- Although overall global smartphone shipments declined in Q2 2023, global foldable shipments rose.

- In H2 2023, competition in the global foldable product market is set to escalate significantly, driven by the earnest entry of Chinese companies like OPPO and HONOR.

- The global foldable market is expected to experience substantial growth in 2024, driven by the introduction of entry-level foldable products.

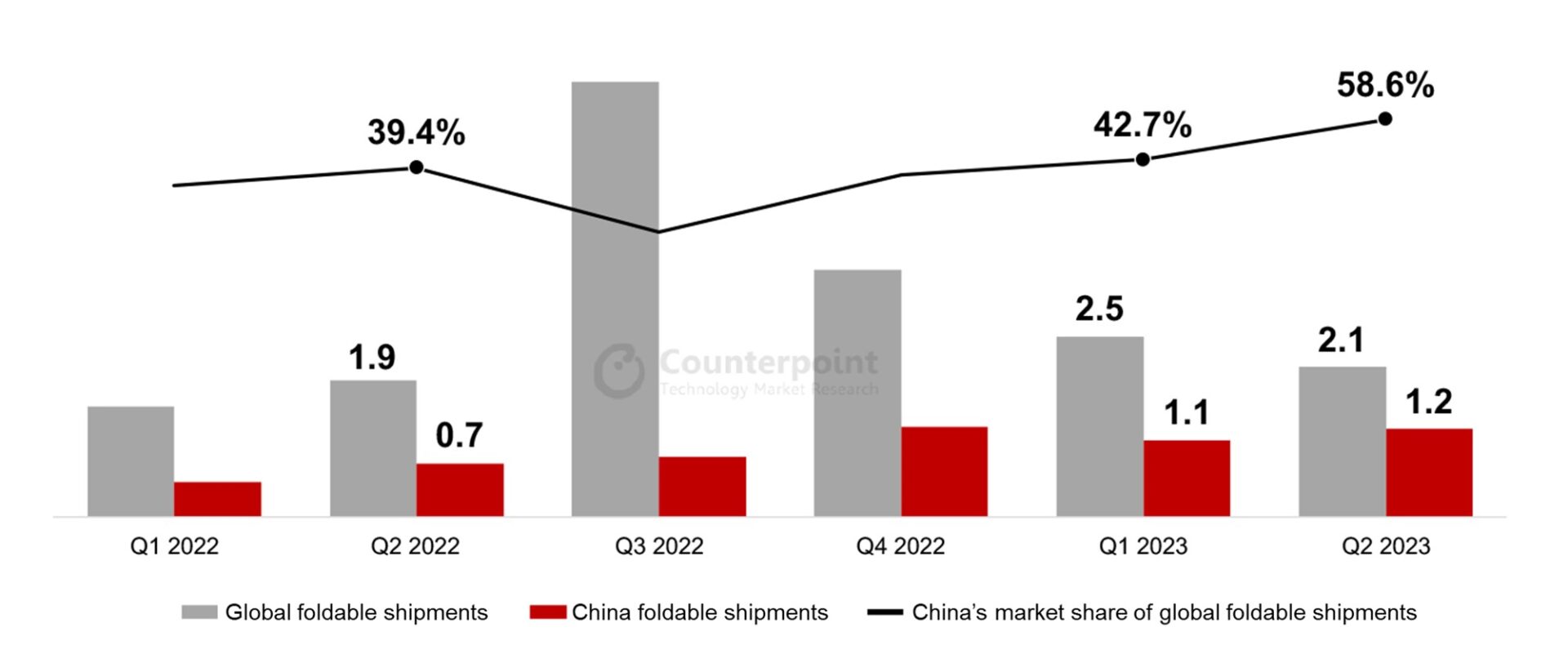

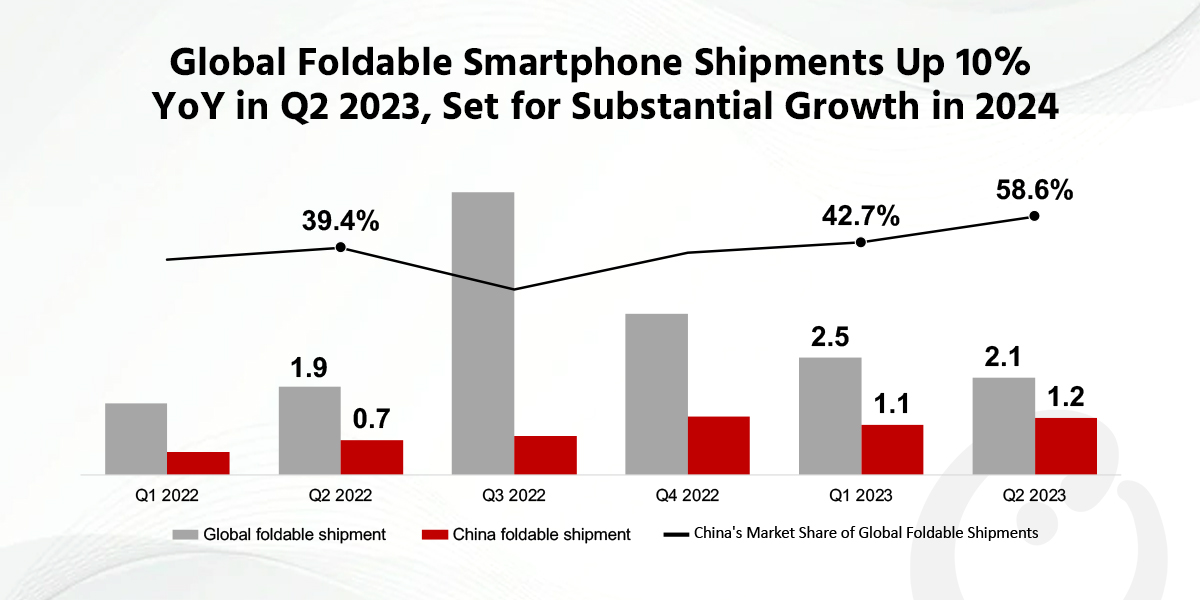

The global foldable smartphone market increased 10% YoY in Q2 2023 to reach 2.1 million units, according to Counterpoint Research’s most recentglobal foldable smartphone tracker.这种增长形成了鲜明对比的global smartphone market, which showed a 9% decline in shipments during the quarter to reach 268 million units. Due to the prolonged Russia-Ukraine war and the ongoing high global inflation, the smartphone market is expected to grow sideways. Nevertheless, the foldable smartphone sector continues to exhibit robust and sustained growth.

Global and ChinaFoldable Smartphone Shipments, Q1 2022-Q2 2023

The foldable smartphone landscape in the Chinese market presents a particularly intriguing scenario. During Q2 2023, shipments in the overall Chinese smartphone market slipped 4% YoY to reach 61.9 million units, hurt by the recent economic challenges faced by the country, which led to a reduction in consumer spending. However, the Chinese foldable smartphone market achieved notable success, surging 64% YoY to reach 1.2 million units. China now commands the largest share of the global foldable smartphone market, with a 58.6% share.

