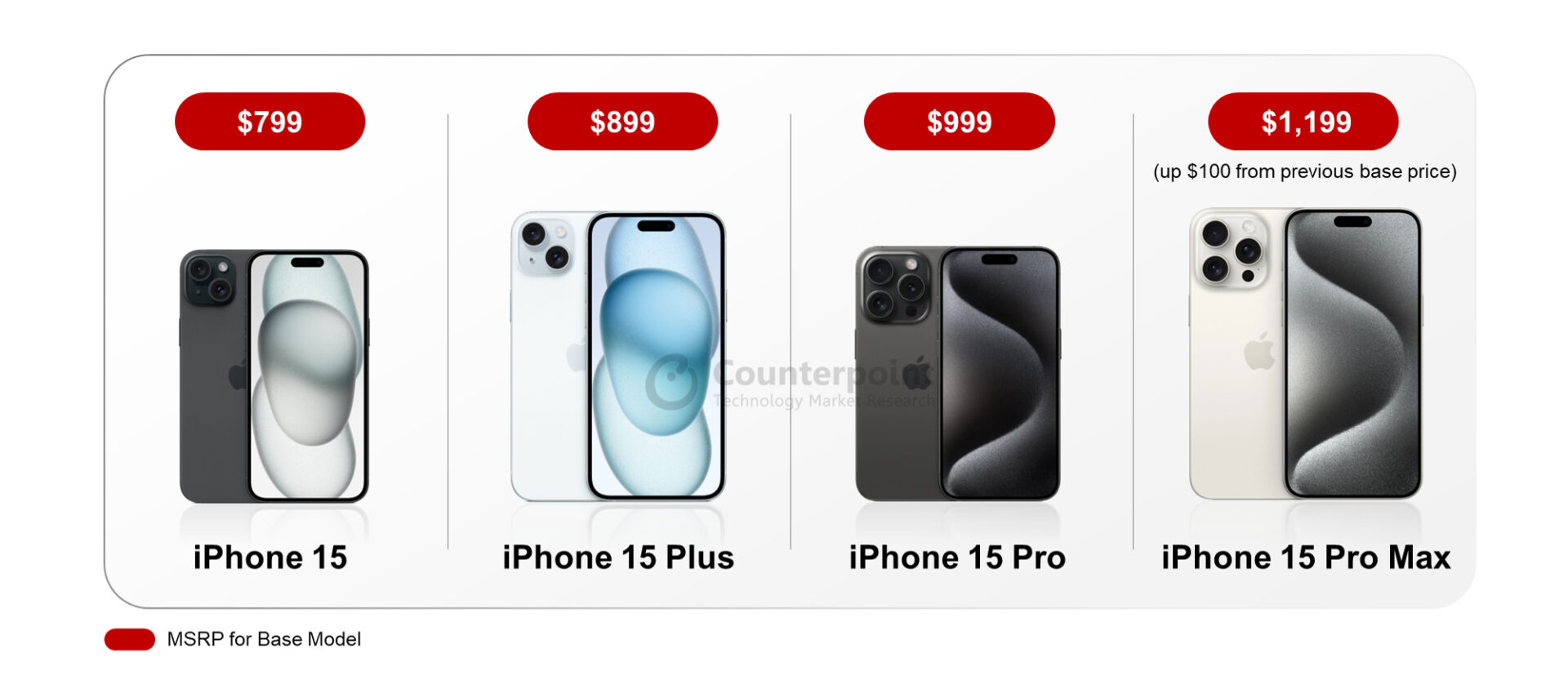

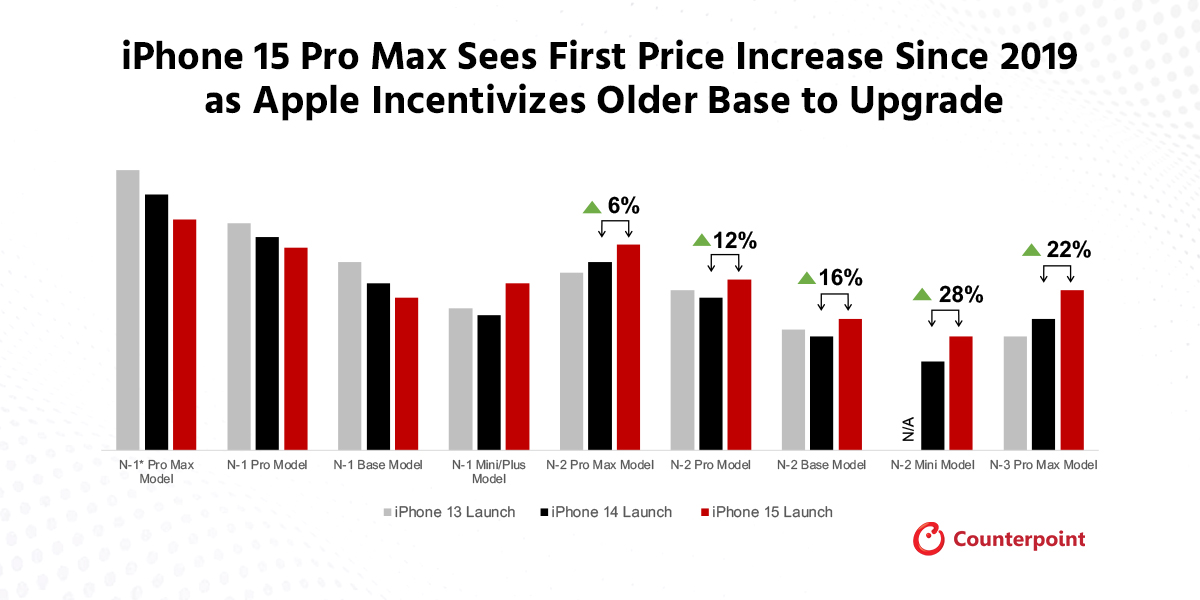

- Apple has increased the price for its latest Pro Max model by $100 in the US.

