Our analystsEthan Qi,Jene Park,Soumen Mandal,Ivan Lam,Shenghao Bai,Archie Zhang,Shaochen WangandAlicia Gong目前正在参加上海2023甚至最有可能的吗t (June 28-June 30). In the following posts, you will experience the full force of our presence at MWC Shanghai as we provide unique insights from our analysts, unveiling the industry-shaping impact of this remarkable gathering.

Day 1 Highlights:

Consumer Electronics:

Meizu showcases capabilities in ‘device-vehicle integration’

During MWC Shanghai 2023, Meizu showcased a series of products and technologies, including the Flyme Auto intelligent system-enabled EV models, Meizu 20 flagship smartphone series, Titan glass and the EcarX Antares 1000 Pro computing platform. The Meizu 20 series, released in March 2023, sports the Snapdragon 8 Gen 2 SoC, 6.5-inch OLED display, 144Hz refresh rate and UFS4.0 and LPDDR5X memory combination. The Meizu 20 INFINITY Ultimate Edition features a dual-sided suspended Titan glass design, highlighting the emerging trend of flagship models in China competing to adopt more durable glass materials. Meizu also expects its Flyme Auto system to emerge as a guiding beacon for the deep integration of the smartphone and automotive ecosystems.

Huawei showcases Vision Glass

Huawei showcased its recently launched smart eyewear product Huawei Vision Glass alongside a range of smartphone models and consumer IoT products. Huawei Vision Glass, unveiled in December 2022, features a Micro OLED display that offers an immersive experience equivalent to a 120-inch virtual giant screen. It boasts 1080p full HD resolution and 480nit brightness and supports a wide color gamut of 90% DCI-P3. In addition, it comes equipped with ultra-thin smart speakers and offers adjustable diopters ranging from 0 to 500 degrees.

ZTE presents nubia Pad 3D, world’s first AI-based naked-eye 3D tablet computer

ZTE highlighted the nubia Pad 3D, which showcases the unique “3D light field” technology for superior naked-eye 3D display quality. It also incorporates AI eye-tracking to provide real-time matching of the most comfortable viewing field. Leveraging the AI neural network deep-learning algorithms, it enables instant conversion of 2D content into 3D. During MWC, ZTE announced collaborations with ecosystem partners such as China Mobile Migu, Jiangxi Kejun, China National Publications Import & Export (Group) Corporation and Datang Xishi to provide a wealth of naked-eye 3D scene applications in areas including film and television, live streaming, gaming, education, healthcare, cultural tourism, online conferences, exhibition display, advertising, and more.

Telecom Operators’ Moves

Establishment of China Mobile Metaverse Industry Alliance

China Mobile has collaborated with metaverse ecosystem partners to establish the China Mobile Metaverse Industry Alliance. It unveiled the first group of 24 alliance members at the MWC. The alliance comprises content provider Mango TV, providers of content and software development tools such as Unity, AI technologies leader Iflytek, as well as hardware companies like Huawei, NOLO, HTC VIVE and Xiaomi. They will prioritize cooperation in four key areas – metaverse content creation, XR terminals, key technologies and computational networks.

China Mobile’s 5G Use Case

China Mobile showcased a remarkable 5G use case for automated quality inspection, eliminating the need for wired connections.

China Unicom’s 5G solutions

China Unicom unveiled a groundbreaking 5G-connected solution for traffic lights and cameras.

China Telecom reveals development strategy for 6G

During his keynote speech at MWC, China Telecom chairman revealed that the company was actively pursuing innovative advancements in the architecture of the simplified 6G network. The research primarily focuses on key core technologies, including near-field cellular integration (P-RAN) and air-space integration. China Telecom will maintain a close collaboration with standardization organizations and industry partners to drive the establishment of globally unified 6G international standards.

Innovations from network, software and component providers

Huawei drives 5G ToB advancement with ‘5G Inside’ technology

Huawei not only perseveres in the development of 5G devices but also drives the advancement of 5G ToB. With 5G Inside, Huawei is collaborating with enterprise customers to deliver customized 5G devices that cater to diverse scenarios and applications.

Huawei’s ‘cloud phone’ solution

华为云手机提供了一个解决方案,用户can access separate or multiple virtual phones through a dedicated app. This innovative B2B solution is ideal for companies seeking to secure their digital assets and provide virtual phone solutions for their sales staff. Government entities also show interest in this virtual phone solution, while cloud mobile gaming presents another exciting use case.

Huawei’s 5GC Intelligent Traffic Express Solution

Huawei’s 5Gc Intelligent Traffic Express Solution enables the detection and monitoring of user live-streaming activities. In cases where user experience worsens, extra resources are allocated to VVIP users, providing operators with the opportunity to monetize on individuals requiring fast and prioritized connections, such as live-streaming bloggers.

H3C’s Wi-Fi7 Announcements

H3C showcased a compelling use case of Wi-Fi7 enabling remote schooling. The enterprise gateway has the capability to support hundreds of terminals, including tablets and PCs, simultaneously.

China Broadnet’s Naked-eye Display

China Broadnet presents a rejuvenated concept of naked-eye displays.

