Counterpoint Research Weekly Newsletter

Counterpoint is attending the IoT Tech Expo Europe on 27thSeptember, 2023

Our Associate DirectorMohit Agrawalwill be attending theIoT Tech Expo Europe, 2023. You can schedule a meeting with him to discuss the latest trends in the technology, media and telecommunications sector and understand how our leadingresearchandservicescan help your business.

When:September 26th – September 27th

Where:Rai, Amsterdam

About the event:

IoT Tech Expo is the leading event for IoT, Digital Twins & Enterprise Transformation, IoT Security IoT Connectivity & Connected Devices, Smart Infrastructures & Automation, Data & Analytics and Edge Platforms. With a myriad of groundbreaking exhibits, expert-led discussions, and networking opportunities, the IoT Tech Expo is your gateway to discovering the IoT landscape.

Click here(or send us an email at contact@www.arena-ruc.com) to schedule a meeting with them.

Read more about the IoT Tech Expo Europe.

Global wireless and positioning technologies leader u-blox’s H1 2023 revenue rose 17% YoY to reach $364.3 million, primarily driven by successful design wins within the automotive andindustrialapplication sectors. However, gains were limited by a decline in consumer revenue.

During u-blox’s earnings call, CEO Stephan Zizala touched upon several important topics like significant design wins, prevailing macroeconomic challenges, and the company’s proactive management strategy for the future.

Macroeconomic Situation and Outlook

CEO:“In a softening macroeconomic and global semiconductor market environment, our order book for H2 2023 developed more slowly than initially anticipated. Mainly due to unfavorable FX rates and overstocking, we expect Q3 revenues and profitability to be weak, with an improvement in Q4.”

Our analyst take:“The IoT module industry is decelerating because of broader macroeconomic conditions and a softening semiconductor market. Key players in thecellularIoT module sector, including Quectel andTelit Cinterion, have witnessed a reduction in growth compared to H1 2022. However, during H1 2023, u-blox achieved significant double-digit expansion, despite significant constraints from the global semiconductor supply chain shortage.”

“However, u-blox is expected to experience a reduction in revenue in Q3 2023 as demand remained weak in the key North American region during H1 2023 and will likely remain sluggish in H2 2023. However, u-blox is optimistic about Q4.”

Management Strategy

Management Strategy

CEO:“While we must deal with cycle adaptation, I remain very confident about u-blox’s long-term outlook and growth trajectory, thanks to our strong structural growth drivers in automotive and industrial target applications. We are winning important new projects at leading customers. A large design win for automated driving ramping in 2026 and an innovative approach for satellite IoT connectivity are testimony to these future development prospects.”

Our analyst take:“The automotive industry is undergoing a significant transformation towardselectrificationand autonomy. This transition highlights the importance of connectivity andnavigation, emerging as crucial factors. u-blox stands out from other GNSS competitors due to its exceptional GNSS quality and centimeter-level precision in positioning.”

“Apart from its focus on GNSS and cellular technology, u-blox’s recent collaborations with satellite player Orbcomm leverage its strides toward present-day trends. The aim is to offer hybrid connectivity solutions (combining cellular and satellite capabilities) catering toagriculture、资产跟踪和海事应用,promising enhanced coverage and communication. However, u-blox is set to encounter intense competition from Quectel, Fibocom, and Telit Cinterion, as they have already introduced hybrid connectivity modules.” H1 2023 Highlights:

H1 2023 Highlights:

Conclusion

Given the macroeconomic challenges characterized by adverse shifts in FX rates and customer overstocking, u-blox’s market outlook for H2 2023 suggests a substantial deceleration. The rise in inventory levels is expected to lead to a decrease in profitability during Q3 2023, followed by a recovery in Q4 2023. However, the demand and requirements for semiconductor solutions, particularly in domains such as autonomous driving, asset tracking and industrial automation, are poised for substantial growth. u-blox remains strategically positioned to capitalize on this growth trend due to its strong expertise in positioning technology and wireless connectivity, which is expected to result in more design wins.

Counterpoint Research is pleased to announce its participation as a Media Partner inDTW23 Ignitewhere our Associate Director,Mohit Agrawal, will be present. You can schedule a meeting with him to discuss the latest trends in the IoT sector and understand how our leading research and services can help your business.

When:19-21 September, 2023

Where:Copenhagen

Click here(or send us an email at contact@www.arena-ruc.com) to schedule a meeting with him.

About the Event:

The telco and cloud worlds are colliding, driving rapid service innovation, upending traditional business models, and ushering in exciting new opportunities for growth. This groundbreaking transformation is being enabled by AI, autonomous networks and open digital architectures.

TM Forum is leading the industry in defining the building blocks for new operating models, impactful new partnerships, and advanced software platforms, unlocking the value of data to create nearly endless opportunities for players across the communications ecosystem.

DTW23 – Ignite will harness the collective ingenuity, innovation, and collaboration of global community to seize the opportunity and lead the communications industry to growth.

eSIMhas been a revolutionary technology driving the digital transformation of acquiring, accessing and consuming connectivity. OEMs are offering eSIM capability at the device level, while eSIM management solution vendors are offering software and services to mobile operators to connect these eSIM-capable devices to eSIMplatformssecurely.

The benefits of eSIMtechnologylie in enabling secure and seamless connectivity from chip to cloud, leading to an array of new business models for a broad range of stakeholders. This includes transforming mobile operators, making connected enterprises “fully digital”, thereby reducing overheads, customer acquisition costs and complexities, boosting customer experience, and driving newer business models connecting people and things at scale.

Demand for eSIM management solutions growing across different stakeholders

eSIM采用在不同的德维克增长迅速e categories and stakeholders. Mobile operators, enterprises, service providers and even platform players are sourcing innovativeeSIM数字化解决方案,扩大他们的服务进攻ring, maintain redundancy, plan hybrid deployments to comply with local regulations, or address specific subscriber or device segments. For example, players such as Uber are climbing on the eSIM bandwagon to drive newer business models and remove customer pain points by offering uninterrupted connectivity. Privatenetworks采用eSIM提供专用的连接吗to their employees and remotely manage the connected IoT assets within the enterprise premises.

