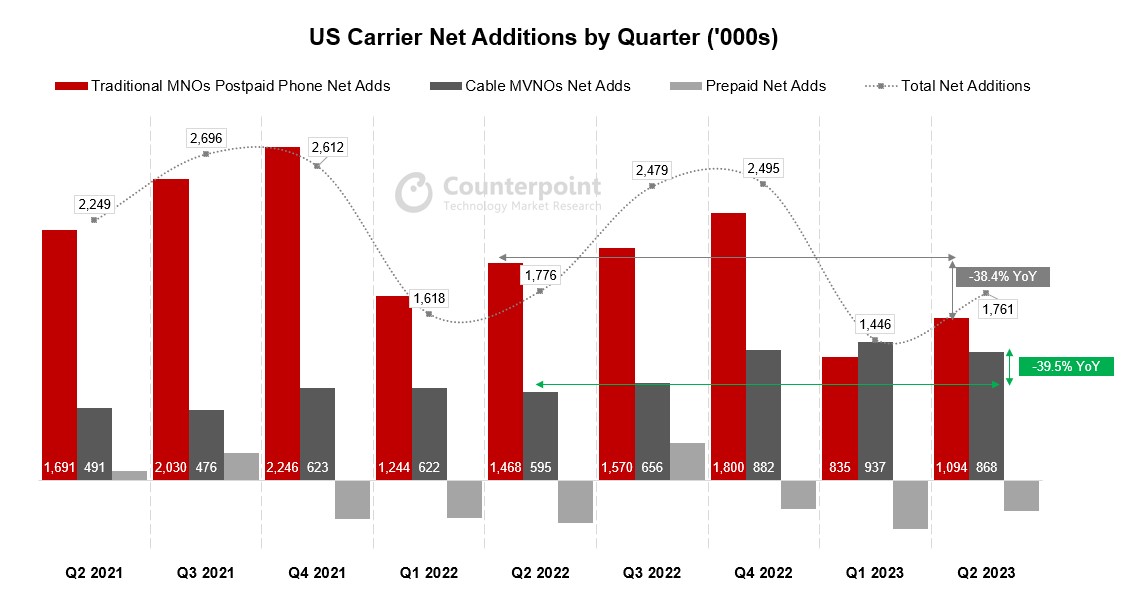

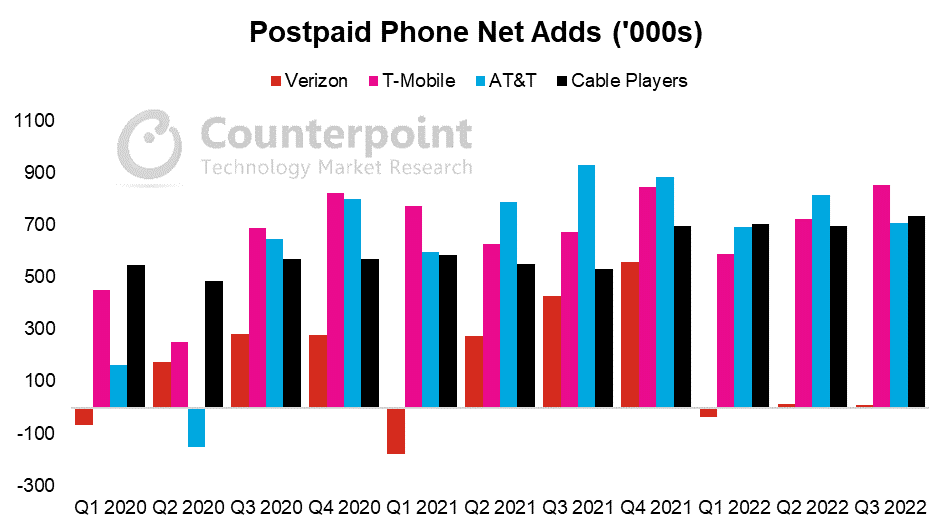

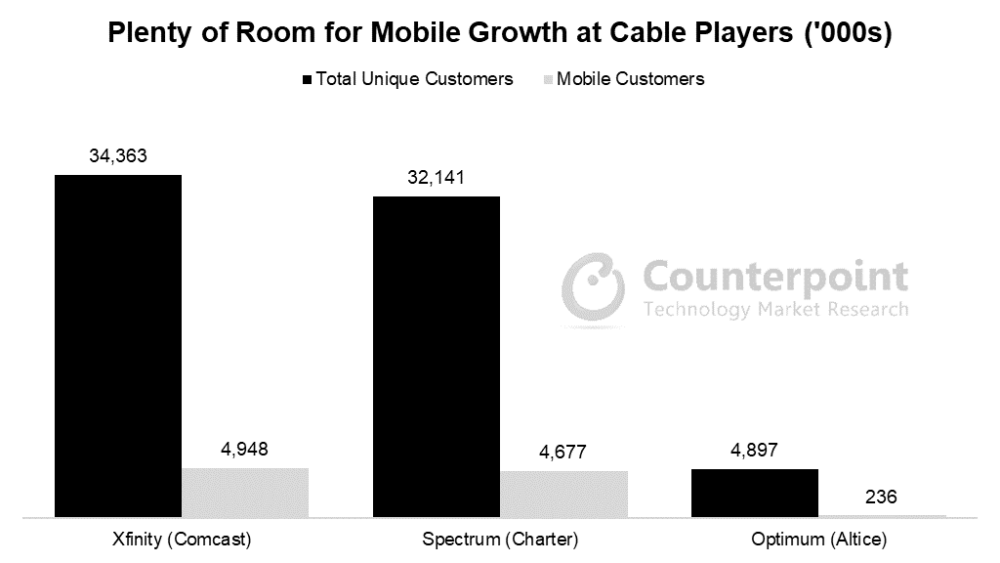

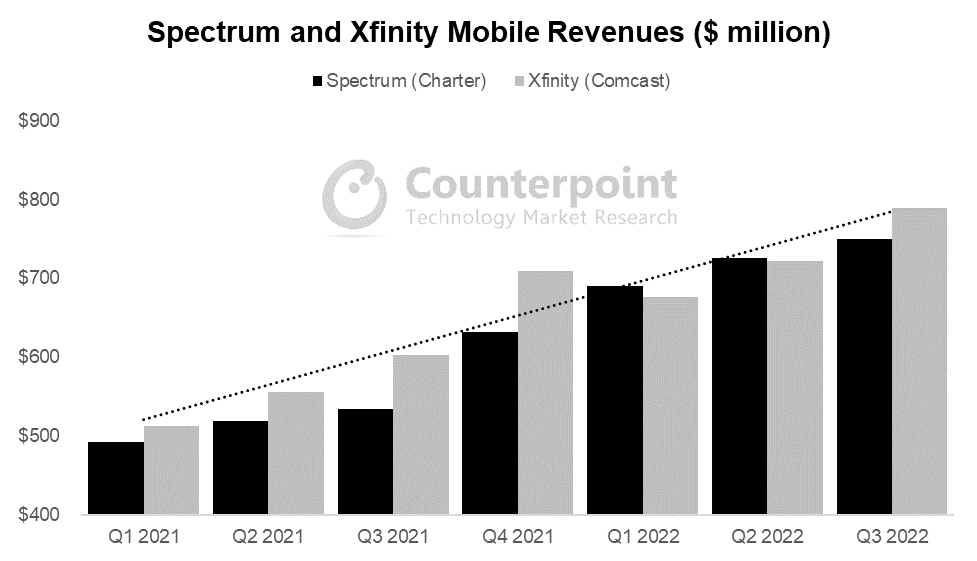

The Q2 2023 earnings season is in the books for the US carriers and several clear trends from the quarter have come into focus. While much of Verizon and AT&T’s earnings calls centered around “lead-sheathed cables”, creating a buzz in the media,the top trends of the quarter for US operators were the ongoing strength of Xfinity and Spectrum Mobile, prepaid to postpaid/cable migration, and record low upgrade rates at the postpaid carriers. Overall phone net additions for Q2 2023 were down slightly YoY with the prepaid market losing value-conscious consumers to Xfinity and Spectrum Mobile, and as Verizon, AT&T and T-Mobile migrated high-value prepaid customers onto their postpaid plans. Additionally, the prepaid market continues to face challenges brought on by recent acquisitions. Meanwhile, existing customers at the postpaid carriers held off on upgrading their devices as overall economic uncertainty resulted in customers holding off on unnecessary upgrades.

