Counterpoint Quarterly

IoT Q2 2023

Published Date: 16th August 2023

Overview:This insightful report covers key trends in Smart Home Security Cameras, Cellular IoT Connections, AI-driven transformations, revenue dynamics, and emerging technologies. It offers concise, valuable insights for informed decision-making across diverse industries.

Sign up with your corporate email below to get access to the exclusive report. We will send the report straight to your inbox.

Table of contents:

- Global Cellular IoT Connections to Cross 6 Billion in 2030

- AI & API Accelerating Digital Transformation Across Verticals

- Netgear Q1 2023: Revenue Stutters as Inventory Correction Set to Spill Into Q2

- India’s Smart Home Security Camera Shipments Up 48% YoY in Q1 2023

- Global Connected Agriculture Node Shipments to Reach 187 Million Units by 2030

- Global Connected Construction Machine Shipments Grew 6.7% YoY in 2022

- PAX Revenues Cross $1 Billion in 2022; SmartPOS Adoption Supports Growth

Automotive Q2 2023

Published Date: 8th August 2023

Overview:This comprehensive analysis covers global EV trends, connected car sales, regional market dynamics, key players, emerging technologies, pricing strategies, and market growth. It also provides concise, insightful automotive trends for informed decision-making.

Sign up with your corporate email below to get access to the exclusive report. We will send the report straight to your inbox.

Table of contents:

- China EV Sales Defy Subsidy Cuts, Maintain Strong Growth in Q1 2023

- AI Needs to Reside in the Vehicle to Work Well

- US EV Sales Up 79% YoY in Q1 2023 Helped by Tax Credit Subsidy

- Global Passenger Electric Vehicle Market Share, Q2 2021 – Q1 2023

- Global EV Sales Up 32% YoY in Q1 2023 Driven by Price War

- Google Puts Auto Expansion in Top Gear

- Huawei ADS 2.0: A Promising New ADAS in Market

- Connected Car Sales Grew 12% YoY in 2022 With Volkswagen Group in Lead

- Price Cuts Boost Tesla Revenue in Q1, Profit Slumps Compared to 2022

- EV Sales in US up 54.5% YoY in 2022; Tesla Market Share at 50.5%

Wearables Q2 2032

Published Date: 24th July 2023

Overview:This is a comprehensive analysis of the latest developments in the wearables industry covering product reviews, market trends, and regional insights. It also includes the Sony WH-CH720N headphones, Apple’s Vision Pro, Meta’s Quest 3, smartwatch markets in China and India, MediaTek’s expansion, AR/VR value chain in China, Apple’s device ecosystem, and wearable innovations at MWC Barcelona 2023.

Sign up with your corporate email below to get access to the exclusive report. We will send the report straight to your inbox.

Table of contents:

- Sony WH-CH720N Review: Good Sound, Effective ANC, Long Battery Life

- Vision Pro, iOS 17, New Macs: Here’s Everything Announced at Apple WWDC 2023

- Apple Thinking About the Next Decade & Beyond with Vision Pro Announcement

- Quest 3 to Help Maintain Meta’s XR Dominance Even as Apple Entry Looms

- China’s Q1 2023 Smartwatch Shipments Drop to Lowest in 12 Quarters

- India Smartwatch Market’s 121% YoY Growth Restricts Global Decline to 1.5% in Q1 2023

- Global Outsourced Manufacturing Smartwatch Shipments Rose 15% YoY in H2 2022

- MediaTek Analyst Summit: Focus on Widening Portfolio, Growth in US and Europe

- Analysis of the AR/VR Value Chain in China: Is China at the forefront of the industry?

- Apple’s Device Ecosystem Multiplies its Brand Strength and Stickiness

- Wearable Innovations Stand out at MWC Barcelona, 2023

Semiconductors Q2 2023

Published Date: 24th July 2023

Overview:This is a comprehensive analysis of the industry, encompassing topics like international policies affecting self-reliance plans, regulatory acts in the US, earnings of major players, semiconductor manufacturing in India, emerging technologies in the market, and key events shaping the industry’s future. It provides valuable insights for stakeholders seeking a concise overview of the semiconductor landscape.