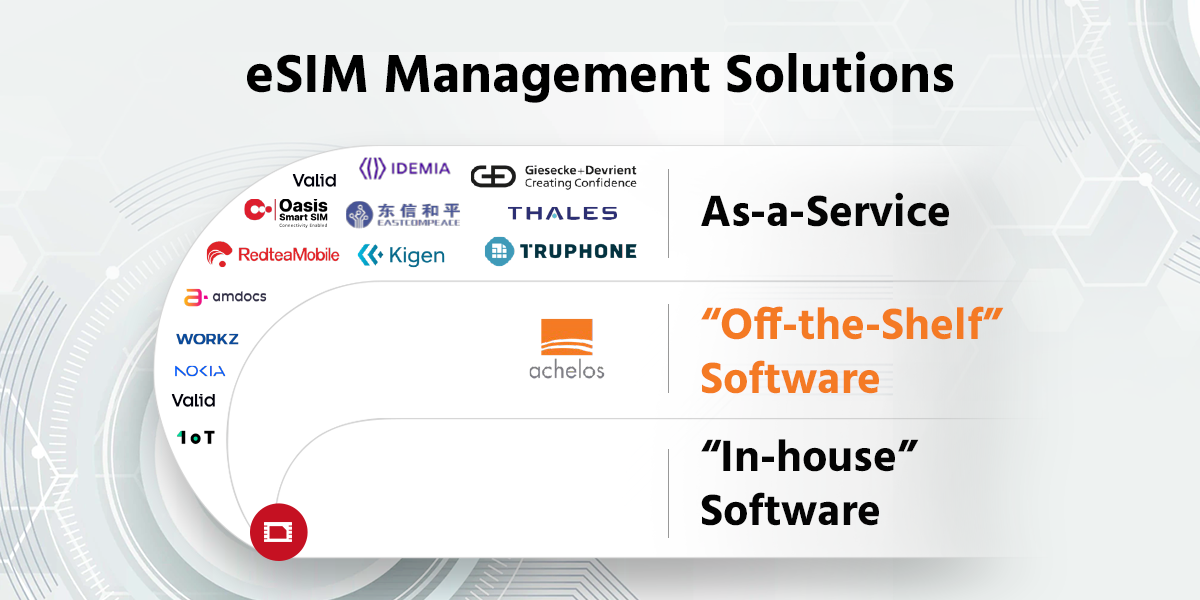

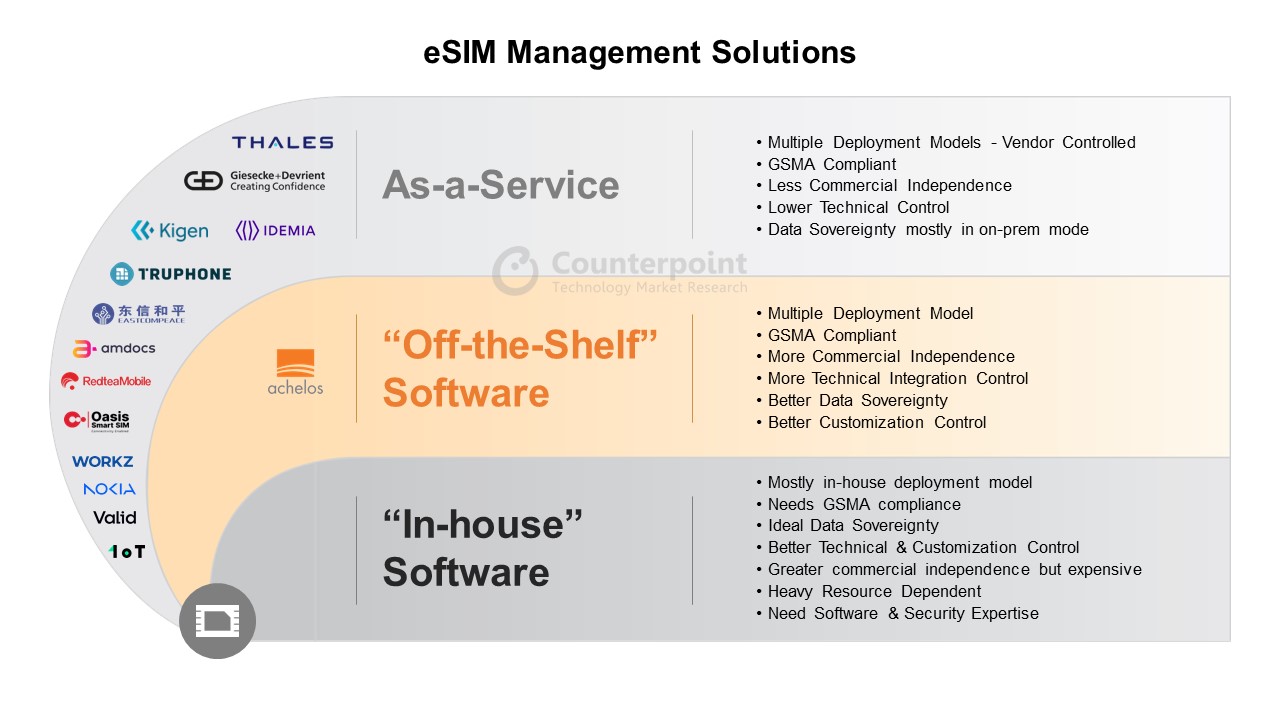

Different flavors of eSIM management solutions

The incumbent SIM vendors have been deliveringeSIMmanagement solutions in the form of ‘eSIM-Management-as-a-Service’ as an extension of their existing SIM business model, with the storage and processing of the subscriber data usually managed by the vendors at their own sites or now in collaboration with third-party cloud platforms such asAzure,AWSandGoogle Cloud. However, in such traditional deployments, the customers, especially other Service and Solution Providers have very limited commercial and technical control over the eSIM-based subscription management and customer data.