Cable Players Continue to Win Subscribers

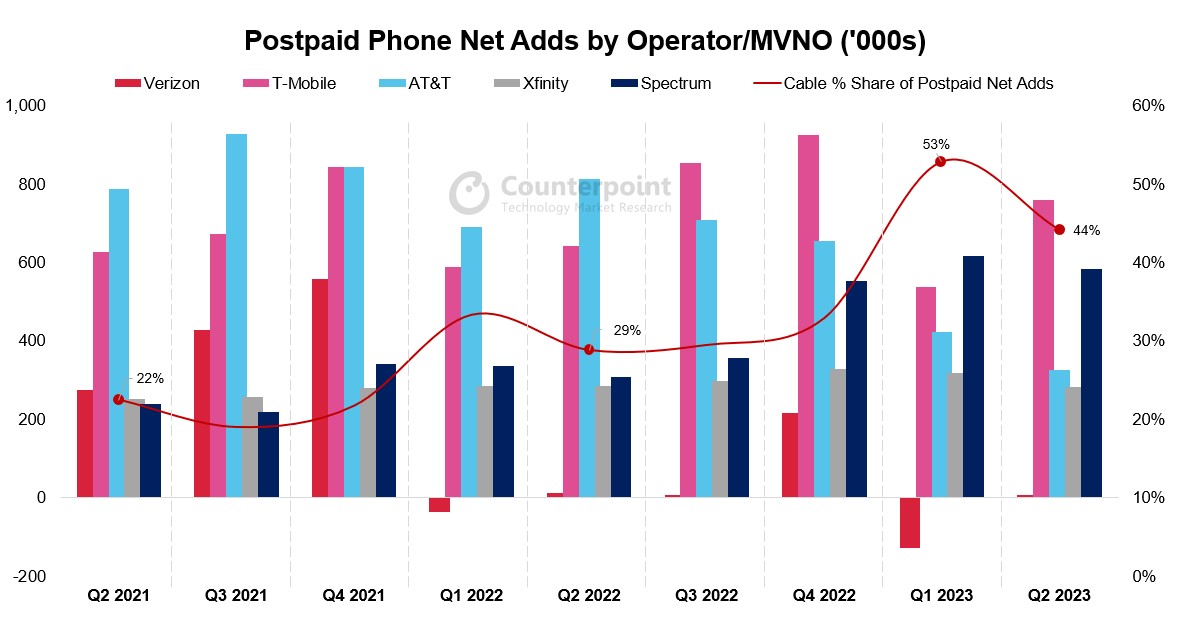

While each of the postpaid carriers posted positive net phone additions in the quarter, their share of net additions was decisively lower than last year. Verizon continues to lag AT&T and T-Mobile by a significant margin in new customer acquisition, but AT&T and T-Mobile are losing steam as the cable players snag a higher share of net additions. In Q1 2023, Xfinity and Spectrum claimed 53% of total net phone additions. In Q2 2023, the figure dropped to 44% but grew significantly from the previous year’s 29% share.

The prepaid segment saw its third consecutive quarter of overall subscriber losses.The segment is seeing value-driven customers opt for competitively priced plans at Xfinity and Spectrum, while the postpaid carriers continue to migrate high-value prepaid customers onto postpaid plans. Verizon continues to see significant subscriber losses as it is still migrating the customers it obtained through the Tracfone acquisition onto its network and off AT&T and T-Mobile’s networks. Verizon has now lost about 1 million of the subscribers it gained from Tracfone. Similarly, Dish continues to see subscriber losses as it struggles to keep the Boost Mobile brand competitive with Metro and Cricket. Dish is also banking on strong performance from its new postpaid Boost Infinite services to keep the brand afloat, although delays in the launch of Boost Infinite and Dish’s slow network buildout have inspired skepticism.

