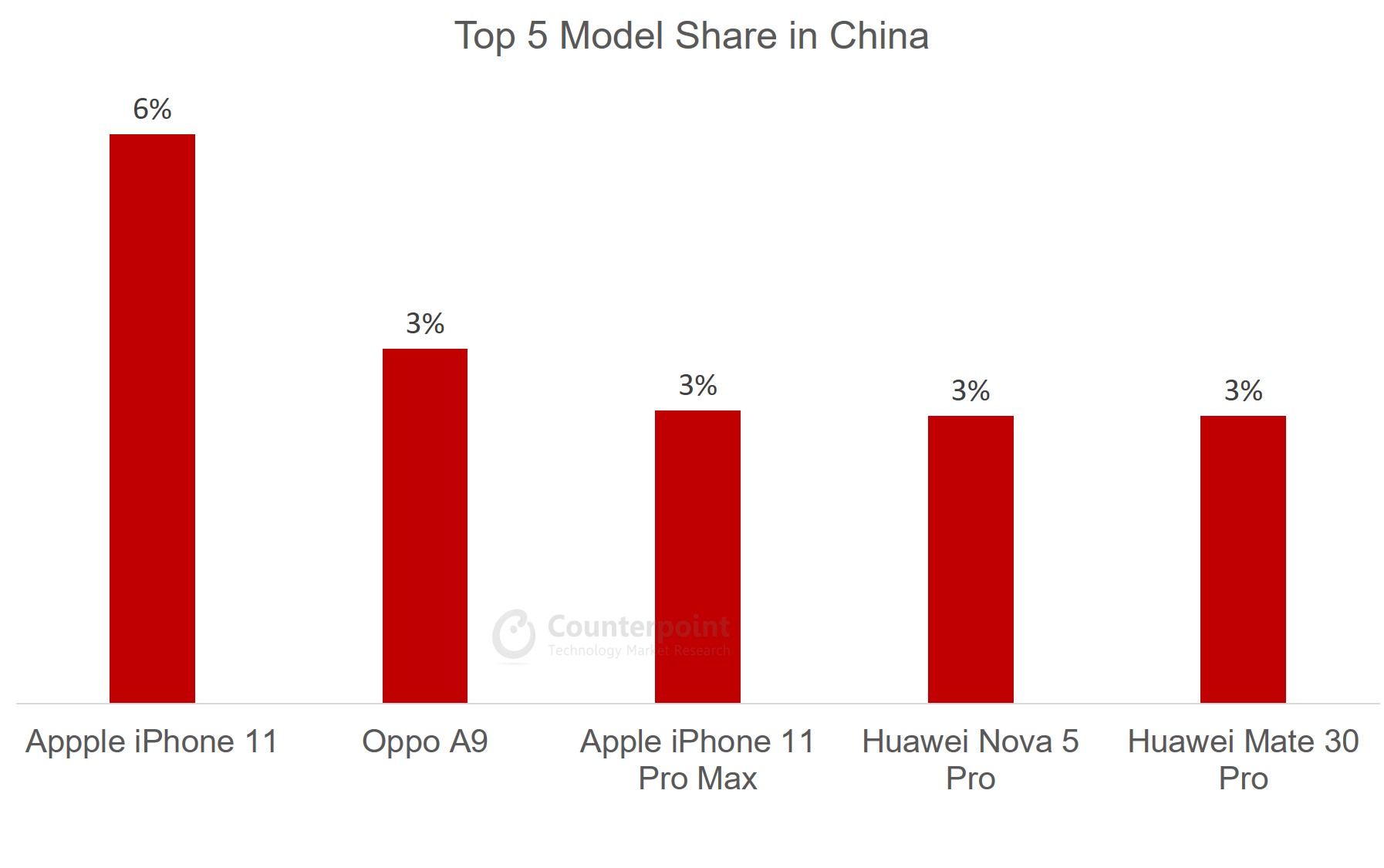

China Model Share

China Model Share

| Rank | Model | % |

| 1 | Appple iPhone 11 | 6% |

| 2 | Oppo A9 | 3% |

| 3 | Apple iPhone 11 Pro Max | 3% |

| 4 | Huawei Nova 5 Pro | 3% |

| 5 | Huawei Mate 30 Pro | 3% |

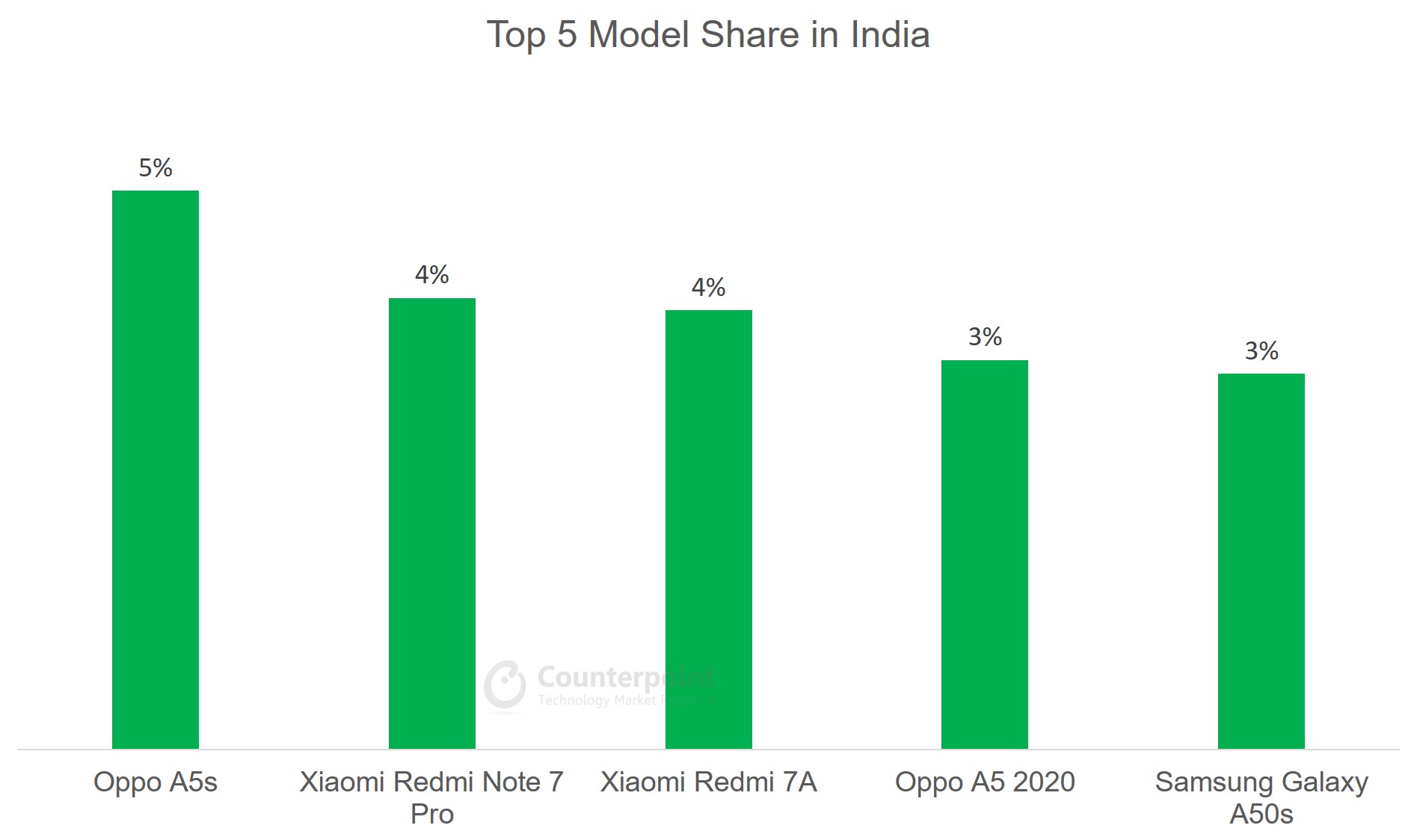

India Model Share

India Model Share

| Rank | Model | % |

| 1 | Oppo A5s | 5% |

| 2 | Xiaomi Redmi Note 7 Pro | 4% |

| 3 | Xiaomi Redmi 7A | 4% |

| 4 | Oppo A5 2020 | 3% |

| 5 | Samsung Galaxy A50s | 3% |

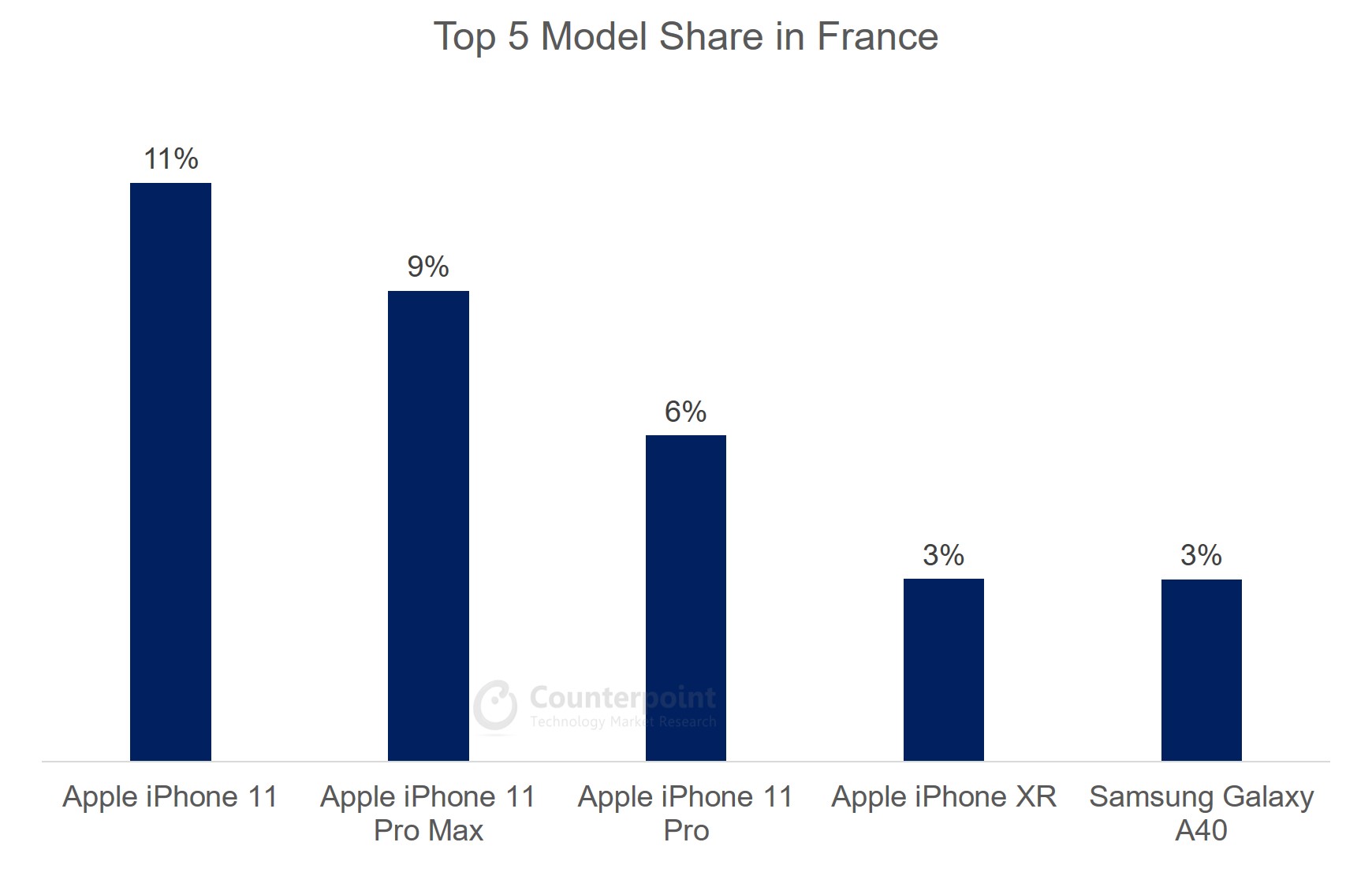

France Model Share

France Model Share

| Rank | Model | % |

| 1 | Apple iPhone 11 | 11% |

| 2 | Apple iPhone 11 Pro Max | 9% |

| 3 | Apple iPhone 11 Pro | 6% |

| 4 | Apple iPhone XR | 3% |

| 5 | Samsung Galaxy A40 | 3% |

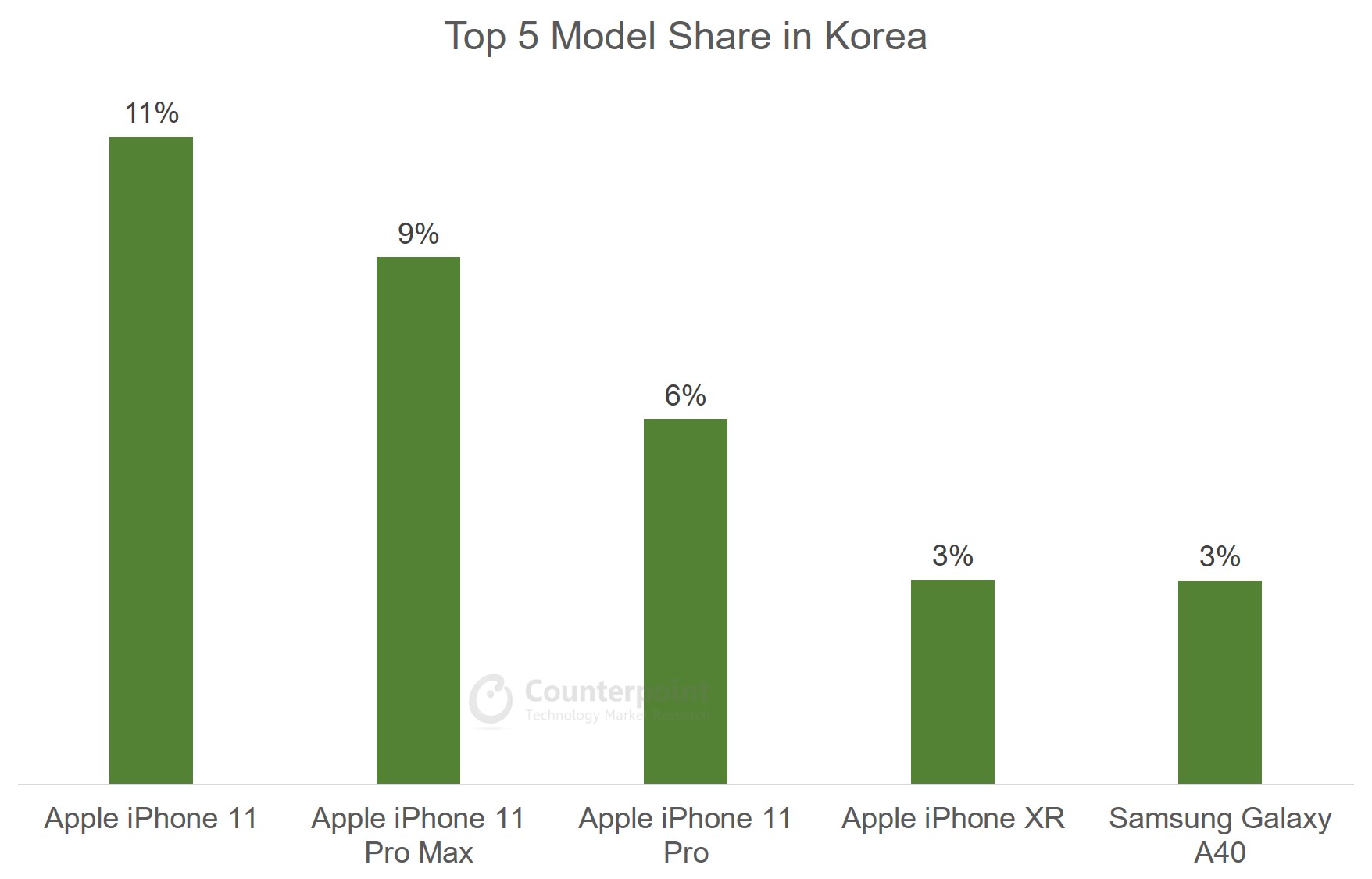

Korea Model Share

Korea Model Share

| Rank | Model | % |

| 1 | Apple iPhone 11 | 11% |

| 2 | Apple iPhone 11 Pro Max | 9% |

| 3 | Apple iPhone 11 Pro | 6% |

| 4 | Apple iPhone XR | 3% |

| 5 | Samsung Galaxy A40 | 3% |

Germany Model Share

Germany Model Share

| Rank | Model | % |

| 1 | Apple iPhone 11 | 12% |

| 2 | Samsung Galaxy A50 | 7% |

| 3 | Apple iPhone XR | 5% |

| 4 | Apple iPhone 11 Pro | 5% |

| 5 | Samsung Galaxy A70 | 4% |

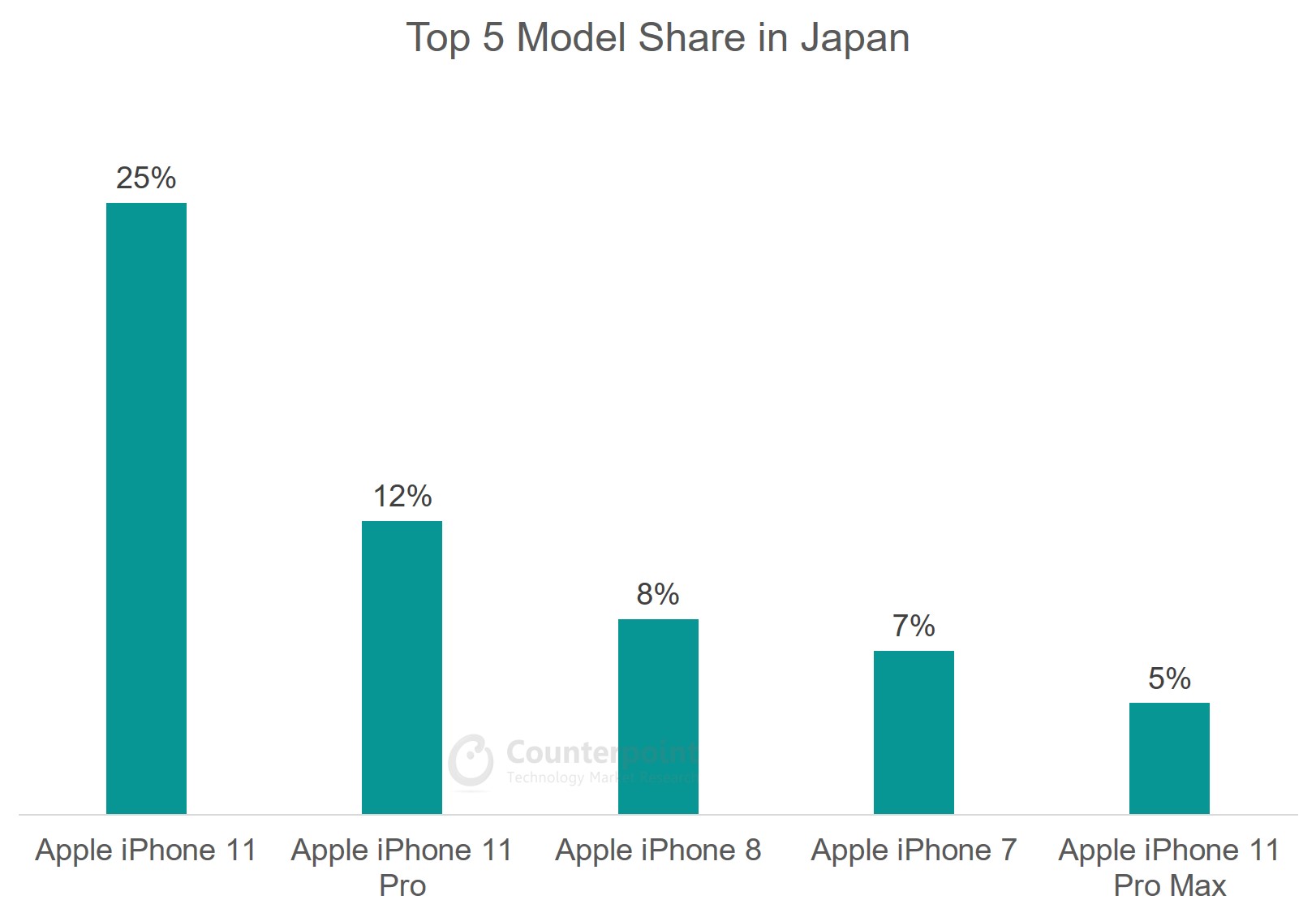

Japan Model Share

Japan Model Share

| Rank | Model | % |

| 1 | Apple iPhone 11 | 25% |

| 2 | Apple iPhone 11 Pro | 12% |

| 3 | Apple iPhone 8 | 8% |

| 4 | Apple iPhone 7 | 7% |