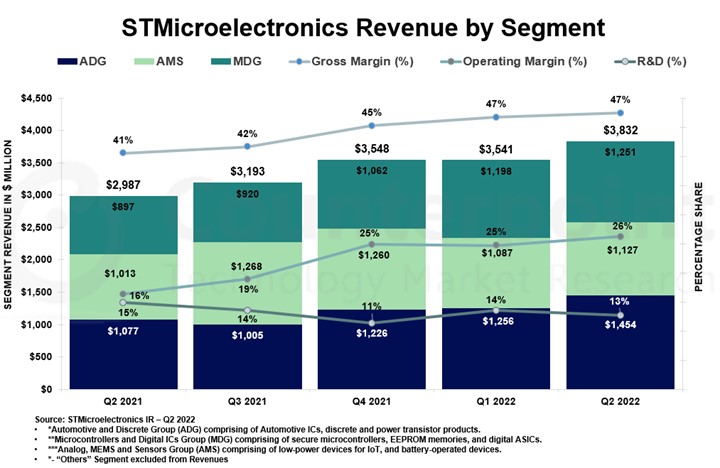

圣Microelectronics Announcements

圣Microelectronics’ integrated wearable sensing unit, with accelerometers and gyroscopes integrated, can efficiently process signals and directly translate movements into actionable data for smart wearable devices.

AMD’s RFFE Solutions

AMD has introduced an advanced RF front-end solution designed specifically for small cell systems.

AAC Expands its Optical R&D Strength

AAC is significantly enhancing its optical R&D capabilities, particularly in the field of waveguide technologies.

Tongxin Microelectronics Announcements

Tongxin Micro’s NFC chips find wide applications in wearables and smartphones, having already been integrated into various commercial models. Besides, the company serves as a provider of eSIM chips. A solution combining both technologies is currently in the works.

ams OSRAM Mira050 with Wafer Level Optics (WLO) Demo Kit

Smallest lens solution with leading-edge NIR-imaging performance – images are sharp from center to edge of image circle. ams OSRAM designed and produced WLO lens mounted on Mira050 EVK sensor board, actively aligned to optimize image quality. Configurable NIR-designs for wavelengths bands around 850nm or 940nm

Kigen and TMC collaborate to drive eSIM innovation

Kigen and Tongxin Microelectronics Co (TMC) have delivered the first-ever simple, global, secure, commercial and GSMA-certified consumer eSIM solution to empower OEM innovation to meet 5G FWA demand for affordable CPE devices. Lead customers are already developing commercial products based on this offering. The companies are now extending it to general availability.

“Global 5G FWA CPE cumulative revenues are expected to reach over $100 billion during 2020-2030. Bringing down the total cost of 5G FWA CPE is integral to 5G broadband adoption, scale and return on investment for all stakeholders in this price-sensitive segment.”Neil Shah, VP of Research, Counterpoint Research

Read the full release here:https://kigen.com/resources/press-releases/kigen-consumer-esim-os-for-cpe-oem/

Day 2 Highlights:

HONOR Magic V2 foldable smartphone launch event

During the launch event, HONOR CEO George Zhao shared thoughts on innovation in future smartphone products:

- Inclusion of AI:George thinks that having AI on the device is vital because it would allow users to have multiple-modal interactions and offers better privacy protection in the future digitalized life.

- Screen size matters but so does the smartphone weight:Future smartphones should be easier to carry around as they need to be.

- Display technology with eye-care features would become popular:In China, more than 30% of smartphone users use their devices for more than five years. Eye-care display technology addresses the consumer’s concerns.

- Longer battery life:Customers want devices with longer battery life since they are using them more and more every day.

At the end of his address, Zhao announced that HONOR’s third foldable phone Magic V2 would be launched on July 12 and the product may bring improvements in the abovementioned areas.

Meizu’s announcements

Meizu’s CEO Shen Ziyu made a keynote speech today, describing his vision of interconnection between the automotive and smartphone segments. Meizu is now owned by Chinese auto giant Geely. Ziyu said the synergy between the two segments would be brought by the sharing of computing power, data and hardware. Automobile operating systems should also become accessible to the huge application ecosystem of smartphones. The company is also working on an infotainment system called Flyme Auto, which will offer the same smooth user experience as seen in the Flyme OS for smartphones. Flyme Auto will be installed on the upcoming Lynkco 08 and Volvo Polestar for the global market.

Day 3 Highlights

Lenovo updates

- Lenovo showcased its consumer electronics products such as laptops, tablets and smartphones, including its recently launched foldable Motorola Razr 40 Ultra.

- Lenovo also had some ToB solutions at its booths, such as AI server, edge computing products, park patrol robot, smart transportation systems and logistics.

- 联想还支持许多ecos公司ystem which have stepped into XR optical solutions, live-streaming supporting platforms, network equipment and smart logistic management system.

- For its smart city business, Lenovo showcased its solutions like smart transportation solutions and city emergency management platform.

China Broadnet showcases new 5G calling features

- Making calls interesting:Users can make calls more fun by using all kinds of emojis with gestures or voice commands.

- Cartoon video call:Users can create their own digital images that can be displayed when making calls without turning on the camera.

- Real-time translation:Multilingual real-time translation into text.

- Smart customer service:Available online 24 hours to answer questions.

- AI/GPT intelligent call:Using AI/GPT to answer questions.

Keynote:Next frontier for AI

- In healthcare, AI can help the doctor detect lesions at an early stage.

- AI can help cars enable intelligent electrification, networking and information sharing.

Note:Please note that the posts above are still under development and are meant for providing general information only. They should not be considered professional advice. The authors and this website are not liable for any errors or damages resulting from the use of this information.