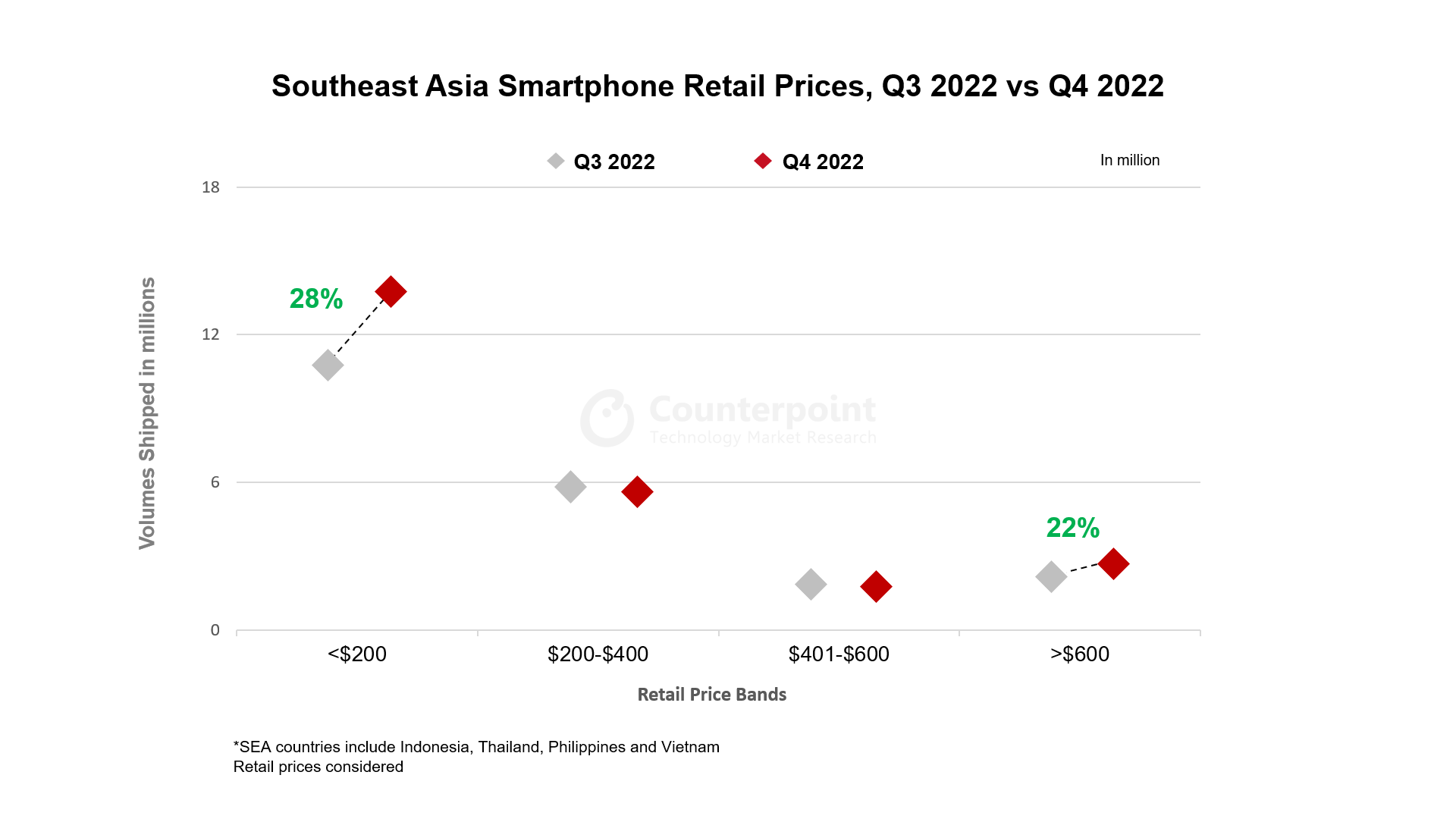

Entry-level Smartphone Shipments Bounce Back in Key SEA Countries, Up 28% QoQ in Q4 2022