| 5 | Apple iPhone 11 Pro Max | 5% |

July 2019

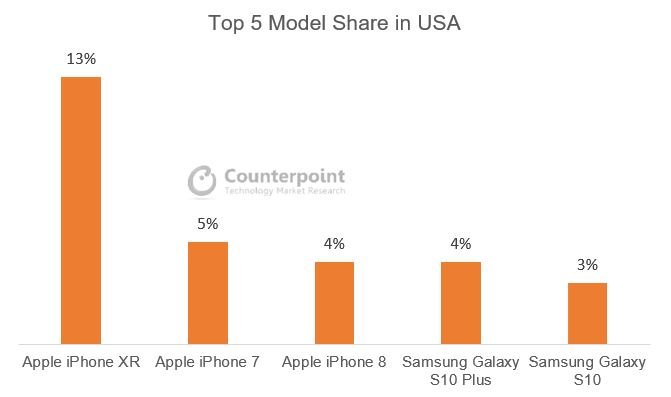

USA Model Share

USA Model Share

| Rank | Model | % |

| 1 | Apple iPhone XR | 13% |

| 2 | Apple iPhone 7 | 5% |

| 3 | Apple iPhone 8 | 4% |

| 4 | Samsung Galaxy S10 Plus | 4% |

| 5 | Samsung Galaxy S10 | 3% |

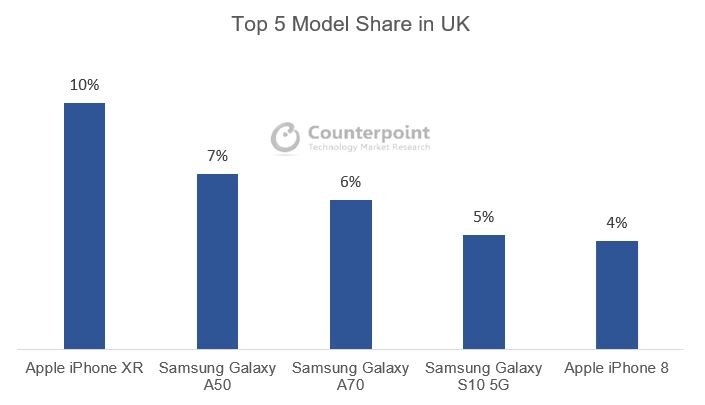

UK Model Share

UK Model Share

| Rank | Model | % |

| 1 | Apple iPhone XR | 10% |

| 2 | Samsung Galaxy A50 | 7% |

| 3 | Samsung Galaxy A70 | 6% |

| 4 | Samsung Galaxy S10 5G | 5% |

| 5 | Apple iPhone 8 | 4% |

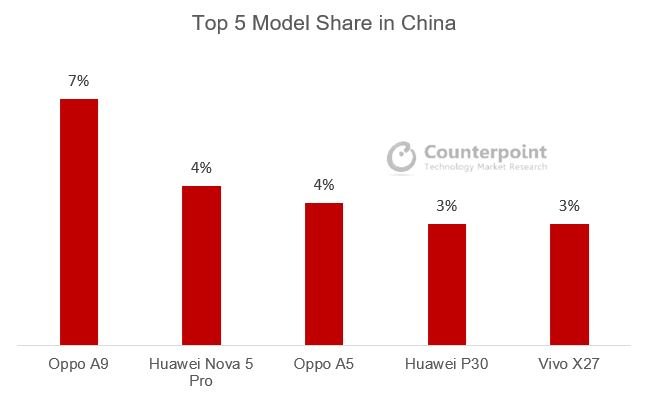

China Model Share

China Model Share

| Rank | Model | % |

| 1 | Oppo A9 | 7% |

| 2 | Huawei Nova 5 Pro | 4% |

| 3 | Oppo A5 | 4% |

| 4 | Huawei P30 | 3% |

| 5 | Vivo X27 | 3% |

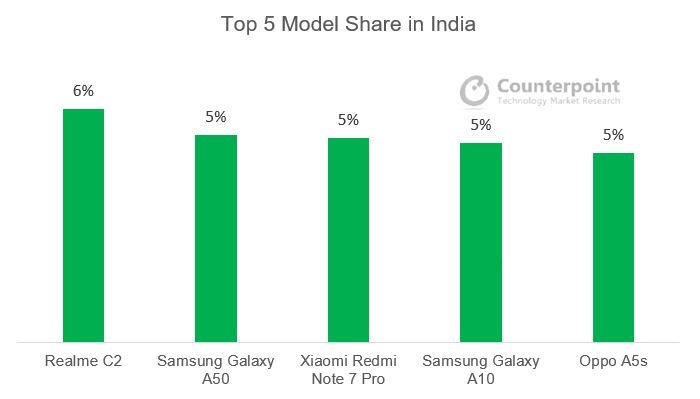

India Model Share

India Model Share

| Rank | Model | % |

| 1 | Realme C2 | 6% |

| 2 | Samsung Galaxy A50 | 5% |

| 3 | Xiaomi Redmi Note 7 Pro | 5% |

| 4 | Samsung Galaxy A10 | 5% |

| 5 | Oppo A5s | 5% |

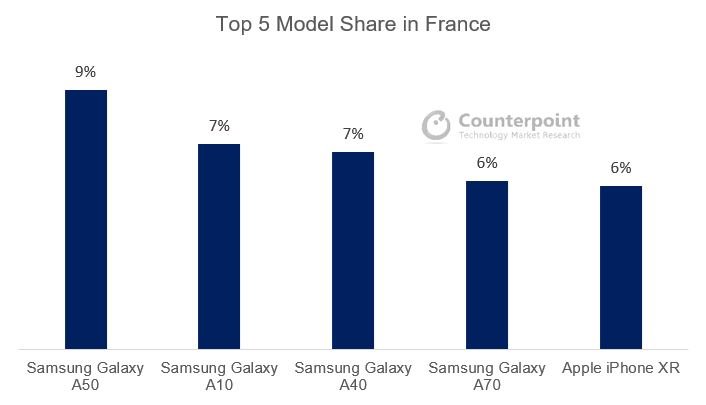

France Model Share

France Model Share

| Rank | Model | % |

| 1 | Samsung Galaxy A50 | 9% |

| 2 | Samsung Galaxy A10 | 7% |

| 3 | Samsung Galaxy A40 | 7% |

| 4 | Samsung Galaxy A70 | 6% |

| 5 | Apple iPhone XR | 6% |

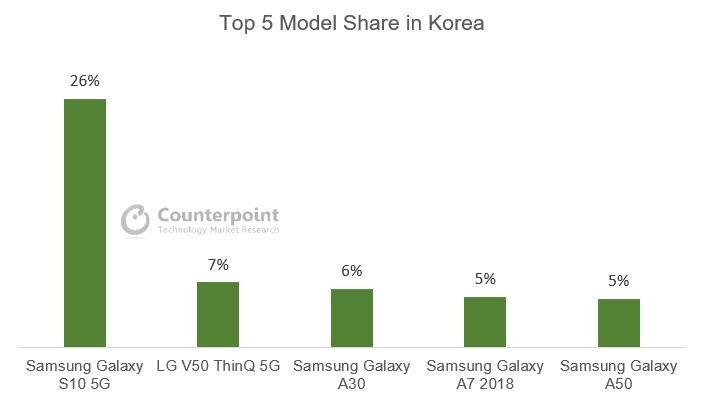

Korea Model Share

Korea Model Share

| Rank | Model | % |

| 1 | Samsung Galaxy S10 5G | 26% |

| 2 | LG V50 ThinQ 5G | 7% |

| 3 | Samsung Galaxy A30 | 6% |