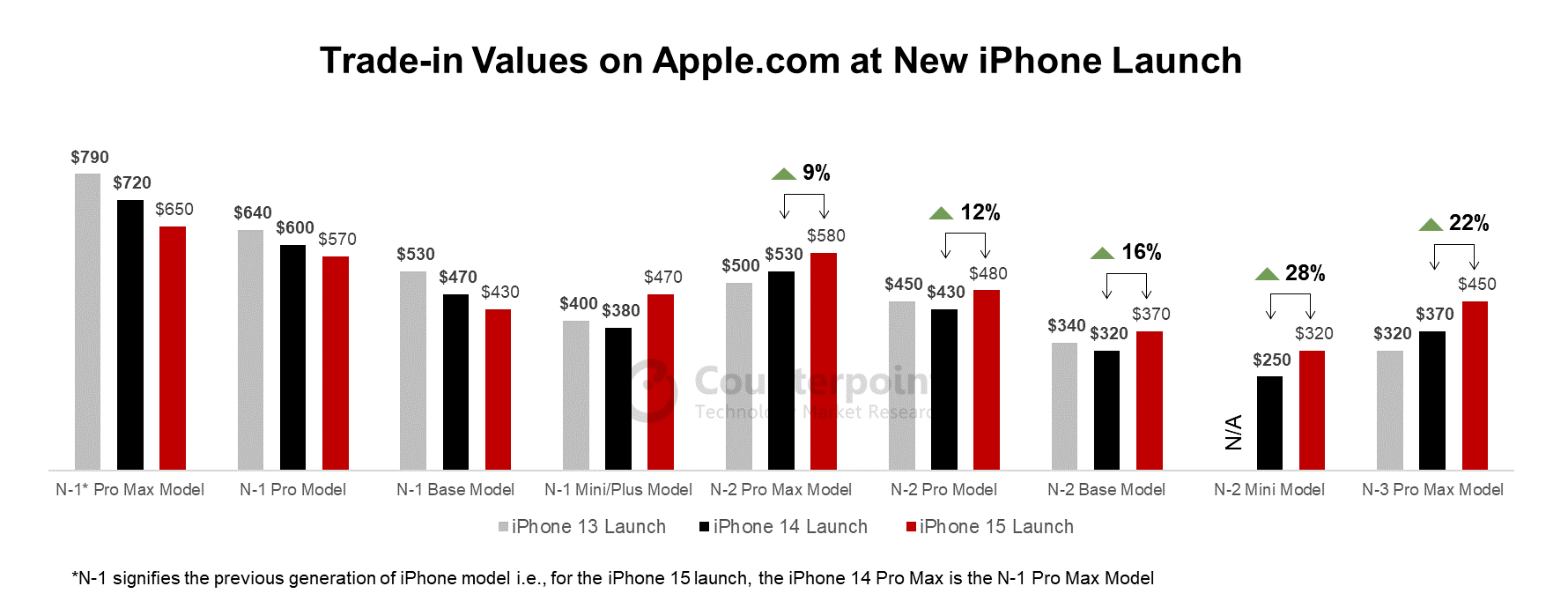

- Apple is offering better trade-in values for N-2 or N-3 devices compared to last year to help upgrade its older-generation base.

- The Pro Max price increase to $1,199 is mostly a result of an upgrade to a titanium chassis as well as a telephoto camera.