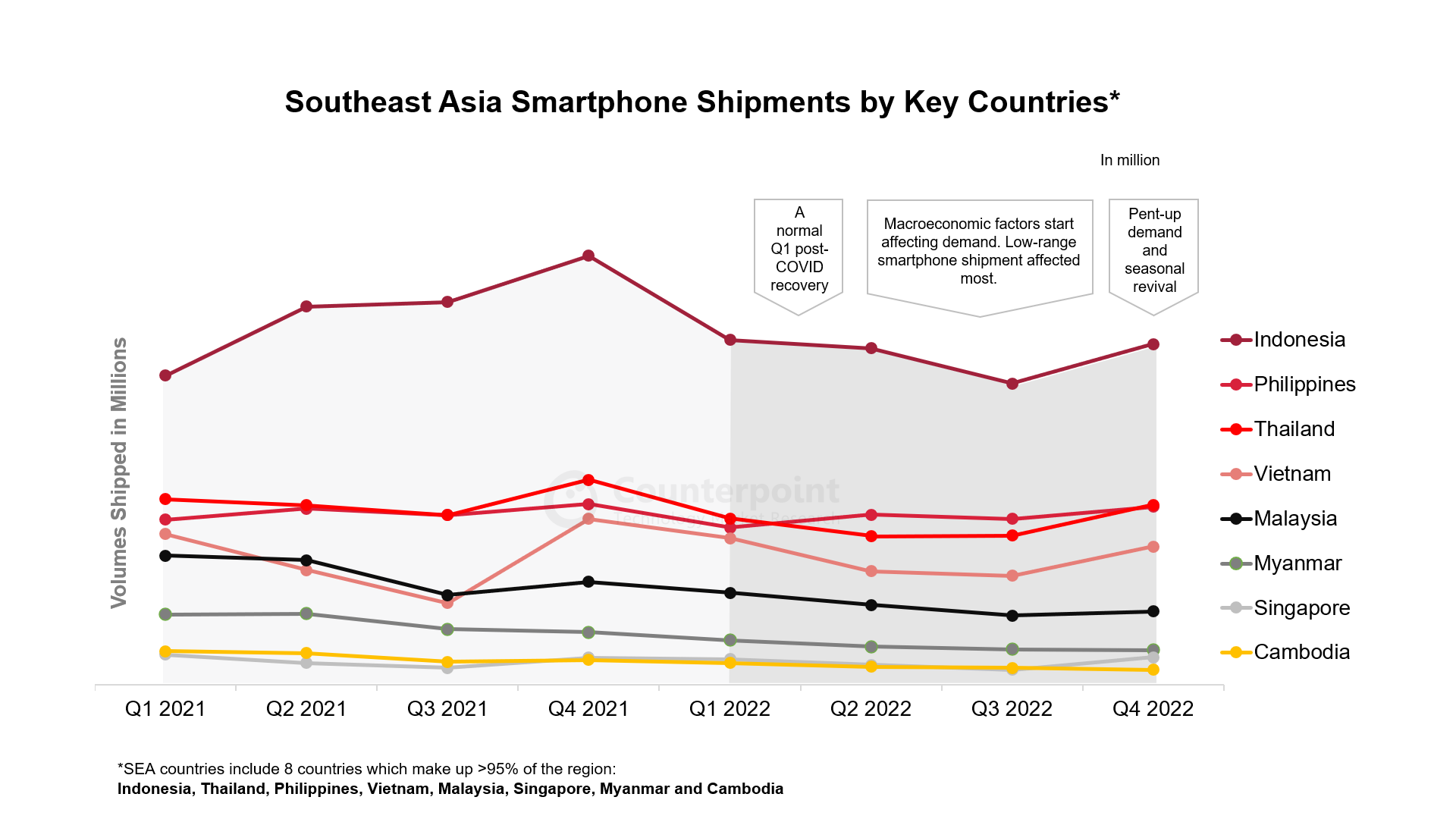

- 2022 saw a 13% YoY decline in smartphone shipments in key Southeast Asian countries*.

- All countries witnessed a YoY drop in shipments through 2022 with the gap widening to -17% in Q4.