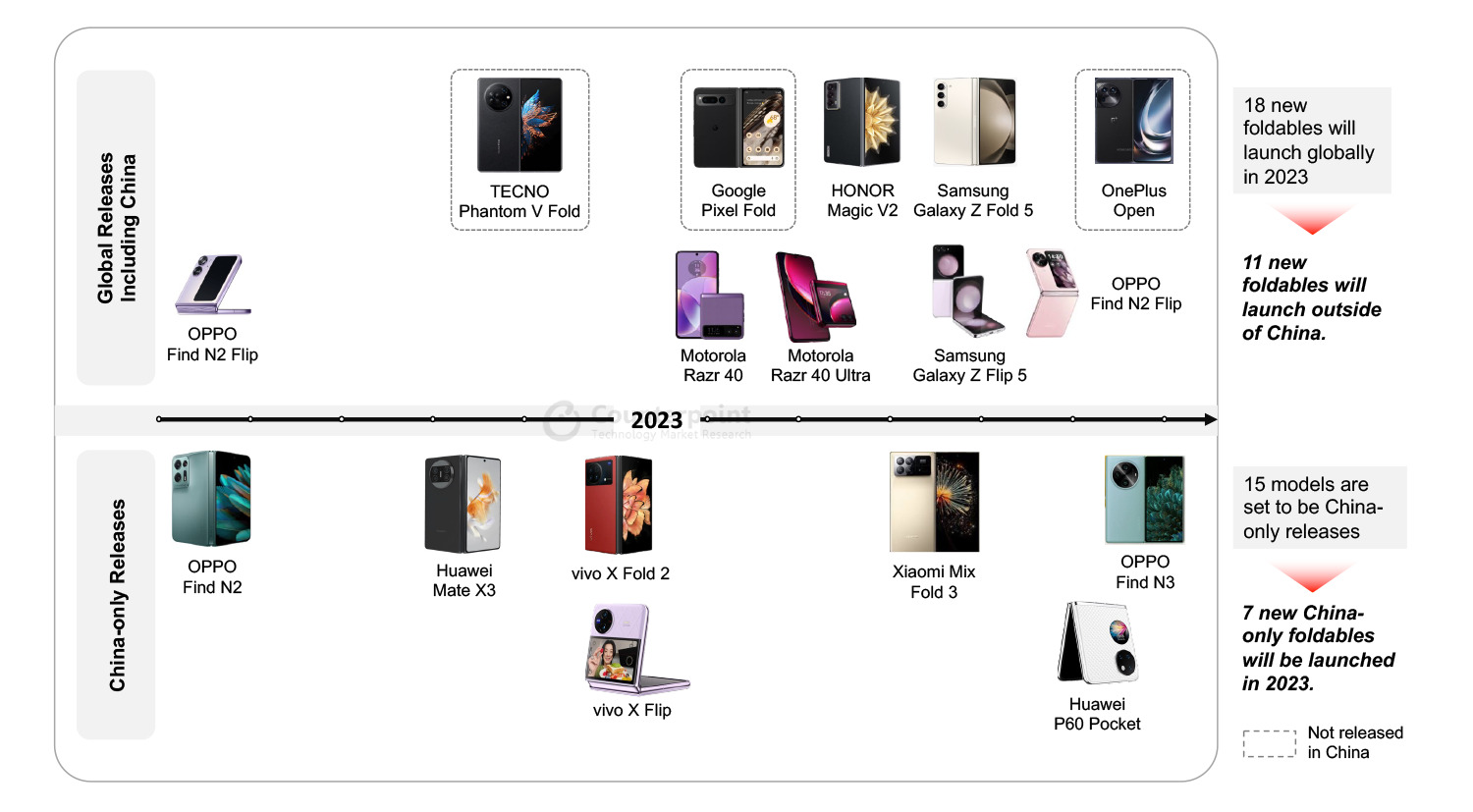

FoldableProduct Launch Status in 2023: Comparison of Global and Chinese Foldable Markets

The rapid growth of the Chinese foldable market is primarily attributed to the introduction of foldable products tailored for the Chinese market, coupled with a strong demand for these products among Chinese consumers. In Q2 2023, significant momentum is building for the continued growth of the foldable market. This surge was driven by the introduction of key products such as the Huawei Mate X3, vivo X Fold 2, and vivo X Flip, primarily targeting the Chinese foldable market. Additionally, the global (including China) launch of the Motorola Razr 40 and Razr 40 Ultra, further contributed to this growth trend. In Q2 2023, China saw the launch of five new foldable products tailored for its market, while the global market outside China only saw two foldable product launches during the same period.

Counterpoint Research Senior Analyst Jene Parksaid, “We believe that these frequent product launches (along with the marketing effects that accompany product launches) are changing Chinese consumers’ perception of foldable products. Consequently, Chinese consumers can access a variety of foldable products more easily and frequently than any other market in the world. The continuous release of various foldable products is recognized as one of the important reasons why the Chinese foldable market has continued to grow significantly compared to other markets.”

Global Foldable Smartphone Forecast,2023-2024

The global foldable smartphone market will undergo significant changes in H2 2023. Chinese manufacturers are expanding their presence internationally during this period, with notable releases including the HONOR Magic V2, OPPO Find N3 Flip, and the yet-to-be-named OnePlus foldable device. Notably, Samsung’s Galaxy Z Fold 5 and Galaxy Z Flip 5, considered to be some of the top-tier foldable offerings, were launched in August and are expected to capture a substantial market share in H2 2023.

Park补充说,“全球智能手机市场可折叠et to see significant growth in the H2 2023, driven by the expansion of Chinese manufacturers. Although Samsung’s market share may dip due to increased competition, we believe that it will be a natural result. However, competition among manufacturers usually has the effect of increasing the size of the market for the product. We believe that the era of the mass foldable phone is expected to start in 2024, mainly led by Samsung and Huawei with their entry-level foldables. Entry-level foldables are expected to be priced around $600 to $700, making them more accessible to consumers.”

