Execution Woes and Economy Sink Intel Earnings

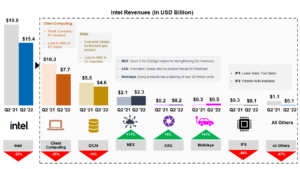

Intel, under immense pressure from internal execution delays in key segments – DCAI, AXG and product design, and economic headwinds from falling consumer demand and fiscal tightening, reported itseighth consecutive YoY revenue declineand itsfirst net loss in 30 years, amounting to $454 Mn.

- The GAAP revenue dropped to $15.3 Bn, a 22% YoY decline and missed its estimate by $2.7 Bn for the Q2 outlook due to weaker demand in CCG and lose of market share to AMD.

- Gross margins declined 15% YoY and stood at 44.8% compared to 59.8% in the previous year quarter due to component pricing not passed onto consumers

This was well below the guidance issued at its Investor Day and Q1quarterly earningswhere it projected to be above 50%.

Segment Reports

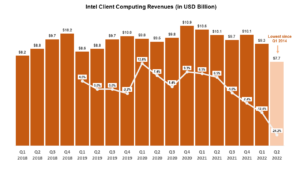

Client Computing:OEM inventory reductionsand soft demand contribute to 25% revenue decline; Lowest since 2014

Client Computing Revenues were at $7.7 Bn a 25% decline in YoY revenues and 29% decline in the ‘Notebook’ segment. The biggest decline factors were:

- OEM inventory reduction followed by softening demand from consumer, education and SMB (Small and Medium Sized Business) customers.

The company expects the revenue to decline in Q3 and then rise again in Q4 due to inventory balancing and price increases. The company expects a10% decline in the PC TAMfor this financial year.

The company expects its roadmap of Raptor Lake processors to be on schedule for this Q3 and Q4 for desktop and notebook chip releases respectively.

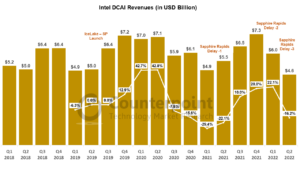

Datacenter and AI (DCAI) underperforms due to execution issues, match-set issues and ethernet & power supply component shortages

The DCAI revenue was $4.6 Bn a 16% YoY decline.

- The revenue slump was primarily due toexecution issues of stepping out ‘Sapphire Rapids’which has been delayed three times due to security and quality performance not being in line with expectations and competitor products.

The company had launched its last generation of processors – Ice Lake in 2019 and Cooper Lake in 2020 with some upgrades in 2021.

- The revenue forDCAI will remain downcastfor the whole year due to the financial impact of Sapphire Rapids ramp only being realized next year and competitive pressures for its existing product line. The company expects a high-volume SKU ramp later this year.

The company launched its next gen AI accelerator Gaudi2 and its software platform security capability – Amber for AI driven continuous optimizations.

On an optimistic note, the company emphasizes the deals it has with Meta, Nvidia and AWS for its multi-year and multi-generational compute expansion.

Network and Edge (NEX) segmentprovides some green amidst the deep red CCG and DCAI revenues

Revenue grew 11% YoY at $2.3 Bn with Xeon D (processor for Network & Edge) and Mount Evans helping to drive the revenue as leading network companies adopt the product into their network infrastructure.

Accelerated Computing Systems and Graphics (AXG) revenue grew 5% with software issues delaying some launches

The AXG revenue stood at $186 Mn representing a 5% increase in revenue YoY.

- The company is poised to miss its target of 4-million-unit shipments in 2022 but to achieve a target of $1 bn in revenues. The Intel Art GPU series remained the revenue driver.

- Intel Arc A5 and A7 Desktop GPU Cards were delayed due to software issues and will start shipping in Q3.

- Data Center GPU – Arctic Sound has shipped to customers and the financial impact will be seen in the next two quarters.

Mobileye has its best ever quarter revenue at $460 Mn representing 46% YoY growth

Mobileyecontinued to outperform the market and increased its backlog by over 21 million units for the upcoming quarters. 16 million units were shipped in the first half of 2022. The company expects to add more customers and is extensively deploying capital for next generation ADAS products.

Intel Foundry Services (IFS)gains support and forms IFS Cloud Alliance to improve foundry design efficiency, time-to-market

The revenue of IFS was $126 Mn representing a 54% decline YoY due to lower mass tool sales以及收入减少汽车gment due to customer shortages in the automotive market.

- The company has added $1 Bn in revenue pipeline for this quarter, including a new client – MediaTek – on Intel 16 node, making the revenue pipeline about $6 Bn in total.

- The advanced node revenue pipeline remains undecided as the company is still working on test chips and design libraries to secure orders. The company is also expected to benefit from the recently passed CHIPS act from 2023 onwards and the industry wide transition to System and Package chipsets vis-à-vis a board chipsets.

Additionally, the IFS Cloud alliance was launched with leading cloud providers – Azure and AWS, and EDA tool providers – Ansys, Cadence, Siemens and Synopsys, to enable secure design environments in the cloud, improving design efficiency and accelerating the time-to-market for chips.

Outlook for Q3 2022 and FY 2022

- Q3 revenue to decline 12-17% YoY to $15-$16 Bn and gross margin to be at 46.5%.

- FY 2022 revenue to be in range of $65-$68 Bn down $8-$11 Bn from earlier guidance.

- Capex reduced by $4 Bn from earlier forecasts to $23 Bn.

The capex reduction will directly impact the wafer fab equipment delivery and possible delays in fab expansion and capacity.

The primary reasons for the forecast revenue declines include – product roadmap delays in DCAI and software issues in AXG product segments. Dampened demand from desktop and notebook industry amid worsening consumer sentiment is also dragging on the revenue outlook.

The company has already indicated a not-too-good Q3 with some breathing room available from Q4.

Though, the company has reiterated its position is on track for its future nodes and product releases we believe the latter half-year launches will crystallize the current status of its advanced nodes and likely delivery of its future product roadmaps.