| 4 | Samsung Galaxy A7 2018 | 5% |

| 5 | Samsung Galaxy A50 | 5% |

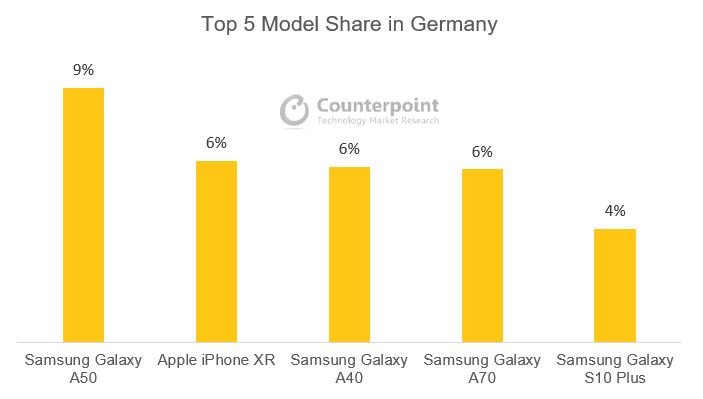

Germany Model Share

Germany Model Share

| Rank | Germany | % |

| 1 | Samsung Galaxy A50 | 9% |

| 2 | Apple iPhone XR | 6% |

| 3 | Samsung Galaxy A40 | 6% |

| 4 | Samsung Galaxy A70 | 6% |

| 5 | Samsung Galaxy S10 Plus | 4% |

Japan Model Share

Japan Model Share

| Rank | Model | % |

| 1 | Apple iPhone XR | 15% |

| 2 | Apple iPhone 8 | 15% |

| 3 | Apple iPhone 7 | 11% |

| 4 | Apple iPhone XS | 7% |

| 5 | Apple iPhone 6s | 5% |

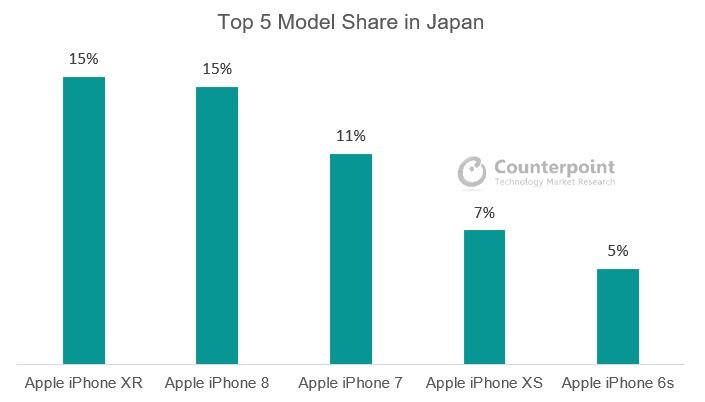

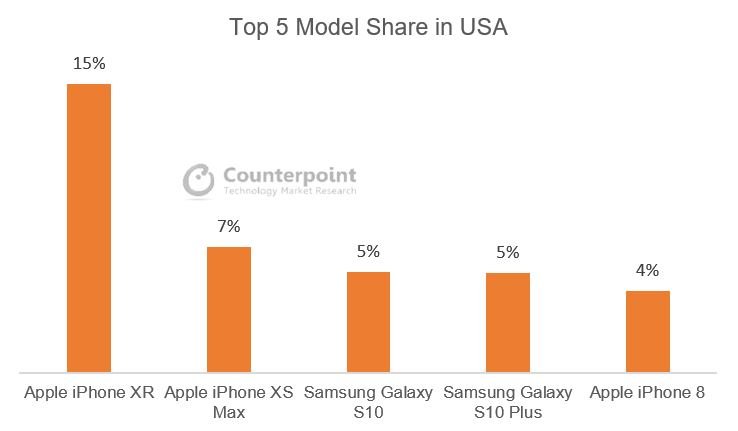

April 2019

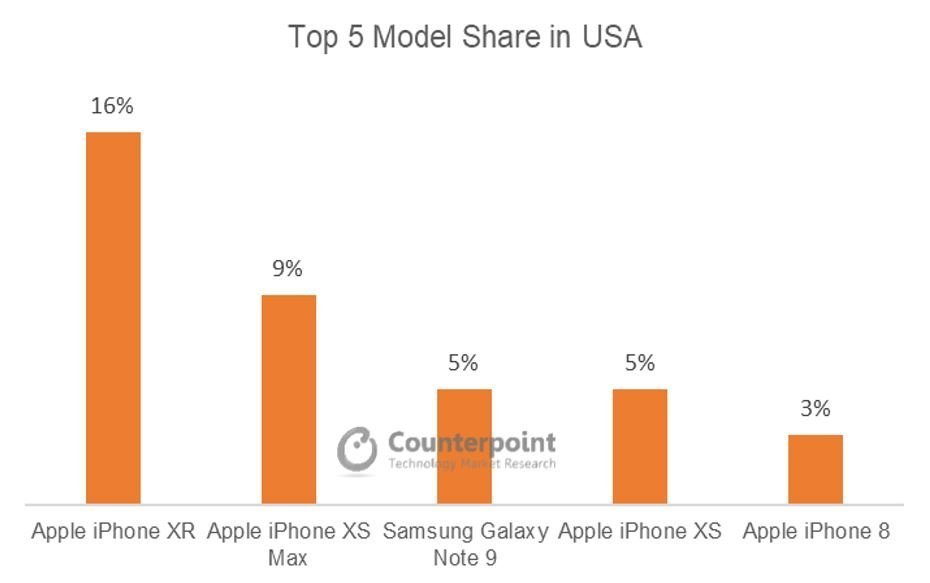

USA Model Share

USA Model Share

| Rank | Model | % |

| 1 | Apple iPhone XR | 15% |

| 2 | Apple iPhone XS Max | 7% |

| 3 | Samsung Galaxy S10 | 5% |

| 4 | Samsung Galaxy S10 Plus | 5% |

| 5 | Apple iPhone 8 | 4% |

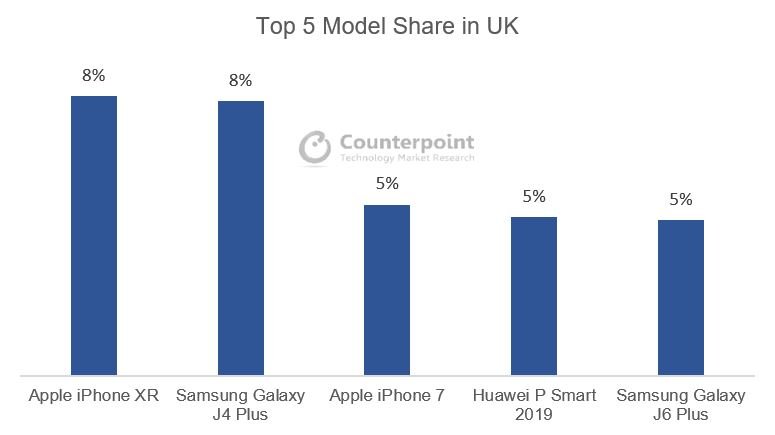

UK Model Share

UK Model Share

| Rank | Model | % |

| 1 | Apple iPhone XR | 8% |

| 2 | Samsung Galaxy J4 Plus | 8% |

| 3 | Apple iPhone 7 | 5% |

| 4 | Huawei P Smart 2019 | 5% |

| 5 | Samsung Galaxy J6 Plus | 5% |

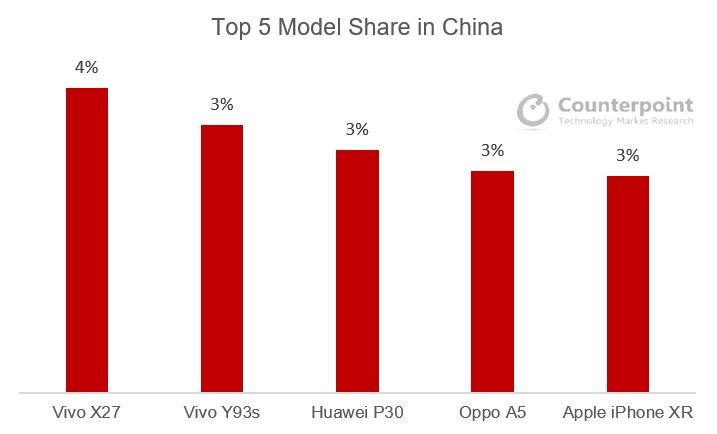

China Model Share

China Model Share

| Rank | Model | % |

| 1 | Vivo X27 | 4% |

| 2 | Vivo Y93s | 3% |

| 3 | Huawei P30 | 3% |

| 4 | Oppo A5 | 3% |

| 5 | Apple iPhone XR | 3% |

India Model Share

India Model Share

| Rank | Model | % |

| 1 | Xiaomi Redmi 6A | 8% |

| 2 | Samsung Galaxy A10 | 6% |

| 3 | Xiaomi Redmi Note 7 | 5% |

| 4 | Xiaomi Redmi Note 7 Pro | 5% |

| 5 | Samsung Galaxy A20 | 5% |

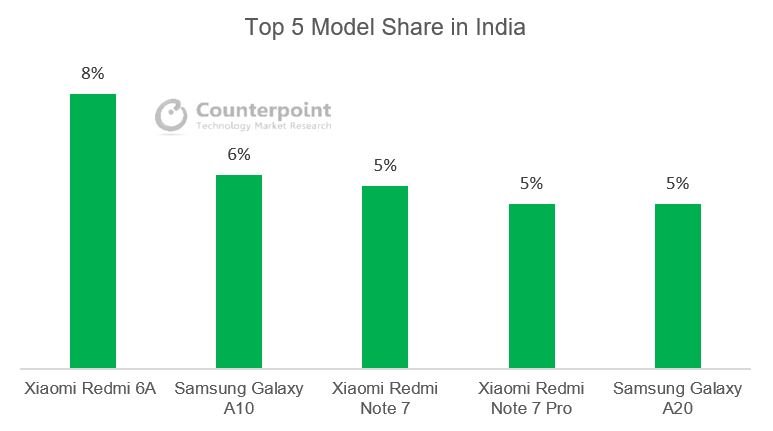

France Model Share

France Model Share

| Rank | Model | % |

| 1 | Apple iPhone XR | 8% |

| 2 | Samsung Galaxy J4 Plus | 5% |

| 3 | Samsung Galaxy J6 | 4% |

| 4 | Samsung Galaxy J6 Plus | 4% |

| 5 | Apple iPhone 7 | 3% |

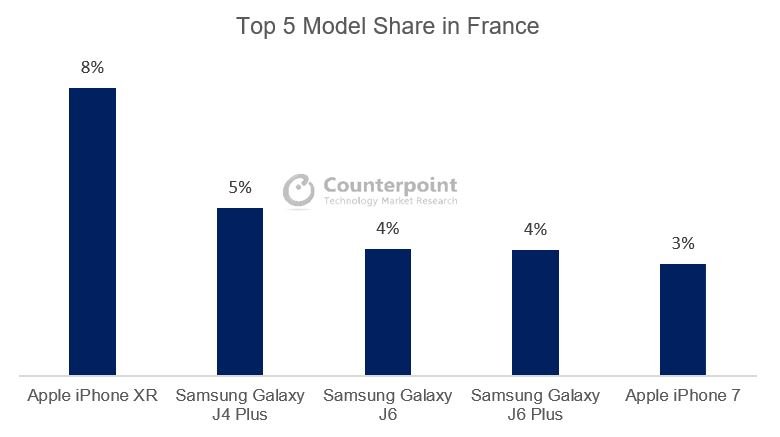

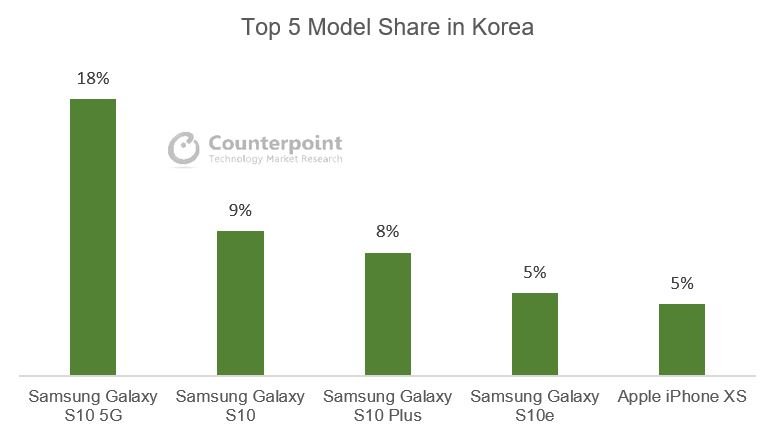

Korea Model Share

Korea Model Share

| Rank | Model | % |

| 1 | Samsung Galaxy S10 5G | 18% |

| 2 | Samsung Galaxy S10 | 9% |

| 3 | Samsung Galaxy S10 Plus | 8% |

| 4 | Samsung Galaxy S10e | 5% |

| 5 | Apple iPhone XS | 5% |

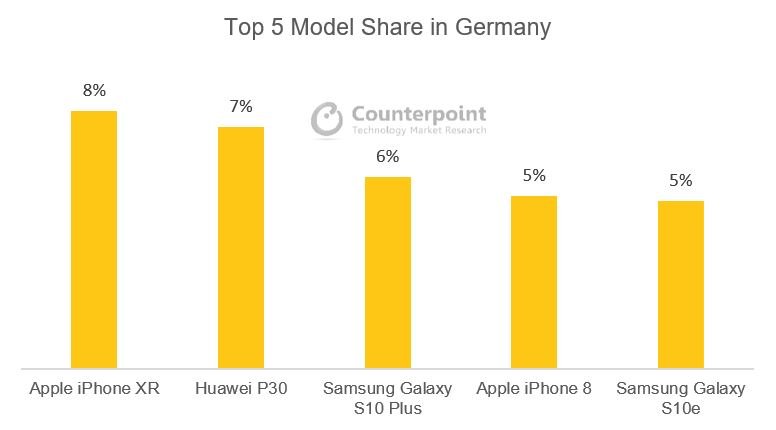

Germany Model Share

Germany Model Share

| Rank | Model | % |

| 1 | Apple iPhone XR | 8% |

| 2 | Huawei P30 | 7% |

| 3 | Samsung Galaxy S10 Plus | 6% |

| 4 | Apple iPhone 8 | 5% |

| 5 | Samsung Galaxy S10e | 5% |

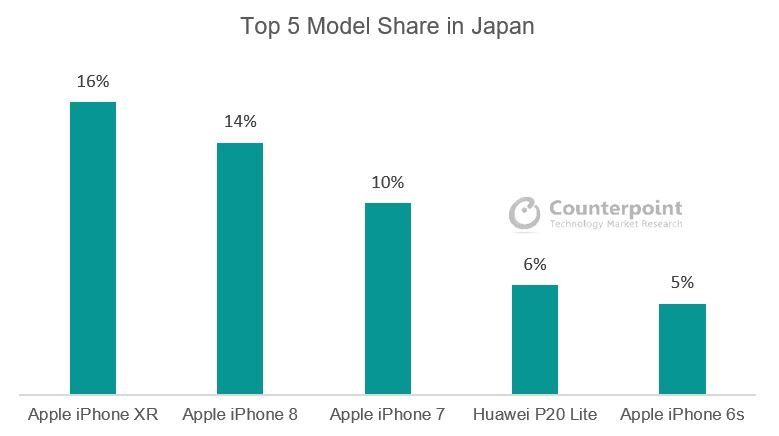

Japan Model Share

Japan Model Share

| Rank | Model | % |

| 1 | Apple iPhone XR | 16% |

| 2 | Apple iPhone 8 | 14% |

| 3 | Apple iPhone 7 | 10% |

| 4 | Huawei P20 Lite | 6% |

| 5 | Apple iPhone 6s | 5% |

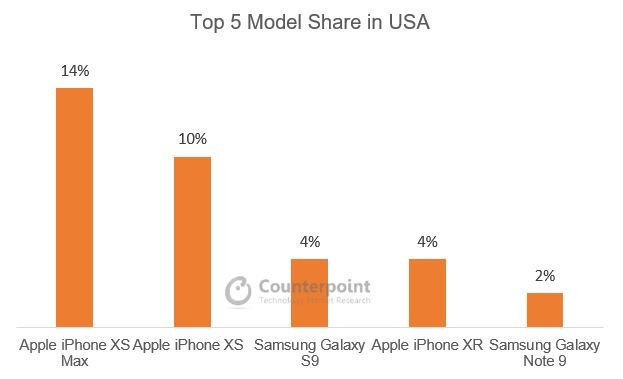

January 2019

USA Model Share

USA Model Share

| Rank | Model | % |

| 1 | Apple iPhone XR | 16% |

| 2 | Apple iPhone XS Max | 9% |

| 3 | Samsung Galaxy Note 9 | 5% |

| 4 | Apple iPhone XS | 5% |

| 5 | Apple iPhone 8 | 3% |