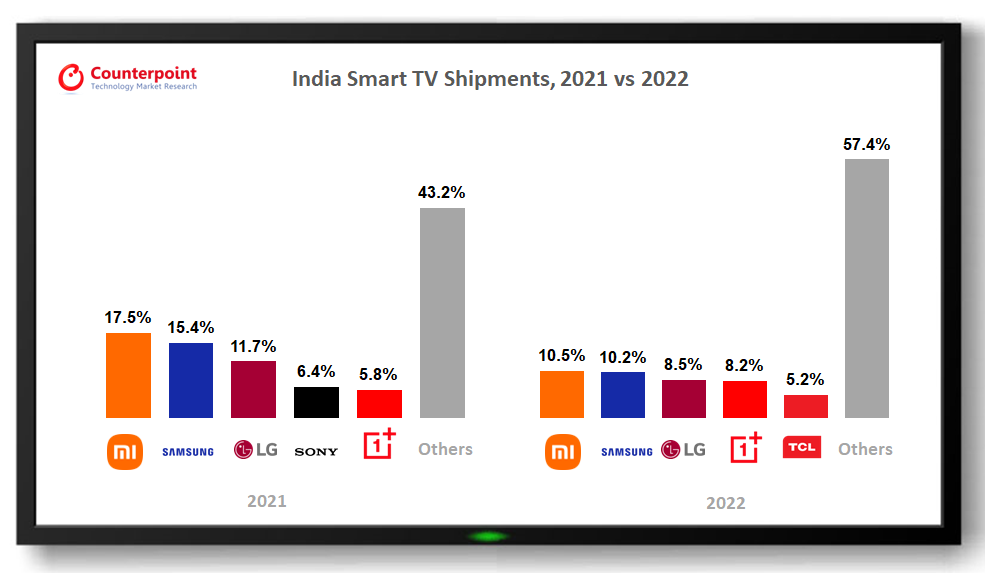

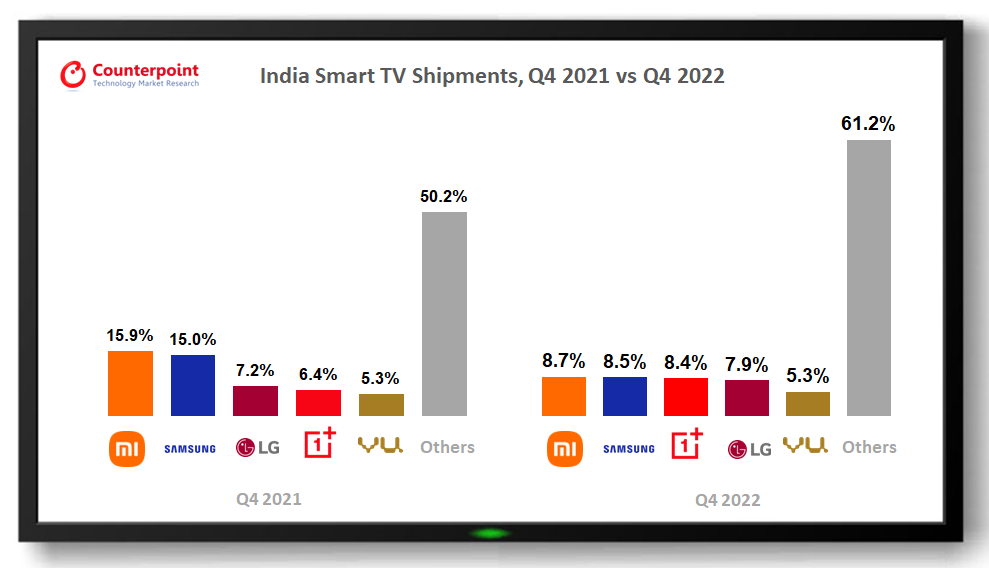

Source: India Smart TV Shipments Model Tracker, Q4 2022

Source: India Smart TV Shipments Model Tracker, Q4 2022 Source: India Smart TV Shipments Model Tracker, Q4 2022

Source: India Smart TV Shipments Model Tracker, Q4 2022

Source: India Hearables (Neckband) Shipments, Model Tracker, Q4 2022

Source: India Hearables (Neckband) Shipments, Model Tracker, Q4 2022