While this has been the established method of eSIM management solution delivery during the early years, which saw very limited eSIM usage, the competitive, geopolitical and regulatorylandscapeis changing. As eSIM technology has matured with a clear path ahead to replace the SIM card, operators as well as service and solution providers are increasingly either considering developing their own eSIM managementsoftwareor licensing it “off the shelf” and building a service on top of it.

Developing software and service “in-house” demands significant resources and domain knowledge, from software to standards to security. This makes the exercise incrementally expensive amid changing technologies and regulations. Therefore, using an off-the-shelfeSIMmanagement software is emerging as a popular solution, offering the best of both worlds, i.e. in-house and as-a-service eSIM management solutions.

achelos GmbH, an important player in the eSIM value chain, is positioned to satisfy the abovementioned needs. The company offers a suite of off-the-shelf GSMA-compliant eSIM RSP software solutions with bespoke features and extensions that perfectly align with the different requirements of a broad range of players, whether MNO, privatenetworkoperator, service provider or system integrator. They fill a gap in the booming eSIM RSP market, helping democratize the technology by offeringeSIMsolutions to potential stakeholders looking for eSIM provisioning capabilities integrated directly into their existing platforms or infrastructure at the software level rather than the traditional as-a-service solution.

In our discussions with multipleoperatorsand stakeholders, the key needs and challenges mentioned are related to having more control, independence over costs, technology, integration, and data to manage the number of connected devices and connectivity on their networks. This is where off-the-shelfeSIMmanagement software solutions are looking to help eliminate the significant cost, risks, resource requirements and compliance requirements. However, with the growing trend of sourcing multiple eSIM management and orchestration solutions, we believe the off-the-shelf software is a nice complement to the traditional as-a-service eSIM solutions, allowing these key stakeholders to strike the right balance between control and flexibility.

Firms such as achelos started as niche players, with a highly focussed “software-only” approach offering flexible, customizable off-the-shelf GSMA SAS-SM-complianteSIMremote SIM provisioning and orchestration software solutions. These complement or offer an alternative to traditional as-a-service solutions by promising proof points across the following key criteria:

Furthermore, having access to an end-to-end suite ofeSIMRSP and orchestration software and capabilities helps potential stakeholders co-develop distinctive features and services on top of the standards efficiently, with full control over security, scalability, and costs.

The key to success with this approach is in having a software partner which embraces open, lightweight, and advanced tools, frameworks and processes. This makes it seamless for the stakeholder’s IT team to co-create unique solutions built on industry standard-compliant and interoperable foundations.

Wrapping up

As the eSIM adoption rises across key stakeholders beyond mobile operators, there are significant opportunities for the vendors providing eSIM solutions in different forms. Different stakeholders have different needs, influenced by their digital transformation journeys, regulations, and need for redundancy or control over the solution and services attached to it.

As a result, we are seeing growing need for off-the-shelf eSIM solutions where some stakeholders want greater control, commercial independence, and sovereignty of the platform alongside the traditional ‘eSIM-Management-as-a-Service’ solutions. Players such as achelos are well positioned to complement and expand the eSIM solution provider ecosystem for the different key stakeholders in their eSIM transformation journey.

