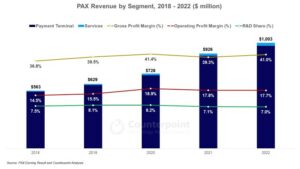

PAX Revenues Cross $1 Billion in 2022; SmartPOS Adoption Supports Growth

- The growth was primarily driven by the strong performance of Android-based payment terminals.

- PAX’s expertise in Android SmartPOS technology and its MAXSTORE platform offers a centralized and seamless way for merchants to navigate an increasingly complex business.

- PAX is expected to maintain its leading position in Android SmartPOS payment solutions.

PAX Global Technology, one of the world’s leading providers of electronicpaymentterminal solutions and related services, posted strong revenue of$1,003 millionin 2022, showing great resilience in a period ofeconomic challengessuch as interest rate hikes and higher inflation. The growth was primarily driven by the strong performance ofAndroid-basedpaymentterminals.Fintechis playing a central role in the advancement ofdigitalandcashless经济通过提供更高的效率,convenience and accessibility to consumers. However, PAX’s software-as-a-service (SaaS) solutions such as theMAXSTOREplatform are enablingpaymentservice providers (PSPs) and acquiring bank (financial institution that processes credit or debitcardtransactions on a merchant’s behalf) to combine core payment services with financial and non-financial applications in a much more flexible and cost-effective way.

Merchants can operatedigitallyand process orders more efficiently with the use of AndroidSmartPOS terminals. These terminals also provide valuable insights into consumer behavior, enable the development of automated marketing campaigns, and help tomanage inventorymore effectively, among other benefits. PAX’s expertise inAndroidSmartPOS technology and its MAXSTORE platform offers a centralized and seamless way formerchantsto navigate an increasingly complex business. The MAXSTORE platform had well over8 millionmanageddevicesby the end of 2022.

Key regional developments

Europe, Middle East and Africa (EMEA)

- EMEA region clocked $319 million in revenue in 2022, an increase of5%compared to 2021.

- The growth was primarily driven by the large-scale adoption ofAndroid SmartPOSdevices across EMEA, primarily in Europe and the Middle East.

- PAX’s partnerships with leading acquiring banks, PSPs and independent sales organisations (ISOs), and tailored solutions for the European market drive its growth across the region. TheUK,ItalyandGermanyhave increasingly become important growth drivers for PAX. Significant gains were made in France, Greece, Scandinavia, Balkans, Poland, Spain and Turkey.

- Saudi Arabia’s‘Vision 2030’计划经济改革和沙特阿拉伯Monetary Authority’s (SAMA’s) openness to innovative technology finance across the Gulf Cooperation Council (GCC) and North Africa continues to accelerate the upgrade of legacypoint-of-sale(POS), driving a big growth for PAXAndroidSmartPOS devices.

Latin America and Commonwealth of Independent States (LACIS)

- LACIS region posted $385 million in revenue, adecline of 8% YoY.PAXexperienced strong growth in this region in 2021, a major reason for the dip in 2022. However, PAX has a diversified product portfolio and a well-establishedchannel partnernetwork which can help increase its footprint in the region.

- Brazil,ChileandArgentinaare the major contributors to the growth in the region with increasing demand for Android SmartPOS solutions in sectors likemultilane, hospitality and parking.

Asia Pacific (APAC)

- APAC region recorded steady growth of 5% YoY with $172 million in revenue. PAX has expanded its footprint to more Asian countries.

- IndiaandJapancontinued to show positive demand forAndroid-based smart payment terminals, which is expected to propel further growth.

- Indonesia, Singapore and Thailand were the major contributors with double-digit revenue growth compared to the previous year. In Indonesia, sales were driven by the government’s ‘Payment System Blueprint 2025’ initiative, which is helping improve the nation’s corepayment infrastructure.

- PAXTechnology, established as a Singapore subsidiary in 2021, focuses on local merchants and financial institutions. Singapore government’s ‘Retail Industry Transformation Map 2025’is encouraging retailers to adopt innovative business models, which is expected to drive the demand for smart payment terminals.

United States and Canada (USCA)

- USCA region posted a robust revenue of $127 million, up35% YoYdriven by PAX’s partnerships with PSPs and ISOs, and its expertise inAndroidSmartPOS solutions.

- PAX Android smart payment terminals offerseamless integrationand diversified payment methods such as mobilewallets,onlineordering, curbside pickup and self-service ordering and checkout, which adds convenience for businesses operating in the retail, supermarket, hospitality and unattended segments.

Key takeaways

- PAX is expected to experience greater adoption in the future, thanks to its ongoing investment in the research and development (R&D) of Android payment terminal technology. PAX spent $72 million onR&Din 2022, which was nearly 7% of its total revenue. Its terminals are user-friendly and offer a range of payment options, which makes them attractive to merchants.

- However, POS vendors are now focusing oncloud-based software solutionsto earn recurring revenue, increase profitability and offer better solutions to customers.

- Along with strong payment solutions, partnerships play a crucial role in the fintech industry. PAX is also determined to strengthen itsinternational salesnetwork and customer relationships across geographies.

- Due to ongoing economic challenges like interest rate hikes and high inflation, and geopolitical tensions, PAX is expectingflattishorlower-single-digitrevenue growth in 2023.

- With its strong portfolio across different sectors catering to different needs of merchants and businesses in different regions,PAX is expected to maintain its leading position in Android SmartPOS payment solutions.

Related Posts

- Global Cellular IoT Module Shipments Jump 14% YoY in 2022 to Reach Highest Ever

- Qualcomm Aware: Pivotal SaaS Play to Catalyze the Complex IoT Ecosystem

- AI, Digital Twins, Real-time Compute Emerge as Top Technology Trends for 2023

- Apple’s Pay Later Option May Impact US Consumption Patterns

- Outsourced Manufacturing Captures More Than Half of Global Cellular IoT Module Shipments in H1 2022

- Global Cellular IoT Smart Module Tracker – Q4 2022

- Global Cellular IoT Module Forecast – Q4 2022

- Global Cellular IoT Chipset Forecast – Q4 2022

- Global Quarterly eSIM Devices Tracker Q4 2022

- Thales, G+D, IDEMIA Lead 2022 Global eSIM Provisioning Landscape