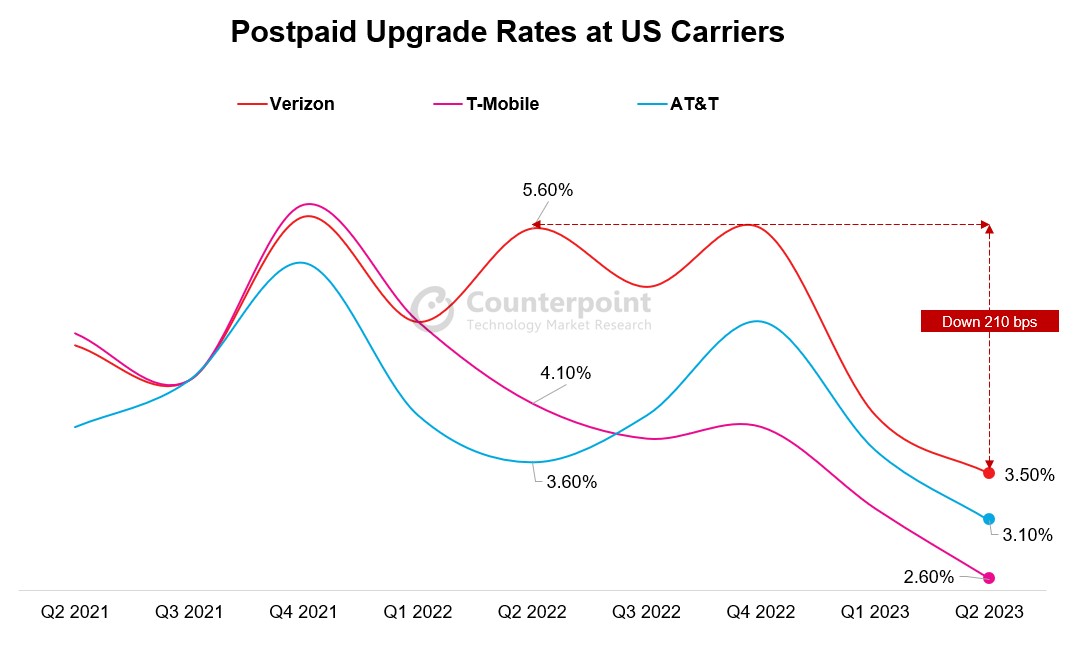

Low Upgrade Rates in Postpaid

Device sales were minimal at the postpaid carriers through Q2 2023 as upgrade rates reached record lows and churn remained minimal. Consequently, equipment revenues were down significantly across the postpaid carriers. As our recent PR noted, smartphone shipments into the US were down 24% YoY, in large part driven by customers holding onto their devices for longer amid economic uncertainty, lower levels of innovation in the smartphone market, and ongoing improvements in device durability. Upgrade rates are likely to remain below last year’s levels through the end of the year and into 2024 constrained by macroeconomic headwinds, but upgrade rates should spike towards the end of Q3 2023 with the launch of the iPhone 15 and through the holiday shopping season in Q4 2023.