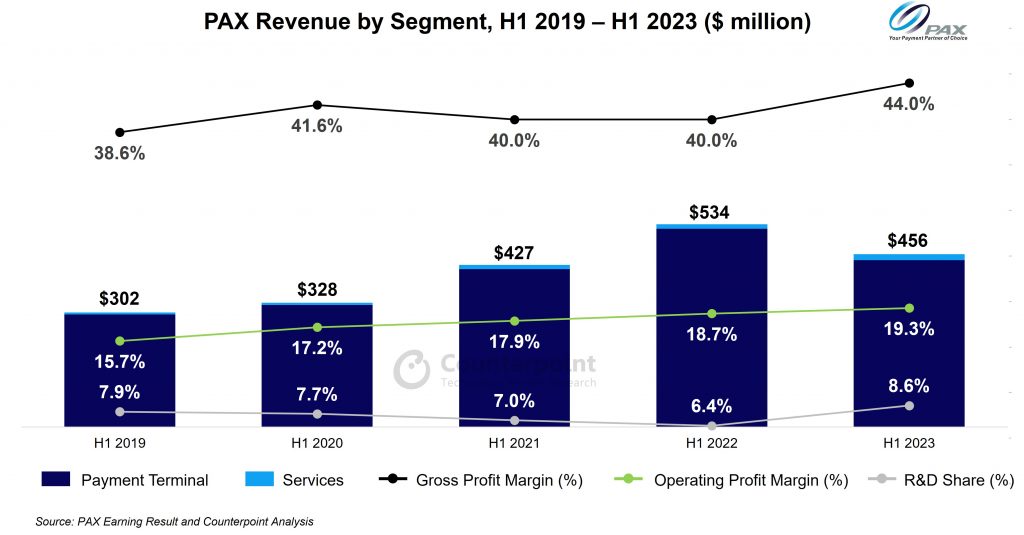

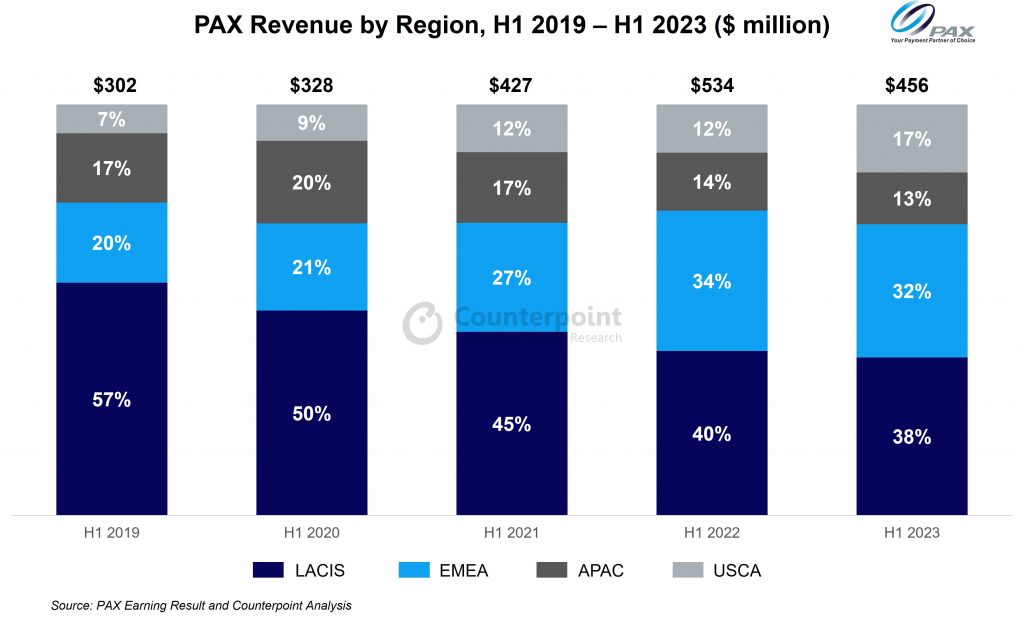

PAX Global Technology’s H1 2023 revenue fell 14.7% YoY to$456 million, as the company’s electronic payment terminal business was constrained by slowing global economic growth and high-interest rates. Meanwhile, revenue from itspaymentterminal-related services segment surged 35.6% YoY during the period, mainly due to the growth in revenue generated from the Software as a Service (SaaS) solutions, maintenance, and installation services.

During PAX’s earnings call, CEO Jack Lu discussed a few key topics including the adoption of Android smart solutions, macroeconomic challenges and forward-going management strategies.

Macroeconomic Situation and Payment Trend

CEO Jack Lu:“Despite short-term macroeconomic challenges, the proliferation of electronic payments continues to be a significant and ongoing global trend. The continued advancement of payment technology, along with growing consumer appetite for convenient and secure payment options, as well as the cashless initiatives promoted by governments worldwide, have continued to open up new opportunities for PAX solutions.”

Our analyst take:“PAX’s strong portfolio across different sectors, combined with its POS terminal management platform, offers a one-stop solution for businesses. PAX is helping businesses scale their operations by providing seamless payment options. The company has strategically set up a dedicated division called Zolon to expand businessInternetof Things (BIoT). PAX’s service segment revenue is expected to receive a further boost from its BIoT solutions, including SaaS (e.g. MAXSTORE) and commercial POS solutions (e.g. Elys). The enterprise IoT solution will mainly target cloud-based services for businesses to secure recurring revenues.”

Management Strategy

CEO Jack Lu:“展望未来,全球工业contin付款ues to embrace a prosperous future. PAX will continue to explore more potential business opportunities by acquiring banks, PSPs and distribution partners, offering future-oriented payment solutions for merchants and consumers across the globe.”

Our analyst take:“The payment industry has undergone fundamental changes in recent years, with a surge in the global acceptance of electronic payment options among consumers and merchants. Governments and financial institutions worldwide now place greater emphasis on their electronic payment acceptance infrastructure and are aiming to implement a more efficient and transparent financial ecosystem. The huge value and potential of the payment terminal market will be further unlocked going forward. PAX’s ongoing strategy is aligned to capture this huge market opportunity and we believe its expanding global presence and increasing investment in R&D will help it drive innovation and increase market share.”

Counterpoint Research will be joiningIndustry of things World Europeas Media Partners. As part of this collaboration, our Associate DirectorMohit Agrawalwill be speaking about security and privacy considerations when managing IoT connectivity, and how do CMPs assist in enforcing security measures. You can schedule a meeting with him to discuss the latest trends in the IoT sector and understand how our leading research and services can help your business.

Topic:

What are the security and privacy considerations when managing IoT connectivity, and how do CMPs assist in enforcing security measures?

When:18th Sept 2023 | Monday

Time:04:30 pm – 05:30 pm GMT+2

Where:Titanic Chaussee, Berlin

Click here(or send us an email at contact@www.arena-ruc.com) to schedule a meeting with him.

About the Event:

At the Industry of Things World Europe more than 450 experts, decision-makers and providers from the industry will discuss use cases and business strategies from the Industry 4.0 universe. Latest technological trends, opportunities and risks as well as direct practical examples from the manufacturing industry – the Industry of Things World is designed to evaluate and discuss your technology strategy for a scalable, secure and efficient IIoT implementation around your production & your products. Don’t miss the opportunity to meet all relevant IIoT stakeholders under one roof. We look forward to welcoming you in Berlin! Your Industry of Things World Team.

Read more about the Industry of things World Europe.

The Internet of Things (IoT) has revolutionized the way we interact with the world around us. From smart homes to industrial automation,IoTdevices are playing a pivotal role in enhancing efficiency and convenience. However, the growing IoT ecosystem has brought forth its own set of challenges. One such challenge is permanent roaming, a phenomenon that has gained significance due to the global nature ofIoTdeployments. In this blog, we will delve into the concept of permanent roaming for IoT, discuss the challenges it poses, and explore potential solutions.

Understanding permanent roaming for IoT

Permanent roaming in the context of IoT refers to the practice of utilizingcellularconnectivity across different geographical locations on a consistent basis. Unlike traditional mobile phones, which might roam temporarily when users travel, IoT devices often need to maintain connectivity across various regions for extended periods. This is a fundamental requirement for IoT devices used in logistics, remote monitoring,agricultureand other activities.