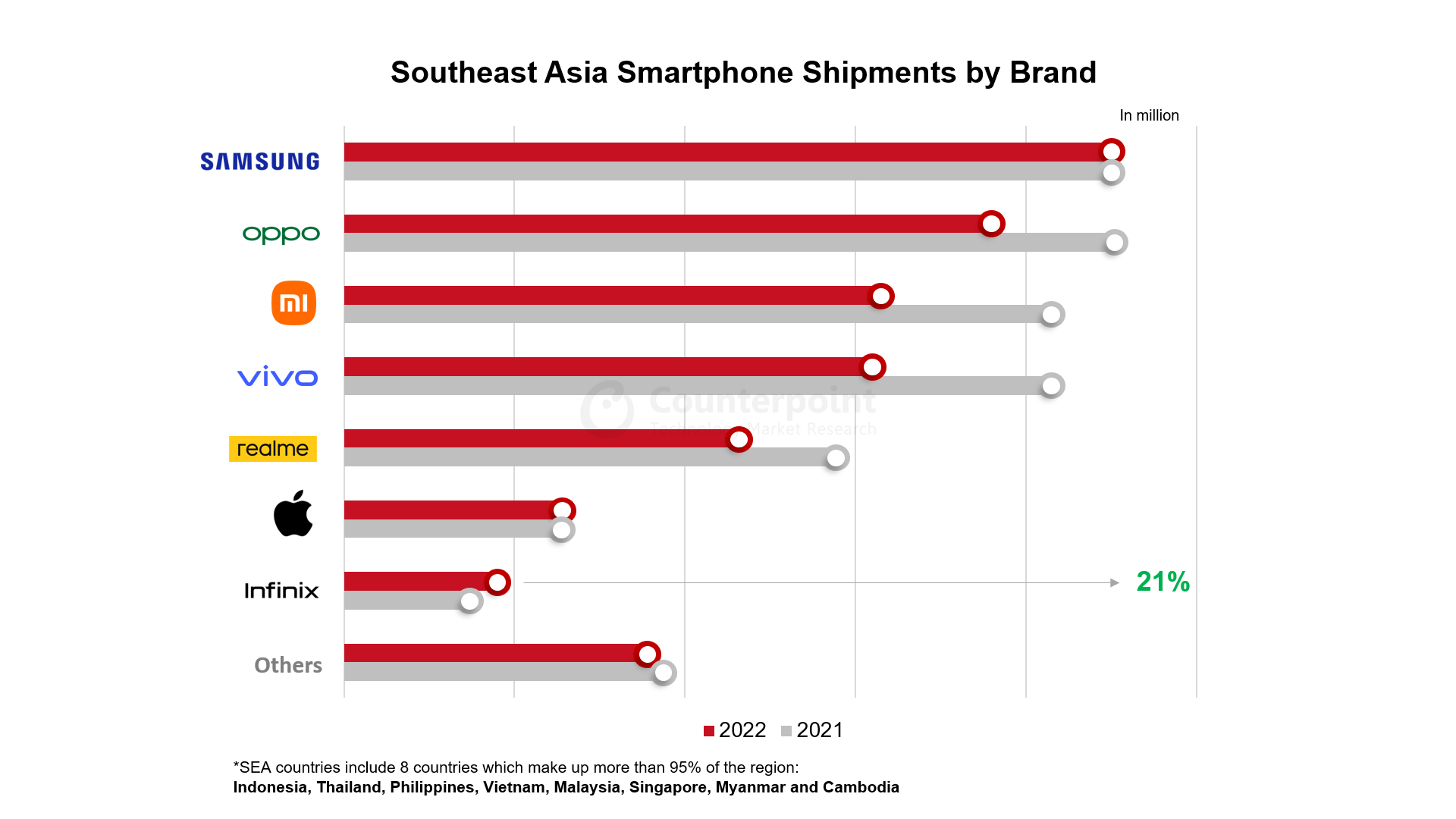

- SamsungandApplesustained volumes through the year, while Infinix grew the most.

- High-end smartphone ($400-$600) shipments increased 8% YoY in 2022.

- The溢价部分(>$600) witnessed a 23% YoY growth.

Hong Kong, Jakarta, London, Boston, Toronto, New Delhi, Beijing, Taipei, Seoul – February 23, 2023

KeySoutheast Asia(SEA) smartphone markets* saw a somewhat consistent YoY drop in shipments throughout 2022. Inventory was still high in countries likeIndonesia, Philippines and Thailand, which led to a 17% YoY drop in shipments in Q4 2022, according to theMarket Monitor Smartphone Quarterly Report.

More notably, the end of the year signaled a much-awaited increase in demand forentry-level smartphones, resulting in a 28% QoQ increase in such shipments. New launches and pent-up demand played major roles in this. In the溢价部分, consumers kept the demand alive due to which there was a 22% QoQ increase in premium shipments.

Source: Counterpoint Research Southeast Asia Smartphone Tracker, February 2023

While the region’s smartphone shipments declined, countries like Vietnam andPhilippinesshowed more resilience to economic factors than others. Consumer demand seemed to have been less affected by macro effects. Smaller markets like Cambodia, Myanmar and even Malaysia declined relatively more. While they represent a small part of the region, their populations include a higher share of economically disadvantaged consumers. The decline in entry-level smartphone shipments affected these countries more than the rest.

Mature markets like Thailand and Singapore concentrated more on 5G penetration and further stages of industrial5Gapplications. Singapore’s operator partnership with Ericsson and 5G utilization in healthcare planning are just a few examples. InThailand, smart factory technology is being developed, private networks are increasingly used, and operators like AIS are helping out on automation through 5G.

Apart from an uptick in premium smartphone sales in these countries, there was also an increased focus on sustainability in the form of trade-ins,refurbishedsmartphone demand and corporate ESG initiatives.

Source: Counterpoint Market Monitor Smartphone Report, February 2023

The IT and e-commerce sectors saw job cuts inSEAwhich did not project a healthy H2 2022. Even the online smartphone channels contributed relatively less in seasonal campaigns like 11.11 and December sales. At the same time, OEMs, operators and retailers have been increasing offline networks across geographies. As the economies are struggling to come back to normal, a surge in tourism in this region contributed to the rebound.

Chinese brands likevivo,realmeand Xiaomi consistently struggled with inventory levels and low shipments during Q3 and Q4 2022.OPPOimproved with demand due to its Reno series.

As premium demand surged,Samsung’sS seriesandApple’siPhone 13 and 14 series contributed to these brands’ volumes. Vietnam showed some surprising success with Apple shipments. Apart from newer models, even older ones like the iPhone 11 series were being sold well in the country.

The biggest gainer of 2022 is clearlyInfinix. TheTranssionbrand steadily grew in this region in 2022. Infinix’s focus on basic specs, practical pricing, channel offers and gaming all helped it gain momentum. The brand is especially doing well in the Philippines, Indonesia and Thailand.

Source: Counterpoint Market Monitor Smartphone Report, February 2023

Commenting on theSEAeconomies in 2023,Senior Analyst Glen Cardozasaid, “Southeast Asia suffered on multiple fronts in 2022. Countries continue to increase interest rates, inflation is still a factor and trade volumes are dependent on the partner country’s demands. Any macro-level improvements in tourism, government relief and financial management will take time to positively impact the common consumer. In the absence of further adverse macro effects, the region is on a path to recovery. OEMs are however pessimistic about the recovery at this point and it is visible in their shipment levels. Improving entry-level smartphone shipments is a much-needed boon at this point. H1 2023 is likely to suffer the effects of low shipments, but we are likely to see a steady increase in shipments starting Q2 2023.”

Industrial and consumer 5G use cases will be visible in countries like Singapore and Thailand, while Indonesia and Philippines will concentrate on 5G penetration more than others.

Industrial and consumer 5G use cases will be visible in countries like Singapore and Thailand, while Indonesia and Philippines will concentrate on 5G penetration more than others.

What isChina’sloss is working out to be Southeast Asia’s gain in part.Manufacturingcenters like Vietnam stand to benefit from increased investments from companies looking to diversify from China.

The silver lining lies in the role of smartphones in digital transformation across this region. It also lies in the increase of foreign direct investment. All macro factors remaining constant, H2 2023 has the potential to make up for H1’s losses.

*Key Southeast Asia countries/marketsinclude Indonesia, Thailand, Philippines, Vietnam, Malaysia, Singapore, Myanmar and Cambodia.

Feel free to contact us atpress@www.arena-ruc.comfor questions regarding our latest research and insights.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Glen Cardoza

Follow Counterpoint Research