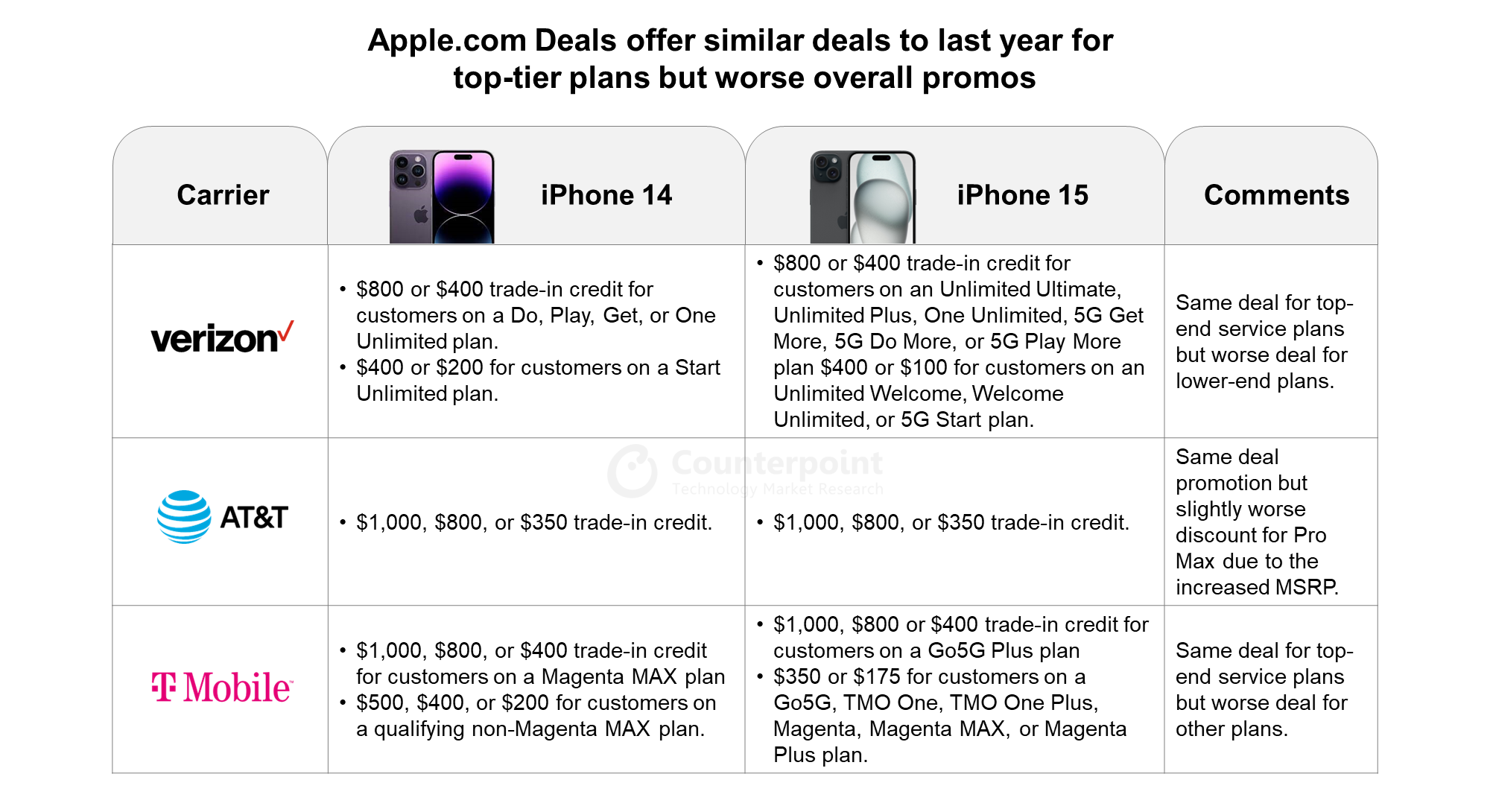

- iPhone 15 promotions are slightly worse compared to last year, especially with the higher price of the iPhone 15 Pro Max.

Apple has released its new iPhone 15 series, confirming the price increase for the Pro Max model by $100 in the US. This is the first time since the Pro series launched in 2019 that Apple has raised its prices. Apple’s carrier promotions have softened slightly compared to the iPhone 14 launch while trade-in values for N-1 devices (newest generation minus one, i.e. iPhone 14) have also decreased. Apple is offering better trade-in values for N-2 or N-3 devices compared to last year to help upgrade its older-generation base.

New pricing for Pro Max – Now at $1,199 for base model

The Pro Max price increase to $1,199 is mostly a result of an upgrade to a titanium chassis as well as a telephoto camera, which will allow for 5x optical zoom with a 120mm lens. The base model now also comes with 256GB of storage. This price increase may change consumer purchasing patterns and potentially have repercussions for Apple’s overall ASP as consumers may decide to purchase more affordable models this time around. It may be noted here that the 256GB iPhone 14 Pro Max also retailed for $1,199.

US promotions decrease slightly

US carriers Verizon, T-Mobile and AT&T generally have the same top-line promotions for the highest tiered plans on Apple’s website as last year’s iPhone 14 launch. This means that both AT&T and T-Mobile will offer up to $1,000 off on devices with a qualifying trade-in and eligible plan. Verizon remains the outlier, offering a discount of only $800. However, Verizon and T-Mobile’s lower-tiered plans have seen a decrease in value. This means that iPhone 15 promotions are slightly worse compared to last year, especially with the higher price of the iPhone 15 Pro Max.