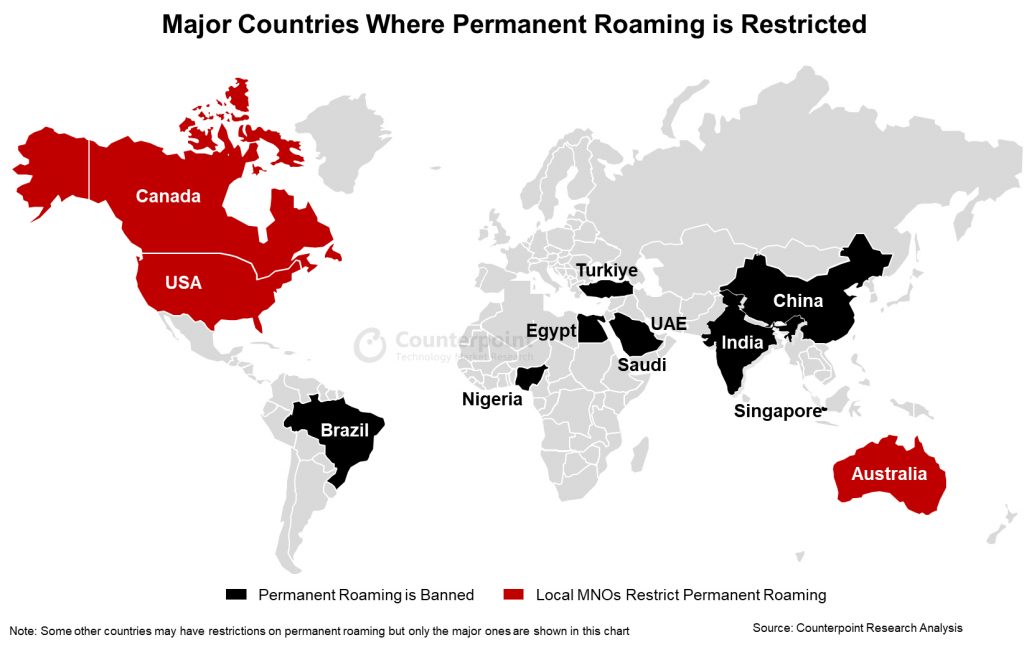

While many countries allow permanent roaming without significant constraints, some big countries have implemented limitations on this practice. The map below shows countries where permanent roaming is banned and those where local carriers have imposed restrictions.

Countries that prohibit permanent roaming includeIndia, China, Brazil, Saudi Arabia, Egypt, Nigeria, Turkiye (formerly Turkey), UAE and Singapore. Besides, mobile operators in the US, Canada and Australia have imposed restrictions on permanent roaming within theirnetworks, effectively imposing a ban on this practice in these countries. Remarkably, these 12 countries collectively cover more than 50% of the world’s population and account for well over three-quarters of the IoT market.

Challenges posed byrestrictions onpermanent roaming

物联网设备通常部署在全球scale, leading to a complex scenario where these devices are connected to multiple mobile network operators (MNOs) across different countries. Imagine an electric car company that markets its vehicles across various regions. In countries where permanent roaming is not allowed, the company must procure local connectivity. This situation presents a host of challenges that ripple through the operational landscape:

Solutionsforpermanent roaming

There are multiple ways to circumvent the problems associated with permanent roaming. However, it is critical to select a managed service provider that has tie-ups with local MNOs/MVNOs. Alternatively, direct MNO relationships can be managed using aggregator connectivity management platforms.

eSIM (embedded SIM):eSIMtechnology is a game changer in the IoT landscape. It enables devices to have programmable SIM cards that can be remotely provisioned over the air. With eSIM, IoT devices can switch between different MNOs without requiring a physical SIM card replacement, thus simplifying the management of connectivity. UsingeSIM,可以在本地配置文件之间切换and multiple roaming profiles every 90 days to avoid permanent roaming. Many managed service providers have this workaround to avoid permanent roaming. The new IoT eSIM specifications will further simplify the provisioning and orchestration of connectivity.

Multi-IMSI (International Mobile Subscriber Identity):Multi-IMSI solutions allow a single physical SIM card to have multiple IMSIs from different MNOs. This enables the device to seamlessly switch between networks while maintaining a single SIM card. By intelligently selecting the optimal IMSI based on factors like network quality and cost, Multi-IMSI solutions optimize connectivity and reduce operational complexities. However, the managed service provider needs to have a local presence or tie-ups.

Aggregator platforms:Aggregator connectivity management platforms (CMPs) act as intermediaries between IoT device owners and various MNOs. These platforms offer a unified interface for managing connectivity, provisioning,billing, and reporting across multiple networks. By consolidating these tasks, aggregator platforms simplify the management of permanent roaming for IoT devices. A new set of aggregator CMPs like IOTM and ConnectedYou is targeting enterprises instead of carriers to solve the problem of managing multiple networks.

Some of the aggregator platforms offer Dynamic Network Selection Algorithms. Smart algorithms can be implemented in IoT devices to dynamically select the most suitable network based on parameters such as signal strength, latency and cost.

Conclusion

With the IoT landscape continuing to expand globally, the challenges associated with permanent roaming are becoming more pronounced. However, with the advent of innovative solutions such aseSIM, Multi-IMSI, aggregator platforms, and dynamic network selection algorithms, these challenges can be effectively mitigated. These solutions not only simplify the management of connectivity but also enhance cost-effectiveness and operational efficiency for IoT deployments. The key is to find the right managed services partner, which has a platform that enables easy management of connectivity.

John Deere, based in Moline, Illinois, is one of the world’s leading manufacturers ofagriculturaland construction machinery. Over the years, John Deere has undergone a remarkable transformation, evolving into a technology-driven company that harnesses cutting-edge advancements like machine learning,cloudcomputing, and automation to optimize the performance of its agricultural and constructionmachinery. The company has earned a stellar reputation forinnovationand excellence, reaching net sales and revenue of $52.6 billion in 2022.

John Deere is trying to solve a major future problem. By 2050, the size of the world’s population will exceed 10 billion, increasing global food demand by around 50%. The company’s goal is to work towards a fully autonomous production system that will be capable of taking care of crops at the individual plant level, by giving each plant proper nutrients, water, soil and more. This would allow farmers to maximize both yield and production of crops.

John Deere had its first tech summit in Austin, Texas, at the beginning of April to showcase its latest agricultural and construction innovations andtechnologies. The analyst community was able to witness its latest See and Spray technology which enables farmers to pinpoint weeds usingcomputer视觉和机器学习瑞士并消除它们ftly. John Deere also demonstrated its new ExactShot technology that will enable farmers to plant seeds and fertilize only the area right around the seed, which will save up to 60% in fertilizer, thus reducing costs for the farmer while also significantly limiting the environmental harm. All these latest technologies rely on John Deere’s “tech stack” that the company has built over the years. From GPS to field mapping that allow tractors to drive in straight lines and even take turnsautonomously, to its connectivity anddigitaltwin solutions for remote monitoring.