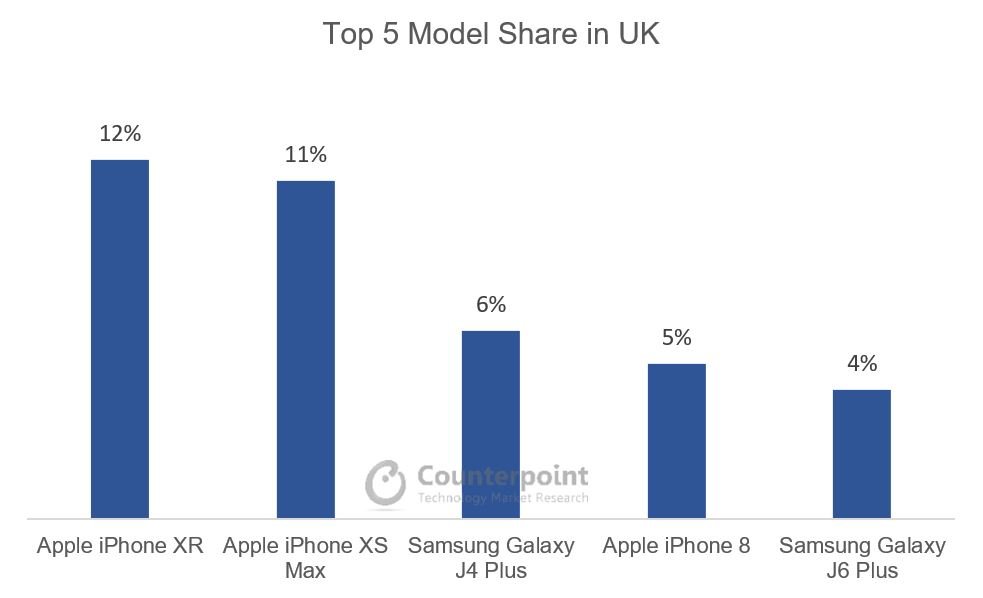

UK Model Share

UK Model Share

| Rank | Model | % |

| 1 | Apple iPhone XR | 12% |

| 2 | Apple iPhone XS Max | 11% |

| 3 | Samsung Galaxy J4 Plus | 6% |

| 4 | Apple iPhone 8 | 5% |

| 5 | Samsung Galaxy J6 Plus | 4% |

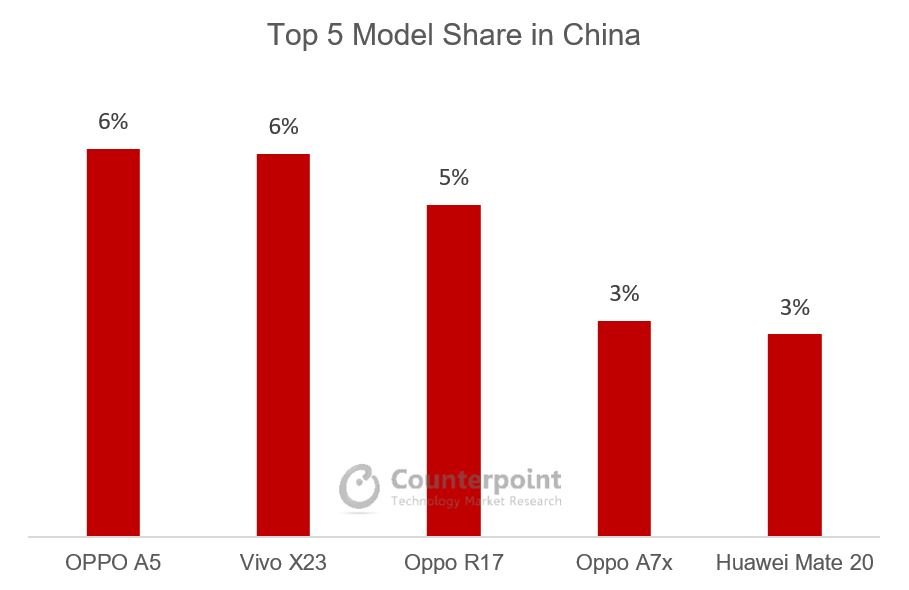

China Model Share

China Model Share

| Rank | Model | % |

| 1 | OPPO A5 | 6% |

| 2 | Vivo X23 | 6% |

| 3 | Oppo R17 | 5% |

| 4 | Oppo A7x | 3% |

| 5 | Huawei Mate 20 | 3% |

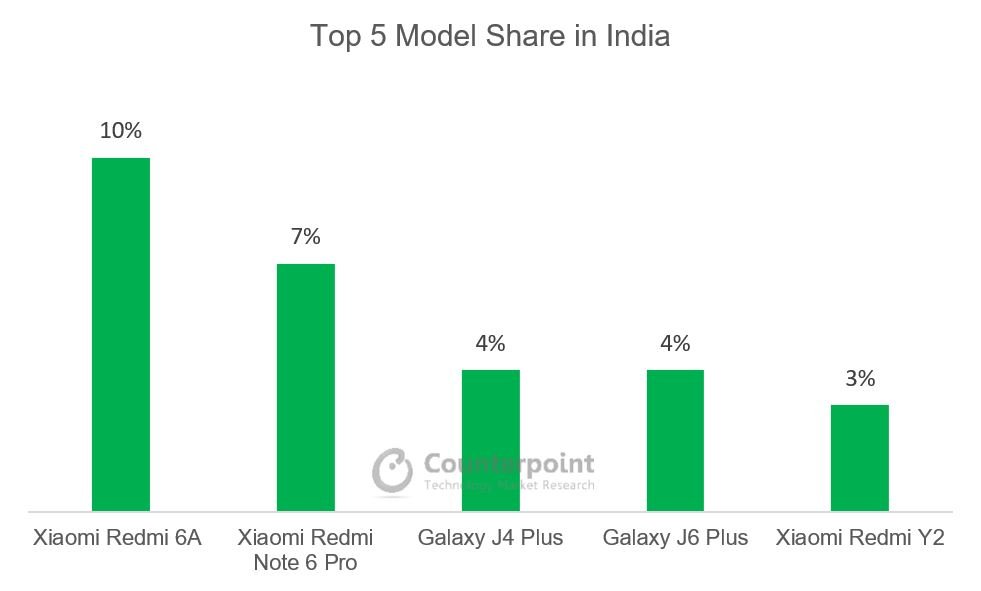

India Model Share

India Model Share

| Rank | Model | % |

| 1 | Xiaomi Redmi 6A | 10% |

| 2 | Xiaomi Redmi Note 6 Pro | 7% |

| 3 | Galaxy J4 Plus | 4% |

| 4 | Galaxy J6 Plus | 4% |

| 5 | Xiaomi Redmi Y2 | 3% |

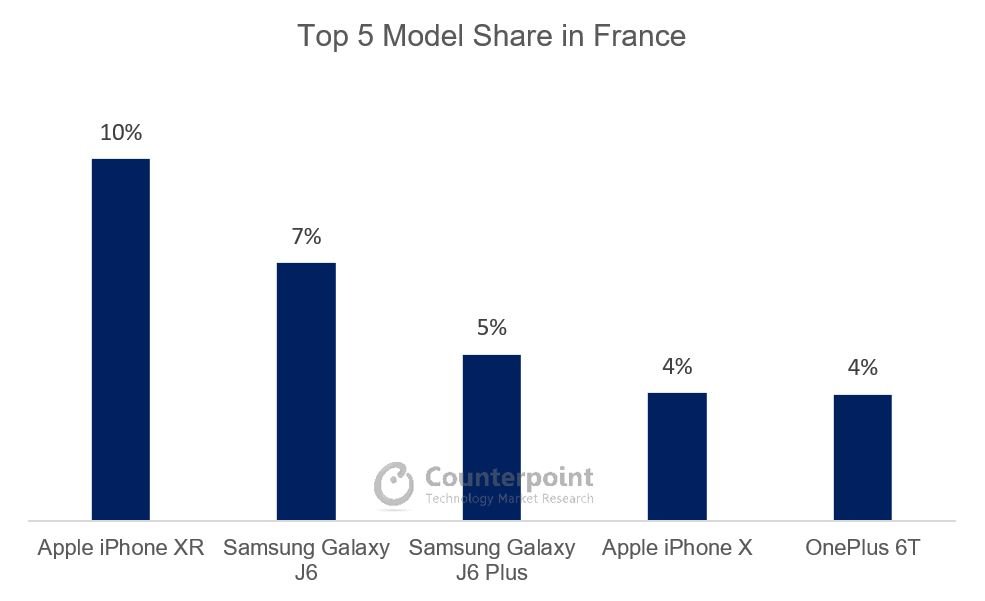

France Model Share

France Model Share

| Rank | Model | % |

| 1 | Apple iPhone XR | 10% |

| 2 | Samsung Galaxy J6 | 7% |

| 3 | Samsung Galaxy J6 Plus | 5% |

| 4 | Apple iPhone X | 4% |

| 5 | OnePlus 6T | 4% |

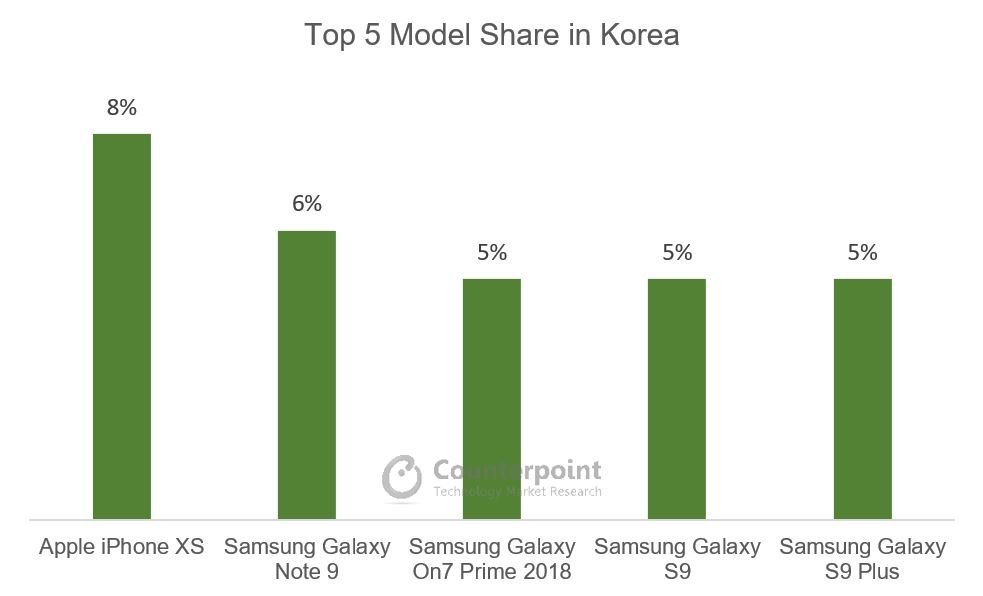

Korea Model Share

Korea Model Share

| Rank | Model | % |

| 1 | Apple iPhone XS | 8% |

| 2 | Samsung Galaxy Note 9 | 6% |

| 3 | Samsung Galaxy On7 Prime 2018 | 5% |

| 4 | Samsung Galaxy S9 | 5% |

| 5 | Samsung Galaxy S9 Plus | 5% |

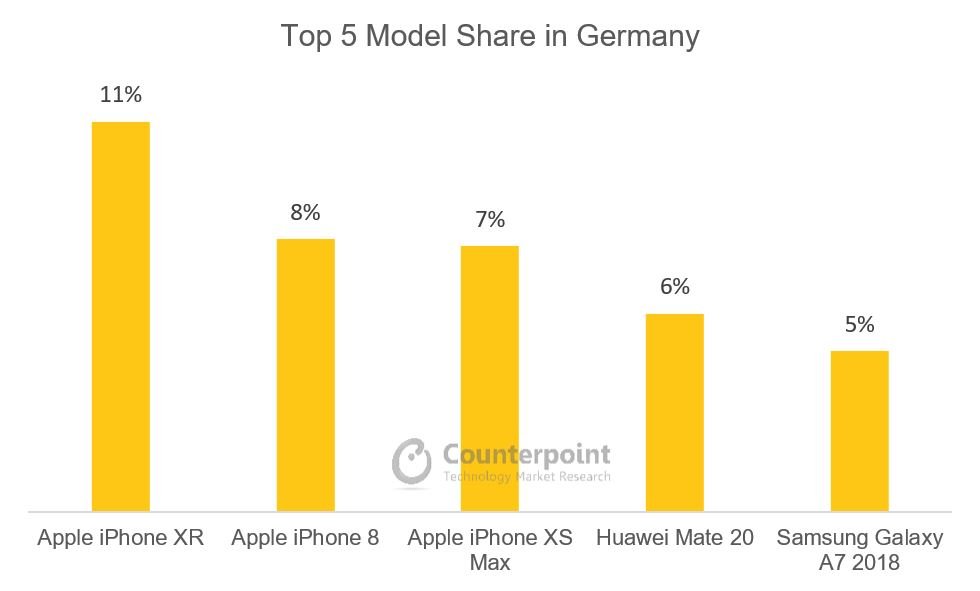

Germany Model Share

Germany Model Share

| Rank | Model | % |

| 1 | Apple iPhone XR | 11% |

| 2 | Apple iPhone 8 | 8% |

| 3 | Apple iPhone XS Max | 7% |

| 4 | Huawei Mate 20 | 6% |

