- 2023 is on track to be the worst year for global smartphone shipments in ten years

- Regional macro risks are extending smartphone replacement rates to record levels

- Asia ex-China/India, North America and China likely biggest drivers of negative growth, respectively

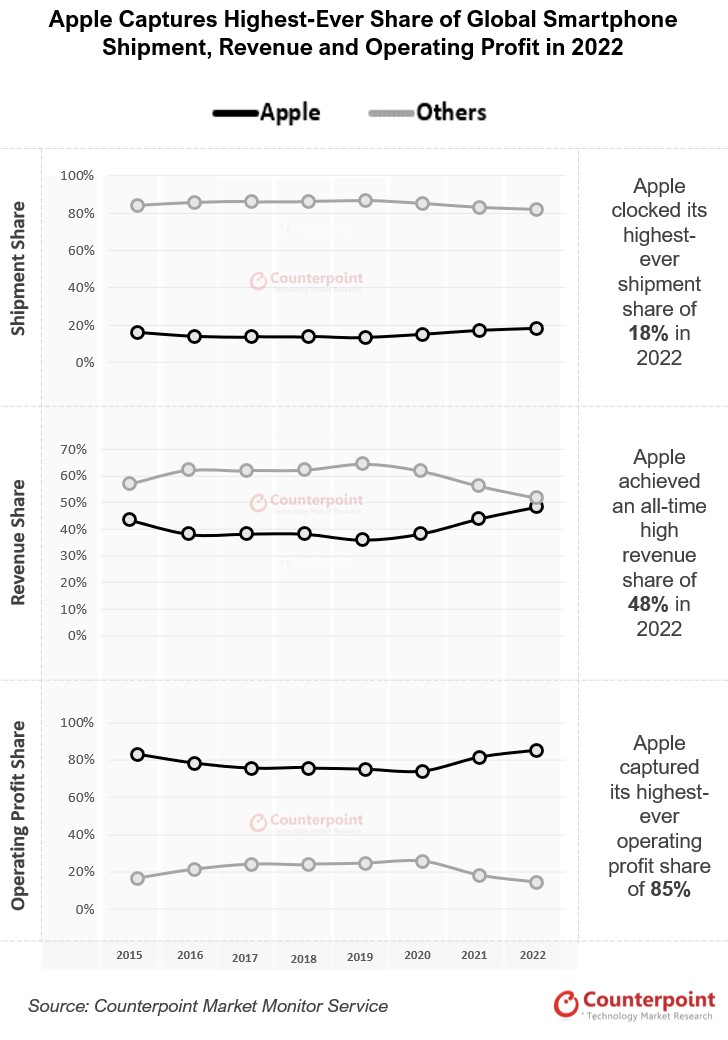

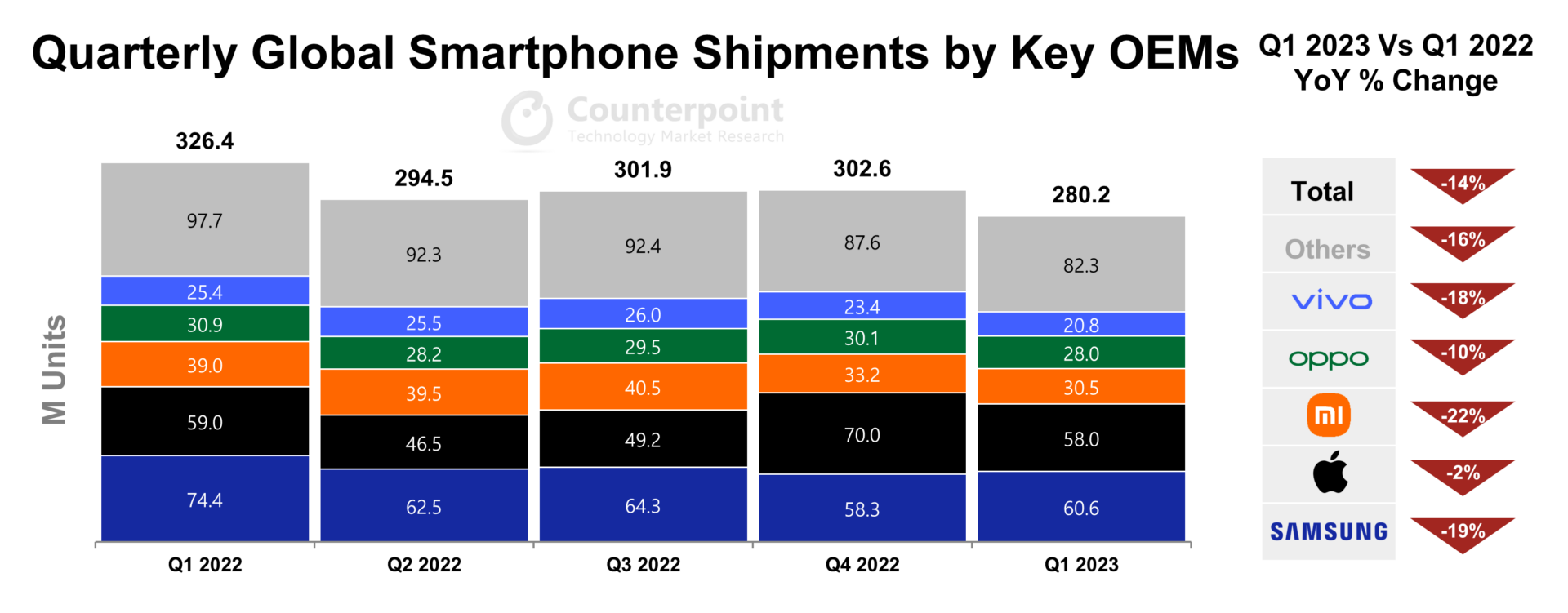

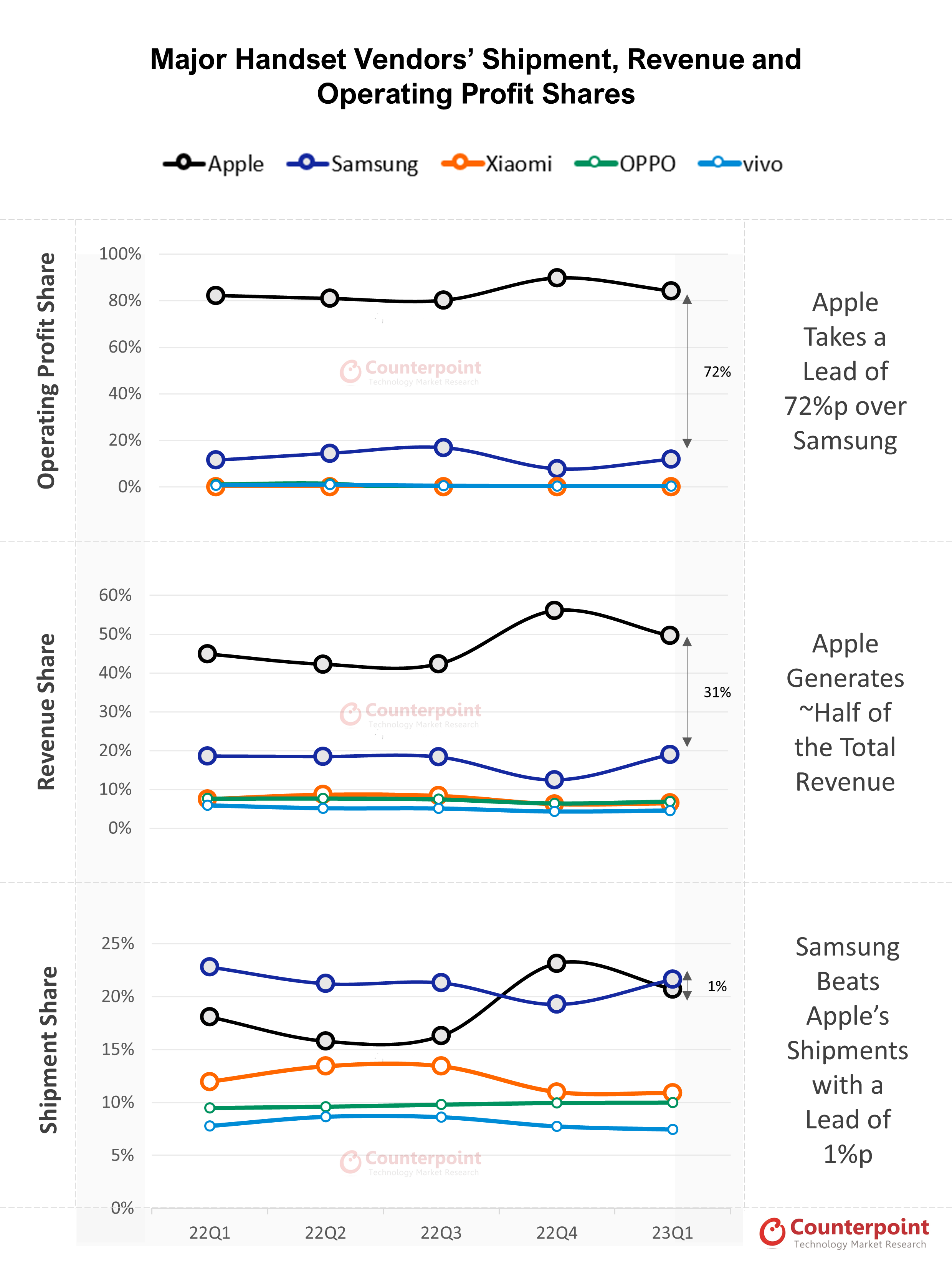

- Apple best positioned amongst key OEMs and could become #1 brand for first time ever

- We remain cautious on Q1 2024 and see elevated risk of a delayed recovery into 2024

Boston, Seoul, Beijing, New Delhi, London – August 17, 2023

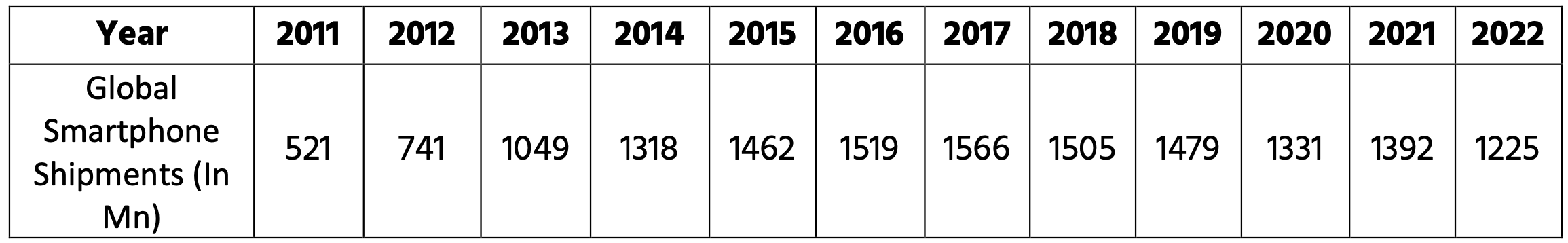

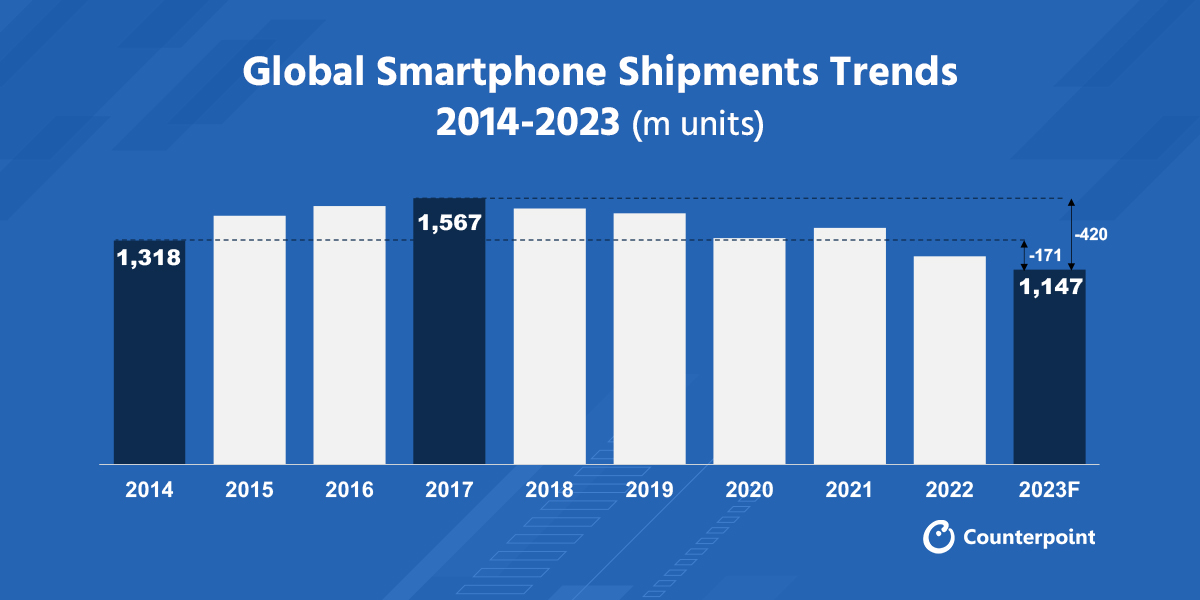

According to preliminary figures from Counterpoint Research’s latestGlobal SmartphoneShipment Forecast, 2023 shipments are forecast to decline 6% to 1.15bn units, the lowest in a decade.

Asia is one of the major hurdles to positive growth, as headwinds halt theeconomicturnaround anticipated forChinaat the start of the year, and the broader region experiences intensifying declines across emerging markets.

As well, North America continues to be a major drag on global recovery, with a disappointing 1H setting it up for double-digit full year declines. Despite strength in the jobs market and inflation falling, consumers are hesitant to upgrade their devices, pushing replacement rates for theUSand globally to record highs. “There’s been a decoupling between what’s happening in the economy and consumers buyingphones. So far this year it’s been record low upgrades across all carriers,” says Jeff Fieldhack, Research Director for North America.

“There’s been a decoupling between what’s happening in the economy and consumers buyingphones. So far this year it’s been record low upgrades across all carriers,” says Jeff Fieldhack, Research Director for North America.

“But we’re watching Q4 with interest because the iPhone 15 launch is a window for carriers to steal high-value customers. And with that big iPhone 12 installed base up for grabs promos are going to be aggressive, leavingApplein a good spot.”

In China, “Apple is well positioned as the premium segment continues to gain more share.” states Ethan Qi, Associate Director for China.

Premium and ultra-premium growth is a trend that is happening globally and favors vendors like Apple which have portfolios heavily weighted in the higher segments.

2023 could mark the start of a new era for Apple as a resilient premium market and strong showing in the US could help it become number one globally in terms of annual shipments for the first time ever. “It’s the closest Apple’s been to the top spot. We’re talking about a spread that’s literally a few days’ worth of sales,” muses Fieldhack. “Assuming Apple doesn’t run into production problems like it did last year, it’s really a toss up at this point.”