In 2022, John Deere launched its Leap Ambitions Framework to unlock a $150-billion incremental opportunity and to measure its SmartIndustrialStrategy – focusing on combining smart technology innovation with the company’s legacy ofmanufacturingexcellence.

The company’sstrategyinvolves increasing the number of acres that are connected via John Deere Operation Center, an online farm management system (farms using this system are known as engaged acres), to 500 million by 2026 from 329 million in 2022, with 75% of engaged acressustainablyengaged by 2030. In terms of its equipment strategy, the company will also ensure that 100% of new small agriculturalequipment启用连接,提供吗electronicoptions, and deliver a fully autonomous battery-poweredelectricagricultural tractor by 2026. Lastly, John Deere’s construction and forestry segment will deliver 20+ electric and hybrid-electric product models and increase the adoption of various technologies by 2026.

Connectivityplays a major role in John Deere’s goals and the company still has an RFP out for a satellite provider that can provide it with 5Mbps download and upload speeds with under 500ms latency. This would be a fallback solution in areas where cellular connectivity is weak or has dead spots and is critical for the company to ensure as all of its autonomoussolutionsneed connectivity to run.

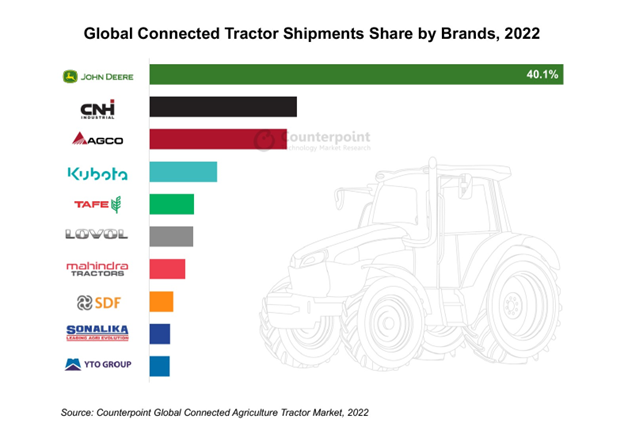

John Deere is a prominent player in the global tractor market. In fact, the company holds a leading position in the connected agriculture space.According to the latestConnected Agriculture trackerby Counterpoint Research, John Deere’s 40% shipment share was the largest in the connected tractors market as of the end of 2022.

John Deere’s competitive advantage rests on a foundation of innovation, connectivity and sustainability. The company’s rapidly growing connected machine portfolio, strong focus on automation and EVs, expanding electric product lineup, and an unparalleled dealer network make it a leader in an increasingly technology-driven agricultural landscape.

John Deere’s vast network of over 2,000 dealer locations across the US and Canada solidifies its competitive edge. With separate dealer groups catering to agriculture and construction/forestry, the company ensures tailored expertise for each sector. Furthermore, John Deere’s commitment to retrofit services and product upgrades demonstrates the company’s dedication to maximizing the longevity and value of its equipment. The substantial contribution of retrofits and upgrades, amounting to 18% of total equipment sales in 2022, highlights the company’s innovative approach to customer satisfaction.

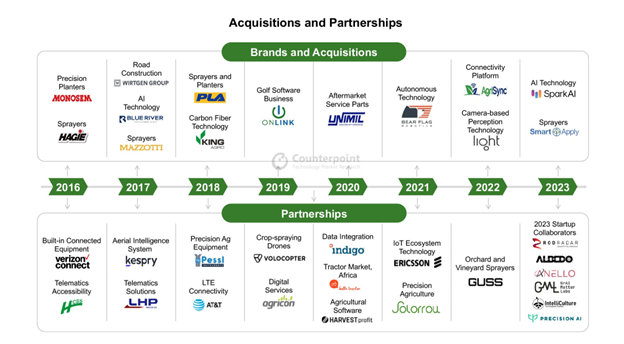

Overall, John Deere is making strides to further agricultural technology in a very steady and strategic manner. The company has been making the right investments. It now has more than 3,400 engineers, and has acquired companies like Blue River and Spark AI, and most recently Smart Apply, to help scale its tech solutions.

Below, we have shared some of John Deere’s most notable partnerships and brand acquisitions, which all synch up strongly with the company’s overall product development and strategy over time:

John Deere’s strength lies in its ability to execute diligently as it is the market share leader in the agriculture space, moving the market along at a pace that is comfortable for most customers. We expect John Deere to continue education efforts through its upcoming tech summits or future CES-level type sponsorships as it tries to establish itself as a household name in the tech space. John Deere has ambitious plans, but it has a strong roadmap to deliver on its leap ambitions and strategy. The company’s partnerships and brand acquisitions through the years further emphasize its commitment to innovation and growth.

Over the last few years, the demand for seamless connectivity has grown exponentially in theautomotivesector. With the rise ofconnectedcars and the integration of various IoT devices, the automotive sector faces the challenge of managing and monetizing connectivity effectively. This is where connectivity management platforms (CMPs) play a crucial role, and among the key components that contribute to their success, split billing stands out as a pivotal feature.

What is a Connectivity Management Platform (CMP)?

Before delving into split billing, let’s understand what CMPs are and how they have evolved. CMPs are centralized systems that facilitate the management, control and monetization of data connectivity services in connected vehicles. These platforms empower automotive manufacturers and service providers to offer innovative connected services to drivers and passengers while efficiently managing data consumption.