Sign up with your corporate email below to get access to the exclusive report. We will send the report straight to your inbox.

![]()

Exhaustive table of contents below:

- Will Japan Curbs Hit China Semiconductor Self-reliance Plans?

- Will CHIPS Act Achieve US Goals?

- UMC Q1 2023 Earnings: Weak Cyclical Recovery But 28nm Remains Resilient

- STMicro Beats Q1 2023 Earnings Expectations Despite Chip Shortages

- India’s Promising Semiconductor Manufacturing Trajectory

- New Layer-1 Accelerator Cards Set To Boost Open RAN Market – Or Create More Lock-In?

- MediaTek Analyst Summit: Focus on Widening Portfolio, Growth in US and Europe

- Neil Shah Joins as Vice-Chairman for IC 50 Committee

- Arm Platform TCS23 Sets Benchmark to Power Advanced, Holistic Mobile Computing Experiences

- BoM Analysis: Samsung Galaxy S23 Ultra Costs $469 to Make

- COMPUTEX 2023: AI Solutions, Capabilities in Focus

- Currency Fluctuation Limits Global Wafer Fab Equipment Revenue Growth to 9% YoY in 2022

Note: The report comprises of carefully selected aggregated insights published by our analysts during Q2 2023. The data presented herein corresponds to the Q1 2023.

Smartphones Q2 2023

Published Date: 12th July 2023

Overview:This report provides a comprehensive analysis of the global smartphone market, covering various topics and regions gathered throughout Q2. It includes insights into consumer preferences, market trends, and key players. The report offers a broad perspective on the industry, exploring topics such as foldable smartphones, market strategies, display technologies, reviews of smartphone models and much more. This report serves as a valuable resource for industry stakeholders seeking a concise overview of the global smartphone market.

Sign up with your corporate email below to get access to the exclusive report. We will send the report straight to your inbox.

Exhaustive table of contents below:

- Survey: 28% of US Smartphone Users Highly Likely to Opt for a Foldable as Next Purchase

- OPPO’s LATAM Strategy is a Success So Far But Challenges Ahead

- China Premium Smartphone Market Outlook: Bright Future Ahead

- Smartphone Displays Moving Towards ‘Brighter’ Future

- OPPO Find X6 Pro Review: A Photographer’s Delight

- Refurbished iPhone Volumes Grew 16% YoY Globally in 2022

- China Smartphone Sales Fall 5% YoY in Q1 2023; Apple on Top With Highest Sales Share

- India Smartphone Market Records Highest Ever Q1 Decline of 19%, 5G Smartphones Contribution at 43%

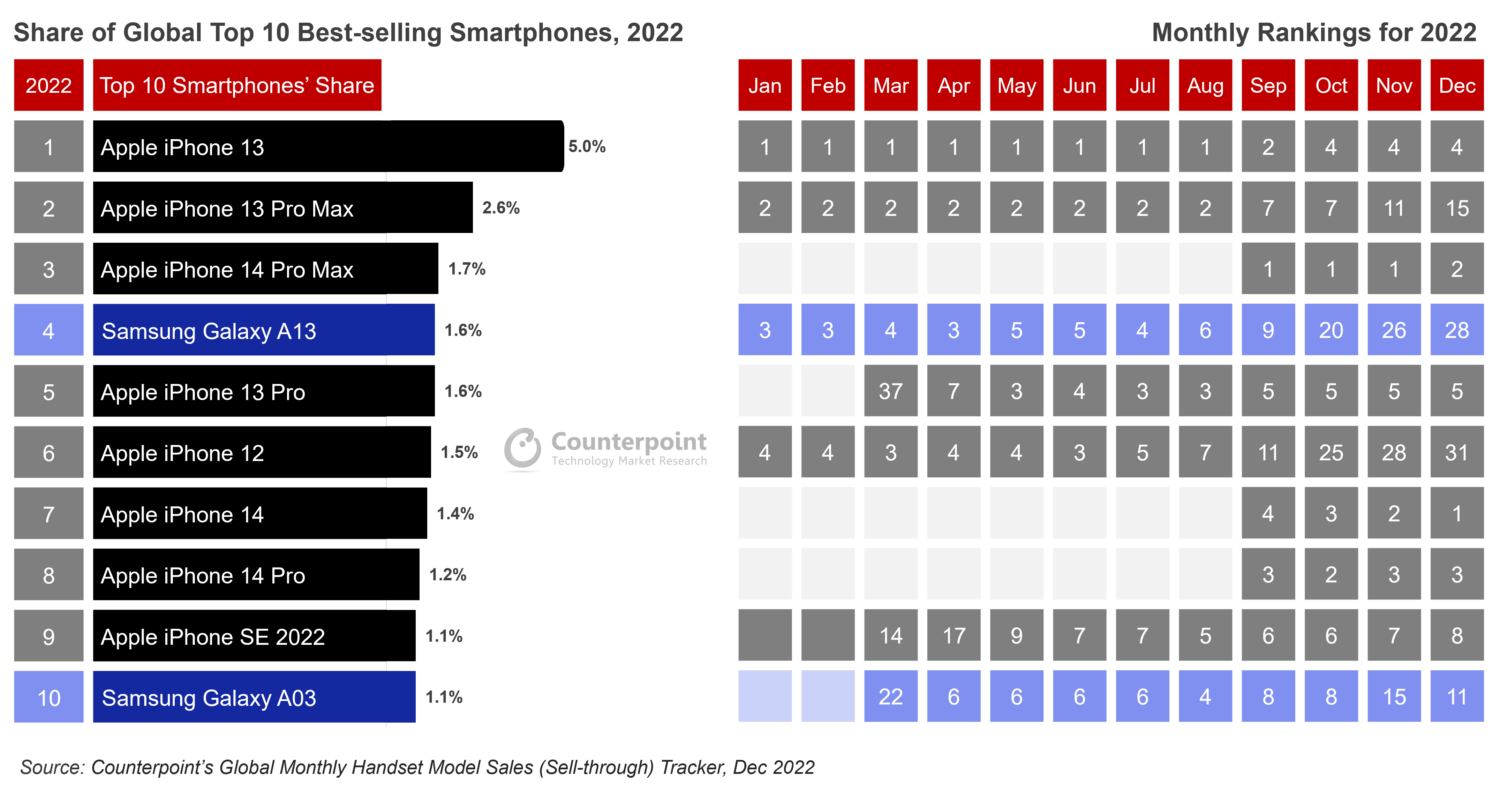

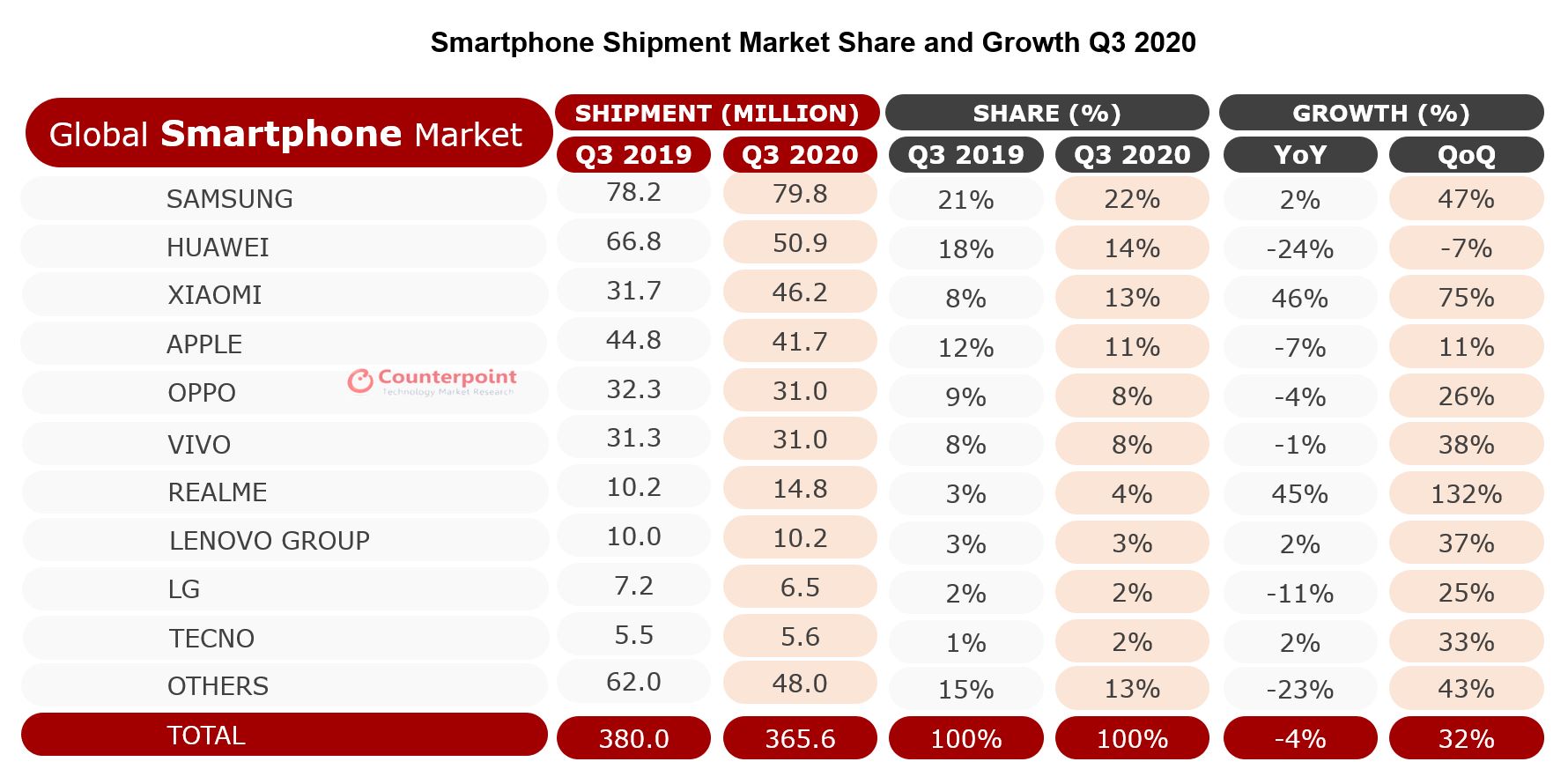

- Global Smartphone Market Declines 14% YoY in Q1 2023; Apple Records Highest-Ever Q1 Share

- Survey: 72% of Smartphone Users in India Experience Low-battery Anxiety

- US Smartphone Shipments Decline in Q1 2023 Amid High Inflation, Inventory Correction; Apple Share Up

- Europe Smartphone Shipments Dropped 23% YoY in Q1 2023; Market at Lowest Levels for Over a Decade

- MEA Smartphone Shipments Fall to Lowest Q1 Level Since 2016

- LATAM Smartphone Shipments Fall 9.9% YoY in Q1 2023, But Most Leading Brands’ Volume, Share Increase

- Apple Shines in a Declining Southeast Asia Smartphone Market

- Transsion Updates – Full Year 2022

- Festive Season Restricts Decline in Indonesia Smartphone Shipments to 8.1% YoY in Q1 2023

- Colombia’s Q1 2023 Smartphone Shipments Hit Three-year Low

- Vietnam’s Smartphone Market Drops 30% in Q1 2023, Biggest Q1 Decline Ever

- Philippines Smartphone Shipments Fall 9% YoY in Q1 2023; realme Leads

- Strategy Trumps Sentiment as OEMs Skip Canada for New Feature Launches

- Apple Thinking About the Next Decade & Beyond with Vision Pro Announcement

- HONOR Bucks Market Trend With Fast Overseas Expansion

- Share of OLED Smartphones at Record High

- China’s <$150 Smartphone Market Posts Surprising Surge in Q1 2023

- Ecuador Smartphone Shipments Up 18% YoY in Q1 2023; Xiaomi Takes Top Spot

Note: The report comprises of carefully selected aggregated insights published by our analysts during Q2 2023. The data presented herein corresponds to the Q1 2023.