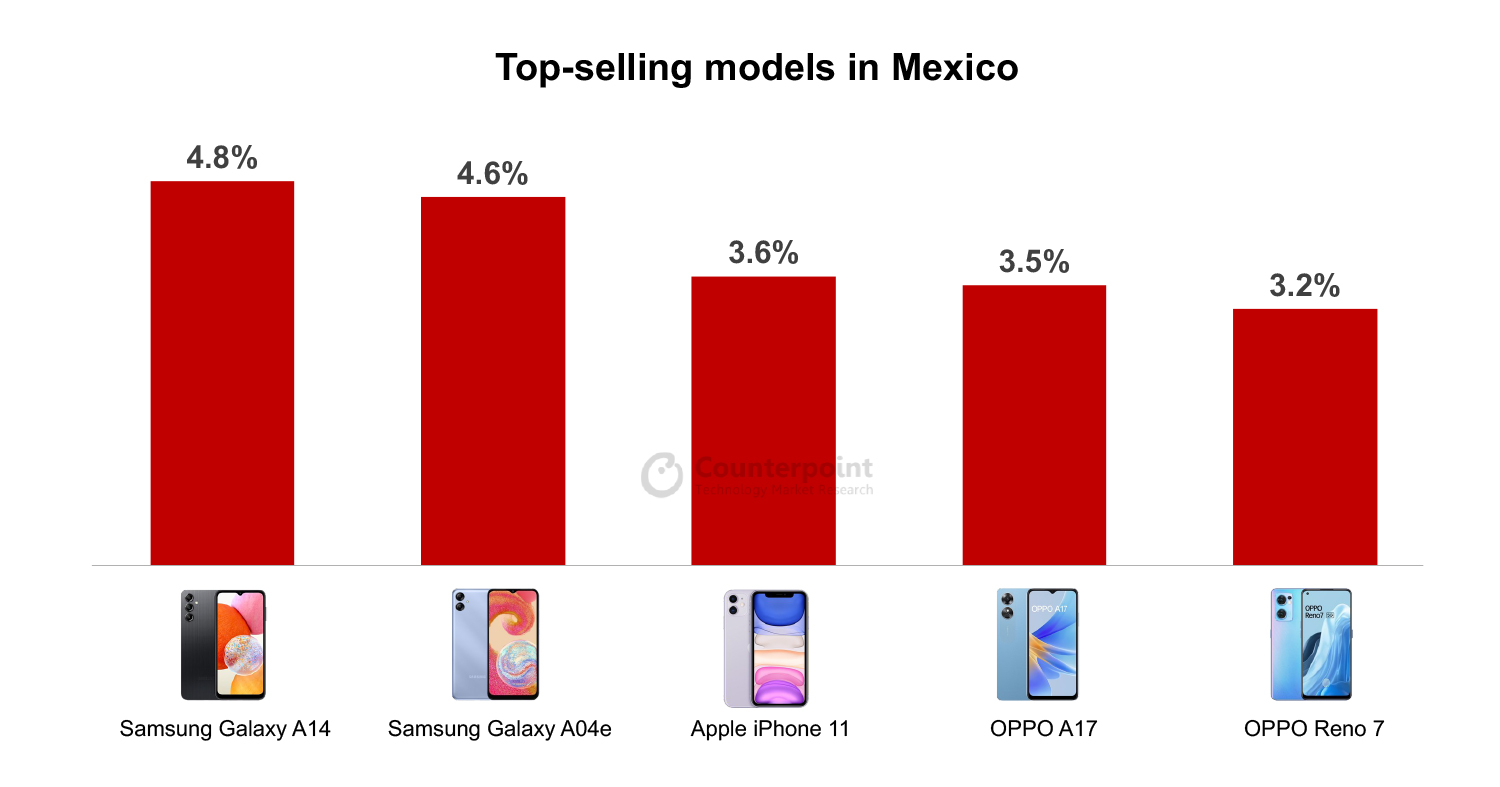

This comes at a time when carriers are seeing historically low upgrade rates and smartphone purchases are being delayed as consumers continue to face economic uncertainty. Nevertheless, we believe the iPhone 15 has the potential to be another big upgrade cycle for Apple, especially for the iPhone 11 and iPhone 12 owners as they look to upgrade their three- to four-year-old devices.

Trade-in Values Have Decreased for N-1 Models, But Apple is Pushing its Older Base to Upgrade

Although the discounts offered have largely remained the same, the pure trade-in values of N-1 devices have fallen, again. When the iPhone 13 series launched, customers could get a maximum of $790 in trade-in value for their old iPhone 12 Pro Max. This trade-in value dropped to $720 for the iPhone 13 Pro Max when the iPhone 14 series released last year. This year’s iPhone 15 launch saw trade-in values drop to $650 for the iPhone 14 Pro Max as the highest-value trade-in device.

Compared to the years before, Apple is putting a stronger focus on offering better trade-in values for its N-2 and N-3 models such as the iPhone 13 series and iPhone 12 series. Trade-in values for N-2 models have increased 9%-28% YoY for this year’s launch. This also shows that Apple wants to incentivize customers to upgrade their older models to the latest iPhone 15 while signaling to the iPhone 14 users to hold off for now. In fact, these trade-in values could potentially be more attractive to customers than carrier deals, especially if they are not on the highest tiered plans available. This might lead to more customers purchasing an unlocked device directly from Apple rather than opting for a carrier promotion offered by Apple.

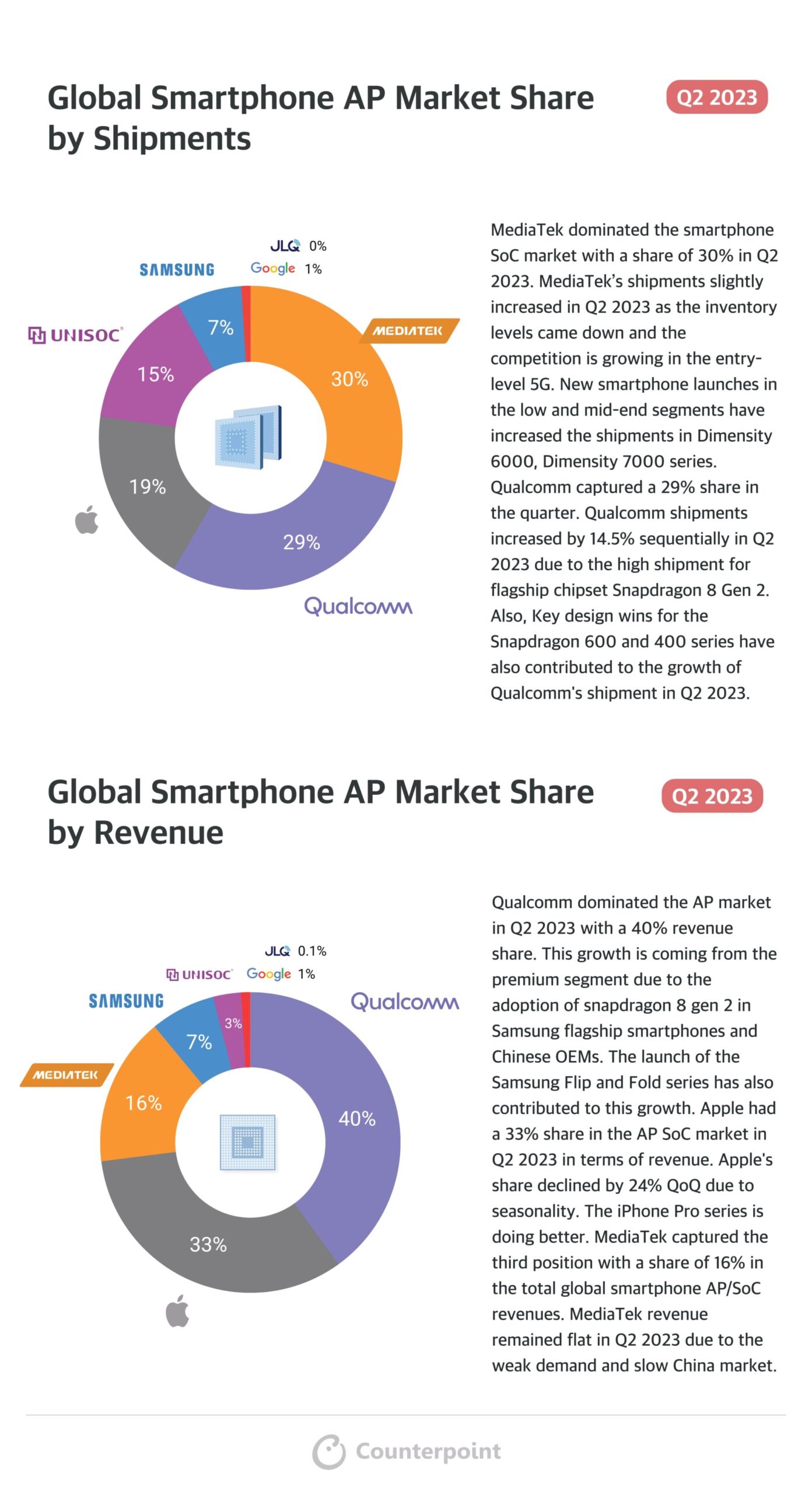

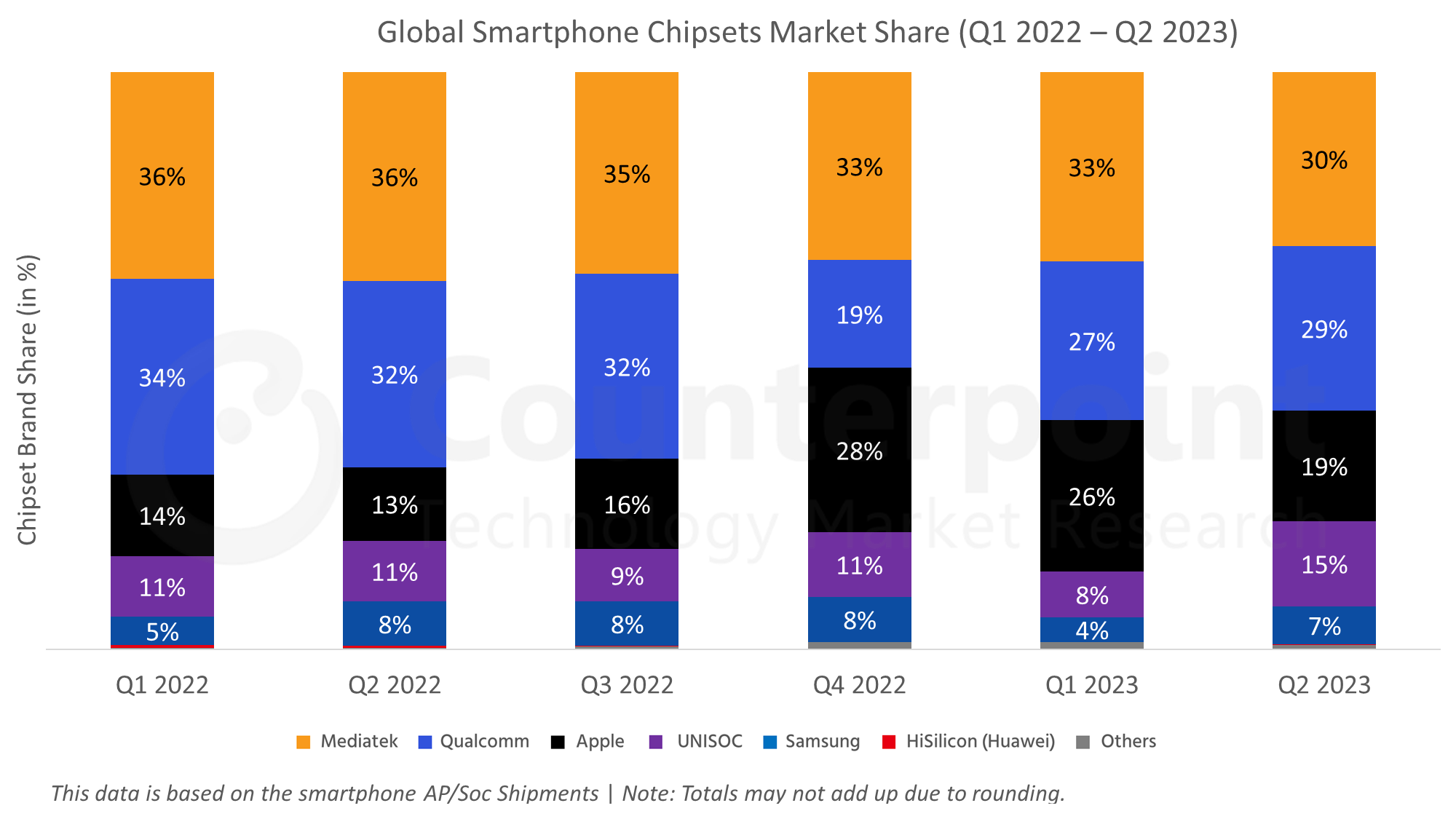

This data is based on the smartphone AP/SoC shipments

This data is based on the smartphone AP/SoC shipments

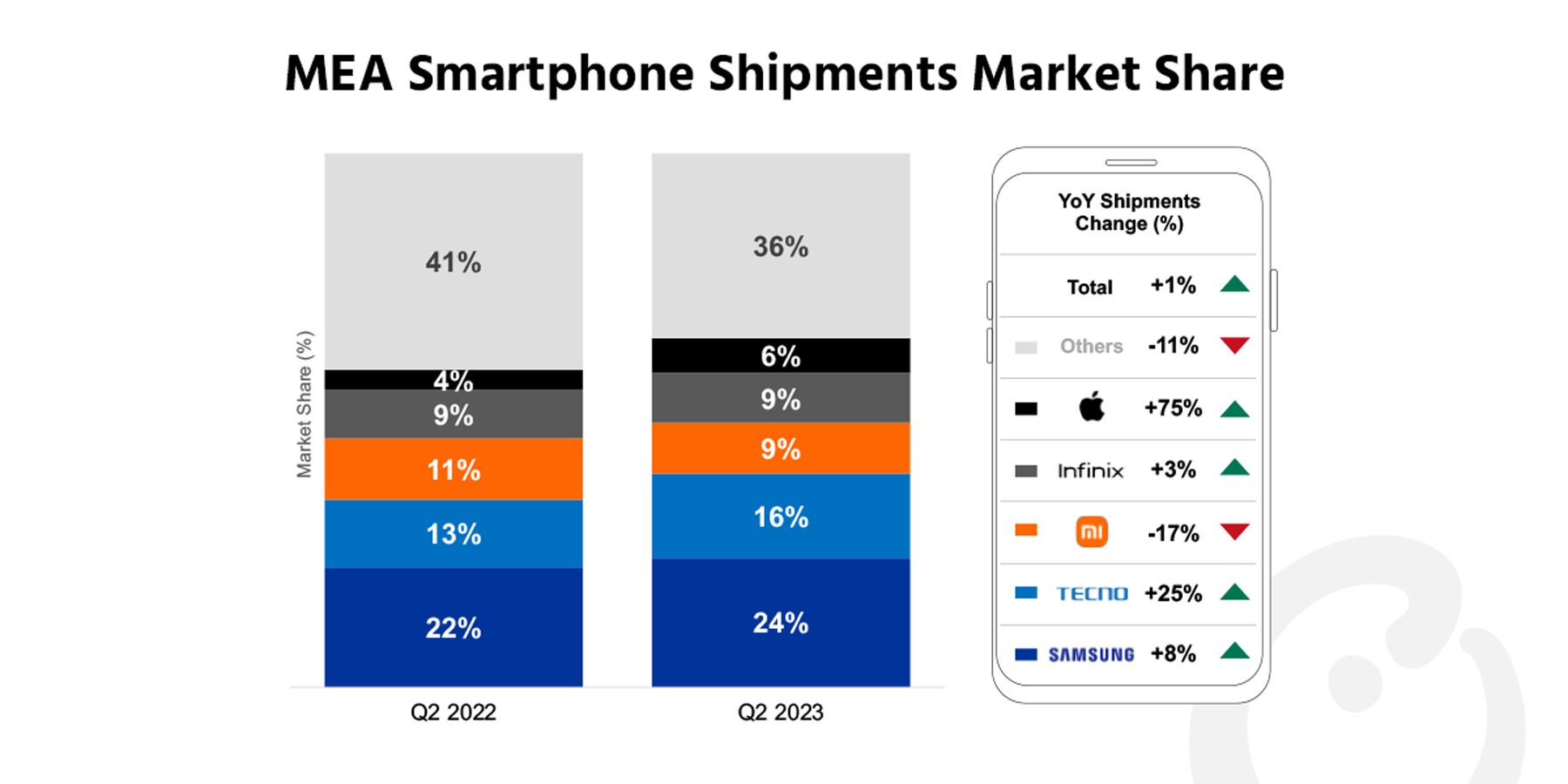

Looking at individual brands, Samsung, TECNO and

Looking at individual brands, Samsung, TECNO and