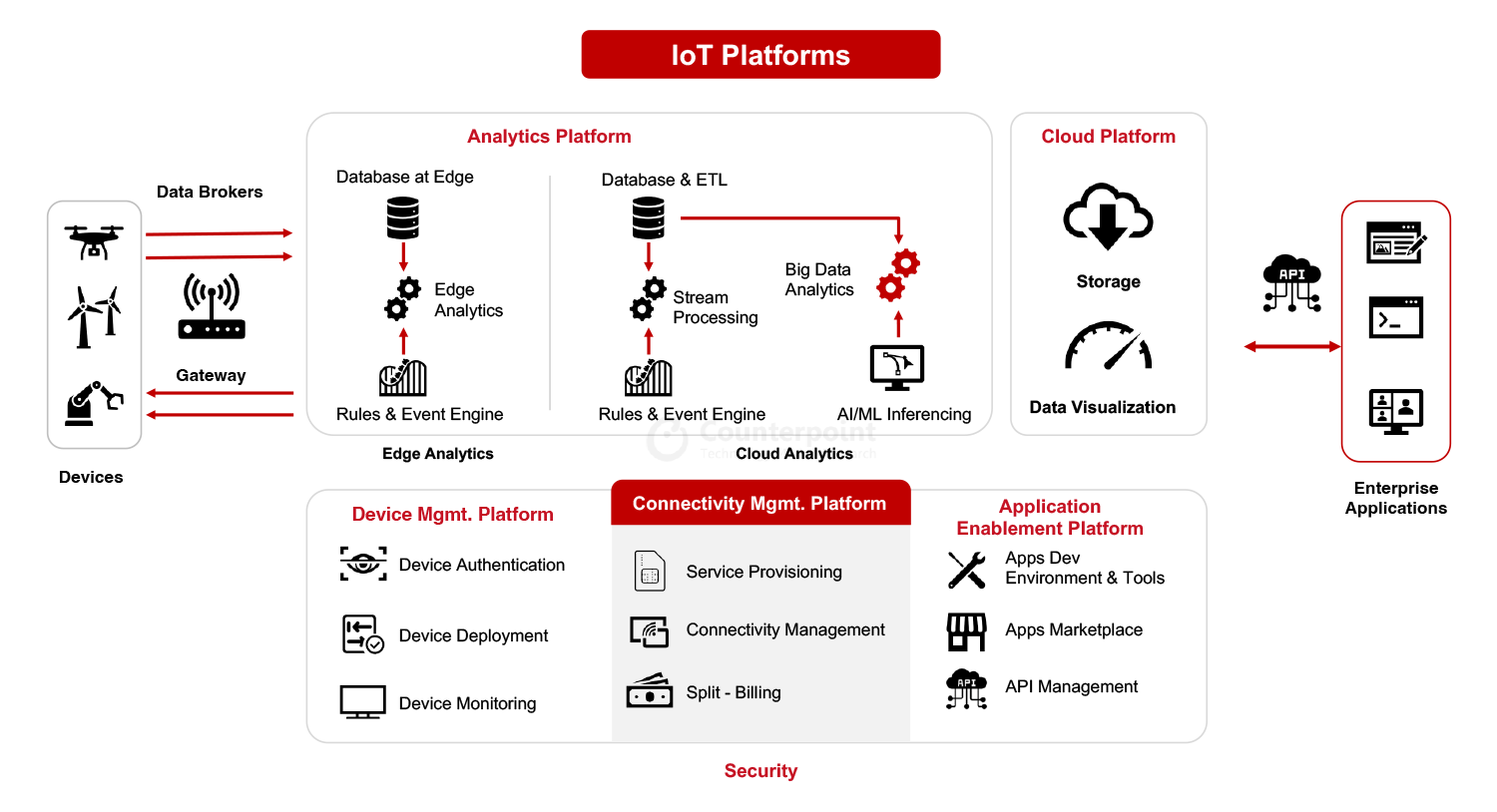

As seen in the chart below, CMP is a component of widerIoTplatforms that include a Device Management Platform (DMP), Analytics Platform and Applications Enablement Platform (AEP). Together, these platforms power large-scale IoT applications.

Many connectivity management platforms integrate split billing functionality to cater to the diverse billing requirements of multiple stakeholders in theIoTecosystem and the automotive industry in particular. Currently, there are many CMPs, such as Cisco, Aeris, CubicTelecomand Wireless Logic, which have the capability to provide split billing.

Challenges in Connectivity Managementfor Automotive:

在过去,predominantl车辆连接y limited to basic telematics services and hence the split billing was not so much of a concern. However, the rapid advancement oftechnologyhas transformed the automotive landscape. Today, connected cars are equipped with sophisticated infotainment systems, navigation tools, real-time diagnostics, and a multitude of sensors that enhance safety, convenience, and the overall driving experience. In the future, the need for connectivity in cars would be very different with autonomous vehicles and V2X communication.

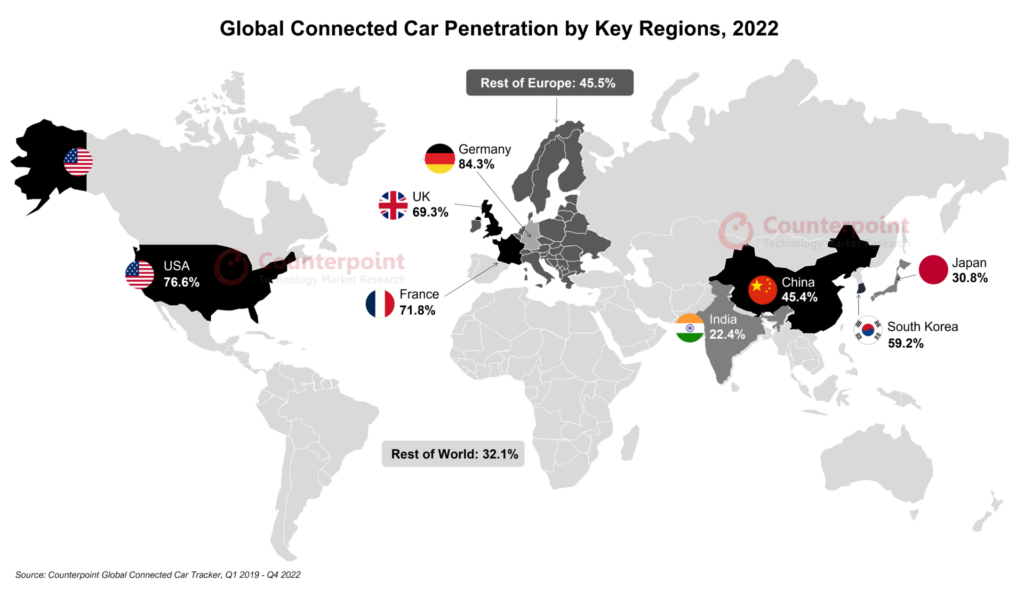

2022 was a pivotal year for connected cars. According to Counterpoint Research analysis, connected cars surpassed 50% of car sales for the first time with the US, Europe and China as the key markets.