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Jeff Fieldhack

Ethan Qi

Follow Counterpoint Research

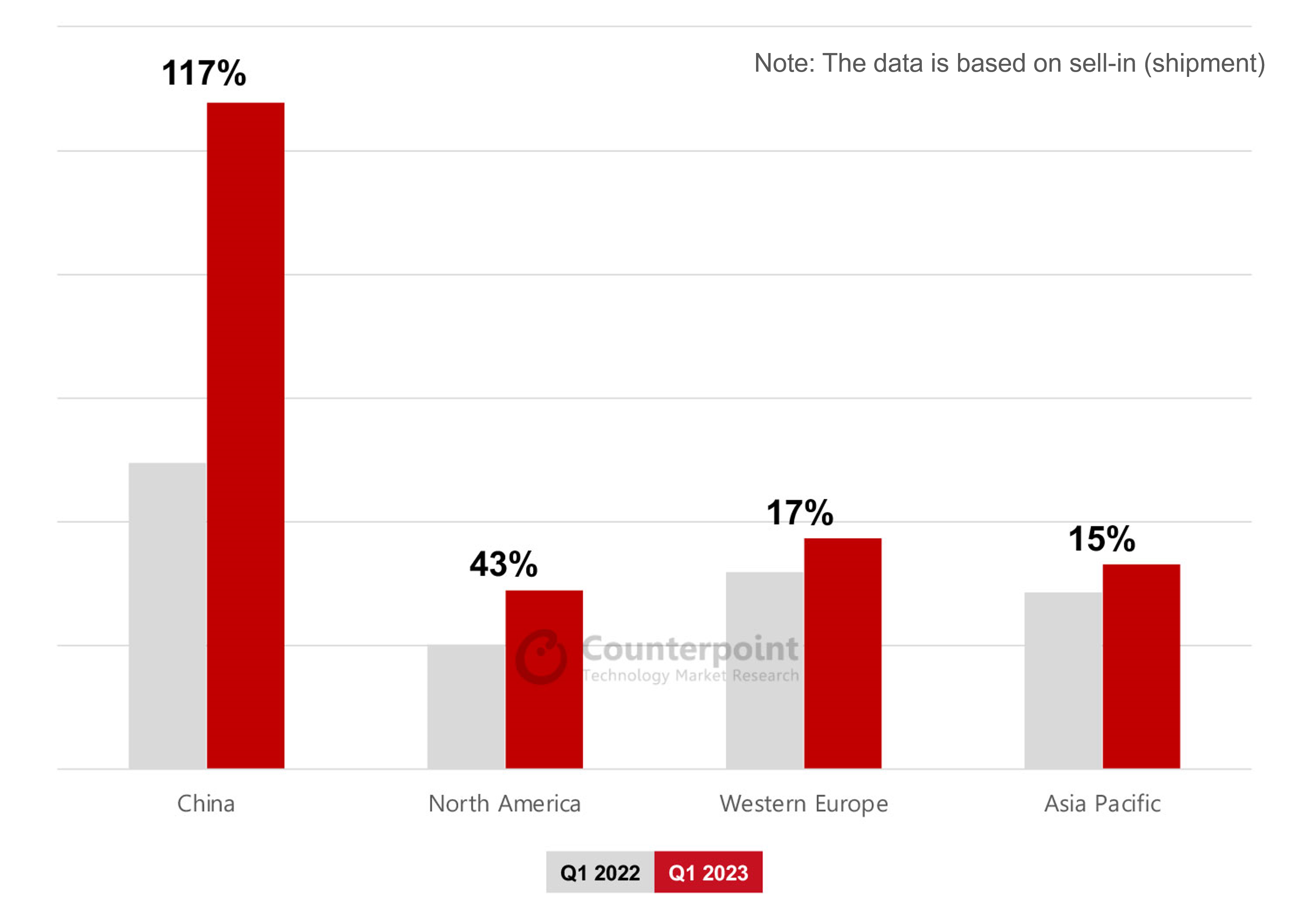

The robust growth in the global foldable market was largely driven by the growth in the Chinese foldable market. Although the Chinese smartphone market declined by about 8% YoY in Q1 2023, the domestic foldable market continued to grow, surging 117% YoY to 1.08 million units. Commenting on this phenomenon,

