Smartphone Sales Grow 4% YoY During the Latest ‘618 E-Commerce Festival’

The popularity of third-party app platforms for shopping is increasing, especially across China’s lower-tier cities.

New Delhi, Hong Kong, Seoul, London, Beijing, San Diego, Buenos Aires –

July 29th, 2019

Due to aslowing smartphone market, smartphone sales during the 2019 edition of the annual 618 e-commerce festival in China grew 4% year-on-year (YoY) to 13 million units, based on data from Counterpoint’s China Channel services. This is due to heavy promotion activity from platforms and OEMs during the festival. The 618 e-commerce festival, first initiated by JD.com, has now become a major sales event in China and is comparable to the Singles’ Day sale for online retailers. The 618 festival now lasts for more than two weeks, with an extended period of promotions running from June 1st to June 18th.

According toMengmeng Zhang,Research Analyst在对位,“JD和淘宝商城还是两个largest players during the 618 festival, accounting for 54% and 23% of market share in the mobile phone category, respectively. However, we are seeingthird-party app platformsPinduoduo playing a greater role in the 618 festival with its large userbase in lower-tier cities across China. Pinduoduo splurged RMB 10 billion (roughly US$ 1.45 billion) as subsidies on more than 10,000 products during the festival. With attractive discounts of nearly 30% on selected iPhone models, sales for iPhones crossed more than 300,000 units during the entire 618 festival period.”

Exhibit 1: China’s mobile e-commerce market share by platform, from June 1-18, 2019

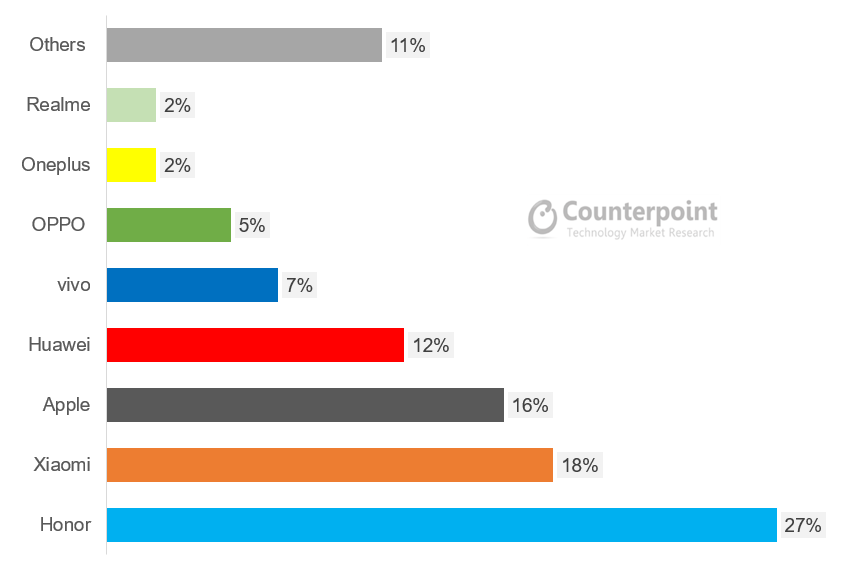

Exhibit 2: Market share of China smartphone market on e-commerce channels, by brand, from June 1-18, 2019

Commenting on the performance of OEMs,James Yan,Research Directorat Counterpoint Research said, “There are very few changes in the top four players of the market. However, there has been increasing competition among other OEMs to secure the remaining top slots in the online market. Realme, a sub-brand of OPPO, which achieved success in India, entered China in April and immediately climbed into the top-selling list. Realme stresses on its high cost-to-performance ratio and is particularly attractive for online markets. In addition, OnePlus, with its exclusive JD partnership, also had a strong performance during this year’s 618 festival.”

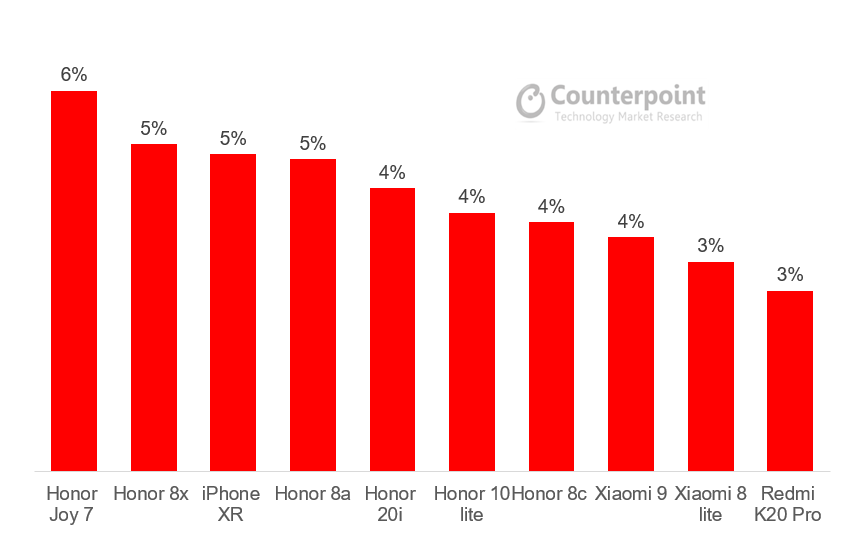

Ethan Qi,Senior Research Analystat Counterpoint Research, added, “As for the top 10 best-selling models, HONOR was the biggest winner this year occupying a total of six slots. Further, we saw a wider price band distribution in the top 10 best-selling list this year compared to previous years, where it was predominantly smartphones around RMB 1,000 (roughly US$ 145). When we expand the list to the top 20 best-selling list, we see an even wider price band. There were nine models priced above RMB 2,000 (roughly US$300) based on JD’s top 20 sellers’ list.”

Exhibit 3: Top 10 best-selling models during the 618 e-commerce festival, from June 1- 18, 2019

More Analysis on Brands During the 618 Festival:

- During this year’s 618 festival, the top six brands (HONOR, Xiaomi, Huawei, Apple, OPPO, and Vivo) accounted for 85% of the market share.

- HONOR has solidified its position as the best-selling online smartphone brand, capturing 27% of the market.

- With the trade ban hurting Huawei’s business in overseas markets, Huawei and HONOR have shifted focus to domestic markets. HONOR offered a heavier discount compared to Xiaomi this year, while Huawei’s P30 series achieved strong performance with both online and offline retailers during the 618 festival.

- The gap between HONOR and Xiaomi has widened this year as Xiaomi faces tougher competition from HONOR, as well as online-focused models from OPPO and Vivo. Nonetheless, Xiaomi has moved up the value chain with more of its flagship models entering the top-selling list, i.e., Xiaomi 9 and Redmi K20 Pro.

- Vivo’s determination in putting more efforts into online channels has paid off with sales during June 1 and June 18 increasing 121% YoY. Vivo’s special gift boxes with different themes for various platforms were all sold out.

- Apple showed stronger performance during the 618 festival period compared to Q1 2019. With sales declining in China, Apple started offering hefty promotions on various platforms. The iPhone XR had the best deals and among the top three best-selling models during this year’s festival.

Analyst Contacts:

Mengmeng Zhang

Flora Tang

Counterpoint Research

press(at)www.arena-ruc.com![]()

You can alsovisit our Data Section(updated quarterly) to view smartphone market shareGloballyand fromthe USA,ChinaandIndia