As vehicles become more connected, the complexity of managing connectivity increases. This gives rise to various difficulties for the automotive, including:

The Role of Split Billing:

In the context of Internet of Things (IoT) connectivity forautomobiles, split billing refers to a billing mechanism that allows for the separation and allocation of data usage costs between different entities involved in theIoTecosystem. This concept is particularly relevant when multiple parties share the data consumption and connectivity expenses of an IoT-enabled vehicle.

In an automobile scenario, various components may require internet connectivity for different purposes:

Split billing allows the data usage and associated costs to be divided among these parties based on their usage patterns and requirements. For example:

This approach helps create a fair and transparent billing structure, where each stakeholder pays only for the services they consume, rather than a single entity covering all data costs.

What does split billing mean for CMPs?

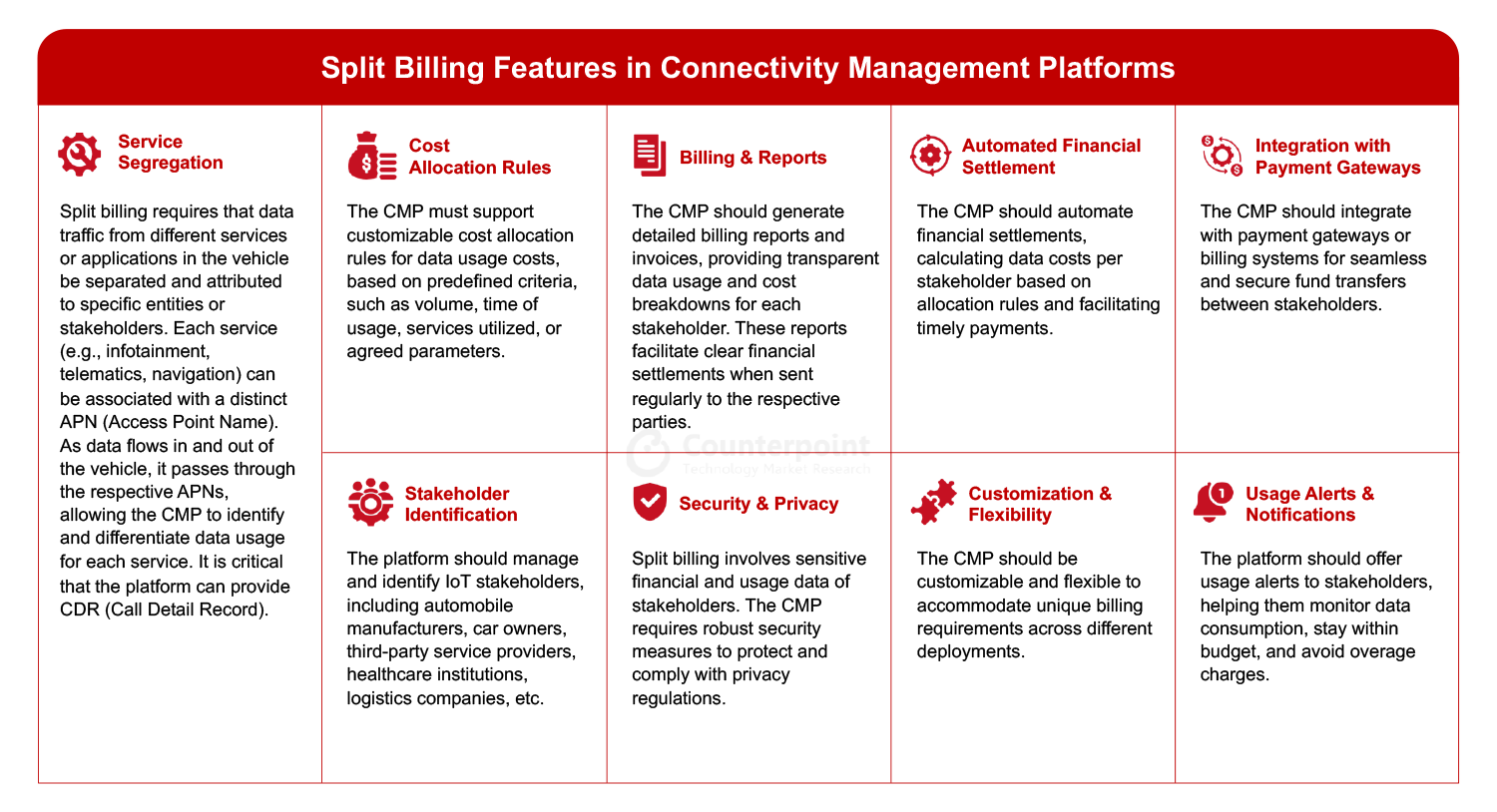

For CMPs, split billing refers to a specific functionality or feature that allows the platform to support the allocation and management of data usage costs among multiple parties or stakeholders in theIoTecosystem. This functionality enables CMPs to handle billing and cost-sharing for IoT connectivity services efficiently. The chart below summaries the key aspects and functionalities related to split billing in CMPs. Overall, split billing functionality in a CMP streamlines the financial aspects of IoT deployments, encourages collaboration between different entities, and ensures that each party pays only for the specific services they utilize, making IoT implementations more transparent and cost-effective.

Overall, split billing functionality in a CMP streamlines the financial aspects of IoT deployments, encourages collaboration between different entities, and ensures that each party pays only for the specific services they utilize, making IoT implementations more transparent and cost-effective.

In conclusion, the evolution of CMPs for split billing has been driven by the increasing complexity of connected services, advancements in data analytics and technology, and the growing demands for personalized billing and improved customer experiences. As the IoT landscape continues to evolve, CMPs will play an increasingly vital role in managing data connectivity and enabling fair and accurate billing for the multitude of services offered in the connected world.