| 5 | Samsung Galaxy A7 2018 | 5% |

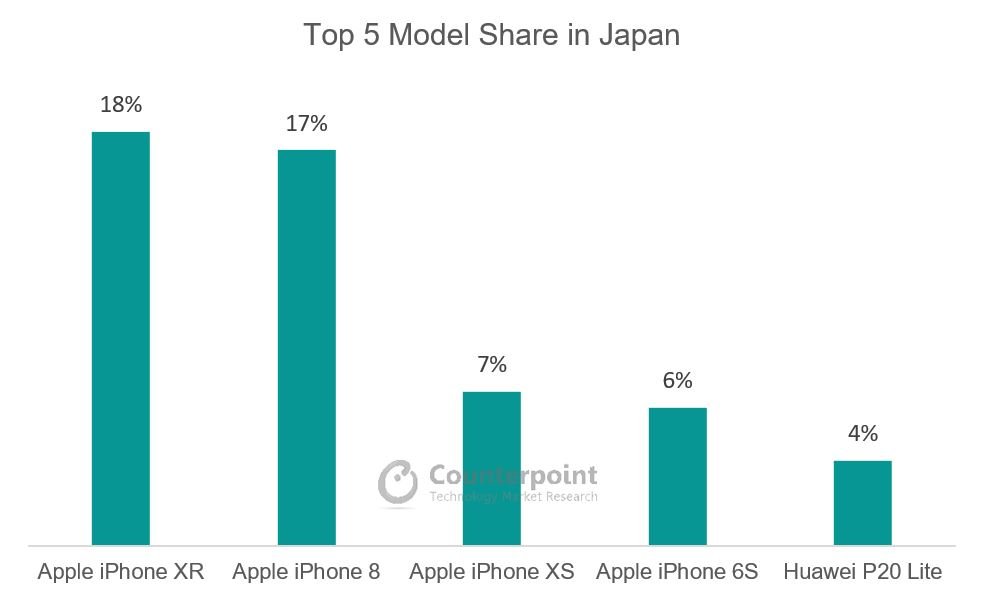

Japan Model Share

Japan Model Share

| Rank | Model | % |

| 1 | Apple iPhone XR | 18% |

| 2 | Apple iPhone 8 | 17% |

| 3 | Apple iPhone XS | 7% |

| 4 | Apple iPhone 6S | 6% |

| 5 | Huawei P20 Lite | 4% |

October 2018

USA Model Share

USA Model Share

| Rank | Model | % |

| 1 | Apple iPhone XS Max | 14% |

| 2 | Apple iPhone XS | 10% |

| 3 | Samsung Galaxy S9 | 4% |

| 4 | Apple iPhone XR | 4% |

| 5 | Samsung Galaxy Note 9 | 2% |

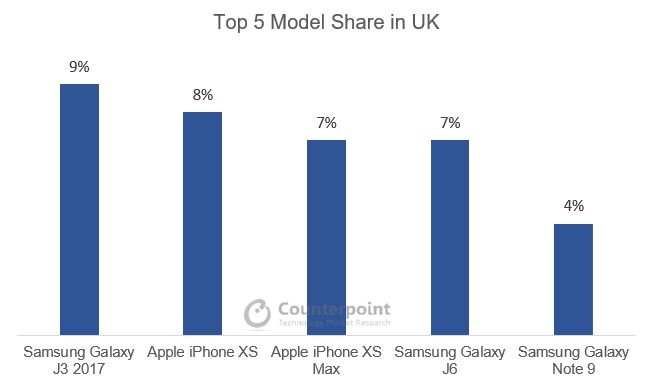

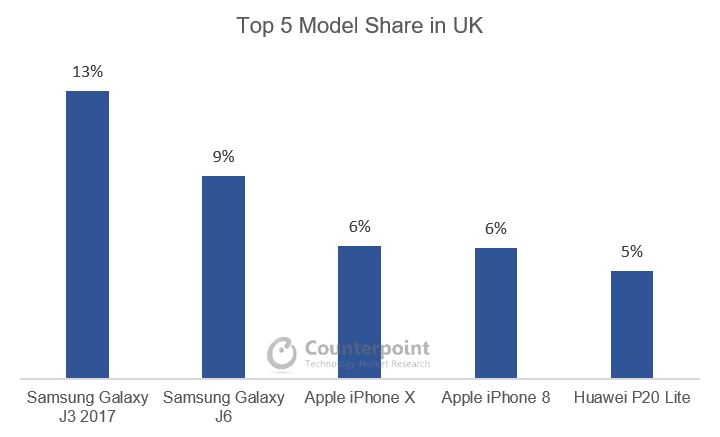

UK Model Share

UK Model Share

| Rank | Model | % |

| 1 | Samsung Galaxy J3 2017 | 9% |

| 2 | Apple iPhone XS | 8% |

| 3 | Apple iPhone XS Max | 7% |

| 4 | Samsung Galaxy J6 | 7% |

| 5 | Samsung Galaxy Note 9 | 4% |

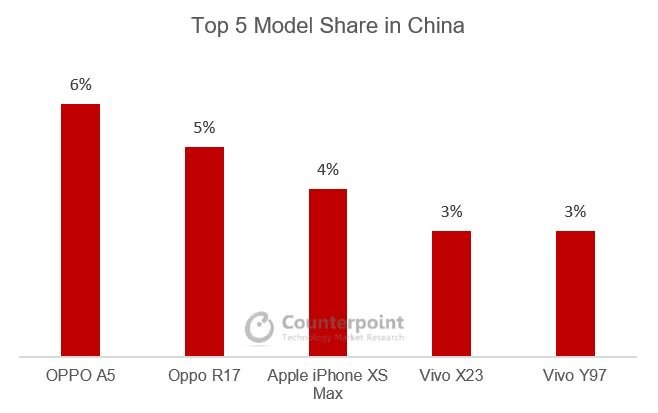

China Model Share

China Model Share

| Rank | Model | % |

| 1 | OPPO A5 | 6% |

| 2 | Oppo R17 | 5% |

| 3 | Apple iPhone XS Max | 4% |

| 4 | Vivo X23 | 3% |

| 5 | Vivo Y97 | 3% |

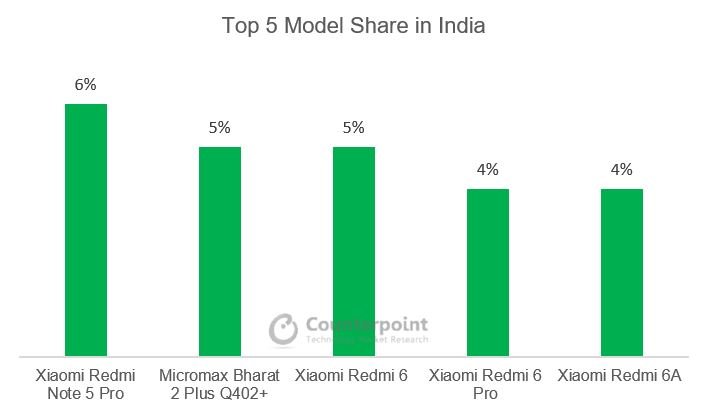

India Model Share

India Model Share

| Rank | Model | % |

| 1 | Xiaomi Redmi Note 5 Pro | 6% |

| 2 | Micromax Bharat 2 Plus Q402+ | 5% |

| 3 | Xiaomi Redmi 6 | 5% |

| 4 | Xiaomi Redmi 6 Pro | 4% |

| 5 | Xiaomi Redmi 6A | 4% |

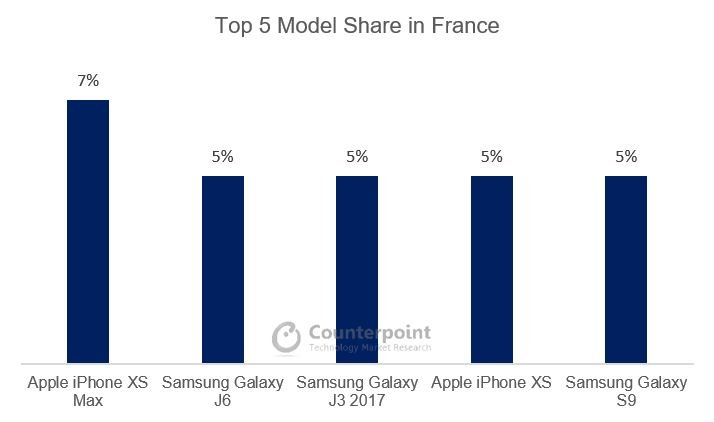

France Model Share

France Model Share

| Rank | Model | % |

| 1 | Apple iPhone XS Max | 7% |

| 2 | Samsung Galaxy J6 | 5% |

| 3 | Samsung Galaxy J3 2017 | 5% |

| 4 | Apple iPhone XS | 5% |

| 5 | Samsung Galaxy S9 | 5% |

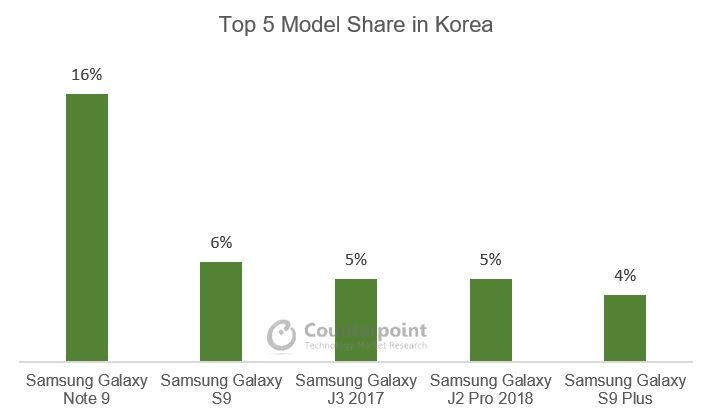

Korea Model Share

Korea Model Share

| Rank | Model | % |

| 1 | Samsung Galaxy Note 9 | 16% |

| 2 | Samsung Galaxy S9 | 6% |

| 3 | Samsung Galaxy J3 2017 | 5% |

| 4 | Samsung Galaxy J2 Pro 2018 | 5% |

| 5 | Samsung Galaxy S9 Plus | 4% |

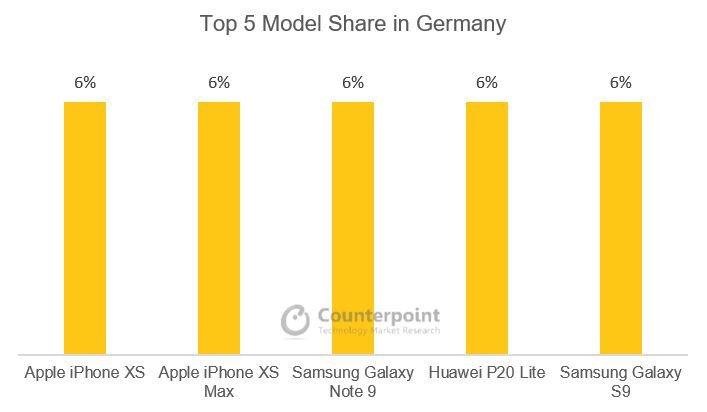

Germany Model Share

Germany Model Share

| Rank | Model | % |

| 1 | Apple iPhone XS | 6% |

| 2 | Apple iPhone XS Max | 6% |

| 3 | Samsung Galaxy Note 9 | 6% |

| 4 | Huawei P20 Lite | 6% |

| 5 | Samsung Galaxy S9 | 6% |

Japan Model Share

Japan Model Share

| Rank | Model | % |

| 1 | Apple iPhone 8 | 14% |

| 2 | Apple iPhone XS | 12% |

| 3 | Apple iPhone XS Max | 7% |

| 4 | Huawei P20 Lite | 7% |

| 5 | Apple iPhone XR | 4% |

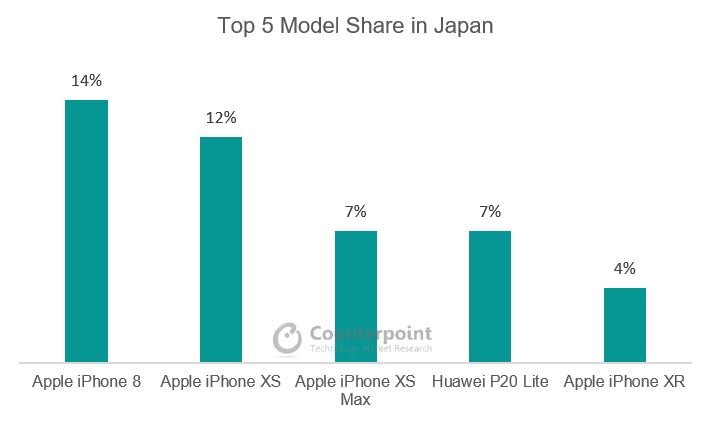

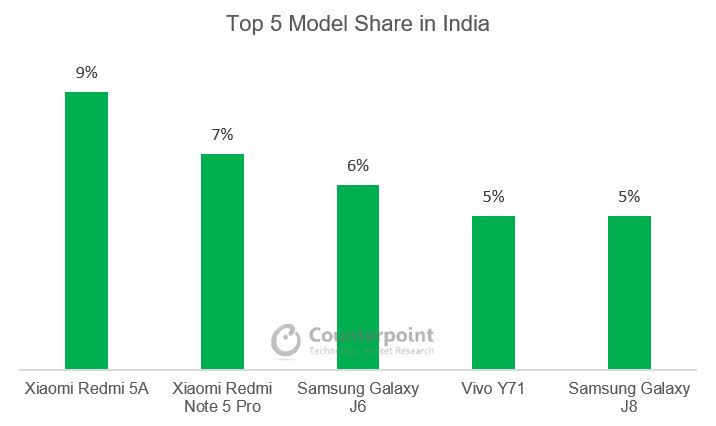

July 2018

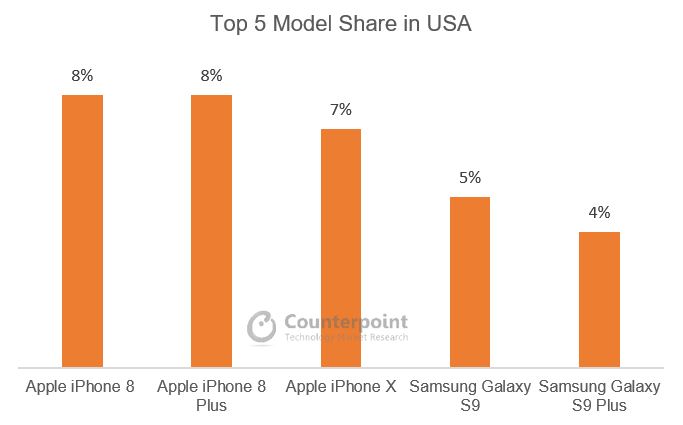

USA Model Share

USA Model Share

| Rank | Model | % |

| 1 | Apple iPhone 8 | 8% |

| 2 | Apple iPhone 8 Plus | 8% |

| 3 | Apple iPhone X | 7% |

| 4 | Samsung Galaxy S9 | 5% |

| 5 | Samsung Galaxy S9 Plus | 4% |

UK Model Share

UK Model Share

| Rank | Model | % |

| 1 | Samsung Galaxy J3 2017 | 13% |

| 2 | Samsung Galaxy J6 | 9% |

| 3 | Apple iPhone X | 6% |

| 4 | Apple iPhone 8 | 6% |

| 5 | Huawei P20 Lite | 5% |

China Model Share

China Model Share

| Rank | Model | % |