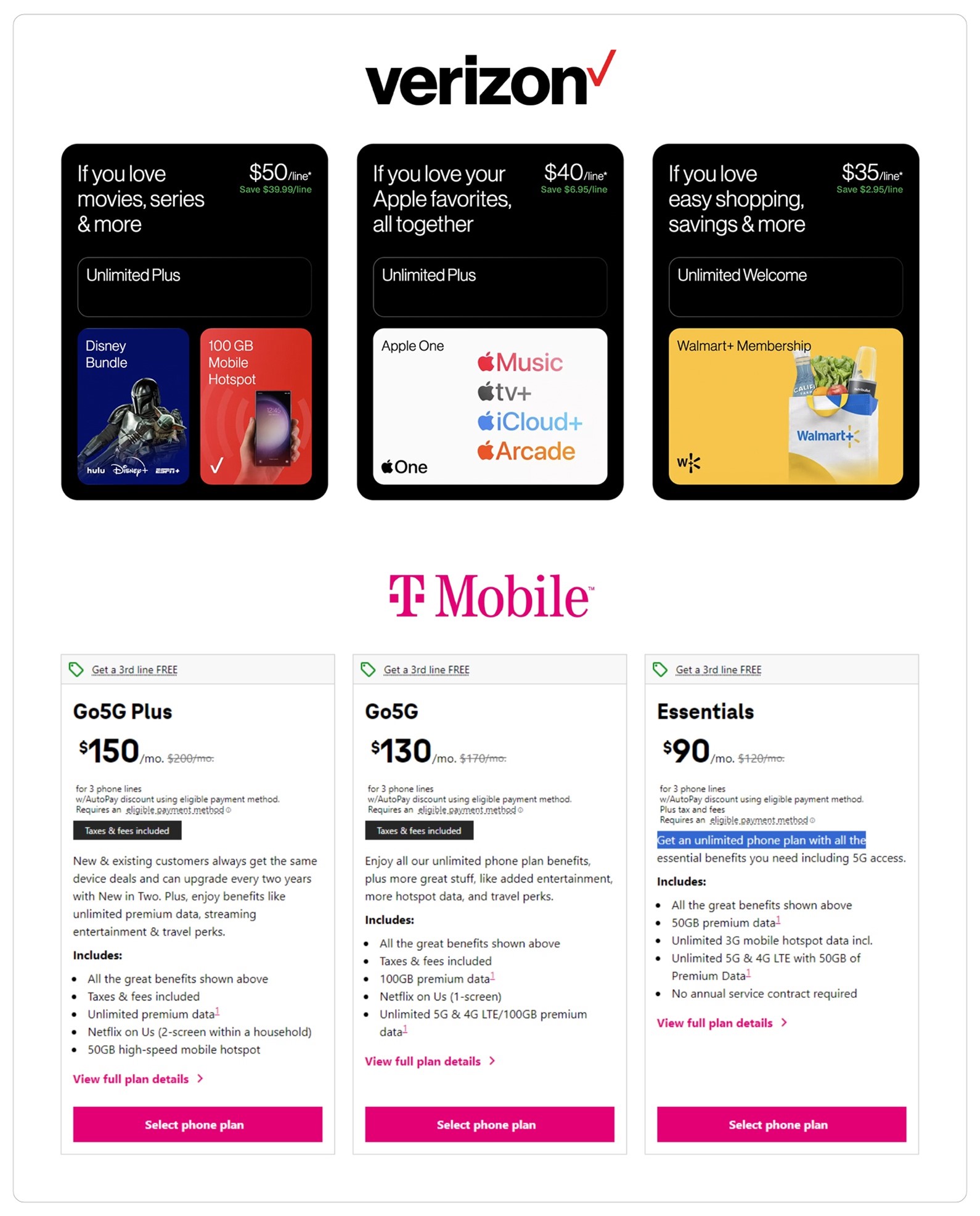

在2023年第二季度,运营商提供了强有力的促销活动for upgraders on flagship devices, keeping upgrade rates and device sales from falling further during the quarter. The carriers generally lose money on device sales and make up for it from service revenues. However, as the cable players snare a higher share of customer additions, the growth potential from subscriber growth and consequent service revenues is limited. To combat this situation, the carriers are looking to increase ARPU by offering higher value plans, but also by offering plans on discount to better compete with the cable players. We have also seen AT&T and Verizon increase prices on old plans to raise ARPU or encourage subscribers to adopt new service plans. Verizon and T-Mobile both restructured their service plans during Q2 2023, simplifying their menu of services and improving the value offered to customers. Meanwhile, AT&T stood pat with its slate of service plans but announced that later this year it would reduce its autopay discount to $5/month from $10/month, which will improve ARPU.

What to Expect in H2 2023

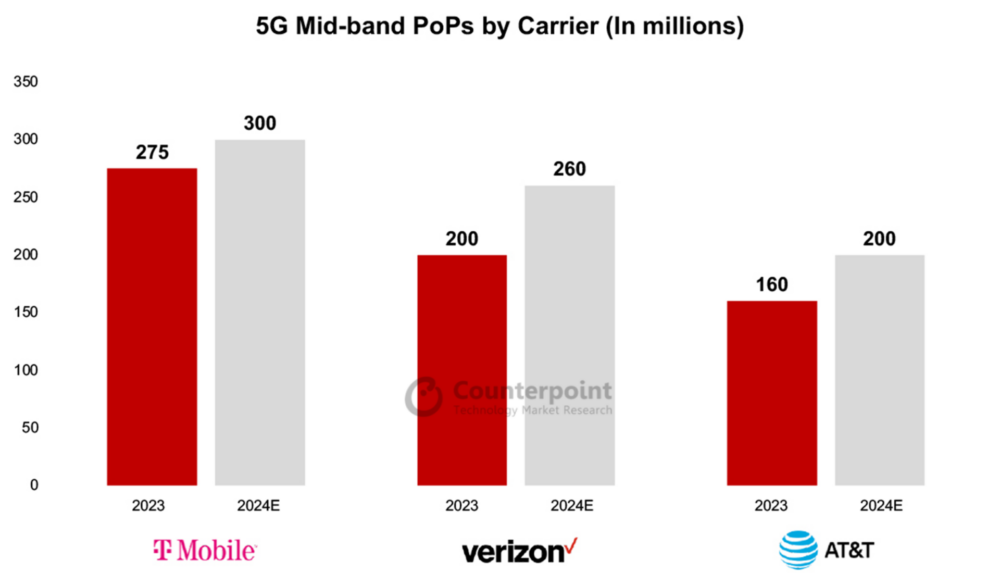

As 2023 marches on, we expect to see the carriers become even more competitive with their service promotions as the cable players continue to win in customer acquisition. Additionally, we see the carriers offering even more “bundling” opportunities, as they aggregate streaming services, internet service, and cellular service to improve their overall value offer. Meanwhile, prepaid will continue to struggle, as customers in this segment have been the worst hit by inflation. The second half of the year will see an uptick in device sales, as usual, with the launch of the Apple iPhone 15 in September and as the holiday shopping season sets in. However, we expect overall smartphone sales to remain down YoY.

*From Q3 earnings

*From Q3 earnings *From Q3 earnings

*From Q3 earnings *From Q3 earnings

*From Q3 earnings *From Q3 earnings

*From Q3 earnings

Source: Counterpoint US Channel Share Tracker

Source: Counterpoint US Channel Share Tracker Source: Counterpoint US Channel Share Tracker

Source: Counterpoint US Channel Share Tracker