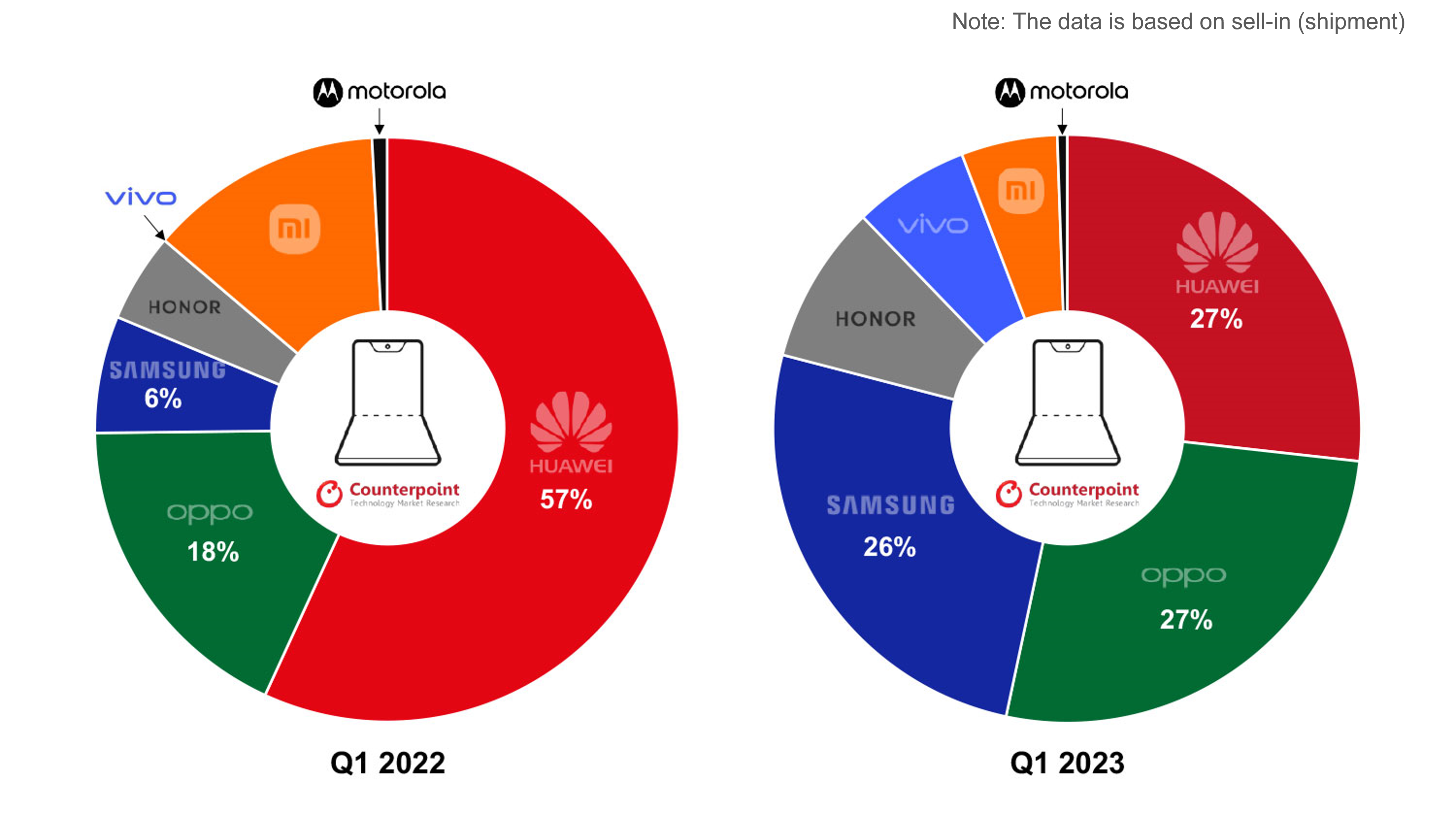

The robust growth in the global foldable market was largely driven by the growth in the Chinese foldable market. Although the Chinese smartphone market declined by about 8% YoY in Q1 2023, the domestic foldable market continued to grow, surging 117% YoY to 1.08 million units. Commenting on this phenomenon, OPPO’s strong Q1 2023 performance is noteworthy as it reflects the brand’s success in the Chinese foldable market, which is emerging as the world’s largest foldable smartphone market. OPPO ranked second in the Chinese foldable market with a slight gap with leader Huawei, helped by the N2 Flip and N2 which were released at the end of 2022. In particular, the N2 Flip, OPPO’s clamshell-type foldable, contributed a lot to the increase in the sales of clamshell-type products in China, beating Huawei’s Pocket S. Samsung’s growth in the China foldable market is also noteworthy. Samsung made efforts to target the Chinese market by launching the W23 and W23 Flip, which are variants of the Z Fold 4 and Z Flip 4, respectively, produced mainly for the Chinese market and MEA market. This helped Samsung grow rapidly in the Chinese foldable market in Q1 2023. Commenting on the foldable smartphone market outlook for 2023,

OPPO’s strong Q1 2023 performance is noteworthy as it reflects the brand’s success in the Chinese foldable market, which is emerging as the world’s largest foldable smartphone market. OPPO ranked second in the Chinese foldable market with a slight gap with leader Huawei, helped by the N2 Flip and N2 which were released at the end of 2022. In particular, the N2 Flip, OPPO’s clamshell-type foldable, contributed a lot to the increase in the sales of clamshell-type products in China, beating Huawei’s Pocket S. Samsung’s growth in the China foldable market is also noteworthy. Samsung made efforts to target the Chinese market by launching the W23 and W23 Flip, which are variants of the Z Fold 4 and Z Flip 4, respectively, produced mainly for the Chinese market and MEA market. This helped Samsung grow rapidly in the Chinese foldable market in Q1 2023. Commenting on the foldable smartphone market outlook for 2023,

Source :

Source :