| 1 | OPPO R15 | 5% |

| 2 | OPPO A83 | 3% |

| 3 | VIVO X21 | 3% |

| 4 | OPPO A3 | 3% |

| 5 | VIVO Y85 | 3% |

India Model Share

India Model Share

| Rank | Model | % |

| 1 | Xiaomi Redmi 5A | 9% |

| 2 | Xiaomi Redmi Note 5 Pro | 7% |

| 3 | Samsung Galaxy J6 | 6% |

| 4 | Vivo Y71 | 5% |

| 5 | Samsung Galaxy J8 | 5% |

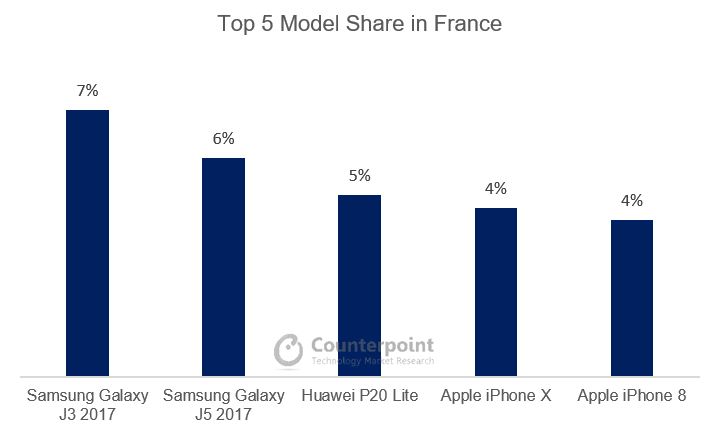

France Model Share

France Model Share

| Rank | Model | % |

| 1 | Samsung Galaxy J3 2017 | 7% |

| 2 | Samsung Galaxy J5 2017 | 6% |

| 3 | Huawei P20 Lite | 5% |

| 4 | Apple iPhone X | 4% |

| 5 | Apple iPhone 8 | 4% |

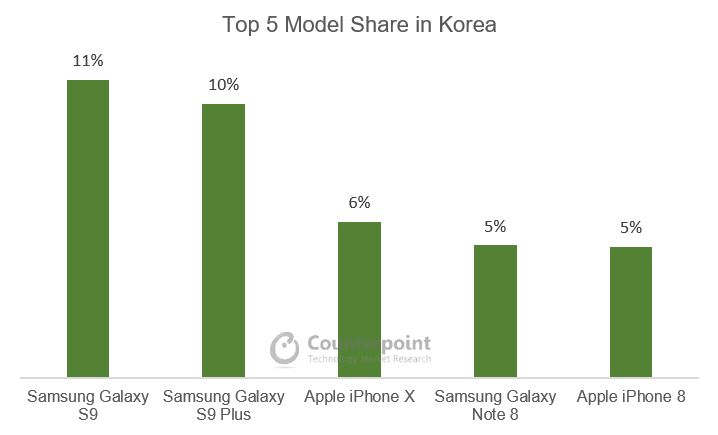

Korea Model Share

Korea Model Share

| Rank | Model | % |

| 1 | Samsung Galaxy S9 | 11% |

| 2 | Samsung Galaxy S9 Plus | 10% |

| 3 | Apple iPhone X | 6% |

| 4 | Samsung Galaxy Note 8 | 5% |

| 5 | Apple iPhone 8 | 5% |

Germany Model Share

Germany Model Share

| Rank | Model | % |

| 1 | Huawei P20 Lite | 10% |

| 2 | Apple iPhone 8 | 5% |

| 3 | Apple iPhone X | 5% |

| 4 | Samsung Galaxy S9 | 5% |

| 5 | Samsung Galaxy S9 Plus | 4% |

Japan Model Share

Japan Model Share

| Rank | Model | % |

| 1 | Apple iPhone 8 | 15% |

| 2 | Apple iPhone X | 5% |

| 3 | Apple iPhone 8 Plus | 4% |

| 4 | Apple iPhone SE | 4% |

| 5 | Huawei P20 Lite | 4% |

Neural Processing Unit (NPU)

Neural Processing Unit (NPU)

There are several reasons for the popularity of feature phone segment:

There are several reasons for the popularity of feature phone segment: