- Global XR headset shipments (covering AR and VR headsets) declined 33% YoY in Q1 2023.

- Consumers are losing interest in the XR market, as market leader Meta’s Quest series has not been refreshed in over two years.

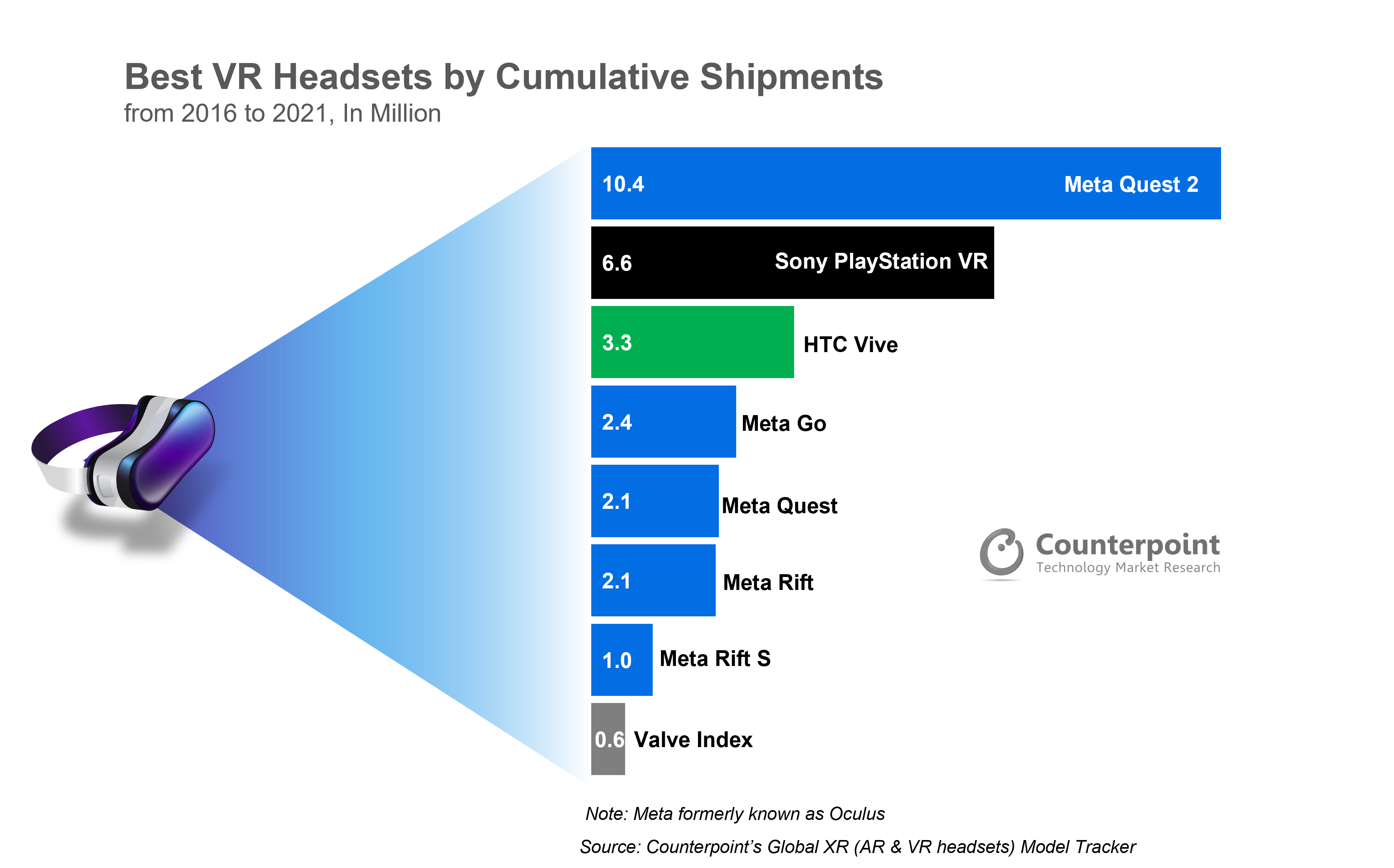

- Quest series has cumulatively shipped more than 20 million units as of Q1 2023, with the Quest 2 contributing 18 million units.

- The newly released PSVR2 garnered significant attention from the video-gaming brand’s user base, leading Sony to capture the second position in Q1 2023.

- 2023 is the year of next-generation VR headset launches. The PSVR2, E4 and Vive XR Elite are some of the prominent launches so far. And then, of course, Apple has announced its Vision Pro.

London, San Diego, New Delhi, Beijing, Buenos Aires, Seoul, Hong Kong – July 5, 2023

Global extended reality (XR)headset shipments (covering augmented reality (AR) and virtual reality (VR) headsets) declined 33% YoY in Q1 2023, according toCounterpoint Research’sXR Model Tracker. Consumers are losing interest in the XR market, as Meta’s Quest series, the market leader, has not been refreshed in over two years. The performance of the newly launched next-generation Sony PSVR2 (PlayStation VR2), along with the price reduction of the Quest 2 by Meta, saved the global market from a more drastic decline.

元was the best-selling global XR headset brand during Q1 2023 with the Quest 2 as its long-time best-performing VR headset. The Quest series has cumulatively shipped more than 20 million units as of Q1 2023, with the Quest 2 contributing 18 million units. The Quest 2 continues to sell relatively well and to maintain its momentum, Meta is making the headset more affordable by lowering its price after last year’s price increases. Besides,元has announced the launch of Quest 3 later this year, which is expected to further boost sales and transition from the success of Quest 2.

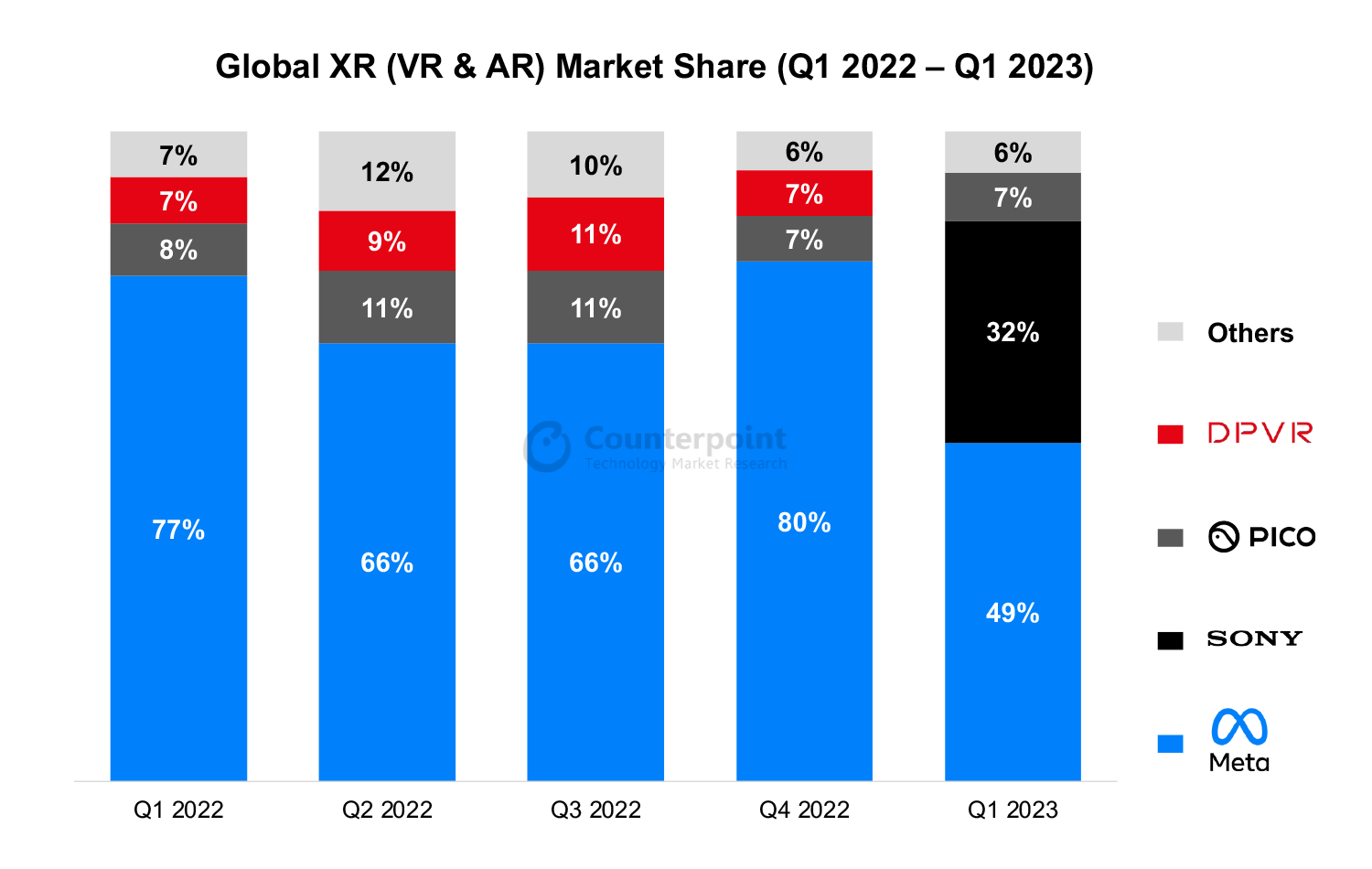

Nevertheless, Meta’s shipment share fell to 49% in Q1 2023, the lowest since the launch of Quest 2 in Q4 2020. This decline was a result of the highly anticipated launch of Sony’s successor to its 2016 headset PSVR. The newly released PSVR2 garnered significant attention from the video-gaming brand’s user base, leading Sony to capture the second position in Q1 2023 with a 32% market share. Besides, the PSVR2 shipped 1.2 times more units than its predecessor in the first quarter of its launch.

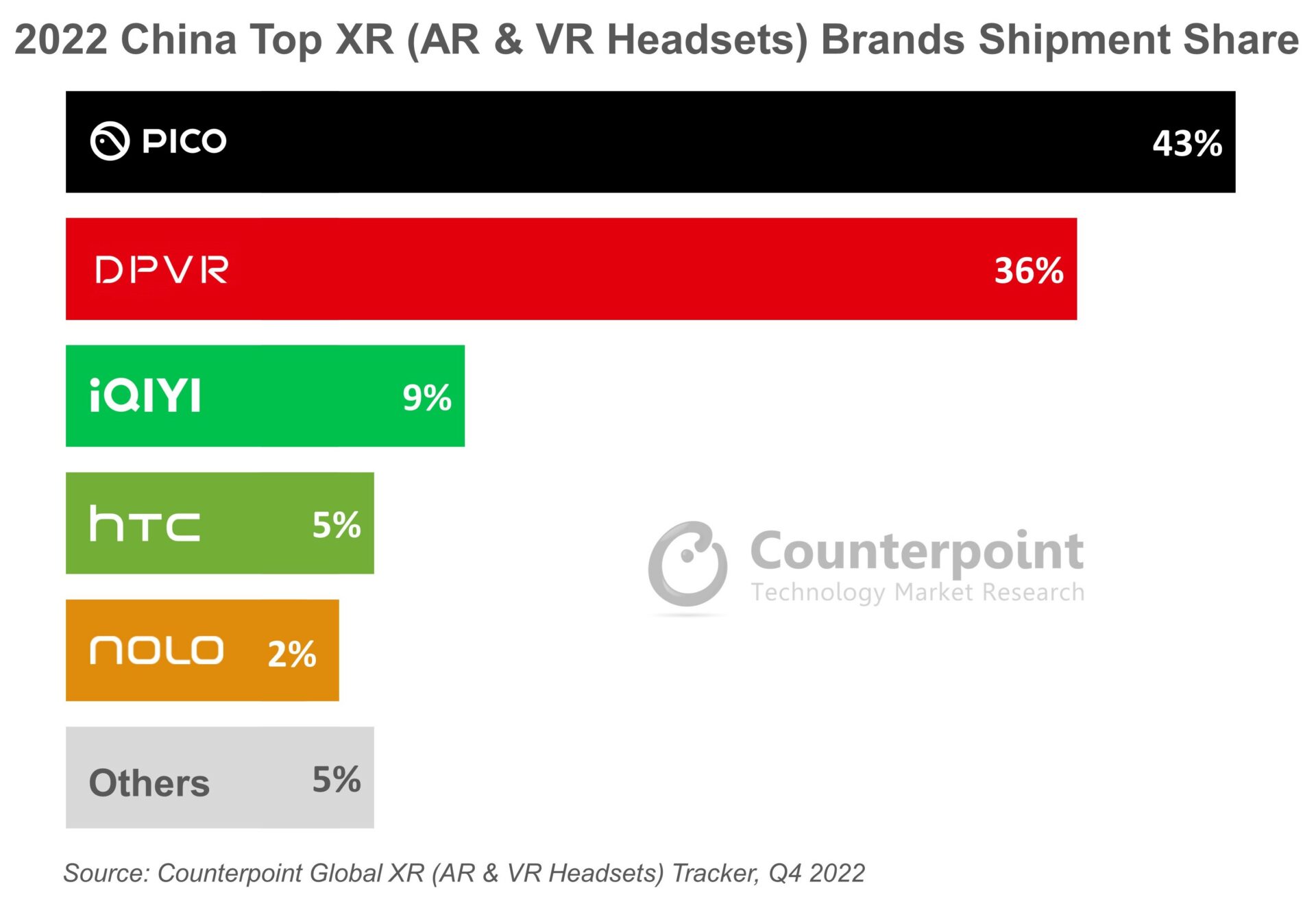

Pico and DPVRtook third and fourth places with market shares of 7% and 6% respectively. While Pico’s performance had earlier improved after its acquisition by TikTok’s parent company ByteDance, a lack of attractive consumer use cases and limited high-quality content resulted in a 38% decline in its shipments in Q1 2023.

DPVR’s shipment volumes are primarily driven by its enterprise partners, with whom it has established strong relationships. These partners regularly place orders for several thousand units. However, delays in orders from education sector partners led to a 40% decline in DPVR’s shipments in Q1 2023.

2023 is the year of next-generation VR headset launches.Sony’s PSVR2, DPVR’s E4 and HTC’s Vive XR Elite are some of the prominent launches so far this year. Having advanced technology and features, these headsets are retailing at around or over $500, which will likely negatively impact their sales potential. It will also depend on how much value consumers perceive these VR headsets are delivering.

And then, of course,Apple has announced its Vision Pro, which has set a new high bar for consumer XR devices, though at a price above most people’s reach. Apple will nevertheless cast a shadow over the market ahead of the Vision Pro’s actual release.

Background:

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Karn Chauhan

Peter Richardson

Harmeet Singh Walia

遵循对比研究

press(at)www.arena-ruc.com![]()