Online Channel Share in the Chinese Smartphone Market Grew in Q3 2019

Combined market share of Huawei and HONOR accounted for 46% of online market share in Q3 2019, reaching an all time high.

New Delhi, Hong Kong, Seoul, London, Beijing, San Diego, Buenos Aires –

Dec 23rd, 2019

China’s online smartphone sales increased to 27% of total sales in Q3 2019 from24%的问1 2019, according to the latest research from Counterpoint’s China Channel Service. China’s smartphone market continued its slowdown due to the sluggish economy and consumers delaying smartphone purchases for 5G network rollouts.China’s smartphone salesin Q3 2019 registered a 5% YoY decline, but increased 3% QoQ but while China’s smartphone market continued its slowdown, the decline has narrowed in YoY terms.

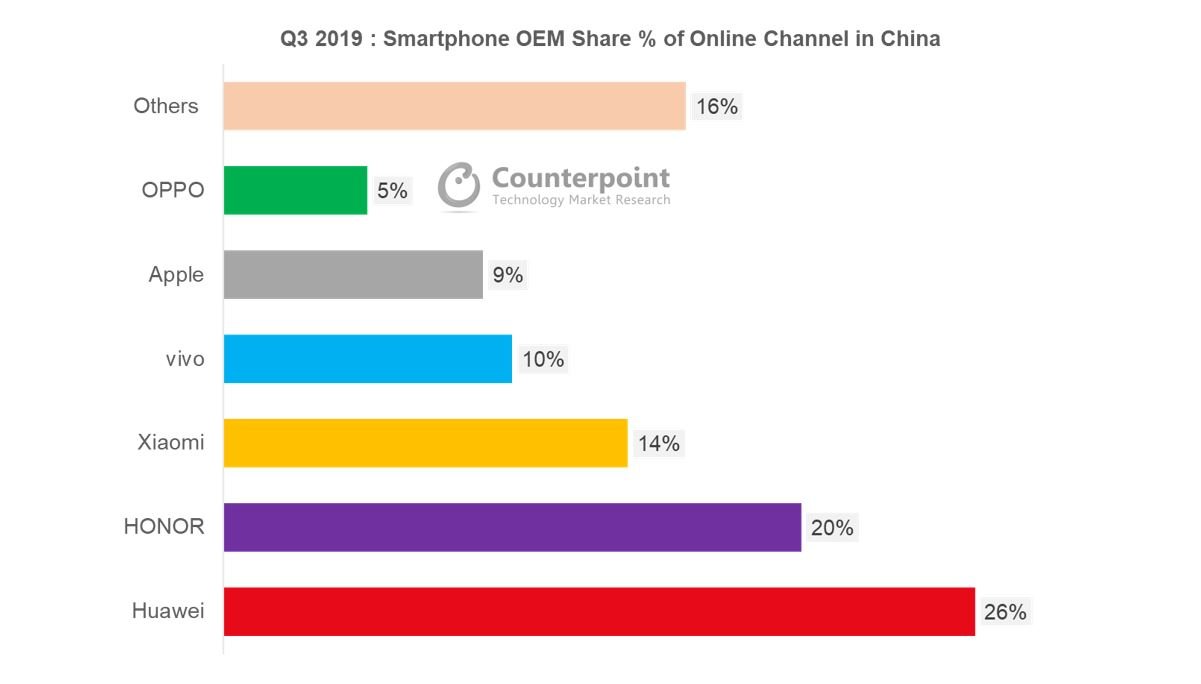

Exhibit 1: China’s Mobile E-Commerce Market Share by Brand – Q3 2019

This was the first time that online smartphone sales increased during a quarter when there were no major e-commerce festivals. The surge in online sales was mainly attributed to rising online sales of Huawei and HONOR, which have been aggressively expanding domestic sales across all channels. The dual brands have popular offerings across all price brands, from the high-end Mate 30 and P30 series, mid-end Nova 5 series and low-end Honor 9X series. The combined market share of Huawei and HONOR accounted for 46% of the online market share in Q3 2019.

Major OEMs have all been expanding their reach in online channels. Vivo’s strategy to penetrate into online channels through the launch of the online-focused Z series, starting in 2018, has paid off. Vivo’s online market share has increased from 7% in Q1 2019 to 10% in Q3 2019. Seeing the success of the budget Z series in online channels, vivo added a mid-to-high end iQOO series targeting online channels in 2019.

Though OPPO’s online market share was flat, it has also launched an online focused K series as well as a separate Realme brand focusing on online market. However, the expansion into online channels for brands which are traditionally strong in offline channels has created more challenges for Xiaomi, which saw its online market share drop below 20% for the first time.

Exhibit 2: China’s Mobile E-Commerce Market Share by Platform – Q3 2019

In terms of platform performance, JD and TMall remained the two largest online retail players, accounting for 49% and 21% of market share in online smartphone sales, respectively. The two platforms’ large customer base along with strong connections with brands helped to secure their top positions in the online space. Nevertheless, third party platforms such as Pinduoduo continue to gain market share with sizable subsidy campaign of RMB 10 bn (roughly US$ 1.4 bn) throughout the year. Pinduoduo offered the most attractive discounts for iPhones among all the platforms. On Pinduoduo, discounts of RMB 500, 700 and 900 (roughly US$71, $100, $128) are given for iPhone 11, iPhone 11 Pro and iPhone 11 Pro Max, respectively. At the moment, iPhones are the most popular models sold in Pinduoduo’s smartphone category. With its growing presence in China’s e-commerce markets, we expect thatPinduoduowill further grow its market share in online smartphone retail through deepening cooperation with leading Chinese smartphone OEMs.

Online smartphone sales are expected to further increase in Q4 2019 as both 11.11 and 12.12 e-commerce festivals take place during the quarter. We also expect the online smartphone retail space to become more consolidated going forward.

Analyst Contacts: